As filed with the Securities and Exchange Commission on August 30, 2023.

Registration No. 333-

____________________________________________________________________________________________________________________

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

BANNER CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

WASHINGTON | | 91-1691604 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

10 South First Avenue

Walla Walla, Washington 99362

(Address of Principal Executive Offices) (Zip Code)

Banner Corporation 2023 Omnibus Incentive Plan

(Full title of the plan)

| | | | | |

Mark Grescovich Banner Corporation 10 South First Avenue Walla Walla, Washington 99362 (509) 527-3636 (Name, address and telephone number, including area code, of agent for service) |

Copies to: |

Andrew J. Schultheis, Esq.

Davis Wright Tremaine LLP

920 Fifth Ave., Ste. 3300

Seattle, Washington 98104

(206) 622-3150

| Sherrey Luetjen, Esq.

Executive Vice President, General Counsel

10 South First Avenue

Walla Walla, Washington 99362

(509) 527-3636 |

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | |

Large accelerated filer ☒ | Accelerated filer ☐ |

Non-accelerated filer ☐ (do not check if a smaller reporting company) | Smaller reporting company ☐ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

Banner Corporation (the “Registrant”) has prepared this registration statement (this “Registration Statement”) in accordance with the requirements of Form S-8 under the Securities Act, to register 625,000 shares of Common Stock issuable pursuant to the Banner Corporation 2023 Omnibus Incentive Plan (the “2023 Plan”). The 2023 Plan has been previously approved by the Registrant’s stockholders.

PART I

INFORMATION REQUIRED IN SECTION 10(A) PROSPECTUS

The documents containing the information specified in Part I of this Form S-8 will be sent or given to participants in the Plan, as specified by Rule 428(b)(1) promulgated by the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”). In accordance with Rule 428 and the requirements of Part I of Form S-8, such document(s) are not being filed with the Commission, either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act, but constitute (along with the documents incorporated by reference into the Registration Statement pursuant to Item 3 of Part II hereof) a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents previously or concurrently filed by the Registrant with the Commission are hereby incorporated by reference in this Registration Statement and the prospectus to which this Registration Statement relates (the “Prospectus”):

(a) The Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (File No. 0-26584) filed with the Commission on February 21, 2023.

(b) All other reports filed by the Registrant pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 since the end of the fiscal year covered by the Annual Report on Form 10-K referred to in Item 3(a) above.

(c) The description of the Registrant’s common stock set forth in its Registration Statement on Form 8-A registering the Registrant’s common stock pursuant to Section 12(g) of the Securities Exchange Act, filed August 8, 1995, and all amendments thereto or reports filed for the purpose of updating such description.

All documents filed by the Registrant with the Commission pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”) (excluding any portions of such documents that have been “furnished” and not “filed” for purposes of the Exchange Act) after the filing of this Registration Statement, and prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed incorporated by reference into this Registration Statement and the Prospectus and to be a part hereof and thereof from the date of the filing of such documents. Any statement contained in the documents incorporated, or deemed to be incorporated, by reference herein or therein shall be deemed to be modified or superseded for purposes of this Registration Statement and the Prospectus to the extent that a statement contained herein or therein or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference herein or therein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement and the Prospectus.

All information appearing in this Registration Statement is qualified in its entirety by the detailed information, including financial statements, appearing in the documents incorporated herein by reference.

Item 4. Description of Securities.

Not Applicable

Item 5. Interests of Named Experts and Counsel.

Not Applicable

Item 6. Indemnification of Directors and Officers.

Article XIV of the Registrant’s Articles of Incorporation requires indemnification of directors and officers to the fullest extent permitted by the Washington Business Corporation Act (“WBCA”). However, the indemnity does not apply to (1) acts or omissions finally adjudged to violate law, (2) conduct finally adjudged to violate the WBCA prohibition against unlawful distributions by the corporation or (3) any transaction with respect to which it was finally adjudged that the director or officer personally received a benefit to which he/she was not legally entitled.

The Registrant has entered into an indemnification agreement with each of its directors. Each indemnification agreement provides generally that the Registrant will hold harmless and indemnify the director to the fullest extent permitted by law against any and all losses, claims, damages and liabilities, including but not limited to judgments, fines, amounts paid in settlement and any related expenses, incurred with respect to any proceeding in which the director is or is threatened to be made a party by reason of the fact that he or she is or was serving as a director of the Registrant or, at the request of the Registrant, is or was serving as a director, officer, employee, trustee or agent of the Registrant or of another entity. Each indemnification agreement further provides that, upon the director’s request, the Registrant will advance expenses to the director, subject to the director’s agreeing to repay the advanced funds if it is ultimately determined, by a final, non-appealable court decision, that he or she is not entitled to be indemnified for such expenses. In addition, each indemnification agreement requires the Registrant to use commercially reasonable efforts to maintain in effect director and officer liability insurance coverage containing substantially the same terms and conditions as the director and officer liability insurance policy in effect at the time the indemnification agreement was entered into.

The WBCA provides for indemnification of directors, officers, employees and agents in certain circumstances. WBCA Section 23B.08.510 provides that a corporation may indemnify an individual made a party to a proceeding because the individual is or was a director against liability incurred in the proceeding if (a) the director acted in good faith, (b) the director reasonably believed that the director’s conduct was in the best interests of the corporation, or in certain instances, at least not opposed to its best interests and (c) in the case of any criminal proceeding, the director had no reasonable cause to believe the director’s conduct was unlawful. However, a corporation may not indemnify a director under this section (a) in connection with a proceeding by or in the right of the corporation in which the director was adjudged liable to the corporation or (b) in connection with any other proceeding charging improper personal benefit to the director in which the director was adjudged liable on the basis that personal benefit was improperly received by the director. WBCA Section 23B.08.520 provides that unless limited by the articles of incorporation, a corporation must indemnify a director who was wholly successful in the defense of any proceeding to which the director was a party because of being a director of the corporation against reasonable expenses incurred by the director in connection with the proceeding. WBCA Section 23B.08.540 provides a mechanism for court-ordered indemnification.

WBCA Section 23B.08.570 provides that unless a corporation’s articles of incorporation provide otherwise, (1) an officer of the corporation who is not a director is entitled to mandatory indemnification under WBCA Section 23B.08.520, and is entitled to apply for court-ordered indemnification under WBCA Section 23B.08.540, (2) the corporation may indemnify and advance expenses under WBCA Section 23B.08.510 through 23B.08.560 to an officer, employee or agent of the corporation who is not a director to the same extent as to a director and (3) a corporation may also indemnify and advance expenses to an officer, employee or agent who is not a director to the extent, consistent with law, that may be provided by its articles of incorporation, bylaws, general or specific action of its board of directors or contract. WBCA Section 23B.08.580 provides that a corporation may purchase insurance on behalf of an individual who is or was a director, officer, employee or agent of the corporation against liability asserted against or incurred by the individual in that capacity, whether or not the corporation would have power to indemnify the individual against the same liability under WBCA Section 23B.08.510 or 23B.08.520.

Item 7. Exemption From Registration Claimed.

Not Applicable

Item 8. Exhibits.

The following exhibits are filed with or incorporated by reference into this Registration Statement on Form S-8:

Exhibit

Number Description

(1) Incorporated by reference to Exhibit 3.1 (b) to the Registrant’s Current Report on Form 8-K filed with the Commission on May 24, 2022.

