U.S. Dollar Falls As ISM Services PMI Disappoints

December 04 2024 - 8:34AM

RTTF2

The U.S. dollar dropped against its major counterparts in the

New York session on Wednesday, after a data showed that the

nation's service sector growth slowed more than anticipated in the

month of November.

Data from the Institute for Supply Management showed that the

services PMI fell to 52.1 in November from 56.0 in October. While a

reading above 50 still indicates growth, economists had expected

the index to show a much more modest decrease to 55.5.

Data from payroll processor ADP showed that private sector

employment in the U.S. increased slightly less than expected in the

month of November.

ADP said private sector employment climbed by 146,000 jobs in

November after jumping by a downwardly revised 184,000 jobs in

October.

Economists had expected private sector employment to grow by

165,000 jobs compared to the surge of 233,000 jobs originally

reported for the previous month.

The greenback dropped to 2-day lows of 1.0543 against the euro

and 1.2721 against the pound, off its early 2-day highs of 1.0471

and 1.2629, respectively. The next possible support for the

currency is seen around 1.08 against the euro and 1.28 against the

pound.

The greenback touched a 2-day low of 0.8826 against the franc.

If the currency falls further, it is likely to test support around

the 0.87 region.

The greenback eased to 149.98 against the yen, from an early

5-day high of 151.22. The currency is seen finding support around

the 144.00 level.

The greenback retreated to 0.6440 against the aussie and 0.5868

against the kiwi, from an early 4-month high of 0.6399 and a 1-week

high of 0.5829, respectively. The currency is likely to locate

support around 0.66 against the aussie and 0.60 against the

kiwi.

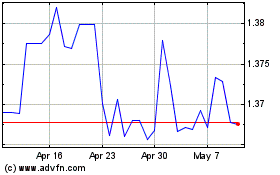

The greenback held steady against the loonie, after climbing to

a 2-day high of 1.4083 in the previous session.

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Nov 2024 to Dec 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Dec 2023 to Dec 2024