Q3

2024

--09-30

false

0001540159

false

false

false

false

0

0

0

http://www.edsa.com/20240630#CanadianImperialBankOfCommerceUSBaseinterestRateMember

0

2

0

0

0

0

0

0

0

0

0

0

September 30, 2027

March 31, 2027

February 28, 2026

December 31, 2025

January 31, 2025

0

0

0

0

0

0

0

0

0

2

5

0

0

Unlimited

Unlimited

00015401592023-10-012024-06-30

thunderdome:item

00015401592024-04-012024-06-30

iso4217:USD

0001540159us-gaap:RevolvingCreditFacilityMemberedsa:PardeepNijhawanMedicineProfessionalCorporationMember2022-10-012023-06-30

0001540159us-gaap:RevolvingCreditFacilityMemberedsa:PardeepNijhawanMedicineProfessionalCorporationMember2023-04-012023-06-30

0001540159us-gaap:RevolvingCreditFacilityMemberedsa:PardeepNijhawanMedicineProfessionalCorporationMember2023-10-012024-06-30

0001540159us-gaap:RevolvingCreditFacilityMemberedsa:PardeepNijhawanMedicineProfessionalCorporationMember2024-04-012024-06-30

0001540159us-gaap:RevolvingCreditFacilityMemberedsa:PardeepNijhawanMedicineProfessionalCorporationMember2024-06-30

xbrli:pure

0001540159us-gaap:RevolvingCreditFacilityMemberedsa:PardeepNijhawanMedicineProfessionalCorporationMember2023-10-31

0001540159us-gaap:RevolvingCreditFacilityMemberedsa:PardeepNijhawanMedicineProfessionalCorporationMemberedsa:CanadianImperialBankOfCommerceUSBaseinterestRateMember2023-10-012023-10-31

00015401592023-10-012023-10-31

0001540159edsa:UnsecuredLineOfCreditMemberedsa:PardeepNijhawanMedicineProfessionalCorporationMember2023-10-31

0001540159srt:ChiefExecutiveOfficerMember2023-06-30

0001540159srt:ChiefExecutiveOfficerMember2024-06-30

utr:Y

0001540159srt:ChiefExecutiveOfficerMember2022-12-31

0001540159srt:ChiefExecutiveOfficerMember2023-10-012024-06-30

0001540159srt:ChiefExecutiveOfficerMember2022-10-012023-06-30

0001540159srt:ChiefExecutiveOfficerMember2023-04-012023-06-30

0001540159srt:ChiefExecutiveOfficerMember2024-04-012024-06-30

00015401592024-06-30

iso4217:CAD

0001540159edsa:OntarioSubsidiaryMember2024-06-30

0001540159edsa:The2023SIFAgreementMember2022-10-012023-06-30

0001540159edsa:The2023SIFAgreementMember2023-04-012023-06-30

0001540159edsa:The2023SIFAgreementMember2023-10-012024-06-30

0001540159edsa:The2023SIFAgreementMember2024-04-012024-06-30

0001540159edsa:The2023SIFAgreementMember2024-06-302024-06-30

0001540159edsa:The2023SIFAgreementMember2024-06-30

0001540159edsa:The2023SIFAgreementMember2023-10-31

0001540159edsa:The2021SIFAgreementMember2024-06-30

0001540159edsa:The2021SIFAgreementMember2021-02-28

0001540159us-gaap:RestrictedStockUnitsRSUMember2024-06-30

xbrli:shares

iso4217:USDxbrli:shares

0001540159us-gaap:RestrictedStockUnitsRSUMember2023-10-012024-06-30

0001540159us-gaap:RestrictedStockUnitsRSUMember2023-09-30

utr:M

0001540159us-gaap:EmployeeStockOptionMember2023-10-012024-06-30

0001540159us-gaap:EmployeeStockOptionMember2024-06-30

0001540159us-gaap:EmployeeStockOptionMember2022-10-012023-06-30

0001540159us-gaap:EmployeeStockOptionMember2023-04-012023-06-30

0001540159us-gaap:EmployeeStockOptionMember2024-04-012024-06-30

00015401592022-10-012023-06-30

0001540159edsa:RangeSevenMember2023-10-012024-06-30

0001540159edsa:RangeSevenMember2024-06-30

0001540159edsa:RangeSixMember2024-06-30

0001540159edsa:RangeFiveMember2023-10-012024-06-30

0001540159edsa:RangeFiveMember2024-06-30

0001540159edsa:RangeFourMember2023-10-012024-06-30

0001540159edsa:RangeFourMember2024-06-30

0001540159edsa:RangeThreeMember2024-06-30

0001540159edsa:RangeTwoMember2024-06-30

0001540159edsa:RangeOneMember2023-10-012024-06-30

0001540159edsa:RangeOneMember2024-06-30

0001540159us-gaap:ShareBasedPaymentArrangementEmployeeMember2023-04-012023-06-30

0001540159us-gaap:ShareBasedPaymentArrangementEmployeeMember2022-10-012023-06-30

0001540159us-gaap:ShareBasedPaymentArrangementNonemployeeMember2023-04-012023-06-30

0001540159us-gaap:ShareBasedPaymentArrangementNonemployeeMember2022-10-012023-06-30

0001540159us-gaap:ShareBasedPaymentArrangementNonemployeeMember2023-10-012024-06-30

0001540159us-gaap:ShareBasedPaymentArrangementNonemployeeMember2024-04-012024-06-30

0001540159us-gaap:ShareBasedPaymentArrangementEmployeeMember2023-10-012024-06-30

0001540159us-gaap:ShareBasedPaymentArrangementEmployeeMember2024-04-012024-06-30

00015401592023-06-30

00015401592022-09-30

00015401592023-09-30

0001540159edsa:The2019PlanMember2024-06-30

0001540159edsa:ClassBWarrantsMemberus-gaap:MeasurementInputExpectedDividendRateMember2023-06-30

0001540159edsa:ClassAWarrantsMemberus-gaap:MeasurementInputExpectedDividendRateMember2023-06-30

0001540159edsa:ClassBWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2023-06-30

0001540159edsa:ClassAWarrantsMemberus-gaap:MeasurementInputPriceVolatilityMember2023-06-30

0001540159edsa:ClassBWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-06-30

0001540159edsa:ClassAWarrantsMemberus-gaap:MeasurementInputExpectedTermMember2023-06-30

0001540159edsa:ClassBWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-06-30

0001540159edsa:ClassAWarrantsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-06-30

