U.S. Dollar Higher On Trump's Policy Outlook

November 13 2024 - 8:46AM

RTTF2

The U.S. dollar climbed against its major counterparts in the

New York session on Wednesday on hopes that President-elect Donald

Trump's policies on tariffs will rekindle inflation and keep

interest rates high.

Trump's policy proposals, such as tax cuts and import tariffs,

would put upward pressure on inflation and prompt the central bank

to adopt a restrictive monetary policy.

Dallas Federal Reserve President Lorie Logan urged caution on

future rate cuts as inflation could re-acclerate, if Fed cuts too

far past neutral.

The Fed will likely need more cuts, but how much and how soon

are not clear.

If bond yields continue to rise, the Fed may need

less-restrictive policy, Logan noted.

Data from the Labor Department showed that consumer prices in

the U.S. rose in line with economist estimates in the month of

October.

The consumer price index crept up by 0.2 percent in October,

matching the upticks seen in each of the three previous months as

well as expectations.

Excluding food and energy prices, core consumer prices climbed

by 0.3 percent in October, matching the increases seen in each of

the two previous months along with expectations.

The greenback moved up to near a 4-month high of 155.42 against

the yen, more than 1-year high of 1.0555 against the euro and more

than a 3-month high of 1.2686 against the pound, off its early lows

of 154.33, 1.0653 and 1.2768, respectively. The next possible

resistance for the currency is seen around 161.00 against the yen,

1.04 against the euro and 1.25 against the pound.

The greenback climbed to a 4-1/2-year high of 1.3999 against the

loonie and more than 3-month highs of 0.6479 against the aussie and

0.5880 against the kiwi, from its early lows of 1.3930, 0.6545 and

0.5947, respectively. The currency is poised to challenge

resistance around 1.41 against the loonie, 0.63 against the aussie

and 0.57 against the kiwi.

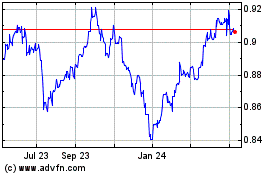

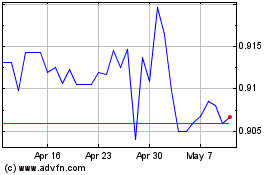

The greenback touched a 3-1/2-month high of 0.8853 against the

franc, from an early 2-day low of 0.8797. Immediate resistance for

the currency is seen around the 0.90 level.

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Dec 2024 to Jan 2025

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Jan 2024 to Jan 2025