Algoma Steel Group Inc. (NASDAQ: ASTL; TSX: ASTL) (“Algoma” or “the

Company”), a leading Canadian producer of hot and cold rolled steel

sheet and plate products, today announced results for its fiscal

fourth quarter and full year ended March 31, 2024.

Unless otherwise specified, all amounts are in

Canadian dollars.

Business Highlights and Fiscal 2024 to Fiscal 2023

Fourth Quarter Comparisons

- Consolidated revenue of $620.6

million, compared to $677.4 million in the prior-year quarter.

- Consolidated income from operations

of $3.1 million, compared to $21.7 million in the prior-year

quarter.

- Net income of $28.0 million,

compared to net loss of $20.4 million in the prior-year

quarter.

- Adjusted EBITDA of $41.5 million and

Adjusted EBITDA margin of 6.7%, compared to $47.9 million and 7.1%

in the prior-year quarter (see “Non-IFRS Measures” below).

- Cash flows generated from operations

of $121.2 million, compared to $95.4 million in the prior-year

quarter.

- Shipments of 450,966 tons, compared

to 571,647 tons in the prior-year quarter.

- Completed latest upgrade related to

the plate mill modernization project phase two.

- Paid quarterly dividend of

US$0.05/share.

Fiscal 2024 to Fiscal 2023 Full Year

Comparisons

- Consolidated revenue of $2,795.8

million, compared to $2,778.5 million the prior year.

- Consolidated income from operations

of $167.3 million, compared to $290.5 million the prior year.

- Net income of $105.2 million,

compared to $298.5 million the prior year.

- Adjusted EBITDA of $312.7 million

and Adjusted EBITDA margin of 11.2%, compared to $452.3 million and

16.3% the prior year (see “Non-IFRS Measures” below).

- Cash flows generated from operations

of $294.4 million, compared to $177.3 million the prior year.

- Shipments of 2,085,465 tons,

compared to 2,002,715 tons the prior year.

Michael Garcia, the Company’s Chief Executive

Officer, commented, “As previously disclosed, early in the quarter

our operations were impacted by a utility corridor collapse at our

coke-making facility that resulted in a blast furnace shutdown. It

was thanks to the decisive and professional actions taken by the

entire team that we were able to bring steel production back to

near normal production levels in approximately three weeks.

Additionally, following the quarter’s end, our team successfully

completed the planned upgrade related to the second phase of our

plate mill modernization project. This upgrade is now operational

and has already resulted in increased plate output, which is

expected to enhance our financial performance for years to

come.”

Rajat Marwah, the Company’s Chief Financial

Officer, added, “During the quarter we issued an aggregate of

US$350.0 million of 9.125% Senior Secured Second Lien Notes,

enhancing the strength and flexibility of our balance sheet. This

successful issuance reflects the positive view that credit

investors have of our company and their confidence in our strategic

direction and financial stability.”

Mr. Garcia concluded, “Fiscal 2025 marks a

pivotal and exciting period for Algoma. We remain on track with our

transformative Electric Arc Furnace project and expect to begin

commissioning activities by the end of calendar 2024, heralding a

new era for our company. This transition will position Algoma as

one of the greenest steel producers in North America, while

simultaneously delivering long-term value to all our

stakeholders.”

Fourth Quarter Fiscal 2024 Financial

Results

Fourth quarter revenue totaled $620.6 million,

compared to $677.4 million in the prior year quarter. As compared

with the prior year quarter, steel revenue was $568.1 million,

compared to $609.2 million, and revenue per ton of steel sold was

$1,376, compared to $1,185.

Income from operations was $3.1 million,

compared to $21.7 million in the prior-year quarter. The year over

year decrease was primarily due to decreased steel production,

higher purchased coke use and higher natural gas use related to the

January 20, 2024 collapse of a structural corridor carrying various

utilities crucial for the coke oven battery and blast furnace

operations.

Net income in the fourth quarter was $26.8

million, compared to a net loss of $20.4 million in the prior-year

quarter. The improvement was driven primarily by the factors

described above under income from operations.

Adjusted EBITDA in the fourth quarter was $41.5

million, compared with $47.9 million for the prior-year quarter.