0001540159edsa:WarrantFiveMember2024-06-30

0001540159edsa:WarrantFourMember2024-06-30

0001540159edsa:WarrantThreeMember2024-06-30

0001540159edsa:WarrantTwoMember2024-06-30

0001540159edsa:WarrantOneMember2024-06-30

0001540159edsa:CanaccordMember2023-10-012024-06-30

0001540159edsa:CanaccordMember2023-03-27

0001540159edsa:ClassBWarrantsMember2022-11-02

0001540159edsa:ClassAWarrantsMember2022-11-02

0001540159edsa:WarrantsIssuedInPrivatePlacementMember2022-11-02

0001540159us-gaap:PrivatePlacementMember2022-11-022022-11-02

0001540159edsa:LicenseAgreementToAcquireGlobalRightsOfPharmaceuticalProductMember2022-10-012023-06-30

0001540159edsa:LicenseAgreementToAcquireGlobalRightsOfPharmaceuticalProductMember2023-04-012023-06-30

0001540159edsa:LicenseAgreementToAcquireGlobalRightsOfPharmaceuticalProductMember2023-10-012024-06-30

0001540159edsa:LicenseAgreementToAcquireGlobalRightsOfPharmaceuticalProductMember2024-04-012024-06-30

0001540159edsa:LicenseAgreementToAcquireGlobalRightsOfPharmaceuticalProductMember2021-03-31

0001540159edsa:LicenseAgreementRelatedToPharmaceuticalProductsMember2023-10-012024-06-30

0001540159edsa:LicenseAgreementRelatedToPharmaceuticalProductsMember2024-04-012024-06-30

0001540159edsa:LicenseAgreementRelatedToPharmaceuticalProductsMember2022-10-012023-06-30

0001540159edsa:LicenseAgreementRelatedToPharmaceuticalProductsMember2023-04-012023-06-30

0001540159edsa:LicenseAgreementRelatedToPharmaceuticalProductsMember2016-12-31

0001540159edsa:LicenseAgreementRelatedToPharmaceuticalProductsMember2020-04-30

0001540159edsa:TheConstructsMember2022-10-012023-06-30

0001540159edsa:TheConstructsMember2023-10-012024-06-30

0001540159edsa:TheConstructsMember2023-04-012023-06-30

0001540159edsa:TheConstructsMember2024-04-012024-06-30

0001540159edsa:TheConstructsMember2020-04-30

00015401592023-04-012023-06-30

0001540159us-gaap:RelatedPartyMember2022-12-31

0001540159edsa:TheConstructsMember2023-09-30

0001540159edsa:TheConstructsMember2024-06-30

0001540159edsa:TheConstructsMember2020-04-012020-04-30

0001540159edsa:TheConstructsMember2020-04-30

0001540159us-gaap:RetainedEarningsMember2023-06-30

0001540159us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-30

0001540159us-gaap:AdditionalPaidInCapitalMember2023-06-30

0001540159us-gaap:CommonStockMember2023-06-30

0001540159us-gaap:RetainedEarningsMember2022-10-012023-06-30

0001540159us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-012023-06-30

0001540159us-gaap:AdditionalPaidInCapitalMember2022-10-012023-06-30

0001540159us-gaap:CommonStockMember2022-10-012023-06-30

0001540159us-gaap:RetainedEarningsMember2022-09-30

0001540159us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-30

0001540159us-gaap:AdditionalPaidInCapitalMember2022-09-30

0001540159us-gaap:CommonStockMember2022-09-30

0001540159us-gaap:RetainedEarningsMember2024-06-30

0001540159us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-30

0001540159us-gaap:AdditionalPaidInCapitalMember2024-06-30

0001540159us-gaap:CommonStockMember2024-06-30

0001540159us-gaap:RetainedEarningsMember2023-10-012024-06-30

0001540159us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-012024-06-30

0001540159us-gaap:AdditionalPaidInCapitalMember2023-10-012024-06-30

0001540159us-gaap:CommonStockMember2023-10-012024-06-30

0001540159us-gaap:RetainedEarningsMember2023-09-30

0001540159us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-30

0001540159us-gaap:AdditionalPaidInCapitalMember2023-09-30

0001540159us-gaap:CommonStockMember2023-09-30

0001540159us-gaap:RetainedEarningsMember2023-04-012023-06-30

0001540159us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-30

0001540159us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-30

0001540159us-gaap:CommonStockMember2023-04-012023-06-30

00015401592023-03-31

0001540159us-gaap:RetainedEarningsMember2023-03-31

0001540159us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-31

0001540159us-gaap:AdditionalPaidInCapitalMember2023-03-31

0001540159us-gaap:CommonStockMember2023-03-31

0001540159us-gaap:RetainedEarningsMember2024-04-012024-06-30

0001540159us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-30

0001540159us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-30

0001540159us-gaap:CommonStockMember2024-04-012024-06-30

00015401592024-03-31

0001540159us-gaap:RetainedEarningsMember2024-03-31

0001540159us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-31

0001540159us-gaap:AdditionalPaidInCapitalMember2024-03-31

0001540159us-gaap:CommonStockMember2024-03-31

00015401592022-10-012023-09-30

00015401592024-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

☒

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended June 30, 2024

OR

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number: 001-37619

EDESA BIOTECH, INC.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada |

N/A |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 100 Spy Court, Markham, ON, Canada L3R 5H6 |

(289)800-9600 |

| (Address of principal executive offices and zip code) |

(Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Shares, without par value |

|

EDSA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of August 9, 2024, the registrant had 3,247,389 common shares issued and outstanding.

EDESA BIOTECH, INC.

QUARTERLY REPORT ON FORM 10-Q

Quarter Ended June 30, 2024

Table of Contents

PART 1 – FINANCIAL INFORMATION

Item 1. Financial Statements

Edesa Biotech, Inc.

