CHARLESTON, W.Va., Jan. 22 /PRNewswire-FirstCall/ -- City Holding

Company, "the Company" (NASDAQ:CHCO), a $2.5 billion bank holding

company headquartered in Charleston, today announced net income of

$53.2 million, or diluted earnings per share of $2.99, for the year

ended December 31, 2006 compared to $50.3 million, or diluted

earnings per share of $2.84 during 2005. This represents an

increase in diluted earnings per share of 5.3% despite an increase

in the Company's provision for loan losses from $1.4 million in

2005 (or 9 basis points of average loans outstanding) to $3.8

million in 2006 (or 23 basis points of average loans outstanding).

Return on assets for the full year was 2.11%, return on equity was

17.9%, the net interest margin was 4.56%, and the efficiency ratio

was 44.5%. This compares with a return on assets of 2.09%, a return

on equity of 18.9%, net interest margin of 4.49%, and an efficiency

ratio of 46.7% for 2005. For the fourth quarter of 2006, the

Company reported net income of $12.9 million, or $0.74 per diluted

share compared to $13.1 million or $0.72 per diluted share in the

fourth quarter of 2005. This represents a 2.8% increase in diluted

earnings per share, even with a loss of $0.7 million in connection

with the redemption of $6.0 million of the Company's trust

preferred securities in 2006. For the fourth quarter of 2006, the

Company achieved a return on assets of 2.06%, a return on equity of

16.9%, a net interest margin of 4.43%, and an efficiency ratio of

46.4%. This compares with a return on assets of 2.10%, a return on

equity of 17.7%, net interest margin of 4.55%, and an efficiency

ratio of 46.6% for the comparable period of 2005. Charles

Hageboeck, Chief Executive Officer and President, stated, "In 2006,

City Holding Company continued as one of the best performing banks

in the industry based on profitability, the net interest margin,

efficiency ratio and asset quality. Through the efforts of our

management and staff, the Company is reporting record earnings for

2006 and increased return on assets to 2.11% from what was already

the highest level of return on assets for banks between $1 and $10

billion during 2005. Diluted earnings per share were up 5.3% in

2006 as compared to 2005 despite headwinds from a higher provision

for loan losses and from a decrease in interest income of $2

million associated with run-off of the legacy portfolio of

previously securitized loans. As a result, we were very pleased

with the underlying performance of the Company during 2006. Beyond

maintaining its enviable financial performance, the Company has

embarked upon strategies to grow the franchise. The Company opened

its first new free-standing branch in eight years in Charles Town,

West Virginia, which is located in the Washington-Baltimore,

DC-MD-VA-WV PMSA in October of 2006. We have broken ground on a new

7,500 square foot office in Martinsburg, WV that will serve as the

headquarters for the bank's presence in the eastern panhandle of

West Virginia and have acquired additional parcels of land for

future branch expansion in areas within our current foothold. As a

result of changes in state law, the Company has hired a team of 6

insurance professionals as part of City Insurance to provide

Worker's Compensation Insurance to businesses throughout West

Virginia -- a move that is expected to lift insurance revenues by

nearly 50% during 2007. The Company has also hired a team of

insurance agents in Beckley, WV to drive significant expansion of

the Company's personal lines insurance business throughout the

Company's footprint. During 2006, the Company sold its credit card

portfolio (which resulted in a $3.6 million gain) to create

shareholder value and leverage our ability to build strong customer

relationships across all of our product lines. The Company

continues to offer credit cards to its customers through its

partnership with Elan Financial Services (Elan), one of the premier

providers of processing services for financial institutions. Due to

the credit card portfolio sale, interest and fee income decreased

$1.0 million from 2005. To mitigate this decrease, the Company

implemented a strategy in the third and fourth quarter to

reposition the balance sheet by selling approximately $55 million

of investment securities and replacing them with higher yielding

investment securities. The Company also repurchased $9.5 million of

its 9.15% trust preferred securities, which reduced total interest

expense by $0.1 million during the third and fourth quarters.

Subsequent to changes the Company implemented in its underwriting

standards beginning in 2001, the Company has demonstrated

considerable consistency in its asset quality. Gross charge-offs at

the Company are monitored by losses on depository accounts, losses

on credit cards, losses on loans acquired in 2005 as part of the

acquisition of Classic Bancshares, losses on loans that were

underwritten prior to 2002, and losses on loans that have been

underwritten since 2002. Loss rates on loans underwritten since

2002 demonstrate the significant turn-around achieved in asset

quality, with gross charge-off rates that have averaged well below

our gross charge-off rate for all loans over this time period. As

time passes, the Company's total gross charge-off experience

increasingly reflects the solid underwriting standards that the

Company utilizes in commercial and retail lending as loans written

prior to 2002 become a smaller portion of our loan portfolio. At

December 31, 2006, balances of loans written subsequent to 2002

comprise approximately 73% of total loan balances. The Company also

remains well positioned with respect to capital. With a tangible

capital ratio in excess of 10%, the Company is positioned to use

its capital to either significantly accelerate the past repurchase

levels of our common stock or to use cash in an accretive

acquisition. In summary, the Company performed well against all

measures during 2006 and I am confident that we are positioned to

continue to perform solidly in 2007 despite what is anticipated to

be a challenging year for banks based on the current economic

environment." Balance Sheet Trends As compared to December 31,

2005, loans have increased $64.6 million (4.0%) at December 31,

2006 with increases in commercial loans of $69.0 million (11.0%),

home equity loans of $20.0 million (6.6%) and residential real

estate loans of $6.0 million (1.0%). These increases were partially

offset by decreases in installment loans of $15.7 million, due

primarily to the sale of the Company's retail credit card

portfolio, and previously securitized loans of $14.7 million (see

Previously Securitized Loans). Total average depository balances

increased $79.6 million, or 4.2%, from the quarter ended December

31, 2005 to the quarter ended December 31, 2006. This growth was

primarily in time deposits, which have increased $105.6 million

from the quarter ended December 31, 2005. Net Interest Income For

the full year, the Company's tax equivalent net interest income

increased $5.3 million, or 5.4%, from $98.1 million in 2005 to

$103.4 million in 2006, despite a decrease of $2.0 million in

interest income from previously securitized loans from 2005 and a

decrease of $0.9 million in interest income from credit cards. The

average balances of previously securitized loans decreased $20.6

million, or 48.0%, from $42.9 million for the year ended December

31, 2005 to $22.3 million for the year ended December 31, 2006.

