As filed with the Securities and Exchange Commission on November 15, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Alphatec Holdings, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

Delaware |

1950 Camino Vida Roble Carlsbad, CA 92008 (760) 431-9286 |

20-2463898 |

(State or other jurisdiction of incorporation or organization) |

(Address of Principal Executive Offices

including Zip Code) |

(I.R.S. Employer Identification No.) |

Patrick S. Miles

Chief Executive Officer

Alphatec Holdings, Inc.

1950 Camino Vida Roble

Carlsbad, CA 92008

(760) 431-9286

(Name, address, including ZIP code, and telephone number, including area code, of agent for service)

Copies to:

Joshua E. Little, Esq.

Dentons Durham Jones Pinegar P.C.

192 E. 200 N., Third Floor

St. George, Utah 84770

(435) 674-0400

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective on filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

Large accelerated filer |

☒ |

Accelerated filer |

☐ |

|

|

|

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

|

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated November 15, 2024.

PRELIMINARY PROSPECTUS

1,133,160 Shares of Common Stock Issuable Upon Exercise of Warrant

This prospectus relates to the offer and resale from time to time by the selling stockholder named in this prospectus of up to 1,133,160 shares (the “Warrant Shares”) of common stock, par value $0.0001 per share, of Alphatec Holdings, Inc., a Delaware corporation, that may be issued upon exercise of a warrant to purchase Common Stock (the “Warrant”) that we issued and sold to the selling stockholder on November 8, 2024 pursuant to the terms of a court order entered by the Delaware Chancery Court.

We are not offering any shares of our common stock for sale under this prospectus. We will receive the proceeds from any exercise of the Warrant for cash. The Warrant entitles the selling stockholder to purchase up to 1,133,160 shares of our common stock at an exercise price of $2.17 per share.

We will bear all costs, expenses, and fees in connection with the registration of the Warrant Shares. The selling stockholder will bear all commissions and discounts, if any, attributable to its sale of the Warrant Shares. Our registration of the Warrant Shares covered by this prospectus does not mean that the selling stockholder will offer or sell any of the Warrant Shares.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should carefully read this prospectus and any prospectus supplement or amendment before you invest. You should read the documents we have referred you to in the “Where You Can Find More Information” and the “Information Incorporated by Reference” sections of this prospectus for information about us and our financial statements.

Investing in our securities involves risks. See the “Risk Factors” beginning on page 2 of this prospectus and any similar section contained in the applicable prospectus supplement or the documents incorporated herein or therein by reference concerning factors you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 15, 2024.

TABLE OF CONTENTS

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The selling stockholder is not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information in this registration statement or any related prospectus, including any information incorporated herein by reference, is accurate as of any date other than the date on the front of the applicable document, or such earlier date as is expressly stated or otherwise apparent with respect to such incorporated information in the applicable document, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since any such date.

The terms “we,” “us,” “our” and the “company,” as used in this prospectus, refer to Alphatec Holdings, Inc., unless otherwise indicated.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this prospectus and in the documents incorporated by reference constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”). We use words like “anticipates,” “believes,” “plans,” “expects,” “future,” “intends,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing,” “estimates” and similar expressions to identify these forward-looking statements.

You should not place undue reliance on our forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. However, our actual results could differ materially from those anticipated in these forward-looking statements as a result of numerous risks and uncertainties that are beyond our control, including those we discuss in “Risk Factors,” the information incorporated therein by reference and elsewhere in this prospectus and in the documents incorporated by reference in this prospectus. The information in this prospectus speaks only as of the date of this prospectus and the information incorporated herein by reference speaks only as of its date. Except as required by law, we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise. You should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and in the documents incorporated by reference. This summary does not contain all the information that you should consider before investing in our common stock. You should read this entire prospectus, including all documents incorporated by reference, carefully, especially “Risk Factors” and our consolidated financial statements and related notes incorporated by reference herein. Please see the section entitled “Where You Can Find More Information” on page 7 of this prospectus.

Our Business

We are a medical technology company focused on the design, development, and advancement of technology for better surgical treatment of spinal disorders. We are dedicated to revolutionizing the approach to spine surgery. We have a broad product portfolio designed to address the majority of U.S. market for fusion-based spinal disorder solutions. We intend to drive growth by exploiting our collective spine experience and investing in research and development to continually differentiate our solutions and improve spine surgery. We believe our future success will be fueled by introducing market-shifting innovation to the spine market, and we believe that we are well-positioned to capitalize on current spine market dynamics.

We market and sell our products in the U.S. through a network of independent distributors and direct sales representatives. An objective of our leadership team is to deliver increasingly consistent, predictable growth. To accomplish this, we have partnered more closely with new and existing distributors to create a more dedicated and loyal sales channel for the future. We have added, and intend to continue to add, new high-quality dedicated distributors to expand future growth. We believe this will allow us to reach an untapped market of surgeons, hospitals, and national accounts across the U.S., as well as better penetrate existing accounts and territories.

We have made significant progress in the transition of our sales channel since early 2017. Going forward, we intend to continue to relentlessly drive toward a fully exclusive network of independent and direct sales agents. Recent consolidation in the industry is facilitating the process, as large seasoned agents are seeking opportunities to re-enter the spine market by partnering with spine-focused companies that have broad, growing product portfolios.