Condensed Interim Consolidated Balance Sheets

| |

|

June 30, 2024

|

|

|

September 30, 2023

|

|

| |

|

|

|

|

|

|

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

2,040,884 |

|

|

$ |

5,361,397 |

|

|

Accounts and other receivable

|

|

|

551,064 |

|

|

|

626,543 |

|

|

Prepaid expenses and other current assets

|

|

|

454,686 |

|

|

|

448,912 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

3,046,634 |

|

|

|

6,436,852 |

|

| |

|

|

|

|

|

|

|

|

|

Non-current assets:

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

- |

|

|

|

8,702 |

|

|

Long-term deposits

|

|

|

40,661 |

|

|

|

173,490 |

|

|

Intangible asset, net

|

|

|

2,104,141 |

|

|

|

2,180,020 |

|

|

Right-of-use assets

|

|

|

36,286 |

|

|

|

91,373 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

5,227,722 |

|

|

$ |

8,890,437 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and shareholders' equity:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$ |

2,321,810 |

|

|

$ |

1,747,150 |

|

|

Short-term right-of-use lease liabilities

|

|

|

38,817 |

|

|

|

74,714 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

2,360,627 |

|

|

|

1,821,864 |

|

| |

|

|

|

|

|

|

|

|

|

Non-current liabilities:

|

|

|

|

|

|

|

|

|

|

Long-term right-of-use lease liabilities

|

|

|

- |

|

|

|

19,773 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

2,360,627 |

|

|

|

1,841,637 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments (Note 5)

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Shareholders' equity:

|

|

|

|

|

|

|

|

|

|

Capital shares

|

|

|

|

|

|

|

|

|

| Authorized unlimited common and preferred shares without par value |

|

|

|

|

|

|

|

|

|

Issued and outstanding:

|

|

|

|

|

|

|

|

|

|

3,247,389 common shares (September 30, 2023 - 3,075,473)

|

|

|

47,236,024 |

|

|

|

46,643,151 |

|

|

Additional paid-in capital

|

|

|

13,482,824 |

|

|

|

13,039,265 |

|

|

Accumulated other comprehensive loss

|

|

|

(224,791 |

) |

|

|

(214,648 |

) |

|

Accumulated deficit

|

|

|

(57,626,962 |

) |

|

|

(52,418,968 |

) |

| |

|

|

|

|

|

|

|

|

|

Total shareholders' equity

|

|

|

2,867,095 |

|

|

|

7,048,800 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity

|

|

$ |

5,227,722 |

|

|

$ |

8,890,437 |

|

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

Edesa Biotech, Inc.

Condensed Interim Consolidated Statements of Operations

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

June 30, 2024

|

|

|

June 30, 2023

|

|

|

June 30, 2024

|

|

|

June 30, 2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

$ |

897,305 |

|

|

$ |

1,025,622 |

|

|

$ |

2,778,100 |

|

|

$ |

3,841,150 |

|

|

General and administrative

|

|

$ |

1,035,140 |

|

|

$ |

1,038,587 |

|

|

$ |

3,232,248 |

|

|

|

3,011,945 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(1,932,445 |

) |

|

|

(2,064,209 |

) |

|

|

(6,010,348 |

) |

|

|

(6,853,095 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reimbursement grant income

|

|

|

236,226 |

|

|

|

- |

|

|

|

661,062 |

|

|

|

- |

|

|

Interest income

|

|

|

32,848 |

|

|

|

82,754 |

|

|

|

137,007 |

|

|

|

217,901 |

|

|

Misc other income

|

|

|

- |

|

|

|

- |

|

|

|

14,766 |

|

|

|

- |

|

|

Foreign exchange loss

|

|

|

(4,841 |

) |

|

|

(3,451 |

) |

|

|

(9,681 |

) |

|

|

(18,078 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

264,233 |

|

|

|

79,303 |

|

|

|

803,154 |

|

|

|

199,823 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes

|

|

|

(1,668,212 |

) |

|

|

(1,984,906 |

) |

|

|

(5,207,194 |

) |

|

|

(6,653,272 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

|

- |

|

|

|

- |

|

|

|

800 |

|

|

|

800 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(1,668,212 |

) |

|

|

(1,984,906 |

) |

|

|

(5,207,994 |

) |

|

|

(6,654,072 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exchange differences on translation

|

|

|

1,612 |

|

|

|

39,839 |

|

|

|

(10,143 |

) |

|

|

23,415 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net comprehensive loss

|

|

$ |

(1,666,600 |

) |

|

$ |

(1,945,067 |

) |

|

$ |

(5,218,137 |

) |

|

$ |

(6,630,657 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares

|

|

|

3,221,806 |

|

|

|

2,930,681 |

|

|

|

3,180,647 |

|

|

|

2,802,793 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per common share - basic and diluted

|

|

$ |

(0.52 |

) |

|

$ |

(0.68 |

) |

|

$ |

(1.64 |

) |

|

$ |

(2.37 |

) |

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

Edesa Biotech, Inc.

Condensed Interim Consolidated Statements of Cash Flows

| |

|

Nine Months Ended

|

|

| |

|

June 30, 2024

|

|

|

June 30, 2023

|

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(5,207,994 |

) |

|

$ |

(6,654,072 |

) |

|

Adjustments for:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

141,843 |

|

|

|

137,501 |

|

|

Share-based compensation

|

|

|

443,559 |

|

|

|

729,380 |

|

|

Gain on payable forgiveness

|

|

|

(14,766 |

) |

|

|

- |

|

|

Changes in working capital items:

|

|

|

|

|

|

|

|

|

|

Accounts and other receivable

|

|

|

71,501 |

|

|

|

1,149,129 |

|

|

Prepaid expenses and other current assets

|

|

|

109,647 |

|

|

|

339,031 |

|

|

Accounts payable and accrued liabilities

|

|

|

533,044 |

|

|

|

(869,430 |

) |

| |

|

|

|

|

|

|

|

|

|

Net cash used in operating activities

|

|

|

(3,923,166 |

) |

|

|

(5,168,461 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common shares and warrants

|

|

|

729,387 |

|

|

|

3,861,245 |

|

|

Proceeds from exercise of warrants

|

|

|

- |

|

|

|

770,531 |

|

|

Payments for issuance costs of common shares and warrants

|

|

|

(76,389 |

) |

|

|

(214,130 |

) |

|

Repayment of debt

|

|

|

(29,532 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities

|

|

|

623,466 |

|

|

|

4,417,646 |

|

| |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents

|

|

|

(20,813 |

) |

|

|

117,066 |

|

| |

|

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents

|

|

|

(3,320,513 |

) |

|

|

(633,749 |

) |

|

Cash and cash equivalents, beginning of period

|

|

|

5,361,397 |

|

|

|

7,090,919 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, end of period

|

|

$ |

2,040,884 |

|

|

$ |

6,457,170 |

|

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

Edesa Biotech, Inc.

