Filed

pursuant to General Instruction II.L of Form F-10

File

No. 333-271498

No

securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise.

This

prospectus supplement (the “Prospectus Supplement”), together with the accompanying short form base shelf prospectus

dated June 30, 2023 to which it relates, as amended or supplemented (the “Base Shelf Prospectus”), and each

document incorporated or deemed to be incorporated by reference in this Prospectus Supplement and in the Base Shelf Prospectus,

constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein

only by persons permitted to sell such securities. See “Plan of Distribution”.

Information

has been incorporated by reference in this Prospectus Supplement, and in the Base Shelf Prospectus to which it relates from documents

filed with securities commissions or similar authorities in Canada and with the United States Securities and Exchange Commission

(the “SEC”). Copies of the documents incorporated herein by reference may be obtained on request without

charge from the Corporate Secretary of Draganfly Inc. at 235, 103rd St. E, Saskatoon, SK, S7N 1Y8 (telephone 1-800-979-9794),

and are also available electronically at www.sedarplus.ca and www.sec.gov.

PROSPECTUS

SUPPLEMENT

TO THE SHORT FORM BASE SHELF PROSPECTUS DATED June 30, 2023

| New Issue |

November 18, 2024 |

DRAGANFLY

INC.

2,880,000

Common Shares

This

Prospectus Supplement, together with the accompanying Base Shelf Prospectus of Draganfly Inc. (“Draganfly”, the “Company”,

“we”, “us” or “our”), relates to: (i) 1,200,000 common shares of Draganfly

(the “Pre-Funded Warrant Shares”) issuable from time to time upon the exercise of 1,200,000 pre-funded common

share purchase warrants (the “Pre-Funded Warrants”); (ii) up to 1,600,000 common shares of Draganfly (the “Warrant

Shares”), issuable from time to time upon the exercise of 1,600,000 common share purchase warrants (the “Warrants”)

expected to be issued by the Company pursuant to the Unit Offering (defined below) and (iii) up to 80,000 common shares of Draganfly

(the “Placement Agent Shares”, and, together with the Pre-Funded Warrant Shares and the Warrant Shares, the “Shares”);

issuable from time to time upon the exercise of 80,000 common share purchase warrants (the “Placement Agent Warrants”),

and (iv) such indeterminate number of additional Pre-Funded Warrant Shares and Warrant Shares (together, the “Anti-Dilution

Shares”) that may be issuable by reason of the anti-dilution provisions contained in the each of the Pre-Funded Warrant Certificate

and the Warrant Certificate (as defined herein) (the “Offering”). See “Description of Securities Being Distributed”.

The

Company filed a prospectus supplement dated November 18, 2024 (the “Pricing Supplement”) to its Base Shelf Prospectus

with the securities commission or similar regulatory authority in each of the provinces of British Columbia, Saskatchewan and Ontario,

and in connection therewith a prospectus supplement dated November 18, 2024 to its registration statement on Form F-10 with the

SEC relating to the offering (the “Unit Offering”) by the Company to the public in the United States of 1,600,000

units (“Units”), with each Unit consisting of (i) one common share of the Company (a “Unit Share”)

and one Warrant at a price of $2.35 per Unit, or (ii) one Pre-Funded Warrant (for purchasers of Units that would otherwise result in

the purchaser’s beneficial ownership exceeding 4.99% of our outstanding common shares of the Company (a “Common Shares”)

immediately following the consummation of the Offering) and one Warrant at a price of $2.3499 per Unit. A holder of Pre-Funded Warrants

will not have the right to exercise any portion of its Pre-Funded Warrants if the holder, together with its affiliates, would beneficially

own in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the number of Common

Shares outstanding immediately after giving effect to such exercise. Each Pre-Funded Warrant will be exercisable for one Common

Share. The purchase price of each Unit including a Pre-Funded Warrant will be equal to the price per Unit including one Unit Share,

minus CA$0.00014 (the Canadian dollar equivalent of US$0.0001), and the remaining exercise price of each Pre-Funded Warrant will equal

CA$0.00014 (the Canadian dollar equivalent of US$0.0001) per Common Share. The Pre-Funded Warrants will be immediately exercisable (subject

to the beneficial ownership cap) and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full.

For each Unit including a Pre-Funded Warrant we sell (without regard to any limitation on exercise set forth therein), the

number of Units including a Unit Share we are offering will be decreased on a one-for-one basis. The Unit Shares and Pre-Funded

Warrants, if any, can each be purchased in this offering only with the accompanying Warrant as part of a Unit, but the components

of the Units will immediately separate upon issuance.

Each

whole Warrant will entitle the holder thereof to purchase one Warrant Share at an exercise price of CA$3.3086 (the Canadian dollar equivalent

of US$2.35), per Warrant Share (the “Warrant Exercise Price”) until 5:00 p.m. (Toronto time) on the date (the “Expiry

Date”) that is sixty (60) months from the closing of the Unit Offering.

Each

Pre-Funded Warrant will entitle the holder thereof to purchase one Pre-Funded Warrant Share at an exercise price of CA$0.00014 (the Canadian

dollar equivalent of US$0.0001) per Pre-Funded Warrant Share. The Pre-Funded Warrants will be immediately exercisable and may be exercised

at any time until all of the Pre- Funded Warrants are exercised in full.

Each

Placement Agent Warrant will entitle the holder thereof to purchase an Placement Agent Share at an exercise price of CA$4.1357 (the Canadian

dollar equivalent of US$2.9375) per Placement Agent Share (the “Placement Agent Warrant Exercise Price”) at any time

until 5:00 p.m. (Toronto time) on the on the date (the “Placement Agent Warrant Expiry Date”) that is three (3)

years from the closing of the Unit Offering.

The

exercise price of the Pre-Funded Warrants and Warrants was determined by negotiation between the Company and Maxim Group LLC (“Maxim”),

who is acting as exclusive placement agent for the Unit Offering (the “Placement Agent”).

This

Prospectus Supplement is filed pursuant to (i) the Base Shelf Prospectus filed in the provinces of British Columbia, Saskatchewan and

Ontario, and (ii) a base shelf prospectus filed as part of the Company’s registration statement on Form F-10 (File No. 333-271498)

(as amended, the “U.S. Registration Statement”) filed with and declared effective by the SEC under the United States

Securities Act of 1933, as amended (the “U.S. Securities Act”).

All

dollar amounts in this Prospectus Supplement are in United States dollars, unless otherwise indicated. See “Exchange Rate Information”.

All

references to “Pre-funded Warrant Shares” and “Warrant Shares” in this Prospectus Supplement include the Anti-Dilution

Shares, as the context permits or requires.

An

investment in the Shares involves a high degree of risk. Prospective investors should carefully consider the risk factors described

in and/or incorporated by reference in this Prospectus Supplement and the Base Shelf Prospectus. See “Cautionary Statement

Regarding Forward-Looking Statements” and “Risk Factors”.

The

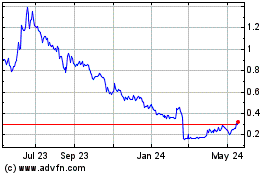

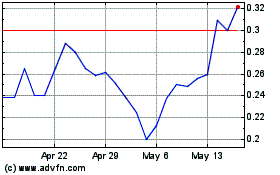

Common Shares are listed on the Canadian Securities Exchange (the “CSE”) under the symbol “DPRO”,

on the Frankfurt Stock Exchange under the symbol “3U8A” and on the Nasdaq Capital Market (“Nasdaq”) under

the symbol “DPRO”. On November 15, 2024, the closing price of the Common Shares on the CSE and Nasdaq was CA$3.53 and US$2.35,

respectively. The Company has given notice to the CSE to list the Unit Shares and Warrant Shares on the CSE and notification has been

or will be provided to Nasdaq. Listing of the Unit Shares and Warrant Shares will be subject to the Company fulfilling the respective

listing requirements of each of the CSE and Nasdaq. Closing of the Offering is subject to usual closing conditions.

The

Placement Agent has not been involved in the preparation of, and has not performed any review of, this Prospectus Supplement.

