DIH Holding US, Inc. ("DIH")(NASDAQ:DHAI), a global provider of

advanced robotic devices used in physical rehabilitation, which

incorporates visual stimulation in an interactive manner to enable

clinical research and intensive functional rehabilitation and

training in patients with walking impairments, reduced balance

and/or impaired arm and hand functions, today announced financial

results for the third fiscal quarter ended December 31, 2024.

Recent Highlights

- Revenue of $15.1 million for the

quarter ended December 31, 2024, representing a decline of 21% over

the prior year period

- Device revenue of $11.7 million and

service revenue of $3.1 million for the quarter ended December 31,

2024, representing a decline of 26% and growth of 4%, respectively,

over the prior year period

- Revenue decline in Europe, Middle

East and Africa (EMEA) and the Americas of 29% and 7%,

respectively, over the prior year period

- Announced collaborations with Nobis

Rehabilitation Partners and Zahrawi Group, expanding our

distribution network and device integration pipeline

- Closed on a public offering

yielding gross proceeds of approximately $4.6 million before

deducting placement agent's fees other offering expenses

- Reiterated revenue guidance for the

fiscal year 2025 to range between $60 and $67 million

“Our third quarter results were in line with our

expectations despite facing challenges with import restrictions

related to the ongoing conflict between Russia and Ukraine and

lower overall European sales volumes. We continue to position the

company for future success through upgrades to our commercial

organizations while also remaining focused on reaching our year-end

revenue targets,” said Jason Chen, Chairman and CEO of DIH.

"Interest in our products remains high, as evidenced by multiple

recently formed partnerships, and the recent stock offering will

enable us to continue working towards fulfilling this order demand.

We remain confident for a strong finish through the remainder of

fiscal year 2025 and are reiterating our full year revenue guidance

range of $60 to $67 million."

Financial Results for the Third Fiscal

Quarter Ended December 31, 2024

Revenue for the three months ended December 31,

2024 decreased by $3.9 million, or 20.6%, to $15.1 million from

$19.0 million for the three months ended December 31, 2023. The

overall decrease was primarily due to a decrease in devices sold of

$4.0 million, or 25.6% year over year. The decrease in devices

revenue was primarily driven by lower sales volume in EMEA. In

EMEA, we sell our equipment through a distributor network across

Europe. One of our largest sales partners, which primarily operates

in Eastern Europe, has been impacted by wartime import restrictions

resulting from the ongoing conflict between Russia and Ukraine. The

decrease was offset by a $0.1 million increase in service revenue

for the three months ended December 31, 2024 compared to the three

months ended December 31, 2023. Other revenue was consistent in the

three months ended December 31, 2024 compared to that in the three

months ended December 31, 2023. Total revenue in the EMEA and in

the Americas decreased by $3.6 million and $0.3 million,

respectively, to $8.7 million and $3.5 million for the three months

ended December 31, 2024 compared to $12.3 million and $3.8 million

for the three months ended December 31, 2023.

The impact due to foreign currency translation

gain was $0.2 million for the three months ended December 31,

2024.

Gross profit for the third fiscal quarter ended

December 31, 2024, was $7.2 million, a decrease of 30.4% compared

to the prior year period. The decrease was driven by a decrease in

sales of $3.9 million, primarily in the EMEA region. Cost of sales

for the three months ended December 31, 2024 decreased by $0.8

million, or 8.7%, to $7.9 million from $8.6 million for the three

months ended December 31, 2023.

Selling, general and administrative expense for

the three months ended December 31, 2024 increased by $2.8 million,

or 50.6%, to $8.2 million from $5.4 million for the three months

ended December 31, 2023. The increase was driven by a $1.1 million

increase in employee compensation due to increase in headcount and

stock compensation and $1.0 million increase in other overhead

costs to support future sales growth. The increase is also

attributable to $0.5 million increase in professional service costs

in connection with the Company becoming a publicly listed company

during the year.