Condensed Interim Consolidated Statements of Changes in Shareholders' Equity

| |

|

Shares #

|

|

|

Common Shares

|

|

|

Additional Paid-in Capital

|

|

|

Accumulated Other Comprehensive Loss

|

|

|

Accumulated Deficit

|

|

|

Total Shareholders' Equity

|

|

|

Three Months Ended June 30, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - March 31, 2024

|

|

|

3,215,968 |

|

|

$ |

47,136,168 |

|

|

$ |

13,373,318 |

|

|

$ |

(226,403 |

) |

|

$ |

(55,958,750 |

) |

|

$ |

4,324,333 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common shares

|

|

|

31,421 |

|

|

|

138,421 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

138,421 |

|

|

Issuance costs

|

|

|

- |

|

|

|

(38,565 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(38,565 |

) |

|

Share-based compensation

|

|

|

- |

|

|

|

- |

|

|

|

109,506 |

|

|

|

- |

|

|

|

- |

|

|

|

109,506 |

|

|

Net loss and comprehensive loss

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,612 |

|

|

|

(1,668,212 |

) |

|

|

(1,666,600 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - June 30, 2024

|

|

|

3,247,389 |

|

|

$ |

47,236,024 |

|

|

$ |

13,482,824 |

|

|

$ |

(224,791 |

) |

|

$ |

(57,626,962 |

) |

|

$ |

2,867,095 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - March 31, 2023

|

|

|

2,865,517 |

|

|

$ |

45,453,733 |

|

|

$ |

12,489,949 |

|

|

$ |

(230,026 |

) |

|

$ |

(48,713,719 |

) |

|

$ |

8,999,937 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common shares upon exercise of warrants

|

|

|

115,441 |

|

|

|

833,749 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

833,749 |

|

|

Issuance costs

|

|

|

- |

|

|

|

(146,295 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(146,295 |

) |

|

Share-based compensation

|

|

|

- |

|

|

|

- |

|

|

|

108,159 |

|

|

|

- |

|

|

|

- |

|

|

|

108,159 |

|

|

Net loss and comprehensive loss

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

39,839 |

|

|

|

(1,984,906 |

) |

|

|

(1,945,067 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - June 30, 2023

|

|

|

2,980,958 |

|

|

$ |

46,141,187 |

|

|

$ |

12,598,108 |

|

|

$ |

(190,187 |

) |

|

$ |

(50,698,625 |

) |

|

$ |

7,850,483 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended June 30, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - September 30, 2023

|

|

|

3,075,473 |

|

|

$ |

46,643,151 |

|

|

$ |

13,039,265 |

|

|

$ |

(214,648 |

) |

|

$ |

(52,418,968 |

) |

|

$ |

7,048,800 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common shares

|

|

|

171,916 |

|

|

|

729,387 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

729,387 |

|

|

Issuance costs

|

|

|

- |

|

|

|

(136,514 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(136,514 |

) |

|

Share-based compensation

|

|

|

- |

|

|

|

- |

|

|

|

443,559 |

|

|

|

- |

|

|

|

- |

|

|

|

443,559 |

|

|

Net loss and comprehensive loss

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(10,143 |

) |

|

|

(5,207,994 |

) |

|

|

(5,218,137 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - June 30, 2024

|

|

|

3,247,389 |

|

|

$ |

47,236,024 |

|

|

$ |

13,482,824 |

|

|

$ |

(224,791 |

) |

|

$ |

(57,626,962 |

) |

|

$ |

2,867,095 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended June 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - September 30, 2022

|

|

|

2,380,280 |

|

|

$ |

42,473,099 |

|

|

$ |

11,176,345 |

|

|

$ |

(213,602 |

) |

|

$ |

(44,044,553 |

) |

|

$ |

9,391,289 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common shares and warrants in equity offering

|

|

|

499,918 |

|

|

|

2,916,418 |

|

|

|

944,827 |

|

|

|

- |

|

|

|

- |

|

|

|

3,861,245 |

|

|

Issuance of common shares upon exercise of warrants

|

|

|

100,760 |

|

|

|

994,618 |

|

|

|

(224,087 |

) |

|

|

- |

|

|

|

- |

|

|

|

770,531 |

|

|

Issuance costs

|

|

|

- |

|

|

|

(242,948 |

) |

|

|

(28,357 |

) |

|

|

- |

|

|

|

- |

|

|

|

(271,305 |

) |

|

Share-based compensation

|

|

|

- |

|

|

|

- |

|

|

|

729,380 |

|

|

|

- |

|

|

|

- |

|

|

|

729,380 |

|

|

Net loss and comprehensive loss

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

23,415 |

|

|

|

(6,654,072 |

) |

|

|

(6,630,657 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - June 30, 2023

|

|

|

2,980,958 |

|

|

$ |

46,141,187 |

|

|

$ |

12,598,108 |

|

|

$ |

(190,187 |

) |

|

$ |

(50,698,625 |

) |

|

$ |

7,850,483 |

|

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

Edesa Biotech, Inc.

Notes to Condensed Interim Consolidated Financial Statements

(Unaudited)

1. Nature of Operations

Edesa Biotech, Inc. (the Company or Edesa) is a biopharmaceutical company focused on acquiring, developing and commercializing clinical stage drugs for inflammatory and immune-related diseases with clear unmet medical needs. The Company is organized under the laws of British Columbia, Canada and is headquartered in Markham, Ontario. It operates under its wholly owned subsidiaries, Edesa Biotech Research, Inc., an Ontario, Canada corporation, and Edesa Biotech USA, Inc., a California, USA corporation.

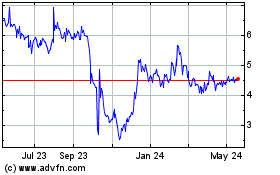

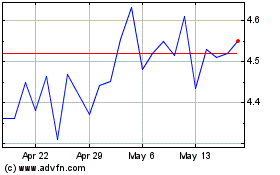

The Company’s common shares trade on The Nasdaq Capital Market in the United States under the symbol “EDSA”.

2. Basis of Presentation

The accompanying unaudited condensed interim consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (U.S. GAAP) for interim financial information and with the instructions to Form 10-Q. They do not include all information and footnotes necessary for a fair presentation of financial position, results of operations and cash flows in conformity with U.S. GAAP for complete financial statements. These unaudited condensed interim consolidated financial statements should be read in conjunction with the consolidated financial statements and related notes contained in the Company’s Annual Report on Form 10-K for the year ended September 30, 2023, which was filed with the Securities and Exchange Commission (SEC) on December 15, 2023.

