false

0000763563

0000763563

2024-07-30

2024-07-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES OF AMERICA

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 30, 2024 (July 30, 2024)

CHEMUNG FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| New York | |

001-35741 | |

16-1237038 |

| (State or other jurisdiction | |

(Commission File Number) | |

(IRS Employer |

| of incorporation) | |

| |

Identification No.) |

One Chemung Canal Plaza, Elmira, NY 14901

(Address of principal executive offices) (Zip Code)

(607) 737-3711

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class | |

Trading symbol | |

Name of exchange on which registered |

| Common stock, par value $0.01 per share | |

CHMG | |

Nasdaq Global Select Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.16e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule

405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a)

of the Exchange Act. ☐

| ITEM 7.01 | Regulation FD Disclosure |

The management of Chemung Financial Corporation (the “Corporation”)

conducted one-on-one meetings with institutional investors and analysts on July 30, 2024, at the 2023 KBW Community Bank Investor Conference

to discuss the Corporation’s strategies and recent financial performance. Anders M. Tomson, Chief Executive Officer, and Dale M.

McKim III, Chief Financial Officer and Treasurer, presented.

The investor presentation prepared by the Corporation for use in these

meetings is available on the Corporation’s website at www.chemungcanal.com under Investor Relations and “Investor Presentation.”

Investors should note that the Corporation announces material information in Securities and Exchange Commission (the “SEC”)

filings and press releases. Based on guidance from the SEC, the Corporation may also use the Investor Relations section of its corporate

website, www.chemungcanal.com, to communicate with investors about the Corporation. It is possible that the information posted there could

be deemed to be material information. The information on the Corporation’s website is not incorporated by reference into this Current

Report on Form 8-K.

This investor presentation is furnished pursuant to Item 7.01 of Form 8-K

and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange

Act”), as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in

any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date of this report, except

as shall be expressly set forth by specific reference in such filing.

The investor presentation is furnished as Exhibit 99.1 to this report.

| ITEM 9.01 | Financial Statements and Exhibits |

Exhibit No.

| 104 | Cover Page Interactive Data File (embedded within the Inline

XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | CHEMUNG FINANCIAL CORPORATION |

| | |

|

| | |

|

| July 30, 2024 | By: |

/s/ Dale M. McKim, III |

| | |

Dale M. McKim, III |

| | |

Chief Financial Officer and Treasurer |

Exhibit 99.1

2024 KBW Community Bank Investor Conference

Chemung Financial Corporation Chemung Financial Corporation With You Today 2 Anders Tomson President & Chief Executive Officer Dale McKim Executive Vice President & Chief Financial Officer

Chemung Financial Corporation Safe Harbor Statement Forward - looking Statements: This report contains forward - looking statements within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act, and the Private Securities Litigation Reform Act of 1995. The Corporation intends its forward - looking statements to be covered by the safe harbor provisions for forward - looking statements in these sections. All statements regarding the Corporation’s expected financial position and operating results, the Corporation’s business strategy, the Corporation’s financial plans, forecasted demographic and economic trends relating to the Corporation’s industry and similar matters are forward - looking statements. These statements can sometimes be identified by the Corporation’s use of forward - looking words such as “may,” “will,” “anticipate,” “estimate,” “expect,” or “intend.” The Corporation cannot guarantee that its expectations in such forward - looking statements will turn out to be correct. The Corporation’s actual results could be materially different from expectations because of various factors, including changes in economic conditions or interest rates, credit risk, difficulties in managing the Corporation’s growth, competition, the impact of the COVID - 19 pandemic, changes in law or the regulatory environment, and changes in general business and economic trends. Information concerning these and other factors can be found in the Corporation’s 2023 Annual Report on Form 10 - K. These filings are available publicly on the SEC’s website at http://www.sec.gov, on the Corporation’s website at http://www.chemungcanal.com or by written request to: Kathleen S. McKillip, Corporate Secretary, Chemung Financial Corporation, One Chemung Canal Plaza, Elmira, NY 14901. Except as otherwise required by law, the Corporation undertakes no obligation to publicly update or revise its forward - looking statements, whether as a result of new information, future events or otherwise. Form 10 - KAnnual Report: A copy of the Corporation’s Form 10 - K Annual Report is available without charge to shareholders after April 24, 2024, upon written request to the Corporation’s secretary. A copy is also available on our Transfer Agent, American Stock Transfer & Trust Company’s website at www.astproxyportal.com/ast/01079. 3