Research and development costs for the three

months ended December 31, 2024 increased by $0.1 million, or 7.7%,

to $1.8 million from $1.7 million for the three months ended

December 31, 2023. The increase was primarily attributable to a

$0.2 million increase in the amortization expense related to

capitalized software that was ready for its intended use in July

2024. The increase was offset by a $0.1 million decrease in

external consulting fees.

Cash and cash equivalents on December 31, 2024

totaled $1.1 million.

Fiscal Year 2025 Outlook

The Company has reiterated its revenue guidance

for fiscal year 2025 to range between $60 million and $67

million.

Subsequent Events

On February 3, 2025, the Company closed an

offering of 5,937,100 Units (“Units”), each consisting of one share

of common stock, par value $0.0001 per share, and one Class A

warrant to purchase one share of common stock at a public offering

price of $0.7832 per Unit, for gross proceeds of $4.6 million. The

Units have no stand-alone rights and will not be certified or

issued as stand-alone securities. The common stock and Class A

warrants are immediately separable and were issued separately in

this offering. Each Class A warrant was immediately exercisable for

one share of common stock at an exercise price of $0.7832 per share

(100% of the public offering price per Unit) and will expire on the

fifth anniversary of the original issuance date. The offering

resulted in a net proceeds of approximately $3.9 million, after

deducting placement agent fees sand estimated offering expenses

payable by the Company.

Subsequent to the close of the stock offering,

the conversion price of the Debentures and the exercise price of

the warrants issued in connection with the convertible note changed

to $0.7832 pursuant to the Purchase Agreement. The number of Common

Stock issuable increased to 2,106,742 shares from 330,000

shares.

About DIH Holding US, Inc.

DIH stands for the vision to “Deliver

Inspiration & Health” to improve the daily lives of millions of

people with disabilities and functional impairments through

providing devices and solutions enabling intensive rehabilitation.

DIH is a global provider of advanced robotic devices used in

physical rehabilitation, which incorporate visual stimulation in an

interactive manner to enable clinical research and intensive

functional rehabilitation and training in patients with walking

impairments, reduced balance and/or impaired arm and hand

functions. Built through the mergers of global-leading niche

technology providers, DIH is a transformative rehabilitation

solutions provider and consolidator of a largely fragmented and

manual-labor-driven industry.

Caution Regarding Forward-Looking

Statement

This press release contains certain statements

which are not historical facts, which are forward-looking

statements within the meaning of the federal securities laws, for

the purposes of the safe harbor provisions under The Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include certain statements made with respect to the

business combination, the services offered by DIH and the markets

in which it operates, and DIH’s projected future results. These

forward-looking statements generally are identified by the words

“believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,”

and similar expressions. Forward-looking statements are predictions

provided for illustrative purposes only, and projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties that could cause the actual results to differ

materially from the expected results. These risks and uncertainties

include, but are not limited to: general economic, political and

business conditions; the ability of DIH to achieve its projected

revenue, the failure of DIH realize the anticipated benefits of the

recently-completed business combination and access to sources of

additional debt or equity capital if needed. While DIH may elect to

update these forward-looking statements at some point in the

future, DIH specifically disclaims any obligation to do so.