The accompanying unaudited condensed interim consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany balances and transactions have been eliminated on consolidation. All adjustments (consisting of normal recurring adjustments and accruals) considered necessary for a fair presentation of the results of operations for the periods presented have been included in the interim periods. Operating results for the three and nine months ended June 30, 2024 are not necessarily indicative of the results that may be expected for other interim periods or the fiscal year ending September 30, 2024.

Use of estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period or year. Actual results could differ from those estimates. Areas where significant judgment is involved in making estimates are valuation of accounts and other receivable; valuation and useful lives of property and equipment; intangible assets; right-of-use assets; deferred income taxes; the determination of fair value of share-based compensation; the determination of fair value of warrants in order to allocate proceeds from equity issuances; and forecasting future cash flows for assessing the going concern assumption.

Functional and reporting currencies

The consolidated financial statements of the Company are presented in U.S. dollars, unless otherwise stated, which is the Company’s and its wholly owned subsidiary’s, Edesa Biotech USA, Inc., functional currency. The functional currency of the Company’s wholly owned subsidiary, Edesa Biotech Research, Inc., as determined by management, is Canadian dollars.

3. Intangible Assets

Acquired license

In April 2020, the Company entered into a license agreement with a pharmaceutical development company to obtain exclusive world-wide rights to know-how, patents and data relating to certain monoclonal antibodies (the Constructs), including sublicensing rights. Unless earlier terminated, the term of the license agreement will remain in effect for 25 years from the date of first commercial sale of licensed products containing the Constructs. Subsequently, the license agreement will automatically renew for five-year periods unless either party terminates the agreement in accordance with its terms.

Under the license agreement, the Company is exclusively responsible, at its expense, for the research, development, manufacture, marketing, distribution and commercialization of the Constructs and licensed products and to obtain all necessary licenses and rights. The Company is required to use commercially reasonable efforts to develop and commercialize the Constructs in accordance with the terms of a development plan established by the parties.

The Company has determined that the license has multiple alternative future uses in research and development projects and sublicensing in other countries or for other disease indications. The value of the acquired license is recorded as an intangible asset with amortization over the estimated useful life of 25 years and evaluation for impairment at the end of each reporting period.

The required upfront license payment of $2.5 million was paid by issuance of Series A-1 Convertible Preferred Shares, which have been fully converted to common shares. The value of the license includes acquisition legal costs. See Note 5 for license commitments.

Intangible assets, net consisted of the following:

| |

|

June 30, 2024

|

|

|

September 30, 2023

|

|

| |

|

|

|

|

|

|

|

|

|

The Constructs

|

|

$ |

2,529,483 |

|

|

$ |

2,529,483 |

|

| |

|

|

|

|

|

|

|

|

|

Less: accumulated amortization

|

|

|

(425,342 |

) |

|

|

(349,463 |

) |

| |

|

|

|

|

|

|

|

|

|

Total intangible assets, net

|

|

$ |

2,104,141 |

|

|

$ |

2,180,020 |

|

Amortization expense amounted to $0.03 million for each of the three months ended June 30, 2024 and 2023 and $0.08 million for each of the nine months ended June 30, 2024 and 2023.

Total estimated future amortization of intangible assets for each fiscal year is as follows:

|

Year Ending

|

|

|

|

|

|

September 30, 2024

|

|

|

25,293 |

|

|

September 30, 2025

|

|

|

101,172 |

|

|

September 30, 2026

|

|

|

101,172 |

|

|

September 30, 2027

|

|

|

101,172 |

|

|

September 30, 2028

|

|

|

101,172 |

|

|

Thereafter

|

|

|

1,674,160 |

|

| |

|

|

|

|

| |

|

$ |

2,104,141 |

|

4. Right-of-Use Lease with Related Party

The Company leases a facility used for executive offices from a related company. The original lease expired in December 2022 and the Company executed a two-year extension through December 2024.

The components of right-of-use lease cost were as follows:

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

June 30, 2024

|

|

|

June 30, 2023

|

|

|

June 30, 2024

|

|

|

June 30, 2023

|

|

|

Right-of-use lease cost, included in general and administrative on the Statements of Operations

|

|

$ |

19,299 |

|

|

$ |

21,188 |

|

|

$ |

59,208 |

|

|

$ |

61,530 |

|

Lease terms and discount rates were as follows:

| |

|

June 30, 2024

|

|

|

September 30,2023

|

|

|

Remaining lease term (months):

|

|

|

6 |

|

|

|

15 |

|

|

Estimated incremental borrowing rate:

|

|

|

9.2 |

% |

|

|

9.2 |

% |

The future minimum lease payments under right-of-use leases at June 30, 2024 were as follows:

|

Year Ending

|

|

|

|

|

|

September 30, 2024

|

|

$ |

19,781 |

|

|

September 30, 2025

|

|

|

19,781 |

|

| |

|

|

|

|

|

Total lease payments

|

|

|

39,562 |

|

|

Less imputed interest

|

|

|

745 |

|

| |

|

|

|

|

|

Present value of right-of-use lease liabilities

|

|

|

38,817 |

|

|

Present value included in current liabilities

|

|

|

38,817 |

|

| |

|

|

|

|

|

Present value included in long-term liabilities

|

|

$ |

- |

|

Cash flow information was as follows:

| |

|

Nine Months Ended

|

|

| |

|

June 30, 2024

|

|

|

June 30, 2023

|

|

|

Cash paid for amounts included in the measurement of right-of-use lease liabilities, included in accounts payable and accrued liabilities on the Statements of Cash Flow.

|

|

$ |

59,732 |

|

|

$ |

59,045 |

|

5. Commitments

Research and other commitments

The Company has commitments for contracted research organizations who perform clinical trials for the Company’s ongoing clinical studies and other service providers. Approximate aggregate future contractual payments at June 30, 2024 are as follows:

|

Year Ending

|

|

|

|

|

| |

|

|

|

|

|

September 30, 2024

|

|

$ |

301,000 |

|

|

September 30, 2025

|

|

|

49,000 |

|

|

September 30, 2026

|

|

|

36,000 |

|

|

September 30, 2027

|

|

|

42,000 |

|

|

September 30, 2028

|

|

|

- |

|

| |

|

|

|

|

| |

|

$ |

428,000 |

|

License and royalty commitments

In April 2020, through its Ontario subsidiary, the Company entered into a license agreement with a third party to obtain exclusive world-wide rights to the Constructs, including sublicensing rights. An intangible asset for the acquired license has been recognized. See Note 3 for intangible assets. Under the license agreement, the Company is committed to payments of up to an aggregate amount of $356 million contingent upon meeting certain milestones outlined in the license agreement, primarily relating to future potential commercial approval and sales milestones. The Company also has a commitment to pay royalties based on any net sales of products containing the Constructs in the countries where the Company directly commercializes the products containing the Constructs and a percentage of any sublicensing revenue received by the Company and its affiliates in the countries where it does not directly commercialize the products containing the Constructs. No milestone, royalty or sublicensing payments were made to the third party during the three and nine months ended June 30, 2024 and 2023.