This resulted in an Adjusted EBITDA margin of 6.7%. Average

realized price of steel net of freight and non-steel revenue was

$1,260 per ton, compared to $1,066 per ton in the prior-year

quarter. Cost per ton of steel products sold was $1,091, compared

to $934 in the prior-year quarter. Shipments for the fourth quarter

decreased by 21.1% to 450,966 tons, compared to 571,647 tons in the

prior-year quarter. See “Non-IFRS Measures” below for an

explanation of Adjusted EBITDA and a reconciliation of net income

(loss) to Adjusted EBITDA.

Full Year Fiscal 2024 Financial

Results

Revenue for fiscal year 2024 totaled $2,795.8

million, compared to $2,778.5 million the prior year. Steel revenue

for fiscal year 2024 was $2,545.3 million, compared to $2,550.1

million the prior year, and revenue per ton of steel sold was

$1,341, compared to $1,387 the prior year.

Income from operations for fiscal year 2024 was

$167.3 million, compared to $290.5 million the prior year. The year

over year decrease was primarily due to increased cost of sales due

to higher purchased coke use, higher natural gas use and labour

costs. This was partially offset by increased revenue driven by

increased steel shipment volume.

Net income for fiscal year 2024 was $105.2

million, compared to $298.5 million the prior year. The year over

year decrease was driven primarily by the factors described above

in respect of income from operations.

Adjusted EBITDA for fiscal year 2024 was $312.7

million, compared with $452.3 million for the prior year. This

resulted in an Adjusted EBITDA margin of 11.2%. Average realized

price of steel net of freight and non-steel revenue for fiscal year

2024 was $1,220 per ton, compared to $1,273 per ton in the prior

year. Cost per ton of steel products sold for fiscal year 2024 was

$1,018, compared to $1,004 in the prior year. Shipments for fiscal

year 2024 increased by 4.1% to 2,085,465 tons, compared to

2,002,715 tons in the prior year. See “Non-IFRS Measures” below for

an explanation of Adjusted EBITDA and a reconciliation of net

income (loss) to Adjusted EBITDA.

Electric Arc Furnace

In November 2021, the Company’s Board of

Directors (the “Board”) authorized the Company to construct two new

state of the art electric arc furnaces (“EAF”) to replace its

existing blast furnace and basic oxygen steelmaking operations. The

project continues to advance, with approximately $800 million of

the budgeted project cost contracted. The Company continues to

expect the project budget to be $825 million to $875 million, and

that the completion of the EAF project will be funded with

cash-on-hand, cash generated through operations, and available

borrowings under the Company’s existing undrawn credit

facility.

Following the transformation to EAF steelmaking,

Algoma’s facility is anticipated to have an annual raw steel

production capacity of approximately 3.7 million tons, matching its

downstream finishing capacity, which is expected to reduce the

Company’s annual carbon emissions by approximately 70%.

Blast Furnace Outage

As previously disclosed, in January 2024 the

Company experienced an unplanned outage at its blast furnace in

connection with a utility corridor collapse at its coke-making

facility. Management estimates the resultant outage negatively

impacted hot metal production in the quarter by approximately

150,000 tons and reduced Adjusted EBITDA by approximately $120 -

$130 million. Algoma has been working closely with relevant

insurance providers as they complete assessments. The amount and

timing of any potential recoveries under these insurance policies

are still to be determined.

Plate Mill Modernization

Project

Subsequent to quarter-end, the Company

successfully completed a planned upgrade related to the

modernization of its plate facility. The upgrade to the mill is now

substantially complete, and the operations and commercial teams are

focused on ramping up the production and sales of plate products,

putting the Company on a path towards our expected annual run rate

capacity of over 650,000 NT.

Senior Secured Second Lien

Notes

On April 5, 2024, the Company’s indirect

wholly-owned subsidiary and operating company, Algoma Steel Inc.

(“ASI"), issued an aggregate of US$350.0 million of 9.125% Senior

Secured Second Lien Notes due April 15, 2029 (the “Notes”). ASI

intends to use the net proceeds from the offering of the Notes for

general corporate purposes, adding strength and flexibility to its

balance sheet.

Quarterly Dividend

The Board has declared a regular quarterly

dividend in the amount of US$0.05 on each common share outstanding,

payable on July 19, 2024 to holders of record of common shares of

the Corporation as of the close of business on July 2, 2024. This

dividend is designated as an “eligible dividend” for Canadian

income tax purposes.