The

Offering is made by a Canadian issuer that is permitted, under a multijurisdictional disclosure system (“MJDS”) adopted by

the United States and Canada, to prepare this Prospectus Supplement and the Base Shelf Prospectus in accordance with Canadian disclosure

requirements. Prospective investors should be aware that such requirements are different from those of the United States. Annual financial

statements for the year ended December 31, 2023 included or incorporated herein have been prepared in accordance with International Financial

Reporting Standards as issued by the International Accounting Standards Board (“IFRS”) and may not be comparable to financial

statements of United States companies.

The

enforcement by investors of civil liabilities under the United States federal securities laws may be affected adversely by the fact

that the Company is incorporated or organized under the laws of a foreign country, that some or all of its officers and directors

may be residents of a foreign country, that some or all of the experts named in this Prospectus Supplement and the Base Shelf Prospectus

may be residents of a foreign country and that all or a substantial portion of the assets of the Company and said persons may be

located outside the United States. See “Enforceability of Civil Liabilities”.

THESE

SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC, THE SECURITIES COMMISSION OF ANY STATE OF THE UNITED STATES OR ANY

CANADIAN SECURITIES REGULATOR NOR HAVE ANY OF THE FOREGOING PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT

AND THE BASE SHELF PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Prospective

investors should be aware that the acquisition, holding or disposition of the Shares described herein may have tax consequences

in the United States. Such consequences for investors who are resident in, or citizens of, the United States and Canada may not

be described fully herein. You should read the tax discussion contained in this Prospectus Supplement and consult your own tax advisor

with respect to your own particular circumstances. See the sections titled “Certain U.S. Federal Income Tax Considerations”

and “Risk Factors”.

The

Company is not making any offer of the Shares in any jurisdiction where the offer is not permitted by law.

Julie

Myers Wood, Thomas Modly and Tim Dunnigan are members of the board of directors of the Company, all reside outside of Canada and

have appointed DLA Piper (Canada) LLP, Suite 2700, 1133 Melville Street, Vancouver, British Columbia, Canada V6E 4E5, as agent

for service of process. Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada

against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or

resides outside of Canada, even if the party has appointed an agent for service of process.

The

Company’s head office is located at 235, 103rd St. E, Saskatoon, SK, S7N 1Y8, and its registered office is located

at Suite 2700, 1133 Melville Street, Vancouver, British Columbia, Canada V6E 4E5.

Table

of Contents

Prospectus

Supplement

Table

of Contents

Base

Shelf Prospectus

GENERAL

MATTERS

This

document is in two parts. The first part is this Prospectus Supplement, which describes the terms of the Offering and adds to and

updates information in the accompanying Base Shelf Prospectus and the documents incorporated by reference herein and therein. The

second part is the accompanying Base Shelf Prospectus, which gives more general information, some of which may not apply to the

Offering. This Prospectus Supplement is deemed to be incorporated by reference into the accompanying Base Shelf Prospectus solely

for the purposes of this Offering. This Prospectus Supplement may add, update or change information contained in the accompanying

Base Shelf Prospectus and the documents incorporated by reference therein. Before investing, you should carefully read both this

Prospectus Supplement and the accompanying Base Shelf Prospectus together with the additional information about the Company to which

you are referred in the sections of this Prospectus Supplement and the Base Shelf Prospectus titled “Documents Incorporated

by Reference”.

Purchasers

of Shares should rely only on the information contained in or incorporated by reference into this Prospectus Supplement and the

Base Shelf Prospectus. The Company has not authorized anyone to provide purchasers with different or additional information. If

information in this Prospectus Supplement is inconsistent with the Base Shelf Prospectus or the information incorporated by reference,

you should rely on this Prospectus Supplement. If anyone provides purchasers with different or additional information, purchasers

should not rely on it. The Company is not making any offer of the Shares in any jurisdiction where the offer not permitted by law.

Purchasers should assume that the information contained in this Prospectus Supplement and the Base Shelf Prospectus is accurate

only as of the date on the front of those documents and that information contained in any document incorporated by reference is

accurate only as of the date of that document, regardless of the time of delivery of this Prospectus Supplement and the Base Shelf

Prospectus or of any sale of the Shares. The Company’s business, financial condition, results of operations and prospects

may have changed since those dates.

The

corporate website of the Company is www.draganfly.com. The information on the Company’s website is not intended to be included

or incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus and prospective purchasers should not

rely on such information when deciding whether or not to invest in the Shares.

Market

data and industry forecasts used throughout this Prospectus Supplement, the Base Shelf Prospectus and the documents incorporated

by reference therein were obtained from various publicly available sources. Although the Company believes that these independent

sources are generally reliable, the accuracy and completeness of the information from such sources are not guaranteed and have not

been independently verified.

This

Prospectus Supplement, the Base Shelf Prospectus and the documents incorporated by reference therein are part of the U.S. Registration

Statement. This Prospectus Supplement and the Base Shelf Prospectus do not contain all of the information set forth in the U.S.

Registration Statement, certain parts of which are omitted in accordance with the rules and regulations of the SEC, or the schedules

or exhibits that are part of the U.S. Registration Statement. Investors in the United States should refer to the U.S. Registration

Statement and the exhibits thereto for further information with respect to Draganfly and the Shares.

In

this Prospectus Supplement, the Base Shelf Prospectus and the documents incorporated by reference herein and therein, unless the

context otherwise requires, references to “Draganfly” or the “Company” refer to Draganfly Inc.

EXCHANGE

RATE INFORMATION

The

consolidated financial statements of the Company incorporated by reference in this Prospectus Supplement have been prepared in accordance

with IFRS and are reported in Canadian dollars.

In

this Prospectus Supplement, unless otherwise indicated, all dollar amounts and references to “$” and “US$” are

to U.S. dollars, and references to “C$” are to Canadian dollars.

The

following table sets out, for the period indicated, certain exchange rates based upon the rate published by the Bank of Canada during

the respective periods. The rates are set out as United States dollars per C$1.00.

| | |

Year ended

December 31, | |

| | |

2023 | | |

2022 | | |

2021 | |

| Low | |

US$ | 0.7207 | | |

US$ | 0.7217 | | |

US$ | 0.7727 | |

| High | |

US$ | 0.7617 | | |

US$ | 0.8031 | | |

US$ | 0.8306 | |

| Average | |

US$ | 0.7410 | | |

US$ | 0.7685 | | |

US$ | 0.7980 | |

On

November 15, 2024, the daily exchange rate for the U.S. dollar in terms of Canadian dollars, as quoted by the Bank of Canada, was US$1.00

= C$1.4079.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

Prospectus Supplement, the accompanying Base Shelf Prospectus and the documents incorporated by reference herein contain certain “forward-looking

statements” and “forward-looking information” within the meaning of applicable securities legislation (collectively,

“forward-looking statements”). Forward-looking statements are neither historical facts nor assurances of future performance.

Instead, they are based on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies,

and other future conditions. Forward-looking statements can be identified by words such as “anticipate,” “believe,”

“envision,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,”

“project,” “target,” “potential,” “will,” “would,” “could,” “should,”

“continue,” “contemplate” and other similar expressions, although not all forward-looking statements contain

these identifying words. These forward-looking statements include all matters that are not historical facts. Forward-looking statements

in this Prospectus Supplement, the Base Shelf Prospectus and the documents incorporated by reference herein and therein include, but

are not limited to, statements with respect to:

| ● | the

use of the net proceeds from the Offering; |

| ● | the

intentions, plans and future actions of the Company; |

| ● | statements

relating to the business and future activities of the Company; |

| ● | anticipated

developments in operations of the Company; |

| ● | market

position, ability to compete and future financial or operating performance of the Company; |

| ● | the

timing and amount of funding required to execute the Company’s business plans; |

| ● | capital

expenditures; |

| ● | the

effect on the Company of any changes to existing or new legislation or policy or government

regulation; |

| ● | the

availability of labour; |

| ● | requirements

for additional capital; |

| ● | goals,

strategies and future growth; |

| ● | the

adequacy of financial resources; |

| ● | expectation

that the Common Shares will continue to be listed on the CSE and the Nasdaq; and, |

| ● | expectations

regarding revenues, expenses and anticipated cash needs. |

Forward-looking

statements are not guarantees of future performance, actions or developments and are based on expectations, assumptions and other factors

that management currently believes are relevant, reasonable and appropriate in the circumstances. The material expectations, assumptions,

and other factors used in developing the forward-looking statements set out in this Prospectus Supplement, the accompanying Base Shelf