In 2016, through its Ontario subsidiary, the Company entered into a license agreement with a third party to obtain exclusive rights to certain know-how, patents and data relating to a pharmaceutical product. The Company will use the exclusive rights to develop the product for therapeutic, prophylactic and diagnostic uses in topical dermal applications and anorectal applications. No intangible assets have been recognized under the license agreement with the third party. Under the license agreement, the Company is committed to payments of various amounts to the third party upon meeting certain milestones outlined in the license agreement, up to an aggregate amount of $18.4 million. Upon divestiture of substantially all of the assets of the Company, the Company shall pay the third party a percentage of the valuation of the licensed technology sold as determined by an external objective expert. The Company also has a commitment to pay the third party a royalty based on net sales of the product in countries where the Company, or an affiliate, directly commercializes the product and a percentage of sublicensing revenue received by the Company and its affiliates in the countries where it does not directly commercialize the product. A milestone payment of $0.04 million and $0.16 million were to the third party during the three and nine months ended June 30, 2023 and no milestone payments were made during the three and nine months ended June 30, 2024.

In March 2021, through its Ontario subsidiary, the Company entered into a license agreement with the inventor of the same pharmaceutical product to acquire global rights for all fields of use beyond those named under the 2016 license agreement. The Company is committed to remaining payments of up to an aggregate amount of $68.9 million, primarily relating to future potential commercial approval and sales milestones. In addition, if the Company fails to file an investigational new drug application or foreign equivalent (IND) for the product within a certain period of time following the date of the agreement, the Company is required to remit to the inventor a fixed license fee quarterly as long as the requirement to file an IND remains unfulfilled. For the three and nine months ended June 30, 2024, the Company recorded an expense of $25,000 and $75,000 as a result of meeting milestones outlined in the 2021 license agreement. There were no milestones achieved in the three and nine months ended June 30, 2023 and no expenses were incurred.

In June 2024, the Company’s drug candidate, EB05, was selected by the Biomedical Advanced Research and Development Authority (BARDA), part of the Administration for Strategic Preparedness and Response within the U.S. Department of Health and Human Services, for evaluation in a U.S. government-funded clinical study. The Phase 2 platform trial will be a randomized, double-blinded, placebo-controlled, multi-center U.S. clinical trial to investigate novel threat-agnostic host-directed therapeutics, including EB05, in hospitalized adult patients with ARDS due to a variety of causes. For the EB05 cohort of the study, patients will be randomized one-to-one to either EB05 plus Standard of Care (SOC) or to a placebo plus SOC control arm. The Company plans to provide drug product for the study as well as technical support. The Company is responsible for providing drug product and placebo for the Phase 2 platform trial.

6. Capital Shares

Equity offerings

On November 2, 2022, the Company completed a private placement of units consisting of 384,475 common shares, Class A warrants to purchase up to an aggregate of 192,248 common shares and Class B warrants to purchase up to an aggregate of 192,248 common shares. Net proceeds from the offering were $2.9 million, which were allocated between the relative fair values of the common shares (using a fair value of $2.7 million) and the common share purchase warrants (using a total fair value of $1.2 million). The warrants became exercisable December 23, 2022. The Class A warrants have an exercise price of $10.50 per share and will expire on December 23, 2025. The Class B warrants have an exercise price of $7.00 per share and expired on December 23, 2023. The warrants are considered contracts on the Company’s own shares and are classified as equity.

Equity distribution agreement

On March 27, 2023, the Company entered into an equity distribution agreement with Canaccord, pursuant to which the Company may offer and sell, from time to time, common shares through an at-the-market equity offering program for up to $20 million in gross proceeds, subject to certain offering limitations that currently allow the Company to offer and sell common shares having an aggregate gross sales price of up to $8.4 million. The Company has no obligation to sell any of the common shares and may at any time suspend sales or terminate the equity distribution agreement in accordance with its terms. During the nine months ended June 30, 2024, the Company sold a total of 171,916 common shares pursuant to the agreement for net proceeds of approximately $0.6 million after deducting commissions and direct costs.

Black-Scholes option valuation model

The Company uses the Black-Scholes option valuation model to determine the fair value of share-based compensation for share options and compensation warrants granted and the fair value of warrants issued. Option valuation models require the input of highly subjective assumptions including the expected price volatility. The Company calculates expected volatility based on historical volatility of the Company’s share price. When there is insufficient data available, the Company uses a peer group that is publicly traded to calculate expected volatility. The Company adopted interest-free rates by reference to the U.S. treasury yield rates. The Company calculated the fair value of share options granted based on the expected life of 5 years considering expected forfeitures during the option term of 10 years. Expected life of warrants is based on warrant terms. The Company did not and is not expected to declare any dividends. Changes in the subjective input assumptions can materially affect the fair value estimates, and therefore the existing models do not necessarily provide a reliable single measure of the fair value of the Company’s warrants and share options.

Warrants

A summary of the Company’s warrant activity is as follows:

| |

|

Number of Warrant Shares (#)

|

|

|

Weighted Average Exercise Price

|

|

|

Nine Months Ended June 30, 2024

|

|

|

|

|

|

|

|

|

|

Balance - September 30, 2023

|

|

|

720,909 |

|

|

$ |

19.51 |

|

| |

|

|

|

|

|

|

|

|

|

Expired

|

|

|

(111,192 |

) |

|

|

7.26 |

|

| |

|

|

|

|

|

|

|

|

|

Balance - June 30, 2024

|

|

|

609,717 |

|

|

$ |

21.74 |

|

| |

|

|

|

|

|

|

|

|

|

Nine Months Ended June 30, 2023

|

|

|

|

|

|

|

|

|

|

Balance - September 30, 2022

|

|

|

521,718 |

|

|

$ |

28.00 |

|

| |

|

|

|

|

|

|

|

|

|

Issued

|

|

|

384,496 |

|

|

|

8.75 |

|

|

Exercised

|

|

|

(100,760 |

) |

|

|

7.63 |

|

|

Expired

|

|

|

(4,018 |

) |

|

|

111.30 |

|

| |

|

|

|

|

|

|

|

|

|

Balance - June 30, 2023

|

|

|

801,436 |

|

|

$ |

20.93 |

|

The weighted average contractual life remaining on the outstanding warrants at June 30, 2024 is 32 months.