Chemung Financial Corporation Key Takeaways 4 2024 KBW Community Bank Investor Conference Continued strength and momentum in underlying businesses High customer engagement across all business lines and geographies. Stable deposit base and ample liquidity Majority of deposits sourced from stable, legacy markets. Community banking flywheel driving growth and profits Demonstrated commercial and consumer growth across all markets. Valuable wealth management business High touch relationships with affluent borrowers provides dependable non - interest income stream. Solid and stable credit quality Consistently low non - performing assets and charge - offs. Contiguous geographic expansion Expansion of the franchise in higher growth markets of Albany and Buffalo.

About Us Elmira, NY 5

Chemung Financial Corporation Oldest locally owned and managed community bank in New York State, dating to 1833. Subsidiary bank - Chemung Canal Trust Company - operates with 31 branches over 14 counties in New York and Pennsylvania. Operating as Capital Bank division in Albany, New York market and Canal Bank division in Buffalo, New York market. Trust and Wealth Management division with $2.4 bn in assets under management or administration. New York chartered bank and member of the Federal Reserve Listed on NASDAQ Global Select (Ticker: CHMG) Market Capitalization of $229.0 million at June 30, 2024 About Us 6 History Operations Legal & Market 6 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation Revenue Growth ▪ Drive growth in Albany and Buffalo with legacy market deposits. ▪ Well positioned to opportunistically acquire when operational model and pricing is right. Seeking wealth management, whole bank or branch opportunities. ▪ Fee and pricing discipline. Operating Efficiencies ▪ Continual evaluation of branch distribution model. ▪ Optimization of vendor contracts. ▪ Rationalization of headcount and outsourcing opportunities. ▪ Robotic Process Automation. Customer Experience and Brand ▪ Launch of Canal Bank brand in Western New York. ▪ Introduction of unified digital experience. ▪ Relationship focus. Colleagues and Community ▪ Believe and behave like a community bank. ▪ Recognized community partner within our markets. ▪ Review of incentive compensation plans to maintain competitiveness. Core Strategies 7

Chemung Financial Corporation Second Quarter 2024 Highlights 8 EPS $1.05 Net Income $5.0M ROA 0.73% ROE 10.27% ROTE 11.56% ACL - to - total Loans 1.05% Non - performing loans - to - total loans 0.41% Returns 8 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation Second Quarter 2024 Highlights 9 ▪ Net interest income $17.8 million, or 4.5%, less than second quarter 2023. ▪ Net interest margin 2.66% ▪ Efficiency ratio 69.19% ▪ Tangible common equity to tangible assets improved by 11 basis points from December 31, 2023 to 6.56% ▪ Loans - to - deposits 83.26% ▪ Dividend of $0.31 declared ▪ Announced Canal Bank, a division of Chemung Canal Trust Company, and a new regional banking center in Williamsville, NY ▪ Received approval to consolidate Ithaca Station branch with other Ithaca locations 9 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation Appendices 10 Company and Financial Highlights Background Page 11 Corporate Organization Markets and Share Management Team Community Loans Page 17 Loan Growth Portfolio Composition Commercial Portfolio Non - Performers Investments Page 27 Portfolio Composition Yield and Duration Fair Value and AOCI Deposits Page 31 Deposit Costs Deposits Composition Liquidity Performance Page 37 Net Income Trend Net Interest Margin Non - Interest Income Non - Interest Expense Expense Management Capital Management 2024 KBW Community Bank Investor Conference