This decrease was partially mitigated as the yield on previously

securitized loans rose from 26.6% for the year ended December 31,

2005 to 42.2% for the year ended December 31, 2006 (see Previously

Securitized Loans). Exclusive of interest income from previously

securitized loans and credit cards, interest income from all other

loans increased $13.1 million from 2005 and the yield on these

loans increased 81 basis points. The average balances of these

loans increased $167 million during 2006 due to both internal

growth and the acquisition of Classic during the second quarter of

2005. Interest income attributable to this growth totaled $10.3

million. These increases were partially offset by an increase of

$15.3 million in interest expense. The average rate paid on

deposits increased 75 basis points during 2006 and resulted in an

increase in deposit interest expense of $11.0 million. Due to the

Classic acquisition and internal growth, the Company experienced an

increase of $153 million, or 10.4%, in average deposit balances

that increased deposit interest expense by $4.3 million. The net

interest margin for the year ended December 31, 2006 of 4.56%

represented a 7 basis point increase from the year ended December

31, 2005's net interest margin of 4.49%. The Company positioned its

balance sheet to benefit from rising interest rates by emphasizing

variable rate loan products. As interest rates rose during 2005 and

2006, the Company's interest rate risk management strategy offset

the decreasing balances of previously securitized loans and

resultant reduced levels of interest income from these assets.

Excluding previously securitized loans, the sale of the Company's

credit card portfolio, and the impact of the Classic acquisition,

the Company's net interest margin increased 26 basis points and net

interest income increased $6.3 million from 2005. The Company's tax

equivalent net interest income decreased $0.5 million, or 2.0%,

from $25.8 million during the fourth quarter of 2005 to $25.3

million during the fourth quarter of 2006. This decrease is

attributable to two factors. First, during the third quarter of

2006, the Company sold its credit card portfolio. Average credit

card loans outstanding were $15.3 million in the fourth quarter of

2005. The sale of these loans resulted in a decrease in interest

income of $0.5 million. Secondly, the Company experienced a

decrease of $0.6 million in interest income from previously

securitized loans in the fourth quarter of 2006 as compared to the

fourth quarter of 2005 as the average balance of these loans

decreased 48.6%. The decrease in average balances was partially

mitigated by an increase in the yield on these loans which rose

from an average of 31.0% for the fourth quarter of 2005 to 46.6%

for the fourth quarter of 2006 (see Previously Securitized Loans).

An increase of $4.3 million in interest income from all other loans

(commercial, residential, home equity, and consumer) was

essentially offset by an increase of $4.0 million in interest

expense on deposits. The Company's net interest margin was 4.43% in

the fourth quarter of 2006 as compared to 4.55% in the fourth

quarter of 2005. The decline in the net interest margin can be

attributed to lower interest income from previously securitized

loans and the sale of the credit card portfolio. Excluding these

assets, the Company's net interest margin decreased 2 basis points

from 4.22% during the fourth quarter of 2005 to 4.20% for the

fourth quarter of 2006 while net interest income increased $0.3

million from the quarter ended December 31, 2005. Credit Quality At

December 31, 2006, the Allowance for Loan Losses ("ALLL") was $15.4

million or 0.92% of total loans outstanding and 385% of

non-performing loans compared to $16.8 million or 1.04% of loans

outstanding and 402% of non- performing loans at December 31, 2005,

and $15.6 million or 0.92% of loans outstanding and 408% of

non-performing loans at September 30, 2006. While the Company's

ALLL as a percent of outstanding loans has decreased since December

31, 2005, this decrease can be directly attributed to the sale of

the bank's credit card portfolio in the third quarter of 2006. In

fact, after consideration of the impact of the sale of the credit

card portfolio, the ALLL (less the portion of the allowance

allocated to credit cards) was 0.93% of total loans outstanding

(net of credit card loans outstanding) and 355% of non-performing

loans (net of non-performing credit card loans) at December 31,

2005. As a result of the Company's quarterly analysis of the

adequacy of the ALLL, the Company recorded a provision for loan

losses of $0.9 million in the fourth quarter of 2006 and $3.8

million for the year ended December 31, 2006 compared to $0.8

million and $1.4 million for the comparable periods in 2005. The

provision for loan losses recorded during 2006 was the result of

increases in allocations to commercial, commercial real estate, and

home equity loans. While the Company has increased the provision

from 2005, the amount of provision recorded was favorably impacted

by continued improvement in the quality of the loan portfolio and

the sale of the credit card portfolio. Changes in the amount of the

provision and related allowance are based on the Company's detailed

methodology and are directionally consistent with growth and

changes in the quality of the Company's loan portfolio. The Company

had net charge-offs of $1.1 million for the fourth quarter of 2006,

with depository accounts representing $0.4 million (or

approximately 36%) of this total. While charge-offs on depository

accounts are appropriately taken against the ALLL, the revenue

associated with depository accounts is reflected in service charges

and has been steadily growing as the core base of checking accounts

has grown. Net charge-offs on commercial loans were $0.7 million

for the fourth quarter, while residential loans experienced net

recoveries of $0.1 million during the quarter. The increase in net

commercial charge-offs was primarily related to four credits that

had been previously identified with appropriate amounts of reserve

allocated for each credit. The Company experienced net charge-offs

related to loans (excluding overdrafts) of 0.11% in 2006; 0.22% in

2005; and 0.17% in 2004. The Company's ratio of non-performing

assets to total loans and other real estate owned has steadily

improved over the last four years, ranging from 0.34% in 2003 to

0.25% at December 31, 2006. This compares quite favorably relative

to the Company's peer group (bank holding companies with total

assets between $1 and $5 billion), which reported average

non-performing assets as a percentage of loans and other real

estate owned for the most recently reported quarter ended September

30, 2006 of 0.70%. The composition of the Company's loan portfolio,

which is weighted more heavily toward residential mortgage loans

and less towards non-real estate secured commercial loans than

peers, has allowed it to maintain a lower allowance in comparison

to peers. In addition, the sale of the Company's credit card

portfolio resulted in a reduction of the allowance by $1.4 million

during 2006. As a result, the Company's ALLL as a percentage of

loans outstanding is 0.92% at December 31, 2006. The Company

believes its methodology for determining the adequacy of its ALLL

adequately provides for probable losses inherent in the loan

portfolio and produces a provision for loan losses that is

directionally consistent with changes in asset quality and loss

experience. Non-interest Income For the full year, net of

investment securities (losses) gains and the gain from the sale of

the Company's credit card portfolio, non-interest income increased

$2.7 million, or 5.4%, from $49.9 million in 2005 to $52.6 million

in 2006. Service charges from depository accounts increased $3.5

million, or 8.9%, from $39.1 million in 2005 to $42.6 million in

2006. This increase is partially due to the acquisition of Classic

Bancshares, Inc. during the second quarter of 2005. This increase

was partially mitigated by a $0.4 million decrease in bank-owned

life insurance revenues from the settlement of insured claims and a

$0.4 million decrease in other income due primarily to lower credit

card fee income as a result of the sale of the credit card

portfolio. Net of investment securities gains, non-interest income

increased $0.1 million to $13.5 million in the fourth quarter of

2006 as compared to $13.4 million in the fourth quarter of 2005.