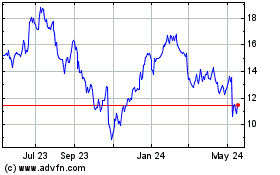

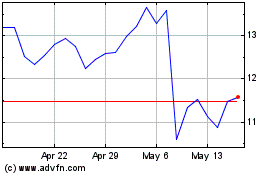

Corporate Information

We are a Delaware corporation incorporated in March 2005. Our common stock trades on the NASDAQ Global Select Market under the symbol “ATEC.” principal executive office is located at 1950 Camino Vida Roble, Carlsbad, California 92008. Our telephone number is (760) 431-9286, and our internet website is located at https://atecspine.com/. The information on our website is not incorporated by reference into this prospectus nor is it part of this prospectus. See the section entitled “Where You Can Find More Information” on page 7 of this prospectus.

The Offering

This prospectus covers up to 1,133,160 shares of common stock issuable upon exercise of the Warrant that we issued to the selling stockholder on November 8, 2024 pursuant to the terms of a court order entered by the Delaware Chancery Court on September 27, 2024. The Warrant is exercisable for an aggregate of 1,133,160 shares of our common stock at an exercise price of $2.17 per share. The Warrant is exercisable through June 21, 2026.

The order of the Delaware Chancery Court also requires that we file a registration statement, within five (5) business days of the issuance of the Warrant, of which this prospectus is a part, to register for resale the Warrant Shares that may be issued upon exercise of the Warrant.

We will not receive any proceeds from the sale of the Warrant Shares by the selling stockholder. See “Use of Proceeds” on page 3 of this prospectus.

RISK FACTORS

Before deciding to purchase, hold or sell our common stock, you should carefully consider the risks, cautionary statements and other information contained in this prospectus and in our other filings with the Securities and Exchange Commission (the “SEC”) that we incorporate by reference, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2024, June 30, 2024 and September 30, 2024 and other documents that we file with the SEC. The risks

and uncertainties described in these documents are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business. If any of these known or unknown risks or uncertainties actually occurs with material adverse effects on our company, our business, financial condition, results of operation and/or liquidity could be seriously harmed. In that event, the market price for our common stock will likely decline, and you may lose all or part of your investment.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We have elected to “incorporate by reference” certain information into this prospectus. By incorporating by reference, we can disclose important information to you by referring you to another document we have filed with the SEC. The information incorporated by reference is deemed to be part of this prospectus, except for information incorporated by reference that is superseded by information contained in this prospectus. This prospectus incorporates by reference the documents set forth below that we have previously filed with the SEC:

•Our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the SEC on February 27, 2024;

•Our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2024, June 30, 2024 and September 30, 2024 filed with the SEC on May 7, 2024, July 31, 2024 and October 30, 2024, respectively;

•Our Current Reports on Form 8-K filed with the SEC on January 8, 2024, February 27, 2024, March 19, 2024, May 7, 2024, June 17, 2024 and July 31, 2024 and October 30, 2024; and

•The description of our common stock contained in our Registration Statement on Form 8-A filed pursuant to Section 12(b) of the Exchange Act as filed with the SEC on May 26, 2006, as updated by Exhibit 4.15 to our Annual Report on Form 10-K for the year ended December 31, 2020 and including any other amendments or reports filed for the purpose of updating such description.

Certain Current Reports on Form 8-K dated both prior to and after the date of this prospectus are or will be furnished to the SEC and shall not be deemed “filed” with the SEC and will not be incorporated by reference into this prospectus. However, all other reports and documents filed by us after the date of this prospectus under Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), prior to the termination of the offering of the securities covered by this prospectus will also be deemed incorporated by reference in this prospectus and considered to be part of this prospectus from the date those documents are filed.

You should read the information relating to us in this prospectus together with the information in the documents incorporated by reference.

You may obtain a copy of any of the above-referenced documents, at no cost, from our website at https://atecspine.com/. The information contained in, or that can be accessed through, our website is not part of this prospectus. We will also furnish without charge to you, on written or oral request, a copy of any or all of the documents incorporated by reference, including exhibits to these documents. You should direct your requests for documents to:

Alphatec Holdings, Inc.

Attn: Corporate Secretary

1950 Camino Vida Roble

Carlsbad, CA 92008

(760) 431-9286

USE OF PROCEEDS

We will not receive any proceeds from the sale or other disposition of the shares of common stock or interests therein offered by this prospectus. We will issue an aggregate of 1,133,160 shares of common stock, subject to adjustment, potentially offered by this prospectus only upon the exercise of the Warrant by the selling stockholder. If the selling stockholder exercises all of the Warrant for cash, we would receive proceeds of approximately $2.5 million. There can be no assurance that the selling stockholder will exercise any of the Warrant, or, if exercised, that any of the underlying shares of common stock will be sold under this prospectus.

DESCRIPTION OF CAPITAL STOCK

The following description summarizes the material terms of our common stock. This summary is qualified by reference to our articles of incorporation and bylaws, which are filed or incorporated by reference as exhibits to the registration statement of which this prospectus forms a part, and by the provisions of applicable law.

As of November 13, 2024, we had 200,000,000 shares of common stock, $0.0001 par value per share, authorized of which 141,815,115 shares are issued and outstanding. In addition to the descriptions set forth below, please refer to our other publicly filed documents incorporated herein by reference, which describe our other outstanding preferred stock, warrants, registration rights, equity incentive plans and other securities.

Subject to any special voting rights of any series of preferred stock that we may issue in the future, each share held of record of our common stock has one vote on all matters voted on by our stockholders, including the election of our directors. Because holders of our common stock do not have cumulative voting rights, the holders of a majority of the shares of our common stock can elect all of the members of the Board of Directors standing for election, subject to the rights, powers and preferences of any outstanding series of preferred stock.

No share of common stock affords any preemptive rights or is convertible, redeemable, assessable or entitled to the benefits of any sinking or repurchase fund. Holders of our common stock are entitled to receive dividends when, as and if declared by the Board of Directors out of funds legally available therefor, subject to any dividend preferences of any outstanding shares of preferred stock. Holders of our common stock will share equally in our assets on liquidation after payment or provision for all liabilities and any preferential liquidation rights of any preferred stock then outstanding. All outstanding shares of our common stock are fully paid and non-assessable. Our common stock is traded on Nasdaq under the symbol “ATEC.”