Background 11

Chemung Financial Corporation Corporate Organization 12 Trust and Wealth Management services Provides mutual funds, securities and insurance brokerage services through LPL Financial Banking operations in Southern Tier and Finger Lakes of New York Wealth Management Group Banking operations in the Capital District of New York Banking operations in the greater Buffalo area of New York 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation Markets 13 Legacy Markets Long, deep relationships since 1833 provide stable funding and earnings engine. Steady and even economy, powered by large corporations (Corning, Inc.), higher education (Cornell University, SUNY Binghamton) and tourism. Growth Opportunity New York’s Capital and Western New York regions offer larger population centers undergoing economic renaissances. Large bank consolidation providing market disruption opportunities. 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation Dominant market share of deposits Legacy Markets Small share of much larger markets; a lot of room to grow. Growth Markets Deployment of lower cost deposits to higher growth markets. Competitive Advantage Share 2023 Deposits County 61.49% $959,331,000 Chemung 1.45% $360,232,000 Albany 26.22% $139,572,000 Tioga 69.99% $181,089,000 Schuyler 9.39% $126,414,000 Steuben 7.56% $121,273,000 Cayuga 4.17% $111,292,000 Tompkins 4.10% $65,042,000 Bradford (PA) 3.18% $110,897,000 Broome 1.89% $123,069,000 Saratoga 3.93% $28,742,000 Seneca 2.18% $19,922,000 Cortland 1.24% $44,654,000 Schenectady 0.00% $3,061,000 Erie $2,394,590,000 Total Market Share 14 Albany, NY 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation President and CEO Industry Experience: 31 years Years with CHMG: 13 years Previously with Citizens Anders Tomson Experienced Management Team 15 EVP & CFO Industry Experience: 28 years Previously with KPMG LLP and Evans Bancorp Dale McKim Regional President Industry Experience: 35 years Years with CHMG: 5 Previously with Five Star Bank Jeffrey Kenefick President, Capital Bank Industry Experience: 23 years Years with CHMG: 11 Previously with First Niagara Daniel Fariello EVP, Wealth Management Industry Experience: 37 years Years with CHMG: 37 years Thomas Wirth EVP, Senior Banking Officer Industry Experience: 31 years Years with CHMG: 8 years Previously with TD Bank Kimberly Hazelton EVP, Chief Credit and Risk Officer Industry Experience: 42 years Years with CHMG: 5 years Previously with First Niagara Peter Cosgrove EVP and Chief Information Officer Industry Experience: 26 years Years with CHMG: 7 years Previously with BOK Financial Dale Cole 15 Vincent Cutrona President, Canal Bank Industry Experience: 27 years Previously with M&T Bank and Evans Bancorp 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation Supporting Our Communities 16 Volunteering Over 8,000 Hours Distributing Nearly $550,000 in Donations and Sponsorships Achieve | Albany Medical Center | American Cancer Society | American Heart Association | ARCs | Arnot Museum | Arnot Health | Auburn Public Theater | Boy Scouts | Broome County Council of Churches Buddy Walk | Capital City Rescue Mission | Capital Region Sponsor - A - Scholar | CareFirst | Career Development Council | Catholic Charities Clemens Center | Colonie Senior Center | Community Foundations | Corning Community College | Disabled American Veterans | Elmira College | Food Bank of the Southern Tier | Girl Scouts | Glassfest | Glove House | Grand Prix Festival | Guthrie | Habitat for Humanity | Historical Society | Ithaca Science Center | Jefferson Awards | JDRF | Junior Achievement | Kiwanis | Lions | Lourdes Foundation | Meals on Wheels | Multiple Sclerosis | Muscular Dystrophy | NAACP | Office for the Aging | PAL | Public Television Reading is Fundamental | Red Cross | Rockwell Museum | Ronald McDonald House Charities | Rotary | Sock Out Cancer | Sidney Albert Jewish Community Center | SPCA | St. Peter’s Hospital | United Health Services | Youth Sports Leagues | YMCA & YWCA… and many many more! 2024 KBW Community Bank Investor Conference