Outlook

The outlook that follows constitutes

forward-looking statements (as defined below) and is based on a

number of assumptions and subject to a number of risks. Actual

results could vary materially from our outlook as a result of

numerous factors, including certain risk factors, many of which are

beyond our control. Please see “Cautionary Statement Regarding

Forward-Looking Statements” below.

In addition to the other assumptions and factors

described in this news release, our outlook assumes modest

improvement in steel prices consistent with the forward curve,

ongoing inflationary pressures on raw material inputs, labor, and

logistics costs, and the absence of material changes in our

industry or the global economy. The following statements supersede

all prior statements made by us and are based on current

expectations.

Based on our current information regarding our

operations and end markets, we currently expect the following for

the first quarter of fiscal 2025:

- Adjusted

EBITDA*: $30 million to $40 million

- Total steel

shipments: 500,000 to 510,000 tons

* See Non-IFRS Measures” below.

Conference Call and Webcast

Details

A webcast and conference call will be held on

Friday, June 21, 2024 at 11:00 a.m. EDT to review the Company’s

fiscal fourth quarter and full year results, discuss recent events,

and conduct a question-and-answer session.

The live webcast and archived replay of the

conference call can be accessed on the Investors section of the

Company’s website at www.algoma.com. For those unable to access the

webcast, the conference call will be accessible domestically or

internationally by dialing 877-425-9470 or 201-389-0878,

respectively. Upon dialing in, please request to join the Algoma

Steel Fourth Quarter Conference Call. To access the replay of the

call, dial 844-512-2921 (domestic) or 412-317-6671 (international)

with passcode 13746955.

Consolidated Financial Statements and

Management's Discussion and Analysis

The Company's audited consolidated financial

statements for the years ended March 31, 2024, and March 31, 2023,

and Management's Discussion & Analysis thereon are available as

part of the Company’s Annual Report on Form 40-F under the

Company’s profile on the U.S. Securities and Exchange Commission’s

(“SEC”) EDGAR website at www.sec.gov and under the Company's

profile on SEDAR+ at www.sedarplus.com. These documents, along with

the Company’s Annual Information Form, are also available on the

Company’s website, www.algoma.com, and shareholders may receive

hard copies of such documents free of charge upon request by

contacting IR@algoma.com.

Cautionary Statement Regarding

Forward-Looking Statements

This news release contains “forward-looking

information” under applicable Canadian securities legislation and

“forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 (collectively,

“forward-looking statements”), including statements regarding

fiscal 2025 first quarter total steel shipments and Adjusted

EBITDA, trends in the pricing of steel, Algoma’s expectation to

continue to pay a quarterly dividend, Algoma’s transition to EAF

steelmaking, including the progress, costs and timing of completion

of the Company’s EAF project and the Company’s expected annual raw

steel production capacity and reduction in carbon emissions

following completion of the EAF project, Algoma’s future as a

leading producer of green steel, the potential impacts of

inflationary pressures, labor availability, global supply chain

disruptions on costs, Algoma’s modernization of its plate mill

facilities (including annual plate capacity going forward),

transformation journey, ability to deliver greater and long-term

value, ability to offer North America a secure steel supply and a

sustainable future, and investment in its people, and processes,

and statements regarding the intended use of proceeds from the

Company’s credit facilities and from the Notes, and the Company’s

strategy, plans or future financial or operating performance. These

forward-looking statements generally are identified by the words

“believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “design,” “pipeline,”

“may,” “should,” “will,” “would,” “will be,” “will continue,” “will

likely result,” and similar expressions. Forward-looking statements

are predictions, projections and other statements about future

events that are based on current expectations and assumptions. Many

factors could cause actual future events to differ materially from

the forward-looking statements in this document. Readers should

also consider the other risks and uncertainties set forth in the

section entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Information” in Algoma’s Annual Information Form,

filed by Algoma with applicable Canadian securities regulatory

authorities (available under the company’s SEDAR+ profile at

www.sedarplus.com) and with the SEC, as part of Algoma’s Annual

Report on Form 40-F (available at www.sec.gov), as well as in

Algoma’s current reports with the Canadian securities regulatory

authorities and SEC. Forward-looking statements speak only as of

the date they are made. Readers are cautioned not to put undue

reliance on forward-looking statements, and Algoma assumes no

obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise.

