Atlanta Braves Holdings Provides Corporate Governance Update

August 23 2024 - 7:15AM

Business Wire

Atlanta Braves Holdings, Inc. (“Atlanta Braves Holdings” or the

“Company”) (Nasdaq: BATRA, BATRK) announced today updates to voting

and governance arrangements at the Company.

Terry McGuirk (“McGuirk”), Chairman and CEO of Braves Holdings,

LLC, the parent company of the Atlanta Braves and the Braves

Development Company, has entered into certain shareholder

arrangements with Dr. John Malone (“Malone”), pursuant to which

Malone has granted McGuirk a proxy to vote 887,079 shares of the

Company’s Series B Common Stock owned by Malone, representing 44%

of the Company’s outstanding voting power, on director elections,

the approval or authorization of executive compensation and other

routine matters. Malone has also granted McGuirk a right of first

refusal with respect to future transfers of the Company shares

beneficially owned by Malone as well as certain appreciation rights

with respect to the value of Malone’s Series B shares. These

arrangements, which have been approved by Major League Baseball,

will be described in further detail in filings to be made with the

SEC by Malone and McGuirk.

“Terry has done a phenomenal job running the Braves

organization, and I have tremendous faith in the work he and the

rest of the Braves management team are doing,” said John Malone. “I

want to thank Greg for his contributions to the Braves’ financial

and strategic growth since Liberty’s acquisition in 2007, including

the maturation of the business into a standalone public company.

These arrangements will better align the routine voting and

operational control of Atlanta Braves Holdings with the management

of the baseball franchise and give Terry the opportunity to share

in the value that he and the management team continue to create for

shareholders, fans and the local community.”

“I am incredibly grateful to John for this opportunity and for

the trust he has continuously placed in me and the Braves

management team,” McGuirk said. “This transaction is a testament to

the work our management team has been doing with the Braves

organization in Atlanta, and the belief that John has in us to keep

executing on our plan and driving shareholder value.”

“The Braves benefit from a large and loyal fan base, a talented

young team and a solid financial profile. The formation of Atlanta

Braves Holdings as a public company in July 2023 has enabled us to

better highlight the value of this strong asset. This action is the

final step in its progression as a standalone public company, and

the Atlanta-based management team is well-equipped to take on the

full operations and drive long-term returns for our shareholders,”

said Greg Maffei, President and CEO of Atlanta Braves Holdings.

Atlanta Braves Holdings and Liberty Media Corporation (“Liberty

Media”) intend to begin transitioning various general and

administrative services currently provided by Liberty Media to the

management of Atlanta Braves Holdings, including legal, tax,

accounting, treasury, information technology, cybersecurity and

investor relations support. As part of that transition, almost all

of the current officer slate of the Company, including Mr. Maffei,

will be stepping down, with the current officers of the Braves

operating team assuming these roles at the end of August.

As of July 31, 2024, Malone beneficially owns approximately 96

thousand shares of Series A common stock, 946 thousand shares of

Series B common stock and 3.0 million shares of Series C common

stock in Atlanta Braves Holdings, representing approximately 47.5%

of the Company’s voting power.

About Atlanta Braves Holdings,

Inc.

Atlanta Braves Holdings, Inc. (NASDAQ: BATRA, BATRK) consists of

100% of the ownership and voting interest in Braves Holdings, LLC,

which is the owner and operator of the Atlanta Braves Major League

Baseball Club and the mixed-use real estate development, The

Battery Atlanta, and is the operator of the Atlanta Braves Major

League Baseball Club’s stadium, Truist Park.

Forward-Looking Statements

This communication includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. All statements other than statements of historical fact

are “forward-looking statements” for purposes of federal and state

securities laws. These forward-looking statements generally can be

identified by phrases such as “possible,” “potential,” “intends” or

“expects” or other words or phrases of similar import or future or

conditional verbs such as “will,” “may,” “might,” “should,”

“would,” “could,” or similar variations. These forward-looking

statements involve many risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

by such statements. These forward-looking statements speak only as

of the date of this communication, and Atlanta Braves Holdings

expressly disclaims any obligation or undertaking to disseminate

any updates or revisions to any forward-looking statement contained

herein to reflect any change in Atlanta Braves Holdings’

expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is based.

Please refer to the publicly filed documents of Atlanta Braves

Holdings, including in its Annual Report on Form 10-K for the

fiscal year ended December 31, 2023, as such risk factors may be

amended, supplemented or superseded from time to time by Atlanta

Braves Holdings’ subsequent filings with the SEC, for additional

information about Atlanta Braves Holdings and about the risks and

uncertainties related to Atlanta Braves Holdings’ business which

may affect the statements made in this communication.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240822090477/en/

Atlanta Braves Holdings, Inc.

Investor Contact Shane Kleinstein

720-875-5432

Braves Media Contact Jennifer

Mastin Giglio 404-614-1336

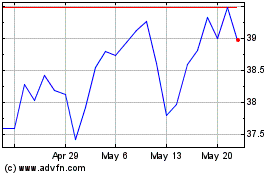

Atlanta Braves (NASDAQ:BATRK)

Historical Stock Chart

From Nov 2024 to Dec 2024

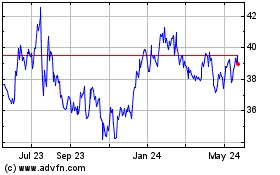

Atlanta Braves (NASDAQ:BATRK)

Historical Stock Chart

From Dec 2023 to Dec 2024