Swiss Franc Weakens Against Majors

January 06 2025 - 7:33AM

RTTF2

The Swiss franc declined against its major counterparts in the

New York session on Monday, as gains in tech stocks lifted Wall

Street.

Chip Stocks rose as contract electronics giant Foxconn reported

record fourth quarter revenue amid strong AI server demand.

Foxconn is an assembly partner with AI darling and market leader

Nvidia (NVDA), which is jumping by 2.6 percent pre-market

trading.

Sentiment improved after the Washington Post reported that

President-elect Donald Trump may scale back his tariff plans.

After Trump called for "universal" tariffs of as high as 10 or

20 percent on everything imported into the U.S., the Washington

Post said his aides are now exploring plans that would apply

tariffs to every country but only cover "critical imports."

The franc fell to a 6-day low of 0.9410 against the euro and a

4-day low of 1.1332 against the pound, off its early highs of

0.9360 and 1.1283, respectively. The currency is seen finding

support around 0.95 against the euro and 1.15 against the

pound.

The franc retreated to 0.9067 against the greenback and 173.23

against the yen, from its early 1-week highs of 0.9008 and 174.50,

respectively. The next possible support for the franc is seen

around 0.92 against the greenback and 168.00 against the yen.

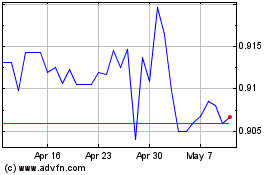

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Dec 2024 to Jan 2025

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Jan 2024 to Jan 2025