Prospectus and the documents incorporated by reference herein and therein include or relate to the following:

| ● | the

Company’s ability to implement its growth strategies; |

| ● | the

Company’s competitive advantages; |

| ● | the

development of new products and services; |

| ● | the

Company’s ability to obtain and maintain financing on acceptable terms; |

| ● | the

impact of competition; |

| ● | changes

in laws, rules and regulations; |

| ● | the

Company’s ability to maintain and renew required licences; |

| ● | the

Company’s ability to maintain good business relationships with its customers, distributors,

suppliers and other strategic partners; |

| ● | the

Company’s ability to protect intellectual property; |

| ● | the

Company’s ability to manage and integrate acquisitions; |

| ● | the

Company’s ability to retain key personnel; and |

| ● | the

absence of material adverse changes in the industry or Canadian or global economy. |

Although

our management believes that the forward-looking statements herein or incorporated herein by reference are reasonable, actual results

could be substantially different due to the risks and uncertainties associated with and inherent in our business, including the following

risks:

| ● | we

have a history of losses; |

| ● | risks

related to the net proceeds to the Company from the Offering; |

| ● | risks

related to the Company’s discretion in the use of proceeds; |

| ● | the

market price of the Common Shares may be volatile after this Offering; |

| ● | sales

of substantial amounts of the Common Shares in the public market, or the perception that

these sales may occur, could cause the market price of the Common Shares to decline; |

| ● | shareholder’s

holdings maybe diluted if the Company issues additional Common Shares or other securities

in the future; |

| ● | we

incur substantial research and development cost and may have reduced profitability as a result; |

| ● | new

business models could fail to produce any financial returns; |

| ● | we

are affected by operational risks; |

| ● | we

operate in evolving markets and we may have difficulty in evaluating future prospects; |

| ● | risks

related to competition in the industry; |

| ● | our

markets are prone to rapid technological change and there are risks relating to the evolving

nature of the market for our products; |

| ● | risks

related to regulatory approvals and permitting requirements; |

| ● | we

may fail to obtain or maintain required regulatory approvals; |

| ● | risks

associated with acquisitions; |

| ● | we

are reliant on our key personnel; |

| ● | risks

related to uncertainty and adverse changes in the economy; |

| ● | risks

associated with foreign operations in other countries; |

| ● | our

estimates of market opportunity and market and revenue growth may be inaccurate or we may

fail to grow at our estimated rates; |

| ● | tax

risks associated with carrying on business in Canada; |

| ● | we

rely on critical components and raw materials to manufacture our products and if they become

unavailable or scarce; |

| ● | there

could be delays in and manufacturing and delivery of our products; |

| ● | risks

inherent for technology-based businesses operated in outdoor conditions; |

| ● | we

may be subject to product liability claims; |

| ● | risks

related to shortfalls in available research and development funding; |

| ● | risks

related to shipping products outside of Canada and approvals required for exporting; |

| ● | risks

related to economic and political uncertainty; |

| ● | risks

related to consumer perception of our products; |

| ● | risks

associated with any failure by us to successfully promote and protect our product brands; |

| ● | we

could suffer security breaches and the other risks associated with data security and hacking; |

| ● | our

business could be adversely affected if its consumer protection and data privacy practices

are breached; |

| ● | we

are reliant on business partners; |

| ● | our

business may suffer if we cannot continue to protect our intellectual property rights; |

| ● | we

may be unable to obtain patent or other proprietary or statutory protection for new or improved

technologies or products; |

| ● | we

may be subject to litigation from time-to-time; |

| ● | risks

related to conflicts of interest of our directors and officers; |

| ● | risks

related to the limited experience of the management team; |

| ● | changes

in laws, regulations, and guidelines relating to the Company’s business, including

tax and accounting requirements; |

| ● | adverse

impacts on the Company’s reported results of operations as a result of adopting new

accounting standards or interpretations; |

| ● | changes

in accounting standards and subjective assumptions, estimates and judgments by management

related to complex accounting matters; |

| ● | investors

may lose their entire investment in the Shares; |

| ● | the

price of the Common Shares may be subject to wide fluctuations; |

| ● | investors

will experience immediate and substantial dilution; |

| ● | investors

will experience dilution upon subsequent offerings; |

| ● | an

active trading market for the Common Shares may not be sustained; |

| ● | the

price of our Common Shares may fall or fail to be sustained; |

| ● | we

have discretion over the net proceeds from the Offering; |

| ● | we

may decrease or not continue paying dividends; |

| ● | we,

or our non-U.S. subsidiaries, may constitute Controlled Foreign Corporations for tax purposes; |

| ● | the

enforcement by investors of civil liabilities under the United States federal or state securities

laws against us and our directors and officers may be difficult; |

| ● | the

liquidity of the Common Shares may be limited; |

| ● | our

compliance with Nasdaq’s continued listing requirements’ |

| ● | investors

may experience dilution resulting from future Common Share issuances by us, including as

a result of the exercise of outstanding stock options or the settlement of our share units; |

| ● | the

costs and obligations operating as a public company in the United States; |

| ● | there

may be more limited public information available to U.S. shareholders given our current status

as a foreign private issuer; and |

| ● | the

risk factors described under “Risk Factors” in this Prospectus Supplement,

the Base Shelf Prospectus, the Annual MD&A (as defined herein) and the Form 20-F (as

defined herein). |

Additional

material risks and uncertainties applicable to the forward-looking statements set out in this Prospectus Supplement, the accompanying

Base Shelf Prospectus and the documents incorporated by reference herein and therein include, without limitation, unforeseen events,

developments, or factors causing any of the aforesaid expectations, assumptions, and other factors ultimately to be inaccurate or irrelevant.

Many of these factors are beyond our control. All forward-looking statements set out in this Prospectus Supplement, the accompanying

Base Shelf Prospectus and the documents incorporated by reference herein and therein are expressly qualified in their entirety by these

cautionary statements. The forward-looking statements set out in this Prospectus Supplement, the accompanying Base Shelf Prospectus and

the documents incorporated by reference herein and therein are made as at the date hereof or thereof, as applicable, and we undertake

no obligation to update publicly or to revise any of the forward-looking statements, whether as a result of new information, future events,

or otherwise, except as may be required by applicable securities laws.

DOCUMENTS

INCORPORATED BY REFERENCE

This

Prospectus Supplement is deemed to be incorporated by reference into the Base Shelf Prospectus solely for the purpose of the Offering.

Other information has also been incorporated by reference in the Base Shelf Prospectus from documents filed with the securities

commissions or similar authorities in Canada, which have also been filed with, or furnished to, the SEC. Copies of the documents

incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of the Company at 235,

103rd St. E, Saskatoon, SK, S7N 1Y8 (telephone 1-800-979-9794), and are also available electronically on the Company’s

issuer profile at www.sedarplus.ca.

In

addition to the continuous disclosure obligations of the Company under the securities laws of certain provinces of Canada, the Company

is subject to certain of the information requirements of the United States Securities Exchange Act of 1934, as amended (the “U.S.

Exchange Act”), and in accordance therewith file reports and other information with the SEC. Under MJDS, some reports

and other information may be prepared in accordance with the disclosure requirements of Canada, which requirements are different from

those of the United States. As a foreign private issuer, the Company is exempt from the rules under the U.S. Exchange Act prescribing

the furnishing and content of proxy statements, and the Company’s officers, directors and principal shareholders are exempt

from the reporting and short-swing profit recovery provisions contained in Section 16 of the U.S. Exchange Act. In addition, the

Company may not be required to publish financial statements as promptly as U.S. companies. A free copy of any public document

filed by Draganfly with the SEC’s Electronic Data Gathering, Analysis and Retrieval (“EDGAR”) system is available

from the SEC’s website at www.sec.gov.