(2) Incorporated by reference to Exhibit 3.2 to the Registrant’s Current Report on Form 8-K filed with the Commission on May 24, 2022.

Item 9. Undertakings.

The undersigned registrant hereby undertakes:

1. To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement; provided, however, that paragraphs (1)(i) and (1)(ii) do not apply if the Registration Statement is on Form S-3, Form S-8 or Form F-3, and the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or 15(d) of the Exchange Act that are incorporated by reference in the Registration Statement.

2. That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3. To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

4. That, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new Registration Statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

5. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Signatures

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Bellevue, State of Washington, on August 30, 2023.

| | | | | |

| BANNER CORPORATION |

|

| By | /s/Mark J. Grescovich |

| Name: Mark J. Grescovich Title: President and Chief Executive Officer (Principal Executive Officer) |

| |

Power Of Attorney

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Mark J. Grescovich and Peter J. Conner, and each of them, each with full power to act without the other, his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully for all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or their substitutes, may lawfully do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | |

| Signature | Title | Date |

/s/Mark J. Grescovich Mark J. Grescovich |

President and Chief Executive Officer (Principal Executive Officer) |

August 30, 2023 |

/s/Peter J. Conner Peter J. Conner |

Executive Vice President and Chief Financial Officer (Principal Financial and Accounting Officer) |

August 30, 2023 |

/s/Ellen R.M. Boyer Ellen R.M. Boyer |

Director |

August 30, 2023 |

/s/Connie R. Collingsworth Connie R. Collingsworth |

Director |

August 30, 2023 |

| | | | | | | | |

/s/Margot J. Copeland Margot J. Copeland |

Director |

August 30, 2023 |

/s/Roberto R. Herencia Roberto R. Herencia |

Director |

August 30, 2023 |

/s/David A. Klaue David A. Klaue |

Director |

August 30, 2023 |

/s/John R. Layman John R. Layman |

Director |

August 30, 2023 |

/s/John Pedersen John Pedersen |

Director |

August 30, 2023 |

/s/Kevin F. Riordan Kevin F. Riordan |

Director |

August 30, 2023 |

/s/Terry Schwakopf Terry Schwakopf |

Director |

August 30, 2023 |

/s/Paul J. Walsh Paul J. Walsh |

Director |

August 30, 2023 |

EXHIBIT INDEX

Exhibit

Number Description

Calculation of Filing Fee Tables

Form S-8

(Form Type)

Banner Corporation

(Exact Name of Registrant as Specified in its Charter)

| | |

| Table 1: Newly Registered Securities |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered(1) | Proposed Maximum Offering Price Per Unit(2) | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

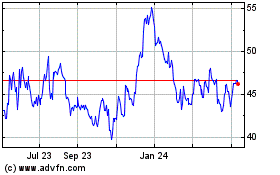

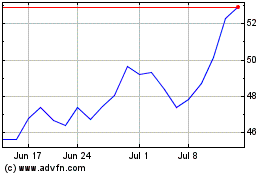

| Equity | Common Stock, par value $0.01 per share | Rule 457(c) and Rule 457(h) | 625,000 | $43.31 | $27,068,750 | 0.00011020 | $2,982.98 |

| Total Offering Amounts | | $27,068,750 | | $2,982.98 |

| Total Fee Offsets | | | | — |

| Net Fee Due | | | | $2,982.98 |

| | | | | | | | |

| (1) | Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional shares of the Common Stock (the “Common Stock”) of Banner Corporation (the “Registrant”) that may be offered or issued under the Registrant’s 2023 Omnibus Incentive Plan (the “2023 Plan”) to prevent dilution resulting from stock splits, stock dividends, or similar transactions. |

| | | | | | | | |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) and Rule 457(h) under the Securities Act and based upon a $43.31 per share average of the high and low sales prices of the Registrant’s Common Stock, as reported on the Nasdaq Global Select Market on August 25, 2023, a date within five business days prior to the filing of this Registration Statement. |

August 30, 2023

Board of Directors

Banner Corporation

10 South First Avenue

Walla Walla, Washington 99362

| | | | | |

| Re: | Registration Statement on Form S-8 |

Dear Ladies and Gentlemen:

This opinion is furnished to Banner Corporation, a corporation formed under the laws of the State of Washington (the “Company”), in connection with the filing of a Registration Statement on Form S-8 (the “Registration Statement”) with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Securities Act”), relating to the proposed sale by the Company of up to 625,000 shares of common stock, par value $0.01 per share (the “Shares”), to be issued pursuant to the Company’s 2023 Omnibus Incentive Plan (the “Plan”).

We have reviewed, among other things, the Company’s Restated Articles of Incorporation, as amended, the Company’s Amended and Restated Bylaws, the Plan, and related agreements and records of corporate proceedings and other actions taken or proposed to be taken by the Company in connection with the offer and sale of the Shares pursuant to the Plan. We have made such other factual inquiries as we deemed necessary to render this opinion. In rendering our opinion, we have also made the assumptions that are customary in opinion letters of this kind. We have not verified any of those assumptions.

Based upon the foregoing and in reliance thereon, it is our opinion that the offer and sale of the Shares pursuant to the Plan for the participants of the beneficiaries thereof, in accordance with the terms of the Plan, have been duly authorized, when issued and sold pursuant thereto, the Shares will be validly issued, fully paid and non-assessable.

We express no opinion herein as to the laws of any state or jurisdiction other than the State of Washington and the federal laws of the United States.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving this consent, we do not thereby admit that we come within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations thereunder.

