Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 05 2025 - 3:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE

ACT OF 1934

For the month of February

2025

Commission File Number: 001-40543

Pop Culture Group Co.,

Ltd

Room 1207-08, No. 2488

Huandao East Road

Huli District, Xiamen

City, Fujian Province

The People’s Republic of China

(Address of principal

executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

Entry into Acquisition Agreement in Respect

of Xiamen Hand in Hand Network Technology Co., Ltd

On January 1, 2025, Pop Culture

Group Co., Ltd, a Cayman Islands company (the “Company”), entered into that certain Agreement for the Acquisition of Equity

through the Issuance of Shares (the “Acquisition Agreement”) with Ling Yang, a current shareholder of Xiamen Hand in Hand

Network Technology Co., Ltd, a limited liability company incorporated in China (the “Target Company”), with respect to the

Target Company.

Pursuant to the Acquisition

Agreement, Guangzhou Shuzhi Culture Communication Co., Ltd., a private company incorporated under the laws of the People’s Republic

of China, wholly owned by the Company’s variable interest entity (“Guangzhou Shuzhi”), agreed to acquire 99% of the

equity interests in the Target Company (the “Target Equity”) from Ling Yang, with the remaining 1% of the equity interests

retained by one current shareholder of the Target Company. In consideration of the sale of the Target Equity, the Company agreed to issue

to Ling Yang 2,000,000 Class A ordinary shares, par value US$0.01 per share, of the Company with an aggregate value of $2,000,000. As

of the date hereof, these shares have not yet been issued. Ling Yang agreed to transfer the Target Equity to Guangzhou Shuzhi within 10

business days after the board of directors of the Company approves the Acquisition Agreement and the transactions contemplated thereby.

The Acquisition Agreement contains other customary obligations and rights of the parties.

The foregoing description

of the Acquisition Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Acquisition

Agreement, which is filed as Exhibit 10.1 to this Form 6-K.

The Acquisition Agreement

and the transactions contemplated thereby were approved and authorized by the board of directors of the Company on January 22, 2025.

This Form 6-K is hereby incorporated

by reference into the registration statement on Form F-3 of the Company (File Number 333-266130), as amended, and the registration statement

on Form F-3 of the Company (File Number 333-283606) and into the base prospectus and the prospectus supplement outstanding under the

foregoing registration statements, to the extent not superseded by documents or reports subsequently filed or furnished by the Company

under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Exhibit Index

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Pop Culture Group Co., Ltd |

| |

|

| Date: February 5, 2025 |

By: |

/s/ Zhuoqin Huang |

| |

Name: |

Zhuoqin Huang |

| |

Title: |

Chief Executive Officer |

2

Exhibit 10.1

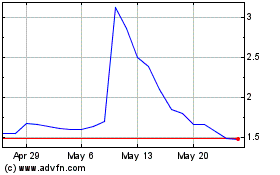

Pop Culture (NASDAQ:CPOP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Pop Culture (NASDAQ:CPOP)

Historical Stock Chart

From Feb 2024 to Feb 2025