Investor Contact Greg Chodaczek

Investor.relations@dih.com

| DIH HOLDING

US, INC.CONSOLIDATED BALANCE SHEETS(in thousands, except share and

per share data, unaudited) |

|

|

|

As of December 31, 2024 |

|

|

As of March 31, 2024 |

|

|

Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,120 |

|

|

$ |

3,225 |

|

|

Accounts receivable, net of allowances of $240 and $667,

respectively |

|

|

3,834 |

|

|

|

5,197 |

|

|

Inventories, net |

|

|

7,962 |

|

|

|

7,830 |

|

|

Due from related party |

|

|

6,333 |

|

|

|

5,688 |

|

|

Other current assets |

|

|

4,909 |

|

|

|

5,116 |

|

|

Total current assets |

|

|

24,158 |

|

|

|

27,056 |

|

| Property,

and equipment, net |

|

|

714 |

|

|

|

530 |

|

| Capitalized

software, net |

|

|

1,768 |

|

|

|

2,131 |

|

| Other

intangible assets, net |

|

|

380 |

|

|

|

380 |

|

| Operating

lease, right-of-use assets, net |

|

|

3,735 |

|

|

|

4,466 |

|

| Other tax

assets |

|

|

152 |

|

|

|

267 |

|

| Other

assets |

|

|

907 |

|

|

|

905 |

|

| Total

assets |

|

$ |

31,814 |

|

|

$ |

35,735 |

|

|

Liabilities and Deficit |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

3,945 |

|

|

$ |

4,305 |

|

|

Due to related party |

|

|

10,213 |

|

|

|

10,192 |

|

|

Advance payments from customers |

|

|

9,476 |

|

|

|

10,562 |

|

|

Current portion of deferred revenue |

|

|

6,644 |

|

|

|

5,211 |

|

|

Employee compensation |

|

|

3,937 |

|

|

|

2,664 |

|

|

Current maturities of convertible debt, at fair value |

|

|

1,918 |

|

|

|

— |

|

|

Current portion of long-term operating lease |

|

|

1,331 |

|

|

|

1,572 |

|

|

Manufacturing warranty obligation |

|

|

582 |

|

|

|

513 |

|

|

Accrued expenses and other current liabilities ($1,111 measured at

fair value) |

|

|

9,278 |

|

|

|

9,935 |

|

| Total

current liabilities |

|

|

47,324 |

|

|

|

44,954 |

|

|

Notes payable - related party |

|

|

8,648 |

|

|

|

11,457 |

|

|

Non-current deferred revenues |

|

|

4,986 |

|

|

|

4,670 |

|

|

Long-term operating lease |

|

|

2,443 |

|

|

|

2,917 |

|

|

Convertible debt, net of current maturities, at fair value |

|

|

693 |

|

|

|

— |

|

|

Deferred tax liabilities |

|

|

221 |

|

|

|

112 |

|

|

Other non-current liabilities |

|

|

5,381 |

|

|

|

4,171 |

|

| Total

liabilities |

|

|

69,696 |

|

|

|

68,281 |

|

| Commitments

and contingencies |

|

|

|

|

|

|

|

Deficit: |

|

|

|

|

|

|

|

Preferred stock, $0.00001 par value; 10,000,000 shares authorized;

no shares issued and outstanding at December 31, 2024 and March 31,

2024 |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.0001 par value; 100,000,000 shares authorized;

34,861,837 shares issued and outstanding at December 31, 2024;

34,544,935 shares issued and outstanding at March 31, 2024 |

|

|

3 |

|

|

|

3 |

|

|

Additional paid-in-capital |

|

|

3,773 |

|

|

|

2,613 |

|

|

Accumulated deficit |

|

|

(39,484 |

) |

|

|

(35,212 |

) |

|

Accumulated other comprehensive income (loss) |

|

|

(2,174 |

) |

|

|

50 |

|

| Total

deficit |

|

|

(37,882 |

) |

|

|

(32,546 |

) |

| Total

liabilities and deficit |

|

$ |

31,814 |

|

|

$ |

35,735 |

|

| DIH HOLDING

US, INC.CONSOLIDATED STATEMENTS OF OPERATIONS(in thousands, except

per share data, unaudited) |

|

|

Three Months

EndedDecember 31, |

|

|

For the Nine Months Ended December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue |

|

$ |

15,094 |

|

|

$ |

19,011 |

|

|

$ |

50,216 |

|

|

$ |

45,116 |

|

| Cost of

sales |

|

|

7,858 |

|

|

|

8,611 |

|

|

|

23,968 |

|

|

|

23,911 |

|

| Gross

profit |

|

|

7,236 |

|

|

|

10,400 |

|

|

|

26,248 |

|

|

|

21,205 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general, and administrative expense |