Very truly yours,

Davis Wright Tremaine LLP

/s/ Davis Wright Tremaine LLP

BANNER CORPORATION

2023 OMNIBUS INCENTIVE PLAN

TABLE OF CONTENTS

Page

| | | | | |

| ARTICLE I ESTABLISHMENT, PURPOSE AND DURATION | |

Section 1.1 Establishment of the Plan. | |

Section 1.2 Purpose of the Plan. | |

Section 1.3 Duration of the Plan. | |

| ARTICLE II AVAILABLE SHARES | |

| ARTICLE III AVAILABLE SHARES - ELIGIBILITY - PARTICIPATION | |

Section 3.1 Shares Available Under the Plan. | |

Section 3.2 Maximum Awards. | |

Section 3.3 Substitute Awards. | |

Section 3.4 Computation of Shares Issued. | |

Section 3.5 Eligibility. | |

Section 3.6 Actual Participation. | |

Section 3.7 Minimum Vesting Period. | |

| ARTICLE IV ADMINISTRATION | |

Section 4.1 Committee. | |

Section 4.2 Committee Powers. | |

| ARTICLE V STOCK OPTIONS | |

Section 5.1 Grant of Options. | |

Section 5.2 Size of Option. | |

Section 5.3 Exercise Price. | |

Section 5.4 Exercise Period. | |

Section 5.5 Vesting Date. | |

Section 5.6 Additional Restrictions on Incentive Stock Options. | |

Section 5.7 Method of Exercise. | |

Section 5.8 Limitations on Options. | |

Section 5.9 Prohibition Against Option Repricing. | |

| ARTICLE VI STOCK APPRECIATION RIGHTS | |

Section 6.1 Grant of Stock Appreciation Rights. | |

Section 6.2 Size of Stock Appreciation Right. | |

Section 6.3 Exercise Price. | |

Section 6.4 Exercise Period. | |

Section 6.5 Vesting Date. | |

Section 6.6 Method of Exercise. | |

Section 6.7 Limitations on Stock Appreciation Rights. | |

Section 6.8 Prohibition Against Stock Appreciation Right Repricing. | |

| ARTICLE VII RESTRICTED AWARDS | |

| | | | | |

Section 7.1 In General. | |

Section 7.2 Size of Restricted Award. | |

Section 7.3 Vesting Date. | |

Section 7.4 Dividend Rights. | |

Section 7.5 Voting Rights. | |

Section 7.6 Designation of Beneficiary. | |

Section 7.7 Manner of Distribution of Awards. | |

| ARTICLE VIII PERFORMANCE Awards | |

Section 8.1 Grant of Performance Awards. | |

Section 8.2 Size of Performance Award. | |

Section 8.3 Award Agreement. | |

Section 8.4 Performance Goals. | |

Section 8.5 Discretionary Adjustments. | |

Section 8.6 Payment of Awards. | |

Section 8.7 Termination of Continuous Service Due to Death, Disability, Retirement or Following a Change in Control. | |

Section 8.8 Termination of Continuous Service for Other Reasons. | |

Section 8.9 Nontransferablity. | |

| ARTICLE IX OTHER STOCK-BASED AWARDS AND CASH AWARDS | |

Section 9.1 Other Stock-Based Awards. | |

Section 9.2 Cash Awards. | |

| ARTICLE X ADDITIONAL TAX PROVISION | |

Section 10.1 Tax Withholding Rights. | |

| ARTICLE XI AMENDMENT AND TERMINATION | |

Section 11.1 Termination | |

Section 11.2 Amendment. | |

Section 11.3 Adjustments in the Event of Business Reorganization. | |

| ARTICLE XII MISCELLANEOUS | |

Section 12.1 Status as an Employee Benefit Plan. | |

Section 12.2 No Right to Continued Service. | |

Section 12.3 Construction of Language. | |

Section 12.4 Severability. | |

Section 12.5 Governing Law. | |

Section 12.6 Headings. | |

Section 12.7 Non-Alienation of Benefits. | |

Section 12.8 Notices. | |

Section 12.9 Approval of Shareholders. | |

Section 12.10 Clawback. | |

Section 12.11 Compliance with Section 409A. | |

Banner Corporation

2023 Omnibus Incentive Plan

ARTICLE I

ESTABLISHMENT, PURPOSE AND DURATION

Section 1.1 Establishment of the Plan.

The Company hereby establishes an incentive compensation plan to be known as the “Banner Corporation 2023 Omnibus Incentive Plan” (the “Plan”), as set forth in this document. The Plan permits the granting of Nonqualified Stock Options, Incentive Stock Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units, Performance Awards, Other Stock-Based Awards and Cash Awards.

The Plan was originally adopted effective as of February 27, 2023 by the Board, and became effective on May 24, 2023 (the “Effective Date”), the date the Plan was approved by the Company’s shareholders.

As of the Effective Date, this Plan shall be treated as a new plan for purposes of Section 422 of the Code (as defined below), so that an Option granted hereunder on a date that is not more than ten years after the Effective Date, and that is intended to qualify as an Incentive Stock Option under Section 422 of the Code, complies with the requirements of Section 422(b)(2) of the Code and the applicable regulations thereunder.

Section 1.2 Purpose of the Plan.

The purpose of the Plan is to promote the success, and enhance the value, of the Company by linking the personal interests of Employees and Directors with those of Company shareholders. The Plan is further intended to provide flexibility to the Company in its ability to motivate, attract, and retain the services of Employees and Directors upon whose judgment, interest, and special effort the successful conduct of its operation largely is dependent.

Section 1.3 Duration of the Plan.

Subject to approval by the shareholders of the Company, the Plan shall commence on the Effective Date, as described in Section 1.1, and shall remain in effect, subject to the right of the Board to terminate the Plan at any time pursuant to Article XII. However, in no event may an Award be granted under the Plan on or after the tenth anniversary of the Effective Date.

ARTICLE II

DEFINITIONS

The following definitions shall apply for the purposes of the Plan, unless a different meaning is plainly indicated by the context:

Affiliate means any “parent corporation” or “subsidiary corporation” of the Company, as those terms are defined in Sections 424(e) and (f), respectively, of the Code.

Award means a grant under the Plan of Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units, Performance Awards, Other Stock-Based Awards or Cash Awards.

Award Agreement means a written instrument evidencing an Award under the Plan and establishing the terms and conditions thereof.

Beneficiary means the Person designated by a Participant to receive any Shares subject to a Restricted Award made to such Participant that become distributable, to have the right to exercise any Options or Stock Appreciation Rights granted to such Participant that are exercisable, or to receive any cash or Shares paid out under an Award to such Participant where such payout is made following the Participant’s death.

Board means the Board of Directors of the Company and any successor thereto.

Cash Award means an Award pursuant to Article IX.

Change in Control means the first to occur of a “change in the ownership” of the Company, a “change in the effective control” of the Company or a “change in the ownership of a substantial portion of the assets” of the Company, as those phrases are determined under Section 409A.

Code means the Internal Revenue Code of 1986, as amended from time to time.

Committee means the Committee described in Article IV.

Company means Banner Corporation, a Washington corporation, and any successor thereto.

Continuous Service means, unless the Committee provides otherwise in an Award Agreement, that the Participant’s service with the Company or an Affiliate, whether as an Employee or a Director, is not interrupted or terminated. The Participant’s Continuous Service shall not be deemed to have terminated merely because of a change in the capacity in which the Participant renders service to the Company or an Affiliate as an Employee or Director or a change in the entity for which the Participant renders such service, provided that there is no interruption or termination of the Participant’s Continuous Service; provided further that if any Award is subject to Section 409A, this sentence shall only be given effect to the extent consistent with Section 409A. For example, a change in status from an Employee of the Company to a Director of an Affiliate will not constitute an interruption of Continuous Service. The Committee or its delegate, in its sole discretion, may determine whether Continuous Service shall be considered interrupted in the case of any leave of absence approved by that party, including sick leave, military leave or any other personal or family leave of absence.

Director means any individual who is a member of the Board or the board of directors of an Affiliate or an advisory or emeritus director of the Company or an Affiliate who is not currently an Employee.

Disability means a total and permanent disability, within the meaning of Section 22(e)(3) of the Code, as determined by the Committee in good faith, upon receipt of sufficient competent medical advice from one or more individuals, selected by the Committee, who are qualified to give professional medical advice.

Domestic Relations Order means a domestic relations order that satisfies the requirements of Section 414(p)(1)(B) of the Code, or any successor provision, as if such section applied to the applicable Award.

Employee means a full-time or part-time employee of the Company or an Affiliate. Directors who are not otherwise employed by the Company or an Affiliate shall not be considered Employees for purposes of the Plan.

Exchange Act means the Securities Exchange Act of 1934, as amended.

Exercise Period means the period during which an Option or Stock Appreciation Right may be exercised.

Exercise Price means the price per Share at which Shares subject to an Option may be purchased upon exercise of the Option and on the basis of which the Shares due upon exercise of a Stock Appreciation Right is computed.