Loans 17

Chemung Financial Corporation Summary of Loan Growth 18 ▪ Total Loans: $2.011 billion at June 30, 2024 ▪ Originated $100.3MM in Commercial Loans to date in 2024 ▪ Originated $25.7MM in Indirect Loans to date in 2024 ▪ Originated $15.5MM in Home Equity Loans to date in 2024 ▪ Opened Loan Production Office in Buffalo, NY in 2021. $113.0MM in loans as of June 30, 2024. *June 30, 2024 figures unaudited 2024 KBW Community Bank Investor Conference 14.3% 14.1% 13.8% 13.4% 14.4% 46.6% 52.9% 54.5% 56.9% 57.4% 9.8% 2.8% 15.6% 17.1% 15.6% 14.1% 13.5% 7.8% 7.8% 11.0% 10.7% 9.9% 5.9% 5.3% 5.1% 4.9% 4.8% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Loans by Type (%) Other Cons. Indirect Cons. Res. Mort. PPP Comm. Mort. Comm. & Ind.

Chemung Financial Corporation $658.5 $592.2 $651.5 $665.7 $653.6 $878.0 $879.0 $1,098.1 $1,206.6 $1,244.9 $47.0 $79.8 $100.4 $113.0 Loans by Division ($ Millions) Chemung Capital Buffalo Summary of Loan Growth Q2 2024 2023 2022 2021 2020 32.49% 33.75% 35.60% 39.01% 42.86% Chemung 61.89% 61.16% 60.04% 57.9% 57.14% Capital 5.62% 5.09% 4.36% 3.09% N/A Buffalo 19 *CAGR: 12/31/19 to 06/30/2024 *June 30, 2024 figures unaudited 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation 14.44% 6.39% 51.02% 13.50% 14.65% Portfolio Concentrations to Total Loans June 30, 2024 Commercial & Ind. CRE Owner Occupied CRE Non-Owner Occupied Residential Mort. Consumer Loan Composition 20 ▪ Effectively managing portfolio composition by establishing limits such as exposure and percentage of capital deployed for each category. ▪ Tactical use of participations to manage risk and capital. *June 30, 2024 figures unaudited 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation 2020 2021 2022 2023 Q2 2024 C&I 188% 118% 105% 105% 110% CRE OO 45% 43% 44% 49% 49% CRE NOO 321% 327% 372% 397% 390% RRE 122% 119% 119% 110% 103% Consumer 108% 92% 123% 122% 112% 0% 50% 100% 150% 200% 250% 300% 350% 400% 450% Portfolio Composition to Tier 1 Capital & ACL June 30, 2024 Loan Composition 21 ▪ Effectively managing portfolio composition by establishing limits such as exposure and percentage of capital deployed for each category. ▪ Tactical use of participations to manage risk and capital. *The CRE Ratio above does not agree to the regulatory guidelines due to the inclusion of owner - occupied loans. The regulatory gu ideline measure was 398% at June 30,2024. *June 30, 2024 figures unaudited 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation Loan Composition 22 ▪ Risk management function continually monitors and stress tests CRE exposure consistent with 2006 and 2015 interagency guidance. *June 30, 2024 figures unaudited 2024 KBW Community Bank Investor Conference 7.66% 10.72% 10.27% 5.17% 4.48% $196.1 $217.2 $239.5 $251.9 $263.1 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 2020 2021 2022 2023 Q2 2024 Tier 1 Capital & ACL ***CECL Adopted 1/1/2023 (in millions) Tier 1 Capital and ACL Growth Tier 1 Capital and ACL