|

|

8,196 |

|

|

|

5,443 |

|

|

|

22,564 |

|

|

|

17,652 |

|

|

Research and development |

|

|

1,786 |

|

|

|

1,659 |

|

|

|

5,341 |

|

|

|

4,681 |

|

| Total

operating expenses |

|

|

9,982 |

|

|

|

7,102 |

|

|

|

27,905 |

|

|

|

22,333 |

|

| Operating

income (loss) |

|

|

(2,746 |

) |

|

|

3,298 |

|

|

|

(1,657 |

) |

|

|

(1,128 |

) |

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(25 |

) |

|

|

(185 |

) |

|

|

(186 |

) |

|

|

(460 |

) |

|

Other income (expense), net |

|

|

(590 |

) |

|

|

237 |

|

|

|

(1,004 |

) |

|

|

(181 |

) |

| Total other

income (expense) |

|

|

(615 |

) |

|

|

52 |

|

|

|

(1,190 |

) |

|

|

(641 |

) |

| Income

(loss) before income taxes |

|

|

(3,361 |

) |

|

|

3,350 |

|

|

|

(2,847 |

) |

|

|

(1,769 |

) |

| Income tax

expense |

|

|

367 |

|

|

|

381 |

|

|

|

1,425 |

|

|

|

659 |

|

| Net Income

(loss) |

|

$ |

(3,728 |

) |

|

$ |

2,969 |

|

|

$ |

(4,272 |

) |

|

$ |

(2,428 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) per share, basic and diluted |

|

$ |

(0.11 |

) |

|

$ |

0.12 |

|

|

$ |

(0.12 |

) |

|

$ |

(0.10 |

) |

| Weighted

average common shares outstanding, basic and diluted |

|

|

34,645 |

|

|

|

25,000 |

|

|

|

34,578 |

|

|

|

25,000 |

|

| DIH HOLDING

US, INC.CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS(in thousands,

unaudited) |

| |

|

Three Months Ended December 31, |

|

|

For the Nine Months Ended December 31, |

|

| |

|

2025 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Net Income (loss) |

|

$ |

(3,728 |

) |

|

$ |

2,969 |

|

|

$ |

(4,272 |

) |

|

$ |

(2,428 |

) |

| Other

comprehensive (loss) income, net of tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments, net of tax of $0 |

|

|

(145 |

) |

|

|

636 |

|

|

|

(1,079 |

) |

|

|

876 |

|

|

Pension liability adjustments, net of tax of $0 |

|

|

(64 |

) |

|

|

(704 |

) |

|

|

(1,145 |

) |

|

|

(1,064 |

) |

|

Other comprehensive loss |

|

|

(209 |

) |

|

|

(68 |

) |

|

|

(2,224 |

) |

|

|

(188 |

) |

|

Comprehensive income (loss) |

|

$ |

(3,937 |

) |

|

$ |

2,901 |

|

|

$ |

(6,496 |

) |

|

$ |

(2,616 |

) |

| DIH HOLDING

US, INC. AND SUBSIDIARIESCONDENSED COMBINED STATEMENTS OF CHANGES

IN EQUITY (DEFICIT)(in thousands, unaudited) |

| |

For the Three Months Ended December 31, |

|

| |

Common Stock |

|

|

|

|

|

|

|

|

|

| |

Shares |

|

Amount |

|

Additional Paid-In Capital |

|

Accumulated Deficit |

|

Accumulated Other Comprehensive Income (Loss) |

|

Total Equity (Deficit) |

|

|

Balance, September 30, 2024 |

|

34,544,935 |

|

$ |

3 |

|

$ |

3,323 |

|

$ |

(35,756 |

) |

$ |

(1,965 |

) |

$ |

(34,395 |

) |

| Net

loss |

|

— |

|

|

— |

|

|

— |

|

|

(3,728 |

) |

|

— |

|

|

(3,728 |

) |

| Other

comprehensive loss, net of tax |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(209 |