Fair Market Value means, with respect to a Share on a specified date:

(a)If the Shares are listed on any U.S. national securities exchange registered under the Securities Exchange Act of 1934 (“National Exchange”), the closing sales price for such stock (or the closing bid, if no sales were reported) as reported on that exchange on the applicable date, or if the applicable date is not a trading day, on the trading day immediately preceding the applicable date;

(b)If the Shares are not listed on a National Exchange but are traded on the over-the-counter market or other similar system, the mean between the closing bid and the asked price for the Shares at the close of trading in the over-the-counter market or other similar system on the applicable date, or if the applicable date is not a trading day, on the trading day immediately preceding the applicable date; and

(c)In the absence of such markets for the Shares, the Fair Market Value shall be determined in good faith by the Committee.

Notwithstanding anything in the Plan to the contrary, the determination of Fair Market Value shall comply with Section 409A, where necessary for the Award or benefit provided thereunder to comply with Section 409A.

Family Member means with respect to any Participant, any child, stepchild, grandchild, parent, stepparent, grandparent, spouse, registered domestic partner (as determined under state law), former spouse, sibling, niece, nephew, mother-in-law, father in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships, any person sharing the Participant’s household (other than a tenant or employee), a trust in which these persons have more than fifty percent of the beneficial interest, a foundation in which these persons (or the Participant) control the management of assets, and any other entity in which these persons (or the Participant) own more than fifty percent of the voting interests.

Incentive Stock Option means an Option that is granted to an Employee that is designated by the Committee to be an Incentive Stock Option and that satisfies the requirements of Section 422 of the Code.

Involuntary Separation from Service means a termination by the Company or Affiliate without “cause” as defined in the relevant incentive plan and/or employment agreement, as applicable, provided that such termination must also qualify as an “involuntary separation from service” within the meaning of Treasury Regulations Section 1.409A-1(n).

Non-Qualified Stock Option means an Option that is not an Incentive Stock Option.

Officer means a person who is an officer of the Company within the meaning of Section 16 of the Exchange Act and the rules and regulations promulgated thereunder.

Option means an Incentive Stock Option or a Non-Qualified Stock Option granted pursuant to Article V.

Option Holder means, at any relevant time with respect to an Option, the person having the right to exercise the Option.

Other Stock-Based Award means an Award granted pursuant to Article IX.

Participant means any Employee or Director who is selected by the Committee to receive an Award.

Performance Award means an Award granted pursuant to Article VIII that is denominated in either shares or cash which entitles a Participant to receive cash, Shares or a combination thereof based on the achievement of one or more pre-established performance goals during a Performance Period.

Performance Period means the period of time as specified by the Committee over which the achievement of performance goals related to Performance Awards is measured.

Period of Restriction means the period during which the entitlement of a Participant under an Award is limited in some way or subject to forfeiture, in whole or in part, based on the passage of time, the achievement of performance goals, or upon the occurrence of other events as determined by the Committee, in its discretion.

Person means an individual, a corporation, a partnership, a limited liability company, an association, a joint-stock company, a trust, an estate, an unincorporated organization and any other business organization or institution.

Plan means the Banner Corporation 2023 Omnibus Incentive Plan, as amended from time to time.

Restricted Award means an Award of Restricted Stock or Restricted Stock Units pursuant to Article VII.

Restricted Stock means an award of Shares subject to a Period of Restriction.

Restricted Stock Units means an Award denominated in shares that represents the right to receive cash and/or Shares subject to a Period of Restriction.

Retirement means, subject to the terms of an Award, in the case of an Employee, the termination of a Participant’s employment with the Company and its Affiliates, other than a Termination for Cause, after the Participant has attained the retirement age, as determined by the Committee and set forth in the applicable plan documents unless otherwise approved by the Committee.

Section 409A means Section 409A of the Code and any regulations or guidance of general applicability thereunder.

Share means a share of common stock of the Company.

Stock Appreciation Right means a right granted pursuant to Article VI to receive a payment in Shares or cash measured by the increase in the Fair Market Value of a Share over the Exercise Price of that Stock Appreciation Right.

Stock Appreciation Right Holder means, at any relevant time with respect to a Stock Appreciation Right, the person having the right to exercise the Stock Appreciation Right.

Termination for Cause means termination of Continuous Service upon an intentional failure to perform stated duties, a breach of a fiduciary duty involving personal dishonesty which results in material loss to the Company or any of its Affiliates or a willful violation of any law, rule or regulation (other than traffic violations or similar offenses) or a final cease-and-desist order which results in material loss to the Company or one of its Affiliates. No act or failure to act on Participant’s part shall be considered willful unless done, or omitted to be done, not in good faith and without reasonable belief that the action or omission was in the best interest of the Company. Notwithstanding the above, if a Participant is subject to a different definition of termination for cause in an employment or severance or similar agreement with the Company or any Affiliate, such other definition shall control.

Vesting Date means, with respect to an Option or a Stock Appreciation Right, the date or dates on which the Option or Stock Appreciation Right is eligible to be exercised, and, with respect to any other Award, the date or dates on which the Award ceases to be forfeitable (e.g., for a Restricted Award, at the end of a Period of Restriction).

ARTICLE III

AVAILABLE SHARES - ELIGIBILITY - PARTICIPATION

Section 3.1 Shares Available Under the Plan.

Subject to adjustment as provided in Section 11.3, the total number of Shares available for grant under the Plan shall be 625,000 (the “Limit”). These Shares may be either authorized but unissued, or Shares that have been reacquired by the Company. Awards that are not settled in Shares shall not be counted against the Limit. Shares representing tandem Stock Appreciation Rights shall for such purpose only be counted as either Shares representing Options outstanding or Stock Appreciation Rights outstanding, but not as both

Section 3.2 Maximum Awards.

The maximum aggregate number of Shares that may be issued pursuant to Options that are Incentive Stock Options is 625,000, subject to adjustment as provided in Section 11.3. Notwithstanding any provision in the Plan to the contrary and subject to adjustment as provided in Section 11.3, the maximum number of Shares subject to Awards granted to a non-employee Director, together with any cash fees paid to the non-employee Director during any calendar year shall not exceed $300,000 (calculating the value of any Awards based on the grant date fair value for financial reporting purposes).

Section 3.3 Substitute Awards.

Awards may, in the sole discretion of the Committee, be granted under the Plan in assumption of, or in substitution for, outstanding awards previously granted by an entity acquired by the Company or with which the Company combines (“Substitute Awards”). Substitute Awards shall not be counted against the Limit; provided, that, Substitute Awards issued in connection with the assumption of, or in substitution for, outstanding options intended to qualify as Incentive Stock Options shall be counted against the Incentive Stock Option limit. Subject to applicable stock exchange requirements, available shares under a shareholder-approved plan of an entity directly or indirectly acquired by the Company or with which the Company combines (as appropriately adjusted to reflect such acquisition or transaction) may be used for Awards under the Plan and shall not count toward the Limit.

Section 3.4 Computation of Shares Issued.

For purposes of this Article III, Shares shall be considered issued pursuant to the Plan only if actually issued upon the exercise of an Award. Any Award subsequently forfeited, in whole or in part, shall not be considered issued. If any Award granted under the Plan is settled in cash, terminates, expires, or lapses for any reason, any Shares subject to such Award again shall be available for the grant of an Award under the Plan. Shares used to pay the Exercise Price of an Option and Shares used to satisfy tax withholding obligations shall not be

available for future Awards under the Plan. (For the avoidance of doubt, to the extent that Shares are delivered pursuant to the exercise of an Option or a stock-settled Stock Appreciation Right, the number of underlying Shares as to which the exercise is related shall be counted against the number of Shares available for Awards, as opposed to only counting the Shares issued).