Non-IFRS Financial

Measures

To supplement our financial statements, which

are prepared in accordance with International Financial Reporting

Standards as issued by the International Accounting Standards Board

(“IFRS”), we use certain non-IFRS measures to evaluate the

performance of Algoma. These terms do not have any standardized

meaning prescribed within IFRS and, therefore, may not be

comparable to similar measures presented by other companies.

Rather, these measures are provided as additional information to

complement those IFRS measures by providing a further understanding

of our financial performance from management’s perspective.

Accordingly, they should not be considered in isolation nor as a

substitute for analysis of our financial information reported under

IFRS.

Adjusted EBITDA, as we define it, refers to net

income (loss) before amortization of property, plant, equipment and

amortization of intangible assets, finance costs, interest on

pension and other post-employment benefit obligations, income

taxes, foreign exchange loss (gain), finance income, carbon tax,

changes in fair value of warrant, earnout and share-based

compensation liabilities, transaction costs, earnout and

share-based compensation liabilities, transaction costs, listing

expense, past service costs – pension, past service costs

–post-employment benefits and share-based compensation related to

performance share units. Adjusted EBITDA margin is calculated by

dividing Adjusted EBITDA by revenue for the corresponding period.

Adjusted EBITDA is not intended to represent cash flow from

operations, as defined by IFRS, and should not be considered as

alternatives to net profit (loss) from operations, or any other

measure of performance prescribed by IFRS. Adjusted EBITDA, as we

define and use it, may not be comparable to Adjusted EBITDA as

defined and used by other companies. We consider Adjusted EBITDA to

be a meaningful measure to assess our operating performance in

addition to IFRS measures. It is included because we believe it can

be useful in measuring our operating performance and our ability to

expand our business and provide management and investors with

additional information for comparison of our operating results

across different time periods and to the operating results of other

companies. Adjusted EBITDA is also used by analysts and our lenders

as a measure of our financial performance. In addition, we consider

Adjusted EBITDA margin to be a useful measure of our operating

performance and profitability across different time periods that

enhance the comparability of our results. However, these measures

have limitations as analytical tools and should not be considered

in isolation from, or as alternatives to, net income, cash flow

from operations or other data prepared in accordance with IFRS.

Because of these limitations, such measures should not be

considered as measures of discretionary cash available to invest in

business growth or to reduce indebtedness. We compensate for these

limitations by relying primarily on our IFRS results using such

measures only as supplements to such results. See the financial

tables below for a reconciliation of net income (loss) to Adjusted

EBITDA.

About Algoma Steel Group Inc.

Based in Sault Ste. Marie, Ontario, Canada,

Algoma is a fully integrated producer of hot and cold rolled steel

products including sheet and plate. Driven by a purpose to build

better lives and a greener future, Algoma is positioned to deliver

responsive, customer-driven product solutions to applications in

the automotive, construction, energy, defense, and manufacturing

sectors. Algoma is a key supplier of steel products to customers in

North America and is the only producer of discrete plate products

in Canada. Its state-of-the-art Direct Strip Production Complex

(“DSPC”) is one of the lowest-cost producers of hot rolled sheet

steel (HRC) in North America.

Algoma is on a transformation journey,

modernizing its plate mill and adopting electric arc technology

that builds on the strong principles of recycling and environmental

stewardship to significantly lower carbon emissions. Today Algoma

is investing in its people and processes, working safely, as a team

to become one of North America's leading producers of green

steel.

