The Chefs’ Warehouse, Inc. (NASDAQ: CHEF) (the “Company” or

“Chefs’”), a premier distributor of specialty food products in the

United States, the Middle East, and Canada, today announced its

preliminary outlook for fiscal year 2025.

Based on current trends in the business, the

Company is providing the following financial guidance for fiscal

year 2025:

- Net sales in the range of $3.94

billion and $4.04 billion;

- Gross profit to be between $951

million and $976 million; and

- Adjusted EBITDA, a non-GAAP

measure, to be between $233 million and $246 million.

The Company’s full year diluted share count is

forecasted to be between 46.3 and 47.0 million shares and

assumes no future share repurchases. The Company expects its senior

convertible notes due in 2028 to be dilutive for the full year and

accordingly, has included in the forecasted fully diluted share

count approximately 6.5 million shares that could be issued upon

conversion of the notes.

Investor Day

The Company plans to host an Investor Day on

March 13, 2025, in New York City, which will also be webcast live

from the Company’s investor relations website. A replay will be

available shortly after the event.

Non-GAAP Financial Measures

We present forecasted EBITDA and adjusted EBITDA

ranges for fiscal 2025, which are not measurements determined in

accordance with the U.S. Generally Accepted Accounting Principles

(“GAAP”), because we believe these measures provide additional

metrics to evaluate our forecasted results and which we believe,

when considered with both our forecasted GAAP results and the

reconciliation to forecasted net income, provide a more complete

understanding of our business than could be obtained absent this

disclosure. We use EBITDA and adjusted EBITDA, together with

financial measures prepared in accordance with GAAP, such as

revenue and cash flows from operations, to assess our historical

and prospective operating performance and to enhance our

understanding of our core operating performance. The use of EBITDA

and adjusted EBITDA as performance measures permits a comparative

assessment of our operating performance relative to our GAAP

performance while isolating the effects of some items that vary

from period to period without any correlation to core operating

performance or that vary widely among similar companies.

Other companies may calculate these non-GAAP

financial measures differently, and therefore our measures may not

be comparable to similarly titled measures of other companies.

These non-GAAP financial measures should only be used as

supplemental measures of our operating performance.

Please see the schedule accompanying this

release for a reconciliation of forecasted EBITDA and adjusted

EBITDA to these measures’ most directly comparable GAAP

measure.

Forward-Looking Statements

Statements in this press release regarding the

Company’s business that are not historical facts are

“forward-looking statements” that involve risks and uncertainties

and are based on current expectations and management estimates;

actual results may differ materially. The risks and uncertainties

which could impact these statements include, but are not limited to

the following: our success depends to a significant extent upon

general economic conditions, including disposable income levels and

changes in consumer discretionary spending; the relatively low

margins of our business, which are sensitive to inflationary and

deflationary pressures and intense competition; the effects of

rising costs, decreases in supply or the interruption of

commodities, ingredients, packaging, other raw materials,

distribution and labor; fuel prices and their impact on

distribution, packaging and energy costs; our ability to grow our

operations whether through expansion of our operations in existing

markets or penetration of new markets, and our effective management

of that growth; our continued ability to promote and protect our

brand successfully, to anticipate and respond to new and existing

customer demands, and to develop new products and markets to

compete effectively; our ability and the ability of our supply

chain partners to continue to operate distribution centers and

other work locations without material disruption, and to procure

ingredients, packaging and other raw materials when needed despite

disruptions in the supply chain or labor shortages; economic and

other developments, or events, including adverse weather

conditions, in the jurisdictions in which we operate; risks

associated with the expansion of our business; our possible

inability to identify new acquisitions or to integrate recent or

future acquisitions, or our failure to realize anticipated revenue

enhancements, cost savings or other synergies from recent or future

acquisitions; other factors that affect the food industry

generally, including: recalls if products become adulterated or

misbranded, liability if product consumption causes injury,

ingredient disclosure and labeling laws and regulations and the

possibility that customers could lose confidence in the safety and

quality of certain food products; new information or attitudes

regarding diet and health or adverse opinions about the health

effects of the products we distribute; our ability to maintain

independent certifications associated with our products; changes in

disposable income levels and consumer purchasing habits;

competitors’ pricing practices and promotional spending levels;