Section 3.5 Eligibility.

Persons eligible to participate in the Plan include all Employees and Directors.

Section 3.6 Actual Participation.

Subject to the provisions of the Plan, the Committee may, from time to time, select from all Employees and Directors, those to whom Awards shall be granted and shall determine the nature, type and amount of each Award. No Employee or Director shall be entitled to be granted an Award under the Plan.

Section 3.7 Minimum Vesting Period.

Notwithstanding any other provision of the Plan to the contrary, Awards granted under the Plan that are payable in Shares shall vest no earlier than the first anniversary of the grant date of the Award, except that this restriction shall not apply to: (a) Substitute Awards, (b) Shares delivered in lieu of fully vested cash Awards, (c) Awards to non-employee Directors (which may vest on the earlier of (i) the one year anniversary of the date of grant or (ii) the next annual meeting of shareholders that occurs prior to such first anniversary, but in any case at least 50 weeks after the date of grant), (d) Awards with respect to a maximum of 5% of the aggregate maximum number of shares specified in Section 3.1, subject to adjustment as provided in Section 11.3, and (e) Awards that may become vested in connection with a termination of Continuous Service on account of death or Disability. Notwithstanding the minimum vesting required by the preceding sentence, the Committee may provide for accelerated vesting or exercisability of an Award, or otherwise act to waive or lapse any restriction on an Award, in connection with a Participant’s death, Disability or Retirement, or in connection with a Change in Control.

ARTICLE IV

ADMINISTRATION

Section 4.1 Committee.

(a) The Plan shall be administered by a Committee appointed by the Board for that purpose and consisting of not less than two (2) members of the Board. Each member of the Committee shall be a “Non-Employee Director” within the meaning of Rule 16b-3(b)(3)(i) under the Exchange Act or a successor rule or regulation and an “Independent Director” under the corporate governance rules and regulations imposing independence standards on committees performing similar functions promulgated by any national securities exchange or quotation system on which Shares are listed.

(b) The act of a majority of the members present at a meeting duly called and held shall be the act of the Committee. Any decision or determination reduced to writing and signed by all members shall be as fully effective as if made by unanimous vote at a meeting duly called and held.

(c) The Committee’s decisions and determinations under the Plan need not be uniform and may be made selectively among Participants, whether or not such Participants are similarly situated.

Section 4.2 Committee Powers.

Subject to the terms and conditions of the Plan and such limitations as may be imposed by the Board, the Committee shall be responsible for the overall management and administration of the Plan. The Committee shall have full power except as limited by law or by the charter or by-laws of the Company or by resolutions adopted by the Board, and subject to the provisions of the Plan, to determine the size and types of Awards; to determine the terms and conditions of such Awards in a manner consistent with the Plan; to construe and interpret the Plan and any agreement or instrument entered into under the Plan; to establish, amend, or waive rules and regulations for the Plan’s administration; and (subject to the provisions of Article XI) to amend or otherwise modify the Plan or the terms and conditions of any outstanding Award to the extent such terms and conditions are within the discretion of the Committee as provided in the Plan and, if the Award is subject to Section 409A, does not cause the Plan or the Award to violate Section 409A. Further, the Committee shall make all other determinations which may be necessary or advisable for the administration of the Plan. As permitted by law, rule, or regulation, the Committee may delegate its authorities as identified hereunder. All decisions, determinations and other actions of the

Committee made or taken in accordance with the terms of the Plan shall be final and conclusive and binding upon all parties having an interest therein.

ARTICLE V

STOCK OPTIONS

Section 5.1 Grant of Options.

(a) Subject to the limitations of the Plan, the Committee may, in its discretion, grant to a Participant an Option. An Option must be designated as either an Incentive Stock Option or a Non-Qualified Stock Option and, if not designated as either, shall be a Non-Qualified Stock Option. Only Employees may receive Incentive Stock Options.

(b) Each Option shall be evidenced by an Award Agreement which shall:

(i)specify the number of Shares covered by the Option;

(ii)specify the Exercise Price;

(iii)specify the Exercise Period;

(iv)specify the Vesting Date; and

(v)contain such other terms and conditions not inconsistent with the Plan as the Committee may, in its discretion, prescribe.

Section 5.2 Size of Option.

Subject to the restrictions of the Plan, the number of Shares as to which a Participant may be granted pursuant to an Option shall be determined by the Committee, in its discretion.

Section 5.3 Exercise Price.

The price per Share at which an Option may be exercised shall be determined by the Committee, in its discretion; provided, however, that the Exercise Price shall not be less than the Fair Market Value of a Share on the date on which the Option is granted. Notwithstanding the foregoing, an Option granted as a Substitute Award may be granted with an Exercise Price lower than that set forth in the preceding sentence if such Option is granted pursuant to an assumption or substitution for another option in a manner satisfying the provisions of Section 424(a) of the Code (if the Option is an Incentive Stock Option) or Section 409A (if the Option is a Non-Qualified Stock Option).

Section 5.4 Exercise Period.

The Exercise Period during which an Option may be exercised shall commence on the Vesting Date. It shall expire on the earliest of:

(a)the date specified by the Committee in the Award Agreement;

(b)unless otherwise determined by the Committee and set forth in the Award Agreement, the last day of the three-month period commencing on the date of the Participant’s termination of Continuous Service, other than a Termination for Cause;

(c)as of the time and on the date of the Participant’s termination of Continuous Service due to a Termination for Cause; or

(d)the last day of the ten-year period commencing on the date on which the Option was granted.

An Option that remains unexercised at the close of business on the last day of the Exercise Period shall be canceled without consideration at the close of business on that date.

Section 5.5 Vesting Date.

(a) The Vesting Date for each Option shall be determined by the Committee and specified in the Award Agreement.

(b) Subject to Section 3.7: (i) each Option shall vest and therefore become exercisable no earlier than one year after the date on which the Option is granted, whether vesting pursuant to a schedule based on the continued service of the Participant, the achievement of performance or other criteria, or a combination of continued service and achievement; and (ii) the Committee may, but shall not be required to, provide for an acceleration of vesting and exercisability in the terms of any Award Agreement upon the occurrence of a specified event. No Option may be exercised for a fraction of a Share.

(c) The following provisions apply if an Option Holder terminates Continuous Service prior to the Vesting Date:

(i)if the Option Holder terminates Continuous Service prior to the Vesting Date for any reason other than death or Disability or a Change in Control, any unvested Option shall be forfeited without consideration;

(ii)if the Option Holder terminates Continuous Service prior to the Vesting Date on account of death or Disability, the Vesting Date shall be accelerated to the date of the Participant’s termination of Continuous Service; and

(iii)if a Change in Control occurs prior to the Vesting Date of an Option that is outstanding on the date of the Change in Control, and the Option Holder experiences an Involuntary Separation from Service during the 365-day period following the date of such Change in Control, then the Vesting Date for any non-vested portion of the Option shall be accelerated to the date of the Participant’s Involuntary Separation from Service. Notwithstanding the preceding sentence, if at the effective time of the Change in Control the successor to the Company’s business and/or assets does not either assume the outstanding Option or replace the outstanding Option with an award that is determined by the Committee to be at least equivalent in value to such outstanding Option on the date of the Change in Control, then the Vesting Date of such outstanding Option shall be accelerated to the date of the Change in Control.