Transfer Agent and Registrar

The transfer agent and registrar for our Common Stock is Computershare, Inc., with a mailing address of 480 Washington Ave., Jersey City, NJ 07310.

SELLING STOCKHOLDER

The shares of common stock being offered by the selling stockholder are those issuable to the selling stockholder, upon exercise of the Warrant held by the selling stockholder. We are registering the shares of common stock issuable upon exercise of the Warrant held by the selling stockholder in order to permit the selling stockholder to offer the shares for resale from time to time.

The table below lists the selling stockholder and other information regarding the beneficial ownership of the shares of our common stock by the selling stockholder. The second column lists the number of shares of our common stock beneficially owned by the selling stockholder, based on its ownership of the shares of our common stock, as of November 13, 2024, assuming exercise of the Warrant held by the selling stockholder on that date, without regard to any limitations on exercise. The third column lists the shares of common stock being offered by this prospectus by the selling stockholder. The fourth column assumes the sale of all of the Warrant Shares offered by the selling stockholder pursuant to this prospectus.

This prospectus covers the resale of the sum of the maximum number of shares of common stock issuable upon exercise of the Warrant, determined as if the Warrant were exercised in full as of the trading day immediately preceding the date this registration statement was initially filed with the SEC, and subject to adjustment as provided in the Warrant, without regard to any limitations on the exercise of the Warrant.

Under the terms of the Warrant, the selling stockholder may not exercise the Warrant to the extent such conversion or exercise would cause such selling stockholder, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which would exceed 4.99% of our then outstanding common stock following such exercise, excluding for purposes of such determination shares of common stock issuable upon exercise of the Warrant which has not been exercised. The number of shares in the second column does not reflect this limitation. The selling stockholder may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

The selling stockholder if affiliated with a registered broker-dealer purchased the securities offered hereby in the ordinary course of business and does not have any agreement or understandings, directly or indirectly, to distribute the shares offered by this prospectus.

|

|

|

|

|

Name of Selling Stockholder |

Number of Shares of Common Stock Owned Prior to the Offering |

Percentage of Shares Beneficially Owned Prior to the Offering |

Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus |

Number of Shares of Common Stock Owned After Offering |

L-5 Healthcare Partners, LLC c/o LS Power Development, LLC 1700 Broadway, 35th Floor New York, NY 10019 |

10,714,698(1) |

7.50% |

1,133,160 |

10,714,698 |

(1)Represents 9,581,538 shares of common stock and 1,133,160 Warrant Shares. L-5 Healthcare Partners, LLC and Paul Segal have shared voting and dispositive power over all of these shares.

PLAN OF DISTRIBUTION

Securities Offered by the Selling Stockholder

The selling stockholder and any of its pledgees, assignees and successors-in-interest may, from time to time, sell any or all of the shares of common stock issuable upon exercise of the Warrant on the principal trading market for our common stock or any other stock exchange, market or trading facility on which our common stock is traded or in private transactions. These sales may be at fixed or negotiated prices. The selling stockholder may use any one or more of the following methods when selling the Warrant Shares:

•ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

•block trades in which the broker-dealer will attempt to sell the Warrant Shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

•an exchange distribution in accordance with the rules of the applicable exchange;

•privately negotiated transactions;

•settlement of short sales;

•in transactions through broker-dealers that agree with the selling stockholder to sell a specified number of such Warrant Shares at a stipulated price per security;

•through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•a combination of any such methods of sale; or

•any other methods permitted pursuant to applicable law.

The selling stockholder may also sell Warrant Shares under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this prospectus.

If requested by the selling stockholder, if the selling stockholder notifies us that a donee, pledgee, transferee or other successor-in-interest of the selling stockholder intends to sell any shares of common stock covered by this prospectus, we will file an amendment to the registration statement of which this prospectus forms a part of or a supplement to this prospectus, if required.

Broker-dealers engaged by the selling stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholder (or, if any broker-dealer acts as agent for the purchaser of Warrant Shares, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with FINRA IM-2440.

The selling stockholder may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or

secured parties may offer and sell shares of common stock from time to time under this prospectus, or under a supplement or amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus.

The selling stockholder may elect to make an in-kind distribution of shares of common stock covered by this prospectus to its members, general or limited partners or shareholders pursuant to the registration statement of which this prospectus is a part by delivering a prospectus. To the extent that such members, general or limited partners or shareholders are not affiliates of ours, such members, partners or shareholders would thereby receive freely tradable shares of common stock pursuant to the distribution through a registration statement. Additionally, to the extent that entities, members, partners or shareholders are affiliates of ours received shares in any such distribution, such affiliates will also be selling stockholders and will be entitled to sell such shares pursuant to this prospectus.

Upon being notified in writing by the selling stockholder that any material arrangement has been entered into with a broker-dealer for the sale of common stock through a block trade, special offering, exchange distribution or secondary distribution or a purchase by a broker or dealer, we will file a supplement to this prospectus, if required, pursuant to Rule 424(b) under the Securities Act, disclosing (i) the name of the selling stockholder and of the participating broker-dealer(s), (ii) the number of shares involved, (iii) the price at which such shares of common stock were sold, (iv) the commissions paid or discounts or concessions allowed to such broker-dealer(s), where applicable, (v) that such broker-dealer(s) did not conduct any investigation to verify the information set out or incorporated by reference in this prospectus, and (vi) other facts material to the transaction. In addition, upon being notified in writing by the selling stockholder that a donee or pledgee intends to sell more than 500 shares of common stock, we will file a supplement to this prospectus if then required in accordance with applicable securities law.