Chemung Financial Corporation Commercial Loan Portfolio – June 30, 2024 23 *June 30, 2024 figures unaudited 2024 KBW Community Bank Investor Conference 70.36% 2.69% 3.90% 1.49% 3.92% 5.14% 3.08% 9.42% NAICS Descriptions Real Estate, Rental & Leasing Manufacturing Health Care & Social Assistance Wholesale Trade Construction Accommodation & Food Services Arts, Entertainment & Recreation Other 33.69% 18.51% 23.98% 8.89% 10.46% 0.04% 4.43% Loan Types Non-Owner Occupied Commercial & Industrial Multi-Family Owner Occupied Construction Agricultural & Farmland Other NAICS Code / Descriptions Balances ($ Thousands) Percentage Real Estate, Rental & Leasing 1,016,915$ 70.36% Accommodation & Food Services 74,285 5.14% Construction 56,677 3.92% Health Care & Social Assistance 56,398 3.90% Arts, Entertainment & Recreation 44,526 3.08% Manufacturing 38,862 2.69% Wholesale Trade 21,506 1.49% Other 136,089 9.42% Total 1,445,258$ 100.00% Loan Types Non-Owner Occupied 486,895$ 33.69% Multi-Family 346,524 23.98% Commercial & Industrial 267,515 18.51% Construction 151,126 10.46% Owner Occupied 128,548 8.89% Agricultural & Farmland 641 0.04% Other 64,009 4.43% Total 1,445,258$ 100.00%

Chemung Financial Corporation 36.49% 17.53% 12.68% 10.47% 7.05% 4.29% 11.49% Multifamily Retail Construction & Land Development Office Warehouse & Storage Hotel Other $1.15 Billion in Total CRE Commercial Real Estate 24 *June 30, 2024 figures unaudited 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation 0.32% 0.41% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% Non - Performing Loans and Assets (% of Total) Non-performing assets to total assets Non-performing loans to total loans Trends in Non - Performing Assets 25 *June 30, 2024 figures unaudited. 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation $8,195 $8,872 $5,000 $7,500 $10,000 $12,500 $15,000 Non - Performing Loans and Assets ($ Thousands) Non Performing Loans Non Performing Assets Trends in Non - Performing Assets 26 *June 30,2024 figures unaudited. 2024 KBW Community Bank Investor Conference

Investments 27

Chemung Financial Corporation 7.6% 8.8% 9.5% 10.1% 84.4% 72.9% 68.8% 69.1% 68.9% 7.8% 5.3% 6.1% 6.6% 6.5% 7.8% 14.2% 16.3% 14.8% 14.5% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2020 2021 2022 2023 Q2 2024 Securities Available for Sale by Type (%) U.S. Government & Enterprises MBS States & Political Other Sec. Investment Portfolio Composition 28 *June 30, 2024 figures unaudited. 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation Investment Portfolio - Yield & Duration 29 ▪ Utilizing cashflows from principal and interest payments to fund loans and pay down borrowings. ▪ Approximately $5 million a month in cash flows. ▪ Principal cash flows representing over 50% of the portfolio to be received in the next five years. *June 30, 2024 figures unaudited. 2024 KBW Community Bank Investor Conference 2.31% 4.0 3.8 4.0 4.2 4.4 4.6 4.8 5.0 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 2020 2021 2022 2023 Q2 2024 Investment Portfolio Yield Duration - Years

Chemung Financial Corporation Investment Portfolio – Fair Value and AOCI 30 $ - $ - $60,431 $55,574 $55,000 $225,029 $467,866 $577,361 $435,131 $389,031 $41,265 $43,405 $42,303 $38,892 $36,153 $15,962 $43,340 $111,931 $102,992 $88,820 $1,834 $12,249 $3,383 $(96,609) $(114,833) $(140,000) $(120,000) $(100,000) $(80,000) $(60,000) $(40,000) $(20,000) $- $20,000 $- $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 $900,000 2019 2020 2021 2022 Q3 2023 Fair Values ($000) U.S. Government & Enterprises MBS States & Political Other Unrealized (Loss)/Gain *June 30, 2024 figures unaudited. 2024 KBW Community Bank Investor Conference $60,431 $55,574 $55,332 $55,474 $467,866 $577,361 $435,131 $403,824 $379,749 $43,405 $42,303 $38,892 $38,686 $35,780 $43,340 $111,931 $102,992 $86,151 $79,924 $12,249 $3,383 $(96,609) $(85,099) $(90,393) $(120,000) $(100,000) $(80,000) $(60,000) $(40,000) $(20,000) $- $20,000 $- $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 $900,000 2020 2021 2022 2023 Q2 2024 Fair Values ($000) U.S. Government & Enterprises MBS States & Political Other Unrealized (Loss)/Gain

