Dovish Fed Comments, Weak Job Openings Data Send U.S. Dollar Down

September 04 2024 - 9:12AM

RTTF2

The U.S. dollar weakened against its major counterparts in the

New York session on Wednesday, as job openings came in below

expectations in July, raising the possibility of a larger interest

rate cut by the U.S. Federal Reserve at the meeting this month.

Data from the Labor Department showed that job openings

decreased to 7.67 million in July from a downwardly revised 7.91

million in June.

Economists had expected job openings to dip to 8.10 million from

the 8.18 million originally reported for the previous month.

Dovish remarks from Atlanta Fed President Raphael Bostic also

weighed on the dollar.

Bostic said that the Fed must not maintain a restrictive policy

stance for too long, intensifying speculation that the central bank

may pivot towards easy policy soon.

"I believe we cannot wait until inflation has actually fallen

all the way to 2 percent to begin removing restriction because that

would risk labor market disruptions that could inflict unnecessary

pain and suffering," he added.

The greenback declined to 5-day lows of 1.1095 against the euro,

1.3175 against the pound and 0.8471 against the franc, off its

early highs of 1.1036, 1.3100 and 0.8518, respectively. The

currency is likely to challenge support around 1.12 against the

euro, 1.33 against the pound and 0.83 against the franc.

The greenback touched 143.99 against the yen, setting a 1-week

low. Immediate support for the currency is seen around the 141.00

level.

The greenback retreated to 0.6749 against the aussie, 1.3500

against the loonie and 0.6216 against the kiwi, from an early more

than 2-week high of 0.6685 and nearly 2-week highs of 1.3565 and

0.6169, respectively. The currency is seen finding support around

0.69 against the aussie, 1.32 against the loonie and 0.63 against

the kiwi.

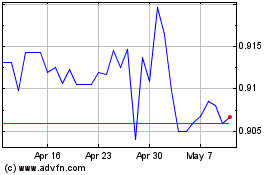

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Oct 2024 to Nov 2024

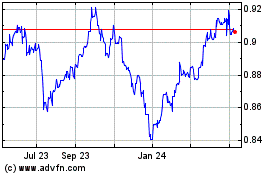

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Nov 2023 to Nov 2024