As a founding industry in their community,

Algoma is drawing on the best of its rich steelmaking tradition to

deliver greater value, offering North America the comfort of a

secure steel supply and a sustainable future as your partner in

steel.

| |

|

|

|

Algoma Steel Group Inc.Consolidated Statements of Financial

Position |

|

As at, |

March 31, 2024 |

|

March 31, 2023 |

|

expressed in millions of Canadian dollars |

|

|

|

Assets |

|

|

|

Current |

|

|

|

Cash |

$97.9 |

|

|

$247.4 |

|

|

Restricted cash |

|

3.9 |

|

|

|

3.9 |

|

|

Taxes receivable |

|

20.0 |

|

|

|

- |

|

|

Accounts receivable, net |

|

246.7 |

|

|

|

291.2 |

|

|

Inventories, net |

|

807.8 |

|

|

|

722.7 |

|

|

Prepaid expenses and deposits |

|

80.5 |

|

|

|

94.4 |

|

|

Other assets |

|

5.7 |

|

|

|

6.7 |

|

|

Total current assets |

$1,262.5 |

|

|

$1,366.3 |

|

|

Non-current |

|

|

|

Property, plant and equipment, net |

$1,405.2 |

|

|

$1,081.3 |

|

|

Intangible assets, net |

|

0.7 |

|

|

|

0.9 |

|

|

Other assets |

|

7.6 |

|

|

|

7.1 |

|

|

Total non-current assets |

$1,413.5 |

|

|

$1,089.3 |

|

|

Total assets |

$2,676.0 |

|

|

$2,455.6 |

|

|

Liabilities and Shareholders' Equity |

|

|

|

Current |

|

|

|

Bank indebtedness |

$0.3 |

|

|

$1.9 |

|

|

Accounts payable and accrued liabilities |

|

286.8 |

|

|

|

204.6 |

|

|

Taxes payable and accrued taxes |

|

30.1 |

|

|

|

14.4 |

|

|

Current portion of other long-term liabilities |

|

1.4 |

|

|

|

0.4 |

|

|

Current portion of governmental loans |

|

16.2 |

|

|

|

10.0 |

|

|

Current portion of environmental liabilities |

|

3.1 |

|

|

|

4.5 |

|

|

Warrant liability |

|

44.9 |

|

|

|

57.3 |

|

|

Earnout liability |

|

13.8 |

|

|

|

16.8 |

|

|

Share-based payment compensation liability |

|

31.9 |

|

|

|

33.5 |

|

|

Total current liabilities |

$428.5 |

|

|

$343.4 |

|

|

Non-current |

|

|

|

Long-term governmental loans |

$127.4 |

|

|

$110.4 |

|

|

Accrued pension liability |

|

238.0 |

|

|

|

184.0 |

|

|

Accrued other post-employment benefit obligation |

|

229.5 |

|

|

|

222.9 |

|

|

Other long-term liabilities |

|

17.0 |

|

|

|

3.7 |

|

|

Environmental liabilities |

|

35.2 |

|

|

|

32.3 |

|

|

Deferred income tax liabilities |

|

98.0 |

|

|

|

96.7 |

|

|

Total non-current liabilities |

$745.1 |

|

|

$650.0 |

|

|

Total liabilities |

$1,173.6 |

|

|

$993.4 |

|

|

Shareholders' equity |

|

|

|

Capital stock |

$963.9 |

|

|

$958.4 |

|

|

Accumulated other comprehensive income |

|

267.1 |

|

|

|

313.6 |

|

|

Retained earnings |

|

288.4 |

|

|

|

211.6 |

|

|

Contributed deficit |

|

(17.0 |

) |

|

|

(21.4 |

) |

|

Total shareholders' equity |

$1,502.4 |

|

|

$1,462.2 |

|

|

Total liabilities and shareholders' equity |

$2,676.0 |

|

|

$2,455.6 |

|

|

|

|

|

| |

|

|

| |

|

|

|

|

|

| Algoma Steel

Group Inc.Consolidated Statements of Net Income

(Loss) |

|

|

Three months ended March 31, |

|

Year ended March 31, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

expressed in millions of Canadian dollars, except for per share

amounts |

|

|

|

|

|

|

Revenue |

$620.6 |

|

|

$677.4 |

|

|

$2,795.8 |

|

|

$2,778.5 |

|

| |

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

Cost of sales |

$585.4 |

|

|

$630.7 |

|

|

$2,513.5 |

|

|

$2,388.7 |

|

|

Administrative and selling expenses |

|

32.1 |

|

|

|

25.0 |

|

|

|

115.0 |

|

|

|

99.3 |

|

|

Income from operations |

$3.1 |

|

|

$21.7 |

|

|

$167.3 |

|

|

$290.5 |

|

| |

|

|

|

|

|

|

Other (income) and expenses |

|

|

|

|

|

|

Finance income |

($1.2 |

) |

|

($2.9 |

) |

|

($10.0 |

) |

|

($13.3 |

) |

|

Finance costs |

|

9.7 |

|

|

|

4.9 |

|

|

|

25.6 |

|

|

|

17.9 |

|

|

Interest on pension and other post-employment benefit

obligations |

|

4.9 |

|

|

|

4.8 |

|

|

|

19.3 |

|

|

|

17.2 |

|

|

Foreign exchange (gain) loss |

|

(15.8 |

) |

|

|

0.1 |

|

|

|

(1.7 |

) |

|

|

(41.1 |

) |

|

Change in fair value of warrant liability |

|

(15.3 |

) |

|

|

19.4 |

|

|

|

(12.1 |

) |

|

|

(47.7 |

) |

|

Change in fair value of earnout liability |

|

(3.4 |

) |

|

|

3.5 |

|

|

|

0.1 |

|

|

|

(5.9 |

) |

|

Change in fair value of share-based compensation liability |

|

(4.8 |

) |

|

|

6.9 |

|

|

|

1.2 |

|

|

|

(12.7 |

) |

| |

($25.9 |

) |

|

$36.7 |

|

|

$22.4 |

|

|

($85.6 |

) |

|

Income (loss) before income taxes |

$29.0 |

|

|

($15.0 |

) |

|

$144.9 |

|

|

$376.1 |

|

|

Income tax expense |

|

1.0 |

|

|

|

5.4 |

|

|

|

39.7 |

|

|

|

77.6 |

|

|

Net income (loss) |

$28.0 |

|

|

($20.4 |

) |

|

$105.2 |

|

|

$298.5 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Net income (loss) per common share |

