UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission File Number 001-38370

CollPlant Biotechnologies Ltd.

(Exact name of registrant as specified in its charter)

4 Oppenheimer St, Weizmann Science Park

Rehovot 7670104, Israel

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

This Form 6-K, the text under the heading “Second

Quarter 2023 Financial Results”, the accompanying consolidated financial statements and “Forward Looking Statements”

of the press release attached to this Form 6-K as Exhibit 99.1, Exhibit 99.2 and Exhibit 99.3 are hereby incorporated by reference into

the registrant’s Registration Statements on Form S-8 (File No. 333-229163, 333-248479, 333-263842 and 333-271320) and Form F-3 (File

No. 333-228054, 333-238731 and 333-269087), to be a part thereof from the date on which this report is submitted, to the extent not superseded

by documents or reports subsequently filed or furnished.

On August 24, 2023, CollPlant Biotechnologies

Ltd. (the “Company”) issued a press release entitled “CollPlant Biotechnologies Provides Business Updates and Second

Quarter 2023 Financial Results”. In addition, on the same day, the Company issued condensed consolidated interim financial statements

(unaudited) as of June 30, 2023 together with the Company’s Operating and Financial Review and Prospects for the same period.

Attached hereto and incorporated by reference herein are the following

exhibits:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

COLLPLANT BIOTECHNOLOGIES LTD. |

| |

|

|

|

| Date: August 24, 2023 |

By: |

/s/ Eran Rotem |

| |

|

Name: |

Eran Rotem |

| |

|

Title: |

Deputy CEO and Chief Financial Officer |

Exhibit 99.1

CollPlant Biotechnologies Announces Second Quarter

Financial Results For 2023 with Revenues of $10.2 Million

| ● | Received

in July 2023, $10 million from partner, AbbVie, for achieving a major milestone in the second quarter, for the clinical-phase dermal

filler product in accordance with the strategic collaboration agreement |

| ● | Entered

into collaboration with Stratasys, a world-leading 3D printing company, with initial focus on the development of a bioprinting solution

for the fabrication of CollPlant’s regenerative breast implants |

| ● | Readying

breast implant study in large animals for initiation by year end |

| ● | Continued

positive sales trajectory for 3D bioinks |

| ● | Cash

and cash equivalents totaled $22.3 million as of June 30, 2023; cash runway extended with additional $10 million milestone payment received

in July 2023 from AbbVie |

| ● | Revenues

of $10.6 million and operating income of $5.7 million for the first six months of 2023 |

| ● | Conference

call to be held on August 24, 2023 at 10:00 am U.S. ET; Dial-in information herein |

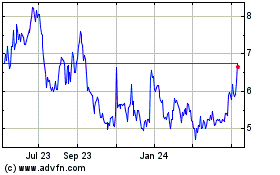

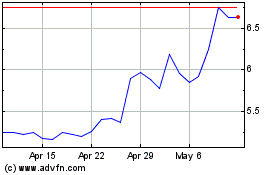

Rehovot, Israel, August 24, 2023 – CollPlant

Biotechnologies (Nasdaq: CLGN), a regenerative and aesthetics medicine company developing innovative technologies and products based on

its non-animal-derived collagen for tissue regeneration and organ manufacturing, today announced financial results for the second quarter

ended June 30, 2023, and provided a corporate update on its programs.

“This quarter, we were very pleased to announce

the achievement of an important milestone related to the dermal filler product developed in collaboration with our partner, AbbVie, for

which we received a $10 million payment. We also announced a joint development and commercialization agreement with Stratasys, a world-leader

in additive manufacturing that will initially focus on developing a bioprinting solution for the fabrication of our regenerative breast

implants in development. Both collaborations are expected to allow us to continue our momentum towards reaching important upcoming milestones

related to these programs, with the former providing a vehicle to maintain our strong cash position,” said

CollPlant’s Chief Executive Officer, Yehiel Tal.

Mr. Tal continued, “One of our upcoming

milestones will be initiating by the end of this year a second large-animal study to evaluate our regenerative breast implants. We have

already established the trial infrastructure and look forward to providing an update as soon as we conclude this study.”

Q2 and recent corporate highlights

Program development

| ● | CollPlant is planning to initiate a second large-animal

study to evaluate commercial sized 3D bioprinted regenerative breast implants, by year end. This study follows the completion of the first

large-animal study, the results of which were announced in January of this year. The first study demonstrated progressive stages of tissue

regeneration after three months, as highlighted by the formation of maturing connective tissue and neovascular networks within the implants,

with no adverse events reported. |

In the U.S.

alone, hundreds of thousands of people per year experience adverse events that range from autoimmune symptoms to the very serious breast

implant-associated anaplastic large cell lymphoma (BIA-ALCL). CollPlant’s breast implants that are comprised of CollPlant’s proprietary

plant-derived rhCollagen and other biomaterials, are expected to regenerate breast tissue without eliciting immune response, and thus

may provide a revolutionary alternative for aesthetic and reconstructive procedures, including postmastectomy for cancer patients.

Collaboration updates

| ● | In

June, CollPlant announced the achievement of a milestone with respect to the clinical phase dermal

filler product, which is under its collaboration agreement with AbbVie. According to the agreement, the achievement of this milestone

triggered a $10 million payment from AbbVie to CollPlant. CollPlant has the potential to receive additional milestone payments

as well as future royalties in accordance with its long-term collaboration with AbbVie for the dermal filler product. |

| ● | In

April, CollPlant announced a joint development and commercialization agreement with Stratasys to collaborate on the development

of a printing solution to bio-fabrication of human tissues and organs using Stratasys’ P3 technology-based bioprinter and CollPlant’s

rh-Collagen-based bioinks. The bioprinting solution is being designed to enable the production

of scaffolds that will accurately mimic the physical properties of human tissues and organs. These scaffolds are to meet the product

specification including resolution and reproducibility. The combined proprietary technologies are expected to enable the fabrication

of tissues and organs that also possess differentiated regenerative properties. The first project focuses on the development of an industrial-scale

solution for CollPlant’s regenerative breast implants program. Under the agreement, both companies have also agreed to cross-promote

each other’s bioprinting products. |

| ● | CollPlant is

developing, together with Tel Aviv University and Sheba Medical Center, a system that enhances the physiological relevance of the

human gut to provide a predictive personalized platform. CollPlant mimics the gut structure by 3D printing the gut tissue geometry in

high resolution using its unique rhCollagen-based bioink formulation. This tissue model is to be used for evaluating therapy response

in patients suffering from ulcerative colitis. Recently, the CollPlant team managed to successfully grow epithelial cells on the

3D printed scaffolds that mimic the gut tissue geometry. The Company expects to be able to provide an update on next steps for this program

by the end of this year. |

| ● | CollPlant

remains engaged in partnering dialogs with several industry leaders and academic institutions interested in the Company’s rhCollagen

technology and expertise in 3D bioprinting to develop therapeutics and medical applications. |

Commercial portfolio of bioink solutions

CollPlant’s

bioink platform is intended to enable its customers to streamline the process of new product development while also accelerating timelines

and reducing overall costs. CollPlant’s new bioink, Collink.3D-50L is the first bioink available in powder form which provides

enhanced operational specificity and flexibility for the end-user because of its mechanical properties to address additional printing

requirements of soft and hard tissues. These features of CollPlant’s new bioink enable the end user to address a wide range of 3D

bioprinting applications, including drug discovery, drug screening and tissue testing, as well as the development of transplantable tissues

and organs.