Except

to the extent that their contents are modified or superseded by a statement contained in this Prospectus Supplement, the Base Shelf

Prospectus or in any other document that is also incorporated by reference in this Prospectus Supplement, as of the date hereof,

the following documents filed by the Company with securities commissions or similar authorities in certain provinces and territories

of Canada are specifically incorporated by reference into, and form an integral part of, this Prospectus Supplement:

| 1. | the

management information circular of the Company dated June 3, 2024 with respect to the annual

general and special meeting of shareholders of the Company held on July 18, 2024. |

| 2. | the

revised annual report on Form 20-F (the “Form 20-F”) of the Company for

the fiscal year ended December 31, 2023; |

| 3. | the

amended and restated audited consolidated financial statements of the Company for the years

ended December 31, 2023 and December 31, 2022, together with the notes thereto and the auditor’s

report thereon; |

| 4. | the

amended and restated management’s discussion and analysis of the financial condition

and results of operations of the Company for the financial year ended December 31, 2023 (the

“Annual MD&A”); |

| 5. | the

unaudited consolidated interim financial statements of the Company for the three and nine

months ended September 30, 2024; |

| 6. | the

management’s discussion and analysis of the financial condition and results of operations

of the Company for the three and nine months ended September 30, 2024 (the “Interim

MD&A”); |

| 7. | the

material change report dated February 9, 2023 in respect of the Company entering into an

equity distribution agreement with Maxim Group LLC dated January 31, 2023, pursuant

to which the Company could, from time to time, distribute in an “at-the-market

offering” of up to US$15 million in Common Shares in the United States only, on

the Nasdaq (the “ATM Offering”); and |

| 8. | the

material change report dated April 6, 2023 in respect of the Company’s underwritten

public offering in the United States of US$8,000,000 Common Shares (the “March

2023 Public Offering”) and closing of the March 2023 Public Offering on March

31, 2023; |

| 9. | the

material change report dated November 3, 2023 in respect of (1) the Company’s underwritten

public offering in the United States of 4,800,000 units of the Company at a price of US$0.55

per unit and 1,600,000 pre-funded units of the Company at a price of US$0.5499 per pre-funded

unit (the “October 2023 Public Offering”) and (2) the Company filing a

prospectus supplement to the Company’s short form base shelf prospectus dated June

30, 2023 in each of the provinces of British Columbia, Ontario and Saskatchewan; |

| 10. | the

material change report dated February 29, 2024 in respect of the Company’s underwritten

public offering in the United States of 13,400,000 units of the Company at a price of US$0.27

per unit (the “February 2024 Public Offering”) of units of the Company

and (2) the Company filing a prospectus supplement to the Company’s short form base

shelf prospectus dated June 30, 2023 in each of the provinces of British Columbia, Ontario

and Saskatchewan; |

| 11. | the

material change report dated May 3, 2024 in respect of (1) the Company’s offering in

the United States of 7,063,514 units of the Company at a price of US$0.259 per unit and 6,450,000

pre-funded units of the Company at a price of US$0.2589 per pre-funded unit (the “May

2024 Public Offering”) and (2) the Company filing a prospectus supplement to the

Company’s short form base shelf prospectus dated June 30, 2023 in each of the provinces

of British Columbia, Ontario and Saskatchewan; |

| 12. | the

material change report dated July 26, 2024 in respect of (1) Andrew Hill Card and John Mitnick

not running for re-election as directors at the Company’s annual general meeting of

the shareholders of the Company held on July 18, 2024, and (2) the election or appointment

of Kim G C Moody, Thomas B. Modly and Tim Dunnigan as directors of the Company; |

| 13. | the

material change report dated August 30, 2024 in respect of (1) the Company’s offering

in the United States of 16,666,666 units of the Company at a price of US$0.12 per unit (the

“August 2024 Public Offering”), (2) the company filing a prospectus supplement

to the Company’s short form base shelf prospectus dated June 30, 2023 in each of the

provinces of British Columbia, Ontario and Saskatchewan, and (3) the consolidation of the

Company’s common shares on a 25:1 basis with an effective date of September 5, 2024;

and |

| 14. | the

material change report dated October 11, 2024 in respect of the resignation of Olen Aasen

as a director of the Company. |

Any

documents of the Company of the type referred to in the preceding paragraph, any other documents of the Company required to be incorporated

by reference pursuant to applicable laws, including but not limited to, all documents of the type referred to in section 11.1 of Form

44-101F1 of National Instrument 44-101 - Short Form Prospectus Distributions filed by the Company with a securities commission

or similar regulatory authority in Canada on or after the date of this Prospectus Supplement and prior to the termination of the

Offering shall be deemed to be incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus.

In

addition, to the extent that any document or information incorporated by reference into this Prospectus Supplement and the Base

Shelf Prospectus is included in any report on Form 6-K, Form 40-F or Form 20-F (or any respective successor form) that is filed

with or furnished to the SEC by the Company after the date of this Prospectus Supplement, such document or information shall be

deemed to be incorporated by reference as an exhibit to the U.S. Registration Statement of which this Prospectus Supplement forms

a part. In addition, the Company may incorporate by reference into this Prospectus Supplement, or the U.S. Registration Statement

of which it forms a part, other information from documents that the Company will file with or furnish to the SEC pursuant to Section

13(a) or 15(d) of the U.S. Exchange Act, if and to the extent expressly provided therein.

Any

statement contained in this Prospectus Supplement, the Base Shelf Prospectus or in a document incorporated or deemed to be incorporated

by reference in this Prospectus Supplement or the Base Shelf Prospectus shall be deemed to be modified or superseded for purposes

of this Prospectus Supplement to the extent that a statement contained herein or in any other subsequently filed document which

also is or is deemed to be incorporated by reference in this Prospectus Supplement or the Base Shelf Prospectus modifies or supersedes

such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include

any other information set forth in the document that it modifies or supersedes. Any statement so modified or superseded shall not

be deemed to constitute a part of this Prospectus Supplement or the Base Shelf Prospectus, except as so modified or superseded.

You

should rely only on the information contained in or incorporated by reference in this Prospectus Supplement and the Base Shelf Prospectus

and on the other information included in the U.S. Registration Statement of which the Base Shelf Prospectus forms a part. The Company

is not making an offer of the Shares in any jurisdiction where the offer is not permitted by law.

WHERE

TO FIND ADDITIONAL INFORMATION

The

Company has filed with the SEC under the U.S. Securities Act the U.S. Registration Statement relating to the Units being offered hereby

and of which this Prospectus Supplement and the Base Shelf Prospectus form a part. This Prospectus Supplement and the Base Shelf Prospectus

do not contain all of the information set forth in the U.S. Registration Statement, as to which reference is made for further information.

The

Company is required to file with the securities commission or authority in each of the applicable provinces of Canada annual and

interim reports, material change reports and other information. In addition, we are subject to the informational requirements of

the U.S. Exchange Act, and, in accordance with the U.S. Exchange Act, we also file reports with, and furnish other information to,

the SEC. Under the MJDS, these reports and other information (including financial information) may be prepared in accordance

with the disclosure requirements of Canada, which differ in certain respects from those in the United States. As a foreign private

issuer, the Company is exempt from the rules under the U.S. Exchange Act prescribing the furnishing and content of proxy statements,

and its officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions

contained in Section 16 of the U.S. Exchange Act. In addition, the Company may not be required to publish financial statements as

promptly as U.S. companies.

Reports

and other information filed by the Company with, or furnished to, the SEC may be accessed on the SEC’s website at www.sec.gov.

You may read and download any public document that the Company has filed with securities commission or similar regulatory authorities

in Canada, on SEDAR at www.sedarplus.ca.