) |

|

(209 |

) |

| Net

transactions with parent |

|

316,902 |

|

|

— |

|

|

450 |

|

|

— |

|

|

— |

|

|

450 |

|

|

Balance, December 31, 2024 |

|

34,861,837 |

|

$ |

3 |

|

$ |

3,773 |

|

$ |

(39,484 |

) |

$ |

(2,174 |

) |

$ |

(37,882 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares(1) |

|

Amount |

|

Additional Paid-In Capital |

|

Accumulated Deficit |

|

Accumulated Other Comprehensive Income (Loss) |

|

Total Equity (Deficit) |

|

|

Balance, September 30, 2023 |

|

25,000,000 |

|

$ |

2 |

|

$ |

(1,898 |

) |

$ |

(32,166 |

) |

$ |

(409 |

) |

$ |

(34,471 |

) |

| Net

loss |

|

— |

|

|

— |

|

|

— |

|

|

2,969 |

|

|

— |

|

|

2,969 |

|

| Other

comprehensive loss, net of tax |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(68 |

) |

|

(68 |

) |

|

Balance, December 31, 2023 |

|

25,000,000 |

|

$ |

2 |

|

$ |

(1,898 |

) |

$ |

(29,197 |

) |

$ |

(477 |

) |

$ |

(31,570 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

For the Nine Months Ended December 31, |

|

| |

Common Stock |

|

|

|

|

|

|

|

|

|

| |

Shares |

|

Amount |

|

Additional Paid-In Capital |

|

Accumulated Deficit |

|

Accumulated Other Comprehensive Income (Loss) |

|

Total Equity (Deficit) |

|

|

Balance, March 31, 2024 |

|

34,544,935 |

|

$ |

3 |

|

$ |

2,613 |

|

$ |

(35,212 |

) |

$ |

50 |

|

$ |

(32,546 |

) |

| Net

loss |

|

— |

|

|

— |

|

|

— |

|

|

(4,272 |

) |

|

— |

|

|

(4,272 |

) |

| Out of

period adjustment related to reverse recapitalization (Note 2) |

|

— |

|

|

— |

|

|

710 |

|

|

— |

|

|

— |

|

|

710 |

|

| Other

comprehensive loss, net of tax |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(2,224 |

) |

|

(2,224 |

) |

| Stock

Compensation |

|

316,902 |

|

|

— |

|

|

450 |

|

|

— |

|

|

— |

|

|

450 |

|

|

Balance, December 31, 2024 |

|

34,861,837 |

|

$ |

3 |

|

$ |

3,773 |

|

$ |

(39,484 |

) |

$ |

(2,174 |

) |

$ |

(37,882 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares(1) |

|

Amount |

|

Additional Paid-In Capital |

|

Accumulated Deficit |

|

Accumulated Other Comprehensive Income (Loss) |

|

Total Equity (Deficit) |

|

|

Balance, March 31, 2023 |

|

25,000,000 |

|

$ |

2 |

|

$ |

(1,898 |

) |

$ |

(26,769 |

) |

$ |

(289 |

) |

$ |

(28,954 |

) |

| Net

loss |

|

— |

|

|

— |

|

|

— |

|

|

(2,428 |

) |

|

— |

|

|

(2,428 |

) |

| Other

comprehensive loss, net of tax |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(188 |

) |

|

(188 |

) |

|

Balance, December 31, 2023 |

|

25,000,000 |

|

$ |

2 |

|

$ |

(1,898 |

) |

$ |

(29,197 |

) |

$ |

(477 |

) |

$ |

(31,570 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

(1) All outstanding share and per-share amounts

have been restated to reflect the reverse recapitalization as

established in the Business Combination Agreement as described in

Note 1 to the condensed consolidated financial statements.

| DIH HOLDING

US, INC.CONSOLIDATED STATEMENTS OF CASH FLOWS(in thousands,

unaudited) |

|

|

|

For the Nine Months Ended December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

