Filed Pursuant

to Rule 424(b)(3)

Registration No. 333-276334

PROSPECTUS SUPPLEMENT NO.

8

(to Prospectus dated June 25, 2024)

Up to 1,997,116 Shares of Common Stock

1,700,884 Shares of Common Stock Underlying

the Warrants

This

prospectus supplement is being filed to update and supplement the information contained in the prospectus dated June 25, 2024 (the “Prospectus”),

which forms a part of our Registration Statement on Form S-11 (File No. 333-276334) with the information contained in our Current

Report on Form 8-K, filed with the U.S. Securities and Exchange Commission on September 9, 2024 (the “Current Report”). Accordingly,

we have attached the Current Report to this prospectus supplement.

Our common stock is currently

listed on the Nasdaq Capital Market (“Nasdaq”) under the ticker symbol “AIRE.” On September 6, 2024, the closing

price of our common stock was $1.32.

This prospectus supplement

updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in

combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction

with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should

rely on the information in this prospectus supplement.

We are a “controlled company” under

the Nasdaq listing rules because Giri Devanur, our chief executive officer and chairman, owns approximately 62.21% of our outstanding

common stock. As a controlled company, we are not required to comply with certain of Nasdaq’s corporate governance requirements;

however, we will not take advantage of any of these exceptions.

INVESTING

IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISKS THAT ARE DESCRIBED IN THE “RISK FACTORS” SECTION BEGINNING ON PAGE 5 OF

THE PROSPECTUS.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if the Prospectus or this prospectus supplement is accurate or complete. Any representation to the contrary is a criminal offense.

The date

of this prospectus supplement is September 9, 2024.

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange

Act of 1934

Date of Report (date

of earliest event reported): September 8, 2024

reAlpha Tech Corp.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-41839 |

|

86-3425507 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

6515 Longshore Loop,

Suite 100, Dublin, OH 43017

(Address of principal

executive offices and zip code)

(707) 732-5742

(Registrant’s

telephone number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

AIRE |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Acquisition of Debt Does Deals, LLC (d/b/a

Be My Neighbor)

On September 8, 2024 (the

“Closing Date”), reAlpha Tech Corp. (the “Company”) entered into a Membership Interest Purchase Agreement (the

“Acquisition Agreement”), with Debt Does Deals, LLC (d/b/a Be My Neighbor), a Texas limited liability company (“Be My

Neighbor”), Christopher Bradley Griffith and Isabel Williams (each, a “Seller,” and collectively, the “Sellers”),

pursuant to which the Company acquired from the Sellers 100% of the membership interests of Be My Neighbor, a mortgage brokerage company,

that were outstanding immediately prior to the execution of the Acquisition Agreement (the “Acquisition”).

In exchange for all of the

membership interests of Be My Neighbor outstanding immediately prior to the execution of the Acquisition Agreement, and pursuant to the

terms and subject to the conditions of the Acquisition Agreement, the Company agreed to pay the Sellers an aggregate purchase price of

up to $6,000,000, subject to the adjustments described below to each of the Earn-Out Payments (as defined below) provided in the Acquisition

Agreement, consisting of: (i) $1,500,000 in cash paid on the Closing Date, with each Seller receiving a cash amount in proportion to each

of their membership interest percentage in Be My Neighbor; (ii) $1,500,000 in restricted shares of the Company’s common stock, par

value $0.001 per share (the “Common Stock”), or 1,146,837 shares of restricted Common Stock at a price of $1.31 per share,

calculated based on the volume weighted average price of the Common Stock as reported on the Nasdaq Capital Market for the seven (7) consecutive

trading days ending on the trading day immediately prior to the Closing Date, to be issued within 90 days from the Closing Date and with

each Seller receiving an amount of shares of Common Stock in proportion to each of their membership interest percentage in Be My Neighbor

(the “Buyer Shares”); and (iii) up to an aggregate of $3,000,000 in potential earn-out payments, payable in three tranches

of up to $500,000, $1,000,000 and $1,500,000, respectively, in cash or restricted shares of Common Stock, at the Company’s sole

discretion, each of which is calculated based on a formula set forth in the Acquisition Agreement and subject to the achievement of certain

financial metrics by Be My Neighbor for three successive measurement periods of 12 months, with the first measurement period ending 12

months after the Closing Date (collectively, the “Earn-Out Payments,” and each, an “Earn-Out Payment”). Specifically,

each Earn-Out Payment will be payable in full if Be My Neighbor achieves certain revenue and earnings before interest, taxes, depreciation

and amortization (“EBITDA”) thresholds for each of the measurement periods, each of which is payable within 120 days of the

end of a measurement period. If Be My Neighbor does not meet the revenue and EBITDA threshold in a measurement period, a pro-rated amount

of the Earn-Out Payment for such measurement period will be paid to Be My Neighbor based on the actual revenue and EBITDA achieved and

in accordance with the formula set forth in the Acquisition Agreement. Further, if Be My Neighbor exceeds such revenue and EBITDA thresholds

during any measurement period, the Earn-Out Payment for such measurement period will not be capped and will be increased accordingly based

on the formula set forth in the Acquisition Agreement.