Operational updates

| ● | In

line with CollPlant’s mission to build a company that operates and works towards solutions that support a sustainable environment,

CollPlant recently recruited a dedicated manager to analyze, formulate and execute upon the set of standards for its Environmental, Social

and Governance (ESG) program. This initiative is designed to help CollPlant meet the evolving standards applicable to publicly listed

companies in the U.S., as well as help business partners and socially conscious investors better understand CollPlant’s alignment

with sustainable values – both operationally and as a component of its overall company mission. |

Second quarter ended June 30, 2023 financial

results

GAAP revenues for the second quarter ended June

30, 2023 were $10.2 million, an increase of $10.1 million compared to $66,000 in the second quarter ended June 30, 2022. The increase

in revenues was mainly related to the achievement of a milestone with respect to the AbbVie agreement, which triggered a $10 million payment.

GAAP cost of revenues for the second quarter ended

June 30, 2023, was $615,000, an increase of $572,000 compared to $43,000 in the second quarter ended June 30, 2022. Cost of revenue mainly

includes the cost of the Company’s rhCollagen based products, and royalties to the Israeli Innovation Authority (IIA) for our sales. The

increase in cost of revenues in the amount of approximately $572,000 is mainly comprised of: (i) $305,000 in royalty expenses to the IIA

mainly related to the milestone payment received from AbbVie, and (ii) $171,000 relating to the BioInk, VergenixFG, and rhCollagen sales.

GAAP gross profit for the second quarter ended

June 30, 2023 was $9.6 million, compared to gross profit of $23,000 in the second quarter ended June 30, 2022.

GAAP operating expenses for the second quarter

ended June 30, 2023 were $3.9 million, compared to $4.2 million in the second quarter ended June 30, 2022. The decrease of $300,000 is

mainly related to general and administrative expenses and comprised of (i) $223,000 in employees’ salaries expense including a decrease

in accrued vacation liability and alterations in employment contractual terms implemented in 2022, and (ii) $194,000 share-based compensation

expenses mainly related to a directors grant in May 2022, offset by an increase of approximately $116,000 in professional services expenses

and patents expenses. On a non-GAAP basis, operating expenses for the second quarter ended June 30, 2023 were $3.6 million, compared to

$3.9 million in the second quarter ended June 30, 2022. Non-GAAP measures exclude certain non-cash expenses.

GAAP financial income, net, for the second quarter

ended June 30, 2023 totaled $85,000, compared to financial expenses, net, of $100,000 in the second quarter of 2022. The increase in financial

income is due to interest received from our short-term cash deposits and exchange rate differences.

GAAP net income for the second quarter ended June

30, 2023 was $5.8 million, or $0.51 basic income per share, compared to a net loss of $4.3 million, or $0.39 basic loss per share, for

the second quarter ended June 30, 2022. Non-GAAP net income for the second quarter ended June 30, 2023 was $6.0 million, or $0.53 income

per share, compared to a net loss of $4.0 million, or $0.36 basic loss per share, for the second quarter ended June 30, 2022.

Cash and cash equivalents as of June 30,

2023, were $22.3 million.

Cash used in operating activities during the three

months ended June 30, 2023 was $3.8 million, compared to $4.0 million cash used in operating activities during the three months ended

June 30, 2022.

Cash used in investing activities during the three

months ended June 30, 2023 and during the three months ended June 30, 2022 was $337,000.

Cash provided by financing activities during the three months ended

June 30, 2023 was $89,000. During the three months ended June 30, 2022, there was no cash provided by financing activities.

Year-to-date (six-month) period ended June

30, 2023 financial results

GAAP revenues for the six months ended June 30,

2023, were $10.6 million and included mainly revenues from the AbbVie Agreement as well as income from sales of the Company’s BioInk and

rhCollagen. Revenues increased by $10.5 million, compared to $132,000 in the six months ended June 30, 2022. The increase is related almost

entirely to the achievement of a milestone under the AbbVie Agreement and $500,000 increase in sales of rhCollagen.

GAAP cost of revenues for the six months ended

June 30, 2023, was $940,000, an increase of $866,000 compared to $74,000 in the six months ended June 30, 2022. The increase in cost of

revenues in the amount of approximately $866,000 is mainly comprised of: (i) $316,000 in royalty expenses to the IIA mainly related to

the milestone payment received from AbbVie, and (ii) $424,000 relating to the sales of BioInk, VergenixFG, and rhCollagen.

GAAP gross profit for the six months ended June

30, 2023, was $9.7 million, compared to gross profit of $58,000 in the six months ended June 30, 2022.

GAAP operating expenses for the six months ended

June 30, 2023, were $7.5 million, compared to $8.0 million, in the six months ended June 30, 2022. The decrease of $500,000 in expenses

is mainly related to general and administrative expenses and comprised of: (i) $278,000 in employees’ salaries expense including a decrease

in accrued vacation liability and alterations in employment contractual terms implemented in 2022, and (ii) $124,000 share-based compensation

expenses mainly related to options granted in 2022. On a non-GAAP basis, the operating expenses for the six months ended June 30, 2023

were $6.7 million, compared to $7.4 million in the six months ended June 30, 2022. Non-GAAP measures exclude certain non-cash expenses.

GAAP financial expenses, net for the six months

ended June 30, 2023, totaled $111,000, compared to $192,000 in the six months ended June 30, 2022. The decrease in financial expenses,

net, is due to interest received from the Company’s short-term cash deposits.

GAAP net income for the six months ended June

30, 2023 was $2.0 million, or $0.18 basic income per share, compared to a net loss of $8.1 million, or $0.74 basic loss per share, for

the six months ended June 30, 2022. Non-GAAP net income for the six months ended June 30, 2023, was $2.7 million, or $0.24 basic loss

per share, compared to $7.5 million loss, or $0.69 basic loss per share, for the six months ended June 30, 2022.

Cash used in operating activities during the six

months ended June 30, 2023 and June 30, 2022, remain unchanged at $7.2 million.

Cash used in investing activities during the six

months ended June 30, 2023 was $541,000, compared to $29.5 million cash provided by investing activities during the six months ended June

30, 2022. The decrease is mainly attributed to repayment and investment in short term cash deposits during the six months ended June 30,

2022.

Cash provided by financing activities during the

six months ended June 30, 2023 was $892,000, compared to cash provided by financing activities of $1.5 million during the six months ended

June 30, 2022. Cash provided by financing activities is attributed to proceeds from the exercise of options and warrants into shares.

Conference call information

CollPlant will hold a conference call to discuss

its second quarter 2023 financial results along with corporate updates on August 24, 2023 at 10 am ET.

To participate in the conference call, please use the dial-in information

below:

U.S. investors: 1-877-407-9716

Investors outside of the U.S.: 1-201-493-6779

Israel investors: 1-809-406-247

Conference ID: 13739191

Note, you can avoid long wait times for the

operator by using the Call me™ feature and clicking the link below 15 minutes prior to the scheduled call start time:

https://callme.viavid.com/viavid/?callme=true&passcode=13728588&h=true&info=company&r=true&B=6

Submit questions to management in advance of the call

To ask management a question ahead of the call, please email John Mullaly

at LifeSci Advisors LLC up until 24 hours before the event at jmullaly@lifesciadvisors.com.

COLLPLANT BIOTECHNOLOGIES LTD.

CONDENSED CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Assets | |

(Unaudited) | | |

(Audited) | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 22,283 | | |

$ | 29,653 | |

| Restricted cash | |

| 83 | | |

| - | |

| Restricted deposit | |

| 22 | | |

| 23 | |

| Trade receivables | |

| 10,160 | | |

| 9 | |

| Inventories | |

| 1,552 | | |

| 1,430 | |

| Other accounts receivable and prepaid expenses | |

| 758 | | |

| 543 | |

| Total current assets | |

| 34,858 | | |

| 31,658 | |

| Non-current assets: | |

| | | |

| | |

| Restricted (deposit | |

| 237 | | |

| 188 | |

| Operating lease right-of-use assets | |

| 3,327 | | |

| 2,711 | |

| Property and equipment, net | |

| 2,931 | | |

| 2,966 | |

| Intangible assets, net | |

| 216 | | |

| 245 | |

| Total non-current assets | |

| 6,711 | | |

| 6,110 | |

| Total assets | |

$ | 41,569 | | |

$ | 37,768 | |

COLLPLANT BIOTECHNOLOGIES LTD.