DOCUMENTS

FILED AS PART OF THE U.S. REGISTRATION STATEMENT

The

following documents have been or will be filed with the SEC as part of the U.S. Registration Statement of which this Prospectus

Supplement is a part insofar as required by the SEC’s Form F-10:

| ● | the

documents listed under “Documents Incorporated by Reference” in this Prospectus

Supplement; |

| ● | the

Agency Agreement described in the Pricing Supplement; |

| ● | the

consent of Dale Matheson Carr-Hilton Labonte LLP, the Company’s independent auditor;

and |

| ● | powers

of attorney of the Company’s directors and officers, as applicable. |

THE

COMPANY

The

Company was incorporated as Drone Acquisition Corp. under the Business Corporations Act (British Columbia) on June 1, 2018 for

the purpose of reorganizing and recapitalizing the business of Draganfly Innovations Inc. Effective July 17, 2019, the Company amended

its articles to remove various classes of authorized but unissued preferred shares and replace them with only one class of preferred

shares (the “Preferred Shares”). Effective August 15, 2019, the Company changed its name to “Draganfly Inc.”

On August 22, 2019, the Company amended its articles to re-designate its Class A Common Shares as Common Shares.

The

Company’s head office is located at 235, 103rd St. E, Saskatoon, SK, S7N 1Y8. The Company’s telephone number is

(800) 979-9794. The Company’s registered office is located at Suite 2700, 1133 Melville Street, Vancouver, British Columbia, Canada

V6E 4E5. The Company’s registered agent in the United States is C T Corporation System, 1015 15th Street N.W., Suite

1000, Washington, D.C., 20005 and its telephone number is (202) 572-3133.

DESCRIPTION

OF THE BUSINESS

The

Company is a manufacturer, contract engineering, and product development company within the unmanned aerial vehicle (UAV) and

health space, serving the public safety, agriculture, industrial inspections, monitoring, spraying, and mapping and surveying

markets. The Company provides sustainable, custom and “off-the-shelf” hardware, services, and solutions to companies

and government agencies. The Company’s mission is to deliver products that provide vital information to its customers

with the hopes of saving time, money and lives.

Products

and Services

The

Company can provide its customers with an entire suite of products and services that include: quadcopters, fixed wing aircrafts,

ground based robots, handheld controllers, flight training, and software used for tracking, live streaming, and data collection.

In addition, Draganfly has launched a health/telehealth platform. The initial focus of the platform is a COVID-19 screening

set of technologies that remotely detects a number of key COVID-19 respiratory symptoms. The Company is also offering sanitary

spraying services to indoor and outdoor public gathering spaces such as sport stadiums and fields to provide additional protection

against the spread of contagious viruses such as COVID-19.

Recent

Developments

On

September 5, 2024, the Company completed a consolidation of its issued and outstanding common shares on the basis of one post-consolidated

Common Share for every 25 pre-consolidated Common shares (the “Consolidation”) which was given effect on September

5, 2024 (the “Effective Date”).

On

October 1, 2024, the Nasdaq Stock Market informed the Company that it had regained compliance with the $1 bid price requirement in Nasdaq

Listing Rule 5550(a)(2) and the $2.5 million stockholders’ equity requirement in Nasdaq Listing Rule 5550(b)(1) (the “Minimum

Stockholders’ Equity Requirement”). The letter from Nasdaq further informed the Company that we are subject to a Mandatory

Panel Monitor for a period of one year from October 1, 2024. If, within that one-year monitoring period, we are again out of compliance

with the Minimum Stockholders’ Equity Requirement, we will not be afforded the opportunity to present a plan of compliance to Nasdaq

with respect to that deficiency nor additional time to cure that deficiency. Instead, Nasdaq will issue a Delist Determination Letter

and we will have the opportunity to request a hearing before a Nasdaq Hearings Panel to respond to such letter.

Pursuant

to a prior underwritten public offering of the Company in the United States, the Company issued 6,400,000 common share purchase

warrants (the “October 2023 Warrants”) with each warrant entitling the holder thereof to purchase one Common

Share at an exercise price of US$0.6123 (subsequently reduced to US$0.259 in May 2024), subject to adjustment, until October 30,

2028. On May 1, 2024, the Company issued 13,513,514 warrants (the “May 2024 Warrants”) to purchase Common Shares

to the Holder at an exercise price of CA$0.3540 per Share, subject to adjustment, until May 1, 2029. To enable each of the October

2023 Warrants and May 2024 Warrants to be treated as shareholders’ equity, and not a derivative liability on the Company’s

balance sheet, the Holder and the Company entered into an amendment agreement to amend certain provisions related to determining

the value of underlying common shares of the Company on completion of fundamental transactions in exchange for the exercise price

of each of the October 2023 Warrants and May 2024 Warrants being reduced to the Canadian dollar equivalent of US$0.1646. The number

and exercise price of the October 2023 Warrants and May 2024 Warrants were subsequently modified in connection with the Consolidation.

CONSOLIDATED

CAPITALIZATION

Since

September 30, 2024, the end of the most recent financial period of the Company for which financial statements have been filed, there

have been no material changes in the loan capital of the Company and no material changes in the share capital of the Company on

a consolidated basis other than as outlined under “Prior Sales.” For information on the exercise of stock options pursuant

to the share compensation plan of the Company and other outstanding convertible securities, see the section titled “Prior

Sales.” As a result of the Offering, the shareholder’s equity of the Company will increase by the amount of the

net proceeds of the Offering and the number of issued and outstanding Common Shares will increase by the number of Unit Shares actually

distributed under the Offering.

USE

OF PROCEEDS

We

will receive all proceeds of the full issue price of (i) CA$0.00014 (the Canadian dollar equivalent of US$0.0001) per Pre-Funded Warrant

Share; (ii) CA$3.3086 (the Canadian dollar equivalent of US$2.35) per Warrant Share and (iii) CA$4.1357 (the Canadian dollar

equivalent of US$2.9375) per Placement Agent Warrant upon issuance of the Pre-Funded Warrant Shares, Warrant Shares and Placement Agent

Warrants upon any exercise for cash of the Pre-Funded Warrants, the Warrants and the Placement Agent Warrants, as applicable, from time

to time.

Assuming

that (i) all of the Pre-Funded Warrants are exercised for cash and (ii) all of the Warrants are exercised prior to 5:00 p.m. (Toronto

time) on the Expiry Date for cash, the proceeds to the Company will be approximately CA$5,624,616.00. There is no assurance as to how

many Pre-Funded Warrants, Warrants and Placement Agent Warrants will be exercised, if any. Accordingly, there is no assurance as to how

many Shares will be issued pursuant to this Prospectus Supplement, if any, or the proceeds of such Offering.

The

Company intends to use the net proceeds from the Offering, together with existing cash, for general corporate purposes, including

to fund its capabilities to meet demand for its new products including growth initiatives and/or for working capital requirements

including the continuing development and marketing of the Company’s core products, potential acquisitions and research

and development.

Until

applied, the net proceeds will be held as cash balances in the Company’s bank account or invested in certificates of deposit and

other instruments issued by banks or obligations of or guaranteed by a government authority.

The

Company had operating losses and negative operating cash flow for the fiscal year ended December 31, 2023. To the extent that the

Company has negative operating cash flows in future periods, it may need to deploy a portion of the net proceeds from the Offering

and/or its existing working capital to fund such negative cash flow. While the Company intends to utilize the net proceeds from

Offering as set forth in this Prospectus Supplement, there may be circumstances where for sound business reasons a reallocation

of funds may be necessary. Management will have significant discretion and flexibility in applying the net proceeds from the Offering.

See “Risk Factors” in this Prospectus Supplement.