The following table summarizes information about the warrants outstanding at June 30, 2024:

|

Number of Warrants (#)

|

|

|

Exercise Prices

|

|

|

Expiry Dates

|

| 1,687 |

|

|

$ |

22.40 |

|

|

January 2025

|

| 173,614 |

|

|

$ |

10.50 |

|

|

December 2025

|

| 15,627 |

|

|

$ |

56.00 |

|

|

February 2026

|

| 27,399 |

|

|

$ |

31.94 |

|

|

March 2027

|

| 391,390 |

|

|

$ |

24.64 |

|

|

September 2027

|

| 609,717 |

|

|

|

|

|

|

|

The fair value of warrants granted during the nine months ended June 30, 2023 was estimated using the Black-Scholes option valuation model using the following assumptions:

| |

|

Nine Months Ended

June 30, 2023

|

| |

|

Class A Warrants

|

|

|

Class B Warrants |

|

| |

|

|

|

|

|

|

|

|

Risk free interest rate

|

|

|

4.54 |

% |

|

4.76 |

% |

|

Expected life (years)

|

|

3.14

|

|

|

1.14 |

|

|

Expected share price volatility

|

|

|

90.73 |

% |

|

89.70 |

% |

|

Expected dividend yield

|

|

|

0.00 |

% |

|

0.00 |

% |

Share options

The Company adopted an Equity Incentive Compensation Plan in 2019 (the 2019 Plan) administered by the independent members of the Board of Directors, which amended and restated prior plans. Options, restricted shares and restricted share units are eligible for grant under the 2019 Plan. The total number of shares available for issuance under the terms of the 2019 Plan is 642,737. The remaining number of shares available to grant at June 30, 2024 is 156,679.

The Company’s 2019 Plan allows options to be granted to directors, officers, employees and certain external consultants and advisers. Under the 2019 Plan, the option term is not to exceed 10 years and the exercise price of each option is determined by the independent members of the Board of Directors.

Options have been granted under the 2019 Plan allowing the holders to purchase common shares of the Company as follows:

| |

|

Number of Options (#)

|

|

|

Weighted Average Exercise Price

|

|

|

Weighted Average Grant Date Fair Value

|

|

|

Nine Months Ended June 30, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - September 30, 2023

|

|

|

420,615 |

|

|

$ |

25.60 |

|

|

$ |

18.84 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Granted

|

|

|

500 |

|

|

|

4.10 |

|

|

|

3.10 |

|

|

Forfeited

|

|

|

(2,401 |

) |

|

|

15.00 |

|

|

|

10.70 |

|

|

Expired

|

|

|

(35,674 |

) |

|

|

33.18 |

|

|

|

24.63 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - June 30, 2024

|

|

|

383,040 |

|

|

$ |

24.93 |

|

|

$ |

18.33 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended June 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - September 30, 2022

|

|

|

314,853 |

|

|

$ |

32.62 |

|

|

$ |

23.94 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Granted

|

|

|

47,571 |

|

|

|

10.01 |

|

|

|

7.49 |

|

|

Forfeited

|

|

|

(12,779 |

) |

|

|

22.96 |

|

|

|

16.38 |

|

|

Expired

|

|

|

(34 |

) |

|

|

2,129 |

|

|

|

2,129 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - June 30, 2023

|

|

|

349,611 |

|

|

$ |

29.61 |

|

|

$ |

21.77 |

|

During the three and nine months ended June 30, 2024, the independent members of the Board of Directors granted 500 employee options and no director options. During the three and nine months ended June 30, 2024 and 2023, there were no employee or director options granted. The options have a term of 10 years and an exercise price equal to the Nasdaq closing price on the grant date.

The weighted average contractual life remaining on the outstanding options at June 30, 2024 is 83 months.

The following table summarizes information about the options under the 2019 Plan outstanding and exercisable at June 30, 2024:

|

Number of Options (#)

|

|

|

Exercisable at

June 30, 2024 (#)

|

|

|

Range of Exercise Prices

|

|

|

Expiry Dates

|

| 374 |

|

|

|

374 |

|

|

$ |

246.96 - 596.82 |

|

|

June 2024 - Mar 2025

|

| 37,719 |

|

|

|

37,719 |

|

|

C$ |

15.12 |

|

|

May 2024 - Dec 2028

|

| 43,031 |

|

|

|

43,031 |

|

|

$ |

22.12 |

|

|

May 2024 - Feb 2030

|

| 51,006 |

|

|

|

51,006 |

|

|

$ |

52.08 - 56.49 |

|

|

May 2024 - Oct 2030

|

| 81,041 |

|

|

|

80,971 |

|

|

$ |

36.75 - 40.18 |

|

|

Apr 2024 - Sep 2031

|

| 58,753 |

|

|

|

48,610 |

|

|

$ |

25.97 |

|

|

Apr 2024 - Feb 2032

|

| 111,116 |

|

|

|

54,551 |

|

|

$ |

4.10 - 10.01 |

|

|

Apr 2024 - Oct 2033

|

| 383,040 |

|

|

|

316,262 |

|

|

|

|

|

|

|

The options exercisable at June 30, 2024 had a weighted average exercise price of $28.05, $22.00 intrinsic value and a weighted average remaining life of 78 months. There were 66,778 options at June 30, 2024 that had not vested with a weighted average exercise price of $10.15, $68.00 intrinsic value and a weighted average remaining life of 104 months.

The fair value of options granted during the nine months ended June 30, 2024 and 2023 was estimated using the Black-Scholes option valuation model using the following assumptions:

| |

|

Nine Months Ended

June 30, 2024

|

|

|

Nine Months Ended

June 30, 2023

|

|

| |

|

|

|

|

|

|

|

|

|

Risk free interest rate

|

|

|

4.92 |

% |

|

|

3.62% - 4.18 |

% |

|

Expected life (years)

|

|

|

5 |

|

|

|

5 |

|

|

Expected share price volatility

|

|

|

97.26 |

% |

|

|

95.3% - 97.34 |

% |

|

Expected dividend yield

|

|

|

0.00 |

% |

|

|

0.00 |

% |

The Company recorded $0.1 million and $0.1 million of share-based compensation expenses for the three months ended June 30, 2024 and 2023, respectively and $0.4 million and $0.7 million for the nine months ended June30, 2024 and 2023.