CONDENSED CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands, except share data)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Liabilities and shareholders’ equity | |

(Unaudited) | | |

(Audited) | |

| Current liabilities: | |

| | | |

| | |

| Trade payables | |

$ | 763 | | |

$ | 1,133 | |

| Operating lease liabilities | |

| 598 | | |

| 529 | |

| Accrued liabilities and other | |

| 1,421 | | |

| 1,443 | |

| Total current liabilities | |

| 2,782 | | |

| 3,105 | |

| Non-current liabilities: | |

| | | |

| | |

| Operating lease liabilities | |

| 2,748 | | |

| 2,382 | |

| Total non-current liabilities | |

| 2,748 | | |

| 2,382 | |

| Total liabilities | |

| 5,530 | | |

| 5,487 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Shareholders’ Equity: | |

| | | |

| | |

| Ordinary shares, NIS 1.5 par value - authorized: 30,000,000 ordinary shares as of June 30, 2023 (unaudited) and December 31, 2022; issued and outstanding: 11,405,394 and 11,186,481 ordinary shares as of June 30, 2023 (unaudited) and December 31, 2022, respectively | |

| 4,963 | | |

| 4,873 | |

| Additional paid in capital | |

| 119,720 | | |

| 118,099 | |

| Currency translation differences | |

| (969 | ) | |

| (969 | ) |

| Accumulated deficit | |

| (87,675 | ) | |

| (89,722 | ) |

| Total shareholders’ equity | |

| 36,039 | | |

| 32,281 | |

| Total liabilities and shareholders’ equity | |

$ | 41,569 | | |

$ | 37,768 | |

COLLPLANT BIOTECHNOLOGIES LTD.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(U.S. dollars in thousands, except share and per

share data)

(Unaudited)

| | |

Six months ended

June 30 | | |

Three months ended

June 30 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues | |

$ | 10,617 | | |

$ | 132 | | |

$ | 10,184 | | |

$ | 66 | |

| Cost of revenues | |

| 940 | | |

| 74 | | |

| 615 | | |

| 43 | |

| Gross Profit | |

| 9,677 | | |

| 58 | | |

| 9,569 | | |

| 23 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 4,676 | | |

| 4,841 | | |

| 2,574 | | |

| 2,599 | |

| General, administrative and marketing | |

| 2,843 | | |

| 3,170 | | |

| 1,318 | | |

| 1,609 | |

| Operating income (loss) | |

| 2,158 | | |

| (7,953 | ) | |

| 5,677 | | |

| (4,185 | ) |

| Financial income (expenses), net | |

| (111 | ) | |

| (192 | ) | |

| 85 | | |

| (100 | ) |

| Net income (loss) for the period | |

$ | 2,047 | | |

$ | (8,145 | ) | |

$ | 5,762 | | |

$ | (4,285 | ) |

| Basic net income (loss) per ordinary share | |

$ | 0.18 | | |

$ | (0.74 | ) | |

$ | 0.51 | | |

$ | (0.39 | ) |

| Diluted net income (loss) per ordinary share | |

$ | 0.17 | | |

$ | (0.74 | ) | |

$ | 0.49 | | |

$ | (0.39 | ) |

| Weighted average ordinary shares outstanding used in computation of basic net income (loss) per share | |

| 11,329,516 | | |

| 10,935,611 | | |

| 11,369,031 | | |

| 11,086,481 | |

| Weighted average ordinary shares outstanding used in computation of diluted net income (loss) per share | |

| 11,738,884 | | |

| 10,935,611 | | |

| 11,777,139 | | |

| 11,086,481 | |

COLLPLANT BIOTECHNOLOGIES LTD.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S. dollars in thousands)

(Unaudited)

| |

|

Six months ended

June 30, |

|

| |

|

2023 |

|

|

2022 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

| Income (loss) |

|

$ |

2,047 |

|

|

$ |

(8,145 |

) |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

546 |

|

|

|

501 |

|

| Interest from Short term deposits |

|

|

- |

|

|

|

(87 |

) |

| Interest from restricted deposits |

|

|

11 |

|

|

|

- |

|

| Share-based compensation to employees and consultants |

|

|

852 |

|

|

|

1,055 |

|

| Exchange differences on cash and cash equivalents |

|

|

444 |

|

|

|

727 |

|

| Changes in operating asset and liability items: |

|

|

|

|

|

|

|

|

| Decrease (increase) in trade receivables |

|

|

(10,151 |

) |

|

|

261 |

|

| Increase in inventories |

|

|

(155 |

) |

|

|

(275 |

) |

| Increase in other accounts receivable and prepaid expenses |

|

|

(215 |

) |

|

|

(170 |

) |

| Decrease in operating right of use assets |

|

|

254 |

|

|

|

220 |

|

| Decrease in trade payables |

|

|

(370 |

) |

|

|

(274 |

) |

| Decrease in lease liabilities |

|

|

(435 |

) |

|

|

(643 |

) |

| Decrease in accrued liabilities and other payables |

|

|

(22 |

) |

|

|

(305 |

) |

| Decrease in deferred revenues |

|

|

- |

|

|

|

(32 |

) |

| Net cash used in operating activities |

|

|

(7,194 |

) |

|

|

(7,167 |

) |

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Capitalization of intangible assets |

|

|

- |

|

|

|

(12 |

) |

| Purchase of property and equipment |

|

|

(482 |

) |

|

|

(678 |

) |

| Repayment of a short term deposits |

|

|

- |

|

|

|

50,238 |

|

| Investment in short term deposits and restricted deposits |

|

|

(59 |

) |

|

|

(20,000 |

) |

| Net cash provided by (used in) investing activities |

|

|

(541 |

) |

|

|

29,548 |

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Exercise of options and warrants into shares |

|

|

892 |

|

|

|

1,474 |

|

| Net cash provided by financing activities |

|

|

892 |

|

|

|

1,474 |

|

| Exchange differences on cash and cash equivalents, restricted cash and restricted deposits |

|

|

(444 |

) |

|

|

(727 |

) |

| Net increase (decrease) in cash and cash equivalents, restricted cash and restricted deposits |

|

|

(7,287 |

) |

|

|

23,128 |

|

| Cash and cash equivalents, restricted cash and restricted deposits at the beginning of the period |

|

|

29,653 |

|

|

|

13,374 |

|

| |

|

|

|

|

|

|

|

|

| Cash and cash equivalents, restricted cash and restricted deposits at the end of the period |

|

$ |

22,366 |

|

|

$ |

36,502 |

|

COLLPLANT BIOTECHNOLOGIES LTD.

APPENDICES TO CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(U.S. dollars in thousands)

(Unaudited)

| | |

Six months ended

June 30, | |

| | |

2023 | | |

2022 | |

| Appendix to the statement of cash flows | |

| | |

| |

| A. Supplementary information on investing and financing activities not involving cash flows: | |

| | |

| |

| | |

| | |

| |

| Right of use assets recognized with corresponding lease liabilities | |

| 870 | | |

| 59 | |

| Capitalization of Share-based compensation to inventory | |

| 33 | | |

| - | |

| | |

| | | |

| | |

| B. Reconciliation of Cash, cash equivalents and restricted cash at the end of the period | |

| | | |

| | |

| | |

| | | |

| | |

| Cash and cash equivalents | |

| 22,283 | | |

| 36,290 | |

| Restricted cash | |

| 83 | | |

| - | |

| Restricted deposits (including long term) | |

| - | | |

| 212 | |

| Total cash and cash equivalents, restricted cash and restricted deposits | |

$ | 22,366 | | |

$ | 36,502 | |

COLLPLANT BIOTECHNOLOGIES LTD.