| Cash

flows from operating activities: |

|

|

|

|

|

|

|

Net loss |

|

$ |

(4,272 |

) |

|

$ |

(2,428 |

) |

| Adjustments

to reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

611 |

|

|

|

230 |

|

|

Provision for credit losses |

|

|

(427 |

) |

|

|

(815 |

) |

|

Allowance for inventory obsolescence |

|

|

(67 |

) |

|

|

705 |

|

|

Stock compensation |

|

|

450 |

|

|

|

— |

|

|

Pension contributions |

|

|

(475 |

) |

|

|

(456 |

) |

|

Pension expense |

|

|

238 |

|

|

|

201 |

|

|

Change in fair value of convertible debt and warrant liability |

|

|

1,193 |

|

|

|

— |

|

|

Foreign exchange (gain) loss |

|

|

(241 |

) |

|

|

181 |

|

|

Noncash lease expense |

|

|

1,263 |

|

|

|

1,165 |

|

|

Noncash interest expense |

|

|

— |

|

|

|

19 |

|

|

Deferred and other noncash income tax (income) expense |

|

|

257 |

|

|

|

(237 |

) |

| Changes in

operating assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

|

1,762 |

|

|

|

1,298 |

|

|

Inventories |

|

|

(106 |

) |

|

|

(2,186 |

) |

|

Due from related parties |

|

|

(1,079 |

) |

|

|

(294 |

) |

|

Due to related parties |

|

|

100 |

|

|

|

1,910 |

|

|

Other assets |

|

|

114 |

|

|

|

(2,540 |

) |

|

Operating lease liabilities |

|

|

(1,275 |

) |

|

|

(1,352 |

) |

|

Accounts payable |

|

|

(336 |

) |

|

|

1,484 |

|

|

Employee compensation |

|

|

1,276 |

|

|

|

(603 |

) |

|

Other liabilities |

|

|

157 |

|

|

|

205 |

|

|

Deferred revenue |

|

|

1,819 |

|

|

|

807 |

|

|

Manufacturing warranty obligation |

|

|

75 |

|

|

|

189 |

|

|

Advance payments from customers |

|

|

(1,036 |

) |

|

|

4,992 |

|

|

Accrued expense and other current liabilities |

|

|

(849 |

) |

|

|

702 |

|

| Net cash

provided by (used in) operating activities |

|

|

(848 |

) |

|

|

3,177 |

|

| Cash

flows from investing activities: |

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(444 |

) |

|

|

(135 |

) |

| Net cash

used in investing activities |

|

|

(444 |

) |

|

|

(135 |

) |

| Cash

flows from financing activities: |

|

|

|

|

|

|

|

Proceeds from issuance of convertible debt, net of issuance

costs |

|

|

2,809 |

|

|

|

— |

|

|

Payment on convertible debt |

|

|

(471 |

) |

|

|

— |

|

|

Payments on related party notes payable |

|

|

(3,156 |

) |

|

|

(4,543 |

) |

| Net cash

used in financing activities |

|

|

(818 |

) |

|

|

(4,543 |

) |

| Effect of

currency translation on cash and cash equivalents |

|

|

5 |

|

|

|

5 |

|

| Net decrease

in cash, and cash equivalents, and restricted cash |

|

|

(2,105 |

) |

|

|

(1,496 |

) |

| Cash, cash

equivalents and restricted cash - beginning of period |

|

|

3,225 |

|

|

|

3,175 |

|

| Cash, cash

equivalents and restricted cash- end of period |

|

$ |

1,120 |

|

|

$ |

1,679 |

|

| |

|

|

|

|

|

|

|

Supplemental disclosure of cash flow

information: |

|

|

|

|

|

|

|

Interest paid |

|

$ |

218 |

|

|

$ |

442 |

|

|

Income tax paid |

|

$ |

15 |

|

|

$ |

— |

|

|

Supplemental disclosure of non-cash investing and financing

activity: |

|

|

|

|

|

|

|

Accounts payable settled upon reverse recapitalization |

|

$ |

710 |

|

|

$ |

— |

|

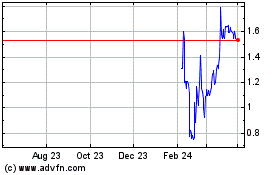

DIH Holdings US (NASDAQ:DHAI)

Historical Stock Chart

From Jan 2025 to Feb 2025

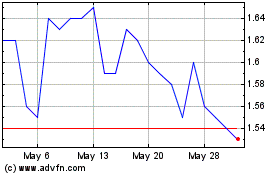

DIH Holdings US (NASDAQ:DHAI)

Historical Stock Chart

From Feb 2024 to Feb 2025