As of June 30, 2024, the Company had approximately $0.1 million of unrecognized share-based compensation expense, which is expected to be recognized over a period of 27 months.

Restricted share units (RSU)

The Company’s 2019 Plan allows restricted share units (RSUs) to be granted to directors, officers, employees and certain external consultants and advisers. Under the 2019 Plan, the RSU term is not to exceed 10 years. The fair value is based on the 5-day VWAP of the Company’s common shares up to the date of grant. The initial grant of RSUs was in August 2023. There were no RSUs granted in the comparative period.

The following is a summary of changes in the status of RSUs from October 1, 2023 through June 30, 2024:

| |

|

Number of RSU (#)

|

|

|

Weighted Average Grant Date Fair Value

|

|

|

Nine Months Ended June 30, 2024

|

|

|

|

|

|

|

|

|

|

Balance - September 30, 2023

|

|

|

33,045 |

|

|

$ |

5.60 |

|

| |

|

|

|

|

|

|

|

|

|

Granted

|

|

|

19,772 |

|

|

|

4.52 |

|

| |

|

|

|

|

|

|

|

|

|

Balance - June 30, 2024

|

|

|

52,817 |

|

|

$ |

5.20 |

|

The following table summarizes information about the RSUs under the 2019 Plan outstanding and exercisable at June 30, 2024:

| |

|

Number of RSU (#)

|

|

|

Expiry Date

|

|

Fully-vested RSUs

|

|

|

52,817 |

|

|

August 2033 - June 2034

|

All RSUs that were granted vested immediately upon the grant date. The outstanding RSUs can be converted to common shares by the holder at any time prior to the expiry date. There is no future unrecorded compensation expense for the RSUs.

7. Government Contributions

Reimbursement grant income for the Company’s federal grant with the Canadian government’s SIF is recorded based on the claim period of eligible costs.

In February 2021, the Company entered into a multi-year contribution agreement (the 2021 SIF Agreement) with the Canadian Government’s Strategic Innovation Fund. Under the 2021 SIF Agreement, the Government of Canada committed up to C$14.1 million in nonrepayable funding which was intended to support research and development related to our EB05 clinical program. No further funding will be received from the 2021 SIF Agreement.

In October 2023, the Company entered into a multi-year contribution agreement (the 2023 SIF Agreement) with the Canadian Government’s Strategic Innovation Fund. Under the 2023 SIF Agreement, the Government of Canada committed up to C$23 million in partially repayable funding toward (i) conducting and completing the Company’s Phase 3 clinical study of its experimental drug EB05 in critical-care patients with Acute Respiratory Distress Syndrome (ARDS) caused by COVID-19 or other infectious agents, (ii) submitting EB05 for governmental approvals and manufacturing scale-up, following, and subject to, completing the Phase 3 study and (iii) conducting two non-clinical safety studies to assess the potential long-term impact of EB05 exposure (the Project). Of the C$23 million committed by SIF, up to C$5.8 million is not repayable by the Company. The remaining C$17.2 million is conditionally repayable starting in 2029 only if and when the Company earns gross revenue. The repayable portion would be payable over fifteen (15) years based on a percentage rate of the Company’s annual revenue growth. The maximum amount repayable under the Agreement is 1.4 times the original repayable amount. In addition, the Company is entitled to partial reimbursement of certain eligible expenses under the Agreement.

Under the Agreement, the Company agreed to certain financial and non-financial covenants and other obligations in relation to the Project. Pursuant to the Agreement, certain customary events of default, such as the Company’s or Edesa Biotech Research’s breach of their covenants and obligations under the Agreement, their insolvency, winding up or dissolution, and other similar events, may permit the Government of Canada to declare an event of default under the Agreement. Upon an event of default, subject to applicable cure, the Government of Canada may exercise a number of remedies, including suspending or terminating funding under the Agreement, demanding repayment of funding previously received and/or terminating the Agreement.

The funding and any associated conditional repayments are not secured by any assets of Edesa Biotech Research or the Company.

The Agreement will expire on the later of December 31, 2042 or the date of the last repayment, unless earlier terminated, subject to certain provisions that extend three (3) years beyond the term or early termination of the Agreement.

Under the 2023 SIF Agreement the Company recorded grant income of $0.2 million and $0.6 million for the three and nine months ended June 30, 2024. No grant income was recorded under the 2023 SIF Agreement for the three and nine months ended June 30, 2023.

8. Financial Instruments

(a) Fair values

The Company uses the fair value measurement framework for valuing financial assets and liabilities measured on a recurring basis in situations where other accounting pronouncements either permit or require fair value measurements.

The Company follows the fair value hierarchy which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. Observable inputs are inputs that reflect assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the Company. Unobservable inputs are inputs that reflect the Company’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

There are three levels of inputs that may be used to measure fair value:

| |

●

|

Level 1 – Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets.

|

| |

●

|

Level 2 – Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs include quoted prices for similar assets or liabilities in active markets, or quoted prices for identical or similar assets and liabilities in markets that are not active.

|

| |

●

|

Level 3 – Unobservable inputs for the asset or liability that are supported by little or no market activity.

|

The carrying value of certain financial instruments such as cash and cash equivalents, accounts and other receivable, accounts payable and accrued liabilities approximates fair value due to the short-term nature of such instruments.

(b) Interest rate and credit risk

Interest rate risk is the risk that the value of a financial instrument might be adversely affected by a change in interest rates. The Company does not believe that the results of operations or cash flows would be affected to any significant degree by a significant change in market interest rates, relative to interest rates on cash and cash equivalents due to the short-term nature of these balances.

The Company is also exposed to credit risk at period end from the carrying value of its cash and cash equivalents and accounts and other receivable. The Company manages this risk by maintaining bank accounts with Canadian Chartered Banks and a U.S. banks believed to be credit worthy and money market mutual funds of U.S. government securities. The Company’s cash is not subject to any external restrictions. The Company assesses the collectability of accounts receivable through a review of the current aging and terms, as well as an analysis of historical collection rates, general economic conditions and credit status of government agencies. Credit risk for the reimbursement grant and HST refunds receivable are not considered significant since amounts are due from the Canadian government’s SIF and the Canada Revenue Agency.

(c) Foreign exchange risk