In connection with the sale of the Warrant Shares or interests therein, the selling stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the Warrant Shares in the course of hedging the positions they assume. The selling stockholder may also sell Warrant Shares short and deliver Warrant Shares to close out their short positions, or loan or pledge the Warrant Shares to broker-dealers that in turn may sell the Warrant Shares. The selling stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholder and any broker-dealers or agents that are involved in selling the Warrant Shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the Warrant Shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. The selling stockholder has informed us that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the Warrant Shares.

Pursuant to the terms of a registration rights agreement, we are required to pay certain fees and expenses we incur incident to the registration of the Warrant Shares. We have agreed to indemnify the selling stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus continuously effective until the (i) the date on which the Warrant Shares may be resold by the selling stockholder without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for us to be in compliance with the current public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the Warrant Shares have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the Warrant Shares may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling stockholder will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the selling stockholder or any other person. We will make copies of this prospectus available to the selling stockholder and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

The validity of our common stock offered hereby will be passed upon for us by Dentons Durham Jones & Pinegar P.C., St. George, Utah.

EXPERTS

The financial statements of Alphatec Holdings, Inc. as of December 31, 2023 and 2022, and for each of the three years in the period ended December 31, 2023, incorporated by reference in this Prospectus, and the effectiveness of Alphatec Holdings Inc.’s internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports. Such financial statements are incorporated by reference in reliance upon the reports of such firm given their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the shares of common stock being offered by this prospectus. Certain information in the registration statement has been omitted from this prospectus in accordance with the rules and regulations of the SEC. For further information with respect to the company and the common stock offered by this prospectus, we refer you to the registration statement and its exhibits. Statements contained in this prospectus as to the contents of any contract or any other document referred to are not necessarily complete, and in each instance, we refer you to the copy of the contract or other document filed as an exhibit to the registration statement. Each of these statements is qualified in all respects by this reference.

We electronically file annual, quarterly and special reports, proxy and information statements and other information with the SEC. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including Alphatec Holdings, Inc. The address of that website is www.sec.gov.

Part II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table lists the costs and expenses payable by the registrant in connection with the sale of the common stock covered by this prospectus other than any sales commissions or discounts, which expenses will be paid by the selling stockholder. All amounts shown are estimates except for the SEC registration fee.

|

|

Commission Registration Fee |

$1,658.53 |

Printing and Related Fees |

* |

Legal Fees and Expenses |

* |

Accounting Fees and Expenses |

* |

Miscellaneous Fees and Expenses |

* |

Total |

$* |

* Estimated expenses not presently known.

Item 15. Indemnification of Directors and Officers.

Subsection (a) of Section 145 of the General Corporation Law of the State of Delaware (the “DGCL”), empowers a corporation to indemnify any person who was or is a party or who is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful.

Subsection (b) of Section 145 empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that the person acted in any of the capacities set forth above, against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection with the defense or settlement of such action or suit if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper. Section 145 further provides that to the extent a director or officer of a corporation has been successful on the merits or otherwise in the defense of any action, suit or proceeding referred to in subsections (a) and (b) of Section 145, or in defense of any claim, issue or matter therein, such person shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection therewith; that indemnification provided for by Section 145 shall not be deemed exclusive of any other rights to which the indemnified party may be entitled; and the indemnification provided for by Section 145 shall, unless otherwise provided when authorized or ratified, continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of such person’s heirs, executors and administrators. Section 145 also empowers the corporation to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against such person and incurred by such person in any such capacity, or arising out of his status as such, whether or not the corporation would have the power to indemnify such person against such liabilities under Section 145.

Section 102(b)(7) of the DGCL provides that a corporation’s certificate of incorporation may contain a provision eliminating or limiting the personal liability of a director to the corporation or its stockholders for monetary damages

for breach of fiduciary duty as a director, provided that such provision shall not eliminate or limit the liability of a director (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the DGCL, or (iv) for any transaction from which the director derived an improper personal benefit.

Our amended and restated certificate of incorporation provides that we shall indemnify, to the fullest extent authorized by the DGCL, each person who is involved in any litigation or other proceeding because such person is or was our director or officer or is or was serving as an officer or director of another entity at our request, against all expense, loss or liability reasonably incurred or suffered in connection therewith. Our amended and restated certificate of incorporation provides that the right to indemnification includes the right to be paid expenses incurred in defending any proceeding in advance of its final disposition, provided, however, that such advance payment will only be made upon delivery to us of an undertaking, by or on behalf of the director or officer, to repay all amounts so advanced if it is ultimately determined that such director is not entitled to indemnification. If we do not pay a proper claim for indemnification in full within 60 days after we receive a written claim for such indemnification, our amended and restated certificate of incorporation and our restated by-laws authorize the claimant to bring an action against us and prescribe what constitutes a defense to such action.

As permitted by Section 145 of the DGCL, we carry insurance policies insuring our directors and officers against certain liabilities that they may incur in their capacity as directors and officers.

We have entered into indemnification agreements with all of our directors. The indemnification agreements require us to indemnify these individuals to the fullest extent permitted by Delaware law and to advance expenses incurred by them in connection with any proceeding against them with respect to which they may be entitled to indemnification by us.

Item 16. Exhibits.

|

|

Exhibit Number |

Description of Document |

4.1 |

Warrant dated November 8, 2024 |

5.1 |

Opinion of Dentons Durham Jones Pinegar P.C. |

23.1 |

Consent of Deloitte & Touche LLP, Independent Registered Public Accounting Firm |

23.2 |

Consent of Dentons Durham Jones Pinegar P.C. (included in Exhibit 5.1.) |

24.1 |

Power of Attorney. Included on signature page. |

107 |

Registration Fee Table |

Item 17. Undertakings.