Section 5.6 Additional Restrictions on Incentive Stock Options.

An Option designated by the Committee to be an Incentive Stock Option shall be subject to the following provisions:

(a)Notwithstanding any other provision of this Plan to the contrary, no Participant may receive an Incentive Stock Option under the Plan if such Participant, at the time the Option is granted, owns (after application of the rules contained in Section 424(d) of the Code) stock possessing more than ten (10) percent of the total combined voting power of all classes of stock of the Company or its Affiliates, unless (i) the Exercise Price for such Incentive Stock Option is at least 110 percent of the Fair Market Value of the Shares subject to such Incentive Stock Option on the date of grant, and (ii) such Option is not exercisable after the date five (5) years from the date such Incentive Stock Option is granted.

(b)Each Participant who receives Shares upon exercise of an Option that is an Incentive Stock Option shall give the Company prompt notice of any sale of Shares prior to a date which is two years from the date the Option was granted or one year from the date the Option was exercised. Such sale shall disqualify the Option as an Incentive Stock Option.

(c)The aggregate Fair Market Value (determined with respect to each Incentive Stock Option at the time such Incentive Stock Option is granted) of the Shares with respect to which Incentive Stock Options are exercisable for the first time by a Participant during any calendar year (under this Plan or any other plan of the Company or an Affiliate) shall not exceed $100,000 and the term of the Incentive Stock Option shall not be more than ten years.

(d)Any Option under this Plan which is designated by the Committee as an Incentive Stock Option but fails, for any reason, to meet the foregoing requirements shall be treated as a Non-Qualified Stock Option.

Section 5.7 Method of Exercise.

(a) Subject to the limitations of the Plan and the Award Agreement, an Option Holder may, at any time on or after the Vesting Date and during the Exercise Period, exercise his or her right to purchase all or any part of the Shares to which the Option relates; provided, however, that the minimum number of Shares which may be purchased at any time shall be 100, or, if less, the total number of Shares relating to the Option which remain un-purchased. An Option Holder shall exercise an Option to purchase Shares by:

(i)giving written notice to the Committee, in such form and manner as the Committee may prescribe, of his or her intent to exercise the Option;

(ii)delivering to the Committee full payment for the Shares as to which the Option is to be exercised; and

(iii)satisfying such other conditions as may be prescribed in the Award Agreement.

(b) The Exercise Price of Shares to be purchased upon exercise of any Option shall be paid in full:

(i)in cash (by certified or bank check or such other instrument as the Company may accept); or

(ii)if and to the extent permitted by the Committee, in the form of Shares already owned by the Option Holder as of the exercise date and having an aggregate Fair Market Value on the date the Option is exercised equal to the aggregate Exercise Price to be paid; or

(iii)if and to the extent permitted by the Committee, by the Company withholding Shares otherwise issuable upon the exercise having an aggregate Fair Market Value on the date the Option is exercised equal to the aggregate Exercise Price to be paid; or

(iv)by a combination thereof.

Payment for any Shares to be purchased upon exercise of an Option may also be made by delivering a properly executed exercise notice to the Company, together with a copy of irrevocable instructions to a broker to deliver promptly to the Company the amount of sale or loan proceeds to pay the purchase price and applicable tax withholding amounts (if any), in which event the Shares acquired shall be delivered to the broker promptly following receipt of payment. Notwithstanding the foregoing, during any period for which the Shares are publicly traded (i.e., the Company’s common stock is listed on any established stock exchange or a national market system) an exercise by a Director or Officer that involves or may involve a direct or indirect extension of credit or arrangement of an extension of credit by the Company, directly or indirectly, in violation of Section 402(a) of the Sarbanes-Oxley Act of 2002 shall be prohibited with respect to any Award under this Plan.

(c) When the requirements of Sections 5.7(a) and (b) have been satisfied, the Committee shall take such action as is necessary to cause the issuance of a stock certificate or cause Shares to be issued by book-entry procedures, in either event evidencing the Option Holder’s ownership of such Shares. The Person exercising the Option shall have no right to vote or to receive dividends, nor have any other rights with respect to the Shares with respect to which the Option is exercised, prior to the date the Shares are transferred to such Person on the stock transfer records of the Company, and no adjustments shall be made for any dividends or other rights for which the record date is prior to the date as of which the transfer is affected.

Section 5.8 Limitations on Options.

(a) An Option by its terms shall not be transferable by the Option Holder other than by will or the laws of descent and distribution, or pursuant to the terms of a Domestic Relations Order, and shall be exercisable, during the life of the Option Holder, only by the Option Holder or an alternate payee designated pursuant to such a Domestic Relations Order (but such transfer shall cause an Incentive Stock Option to become an Non-Qualified Stock Option as of the day of the transfer); provided, however, that a Participant may, at any time at or after the grant of a Non-Qualified Stock Option under the Plan, apply to the Committee for approval to transfer all or any portion of such Non-Qualified Stock Option which is then unexercised to such Participant’s Family Member; and provided further, than an Incentive Stock Option may be transferred to a trust if, under Section 671 of the Code and applicable state law, the Participant is considered the sole beneficial owner of the Incentive Stock Option while it is held by the trust. The Committee may approve or withhold approval of such transfer in its sole and absolute discretion. If such transfer is approved, it shall be effected by written notice to the Company given in such form and

manner as the Committee may prescribe and actually received by the Company prior to the death of the person giving it. Thereafter, the transferee shall have all of the rights, privileges and obligations which would attach thereunder to the Participant. If a privilege of the Option depends on the life, Continuous Service or other status of the Participant, such privilege of the Option for the transferee shall continue to depend upon the life, Continuous Service or other status of the Participant. The Committee shall have full and exclusive authority to interpret and apply the provisions of the Plan to transferees to the extent not specifically addressed herein.

(b) The Company’s obligation to deliver Shares with respect to an Option shall, if the Committee so requests, be conditioned upon the receipt of a representation as to the investment intention of the Option Holder to whom such Shares are to be delivered, in such form as the Committee shall determine to be necessary or advisable to comply with the provisions of applicable federal, state or local law. It may be provided that any such representation shall become inoperative upon a registration of the Shares or upon the occurrence of any other event eliminating the necessity of such representation. The Company shall not be required to deliver any Shares under the Plan prior to:

(i)the admission of such Shares to listing on any stock exchange or trading on any automated quotation system on which Shares may then be listed or traded; or

(ii)the completion of such registration or other qualification under any state or federal law, rule or regulation as the Committee shall determine to be necessary or advisable.

(c) An Option Holder may designate a Beneficiary to receive any Options that may be exercised after his or her death. Such designation and any change or revocation of such designation shall be made in writing in the form and manner prescribed by the Committee. In the event that the designated Beneficiary dies prior to the Option Holder, or in the event that no Beneficiary has been designated, any Options that may be exercised following the Option Holder’s death shall be transferred to the Option Holder’s estate. If the Option Holder and his or her Beneficiary shall die in circumstances that cause the Committee, in its discretion, to be uncertain which shall have been the first to die, the Option Holder shall be deemed to have survived the Beneficiary.