The largest source of non-interest income is service charges from

depository accounts, which increased $0.4 million, or 4.1%, from

$10.5 million during the fourth quarter of 2005 to $10.9 million

during the fourth quarter of 2006. This increase was essentially

offset by a decrease in other income of $0.3 million due to lower

credit card fee income due to the sale of the credit card portfolio

on August 4, 2006 to Elan. Non-interest Expenses For the full year,

non-interest expenses increased $2.2 million, or 3.1%, from $69.1

million in 2005 to $71.3 million in 2006. The increase was

primarily a result of the Classic acquisition during the second

quarter of 2005, which increased non-interest expenses by $1.8

million from 2005. In addition, the Company recognized $1.4 million

of losses from the redemption of $12.0 million of its trust

preferred securities during 2006. Other expenses decreased $1.3

million from 2005 due to a charge recorded in 2005 that was

associated with interest rate floors utilized in the Company's

interest rate risk management process. Exclusive of these items,

non-interest expenses increased by $0.3 million from 2005 due to

increased advertising expenses incurred to facilitate the Company's

focused efforts to attract and grow new customer relationships. The

Company's efficiency ratio improved from 46.7% for the year ended

December 31, 2005 to 44.5% for the year ended December 31, 2006,

reflecting ongoing strength in managing expenses while increasing

revenues. The average efficiency ratio for the Company's peer group

for the most recently reported quarter was 58.5%. Non-interest

expenses decreased $0.2 million from $18.3 million in the fourth

quarter of 2005 to $18.1 million in the fourth quarter of 2006. The

Company incurred a loss of $0.7 million during the fourth quarter

of 2006 in connection with the redemption of $6.0 million of its

trust preferred securities. The Company redeemed the trust

preferred securities that have a stated interest rate of 9.15% in

2006 as a part of its strategy to reposition the balance sheet in

response to the sale of its credit card portfolio. In addition, the

Company experienced a decrease in health insurance costs of $0.4

million during fourth quarter of 2006, although such savings are

not expected to be of a recurring nature. During the fourth quarter

of 2005 the Company recorded a charge of $1.3 million associated

with interest rate floors. Previously Securitized Loans At December

31, 2006, the Company reported "Previously Securitized Loans" of

$15.6 million compared to $30.3 million at December 31, 2005,

representing a decrease of 48.5%. The yield on the previously

securitized loans was 46.6% for the quarter ended December 31,

2006, compared to 43.2% for the quarter ended September 30, 2006,

and 31.0% for the quarter ended December 31, 2005. The yield on the

previously securitized loans has increased due to improved cash

flows as net default rates have been less than previously

estimated. The default rates have decreased as a result of the

Company's assumption of the servicing of all of the pool balances

during the second quarter of 2005. Subsequent to our assumption of

the servicing of these loans, the Company has averaged net

recoveries but does not believe that continued net recoveries can

be sustained indefinitely. The Company now projects that the yield

on these loans will be in the range of 47-49%. Capitalization and

Liquidity One of the Company's strengths is that it is highly

profitable while maintaining strong liquidity and capital. With

respect to liquidity, the Company's loan to deposit ratio was 84.5%

and the loan to asset ratio was 66.9% at December 31, 2006. The

Company maintained investment securities totaling 20.7% of assets

as of this date. Further, the Company's deposit mix is weighted

heavily toward checking and saving accounts that fund 42.5% of

assets at December 31, 2006. Time deposits fund 36.7% of assets at

December 31, 2006, but very few of these deposits are in accounts

that have balances of more than $150,000, reflecting the core

retail orientation of the Company. The Company is also strongly

capitalized. With respect to regulatory capital, at December 31,

2006, the Company's Leverage Ratio is 10.79%, the Tier I Capital

ratio is 15.30%, and the Total Risk-Based Capital ratio is 16.19%.

These regulatory capital ratios are significantly above levels

required to be considered "well capitalized," which is the highest

possible regulatory designation. The Company's tangible equity

ratio was 10.0% at December 31, 2006 compared with a tangible

equity ratio of 9.5% at December 31, 2005. During the year ended

December 31, 2006, the Company repurchased 666,753 common shares at

a weighted average price of $36.45 as part of a one million share

repurchase plan authorized by the Board of Directors in June 2005.

On December 21, 2006, the Company announced that the Board of

Directors authorized the Company to buy back up to one million

shares of its common shares (approximately 5% of outstanding

shares) in open market transactions at prices that are accretive to

the earnings per share of continuing shareholders. No time limit

was placed on the duration of the share repurchase program. As part

of this authorization, the Company rescinded the previous share

repurchase program plan approved in June 2005. The Company had

repurchased 837,853 shares under the June 2005 Stock Repurchase

Plan. Due to the Company's strong earnings, the Company was able to

both repurchase these shares and increase its tangible equity

ratio. As a result of repurchases completed in 2006, the Company's

outstanding shares decreased 666,753 shares during the year

(exclusive of stock option exercises), providing the Company's

shareholders increased earnings capacity as shares repurchased

improve earnings per share on the remaining shares outstanding. As

of January 19, 2007, the Company has approximately 931,000 shares

remaining for repurchase under the plan approved by the Board of

Directors in December 2006. The repurchase of 666,753 shares during

2006 represents 3.7% of total shares outstanding as of December 31,

2005. City Holding Company is the parent company of City National

Bank of West Virginia. City National operates 67 branches across

West Virginia, Eastern Kentucky and Southern Ohio. Forward-Looking

Information This news release contains certain forward-looking

statements that are included pursuant to the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995. Such

information involves risks and uncertainties that could result in

the Company's actual results differing from those projected in the

forward-looking statements. Important factors that could cause

actual results to differ materially from those discussed in such

forward-looking statements include, but are not limited to, (1) the

Company may incur additional loan loss provision due to negative

credit quality trends in the future that may lead to a

deterioration of asset quality; (2) the Company may incur increased

charge-offs in the future; (3) the Company may experience increases

in the default rates on previously securitized loans that would

result in impairment losses or lower the yield on such loans; (4)

the Company may continue to benefit from strong recovery efforts on

previously securitized loans resulting in improved yields on these

assets; (5) the Company could have adverse legal actions of a

material nature; (6) the Company may face competitive loss of

customers; (7) the Company may be unable to manage its expense

levels; (8) the Company may have difficulty retaining key

employees; (9) changes in the interest rate environment may have

results on the Company's operations materially different from those

anticipated by the Company's market risk management functions; (10)

the Company may be unable to increase its insurance revenues as

expected; (11) changes in general economic conditions and increased

competition could adversely affect the Company's operating results;