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the registration statement is on Form S-3 or Form F-3 and the information required to be included in a

post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act to any purchaser:

(i) If the registrant is relying on Rule 430B (§230.430B of this chapter):

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 4115(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or

(ii) If the registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness; provided, however, that no statement made in the registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant's annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act (and, where applicable, each filing of an employee benefit plan's annual report pursuant to section 15(d) of the Securities Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Carlsbad, State of California, on the 15th day of November, 2024.

|

|

ALPHATEC HOLDINGS, INC. |

|

|

By: |

/s/ Patrick S. Miles |

|

Patrick S. Miles |

|

Chief Executive Officer |

KNOW ALL BY THESE PRESENTS, that each person whose signature appears below hereby severally constitutes and appoints each of Patrick S. Miles and J. Todd Koning, and each of them singly, as such person’s true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for such person and in such person’s name, place and stead, in any and all capacities, to sign any or all amendments (including, without limitation, post-effective amendments) to this registration statement (or any registration statement for the same offering that is to be effective upon filing pursuant to Rule 462(b) under the Securities Act of 1933), and to file the same, with all exhibits thereto, and all documents in connection therewith, with the Securities and Exchange Commission, granting unto each said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as such person might or could do in person, hereby ratifying and confirming all that any said attorney-in-fact and agent, or any substitute or substitutes of any of them, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

|

Signature |

|

Title(s) |

|

Date |

/s/Patrick S. Miles |

|

Chairman and Chief Executive Officer |

|

November 15, 2024 |

Patrick S. Miles |

|

(Principal Executive Officer) |

|

|

|

|

|

|

|

/s/J. Todd Koning |

|

EVP and Chief Financial Officer |

|

November 15, 2024 |

J. Todd Koning |

|

(Principal Financial Officer and Principal Accounting Officer) |

|

|

|

|

|

|

|

/s/Evan Bakst |

|

Director |

|

November 15, 2024 |

Evan Bakst |

|

|

|

|

|

|

|

|

|

/s/Mortimer Berkowitz III |

|

Director |

|

November 15, 2024 |

Mortimer Berkowitz III |

|

|

|

|

|

|

|

|

|

/s/Quentin Blackford |

|

Director |

|

November 15, 2024 |

Quentin Blackford |

|

|

|

|

|

|

|

|

|

/s/Dave Demski |

|

Director |

|

November 15, 2024 |

Dave Demski |

|

|

|

|

|

|

|

|

|

/s/Karen K. McGinnis |

|

Director |

|

November 15, 2024 |

Karen K. McGinnis |

|

|

|

|

|

|

|

|

|

/s/David R. Pelizzon |

|

Director |

|

November 15, 2024 |

David R. Pelizzon |

|

|

|

|

|

|

|

|

|

/s/Jeffrey P. Rydin |

|

Director |

|

November 15, 2024 |

Jeffrey P. Rydin |

|

|

|

|

|

|

|

|

|

/s/Keith Valentine |

|

Director |

|

November 15, 2024 |

Keith Valentine |

|

|

|

|

|

|

|

|

|

/s/Ward W. Woods |

|

Director |

|

November 15, 2024 |

Ward W. Woods |

|

|

|

|

EXHIBIT INDEX

NEITHER THIS SECURITY NOR THE SECURITIES FOR WHICH THIS SECURITY IS EXERCISABLE HAVE BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS. THIS SECURITY AND THE SECURITIES ISSUABLE UPON EXERCISE OF THIS SECURITY MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN SECURED BY SUCH SECURITIES.

COMMON STOCK PURCHASE WARRANT

ALPHATEC HOLDINGS, inc.

Warrant Shares: 1,133,160 Issue Date: November 8, 2024

THIS COMMON STOCK PURCHASE WARRANT (the “Warrant”) certifies that, for value received, L-5 Healthcare Partners, LLC, a Delaware limited liability company or its assigns (the “Holder”) is entitled, upon the terms and subject to the limitations on exercise and the conditions hereinafter set forth, at any time on or after November 8, 2024 (the “Initial Exercise Date”) and on or prior to the close of business on August 5, 2026 (the “Termination Date”), but not thereafter, to subscribe for and purchase from Alphatec Holdings, Inc., a Delaware corporation (the “Company”), up to 1,133,160 shares (as subject to adjustment hereunder, the “Warrant Shares”) of Common Stock. The purchase price of one share of Common Stock under this Warrant shall be equal to the Exercise Price, as defined in Section 2(b).

Section 1. Definitions. As used in this Warrant, the following terms have the respective meaning set forth below:

“Affiliate” means any Person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control with a Person, as such terms are used in and construed under Rule 405 under the Securities Act.

“Common Stock” means the common stock of the Company, par value $0.0001 per share, and any other class of securities into which such securities may hereafter be reclassified or changed.

“Common Stock Equivalents” means any securities of the Company or the subsidiaries which would entitle the holder thereof to acquire at any time Common Stock, including, without limitation, any debt, preferred stock, right, option, warrant or other instrument that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

“Common Stock Deemed Outstanding” means, at any given time, the sum of (a) the number of shares of Common Stock actually outstanding at such time, plus (b) the number of shares of Common Stock issuable upon exercise of Options actually outstanding at such time, plus (c) the number of shares of Common Stock issuable upon conversion or exchange of Convertible Securities actually outstanding at such time (treating as actually outstanding any Convertible Securities issuable upon exercise of Options actually outstanding at such time), in each case, regardless of whether the Options or Convertible Securities are actually exercisable at such time; provided, that Common Stock Deemed Outstanding at any given time shall not include shares owned or held by or for the account of the Company or any of its wholly owned subsidiaries.