Deposits 31

Chemung Financial Corporation 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2020 2021 2022 2023 Q2 2024 Cost of Deposits NOW Savings and Money Market Time Deposits Brokered Deposits Total Cost of Interest Bearing Deposits Deposit Costs 32 • Cumulative deposit beta for the period of December 2021 through June 2024: 38%^ • 2023 deposit beta: 84%^ *June 30, 2024 figures unaudited. 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation 30.4% 34.3% 31.5% 26.8% 25.6% 13.9% 13.3% 11.8% 12.0% 13.6% 29.6% 30.4% 27.5% 25.7% 25.4% 12.1% 13.0% 12.0% 10.3% 10.3% 14.0% 9.0% 14.0% 19.3% 22.2% 3.2% 5.9% 2.9% 2020 2021 2022 2023 Q2 2024 Account Types (%) Non-Interest Bearing DDA Interest Bearing DDA Money Market Savings Time Deposit Brokered Deposits Q2 2024 2023 2022 2021 2020 Rate 1.79% 1.10% 0.15% 0.08% 0.14% NOW 2.01% 1.45% 0.24% 0.10% 0.16% Savings and Money Market 4.20% 3.31% 1.08% 0.83% 1.16% Time Deposits 5.42% 5.22% 2.88% Brokered Deposits 2.80% 2.11% 0.44% 0.22% 0.31% Total Cost of Interest Bearing Deposits 2.08% 1.51% 0.30% 0.15% 0.21% Total Cost of Deposits Deposit Costs 33 • 2024 Total Deposits $2.416B; a decrease of $13.5 million from December 31, 2023 • 2024 Brokered Deposits $69.5 million; a decrease of $73.3 million from December 31, 2023 *June 30, 2024 figures unaudited. 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation 53.1% 52.8% 51.2% 50.2% 50.4% 43.8% 45.0% 44.0% 42.0% 43.7% 24.7% 24.1% 26.9% 28.4% 29.4% 34.0% 34.1% 30.1% 28.2% 26.6% 10.4% 9.1% 9.1% 9.1% 8.7% 6.6% 7.5% 6.8% 6.3% 7.8% 3.2% 5.9% 2.9% 11.8% 14.0% 12.8% 12.3% 11.5% 15.6% 13.4% 15.9% 17.6% 19.0% Deposits by Customer (%) Consumer Commerical Public Brokered ICS / CDARS Deposit Composition 34 *June 30, 2024 figures unaudited. 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation $1,686.3 $1,738.0 $1,815.5 $1,899.8 $1,976.0 $351.4 $415.6 $435.2 $381.0 $364.0 $73.5 $142.8 $69.5 $1.8 $3.0 $5.8 $6.4 32.0% 33.6% 30.1% 27.0% 26.3% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 2020 2021 2022 2023 Q2 2024 Deposits by Division ($ Millions) CCTC Capital Bank Brokered Western New York Uninsured Deposits Deposit Composition 35 *CAGR 12/31/2019 to 06/30/2024 *June 30, 2024 figures unaudited. 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation Liquidity 36 Williamsville, New York Branch Remaining Available Outstanding Total Available Dollars in Thousands 191,409 $ 30,000 $ 221,409 $ FHLB Advances 60,000 - 60,000 Correspondent Bank Lines of Credit 206,081 69,500 275,581 Brokered Deposits 206,406 - 206,406 Unencumbered Securities 663,896 $ 99,500 $ 763,396 $ Total Sources of Liquidity 635,187 $ Uninsured Deposits* 26.3% Uninsured Deposits to Total Deposits *Includes $188.8 M in collateralized municipal deposits 2024 KBW Community Bank Investor Conference