Business

Objectives and Milestones

The

primary business objectives for the Company over the next 12 months are:

| (a) | Perform

R&D for the company’s continued evolution of products and services offering; |

| (b) | Retain

and hire sales/marketing people to promote our product lines, new and existing drone as a

service work, and engineering services work; |

| (c) | Diversify

and expand business lines organically and by potential acquisitions; |

| (d) | Update/capex

machinery used for manufacturing and production along with a potential expansion of leased

space; and |

| (e) | Strengthen

balance sheet by providing a strong working capital position. |

Significant

events that need to occur for the business objectives to be accomplished:

| (a) | Successfully,

retain, find and hire the appropriate engineering staff that can perform very innovative

and challenging work specific to the drone industry; |

| (b) | Successfully

use the capital to enhance and create new product offerings; |

| (c) | Successfully

source sales and marketing personnel who will grow and generate increased revenues within

the next 6 to 12 months along with marketing initiatives; and |

| (d) | Further,

the Company has a number of innovative ideas for new products that it would like to develop

and increase its current product offering to various niche and mainstream industries. Finally,

the Company has considered offering various other non-engineering services and it may make

more sense to buy an existing industry player than to build out this offering. This isn’t

something the Company has to do but it will be opportunistic to learn about potential opportunities

in the existing fiscal year and the near future. |

PLAN

OF DISTRIBUTION

This

Prospectus Supplement relates to: (i) up to 1,200,000 Pre-Funded Warrant Shares issuable from time to time on exercise of 1,200,000

Pre-Funded Warrants expected to be issued by the Corporation pursuant to the Unit Offering; (ii) up to 1,600,000 Warrant Shares

issuable from time to time on exercise of 1,600,000 Warrants expected to be issued by the Corporation pursuant to the Unit Offering;

(iii) up to 80,000 Placement Agent Shares issuable from time to time on exercise of 80,000 Placement Agent Warrants expected

to be issued by the Corporation in connection with the Unit Offering; and (iv) such indeterminate number of Anti-Dilution Shares that

may be issuable by reason of the anti-dilution provisions contained in each of the Pre-Funded Warrant Certificate and the Warrant Certificate.

Each

Pre-Funded Warrant will entitle the holder thereof to purchase one Pre-Funded Warrant Share at an exercise price of CA$0.00014 (the Canadian

dollar equivalent of US$0.0001) per Pre-Funded Warrant Share, subject to adjustment and in accordance with the terms of the Pre-Funded

Warrant Certificate (as defined herein).

Each

Warrant will entitle the holder thereof to purchase a Warrant Share at the Warrant Exercise Price at any time until 5:00 p.m. (Toronto

time) on the Expiry Date, subject to adjustment and in accordance with the terms and conditions set out in the Warrant Certificate (as

defined herein), after which such Warrants will become null and void.

Each

Placement Agent Warrant will entitle the holder thereof to purchase an Placement Agent Share at the Placement Agent Warrant Exercise

Price at any time until 5:00 p.m. (Toronto time) on the Placement Agent Warrant Expiry Date, subject to adjustment and in accordance

with the terms and conditions set out in the Placement Agent Warrant Certificate (as defined herein), after which such Placement Agent

Warrants will become null and void.

The

following summary of certain provisions of the Pre-Funded Warrant Certificate and Warrant Certificate does not purport to be complete

and is subject in its entirety to the detailed provisions of the executed Pre-Funded Warrant Certificate and Warrant Certificate. Reference

is made to the Pre-Funded Warrant Certificate and Warrant Certificate, for the full text of the attributes of the Pre-Funded Warrants

and Warrants, which have been or will be filed on SEDAR+ under the issuer profile of the Corporation at www.sedarplus.ca and with the

SEC at www.sec.gov. The holders of Pre-Funded Warrants, Warrants or Placement Agent Warrants will not, as such, have any voting right

or other right attached to Pre-Funded Warrant Shares, Warrant Shares or Placement Agent Shares until and unless the Pre-Funded Warrants,

the Warrants and the Placement Agent Warrants, as explicable, are duly exercised as provided for in the applicable certificate.

The

exercise price for the Pre-Funded Warrants and the Warrants will be payable in Canadian dollars.

Warrants

The

Warrants will be governed by a form of warrant certificate (“Warrant Certificate”). Each Warrant will entitle the

holder to purchase one Warrant Share from the treasury of the Corporation at the price of CA$3.3086 (the Canadian dollar equivalent

of US$2.35) per Warrant Share until 5:00 p.m. (Toronto time) on the Expiry Date, subject to adjustment and in accordance with the terms

and conditions set out in the Warrant Certificate, after which such Warrants will become null and void.

The

following summary of certain anticipated provisions of the Warrants does not purport to be complete and is subject in its entirety to

the detailed provisions of the Warrant Certificate. Reference is made to the Warrant Certificate for the full text of the attributes

of the Warrants, which have been or will be filed on SEDAR+ under the issuer profile of the Corporation at www.sedarplus.ca and with

the SEC at www.sec.gov. The holders of Warrants will not, as such, have any voting right or other right attached to the Warrant Shares

until and unless the Warrants are duly exercised as provided for in the Warrant Certificate.

The

exercise price for the Warrants will be payable in Canadian dollars.

The

Placement Agent Warrants will be in the same form as the Warrants, except as otherwise required by the Financial Industry Regulatory

Authority, Inc and as described in the Pricing Supplement.

The

Warrants will not be listed for trading on any stock exchange or market quotation system.

Pre-Funded

Warrants

The

Pre-Funded Warrants will be governed by a form of pre-funded warrant certificate (the “Pre-Funded Warrant Certificate”).

Each Pre-Funded Warrant offered hereby has an initial exercise price per share equal to CA$0.00014 (the Canadian dollar equivalent of

US$0.0001). The Pre-Funded Warrants are immediately exercisable and will expire when exercised in full.

The

following summary of certain provisions of the Pre-Funded Warrant Certificate does not purport to be complete and is subject in

its entirety to the detailed provisions of the Pre-Funded Warrant Certificate. Reference is made to the Pre-Funded Warrant Certificate

for the full text of the attributes of the Pre-Funded Warrants, which will be filed on SEDAR+ under the issuer profile of the Corporation

at www.sedarplus.ca and with the SEC at www.sec.gov. The holders of Pre-Funded Warrants will not, as such, have any voting right

or other right until and unless the Pre-Funded Warrants are duly exercised as provided for in the Pre-Funded Warrant Certificate.

The

exercise price for the Pre-Funded Warrant will be payable in Canadian dollars.

The

Pre-Funded Warrants will not be listed for trading on any stock exchange or market quotation system.

The

Corporation filed a prospectus supplement dated November 18, 2024 to its Base Shelf Prospectus with the securities commission

or similar regulatory authority in each of the provinces of British Columbia, Saskatchewan and Ontario, and prospectus supplement

dated November 18, 2024 to the Registration Statement with the SEC relating to the Unit Offering by the Corporation

to the public in Canada and the United States of Units. The Unit Offering is expected to be completed on or about November

19, 2024. The exercise price of the Pre-Funded Warrants and Warrants was determined by negotiation between the Corporation

and the Placement Agent.

It

is a condition of closing of the Unit Offering that the Corporation has filed with the SEC this Prospectus Supplement registering

the offering of the Shares issuable from time to time upon the exercise of the Pre-Funded Warrants, the Warrants and Placement

Agent Warrants, as applicable. This Prospectus Supplement registers the offering of the securities to which it relates under the U.S.

Securities Act in accordance with the MJDS. This Prospectus Supplement does not qualify in any of the provinces or territories

of Canada the distribution of the Shares to which it relates.

The

Shares to which this Prospectus Supplement relates will be sold directly by the Corporation to holders of Pre-Funded Warrant, Warrants

and Placement Agent Warrants upon any exercise of such Pre-Funded Warrants, Warrants and Placement Agent Warrants, as applicable.

No underwriters, dealers or agents will be involved in these sales.

The

Common Shares are listed on the CSE under the symbol “DPRO”, on the Frankfurt Stock Exchange under the symbol “3U8A”

and on the Nasdaq under the symbol “DPRO”. The Company has given notice to the CSE to list the Warrant Shares on the

CSE and notification has been or will be provided to Nasdaq. Listing of the Warrant Shares will be subject to the Company fulfilling

the respective listing requirements of each of the CSE and Nasdaq.

There

is no assurance as to how many of the Pre-Funded Warrant, Warrants and Placement Agent Warrants will be exercised, and accordingly,

there is no assurance as to how many Shares will be issued pursuant to this Prospectus Supplement, if any. No party has any obligation

to purchase any Shares qualified by this Prospectus Supplement.