(12) changes in other regulations and government policies affecting

bank holding companies and their subsidiaries, including changes in

monetary policies, could negatively impact the Company's operating

results; and (13) the Company may experience difficulties growing

loan and deposit balances. Forward-looking statements made herein

reflect management's expectations as of the date such statements

are made. Such information is provided to assist stockholders and

potential investors in understanding current and anticipated

financial operations of the Company and is included pursuant to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. The Company undertakes no obligation to update any

forward-looking statement to reflect events or circumstances that

arise after the date such statements are made. CITY HOLDING COMPANY

AND SUBSIDIARIES Financial Highlights (Unaudited) Three Months

Ended Dec 31 Dec 31 Percent 2006 2005 Change Earnings ($000s,

except per share data): Net Interest Income (FTE) $25,333 $25,844

(1.98)% Net Income 12,939 13,089 (1.15)% Earnings per Basic Share

0.74 0.72 2.78% Earnings per Diluted Share 0.74 0.72 2.78% Key

Ratios (percent): Return on Average Assets 2.06% 2.10% (1.91)%

Return on Average Equity 16.93% 17.66% (4.11)% Net Interest Margin

4.43% 4.55% (2.65)% Efficiency Ratio 46.40% 46.57% (0.37)% Average

Shareholders' Equity to Average Assets 12.14% 11.87% 2.25%

Risk-Based Capital Ratios (a): Tier I 15.30% 15.41% (0.72)% Total

16.19% 16.38% (1.16)% Average Tangible Equity to Average Tangible

Assets 10.06% 9.52% 5.71% Common Stock Data: Cash Dividends

Declared per Share $0.28 $0.25 12.00% Book Value per Share 17.46

16.14 8.17% Tangible Book Value per Share 14.09 12.85 9.68% Market

Value per Share: High 41.87 37.62 11.30% Low 37.49 32.68 14.72% End

of Period 40.89 35.95 13.74% Price/Earnings Ratio (b) 13.81 12.48

10.67% Twelve Months Ended Dec 31 Dec 31 Percent 2006 2005 Change

Earnings ($000s, except per share data): Net Interest Income (FTE)

$103,359 $98,097 5.36% Net Income 53,187 50,288 5.76% Earnings per

Basic Share 3.00 2.87 4.53% Earnings per Diluted Share 2.99 2.84

5.28% Key Ratios (percent): Return on Average Assets 2.11% 2.09%

0.93% Return on Average Equity 17.91% 18.98% (5.64)% Net Interest

Margin 4.56% 4.49% 1.55% Efficiency Ratio 44.49% 46.66% (4.65)%

Average Shareholders' Equity to Average Assets 11.80% 11.03% 6.96%

Common Stock Data: Cash Dividends Declared per Share $1.12 $1.00

12.00% Market Value per Share: High 41.87 39.21 6.78% Low 34.53

27.57 25.24% (a) December 31, 2006 risk-based capital ratios are

estimated. (b) December 31, 2006 price/earnings ratio computed

based on annualized fourth quarter 2006 earnings. CITY HOLDING

COMPANY AND SUBSIDIARIES Financial Highlights (Unaudited) Book

Value and Market Price Range per Share Market Price Book Value per

Share Range per Share March 31 June 30 September 30 December 31 Low

High 2002 $8.92 $9.40 $9.64 $9.93 $12.04 $30.20 2003 10.10 10.74

11.03 11.46 25.50 37.15 2004 12.09 11.89 12.70 13.03 27.30 37.58

2005 13.20 15.56 15.99 16.14 27.57 39.21 2006 16.17 16.17 16.99

17.46 34.53 41.87 Earnings per Basic Share Quarter Ended March 31

June 30 September 30 December 31 Year-to-Date 2002 $0.38 $0.45

$0.53 $0.56 $1.92 2003 0.56 0.73 0.69 0.64 2.62 2004 0.66 0.80 0.66

0.67 2.79 2005 0.70 0.72 0.73 0.72 2.87 2006 0.71 0.78 0.78 0.74

3.00 Earnings per Diluted Share Quarter Ended March 31 June 30

September 30 December 31 Year-to-Date 2002 $0.38 $0.45 $0.52 $0.55

$1.90 2003 0.55 0.72 0.68 0.63 2.58 2004 0.65 0.79 0.65 0.66 2.75

2005 0.69 0.71 0.72 0.72 2.84 2006 0.71 0.77 0.77 0.74 2.99 CITY

HOLDING COMPANY AND SUBSIDIARIES Consolidated Statements of Income

(Unaudited) ($ in 000s, except per share data) Three Months Ended

December 31, 2006 2005 Interest Income Interest and fees on loans

$32,157 $28,918 Interest on investment securities: Taxable 6,800

7,188 Tax-exempt 423 497 Interest on deposits in depository

institutions 459 36 Interest on federal funds sold 86 - Total

Interest Income 39,925 36,639 Interest Expense Interest on deposits

12,543 8,569 Interest on short-term borrowings 1,304 1,049 Interest

on long-term debt 973 1,446 Total Interest Expense 14,820 11,064

Net Interest Income 25,105 25,575 Provision for loan losses 901 800

Net Interest Income After Provision for Loan Losses 24,204 24,775

Non-Interest Income Investment securities gains (losses) 72 125

Service charges 10,962 10,530 Insurance commissions 675 620 Trust

and investment management fee income 498 504 Bank owned life

insurance 576 691 Other income 803 1,067 Total Non-Interest Income

13,586 13,537 Non-Interest Expense Salaries and employee benefits

8,354 8,416 Occupancy and equipment 1,655 1,569 Depreciation 1,037

1,062 Professional fees and litigation expense 415 486 Postage,

delivery, and statement mailings 735 728 Advertising 876 710

Telecommunications 549 560 Bankcard expenses 478 540 Insurance and

regulatory 375 380 Office supplies 408 388 Repossessed asset losses

(gains), net of expenses 6 (28) Loss on early extinguishment of

debt 708 - Other expenses 2,503 3,528 Total Non-Interest Expense

18,099 18,339 Income Before Income Taxes 19,691 19,973 Income tax

expense 6,752 6,884 Net Income $12,939 $13,089 Basic earnings per

share $0.74 $0.72 Diluted earnings per share $0.74 $0.72 Average

Common Shares Outstanding: Basic 17,535 18,127 Diluted 17,601

18,211 CITY HOLDING COMPANY AND SUBSIDIARIES Consolidated

Statements of Income (Unaudited) ($ in 000s, except per share data)