Performance 37

Chemung Financial Corporation $2,491 $5,827 $5,711 $5,233 $6,530 $6,795 $6,646 $6,454 $6,867 $8,024 $6,453 $7,439 $7,270 $6,280 $7,648 $3,802 $7,050 $4,987 $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Net Income - Quarterly Trend ($ Thousands) 38 *March 31, 2024, and June 30, 2024 figures unaudited. 2024 KBW Community Bank Investor Conference $19.2MM $26.4MM $28.8MM $25.00MM $12.0MM 2020 2021 2022 2023 2024

Chemung Financial Corporation 2020 2021 2022 2023 2024 Q1 3.55% 2.86% 2.87% 3.14% 2.73% Q2 3.26% 2.76% 2.97% 2.87% 2.66% Q3 3.20% 2.88% 3.08% 2.73% Q4 3.06% 2.85% 3.26% 2.69% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% Fully Taxable Equivalent Net Interest Margin (%) Q1 Q2 Q3 Q4 Net Interest Margin 39 *March 31, 2024, and June 30, 2024 figures unaudited. ▪ 26.6% of the loan portfolio reprices or matures within the next 90 days ▪ 20.5% of the commercial loan portfolio reprices or matures within the next 90 days ▪ 48.5% of the commercial loan portfolio reprices or matures within the next 5 years ▪ 70.4% of the commercial loan portfolio is variable 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation 3.25% 2.84% 3.05% 2.85% 2.69% 1.00% 1.40% 1.80% 2.20% 2.60% 3.00% 3.40% 3.80% 2020 2021 2022 2023 YTD 2024 Fully Taxable Equivalent Net Interest Margin (%) Net Interest Margin 40 ▪ Net interest margin impacted by low yielding mortgage - backed securities ▪ No loss trade transactions executed to date ▪ Loss trades are continually evaluated by the Board of Directors and Management *June 30, 2024 figures unaudited. 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation Overdraft Fees 12.69% Service Charges on Deposits 4.31% Interchange Income 19.58% Wealth Management Revenue 49.43% CFS Group, Inc. Revenue 4.27% Net Gains on Sales of Loans 0.63% Change in FV of Equity Securities 1.02% Other 8.07% $11.3 Million 6/30/2024 Overdraft Fees Service Charges on Deposits Interchange Income Wealth Management Revenue CFS Group, Inc. Revenue Net Gains on Sales of Loans Change in FV of Equity Securities Other Non - Interest Income Components 41 *June 30, 2024 figures unaudited. 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation Salaries , 42.04% Data Processing , 14.79% Employee Benefits , 11.23% Net Occupancy , 8.93% FDIC Insurance , 3.32% Professional Services , 3.39% Furniture/Equipment , 2.42% Marketing , 2.23% Other , 11.65% $32.9 Million 6/30/2024 Salaries Data Processing Employee Benefits Net Occupancy FDIC Insurance Professional Services Furniture/Equipment Marketing Other Non - Interest Expense Components 42 *June 30, 2024 figures unaudited. 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation 67.22 67.95 65.71 61.71 61.71 66.20 69.64 56.00 58.00 60.00 62.00 64.00 66.00 68.00 70.00 72.00 2018 2019 2020 2021 2022 2023 Q2 2024 Efficiency Ratio (%)** Expense Management and Control 43 Goal is both cost containment and cost savings ▪ Increase efficiency in banking operations (e.g., hub and spoke) ▪ Identify internal best practices ▪ Develop clear action plans to implement best practices across the organization ▪ Growth without adding cost Cost savings recognized: ▪ Reduction in headcount ▪ Frozen pension plan and post - retirement healthcare accruals ▪ Consolidation of six branch locations within existing footprint including Ithaca Station office, which will officially consolidate on November 15, 2024 **Efficiency ratio (adjusted) is non - interest expense less amortization of intangible assets divided by the total of fully taxab le equivalent net interest income plus non - interest income less net gains or losses on securities transactions *June 30, 2024 figures unaudited. 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation 7.90% 8.06% 8.23% 8.62% 8.85% 12.37% 12.96% 11.54% 12.08% 12.28% 13.62% 14.21% 12.57% 13.26% 13.35% 7.87% 7.91% 5.51% 6.45% 6.56% 4% 6% 8% 10% 12% 14% 16% Chemung Financial Corporation - Capital Ratios (%) Tier 1 Leverage Tier 1 Capital / CET1 Total Capital TCE Ratio Capital Management 44 ▪ Grow capital organically through earnings ▪ Continually evaluating capital strategies ▪ Positive stress testing results *June 30, 2024 figures unaudited. 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation Capital Management 45 ▪ Continue to remain profitable and pay dividends ▪ Announced share repurchase program of 250,000 shares in January 2021 ▪ As of June 30, 2024: 49,184 shares had been repurchased 2024 KBW Community Bank Investor Conference 2020 2021 2022 2023 Q2 2024 EPS $4.01 $5.64 $6.13 $5.28 $2.53 Dividends / Share $1.04 $1.19 $1.24 $1.24 $0.62 Book Value / Share $42.53 $45.09 $35.32 $41.07 $42.17 Tangible Book Value / Share $37.83 $40.44 $30.69 $36.48 $37.59 $- $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $- $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 $45.00 $50.00 Earnings and Dividends Per Share Tangible Book Value Per Share *June 30, 2024 figures unaudited.