DESCRIPTION

OF SECURITIES BEING DISTRIBUTED

Common

Shares

Draganfly’s

authorized share capital consists of an unlimited number of Common Shares and Preferred Shares issuable in series, all without par

value. As of November 15, 2024, a total of 3,827,795 Common Shares and no Preferred Shares were issued and outstanding.

See

“Description of Share Capital” in the Base Shelf Prospectus for a detailed description of the attributes of the Common

Shares.

The

Common Shares are listed on the CSE under the symbol “DPRO”, on the Nasdaq under the symbol “DPRO” and on the

Frankfurt Stock Exchange under the trading Symbol “3U8A”.

See

“Trading Price and Volume” in the Base Shelf Prospectus and in this Prospectus Supplement for detailed information

on the price ranges and trading volume of the Common Shares on the CSE and the Nasdaq.

The

Shares being distributed pursuant to this Offering may be issued from time to time upon the exercise of the Warrants and Pre-Funded Warrants

(and Placement Agent Warrants) issued pursuant to the Unit Offering, the terms of which securities are described below.

Warrants

The

following summary of certain terms and provisions of the Warrants to be issued as part of this Offering is not complete and is subject

to, and qualified in its entirety by, the provisions of the Warrants, the form of which will be filed on Form 6-K with the SEC at www.sec.gov

and incorporated by reference into the U.S. Registration Statement, of which this Prospectus Supplement forms a part. Prospective investors

should carefully review the terms and provisions of the Warrant Certificate for a complete description of the terms and conditions of

the Warrants.

Duration

and Exercise Price

Each

Warrant included in the Units will have an initial exercise price equal to CA$3.3086 (the Canadian dollar equivalent of US$2.35) per

Warrant Share. The Warrants will be immediately exercisable and will expire on the five (5) year anniversary of the original issuance

date. The exercise price and number of Warrant Shares issuable upon exercise is subject to appropriate adjustment in the event of share

dividends, share splits, reorganizations or similar events affecting the Common Shares and the exercise price. The Warrants will be issued

separately from the Unit Shares included in the Units. One Warrant to purchase one Warrant Share will be included in each Unit purchased

in this offering.

Exercisability

The

Warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice

accompanied by payment in full for the number of Warrant Shares purchased upon such exercise. A holder (together with its affiliates)

may not exercise any portion of the Warrant to the extent that the holder would own more than 4.99% of the outstanding Common Shares

immediately after exercise, except that upon at least 61 days’ prior notice from the holder to us, the holder may increase the

amount of ownership of outstanding shares after exercising the holder’s Warrants up to 9.99% of the number of Common Shares outstanding

immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Warrants.

Purchasers of Warrants in the Unit Offering may also elect prior to the issuance of the Warrants to have the initial exercise limitation

set at 9.99% of our outstanding Common Shares.

Fractional

Shares

No

fractional Warrant Shares will be issued upon the exercise of the Warrants. Rather, the number of Warrant Shares to be issued will be

rounded up, to the nearest whole number, or the Company shall pay a cash adjustment in respect of the fractional share.

Transferability

Subject

to applicable laws, the Warrants in physical form may be transferred upon surrender of the Warrant to the Company together with the appropriate

instruments of transfer.

Exchange

Listing

There

is no trading market available for the Warrants on any securities exchange or nationally recognized trading system. The Company does

not intend to list the Warrants on any securities exchange or nationally recognized trading system.

Right

as a Shareholder

Except

as otherwise provided in the Warrants or by virtue of such holder’s ownership of Warrant Shares, the holders of the Warrants do

not have the rights or privileges of holders of our Common Shares, including any voting rights, until they exercise their Warrants.

Fundamental

Transaction

In

the event of a fundamental transaction, as described in the Warrants and generally including any reorganization, recapitalization or

reclassification of the Common Shares, the sale, transfer or other disposition of all or substantially all of the Company’s properties

or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of the outstanding Common Shares,

or any person or group becoming the beneficial owner of 50% of the voting power represented by the outstanding Common Shares, the holders

of the Warrants will be entitled to receive upon exercise of the Warrants the kind and amount of securities or additional consideration

that the holders would have received had they exercised the Warrants immediately prior to such fundamental transaction.

Liquidated

Damages

If

we fail for any reason to deliver Warrant Shares upon the valid exercise of the Warrants, subject to our receipt of a valid exercise

notice and the aggregate exercise price, by the time period set forth in the Warrants, we are required to pay the applicable holder,

in cash, as liquidated damages as set forth in the Warrants. The Warrants also include customary buy-in rights in the event we fail to

deliver Warrant Shares upon exercise thereof within the time periods set forth in the Warrants.

Pre-Funded

Warrants

The

following summary of certain terms and provisions of the Pre-Funded Warrants to be issued as part of this Offering is not complete

and is subject to, and qualified in its entirety by, the provisions of the Pre-Funded Warrants, the form of which will be filed

on Form 6-K with the SEC at www.sec.gov and incorporated by reference into the U.S. Registration Statement, of which this Prospectus

Supplement forms a part. Prospective investors should carefully review the terms and provisions of the Pre-Funded Warrant Certificate

for a complete description of the terms and conditions of the Pre-Funded Warrants.

Duration

and Exercise Price

Each

Pre-Funded Warrant offered hereby will have an initial exercise price of CA$0.00014 (the Canadian dollar equivalent of US$0.0001) per

share. The Pre-Funded Warrants will be immediately exercisable and may be exercised at any time until the Pre-Funded Warrants are exercised

in full. The exercise price and number of Common Shares issuable upon exercise is subject to appropriate adjustment in the event

of share dividends, share splits, reorganizations or similar events affecting our Common Shares and the exercise price.

Exercisability

The

Pre-Funded Warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed

exercise notice accompanied by payment in full for the number of Common Shares purchased upon such exercise. A holder (together

with its affiliates) may not exercise any portion of the Pre-Funded Warrant to the extent that the holder would own more than 4.99%

(or 9.99% if elected by the purchaser) of the outstanding Common Shares immediately after exercise, except that upon at

least 61 days’ prior notice from the holder to us, the holder may decrease the amount of ownership of outstanding shares after

exercising the holder’s Pre-Funded Warrants. No fractional Common Shares will be issued in connection with the exercise of

a Pre-Funded Warrant. In lieu of fractional shares, we will pay the holder an amount in cash equal to the fractional amount multiplied

by the exercise price.

Fundamental

Transaction

In the event of a fundamental transaction, as described in the Pre-Funded Warrants and generally including any reorganization,

recapitalization or reclassification of our Common Shares, the sale, transfer or other disposition of all or substantially all of

our properties or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding

voting securities, the holders of the Pre-Funded Warrants will be entitled to receive upon exercise of the Pre-Funded Warrants the

kind and amount of securities or additional consideration that the holders would have received had they exercised the Pre-Funded Warrants

immediately prior to such fundamental transaction.

Liquidated

Damages

If

we fail for any reason to deliver Common Shares upon the valid exercise of the Pre-Funded warrants, subject to our receipt of a

valid exercise notice and the aggregate exercise price, by the time period set forth in the Pre-Funded Warrants, we are required to pay

the applicable holder, in cash, as liquidated damages as set forth in the Pre-Funded Warrants. The Pre-Funded Warrants also include customary

buy-in rights in the event we fail to deliver shares of common share upon exercise thereof within the time periods set forth in

the Pre-Funded Warrants.

Transferability

Subject

to applicable laws, a Pre-Funded Warrant in physical form may be transferred upon surrender of the Pre-Funded Warrant to the Company

together with the appropriate instruments of transfer.

Exchange

Listing

We

do not intend to list the Pre-Funded Warrants on any securities exchange or nationally recognized trading system.

Rights

as a Shareholder

Except

as otherwise provided in the Pre-Funded Warrants or by virtue of such holder’s ownership of, the holders of the Pre-Funded

Warrants do not have the rights or privileges of holders of our common shares, including any voting rights, until they exercise

their Pre-Funded Warrants.

PRIOR

SALES

Except

as disclosed under this heading, no other Common Shares or securities exchangeable or convertible into Common Shares have been issued

during the twelve-month period preceding the date of this Prospectus Supplement.