fluctuations in the level of our customers’ inventories, credit,

payment of accounts and other related business risks; and the risks

associated with third-party suppliers, including the risk that any

failure by one or more of our third-party suppliers to comply with

food safety or other laws and regulations may disrupt our supply of

raw materials or certain products or injure our reputation; our

ability to recruit and retain senior management and a highly

skilled and diverse workforce; the influence of significant

corporate decisions due to the concentration of ownership among

existing officers, directors and their affiliates; unanticipated

expenses, including, without limitation, litigation or legal

settlement expenses and impairment charges; changing rules, public

disclosure regulations and stakeholder expectations on ESG-related

matters; climate change, or the legal, regulatory or market

measures being implemented to address climate change; the cost and

adequacy of our insurance policies; the impact and effects of

public health crises, pandemics and epidemics and the adverse

impact thereof on our business, financial condition, and results of

operations; interruption of operations due to information

technology system failures, cybersecurity incidents, or other

disruptions to use of technology and networks; the possibility that

information technology investments may not produce anticipated

results; significant governmental regulation and any potential

failure to comply with such regulations; federal, state, provincial

and local tax rules in the United States and the foreign countries

in which we operate, including tax reform and legislation; risks

relating to our substantial indebtedness; our ability to raise

additional capital and/or obtain debt or other financing, on

commercially reasonable terms or at all; our ability to meet future

cash requirements, including the ability to access financial

markets effectively and maintain sufficient liquidity; the effects

of currency movements in the jurisdictions in which we operate as

compared to the U.S. dollar; changes in the method of determining

Secured Overnight Financing Rate (“SOFR”), or the replacement of

SOFR with an alternative rate; and the effects of international

trade disputes, tariffs, quotas and other import or export

restrictions on our international procurement, sales and

operations. Any forward-looking statements are made pursuant to the

Private Securities Litigation Reform Act of 1995 and, as such,

speak only as of the date made. A more detailed description of

these and other risk factors is contained in the Company’s most

recent Annual Report on Form 10-K filed with the Securities and

Exchange Commission (“SEC”) on February 27, 2024 and other

reports filed by the Company with the SEC since that date. The

Company is not undertaking to update any information until required

by applicable laws. Any projections of future results of operations

are based on a number of assumptions, many of which are outside the

Company’s control and should not be construed in any manner as a

guarantee that such results will in fact occur. These projections

are subject to change and could differ materially from final

reported results. The Company may from time to time update these

publicly announced projections, but it is not obligated to do

so.

About The Chefs’ Warehouse

The Chefs’ Warehouse, Inc.

(http://www.chefswarehouse.com) is a premier distributor of

specialty food products in the United States, the Middle East and

Canada focused on serving the specific needs of chefs who own

and/or operate some of the nation’s leading menu-driven independent

restaurants, fine dining establishments, country clubs, hotels,

caterers, culinary schools, bakeries, patisseries, chocolateries,

cruise lines, casinos and specialty food stores. The Chefs’

Warehouse, Inc. carries and distributes more than 70,000 products

to more than 44,000 customer locations throughout the United

States, the Middle East and Canada.

Contact:Investor Relations Jim Leddy, CFO,

(718) 684-8415

|

THE CHEFS’ WAREHOUSE, INC.RECONCILIATION

OF ADJUSTED EBITDA GUIDANCE FOR FISCAL 2025 |

|

|

| (unaudited - in millions) |

Low-End |

|

High-End |

|

Net Income: |

$ |

68.0 |

|

$ |

72.0 |

|

Provision for income tax expense |

|

29.0 |

|

|

31.0 |

|

Depreciation and amortization |

|

74.0 |

|

|

76.0 |

|

Interest expense |

|

42.0 |

|

|

44.0 |

| EBITDA |

|

213.0 |

|

|

223.0 |

| Adjustments: |

|

|

|

|

Stock compensation (1) |

|

17.5 |

|

|

18.5 |

|

Duplicate rent (2) |

|

1.5 |

|

|

2.5 |

|

Other operating expenses (3) |

|

0.5 |

|

|

1.0 |

|

Moving expenses (4) |

|

0.5 |

|

1.0 |

| Adjusted EBITDA |

$ |

233.0 |

|

$ |

246.0 |

| |

|

|

|

|

|

- Represents non-cash stock

compensation expense associated with awards of restricted shares of

our common stock and stock options to our key employees and our

independent directors.

- Represents rent and occupancy costs

expected to be incurred in connection with our facility

consolidations while we are unable to use those facilities.

- Represents non-cash changes in the

fair value of contingent earn-out liabilities related to our

acquisitions, non-cash charges related to asset disposals, asset

impairments, including intangible asset impairment charges, certain

third-party deal costs incurred in connection with our acquisitions

or financing arrangements and certain other costs.

- Represents moving expenses for the

consolidation and expansion of several of our distribution

facilities.

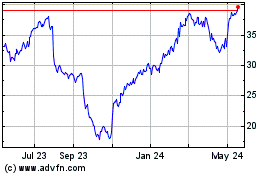

Chefs Warehouse (NASDAQ:CHEF)

Historical Stock Chart

From Dec 2024 to Jan 2025

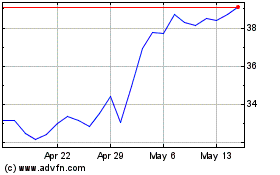

Chefs Warehouse (NASDAQ:CHEF)

Historical Stock Chart

From Jan 2024 to Jan 2025