Reconciliation of GAAP to Non-GAAP Financial

Measures

(U.S. dollars in thousands, except per share data)

(Unaudited)

| |

|

Six months ended

June 30 |

|

|

Three months ended

June 30 |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

USD in thousands |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP gross profit |

|

$ |

9,677 |

|

|

$ |

58 |

|

|

$ |

9,569 |

|

|

$ |

23 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP operating costs and expenses: |

|

|

7,519 |

|

|

|

8,011 |

|

|

|

3,892 |

|

|

|

4,208 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change of operating lease accounts |

|

|

33 |

|

|

|

423 |

|

|

|

12 |

|

|

|

329 |

|

| Share-based compensation to employees, directors and consultants |

|

|

(852 |

) |

|

|

(1,055 |

) |

|

|

(338) |

|

|

|

(594 |

) |

| Non-GAAP operating costs and expenses: |

|

|

6,700 |

|

|

|

7,379 |

|

|

|

3,566 |

|

|

|

3,943 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP operating income (loss) |

|

|

2,158 |

|

|

|

(7,953 |

) |

|

|

5,677 |

|

|

|

(4,185 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP operating income (loss) |

|

|

2,977 |

|

|

|

(7,321 |

) |

|

|

6,003 |

|

|

|

(3,920 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP Net Income (loss) |

|

|

2,047 |

|

|

|

(8,145 |

) |

|

|

5,762 |

|

|

|

(4,285 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change of operating lease accounts |

|

|

(181) |

|

|

|

(423 |

) |

|

|

(76) |

|

|

|

(329 |

) |

| Share-based compensation to employees, directors and consultants |

|

|

852 |

|

|

|

1,055 |

|

|

|

338 |

|

|

|

594 |

|

| Non-GAAP Net income (loss) |

|

$ |

2,718 |

|

|

$ |

(7,513 |

) |

|

$ |

6,024 |

|

|

$ |

(4,020 |

) |

| GAAP Basic income (loss) per ordinary share |

|

$ |

0.18 |

|

|

$ |

(0.74 |

) |

|

$ |

0.51 |

|

|

$ |

(0.39 |

) |

| NON- GAAP Basic income (loss) per ordinary share |

|

$ |

0.24 |

|

|

$ |

(0.69 |

) |

|

$ |

0.53 |

|

|

$ |

(0.36 |

) |

| GAAP Diluted income (loss) per ordinary share |

|

$ |

0.17 |

|

|

$ |

(0.74 |

) |

|

$ |

0.49 |

|

|

$ |

(0.39 |

) |

| Non-GAAP Diluted income (loss) per ordinary share |

|

$ |

0.23 |

|

|

$ |

(0.69 |

) |

|

$ |

0.52 |

|

|

$ |

(0.36 |

) |

About CollPlant

CollPlant is a regenerative and aesthetic medicine

company focused on 3D bioprinting of tissues and organs, and medical aesthetics. The Company’s products are based on its rhCollagen (recombinant

human collagen) produced with CollPlant’s proprietary plant based genetic engineering technology. These products address indications for

the diverse fields of tissue repair, aesthetics, and organ manufacturing, and are ushering in a new era in regenerative and aesthetic

medicine.

In 2021 CollPlant entered into a development and

global commercialization agreement for dermal and soft tissue fillers with Allergan, an AbbVie company, the global leader in the dermal

filler market.

For more information about CollPlant, visit http://www.collplant.com

Use of Non-US GAAP (“non-GAAP”)

Financial results for 2023 and 2022 are presented

on both a GAAP and a non-GAAP basis. GAAP results were prepared in accordance with U.S. GAAP and include all revenue and expenses recognized

during the period. The release contains certain non-GAAP financial measures for operating costs and expenses, operating income (or loss),

net income (or loss) and basic and diluted net income (or loss) per share that exclude the effects of non-cash expense for share-based

compensation to employees, directors and consultants, and change in operating lease accounts. CollPlant’s management believes that

these non-GAAP financial measures provide meaningful supplemental information regarding the Company’s performance that enhances

management’s and investors’ ability to evaluate the Company’s operating costs, net income (or loss) and income (or loss)

per share, and to compare them to historical Company results.

The presentation of this non-GAAP financial information

is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with

GAAP. Management uses both GAAP and non-GAAP measures when operating and evaluating the Company’s business internally and therefore

decided to make these non-GAAP adjustments available to investors. The non-GAAP financial measures used by the Company in this press release

may be different from the measures used by other companies.

For more information on the non-GAAP financial

measures, please see the “Reconciliation of GAAP to Non-GAAP Financial Measures” later in this release. This accompanying

table has more details on the GAAP financial measures that are most directly comparable to non-GAAP financial measures and the related

reconciliations between these financial measures.

The Company’s consolidated financial results

for the second quarter ended June 30, 2023, are presented in accordance with generally accepted accounting principles in the U.S.

A copy of the Company’s annual report on

Form 20-F for the year ended December 31, 2022 has been filed with the U.S. Securities and Exchange Commission at www.sec.gov and posted

on the Company’s investor relations website at http://ir.collplant.com/. The Company will deliver a hard copy of its annual report,

including its complete audited consolidated financial statements, free of charge, to its shareholders upon request to CollPlant Investor

Relations at 4 Oppenheimer, Weizmann Science Park, Rehovot 767104, Israel or by phone at +972-73-232 5600.

Safe Harbor Statements

This press release may include forward-looking

statements. Forward-looking statements may include, but are not limited to, statements relating to CollPlant’s objectives plans

and strategies, as well as statements, other than historical facts, that address activities, events or developments that CollPlant intends,

expects, projects, believes or anticipates will or may occur in the future. These statements are often characterized by terminology such

as “believes,” “hopes,” “may,” “anticipates,” “should,” “intends,”

“plans,” “will,” “expects,” “estimates,” “projects,” “positioned,”

“strategy” and similar expressions and are based on assumptions and assessments made in light of management’s experience

and perception of historical trends, current conditions, expected future developments and other factors believed to be appropriate.

Forward-looking statements are not guarantees

of future performance and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed

or implied in such statements. Many factors could cause CollPlant’s actual activities or results to differ materially from the activities

and results anticipated in forward-looking statements, including, but not limited to, the following: the Company’s history of significant

losses, its need to raise additional capital and its inability to obtain additional capital on acceptable terms, or at all; the Company’s

ability to develop a printing solution for its breast implants program, or at all; the Company’s expectations regarding the timing

and cost of commencing pre-clinical and clinical trials, or at all, with respect to breast implants, tissues and organs which are based

on its rhCollagen based BioInk and other products for medical aesthetics, and specifically the Company’s ability to initiate a second

large-animal study for its breast implants in a timely manner, or at all; the Company’s ability to obtain favorable pre-clinical

and clinical trial results with respect to the foregoing trials; regulatory action with respect to rhCollagen based BioInk and medical

aesthetics products including but not limited to acceptance of an application for marketing authorization review and approval of such

application, and, if approved, the scope of the approved indication and labeling; commercial success and market acceptance of the bioprinter

under development with Stratasys and/or future potential collaborative products and/or CollPlant’s regenerative breast implants

and/or dermal filler product under development with AbbVie and/or other medical aesthetics products; the Company’s ability to establish

sales and marketing capabilities or enter into agreements with third parties and its reliance on third party distributors and resellers;

the Company’s ability to establish and maintain strategic partnerships and other corporate collaborations, including its partnership

with AbbVie and its ability to continue to received milestone and royalties payments under the AbbVie agreement; the Company’s

reliance on third parties to conduct some or all aspects of its product manufacturing; the scope of protection the Company is able to

establish and maintain for intellectual property rights and the Company’s ability to operate its business without infringing the

intellectual property rights of others; current or future unfavorable economic and market conditions and adverse developments with respect

to financial institutions and associated liquidity risk; the impact of competition and new technologies; general market, political, and

economic conditions in the countries in which the Company operates; projected capital expenditures and liquidity; changes in the Company’s

strategy; and litigation and regulatory proceedings. More detailed information about the risks and uncertainties affecting CollPlant is

contained under the heading “Risk Factors” included in CollPlant’s most recent annual report on Form 20-F filed with

the SEC, and in other filings that CollPlant has made and may make with the SEC in the future. The forward-looking statements contained

in this press release are made as of the date of this press release and reflect CollPlant’s current views with respect to future

events, and CollPlant does not undertake and specifically disclaims any obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise.