Common

Shares

During

the twelve-month period prior to the date of this Prospectus Supplement, the Company has issued:

| Date of Issue | |

Number of Common Shares Issued* | | |

Issuance Price* | |

| November 14, 2023 | |

| 203,251 | (1) | |

US$ | 0.55067 | |

| December 11, 2023 | |

| 88,365 | (1) | |

US$ | 0.55067 | |

| December 12, 2023 | |

| 237,704 | (1) | |

US$ | 0.55067 | |

| December 20, 2023 | |

| 50,000 | (1) | |

C$ | 0.73 | |

January, 25, 2024

| |

| 34,070 | (1) | |

US$ | 0.35975 | |

| January 29, 2024 | |

| 29,588 | (1) | |

US$ | 0.35975 | |

| February 6, 2024 | |

| 1,600,000 | (5) | |

US$ | 0.0001 | |

| February 26, 2024 | |

| 11,200,000 | (6) | |

US$ | 0.27 | |

| February 26, 2024 | |

| 2,200,000 | (7) | |

US$ | 0.0001 | |

| March 1, 2024 | |

| (900,000 | )(8) | |

| - | |

| April 2, 2024 | |

| 25,690 | (1) | |

C$ | 1.13 | |

| April 3, 2024 | |

| 300,000 | (9) | |

US$ | 0.1761 | |

| April 5, 2024 | |

| 22,310 | (1) | |

C$ | 1.13 | |

| April 5, 2024 | |

| 88,450 | | |

US$ | 0.1761 | |

| April 9, 2024 | |

| 50,000 | | |

US$ | 0.1761 | |

| April 11, 2024 | |

| 120,000 | | |

US$ | 0.1761 | |

| April 16, 2024 | |

| 38,250 | | |

US$ | 0.1761 | |

| April 17, 2024 | |

| 75,000 | | |

US$ | 0.1761 | |

| April 25, 2024 | |

| 100,000 | | |

US$ | 0.1761 | |

| April 29, 2024 | |

| 85,000 | (9) | |

US$ | 0.1761 | |

| April 29, 2024 | |

| 85,000 | (9) | |

US$ | 0.1761 | |

| April 30, 2024 | |

| 3,334 | (1) | |

C$ | 2.03 | |

| May 1, 2024 | |

| 7,063,514 | (10) | |

US$ | 0.2590 | |

| May 17, 2024 | |

| 235,000 | (9) | |

US$ | 0.1761 | |

| May 17, 2024 | |

| 10,000 | (9) | |

US$ | 0.1761 | |

| May 21, 2024 | |

| 250,500 | (9) | |

US$ | 0.1761 | |

| May 21, 2024 | |

| 3,351,000 | (9) | |

US$ | 0.0001 (C$0.00014) | |

| May 24, 2024 | |

| 85,000 | (9) | |

US$ | 0.1761 | |

| July 22, 2024 | |

| 3,099,000 | (9) | |

US$ | 0.0001 (C$0.00014) | |

| August 7, 2024 | |

| 1,000 | (9) | |

US$ | 0.1761 | |

| August 21, 2024 | |

| 8,666,666 | (11) | |

US$ | 0.12 | |

Notes:

| * | The

information provided in the table above and notes below reflects the numbers and prices of

the Common Shares at the time of issue (i.e., on a pre-Consolidation basis). |

| (1) | Issued

pursuant to the settlement of RSUs (as such term is defined below). |

| (2) | Issued

pursuant to the ATM Offering. |

| (3) | Issued

pursuant to the March 2023 Public Offering. |

| (4) | Issued

pursuant to the October 2023 Public Offering. |

| (5) | Issued

pursuant to the exercise of October 2023 Pre-Funded Warrants. |

| (6) | Issued

pursuant to the February 2024 Public Offering. |

| (7) | Issued

pursuant to the exercise of February 2024 Pre-Funded Warrants (as such term is defined below). |

| (8) | Return

to treasury. |

| (9) | Issued

pursuant to the exercise of warrants. |

| (10) | Common

Shares underlying units issued pursuant to the May 2024 Public Offering at US$0.259 per unit.

|

| (11) | Common

Shares underlying units issued pursuant to the August 2024 Public Offering at US$0.12 per

unit. |

| Date of Issue | |

Number of Common Shares Issued* | | |

Issuance Price | |

| September 5, 2024 | |

| 320,000 | (1) | |

US$ | 1.77236 | |

| September 10, 2024 | |

| 2,548 | (2) | |

US$ | 1.77236 | |

| September 10, 2024 | |

| 6,887 | (2) | |

US$ | 1.77236 | |

| September 16, 2024 | |

| 8,730 | (2) | |

US$ | 1.77236 | |

| October 8, 2024 | |

| 2,587 | (2) | |

US$ | 3.47 | |

Notes:

| * | The

information presented in the table above reflects the numbers and prices of the Common Shares

on a post-Consolidation basis. |

| (1) | Issued

pursuant to the exercise of August 2024 Pre-Funded Warrants. |

| (2) | Issued

pursuant to the settlement of RSUs (as such term is defined below). |

Warrants

During

the twelve-month period prior to the date of this Prospectus Supplement, the Company has issued the following Warrants. The information

provided in the table and notes below reflects the numbers and prices of the Warrants on a pre-Consolidation basis:

| Date of Issuance | |

Number of Warrants Issued | | |

Exercise Price | |

| October 30, 2023 | |

| 6,400,000 | (1)(10) | |

C$ | 0.2277 (US$0.1646) | |

| October 30, 2023 | |

| 1,600,000 | (2) | |

US$ | 0.0001 | |

| October 30, 2023 | |

| 320,000 | (3) | |

US$ | 0.6875 | |

| February 26, 2024 | |

| 13,400,000 | (4) | |

US$ | 0.36 | |

| February 26, 2024 | |

| 2,200,000 | (4) | |

US$ | 0.0001 | |

| February 26, 2024 | |

| 670,000 | (5) | |

US$ | 0.3375 | |

| May 1, 2024 | |

| 6,450,000 | (6) | |

C$ | 0.0014 (US$0.001) | |

| May 1, 2024 | |

| 13,513,514 | (6)(10) | |

C$ | 0.2250 | |

| May 1, 2024 | |

| 675,676 | (7) | |

C$ | 0.4425 | |

| August 21, 2024 | |

| 8,000,000 | (8) | |

C$ | 0.00014 (US$0.0001) | |

| August 21, 2024 | |

| 16,666,666 | (8)(10) | |

C$ | 0.2048 (US$0.15) | |

| August 21, 2024 | |

| 833,333 | (9) | |

C$ | 0.2048 (US$0.15) | |

Notes:

| (1) | Pursuant

to the October 2023 Public Offering, the Company issued 6,400,000 October 2023 Warrants,

with each October 2023 Warrant entitling the holder thereof to purchase one Common Share

at an exercise price of US$0.6123, subject to adjustment, until October 30, 2028. In connection

with the closing of the May 2024 Public Offering, the Company and the holder of the October

2023 Warrants closed an amendment agreement, whereby the exercise price of the October 2023

Warrants was reduced to CA$0.3853 (the Canadian dollar equivalent of US$0.259), the cashless

exercise procedure of the October 2023 Warrants was removed, and the functional currency

of the October 2023 Warrants was converted to Canadian dollars. On August 7, 2024, the

exercise price of the October 2023 Warrants was amended to CA$0.2277 (the Canadian dollar

equivalent of US$0.1646, based on an exchange rate of US$1 = C$1.3833 on October

30, 2023). |

| (2) | Pursuant

to the October 2023 Public Offering, the Company issued 1,600,000 pre-funded warrants (the

“October 2023 Pre-Funded Warrants”), with each October 2023 Pre-Funded

Warrant entitling the holder thereof to purchase one Common Share at an exercise price of

US$0.0001, subject to adjustment, until the October 2023 Pre-Funded Warrants are exercised

in full. |

| (3) | In

connection with the October 2023 Public Offering, the Company issued 320,000 underwriter

warrants (the “October 2023 Underwriter Warrants”), with each October