“Convertible Securities” means any securities (directly or indirectly) convertible into or exchangeable for Common Stock, but excluding Options.

“Excluded Issuances” means any issuance or sale (or deemed issuance or sale in accordance with Section 3(e)) by the Company after the Initial Exercise Date of: (a) shares of Common Stock issued upon the exercise of this Warrant and warrants to purchase shares of Common Stock issued prior to the Initial Exercise Date; (b) shares of Common Stock issued directly or upon the exercise of Options to directors, officers, employees, or consultants of the Company in connection with their service as directors of the Company, their employment by the Company or their retention as consultants by the Company, in each case authorized by the Company’s Board of Directors (“Board”), approved by the stockholders, if required, and issued pursuant to the Company’s 2016 Equity Incentive Plan, 2016 Employment Inducement Award Plan (including all such shares of Common Stock and Options outstanding prior to the Initial Exercise Date) and an employee stock purchase plan; (c) shares of Common Stock issued upon the conversion or exercise of Options (other than Options covered by clause (b) above) or Convertible Securities issued prior to the Initial Exercise Date, provided that such securities are not amended after the date hereof to increase the number of shares of Common Stock issuable thereunder or to lower the exercise or conversion price thereof; (d) shares of Common Stock, Options or Convertible Securities issued (i) to persons in connection with a joint venture, strategic alliance or other commercial relationship with such person (including persons that are customers, suppliers and strategic partners of the Company) relating to the operation of the Company’s business and not for the primary purpose of raising equity capital and approved by the Board, (ii) in connection with a transaction in which the Company, directly or indirectly, acquires another business or its tangible or intangible assets, or (iii) to lenders as equity kickers in connection with debt financings of the Company, in each case where such transactions have been approved by the Board; (e) shares of Common Stock in an offering for cash for the account of the Company that is underwritten on a firm commitment basis and is registered with the Securities and Exchange Commission (“Commission”) under the Securities Act of 1933, as amended; or (f) shares of Common Stock, Options or Convertible Securities issued to the lessor or vendor in any office lease or equipment lease or similar equipment financing transaction in which the Company obtains the use of such office space or equipment for its business.

“Person” means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company, joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Options” means any warrants or other rights or options to subscribe for or purchase Common Stock or Convertible Securities.

“Trading Day” means a day on which the principal Trading Market is open for trading.

“Trading Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question: the NYSE MKT, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York Stock Exchange (or any successors to any of the foregoing).

“Transfer Agent” means Computershare, Inc., the current transfer agent of the Company, with a mailing address of 480 Washington Avenue, Jersey City, New Jersey 07310, and any successor transfer agent of the Company.

Section 2. Exercise.

(a)Exercise of Warrant. Exercise of the purchase rights represented by this Warrant may be made, in whole or in part, at any time or times on or after the Initial Exercise Date and on or before the Termination Date by delivery to the Company (or such other office or agency that the Company may designate by notice in writing to the registered Holder at the address of the Holder appearing on the books of the Company), as applicable, of a duly executed facsimile copy or PDF copy submitted by electronic (or e-mail attachment) of the Notice of Exercise in the form annexed hereto as Exhibit A. Within the earlier of (i) three (3) Trading Days and (ii) the number of Trading Days comprising the Standard Settlement Period (as defined in Section 2(d)(i) herein) following the date of exercise as aforesaid, the Holder shall deliver the aggregate Exercise Price for the shares specified in the applicable Notice of Exercise by wire transfer or cashier’s check drawn on a United States bank unless the cashless exercise procedure specified in Section 2(c) below is specified in the applicable Notice of Exercise. No ink-original Notice of Exercise shall be required, nor shall any medallion guarantee (or other type of guarantee or notarization) of any Notice of Exercise form be required. Notwithstanding anything herein to the contrary, the Holder shall not be required to physically surrender this Warrant to the Company until the Holder has purchased all of the Warrant Shares available hereunder and the Warrant has been exercised in full, in which case, the Holder shall surrender this Warrant to the Company for cancellation within three (3) Trading Days of the date the final Notice of Exercise is delivered to the Company. Partial exercises of this Warrant resulting in purchases of a portion of the total number of Warrant Shares available hereunder shall have the effect of lowering the outstanding number of Warrant Shares purchasable hereunder in an amount equal to the applicable number of Warrant Shares purchased. The Holder and the Company shall maintain records showing the number of Warrant Shares purchased and the date of such purchases. The Company shall deliver any objection to any Notice of Exercise within one (1) Business Day of receipt of such notice. The Holder and any assignee, by acceptance of this Warrant, acknowledge and agree that, by reason of the provisions of this paragraph, following the purchase of a portion of the Warrant Shares hereunder, the number of Warrant Shares available for purchase hereunder at any given time may be less than the amount stated on the face hereof.

(b)Exercise Price. The exercise price per share of the Common Stock under this Warrant shall be $2.17, subject to adjustment hereunder (the “Exercise Price”).