Contacts

CollPlant:

Eran Rotem

Deputy CEO & CFO

Tel: + 972-73-2325600

Eran@collplant.com

Investors:

LifeSci Advisors

John Mullaly

jmullaly@lifesciadvisors.com

15

Exhibit 99.2

COLLPLANT BIOTECHNOLOGIES LTD.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

AS OF JUNE 30, 2023

COLLPLANT BIOTECHNOLOGIES LTD.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

AS OF JUNE 30, 2023

TABLE OF CONTENTS

___________________

___________________________

___________________

COLLPLANT BIOTECHNOLOGIES LTD.

CONDENSED CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

(Audited) | |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 22,283 | | |

$ | 29,653 | |

| Restricted cash | |

| 83 | | |

| - | |

| Restricted deposit | |

| 22 | | |

| 23 | |

| Trade receivables | |

| 10,160 | | |

| 9 | |

| Inventories | |

| 1,552 | | |

| 1,430 | |

| Other accounts receivable and prepaid expenses | |

| 758 | | |

| 543 | |

| Total current assets | |

| 34,858 | | |

| 31,658 | |

| Non-current assets: | |

| | | |

| | |

| Restricted deposit | |

| 237 | | |

| 188 | |

| Operating lease right-of-use assets | |

| 3,327 | | |

| 2,711 | |

| Property and equipment, net | |

| 2,931 | | |

| 2,966 | |

| Intangible assets, net | |

| 216 | | |

| 245 | |

| Total non-current assets | |

| 6,711 | | |

| 6,110 | |

| Total assets | |

$ | 41,569 | | |

$ | 37,768 | |

COLLPLANT BIOTECHNOLOGIES LTD.

CONDENSED CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

(Audited) | |

| Liabilities and shareholders’ equity | |

| | |

| |

| Current liabilities: | |

| | |

| |

| Trade payables | |

$ | 763 | | |

$ | 1,133 | |

| Operating lease liabilities | |

| 598 | | |

| 529 | |

| Accrued liabilities and other | |

| 1,421 | | |

| 1,443 | |

| Total current liabilities | |

| 2,782 | | |

| 3,105 | |

| Non-current liabilities: | |

| | | |

| | |

| Operating lease liabilities | |

| 2,748 | | |

| 2,382 | |

| Total non-current liabilities | |

| 2,748 | | |

| 2,382 | |

| Total liabilities | |

| 5,530 | | |

| 5,487 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Shareholders’ Equity: | |

| | | |

| | |

| Ordinary shares, NIS 1.5 par value - authorized: 30,000,000 ordinary shares as of June 30, 2023 (unaudited) and December 31, 2022; issued and outstanding: 11,405,394 and 11,186,481 ordinary shares as of June 30, 2023 (unaudited) and December 31, 2022, respectively | |

| 4,963 | | |

| 4,873 | |

| Additional paid in capital | |

| 119,720 | | |

| 118,099 | |

| Currency translation differences | |

| (969 | ) | |

| (969 | ) |

| Accumulated deficit | |

| (87,675 | ) | |

| (89,722 | ) |

| Total shareholders’ equity | |

| 36,039 | | |

| 32,281 | |

| Total liabilities and shareholders’ equity | |

$ | 41,569 | | |

$ | 37,768 | |

The accompanying notes are an integral part

of these condensed consolidated financial statements.

COLLPLANT BIOTECHNOLOGIES LTD.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(U.S. dollars in thousands, except share and per share data)

(Unaudited)

| | |

Six months ended

June 30 | | |

Three months ended

June 30 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues | |

$ | 10,617 | | |

$ | 132 | | |

$ | 10,184 | | |

$ | 66 | |

| Cost of revenues | |

| 940 | | |

| 74 | | |

| 615 | | |

| 43 | |

| Gross Profit | |

| 9,677 | | |

| 58 | | |

| 9,569 | | |

| 23 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 4,676 | | |

| 4,841 | | |

| 2,574 | | |

| 2,599 | |

| General, administrative and marketing | |

| 2,843 | | |

| 3,170 | | |

| 1,318 | | |

| 1,609 | |

| Operating income (loss) | |

| 2,158 | | |

| (7,953 | ) | |

| 5,677 | | |

| (4,185 | ) |

| Financial income (expenses), net | |

| (111 | ) | |

| (192 | ) | |

| 85 | | |

| (100 | ) |

| Net income (loss) for the period | |

$ | 2,047 | | |

$ | (8,145 | ) | |

$ | 5,762 | | |

$ | (4,285 | ) |

| Basic net income (loss) per ordinary share | |

$ | 0.18 | | |

$ | (0.74 | ) | |

$ | 0.51 | | |

$ | (0.39 | ) |

| Diluted net income (loss) per ordinary share | |

$ | 0.17 | | |

$ | (0.74 | ) | |

$ | 0.49 | | |

$ | (0.39 | ) |

| Weighted average ordinary shares outstanding used in computation of basic net income (loss) per share | |

| 11,329,516 | | |

| 10,935,611 | | |

| 11,369,031 | | |

| 11,086,481 | |

| Weighted average ordinary shares outstanding used in computation of diluted net income (loss) per share | |

| 11,738,884 | | |

| 10,935,611 | | |

| 11,777,139 | | |

| 11,086,481 | |

The accompanying notes are an integral part

of these condensed consolidated financial statements.

COLLPLANT BIOTECHNOLOGIES LTD.

CONDENSED CONSOLIDATED STATEMENTS SHAREHOLDERS’ EQUITY

(U.S. dollars in thousands, except share data)

(Unaudited)

| | |

Ordinary shares | | |

Additional | | |

Currency | | |

| | |

| |

| | |

Number of

shares | | |

Amounts | | |

paid-in

capital | | |

translation

differences | | |

Accumulated

deficit | | |

Total | |

| BALANCE AT DECEMBER 31, 2021 | |

| 10,722,024 | | |

$ | 4,664 | | |

$ | 114,223 | | |

$ | (969 | ) | |

$ | (72,797 | ) | |

$ | 45,121 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Exercise of options | |

| 39,457 | | |

| 18 | | |

| 156 | | |

| - | | |

| - | | |

| 174 | |

| Exercise of warrants | |

| 325,000 | | |

| 149 | | |

| 1,151 | | |

| - | | |

| - | | |

| 1,300 | |

| Share-based compensation | |

| - | | |

| - | | |

| 1,055 | | |

| - | | |

| - | | |

| 1,055 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (8,145 | ) | |

| (8,145 | ) |

| BALANCE AT JUNE 30, 2022 | |

| 11,086,481 | | |

$ | 4,831 | | |

$ | 116,585 | | |

$ | (969 | ) | |

$ | (80,942 | ) | |

$ | 39,505 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| BALANCE AT DECEMBER 31, 2022 | |

| 11,186,481 | | |

$ | 4,873 | | |

$ | 118,099 | | |

$ | (969 | ) | |

$ | (89,722 | ) | |

$ | 32,281 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Exercise of options | |

| 32,913 | | |

| 14 | | |

| 134 | | |

| - | | |

| - | | |

| 148 | |

| Exercise of warrants | |

| 186,000 | | |

| 76 | | |

| 668 | | |

| - | | |

| - | | |

| 744 | |

| Share-based compensation | |

| - | | |

| - | | |

| 819 | | |

| - | | |

| - | | |

| 819 | |

| Net income | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,047 | | |

| 2,047 | |

| BALANCE AT JUNE 30, 2023 | |

| 11,405,394 | | |

$ | 4,963 | | |

$ | 119,720 | | |

$ | (969 | ) | |

$ | (87,675 | ) | |

$ | 36,039 | |

COLLPLANT BIOTECHNOLOGIES LTD.

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(U.S. dollars in thousands, except share data)

(Unaudited)

| | |

Ordinary shares | | |

Additional | | |

Currency | | |

| | |

| |

| | |

Number of

shares | | |

Amounts | | |

paid-in

capital | | |

translation

differences | | |

Accumulated

deficit | | |

Total | |

| BALANCE AT MARCH 31, 2022 | |

| 11,086,481 | | |

$ | 4,831 | | |

$ | 115,991 | | |

$ | (969 | ) | |

$ | (76,657 | ) | |

$ | 43,196 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based compensation | |

| - | | |

| - | | |

| 594 | | |

| - | | |

| - | | |

| 594 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,285 | ) | |

| (4,285 | ) |

| BALANCE AT JUNE 30, 2022 | |

| 11,086,481 | | |

$ | 4,831 | | |

$ | 116,585 | | |

$ | (969 | ) | |

$ | (80,942 | ) | |

$ | 39,505 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| BALANCE AT MARCH 31, 2023 | |

| 11,385,041 | | |

$ | 4,955 | | |

$ | 119,341 | | |

$ | (969 | ) | |

$ | (93,437 | ) | |

$ | 29,890 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Exercise of options | |

| 20,353 | | |

| 8 | | |

| 81 | | |

| - | | |

| - | | |

| 89 | |

| Share-based compensation | |

| - | | |

| - | | |

| 298 | | |

| - | | |

| - | | |

| 298 | |

| Net income | |

| - | | |

| - | | |

| - | | |

| - | | |

| 5,762 | | |

| 5,762 | |

| BALANCE AT JUNE 30, 2023 | |

| 11,405,394 | | |

$ | 4,963 | | |

$ | 119,720 | | |

$ | (969 | ) | |

$ | (87,675 | ) | |

$ | 36,039 | |

The accompanying notes are an integral part

of these condensed consolidated financial statements.

COLLPLANT BIOTECHNOLOGIES LTD.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S. dollars in thousands)

(Unaudited)

| | |

Six months ended

June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | |

| |

| Income (loss) | |

$ | 2,047 | | |

$ | (8,145 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities | |

| | | |

| | |

| Depreciation and amortization | |

| 546 | | |

| 501 | |

| Interest from Short term deposits | |

| - | | |

| (87 | ) |

| Interest from restricted deposits | |

| 11 | | |

| - | |

| Share-based compensation to employees and consultants | |

| 852 | | |

| 1,055 | |

| Exchange differences on cash and cash equivalents | |

| 444 | | |

| 727 | |

| Changes in operating asset and liability items: | |

| | | |

| | |

| Decrease (increase) in trade receivables | |

| (10,151 | ) | |

| 261 | |

| Increase in inventories | |

| (155 | ) | |

| (275 | ) |

| Increase in other accounts receivable and prepaid expenses | |

| (215 | ) | |

| (170 | ) |

| Decrease in operating right of use assets | |

| 254 | | |

| 220 | |

| Decrease in trade payables | |

| (370 | ) | |

| (274 | ) |

| Decrease in lease liabilities | |

| (435 | ) | |

| (643 | ) |

| Decrease in accrued liabilities and other payables | |

| (22 | ) | |

| (305 | ) |

| Decrease in deferred revenues | |

| - | | |

| (32 | ) |

| Net cash used in operating activities | |

| (7,194 | ) | |

| (7,167 | ) |

| Cash flows from investing activities: | |

| | | |

| | |

| Capitalization of intangible assets | |

| - | | |

| (12 | ) |

| Purchase of property and equipment | |

| (482 | ) | |

| (678 | ) |

| Repayment of a short-term cash deposits | |

| - | | |

| 50,238 | |

| Investment in short term cash deposits and restricted deposits | |

| (59 | ) | |

| (20,000 | ) |

| Net cash provided by (used in) investing activities | |

| (541 | ) | |

| 29,548 | |

| Cash flows from financing activities: | |

| | | |

| | |

| Exercise of options and warrants into shares | |

| 892 | | |

| 1,474 | |

| Net cash provided by financing activities | |

| 892 | | |

| 1,474 | |

| Exchange differences on cash and cash equivalents, restricted cash and restricted deposits | |

| (444 | ) | |

| (727 | ) |

| Net increase (decrease) in cash and cash

equivalents, restricted cash and restricted deposits | |

| (7,287 | ) | |

| 23,128 | |

| Cash and cash

equivalents, restricted cash and restricted deposits at the beginning of the period | |

| 29,653 | | |

| 13,374 | |

| | |

| | | |

| | |

| Cash and cash

equivalents, restricted cash and restricted deposits at the end of the period | |

$ | 22,366 | | |

$ | 36,502 | |

COLLPLANT BIOTECHNOLOGIES LTD.

APPENDICES TO CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S. dollars in thousands)

(Unaudited)

| | |

Six months ended

June 30, | |

| | |

2023 | | |

2022 | |

| Appendix to the statement of cash flows | |

| | |

| |

| A. Supplementary information on investing and financing activities not involving cash flows: | |

| | |

| |

| | |

| | |

| |

| Right of use assets recognized with corresponding lease liabilities | |

| 870 | | |

| 59 | |

| Capitalization of Share-based compensation to inventory | |

| 33 | | |

| - | |

| | |

| | | |

| | |

| B. Reconciliation of Cash, cash equivalents and restricted cash at the end of the period | |

| | | |

| | |

| | |

| | | |

| | |

| Cash and cash equivalents | |

| 22,283 | | |

| 36,290 | |

| Restricted cash | |

| 83 | | |

| - | |

| Restricted deposits (including long term) | |

| - | | |

| 212 | |

| Total cash and cash equivalents, restricted cash and restricted deposits | |

$ | 22,366 | | |

$ | 36,502 | |

The accompanying notes are an integral part

of these condensed consolidated financial statements.

COLLPLANT BIOTECHNOLOGIES

LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(U.S. dollars in thousands, except share and per share amounts)

(Unaudited)

Note

1 - NATURE OF OPERATIONS:

CollPlant Biotechnologies Ltd.

(the “Company”) is a regenerative and aesthetic medicine company focused on 3D bioprinting of tissues and organs and medical

aesthetics. The Company’s products are based on its recombinant human collagen (rhCollagen) produced with its proprietary plant

based technology. These products address indications for the diverse fields of tissue repair, aesthetics, and organ manufacturing.

The Company’s revenues include

income from business collaborators and from sales of (i) BioInk products for the development of 3D bioprinting of organs and tissues,

(ii) rhCollagen for the medical aesthetics market, and (iii) rhCollagen-based products for tendinopathy and wound healing.

The Company operates through its wholly-owned

subsidiary, CollPlant Ltd. (“CollPlant”). In November 2021 CollPlant established CollPlant Inc., a wholly owned subsidiary

in the United States. As of June 30, 2023, CollPlant Inc. has not commenced operation.

NOTE

2 - SIGNIFICANT ACCOUNTING POLICIES:

The unaudited condensed consolidated

financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States

of America (“US GAAP”) for interim financial information. Accordingly, they do not contain all information and notes required

by US GAAP for annual financial statements. In the opinion of management, these unaudited condensed consolidated financial statements

reflect all adjustments, which include normal recurring adjustments, necessary for a fair presentation of the results for the interim

periods presented.

These unaudited condensed consolidated

financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s

annual financial statements for the year ended December 31, 2022, as filed in the 20-F on March 29, 2023.

The Company’s interim period results

do not necessarily indicate the results that may be expected for any other interim period or for the full fiscal year. The significant

accounting policies applied in the annual consolidated financial statements of the Company as of December 31, 2022, contained in the

Company’s Annual Report have been applied consistently in these unaudited condensed consolidated financial statements.

| | b. | Use of estimates in the preparation of financial statements |

The preparation of financial statements

in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities,

the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and

expenses during the reporting period. The Company’s management believes that the estimates, judgment and assumptions used are reasonable

based upon information available at the time they are made. Actual results may differ from those estimates.

COLLPLANT BIOTECHNOLOGIES LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(U.S. dollars in thousands, except share and per share amounts)

(Unaudited)

NOTE

2 - SIGNIFICANT ACCOUNTING POLICIES (continue):

| | c. | Principles of consolidation |

The consolidated financial statements

include the accounts of CollPlant Biotechnologies Ltd. and its wholly-owned subsidiary, CollPlant Ltd. Intercompany balances and transactions

have been eliminated upon consolidation.

The carrying amount of the cash and

cash equivalents, restricted deposits, trade receivable, trade payables, accrued expenses and other liabilities approximates their fair

value.

| e. | Income

(loss) per share |

Basic income (loss) per share is computed

on the basis of the net income (loss), for the period divided by the weighted average number of ordinary shares outstanding during the

period. Diluted income (loss) per share is based upon the weighted average number of ordinary shares and of ordinary shares equivalents

outstanding when dilutive. Ordinary share equivalents include outstanding share options and warrants, which are included under the treasury

stock method when dilutive.

| | |

Six months ended

June 30, | | |

Three months ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Numerator: | |

| | |

| | |

| | |

| |

| Net income (loss) | |

$ | 2,047 | | |

$ | (8,145 | ) | |

$ | 5,762 | | |

$ | (4,285 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Denominator: | |

| | | |

| | | |

| | | |

| | |

| Basic weighted-average ordinary shares outstanding | |

| 11,329,516 | | |

| 10,935,611 | | |

| 11,369,031 | | |

| 11,086,481 | |

| Effect of share-based compensation | |

| 409,368 | | |

| — | | |

| 408,108 | | |

| — | |

| Diluted weighted average ordinary shares outstanding | |

| 11,738,884 | | |

| 10,935,611 | | |

| 11,777,139 | | |

| 11,086,481 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic net income (loss) per share | |

$ | 0.18 | | |

$ | (0.74 | ) | |

$ | 0.51 | | |

$ | (0.39 | ) |

| Diluted net income (loss) per share | |

$ | 0.17 | | |

$ | (0.74 | ) | |

$ | 0.49 | | |

$ | (0.39 | ) |

1,201,811 options were excluded from

the calculation of diluted net income per share due to their anti-dilutive effect for the six and the three months ended June 30, 2023.

COLLPLANT BIOTECHNOLOGIES LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(U.S. dollars in thousands, except share and per share amounts)

(Unaudited)

NOTE

3 - INVENTORY:

| a. | Inventories at June 30, 2023 and December 31, 2022 consisted

of the following: |

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

(Audited) | |

| Work in progress | |

$ | 682 | | |

$ | 881 | |

| Finished goods’ | |

| 870 | | |

| 549 | |

| Total inventory | |

$ | 1,552 | | |

$ | 1,430 | |

| b. | During the six and three months period ended June 30, 2023,

the Company recorded approximately $261 and $215 for write-down of inventory under cost of revenues, respectively. |

During the six and three months period

ended June 30, 2022, the Company recorded approximately $23 and $6 for write-down of inventory under cost of revenues, respectively.

NOTE

4 - SHARE CAPITAL:

| a. | Changes in share capital |

| | ● | In 2022, three U.S investors exercised 425,000 warrants into 425,000 ordinary shares in return for $1,700. |

| | ● | On February 23, 2023, Ami Sagi exercised 186,000 warrants into 186,000 ordinary shares in return for $744. |

| b. | Share- based compensation |

Under the Company’s Share Ownership and Option Plan (2010), or

the 2010 Plan, employees, directors and consultants of the Company may be granted options, each exercisable into one ordinary share of

the Company of NIS 1.50 par value.

COLLPLANT BIOTECHNOLOGIES LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(U.S. dollars in thousands, except share and per share amounts)

(Unaudited)

NOTE

4 - SHARE CAPITAL (continue):

Options granted

under the 2010 Plan:

In the six months ended June 30, 2023

and 2022, the Company granted options as follows:

| | |

Six months ended June 30, 2023 |

| | |

Number of options granted | | |

Exercise

price

range | | |

Vesting

period | |

Expiration |

| Employees | |

| 104,500 | | |

$ | 7.5 | | |

4 years | |

10 years |

| | |

Six months ended June 30, 2022 |

| | |

Number of options granted | | |

Exercise

price

range | | |

Vesting

period

range | |

Expiration |

| Employees | |

| 398,000 | | |

$ | 9.22 | | |

4 years | |

10 years |

| Directors | |

| 217,000 | | |

$ | 9.22 | | |

4 years | |

10 years |

The fair value of options granted during

the six months ended June 30, 2023, and 2022 was $505 and $3,511, respectively.

The fair value of options granted on

the date of grant was computed using the Black-Scholes model. The underlying data used for computing the fair value of the options are

as follows:

| | |

Six months ended

June 30 | |

| | |

2023 | | |

2022 | |

| Value of ordinary share | |

$ | 7.5 | | |

$ | 9.07-9.22 | |

| Dividend yield | |

| 0 | % | |

| 0 | % |

| Expected volatility | |

| 74.1 | % | |

| 67.28%-67.95 | % |

| Risk-free interest rate | |

| 0.36 | % | |

| 1.72%-3.03 | % |

| Expected term | |

| 6.11 years | | |

| 6.11 years | |

COLLPLANT BIOTECHNOLOGIES LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(U.S. dollars in thousands, except share and per share amounts)

(Unaudited)

NOTE

4 - SHARE CAPITAL (continue):

| | The following table summarizes the number of options granted to employees and directors under the 2010 Plan for the six months period ended June 30, 2023: |

| | |

Number of

options | | |

Weighted

average

exercise

price | |

| Options outstanding at the beginning of the period | |

| 1,868,749 | | |

$ | 7.85 | |

| Granted | |

| 104,500 | | |

| 7.5 | |

| Exercised | |

| (29,163 | ) | |

| 4.43 | |

| Forfeited or expired | |

| (95,559 | ) | |

| 9.43 | |

| Options outstanding at the end of the period | |

| 1,848,527 | | |

$ | 7.8 | |

| Options exercisable at the end of the period | |

| 1,105,189 | | |

$ | 7.35 | |

The following table summarizes the

number of options granted to consultants under the Option Plan for the six months period ended June 30, 2023:

| | |

Number of

options | | |

Weighted

average

exercise

price | |

| Options outstanding at the beginning of the period | |

| 15,416 | | |

$ | 16.04 | |

| Granted | |

| - | | |

| - | |

| Exercised | |

| (3,750 | ) | |

| 5.07 | |

| Forfeited or expired | |

| - | | |

| - | |

| Options outstanding at the end of the period | |

| 11,666 | | |

$ | 16.45 | |

| Options exercisable at the end of the period | |

| 6,329 | | |

$ | 9.81 | |

| 3) | The following table illustrates the effect of share-based

compensation on the statements of operations: |

| | |

Six months ended

June 30 | | |

Three months ended

June 30 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Cost of revenue | |

$ | 19 | | |

$ | 2 | | |

$ | 11 | | |

$ | 2 | |

| Research and development | |

| 307 | | |

| 374 | | |

| 121 | | |

| 173 | |

| General, administrative and marketing | |

| 526 | | |

| 647 | | |

| 206 | | |

| 400 | |

| | |

$ | 852 | | |

$ | 1,023 | | |

$ | 338 | | |

$ | 575 | |

COLLPLANT BIOTECHNOLOGIES LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(U.S. dollars in thousands, except share and per share amounts)

(Unaudited)

NOTE 5 - Development,

Exclusivity and Option Products Agreement

On February 5, 2021, CollPlant entered

into a Development, Exclusivity and Option Products Agreement (the “Development Agreement”) with AbbVie, pursuant to which

CollPlant and AbbVie will collaborate in the development and commercialization of dermal and soft tissue filler products for the medical

aesthetics market, using CollPlant rhCollagen technology and AbbVie’s technology.

Pursuant to the Development Agreement,

CollPlant agreed to undertake projects for the development of an aseptic process for sterile rhCollagen that meets or exceeds certain

specifications as set forth in the Development Agreement. CollPlant has successfully completed the development of the aseptic process

and is producing and supplying sterile rhCollagen.

Pursuant to the Development Agreement,

CollPlant granted to AbbVie and certain of its affiliates, worldwide exclusive rights to use its rhCollagen in combination with AbbVie

proprietary technologies, for the production and commercialization of dermal and soft tissue filler products, or the Exclusive Products.

The Development Agreement provides that

with respect to the Exclusive Products CollPlant shall be entitled to receive up to $50,000 comprised of an upfront cash payment of $14,000,

which was received in February 2021, and up to $36,000 in proceeds upon the achievement of certain development, clinical trial, regulatory

and commercial sale milestones. In addition, CollPlant shall be entitled to a fixed-fee royalty payment (subject to certain adjustments)

for each product commercially sold during the applicable royalty term as well as a fee for the supply of rhCollagen to AbbVie.

In June 2023, the Company announced the achievement of a milestone

with respect to the clinical phase dermal filler product. According to the Development Agreement, the milestone achievement triggered

a $10,000 payment from AbbVie to CollPlant, which was received in July 2023.

COLLPLANT BIOTECHNOLOGIES LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(U.S. dollars in thousands, except share and per share amounts)

(Unaudited)

NOTE 6 - SUPPLEMENTARY FINANCIAL STATEMENT

INFORMATION

| a. | Disaggregated

revenues: |

| | |

Six months ended

June 30, | | |

Three months ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues from milestones (See note 5) | |

$ | 10,000 | | |

$ | - | | |

$ | 10,000 | | |

$ | - | |

| Revenues from the sales of goods | |

| 617 | | |

| 132 | | |

| 184 | | |

| 66 | |

| Total revenues | |

$ | 10,617 | | |

$ | 132 | | |

$ | 10,184 | | |

$ | 66 | |

| b. | Revenues

by geographic area were as follows: |

| | |

Six months ended

June 30, | | |

Three months ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| United states and Canada | |

$ | 10,592 | | |

$ | 74 | | |

$ | 10,161 | | |

$ | 41 | |

| | |

| | | |

| | | |

| | | |

| | |

| Europe and others | |

| 25 | | |

| 58 | | |

$ | 23 | | |

| 25 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total revenues | |

$ | 10,617 | | |

$ | 132 | | |

$ | 10,184 | | |

$ | 66 | |

| |

c. | Revenue recognized in the reporting period that was included

in the deferred revenues balance at the beginning of the period is $32 for the six months period ended June 30, 2022. |

COLLPLANT BIOTECHNOLOGIES LTD.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

(U.S. dollars in thousands, except share and per share amounts)

(Unaudited)

NOTE 6 - SUPPLEMENTARY FINANCIAL

STATEMENT INFORMATION (continue):

Set forth below is a breakdown of the

Company’s revenue by major customers (major customer –revenues from these customers constitute at least 10% of total revenues

in a certain period):

| | |

Six

months ended

June 30, | | |

Three

months ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Customer

A | |

$ | 10,527 | | |

$ | * | ) | |

$ | 10,151 | | |

$ | 9 | |

| | |

| | | |

| | | |

| | | |

| | |

| Customer

B | |

$ | * | ) | |

$ | 64 | | |

$ | * | ) | |

$ | 32 | |

| | |

| | | |

| | | |

| | | |

| | |

| Customer

C | |

$ | * | ) | |

$ | 37 | | |

$ | * | ) | |

$ | * | ) |

NOTE 7 - SUBSEQUENT EVENTS

| | a. | On August 23, 2023, the board of directors approved the grant of an aggregate of 33,500 options exercisable into 33,500 ordinary shares to the Company’s employees, at an exercise price of $6.5 per share. The options will vest over four years with one quarter vesting one year after the grant date and the remaining balance will vest in equal parts at the end of each subsequent quarter. |

| | b. | On August 23, 2023, the board of directors approved repricing of outstanding

options to purchase an aggregate of 999,648 ordinary shares held by the Company’s employees and directors to an exercise price of

$6.39 per share, subject to obtaining regulatory approvals, and with regard to options granted to members of the board (including the

Company’s Chief Executive Officer), subject to shareholders’ approval. |

false

--12-31

Q2

2023-06-30

0001631487

0001631487

2023-01-01

2023-06-30

0001631487

2023-06-30

0001631487

2022-12-31

0001631487

2022-01-01

2022-06-30

0001631487

2023-04-01

2023-06-30

0001631487

2022-04-01

2022-06-30

0001631487

us-gaap:CommonStockMember

2021-12-31

0001631487

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001631487

clgn:CurrencyTranslationDifferencesMember

2021-12-31

0001631487

us-gaap:RetainedEarningsMember

2021-12-31

0001631487

2021-12-31

0001631487

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001631487

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-06-30

0001631487

clgn:CurrencyTranslationDifferencesMember

2022-01-01

2022-06-30

0001631487

us-gaap:RetainedEarningsMember

2022-01-01

2022-06-30

0001631487

us-gaap:CommonStockMember

2022-06-30

0001631487

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001631487

clgn:CurrencyTranslationDifferencesMember

2022-06-30

0001631487

us-gaap:RetainedEarningsMember

2022-06-30

0001631487

2022-06-30

0001631487

us-gaap:CommonStockMember

2022-12-31

0001631487

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001631487

clgn:CurrencyTranslationDifferencesMember

2022-12-31

0001631487

us-gaap:RetainedEarningsMember

2022-12-31

0001631487

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001631487

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001631487

clgn:CurrencyTranslationDifferencesMember

2023-01-01

2023-06-30

0001631487

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001631487

us-gaap:CommonStockMember

2023-06-30

0001631487

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001631487

clgn:CurrencyTranslationDifferencesMember

2023-06-30

0001631487

us-gaap:RetainedEarningsMember

2023-06-30

0001631487

us-gaap:CommonStockMember

2022-03-31

0001631487

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001631487