|

|

|

|

|

|

Basic |

$0.26 |

|

|

($0.19 |

) |

|

$0.97 |

|

|

$2.43 |

|

|

Diluted |

$0.10 |

|

|

($0.19 |

) |

|

$0.70 |

|

|

$1.71 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Algoma Steel

Group Inc.Consolidated Statements of Cash Flows |

|

|

Three months ended March 31, |

|

Year ended March 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

expressed in millions of Canadian dollars |

|

|

|

|

|

|

Operating activities |

|

|

|

|

|

|

Net income (loss) |

$28.0 |

|

|

($20.4 |

) |

|

$105.2 |

|

|

$298.5 |

|

|

Items not affecting cash: |

|

|

|

|

|

|

Depreciation of property, plant and equipment and intangible

assets |

|

34.8 |

|

|

|

25.6 |

|

|

|

115.0 |

|

|

|

95.3 |

|

|

Deferred income tax (benefit) expense |

|

(5.2 |

) |

|

|

(0.8 |

) |

|

|

1.2 |

|

|

|

(12.0 |

) |

|

Pension expense in excess of funding (pension funding in excess of

expense) |

|

(1.2 |

) |

|

|

1.3 |

|

|

|

(0.8 |

) |

|

|

49.6 |

|

|

Post-employment benefit funding in excess of expense |

|

(2.1 |

) |

|

|

(1.4 |

) |

|

|

(7.5 |

) |

|

|

(4.0 |

) |

|

Unrealized foreign exchange gain (loss) on: |

|

|

|

|

|

|

accrued pension liability |

|

(5.7 |

) |

|

|

(0.3 |

) |

|

|

(0.9 |

) |

|

|

(14.2 |

) |

|

post-employment benefit obligations |

|

(5.8 |

) |

|

|

0.2 |

|

|

|

(0.7 |

) |

|

|

(17.7 |

) |

|

Finance costs |

|

9.3 |

|

|

|

4.9 |

|

|

|

25.2 |

|

|

|

17.9 |

|

|

Loss on disposal of property, plant and equipment |

|

0.5 |

|

|

|

0.1 |

|

|

|

0.5 |

|

|

|

0.1 |

|

|

Interest on pension and other post-employment benefit

obligations |

|

4.9 |

|

|

|

4.8 |

|

|

|

19.3 |

|

|

|

17.2 |

|

|

Interest on finance lease |

|

0.3 |

|

|

|

0.1 |

|

|

|

0.4 |

|

|

|

0.1 |

|

|

Accretion of governmental loans and environmental liabilities |

|

7.8 |

|

|

|

3.3 |

|

|

|

19.2 |

|

|

|

13.0 |

|

|

Unrealized foreign exchange (gain) loss on government loan

facilities |

|

(3.4 |

) |

|

|

0.4 |

|

|

|

(0.7 |

) |

|

|

(7.6 |

) |

|

(Decrease) increase in fair value of warrant liability |

|

(15.3 |

) |

|

|

19.4 |

|

|

|

(12.1 |

) |

|

|

(47.7 |

) |

|

(Decrease) increase in fair value of earnout liability |

|

(3.4 |

) |

|

|

3.5 |

|

|

|

0.1 |

|

|

|

(5.9 |

) |

|

(Decrease) increase in fair value of share-based payment

compensation liability |

|

(4.8 |

) |

|

|

6.9 |

|

|

|

1.2 |

|

|