Section 5.9 Prohibition Against Option Repricing.

Except as provided in Section 11.3 and notwithstanding any other provision of this Plan, neither the Committee nor the Board shall have the right or authority following the grant of an Option pursuant to the Plan to amend or modify the Exercise Price of any such Option, or to cancel the Option at a time when the Exercise Price is greater than the Fair Market Value of the Shares in exchange for another Option or Award or for a cash payment.

ARTICLE VI

STOCK APPRECIATION RIGHTS

Section 6.1 Grant of Stock Appreciation Rights.

(a) Subject to the limitations of the Plan, the Committee may, in its discretion, grant to a Participant a Stock Appreciation Right. A Stock Appreciation Right must be designated as either a tandem Stock Appreciation Right or a stand-alone Stock Appreciation Right and, if not so designated, shall be deemed to be a stand-alone Stock Appreciation Right. A tandem Stock Appreciation Right may only be granted at the same time as the Option to which it relates. The exercise of a tandem Stock Appreciation Right shall cancel the related Option for a like number of Shares and the exercise of a related Option shall cancel a tandem Stock Appreciation Right for a like number of Shares.

(b) Each Stock Appreciation Right shall be evidenced by an Award Agreement which shall:

(i)specify the number of Shares covered by the Stock Appreciation Right;

(ii)specify the Exercise Price;

(iii)specify the Exercise Period;

(iv)specify the Vesting Date;

(v)specify that the Stock Appreciation Right shall be settled in cash or Shares, or a combination of cash and Shares; and

(vi)contain such other terms and conditions not inconsistent with the Plan as the Committee may, in its discretion, prescribe.

The terms and conditions of any Stock Appreciation Right shall not include provisions that provide for the deferral of compensation other than the recognition of income until the exercise of the Stock Appreciation Right (so that the Stock Appreciation Right will not be subject to Section 409A).

Section 6.2 Size of Stock Appreciation Right.

Subject to the restrictions of the Plan, the number of Shares as to which a Participant may be granted pursuant to a Stock Appreciation Right shall be determined by the Committee, in its discretion.

Section 6.3 Exercise Price.

The price per Share at which a Stock Appreciation Right may be exercised shall be determined by the Committee, in its discretion; provided, however, that the Exercise Price shall not be less than the Fair Market Value of a Share on the date on which the Stock Appreciation Right is granted. Notwithstanding the foregoing, a Stock Appreciation Right granted as a Substitute Award may be granted with an Exercise Price lower than that set forth in the preceding sentence if the Stock Appreciation Right is granted pursuant to an assumption or substitution for another option in a manner satisfying the provisions of Section 409A.

Section 6.4 Exercise Period.

The Exercise Period during which a Stock Appreciation Right may be exercised shall commence on the Vesting Date. It shall expire on the earliest of:

(a)the date specified by the Committee in the Award Agreement;

(b)unless otherwise determined by the Committee or set forth in the Award Agreement, the last day of the three-month period commencing on the date of the Participant’s termination of Continuous Service, other than a Termination for Cause;

(c)as of the time and on the date of the Participant’s termination of Continuous Service due to a Termination for Cause; or

(d)the last day of the ten-year period commencing on the date on which the Stock Appreciation Right was granted.

A Stock Appreciation Right that remains unexercised at the close of business on the last day of the Exercise Period shall be canceled without consideration at the close of business on that date.

Section 6.5 Vesting Date.

(a) The Vesting Date for each Stock Appreciation Right Award shall be determined by the Committee and specified in the Award Agreement.

(b) Subject to Section 3.7: (i) each Stock Appreciation Right shall vest and therefore become exercisable no earlier than one year after the date on which the Stock Appreciation Right is granted; and (ii) the Committee may, but shall not be required to, provide for an acceleration of vesting and exercisability in the terms of any Award Agreement upon the occurrence of a specified event. No Stock Appreciation Right may be exercised for a fraction of a Share.

(c) The following provisions apply if a Stock Appreciation Rights Holder terminates Continuous Service prior to the Vesting Date:

(i)if the Stock Appreciation Right Holder terminates Continuous Service prior to the Vesting Date for any reason other than death, Disability or a Change in Control, any unvested Award shall be forfeited without consideration;

(ii)if the Stock Appreciation Right Holder terminates Continuous Service prior to the Vesting Date on account of death or Disability, the Vesting Date shall be accelerated to the date of the Participant’s termination of Continuous Service; and

(iii)if a Change in Control occurs prior to the Vesting Date of a Stock Appreciation Right that is outstanding on the date of the Change in Control, and the Stock Appreciation Right Holder experiences an Involuntary Separation from Service during the 365-day period following the date of such Change in Control, then the Vesting Date for any non-vested portion of the Stock Appreciation Right shall be accelerated to the date of the Participant’s Involuntary Separation from Service. Notwithstanding the preceding sentence, if at the effective time of the Change in Control the successor to the Company’s business and/or assets does not either assume the outstanding Stock Appreciation Right Award or replace the outstanding Stock Appreciation Right Award with an award that is determined by the Committee to be at least equivalent in value to such outstanding Stock Appreciation Right Award on the date of the Change in Control, then the Vesting Date of such outstanding Stock Appreciation Right Award shall be accelerated to the date of the Change in Control.

Section 6.6 Method of Exercise.

(a) Subject to the limitations of the Plan and the Award Agreement, a Participant may, at any time on or after the Vesting Date and during the Exercise Period, exercise his or her Stock Appreciation Right as to all or any part of the Shares to which the Stock Appreciation Right relates; provided, however, that the minimum number of Shares as to which a Stock Appreciation Right may be exercised shall be 100, or, if less, the total number of Shares relating to the Stock Appreciation Right which remain unexercised. A Stock Appreciation Right Holder shall exercise a Stock Appreciation Right by:

(i)giving written notice to the Committee, in such form and manner as the Committee may prescribe, of his or her intent to exercise the Stock Appreciation Right; and

(ii)satisfying such other conditions as may be prescribed in the Award Agreement.

(b) When the requirements of Section 6.6(a) have been satisfied, the Committee shall take such action as is necessary to cause the remittance to the Stock Appreciation Right Holder (or, in the event of his or her death, his or her Beneficiary) of cash or a number of Shares (as determined by the Committee in its sole discretion) with an aggregate Fair Market Value equal to the excess (if any) of (i) the Fair Market Value of a Share on the date of exercise over (ii) the Exercise Price per Share, times the number of Stock Appreciation Rights exercised. The Person exercising the Stock Appreciation Right shall have no right to vote or to receive dividends, nor have any other rights with respect to the Shares, if any, with respect to which the Stock Appreciation right is exercised, prior to the date the Shares are transferred to such Person on the stock transfer records of the Company, and no adjustments shall be made for any dividends or other rights for which the record date is prior to the date as of which the transfer is affected.

Section 6.7 Limitations on Stock Appreciation Rights.