(c)Cashless Exercise. This Warrant may also be exercised, in whole or in part, by means of a “cashless exercise” in which the Holder shall be entitled to receive a number of Warrant Shares equal to the quotient obtained by dividing [(A-B) (X)] by (A), where:

(A) = as applicable: (i) the VWAP on the Trading Day immediately preceding the date of the applicable Notice of Exercise if such Notice of Exercise is (1) both executed and delivered pursuant to Section 2(a) hereof on a day that is not a Trading Day or (2) both executed and delivered pursuant to Section 2(a) hereof on a Trading Day prior to the opening of “regular trading hours” (as defined in Rule 600(b)(64) of Regulation NMS promulgated under the federal securities laws) on such Trading Day, (ii) at the option of the Holder, (y) the VWAP on the Trading Day immediately preceding the date the applicable Notice of Exercise is delivered or (z) the Bid Price of the Common Stock on the principal Trading Market as reported by Bloomberg L.P. as of the time of the Holder’s execution of the applicable Notice of Exercise if such Notice of Exercise is executed during “regular trading hours” on a Trading Day and is delivered within two (2) hours thereafter pursuant to Section 2(a) hereof or (iii) the VWAP on the date of the applicable Notice of Exercise if the date of such Notice of Exercise is a Trading Day and such Notice of Exercise is both executed and delivered pursuant to Section 2(a) hereof after the close of “regular trading hours” on such Trading Day;

(B) = the Exercise Price of this Warrant, as adjusted hereunder; and

(X) = the number of Warrant Shares that would be issuable upon exercise of this Warrant in accordance with the terms of this Warrant if such exercise were by means of a cash exercise rather than a cashless exercise.

If Warrant Shares are issued in such a cashless exercise, the parties acknowledge and agree that in accordance with Section 3(a)(9) of the Securities Act, the Warrant Shares shall take on the characteristics of the Warrants being exercised, and the holding period of the Warrant Shares being issued may be tacked on to the holding period of this Warrant. The Company agrees not to take any position contrary to this Section 2(c).

“Bid Price” means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed or quoted on a Trading Market, the bid price of the Common Stock for the time in question (or the nearest preceding date) on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg L.P. (based on a Trading Day from 9:30 a.m. (New York City time) to 4:02 p.m. (New York City time)), (b) if OTCQB or OTCQX is not a Trading Market, the volume weighted average price of the Common Stock for such date (or the nearest preceding date) on OTCQB or OTCQX as applicable, (c) if the Common Stock is not then listed or quoted for trading on

OTCQB or OTCQX and if prices for the Common Stock are then reported in the “Pink Sheets” published by OTC Markets Group, Inc. (or a similar organization or agency succeeding to its functions of reporting prices), the most recent bid price per share of the Common Stock so reported, or (d) in all other cases, the fair market value of a share of Common Stock as determined by an independent appraiser selected in good faith by the Holder and reasonably acceptable to the Company, the fees and expenses of which shall be paid by the Company.

“VWAP” means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed or quoted on a Trading Market, the daily volume weighted average price of the Common Stock for such date (or the nearest preceding date) on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg L.P. (based on a Trading Day from 9:30 a.m. (New York City time) to 4:02 p.m. (New York City time)), (b) if OTCQB or OTCQX is not a Trading Market, the volume weighted average price of the Common Stock for such date (or the nearest preceding date) on OTCQB or OTCQX as applicable, (c) if the Common Stock is not then listed or quoted for trading on OTCQB or OTCQX and if prices for the Common Stock are then reported in the “Pink Sheets” published by OTC Markets Group, Inc. (or a similar organization or agency succeeding to its functions of reporting prices), the most recent bid price per share of the Common Stock so reported, or (d) in all other cases, the fair market value of a share of Common Stock as determined by an independent appraiser selected in good faith by the Holder and reasonably acceptable to the Company, the fees and expenses of which shall be paid by the Company.

Notwithstanding anything herein to the contrary, on the Termination Date, this Warrant shall be automatically exercised via cashless exercise pursuant to this Section 2(c).

(d)Mechanics of Exercise.

(i)Delivery of Warrant Shares Upon Exercise. Warrant Shares purchased hereunder shall be transmitted by the Transfer Agent to the Holder by crediting the account of the Holder’s or its designee’s balance account with The Depository Trust Company through its Deposit or Withdrawal at Custodian system (“DWAC”) if the Company is then a participant in such system and either (A) there is an effective registration statement permitting the issuance of the Warrant Shares to or resale of the Warrant Shares by the Holder or (B) the Warrant Shares are eligible for resale by the Holder without volume or manner-of-sale limitations pursuant to Rule 144, and otherwise by physical delivery of a certificate, registered in the Company’s share register in the name of the Holder or its designee, for the number of Warrant Shares to which the Holder is entitled pursuant to such exercise to the address specified by the Holder in the Notice of Exercise by the date that is the earlier of (i) three (3) Trading Days and (ii) the number of Trading Days comprising the Standard Settlement Period after the delivery to the Company of the Notice of Exercise (such date, the “Warrant Share Delivery Date”). Upon delivery of the Notice of Exercise, the Holder shall be deemed for all corporate purposes to have become the holder of record of the Warrant Shares with respect to which this Warrant has been exercised, irrespective

of the date of delivery of the Warrant Shares, provided that payment of the aggregate Exercise Price (other than in the case of a cashless exercise) is received within the earlier of (i) three (3) Trading Days and (ii) the number of Trading Days comprising the Standard Settlement Period following delivery of the Notice of Exercise. If the Company fails for any reason to deliver to the Holder the Warrant Shares subject to a Notice of Exercise by the Warrant Share Delivery Date, the Company shall pay to the Holder, in cash, as liquidated damages and not as a penalty, for each $1,000 of Warrant Shares subject to such exercise (based on the VWAP of the Common Stock on the date of the applicable Notice of Exercise), $5 per Trading Day (increasing to $10 per Trading Day on the fifth (5th) Trading Day after such liquidated damages begin to accrue) for each Trading Day after such Warrant Share Delivery Date (subject to receipt of the aggregate Exercise Price for the applicable exercise (other than in the case of a cashless exercise)) until such Warrant Shares are delivered or Holder rescinds such exercise. The Company agrees to maintain a transfer agent that is a participant in the FAST program so long as this Warrant remains outstanding and exercisable. As used herein, “Standard Settlement Period” means the standard settlement period, expressed in a number of Trading Days, on the Company’s primary Trading Market with respect to the Common Stock as in effect on the date of delivery of the Notice of Exercise.