Twelve Months Ended December 31, 2006 2005 Interest Income Interest

and fees on loans $123,945 $103,714 Interest on investment

securities: Taxable 28,418 29,804 Tax-exempt 1,782 1,887 Interest

on loans held for sale 322 - Interest on deposits in depository

institutions 1,477 109 Interest on federal funds sold 179 4 Total

Interest Income 156,123 135,518 Interest Expense Interest on

deposits 44,046 28,805 Interest on short-term borrowings 5,099

3,369 Interest on long-term debt 4,579 6,264 Total Interest Expense

53,724 38,438 Net Interest Income 102,399 97,080 Provision for loan

losses 3,801 1,400 Net Interest Income After Provision for Loan

Losses 98,598 95,680 Non-Interest Income Investment securities

(losses) gains (1,995) 151 Service charges 42,559 39,091 Insurance

commissions 2,335 2,352 Trust and investment management fee income

2,140 2,025 Bank owned life insurance 2,352 2,779 Gain on sale of

credit card portfolio 3,563 - Other income 3,249 3,693 Total

Non-Interest Income 54,203 50,091 Non-Interest Expense Salaries and

employee benefits 34,484 33,479 Occupancy and equipment 6,481 6,295

Depreciation 4,219 4,096 Professional fees and litigation expense

1,760 2,021 Postage, delivery, and statement mailings 2,832 2,666

Advertising 3,216 2,941 Telecommunications 2,048 2,248 Bankcard

expenses 1,964 2,137 Insurance and regulatory 1,528 1,496 Office

supplies 1,578 1,193 Repossessed asset (gains), net of expenses

(98) (78) Loss on early extinguishment of debt 1,368 - Other

expenses 9,905 10,619 Total Non-Interest Expense 71,285 69,113

Income Before Income Taxes 81,516 76,658 Income tax expense 28,329

26,370 Net Income $53,187 $50,288 Basic earnings per share $3.00

$2.87 Diluted earnings per share $2.99 $2.84 Average Common Shares

Outstanding: Basic 17,701 17,519 Diluted 17,762 17,690 CITY HOLDING

COMPANY AND SUBSIDIARIES Consolidated Statements of Changes in

Stockholders' Equity (Unaudited) ($ in 000s) Three Months Ended

December 31, 2006 December 31, 2005 Balance at October 1 $298,327

$290,432 Net income 12,939 13,089 Other comprehensive income:

Change in unrealized gain on securities available-for-sale 1,913

(3,701) Change in underfunded pension liability 503 (748) Change in

unrealized gain on interest rate floors (663) - Reclassification of

unrealized derivative losses - 543 Cash dividends declared

($0.28/share) (4,896) - Cash dividends declared ($0.25/share) -

(4,522) Issuance of stock awards, net 13 - Exercise of 104,966

stock options - 3,128 Exercise of 6,488 stock options 145 - Excess

tax benefits on stock compensation 47 - Purchase of 171,000 common

shares of treasury - (6,080) Purchase of 76,700 common shares of

treasury (3,021) - Balance at December 31 $305,307 $292,141 Twelve

Months Ended December 31, 2006 December 31, 2005 Balance at January

1 $292,141 $216,080 Net income 53,187 50,288 Other comprehensive

income: Change in unrealized gain on securities available-for-sale

2,190 (6,120) Change in unrealized gain on interest rate floors

(210) - Change in underfunded pension liability 503 (748) Cash

dividends declared ($1.12/share) (19,721) - Cash dividends declared

($1.00/share) - (17,716) Issuance of 1,580,034 shares for

acquisition of Classic Bancshares, net 108,173 owned and

transferred to treasury - 54,339 Issuance of stock awards, net 484

147 Exercise of 367,675 stock options - 7,783 Exercise of 46,423

stock options 798 - Excess tax benefits on stock compensation 269 -

Purchase of 342,576 common shares of treasury - (11,912) Purchase

of 666,753 common shares of treasury (24,334) - Balance at December

31 $305,307 $292,141 CITY HOLDING COMPANY AND SUBSIDIARIES

Condensed Consolidated Quarterly Statements of Income (Unaudited)

($ in 000s, except per share data) Quarter Ended Dec 31 Sept 30

June 30 March 31 Dec 31 2006 2006 2006 2006 2005 Interest income

$39,925 $39,747 $39,010 $37,441 $36,639 Taxable equivalent

adjustment 228 236 246 252 269 Interest income (FTE) 40,153 39,983

39,256 37,693 36,908 Interest expense 14,820 14,233 13,085 11,588

11,064 Net interest income 25,333 25,750 26,171 26,105 25,844

Provision for loan losses 901 1,225 675 1,000 800 Net interest

income after provision for loan losses 24,432 24,525 25,496 25,105

25,044 Noninterest income 13,586 14,766 13,463 12,389 13,537

Noninterest expense 18,099 18,133 17,555 17,497 18,339 Income

before income taxes 19,919 21,158 21,404 19,997 20,242 Income tax

expense 6,752 7,302 7,397 6,879 6,884 Taxable equivalent adjustment

228 236 246 252 269 Net income $12,939 $13,620 $13,761 $12,866

$13,089 Basic earnings per share $0.74 $0.78 $0.78 $0.71 $0.72

Diluted earnings per share 0.74 0.77 0.77 0.71 0.72 Cash dividends

declared per share 0.28 0.28 0.28 0.28 0.25 Average Common Share

(000s): Outstanding 17,535 17,557 17,719 18,006 18,127 Diluted

17,601 17,619 17,772 18,067 18,211 Net Interest Margin 4.43% 4.51%

4.58% 4.71% 4.55% CITY HOLDING COMPANY AND SUBSIDIARIES

Non-Interest Income and Non-Interest Expense (Unaudited) ($ in

000s) Quarter Ended Dec 31 Sept 30 June 30 March 31 Dec 31 2006

2006 2006 2006 2005 Non-Interest Income: Service charges $10,962

$10,833 $10,903 $9,862 $10,530 Insurance commissions 675 526 521

614 620 Trust and investment management fee income 498 572 504 566

504 Bank owned life insurance 576 561 678 537 691 Other income 803

778 857 810 1,067 Subtotal 13,514 13,270 13,463 12,389 13,412

Investment security gains (losses) 72 (2,067) - - 125 Gain on sale

of credit card portfolio - 3,563 - - - Total Non-Interest Income

$13,586 $14,766 $13,463 $12,389 $13,537 Non-Interest Expense:

Salaries and employee benefits $8,354 $8,733 $8,764 $8,632 $8,416

Occupancy and equipment 1,655 1,602 1,624 1,599 1,569 Depreciation

1,037 1,061 1,071 1,050 1,062 Professional fees and litigation

expense 415 379 571 395 486 Postage, delivery, and statement

mailings 735 765 689 644 728 Advertising 876 810 755 774 710

Telecommunications 549 498 525 476 560 Bankcard expenses 478 485

458 543 540 Insurance and regulatory 375 384 381 388 380 Office

supplies 408 417 372 383 388 Repossessed asset losses (gains) net

of expenses 6 20 (129) 4 (28) Loss on early extinguishment of debt

708 379 - 282 - Other expenses 2,503 2,600 2,474 2,327 3,528 Total

Non-Interest Expense $18,099 $18,133 $17,555 $17,497 $18,339

Employees (Full Time Equivalent) 779 767 779 764 770 Branch

Locations 67 67 67 66 67 CITY HOLDING COMPANY AND SUBSIDIARIES

Consolidated Balance Sheets ($ in 000s) December 31 December 31

2006 2005 (Unaudited) Assets Cash and due from banks $58,014

$81,822 Interest-bearing deposits in depository institutions 27,434

4,451 Federal funds sold 25,000 - Cash and cash equivalents 110,448

86,273 Investment securities available-for-sale, at fair value

472,398 549,966 Investment securities held-to-maturity, at

amortized cost 47,500 55,397 Total investment securities 519,898

605,363 Gross loans 1,677,469 1,612,827 Allowance for loan losses

(15,405) (16,790) Net loans 1,662,064 1,596,037 Bank owned life

insurance 55,195 52,969 Premises and equipment 44,689 42,542

Accrued interest receivable 12,337 13,134 Net deferred tax assets

23,652 27,929 Intangible assets 58,857 59,559 Other assets 20,667

18,791 Total Assets $2,507,807 $2,502,597 Liabilities Deposits:

Noninterest-bearing $321,038 $376,076 Interest-bearing: Demand

deposits 422,925 437,639 Savings deposits 321,075 302,571 Time

deposits 920,179 812,134 Total deposits 1,985,217 1,928,420

Short-term borrowings 136,570 152,255 Long-term debt 48,069 98,425

Other liabilities 32,644 31,356 Total Liabilities 2,202,500

2,210,456 Stockholders' Equity Preferred stock, par value $25 per

share: 500,000 shares authorized; none issued - - Common stock, par

value $2.50 per share: 50,000,000 shares authorized; 18,499,282

shares issued at December 31, 2006 and December 31, 2005 less

1,009,095 and 395,465 shares in treasury, respectively 46,249

46,249 Capital surplus 104,043 104,435 Retained earnings 194,213

160,747 Cost of common stock in treasury (33,669) (11,278)

Accumulated other comprehensive (loss) income: Unrealized loss on

securities available-for-sale (2,649) (4,839) Unrealized loss on

derivative instruments (210) - Underfunded pension liability

(2,670) (3,173) Total Accumulated Other Comprehensive (Loss) Income

(5,529) (8,012) Total Stockholders' Equity 305,307 292,141 Total

Liabilities and Stockholders' Equity $2,507,807 $2,502,597 CITY

HOLDING COMPANY AND SUBSIDIARIES Loan Portfolio (Unaudited) ($ in

000s) Dec 31 Sept 30 June 30 March 31 Dec 31 2006 2006 2006 2006

2005 Residential real estate $598,502 $604,867 $601,097 $595,093

$592,521 Home equity 321,708 318,666 313,301 304,559 301,728

Commercial, financial, and agriculture 698,719 713,933 668,581

643,269 629,670 Installment loans to individuals 42,943 41,215

42,307 54,287 58,652 Previously securitized loans 15,597 18,520

22,253 25,918 30,256 Gross Loans $1,677,469 $1,697,201 $1,647,539

$1,623,126 $1,612,827 CITY HOLDING COMPANY AND SUBSIDIARIES

Previously Securitized Loans (Unaudited) ($ in millions) Annualized

Effective December 31 Interest Annualized Year Ended: Balance (a)

Income (a) Yield (a) 2005 $30.3 $11.4 27% 2006 15.6 9.4 42% 2007

10.9 6.2 47% 2008 8.5 4.6 47% 2009 7.2 3.8 47% a - 2005 and 2006

amounts are based on actual results. 2007, 2008 and 2009 amounts

are based on estimated amounts. Note: The amounts reflected in the

table above require management to make significant assumptions

based on estimated future default, prepayment, and discount rates.