(a) A Stock Appreciation Right by its terms shall not be transferable by the Stock Appreciation Right Holder other than by will or the laws of descent and distribution, or pursuant to the terms of a Domestic Relations Order, and shall be exercisable, during the life of the Stock Appreciation Right Holder, only by the Stock Appreciation Right Holder or an alternate payee designated pursuant to such a Domestic Relations Order; provided, however, that a Participant may, at any time at or after the grant of a Stock Appreciation Right under the Plan, apply to the Committee for approval to transfer all or any portion of such Stock Appreciation Right which is then unexercised to such Participant’s Family Member. The Committee may approve or withhold approval of such transfer in its sole and absolute discretion. If such transfer is approved, it shall be effected by written notice to the Company given in such form and manner as the Committee may prescribe and actually received by the Company prior to the death of the person giving it. Thereafter, the transferee shall have, with respect to such Stock Appreciation Right, all of the rights, privileges and obligations which would attach thereunder to the Participant. If a privilege of the Stock Appreciation Right depends on the life, Continuous Service or other status of the Participant, such privilege of the Stock Appreciation Right for the transferee shall continue to depend upon the life, Continuous Service or other status of the Participant. The Committee shall have full and exclusive authority to interpret and apply the provisions of the Plan to transferees to the extent not specifically addressed herein.

(b) The Company’s obligation to deliver Shares with respect to a Stock Appreciation Right shall, if the Committee so requests, be conditioned upon the receipt of a representation as to the investment intention of the Stock Appreciation Right Holder to whom such Shares are to be delivered, in such form as the Committee shall determine to be necessary or advisable to comply with the provisions of applicable federal, state or local law. It may be provided that any such representation shall become inoperative upon a registration of the Shares or upon the

occurrence of any other event eliminating the necessity of such representation. The Company shall not be required to deliver any Shares under the Plan prior to:

(i)the admission of such Shares to listing on any stock exchange or trading on any automated quotation system on which Shares may then be listed or traded; or

(ii)the completion of such registration or other qualification under any state or federal law, rule or regulation as the Committee shall determine to be necessary or advisable.

(c) A Stock Appreciation Right Holder may designate a Beneficiary to receive any Stock Appreciation Right that may be exercised after his or her death. Such designation and any change or revocation of such designation shall be made in writing in the form and manner prescribed by the Committee. In the event that the designated Beneficiary dies prior to the Stock Appreciation Right Holder, or in the event that no Beneficiary has been designated, any Stock Appreciation Rights that may be exercised following the Stock Appreciation Right Holder’s death shall be transferred to the Stock Appreciation Right Holder’s estate. If the Stock Appreciation Right Holder and his or her Beneficiary shall die in circumstances that cause the Committee, in its discretion, to be uncertain which shall have been the first to die, the Stock Appreciation Right Holder shall be deemed to have survived the Beneficiary.

Section 6.8 Prohibition Against Stock Appreciation Right Repricing.

Except as provided in Section 11.3 and notwithstanding any other provision of this Plan, neither the Committee nor the Board shall have the right or authority following the grant of a Stock Appreciation Right pursuant to the Plan to amend or modify the Exercise Price of any such Stock Appreciation Right, or to cancel the Stock Appreciation Right at a time when the Exercise Price is greater than the Fair Market Value of the Shares in exchange for another Stock Appreciation Right or Award or a cash payment.

ARTICLE VII

RESTRICTED AWARDS

Section 7.1 In General.

(a) Each Restricted Award shall be evidenced by an Award Agreement which shall specify:

(i)the number of shares of Restricted Stock or Restricted Stock Units covered by the Restricted Award;

(ii)the amount, if any, which the Participant shall be required to pay to the Company in consideration for the issuance of such Restricted Stock or Restricted Stock Units;

(iii)the date of grant of the Restricted Award;

(iv)the Period of Restriction for the Restricted Award (including the performance conditions, if any, which must be satisfied in order for the Vesting Date to occur);

(v)as to Restricted Stock, the rights of the Participant with respect to dividends, voting rights and other rights and preferences associated with such Shares; and

(vi)as to Restricted Stock Units, the rights of the Participant with respect to attributes of the Restricted Stock Units which are the equivalent of dividends and other rights and preferences associated with Shares and the circumstances pursuant to which Restricted Stock Units shall be converted to Shares.

Restricted Awards may contain such other terms and conditions not inconsistent with the Plan as the Committee may, in its discretion, prescribe.

Restricted Stock Units shall be settled (paid) at such time as is specified in the Restricted Stock Unit Award. Unless otherwise specified in the Award, when and if Restricted Stock Units become payable, a Participant having received the grant of such units shall be entitled to receive payment from the Company in cash, Shares or a combination thereof, as determined by the Committee in its sole discretion.

As to Restricted Stock Units, the terms of the Award shall either result in the Restricted Stock Units not being subject to Section 409A or, if the Restricted Stock Units are subject to Section 409A, include terms that cause the Restricted Stock Units to comply with Section 409A.

(b) All Awards consisting of Restricted Stock shall be in the form of issued and outstanding Shares that shall be registered in the name of the Participant, subject to written transfer restriction instructions issued to the Company’s stock transfer agent, together with an irrevocable stock power executed by the Participant in favor of and held by the Committee or its designee, pending the vesting or forfeiture of the Restricted Award. The Shares shall at all times prior to the applicable Vesting Date be subject to the following restriction, communicated in writing to the Company’s stock transfer agent:

These shares of common stock are subject to the terms of an Award Agreement between Banner Corporation and [Name of Participant] dated [Award Date] made pursuant to the terms of the Banner Corporation 2023 Omnibus Incentive Plan, copies of which are on file at the executive offices of Banner Corporation and may not be sold, encumbered, hypothecated or otherwise transferred, except in accordance with the terms of such Plan and Award Agreement.

or such other restrictive communication or legend as the Committee, in its discretion, may specify.

(c) Unless otherwise set forth in the Award Agreement, a Restricted Award by its terms shall not be transferable by the Participant other than by will or by the laws of descent and distribution, or pursuant to the terms of a Domestic Relations Order; provided, however, that a Participant may, at any time at or after the grant of a Restricted Award, apply to the Committee for approval to transfer all or any portion of such Restricted Award which is then unvested to such Participant’s Family Member. The Committee may approve or withhold approval of such transfer in its sole and absolute discretion. If such transfer is approved, it shall be effected by written notice to the Company given in such form and manner as the Committee may prescribe and actually received by the Company prior to the death of the person giving it. Thereafter, the transferee shall have, with respect to such Restricted Award, all of the rights, privileges and obligations which would attach thereunder to the Participant. If a privilege of the Restricted Award depends on the life, Continuous Service or other status of the Participant, such privilege of the Restricted Award for the transferee shall continue to depend upon the life, Continuous Service or other status of the Participant. The Committee shall have full and exclusive authority to interpret and apply the provisions of the Plan to transferees to the extent not specifically addressed herein.

Section 7.2 Size of Restricted Award.

Subject to the restrictions of the Plan, the number of Shares as to which a Participant may be granted pursuant to a Restricted Award shall be determined by the Committee, in its discretion.

Section 7.3 Vesting Date.

(a) The Period of Restriction and Vesting Date for each Restricted Award shall be determined by the Committee and specified in the Award Agreement.

(b) Subject to Section 3.7: (i) the Period of Restriction shall end no earlier than one year after the date a Restricted Award is granted, and (ii) any Restricted Award that vests based on the achievement of performance or other criteria shall vest no earlier than one year after the date on which the Restricted Award is granted.

(c) The following provisions shall apply if a Participant holding a Restricted Award terminates Continuous Service prior to the Vesting Date: