Fifth & Pacific to Sell Lucky Brand - Analyst Blog

December 11 2013 - 2:00PM

Zacks

Fifth & Pacific Companies Inc. (FNP), as a

part of its previously conducted brand evaluation, has agreed to

sell its second non-core brand, Lucky Brand Jeans. The brand sale

follows the company’s announcement to dispose its Juicy Couture

brand in early October. These divestitures will make Fifth &

Pacific a single-brand company focused on getting the best out of

its core Kate Spade brand.

Under the sale agreement, Fifth & Pacific has decided to sell

its Lucky Brand Jeans to a partner of Leonard Green & Partners

L.P. The company will receive $225 million from the sale,

comprising $140 million in cash and the remaining $85 million as a

three-year seller note.

Additionally, the deal allows Lucky Brand to assume a proportionate

share of Fifth & Pacific’s sourcing contract with Li & Fung

along with other obligations. Moreover, to enable smooth transition

of the sold brand, Fifth & Pacific has agreed to sign a

Transition Services Agreement (TSA) for a nearly 24-month span.

The sale, conditioned upon the completion of certain general

conditions, is expected to close in the first quarter of 2014.

In October, Fifth & Pacific had agreed to divest its Juicy

Couture brand to privately held Authentic Brands Group LLC for

about $195 million in cash. Together, the sale of these two brands

is expected to generate $370–$380 million liquidity for the

company, including the face value of the seller note issued for

Lucky Brand.

The process for the sale of the two brands began last year, when

the company initiated a study to estimate its capital and resource

needs, as well as risks and opportunities related to the operation

of its three brands – Kate Spade, Lucky Brand and Juicy Couture,

while also focusing on maximizing shareholder value.

Following the sale of the two non-core brands, the company will

focus wholly on expanding its Kate Spade brand. Today, Kate Spade

offers rapid growth prospects, given its worldwide demand, strong

margins and better merchandise assortments, compared to its peers.

The company expects to provide guidance for fiscal 2014 in early

January, revealing a clearer picture about its future plans.

Fifth & Pacific currently has a Zacks Rank #3 (Hold).

Better-ranked stocks among apparel retailers include Citi

Trends Inc. (CTRN), Fossil Group Inc.

(FOSL) and Michael Kors Holdings Limited (KORS).

All these stocks carry a Zacks Rank #2 (Buy).

CITI TRENDS INC (CTRN): Free Stock Analysis Report

FIFTH PACIFIC (FNP): Free Stock Analysis Report

FOSSIL GRP INC (FOSL): Free Stock Analysis Report

MICHAEL KORS (KORS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

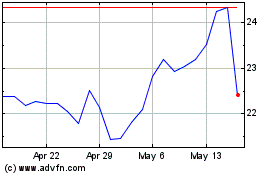

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jun 2024 to Jul 2024

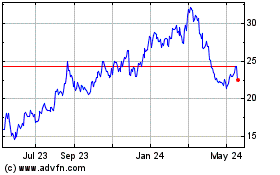

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Jul 2023 to Jul 2024