Actual performance could be different from that assumed, which

could result in the actual results being materially different from

the amounts estimated above. CITY HOLDING COMPANY AND SUBSIDIARIES

Consolidated Average Balance Sheets, Yields, and Rates (Unaudited)

($ in 000s) Three Months Ended December 31, 2006 Average Yield/

Balance Interest Rate Assets: Loan portfolio: Residential real

estate $600,372 $8,853 5.85% Home equity 320,302 6,439 7.98%

Commercial, financial, and agriculture 710,467 13,584 7.59%

Installment loans to individuals 41,827 1,297 12.30% Previously

securitized loans 16,878 1,984 46.64% Total loans 1,689,846 32,157

7.55% Securities: Taxable 494,380 6,800 5.46% Tax-exempt 40,006 650

6.45% Total securities 534,386 7,450 5.53% Deposits in depository

institutions 37,827 459 4.81% Federal funds sold 5,989 87 5.76%

Total interest-earning assets 2,268,048 40,153 7.02% Cash and due

from banks 49,068 Bank premises and equipment 44,073 Other assets

172,709 Less: Allowance for loan losses (15,631) Total assets

$2,518,267 Liabilities: Interest-bearing demand deposits 426,536

1,367 1.27% Savings deposits 316,734 1,207 1.51% Time deposits

915,041 9,969 4.32% Short-term borrowings 125,448 1,304 4.12%

Long-term debt 74,200 973 5.20% Total interest-bearing liabilities

1,857,959 14,820 3.16% Noninterest-bearing demand deposits 323,500

Other liabilities 31,153 Stockholders' equity 305,655 Total

liabilities and stockholders' equity $2,518,267 Net interest income

$25,333 Net yield on earning assets 4.43% CITY HOLDING COMPANY AND

SUBSIDIARIES Consolidated Average Balance Sheets, Yields, and Rates

(Unaudited) ($ in 000s) Three Months Ended December 31, 2005

Average Yield/ Balance Interest Rate Assets: Loan portfolio:

Residential real estate $595,309 $8,365 5.57% Home equity 303,977

5,318 6.94% Commercial, financial, and agriculture 626,341 10,928

6.92% Installment loans to individuals 60,233 1,739 11.45%

Previously securitized loans 32,851 2,569 31.03% Total loans

1,618,711 28,919 7.09% Securities: Taxable 580,845 7,187 4.91%

Tax-exempt 47,675 766 6.37% Total securities 628,520 7,953 5.02%

Deposits in depository institutions 5,188 36 2.75% Federal funds

sold - - - Total interest-earning assets 2,252,419 36,908 6.50%

Cash and due from banks 52,828 Bank premises and equipment 42,432

Other assets 168,395 Less: Allowance for loan losses (17,272) Total

assets $2,498,802 Liabilities: Interest-bearing demand deposits

442,130 1,207 1.08% Savings deposits 302,904 684 0.90% Time

deposits 809,433 6,678 3.27% Short-term borrowings 159,185 1,049

2.61% Long-term debt 114,590 1,446 5.01% Total interest-bearing

liabilities 1,828,242 11,064 2.40% Noninterest-bearing demand

deposits 347,777 Other liabilities 26,287 Stockholders' equity

296,496 Total liabilities and stockholders' equity $2,498,802 Net

interest income $25,844 Net yield on earning assets 4.55% CITY

HOLDING COMPANY AND SUBSIDIARIES Consolidated Average Balance

Sheets, Yields, and Rates (Unaudited) ($ in 000s) Twelve Months

Ended December 31, 2006 Average Yield/ Balance Interest Rate

Assets: Loan portfolio: Residential real estate $598,017 $34,483

5.77% Home equity 311,854 24,384 7.82% Commercial, financial, and

agriculture 670,243 50,165 7.48% Installment loans to individuals

47,477 5,507 11.60% Previously securitized loans 22,273 9,406

42.23% Total loans 1,649,864 123,945 7.51% Securities: Taxable

539,634 28,418 5.27% Tax-exempt 42,113 2,741 6.51% Total securities

581,747 31,159 5.36% Loans held for sale 2,496 322 12.90% Deposits

in depository institutions 30,633 1,478 4.82% Federal funds sold

3,433 179 5.21% Total interest-earning assets 2,268,173 157,083

6.93% Cash and due from banks 50,571 Bank premises and equipment

43,111 Other assets 171,214 Less: Allowance for loan losses

(16,008) Total assets $2,517,061 Liabilities: Interest-bearing

demand deposits 433,244 5,284 1.22% Savings deposits 314,732 3,983

1.27% Time deposits 877,592 34,779 3.96% Short-term borrowings

143,705 5,099 3.55% Long-term debt 85,893 4,579 5.33% Total

interest-bearing liabilities 1,855,166 53,724 2.90%

Noninterest-bearing demand deposits 335,089 Other liabilities

29,840 Stockholders' equity 296,966 Total liabilities and

stockholders' equity $2,517,061 Net interest income $103,359 Net

yield on earning assets 4.56% CITY HOLDING COMPANY AND SUBSIDIARIES

Consolidated Average Balance Sheets, Yields, and Rates (Unaudited)

($ in 000s) Twelve Months Ended December 31, 2005 Average Yield/

Balance Interest Rate Assets: Loan portfolio: Residential real

estate $545,280 $30,570 5.61% Home equity 305,525 19,088 6.25%

Commercial, financial, and agriculture 564,612 36,287 6.43%

Installment loans to individuals 56,091 6,368 11.35% Previously

securitized loans 42,859 11,401 26.60% Total loans 1,514,367

103,714 6.85% Securities: Taxable 623,155 29,804 4.78% Tax-exempt

43,767 2,904 6.64% Total securities 666,922 32,708 4.90% Loans held

for sale - - - Deposits in depository institutions 4,609 109 2.36%

Federal funds sold 105 4 3.81% Total interest-earning assets

2,186,003 136,535 6.25% Cash and due from banks 48,562 Bank

premises and equipment 39,109 Other assets 145,899 Less: Allowance

for loan losses (17,515) Total assets $2,402,058 Liabilities:

Interest-bearing demand deposits 433,831 3,866 0.89% Savings

deposits 295,045 2,070 0.70% Time deposits 743,725 22,869 3.07%

Short-term borrowings 157,264 3,369 2.14% Long-term debt 137,340

6,264 4.56% Total interest-bearing liabilities 1,767,205 38,438

2.18% Noninterest-bearing demand deposits 341,873 Other liabilities

28,026 Stockholders' equity 264,954 Total liabilities and

stockholders' equity $2,402,058 Net interest income $98,097 Net

yield on earning assets 4.49% CITY HOLDING COMPANY AND SUBSIDIARIES

Analysis of Risk-Based Capital (Unaudited) ($ in 000s) Dec 31 Sept

30 June 30 2006 (a) 2006 2006 Tier I Capital: Stockholders' equity

$305,307 $298,327 $284,120 Goodwill and other intangibles (58,857)