(ii)Delivery of New Warrants Upon Exercise. If this Warrant shall have been exercised in part, the Company shall, at the request of a Holder and upon surrender of this Warrant certificate, at the time of delivery of the Warrant Shares, deliver to the Holder a new Warrant evidencing the rights of the Holder to purchase the unpurchased Warrant Shares called for by this Warrant, which new Warrant shall in all other respects be identical with this Warrant.

(iii)Rescission Rights. If the Company fails to cause the Transfer Agent to transmit to the Holder the Warrant Shares pursuant to Section 2(d)(i) by the Warrant Share Delivery Date (subject to receipt of the aggregate Exercise Price for the applicable exercise (other than in the case of a cashless exercise)), then the Holder will have the right to rescind such exercise.

(iv)Compensation for Buy-In on Failure to Timely Deliver Warrant Shares Upon Exercise. In addition to any other rights available to the Holder, if the Company fails to cause the Transfer Agent to transmit to the Holder the Warrant Shares in accordance with the provisions of Section 2(d)(i) above pursuant to an exercise on or before the Warrant Share Delivery Date (subject to receipt of the aggregate Exercise Price for the applicable exercise (other than in the case of a cashless exercise)), and if after such date the Holder is required by its broker to purchase (in an open market transaction or otherwise) or the Holder’s brokerage firm otherwise purchases, shares of Common Stock to deliver in satisfaction of a sale by the Holder of the Warrant Shares which the Holder anticipated receiving upon such exercise (a “Buy-In”), then the Company shall (A) pay in cash to the Holder the amount, if any, by which (x) the Holder’s total purchase price (including brokerage commissions, if any) for the shares of Common Stock so purchased exceeds (y) the amount obtained by multiplying (1) the number of Warrant Shares that the Company was required to deliver to the Holder in connection with the exercise at issue times (2) the price at which the sell order giving rise to such purchase obligation was executed, and (B) at the option of the Holder, either reinstate the portion of the Warrant and equivalent number of Warrant Shares for which such exercise was not honored (in which case such exercise shall be deemed rescinded) or deliver to the Holder the number of shares of Common Stock that would have been issued had the Company timely complied with its exercise and delivery obligations hereunder. For example, if the Holder purchases Common Stock having a total purchase price of

$11,000 to cover a Buy-In with respect to an attempted exercise of shares of Common Stock with an aggregate sale price giving rise to such purchase obligation of $10,000, under clause (A) of the immediately preceding sentence the Company shall be required to pay the Holder $1,000. The Holder shall provide the Company written notice indicating the amounts payable to the Holder in respect of the Buy-In and, upon request of the Company, evidence of the amount of such loss. Nothing herein shall limit a Holder’s right to pursue any other remedies available to it hereunder, at law or in equity including, without limitation, a decree of specific performance and/or injunctive relief with respect to the Company’s failure to timely deliver shares of Common Stock upon exercise of the Warrant as required pursuant to the terms hereof.

(v)No Fractional Shares or Scrip. No fractional shares or scrip representing fractional shares shall be issued upon the exercise of this Warrant. As to any fraction of a share which the Holder would otherwise be entitled to purchase upon such exercise, the Company shall, at its election, either pay a cash adjustment in respect of such final fraction in an amount equal to such fraction multiplied by the Exercise Price or round up to the next whole share.

(vi)Charges, Taxes and Expenses. Issuance of Warrant Shares shall be made without charge to the Holder for any issue or transfer tax or other incidental expense in respect of the issuance of such Warrant Shares, all of which taxes and expenses shall be paid by the Company, and such Warrant Shares shall be issued in the name of the Holder or in such name or names as may be directed by the Holder; provided, however, that in the event that Warrant Shares are to be issued in a name other than the name of the Holder, this Warrant when surrendered for exercise shall be accompanied by the Assignment Form, in the form attached hereto as Exhibit B, duly executed by the Holder and the Company may require, as a condition thereto, the payment of a sum sufficient to reimburse it for any transfer tax incidental thereto. The Company shall pay all Transfer Agent fees required for same-day processing of any Notice of Exercise and all fees to the Depository Trust Company (or another established clearing corporation performing similar functions) required for same-day electronic delivery of the Warrant Shares.

(vii)Closing of Books. The Company will not close its stockholder books or records in any manner which prevents the timely exercise of this Warrant, pursuant to the terms hereof.

(e)Holder’s Exercise Limitations. Unless a Holder has made an election on its signature page hereto, to have this Section 2(e) not apply to him/her/it, the Company shall not effect any exercise of this Warrant, and a Holder shall not have the right to exercise any portion of this Warrant, pursuant to Section 2 or otherwise, to the extent that after giving effect to such issuance after exercise as set forth on the applicable Notice of Exercise, the Holder (together with the Holder’s Affiliates, and any other Persons acting as a group together with the Holder or any of the Holder’s Affiliates (such Persons, “Attribution Parties”)), would beneficially own in excess of the Beneficial Ownership Limitation (as defined below). For purposes of the foregoing sentence, the number of shares of Common Stock beneficially owned by the Holder and its Affiliates and Attribution Parties shall include the number of shares of Common Stock issuable upon exercise of this Warrant with respect to which such determination is being made, but shall exclude the number of shares of Common Stock which would be issuable upon (i) exercise of the remaining, nonexercised portion of this Warrant beneficially owned by the Holder or any of its Affiliates or Attribution Parties and (ii) exercise or conversion of the unexercised or nonconverted portion of