The Buyer Shares, and any

shares of Common Stock issued as payment for an Earn-Out Payment (collectively, the “Shares”), if any, will be subject to

a restrictive period of 180 days following the date of their respective issuances, during which period each Seller will not be able to

dispose, assign, sell and/or transfer such Shares. The aggregate amount of Shares issuable under the Acquisition Agreement, for purposes

of complying with Nasdaq Listing Rule 5635(a), may in no case exceed 19.99% of the Company’s issued and outstanding shares of Common

Stock immediately prior to the execution of the Acquisition Agreement, or 8,880,383 shares of Common Stock (the “Cap Amount”),

subject to stockholder approval of any shares exceeding such amount. In the event the Shares issuable thereunder exceed the Cap Amount,

the Company will pay the Sellers cash in lieu of such excess shares of Common Stock, based on a formula set forth in the Acquisition Agreement.

Following the closing of the

Acquisition, the Sellers are required to indemnify the Company and its affiliates for any liability, damages, losses, costs and/or expenses

arising out of breaches by the Sellers of their respective covenants and certain other matters specified in the Acquisition Agreement,

subject to certain limitations and exclusions as identified therein. The Company also has the right to set-off any amount owed to the

Sellers in connection with the Acquisition Agreement, including Earn-Out Payments, against the obligations and liabilities of the Sellers

or Be My Neighbor to the Company under the Acquisition Agreement The Acquisition Agreement also contains representations and warranties,

covenants, conditions, and no-solicitation and non-compete provisions, in each case, customary for transactions of this type.

The foregoing description

of the Acquisition Agreement in this Current Report on Form 8-K (this “Form 8-K”) does not purport to be a complete description

of the rights and obligations of the parties thereunder and is qualified in its entirety by reference to the full text of the Acquisition

Agreement, a copy of which is attached hereto as Exhibit 2.1 and incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The

information included in Item 1.01 of this Form 8-K is incorporated by reference into this Item 2.01 to the extent required.

Item 3.02 Unregistered Sales of Equity Securities.

The

information included in Item 1.01 of this Form 8-K is incorporated by reference into this Item 3.02 to the extent required. The Shares

issuable under the Acquisition Agreement, when issued, will be issued pursuant to an exemption from registration provided by Section 4(a)(2)

and/or Rule 506 of Regulation D of the Securities Act of 1933, as amended (the “Securities Act”) because such issuances will

not involve a public offering, the recipient will take the securities for investment and not resale, the Company took appropriate measures

to restrict transfer, and the recipients are sophisticated investors. The Shares are subject to transfer restrictions, and the book-entry

records evidencing the Shares contain an appropriate legend stating that such securities have not been registered under the Securities

Act and may not be offered or sold absent registration or pursuant to an exemption therefrom. The securities were not registered under

the Securities Act and such securities may not be offered or sold in the United States absent registration or an exemption from registration

under the Securities Act and any applicable state securities laws.

On

August 28, 2024, pursuant to agreements entered into with certain service providers, the Company issued an aggregate of 83,000 shares

of Common Stock for the services rendered to the Company, which were issued pursuant to an exemption from registration provided by Section

4(a)(2) and/or Rule 506 of Regulation D of the Securities Act because such issuances did not involve a public offering, the recipient

took the securities for investment and not resale, the Company took appropriate measures to restrict transfer, and the recipients are

sophisticated investors. The securities are subject to transfer restrictions, and the book-entry records evidencing the securities contain

an appropriate legend stating that such securities have not been registered under the Securities Act and may not be offered or sold absent

registration or pursuant to an exemption therefrom. The securities were not registered under the Securities Act and such securities may

not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act and any applicable

state securities laws.

As of the date of this Form

8-K, there are 44,424,130 shares of Common Stock issued and outstanding.

Item 8.01 Other Events.

On

September 9, 2024, the Company issued a press release announcing the transaction described in Item 1.01 of this Form 8-K. A copy of the

press release is attached as Exhibit 99.1 and is incorporated herein by reference.

The

information set forth and incorporated into this Item 8.01 of this Form 8-K, including Exhibit 99.1, is being furnished pursuant to Item

8.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

into any of the Company’s filings under the Securities Act or the Exchange Act, whether made before or after the date hereof and

regardless of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such

a filing.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements

of businesses acquired.

The

Company has determined that the Acquisition will not constitute an acquisition of a significant amount of assets (as defined in Instruction

4 of Item 2.01) and, as such, financial statements contemplated by Item 9.01 of Form 8-K are not required to be reported by Form 8-K with

respect to the Acquisition.

(b) Pro forma financial

information.

The

Company has determined that the Acquisition will not constitute an acquisition of a significant amount of assets (as defined in Instruction

4 of Item 2.01) and, as such, pro forma financial information contemplated by Item 9.01 of Form 8-K is not required to be reported by

Form 8-K with respect to the Acquisition.

(d) Exhibits

| + | Certain schedules and exhibits to this agreement have been omitted

pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished to

the SEC upon request. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: September 9, 2024 |

reAlpha Tech Corp. |

| |

|

|

| |

By: |

/s/ Giri Devanur |

| |

|

Giri Devanur |

| |

|

Chief Executive Officer |

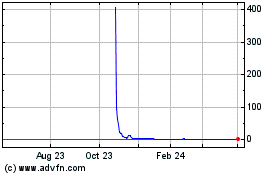

reAlpha Tech (NASDAQ:AIRE)

Historical Stock Chart

From Dec 2024 to Jan 2025

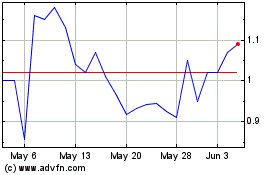

reAlpha Tech (NASDAQ:AIRE)

Historical Stock Chart

From Jan 2024 to Jan 2025