|

(12.7 |

) |

|

Other |

|

(0.9 |

) |

|

|

(4.5 |

) |

|

|

4.7 |

|

|

|

(7.6 |

) |

|

|

$37.8 |

|

|

$43.1 |

|

|

$269.3 |

|

|

$362.3 |

|

|

Net change in non-cash operating working capital |

|

84.1 |

|

|

|

52.3 |

|

|

|

33.1 |

|

|

|

(178.7 |

) |

|

Share-based payment compensation and earnout units settled |

|

- |

|

|

|

- |

|

|

|

(2.5 |

) |

|

|

(4.6 |

) |

|

Environmental liabilities paid |

|

(0.7 |

) |

|

|

- |

|

|

|

(5.0 |

) |

|

|

(1.7 |

) |

|

Cash generated by operating activities |

$121.2 |

|

|

$95.4 |

|

|

$294.9 |

|

|

$177.3 |

|

|

Investing activities |

|

|

|

|

|

|

Acquisition of property, plant and equipment |

($120.4 |

) |

|

($103.4 |

) |

|

($490.1 |

) |

|

($371.1 |

) |

|

Cash used in investing activities |

($120.4 |

) |

|

($103.4 |

) |

|

($490.1 |

) |

|

($371.1 |

) |

|

Financing activities |

|

|

|

|

|

|

Bank indebtedness (repaid) advanced, net |

($5.1 |

) |

|

($10.5 |

) |

|

($1.7 |

) |

|

$1.8 |

|

|

Transaction costs on bank indebtedness |

|

- |

|

|

|

- |

|

|

|

(1.7 |

) |

|

|

|

Governmental loans received |

|

15.5 |

|

|

|

33.1 |

|

|

|

74.8 |

|

|

|

63.3 |

|

|

Repayment of governmental loans |

|

(2.5 |

) |

|

|

(2.5 |

) |

|

|

(10.0 |

) |

|

|

(10.0 |

) |

|

Interest paid |

|

(0.1 |

) |

|

|

(0.1 |

) |

|

|

(0.3 |

) |

|

|

(0.2 |

) |

|

Dividends paid |

|

(7.1 |

) |

|

|

(7.1 |

) |

|

|

(27.9 |

) |

|

|

(30.7 |

) |

|

Common shares repurchased and cancelled |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(553.2 |

) |

|

Other |

|

(0.4 |

) |

|

|

(0.3 |

) |

|

|

11.2 |

|

|

|

(3.0 |

) |

|

Cash generated by (used in) financing

activities |

$0.3 |

|

|

$12.6 |

|

|

$44.4 |

|

|

($532.0 |

) |

|

Effect of exchange rate changes on cash |

$2.1 |

|

|

($1.9 |

) |

|

$1.3 |

|

|

$57.9 |

|

|

Cash |

|

|

|

|

|

|

Increase (decrease) in cash |

|

3.2 |

|

|

|

2.7 |

|

|

|

(149.5 |

) |

|

|

(667.9 |

) |

|

Opening balance |

|

94.7 |

|

|

|

244.7 |

|

|

|

247.4 |

|

|

|

915.3 |

|

|

Ending balance |

$97.9 |

|

|

$247.4 |

|

|

$97.9 |

|

|

$247.4 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Algoma Steel

Group Inc.Reconciliation of Net Income (Loss) to Adjusted

EBITDA |

|

|

Three months ended March 31, |

|

Year ended March 31, |

|

millions of dollars |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Net income