(59,038) (59,219) Accumulated other comprehensive income 2,859

4,109 9,762 Qualifying trust preferred stock 16,000 22,000 25,500

Excess deferred tax assets - - (4,079) Total tier I capital

$265,309 $265,398 $256,084 Total Risk-Based Capital: Tier I capital

$265,309 $265,398 $256,084 Qualifying allowance for loan losses

15,405 15,557 15,268 Total risk-based capital $280,714 $280,955

$271,352 Net risk-weighted assets $1,734,214 $1,770,458 $1,757,720

Ratios: Average stockholders' equity to average assets 12.14%

11.67% 11.51% Tangible capital ratio 10.06% 9.69% 9.13% Risk-based

capital ratios: Tier I capital 15.30% 14.99% 14.58% Total

risk-based capital 16.19% 15.87% 15.45% Leverage capital 10.79%

10.81% 10.34% (a) December 31, 2006 risk-based capital ratios are

estimated. CITY HOLDING COMPANY AND SUBSIDIARIES Analysis of

Risk-Based Capital (Unaudited) ($ in 000s) March 31 Dec 31 2006

2005 Tier I Capital: Stockholders' equity $288,376 $292,141

Goodwill and other intangibles (59,378) (59,559) Accumulated other

comprehensive income 6,265 8,012 Qualifying trust preferred stock

25,500 28,000 Excess deferred tax assets (2,254) (1,071) Total tier

I capital $258,509 $267,523 Total Risk-Based Capital: Tier I

capital $258,509 $267,523 Qualifying allowance for loan losses

16,818 16,790 Total risk-based capital $275,327 $284,313 Net

risk-weighted assets $1,743,243 $1,735,538 Ratios: Average

stockholders' equity to average assets 11.87% 11.87% Tangible

capital ratio 9.24% 9.52% Risk-based capital ratios: Tier I capital

14.83% 15.41% Total risk-based capital 15.80% 16.38% Leverage

capital 10.62% 10.97% (a) December 31, 2006 risk-based capital

ratios are estimated. CITY HOLDING COMPANY AND SUBSIDIARIES

Intangibles (Unaudited) ($ in 000s) As of and for the Quarter Ended

Dec 31 Sept 30 June 30 March 31 Dec 31 2006 2006 2006 2006 2005

Intangibles, net $58,857 $59,038 $59,219 $59,378 $59,559

Intangibles amortization expense 181 181 181 181 183 CITY HOLDING

COMPANY AND SUBSIDIARIES Summary of Loan Loss Experience

(Unaudited) ($ in 000s) Quarter Ended Dec 31 Sept 30 June 30 2006

2006 2006 Balance at beginning of period $15,557 $15,268 $16,818

Reduction of allowance for loans held for sale - - (1,368)

Charge-offs: Commercial, financial, and agricultural 844 207 43

Real estate-mortgage 230 177 232 Installment loans to individuals

126 165 239 Overdraft deposit accounts 892 1,018 955 Total

charge-offs 2,092 1,567 1,469 Recoveries: Commercial, financial,

and agricultural 101 44 33 Real estate-mortgage 350 64 56

Installment loans to individuals 118 131 151 Overdraft deposit

accounts 470 392 372 Total recoveries 1,039 631 612 Net charge-offs

1,053 936 857 Provision for loan losses 901 1,225 675 Balance at

end of period $15,405 $15,557 $15,268 Loans outstanding $1,677,469

$1,697,201 $1,647,539 Average loans outstanding 1,689,846 1,662,929

1,630,454 Allowance as a percent of loans outstanding 0.92% 0.92%

0.93% Allowance as a percent of non-performing loans 384.93%

408.43% 408.02% Net charge-offs (annualized) as a percent of

average loans outstanding 0.25% 0.23% 0.21% Net charge-offs,

excluding overdraft deposit accounts, (annualized) as a percent of

average loans outstanding 0.15% 0.07% 0.07% CITY HOLDING COMPANY

AND SUBSIDIARIES Summary of Loan Loss Experience (Unaudited) ($ in

000s) Quarter Ended March 31 Dec 31 2006 2005 Balance at beginning

of period $16,790 $17,768 Reduction of allowance for loans held for

sale - - Charge-offs: Commercial, financial, and agricultural 185

527 Real estate-mortgage 296 302 Installment loans to individuals

368 664 Overdraft deposit accounts 958 996 Total charge-offs 1,807

2,489 Recoveries: Commercial, financial, and agricultural 32 30

Real estate-mortgage 105 188 Installment loans to individuals 198

163 Overdraft deposit accounts 500 330 Total recoveries 835 711 Net

charge-offs 972 1,778 Provision for loan losses 1,000 800 Balance

at end of period $16,818 $16,790 Loans outstanding $1,623,126

$1,612,827 Average loans outstanding 1,615,242 1,618,711 Allowance

as a percent of loans outstanding 1.04% 1.04% Allowance as a

percent of non-performing loans 503.53% 401.96% Net charge-offs

(annualized) as a percent of average loans outstanding 0.24% 0.44%

Net charge-offs, excluding overdraft deposit accounts, (annualized)

as a percent of average loans outstanding 0.13% 0.27% CITY HOLDING

COMPANY AND SUBSIDIARIES Summary of Non-Performing Assets

(Unaudited) ($ in 000s) Dec 31 Sept 30 June 30 March 31 Dec 31 2006

2006 2006 2006 2005 Nonaccrual loans $3,319 $3,359 $3,046 $2,743

$2,785 Accruing loans past due 90 days or more 635 328 573 512

1,124 Previously securitized loans past due 90 days or more 48 122

123 85 268 Total non-performing loans 4,002 3,809 3,742 3,340 4,177

Other real estate owned, excluding property associated with

previously securitized loans 161 499 294 403 135 Other real estate

owned associated with previously securitized loans 20 20 92 306 -

181 519 386 709 135 Total non-performing assets $4,183 $4,328

$4,128 $4,049 $4,312 Non-performing assets as a percent of loans

and other real estate owned 0.25% 0.25% 0.25% 0.25% 0.27%

DATASOURCE: City Holding Company CONTACT: Charles R. Hageboeck,

Chief Executive Officer and President, of City Holding Company

+1-304-769-1102 Web site: http://www.cityholding.com/

Copyright

City (NASDAQ:CHCO)

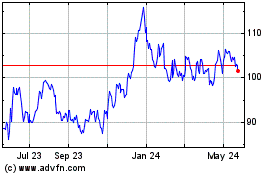

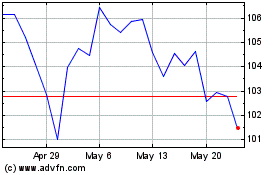

Historical Stock Chart

From Jun 2024 to Jul 2024

City (NASDAQ:CHCO)

Historical Stock Chart

From Jul 2023 to Jul 2024