Chemung Financial Corporation 4.8 million Shares Outstanding* $229.0M Market Capitalization* $0.62 YTD Dividend Per Share^ 2.58% Dividend Yield (TTM)* 7,478 Average Daily Volume^ $42.17 Book Value Per Share* $37.59 Tangible Book Value Per Share* $48.00 Stock Price* 9.43x Price to Earnings (TTM)* 1.28x Price to Tangible Book* 0.89% Return on Average Assets^ 12.37% Return on Average Equity^ CHMG Stock At a Glance 46 *As of June 30, 2024 (unaudited). ^YTD, June 30,2024 (unedited). 46 2024 KBW Community Bank Investor Conference

Chemung Financial Corporation One Chemung Canal Plaza Elmira, New York 14901 Anders Tomson 607 737 - 3756 atomson@chemungcanal.com Get In Touch Chemung Financial Corporation is a $2.8 billion financial services holding company headquartered in Elmira, New York and operates 31 retail offices through its principal subsidiary, Chemung Canal Trust Company, a full - service community bank with trust powers. Established in 1833, Chemung Canal Trust Company is the oldest locally - owned and managed community bank in New York State. Chemung Financial Corporation is also the parent of CFS Group, Inc., a financial services subsidiary offering non - traditional services including mutual funds, annuities, brokerage services, tax preparation services and insurance. Dale McKim 607 737 - 3714 dmckim@chemungcanal.com 47 2024 KBW Community Bank Investor Conference

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

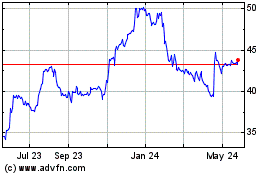

Chemung Financial (NASDAQ:CHMG)

Historical Stock Chart

From Nov 2024 to Dec 2024

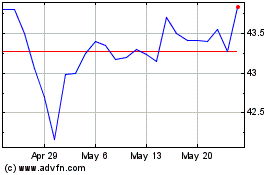

Chemung Financial (NASDAQ:CHMG)

Historical Stock Chart

From Dec 2023 to Dec 2024