Ameristar Casinos, Inc. (NASDAQ: ASCA) ("Ameristar") announced

today that, pursuant to a supplement dated March 25, 2013 (the

"Supplement") to the Consent Solicitation Statement dated March 18,

2012 (the "Consent Solicitation Statement"), at the request and

expense of Pinnacle Entertainment, Inc. ("Pinnacle"), it has

amended the terms of its previously announced consent solicitation

(the "Consent Solicitation") seeking consents from holders of the

$1,040,000,000 outstanding principal amount of its 7.50% Senior

Notes due 2021 (the "Notes") for waivers (the "Proposed Waivers")

of and amendments (the "Proposed Amendments") to certain provisions

of the indenture governing the Notes (the "Indenture"). Ameristar

commenced the Consent Solicitation at the request and expense of

Pinnacle in connection with the previously announced proposed

merger between Ameristar and Pinnacle (the "Merger").

Pursuant to the Supplement, Ameristar has increased the consent

fee payable to consenting holders from $10.00 to $19.00 for each

$1,000 in principal amount of the Notes for which consents are

validly delivered and unrevoked on or prior to the Expiration Time,

50% of which will be payable promptly after the Expiration Time and

the remaining 50% of which will be payable, if at all, promptly

after the date of the consummation of the Merger, subject, in each

case, to the conditions described in the Consent Solicitation

Statement.

In addition, the Consent Solicitation, which was previously

scheduled to expire at 5:00 p.m., New York City time, on March 27,

2013, has been further extended to 5:00 p.m., New York City time,

on April 2, 2013, unless further extended or terminated by

Ameristar.

The amended terms of the Consent Solicitation also would reduce

the capacity of Pinnacle, as the successor to Ameristar under the

Indenture upon consummation of the Alternative Merger and

Post-Effective Merger (as such terms are defined in the Consent

Solicitation Statement), to make certain restricted payments under

the Indenture from and after the effective time of the

Post-Effective Merger. The amended terms of the Consent

Solicitation also amend and supplement other terms of the Consent

Solicitation Statement as described in the Supplement.

All other terms and conditions of the Consent Solicitation, as

set forth in the Consent Solicitation Statement and the Consent

Letter, in each case, as amended and supplemented by the

Supplement, remain the same. Holders of the Notes who have

previously delivered consents do not need to redeliver such

consents or take any other action in response to this announcement

in order to receive the increased consent fee upon the successful

conclusion of the Consent Solicitation and any such previously

delivered consents shall be deemed to include a consent to the

additional amendments and supplements contained in the Supplement.

Consents (whether previously or hereafter delivered) may only be

revoked in the manner described in the Consent Solicitation

Statement.

The Consent Solicitation is being made solely on the terms and

subject to the conditions set forth in the Consent Solicitation

Statement and the accompanying Consent Letter, each as amended and

supplemented by the Supplement. Holders of the Notes are urged to

review the Consent Solicitation Statement, the Consent Letter and

the Supplement for the detailed terms of the consent solicitation

and the procedures for consenting to the Proposed Amendments and

Proposed Waivers. Any persons with questions regarding the consent

solicitation should contact the Solicitation Agents, J.P. Morgan at

(212) 270-1200 (collect) or (800) 245-8812 (toll free), Goldman,

Sachs & Co. at (212) 902-5183 (collect) or (800) 828-3182 (toll

free), Barclays at (212) 528-7581 (collect) or (800) 438-3242 (toll

free), BofA Merrill Lynch at (980) 388-3646 (collect) or (888)

292-0070 (toll free), Credit Agricole CIB at (212) 261-3678

(collect), Deutsche Bank Securities at (212) 250-7527 (collect) or

(855) 287-1922 (toll free), UBS Investment Bank at (203) 719-7991

(collect) or Wells Fargo Securities at (704) 410-4760 (collect) or

(866) 309-6316 (toll free).

This announcement is for informational purposes only and is

neither an offer to sell nor a solicitation of an offer to buy any

security. This announcement is also not a solicitation of consents

with respect to the Proposed Waivers and Proposed Amendments or any

securities. No recommendation is being made as to whether holders

of Notes should consent to the Proposed Waivers and Proposed

Amendments. The solicitation of consents is not being made in any

jurisdiction in which, or to or from any person to or from whom, it

is unlawful to make such solicitation under applicable state or

foreign securities or "blue sky" laws.

About Ameristar Casinos

Ameristar Casinos is an innovative casino gaming company

featuring the newest and most popular slot machines. Our 7,100

dedicated team members pride themselves on delivering consistently

friendly and appreciative service to our guests. We continuously

strive to increase the loyalty of our guests through the quality of

our slot machines, table games, hotel, dining and other leisure

offerings. Our eight casino hotel properties primarily serve guests

from Colorado, Idaho, Illinois, Indiana, Iowa, Kansas, Louisiana,

Mississippi, Missouri, Nebraska and Nevada. We began construction

on our ninth property, a casino resort in Lake Charles, La., in

July 2012, which we expect will open in the third quarter of 2014.

We have been a public company since 1993, and our stock is traded

on the Nasdaq Global Select Market. We generate more than $1

billion in net revenues annually.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements include information concerning

possible or assumed future results of operations, descriptions of

our business plans and strategies and the effects of the Merger,

the Proposed Waivers and the Proposed Amendments on the Notes or on

Ameristar or Pinnacle after the Merger, if consummated. These

statements often include words such as "anticipate," "expect,"

"suggest," "plan," "believe," "intend," "estimate," "target,"

"project," "forecast," "should," "could," "would," "may," "will"

and other similar expressions. We have based these forward-looking

statements on our current expectations, plans and assumptions that

we have made in light of our experience in the industry, as well as

our perceptions of historical trends, current conditions, expected

future developments and other factors we believe are appropriate

under the circumstances and at the time such statements were made.

Although we believe that these forward-looking statements are based

on reasonable assumptions, you should be aware that many important

factors could affect Ameristar's, Pinnacle's or the combined

company's actual financial condition or results of operations, the

proposed merger between Ameristar and Pinnacle, the Proposed

Waivers and Proposed Amendments, or the Notes, and could cause

actual results to differ materially from those expressed in the

forward-looking statements. Such factors include, but are not

limited to, those set forth under the heading "Solicitation

Considerations" in the Consent Solicitation Statement, in the

respective Annual Reports on Form 10-K of Ameristar and Pinnacle

for the fiscal year ended December 31, 2012 and in any report,

statement or other information of Ameristar and Pinnacle that is

incorporated by reference in the Consent Solicitation Statement.

You should consider these areas of risk in connection with

considering any forward-looking statements that may be made by us

generally. The forward-looking statements contained in this press

release speak only as of the date of this press release. Except as

may be required by the federal securities laws, we undertake no

obligation to revise these forward-looking statements to reflect

events or circumstances arising after the date of this press

release or to reflect the occurrence of unanticipated events.

Visit Ameristar Casinos' website at www.ameristar.com (which

shall not be deemed to be incorporated in or a part of this news

release).

CONTACT: Tom Steinbauer Senior Vice President, Chief

Financial Officer Ameristar Casinos, Inc. 702-567-7000

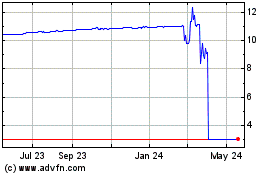

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Feb 2025 to Mar 2025

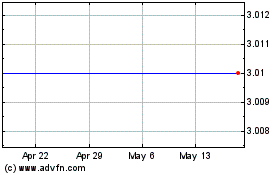

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Mar 2024 to Mar 2025