(loss) |

$28.0 |

|

|

($20.4 |

) |

|

$105.2 |

|

|

$298.5 |

|

| |

|

|

|

|

|

|

Depreciation of property, plant and equipment and amortization of

intangible assets |

|

34.8 |

|

|

|

25.6 |

|

|

|

115.0 |

|

|

|

95.3 |

|

|

Finance costs |

|

9.6 |

|

|

|

4.9 |

|

|

|

25.6 |

|

|

|

17.9 |

|

|

Interest on pension and other post-employment benefit

obligations |

|

4.9 |

|

|

|

4.8 |

|

|

|

19.3 |

|

|

|

17.2 |

|

|

Income taxes |

|

1.0 |

|

|

|

5.4 |

|

|

|

39.7 |

|

|

|

77.6 |

|

|

Foreign exchange (gain) loss |

|

(15.8 |

) |

|

|

0.1 |

|

|

|

(1.7 |

) |

|

|

(41.1 |

) |

|

Finance income |

|

(1.2 |

) |

|

|

(2.9 |

) |

|

|

(10.0 |

) |

|

|

(13.3 |

) |

|

Inventory write-downs(depreciation on property, plant and equipment

in inventory) |

|

(3.9 |

) |

|

|

(3.8 |

) |

|

|

(0.5 |

) |

|

|

1.1 |

|

|

Carbon tax |

|

6.4 |

|

|

|

2.9 |

|

|

|

24.6 |

|

|

|

7.2 |

|

|

(Decrease) increase in fair value of warrant liability |

|

(15.3 |

) |

|

|

19.4 |

|

|

|

(12.1 |

) |

|

|

(47.7 |

) |

|

(Decrease) increase in fair value of earnout liability |

|

(3.4 |

) |

|

|

3.5 |

|

|

|

0.1 |

|

|

|

(5.9 |

) |

|

(Decrease) increase in fair value of share-based payment

compensation liability |

|

(4.8 |

) |

|

|

6.9 |

|

|

|

1.2 |

|

|

|

(12.7 |

) |

|

Share-based compensation |

|

1.2 |

|

|

|

1.5 |

|

|

|

6.3 |

|

|

|

4.9 |

|

|

Past service costs - pension benefits |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

49.5 |

|

|

Past service costs - post-employment benefits |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3.8 |

|

|

Adjusted EBITDA (i) |

$41.5 |

|

|

$47.9 |

|

|

$312.7 |

|

|

$452.3 |

|

| Net

Income (Loss) Margin |

|

4.5% |

|

|

|

(3.0% |

) |

|

|

3.8% |

|

|

|

10.7% |

|

| Net

Income (Loss) / ton |

$62.1 |

|

|

($35.7 |

) |

|

$50.4 |

|

|

$149.0 |

|

|

Adjusted EBITDA Margin (ii) |

|

6.7% |

|

|

|

7.1% |

|

|

|

11.2% |

|

|

|

16.3% |

|

|

Adjusted EBITDA / ton |

$92.0 |

|

|

$83.8 |

|

|

$149.9 |

|

|

$225.9 |

|

|

|

|

|

|

|

|

| (i) See "Non-IFRS

Financial Measures" in this Press Release for information regarding

the limitations of using Adjusted EBITDA. |

| (ii) Adjusted EBITDA

Margin is Adjusted EBITDA as a percentage of revenue. |

| |

For more information, please contact:

Michael MoracaTreasurer & Investor

Relations OfficerAlgoma Steel Group Inc.Phone:

705.945.3300E-mail: IR@algoma.com

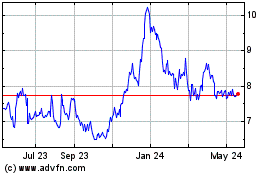

Algoma Steel (NASDAQ:ASTL)

Historical Stock Chart

From Feb 2025 to Mar 2025

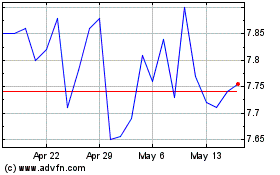

Algoma Steel (NASDAQ:ASTL)

Historical Stock Chart

From Mar 2024 to Mar 2025