UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES

EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant

☒

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| |

|

| ☐ |

Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive Proxy Statement |

| |

|

| ☐ |

Definitive Additional Materials |

| |

|

| ☒ |

Soliciting Material under §240.14a-12 |

EMCORE Corporation

(Name of Registrant as Specified In Its Charter)

Mobix Labs, Inc.

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September 30, 2024

MOBIX LABS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40621 |

|

98-1591717 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

15420

Laguna Canyon Road, Suite 100

Irvine,

California |

|

92618 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (949) 808-8888

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class A Common Stock, par value $0.00001 per share |

|

MOBX |

|

Nasdaq

Global Market |

| Redeemable warrants, each warrant exercisable for one share of Class A Common Stock |

|

MOBXW |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events.

On

September 30, 2023, Mobix Labs, Inc. (“Mobix”) issued a press release announcing that it has submitted a non-binding proposal

to acquire all of the outstanding shares of EMCORE Corporation (“Emcore”). A copy of the press release is attached hereto

as Exhibit 99.1 and incorporated herein by reference.

No

Offer or Solicitation

This

document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of

securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification

under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the

requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional

Information and Where to Find It

This

communication does not constitute an offer to buy or solicitation of an offer to sell any securities. This communication relates to

a proposal that Mobix has made for a business combination transaction with Emcore. In furtherance of this proposal and subject to

future developments, Mobix (and, if a negotiated transaction is agreed to, Emcore) may file one or more registration statements,

proxy statements, tender offer statements or other documents with the Securities and Exchange Commission (the “SEC”).

This communication is not a substitute for any proxy statement, registration statement, tender offer statement, prospectus or other

document Mobix and/or Emcore may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF

MOBIX AND EMCORE ARE URGED TO READ THE PROXY STATEMENT(S), REGISTRATION STATEMENT, TENDER OFFER STATEMENT, PROSPECTUS AND/OR OTHER

DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. Any definitive proxy statement(s) or prospectus(es) (if and when available) will be

mailed to stockholders of Mobix and/or Emcore, as applicable. Investors and security holders will be able to obtain free copies

of these documents (if and when available) and other documents filed with the SEC by Mobix through the website maintained

by the SEC at www.sec.gov, and by visiting Mobix’s investor relations site

at https://investors.mobixlabs.com.

Participants

in the Solicitation

This

communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the

SEC. Nonetheless, Mobix and its directors and executive officers may be deemed to be participants in the solicitation of proxies in connection

with the proposed transaction. Information about the directors and executive officers of Mobix is set forth in its amendment number 1

to the registration statement on Form S-1, which was filed with the SEC on August 26, 2024. These documents can be obtained free of charge

from the sources indicated above. Additional information regarding the potential participants in the proxy solicitations and a description

of their direct and indirect interests, by security holdings or otherwise, will be contained in one or more registration statements,

proxy statements, tender offer statements or other documents filed with the SEC if and when they become available.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Mobix

Labs, Inc. |

| |

|

| Date:

September 30, 2024 |

By: |

/s/

Keyvan Samini |

| |

Name: |

Keyvan

Samini |

| |

Title: |

President

and Chief Financial Officer |

Exhibit 99.1

Mobix Labs Submits All Cash Offer to Acquire EMCORE

Corporation

Synergistic Acquisition would enhance Mobix

Labs’ competitive strength in aerospace and defense sector

Scales operations and cash flow

IRVINE, Calif.--(BUSINESS WIRE)--Sep. 30, 2024-- Mobix Labs,

Inc. (Nasdaq: MOBX) (“Mobix Labs”, “Mobix” or the “Company”), a leader in advanced wireless and

connectivity solutions for the military and defense sector, today announced it has submitted a compelling non-binding proposal to the

Board of Directors of EMCORE Corporation (Nasdaq: EMKR) (“Emcore”), the world’s largest independent provider

of inertial navigation solutions to the aerospace and defense industry, to acquire all of EMCORE’s outstanding shares for $3.80 per

share in cash.

Mobix Labs’ all cash proposed offer to the EMCORE Board represents

a more than 200% premium over EMCORE’s current stock price as of September 27, 2024. Based upon its 2022 and 2023 10-K filings, EMCORE’s

revenue in its fiscal year ending 9/30/23 grew 115% to $97 million from the prior year.

EMCORE is a leading supplier of inertial sensors and systems for land,

sea, air, and space applications in the aerospace and defense market. “We believe this proposal presents an exceptional opportunity

for EMCORE shareholders to realize immediate and significant value for their investment,” said Fabian Battaglia, CEO of Mobix

Labs. “Our recent strategic acquisitions, including EMI Solutions and RaGE Systems, have significantly strengthened our position

in the military, defense, and high-reliability electronics sector,” Battaglia added. “We believe integrating EMCORE’s products

would further accelerate our growth and innovation in critical markets.”

Mobix Labs is led by seasoned industry veterans, including Board of

Directors members James Peterson, former CEO and Chairman of Microsemi, and David Aldrich, former CEO and Chairman of Skyworks

Solutions.

Transaction Details

Mobix Labs’ proposal has the support of its Board of Directors. Mobix

Labs’ all cash offer is subject to the approval of the EMCORE Board of Directors, the execution of a definitive agreement between Mobix

Labs and EMCORE, and any shareholder approval that may be required by law.

About Mobix Labs, Inc.

At Mobix Labs, we’re committed to transforming connectivity

by partnering closely with our customers to deliver advanced semiconductor and wireless systems solutions tailored to their needs. Based

in Irvine, California, we specialize in four key areas; EMI Interconnect Solutions for secure aerospace and GPS systems, Active Optical

Cables (AOC) for high-speed AI datacenter interconnects, 5G IC Solutions for mmWave communications, and Wireless Systems Solutions, including

joint design and manufacturing services for RF technologies, serving customers in 5G, radar, and imaging sensors. Through deep collaboration

and innovation, we’re shaping the future of connectivity. Visit mobixlabs.com and follow us on LinkedIn.

Mobix Labs, the logo, and SMART™ Edge Device are among the trademarks

of Mobix Labs. Other trademarks are the property of their respective owners.

Forward-looking Information

This press release and the related earnings call contain “forward-looking

statements” regarding the intent, beliefs or current expectations of the Company for purposes of the federal securities laws. These

forward-looking statements include, but are not limited to, statements regarding Mobix Labs, Inc. and Mobix Labs, Inc.’s

management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intends,”

“may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,”

“should,” “will,” “would,” “poised” and similar expressions may identify forward-looking

statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this presentation

and discussion may include, for example, statements regarding our proposal to acquire EMCORE, the value to EMCORE shareholders, the expected

per-share price, and the expected synergies and operations of the companies on a combined basis. These forward-looking statements are

based on information available as of the date of this presentation and discussion, and current expectations, forecasts and assumptions,

and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing

our views as of any subsequent date, and we undertake no obligations to update forward-looking statements to reflect events or circumstances

after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable

securities laws.

As a result of a number of known and unknown risks and uncertainties, our

actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors

that could cause actual results to differ include the outcome of discussions between Mobix Labs and EMCORE with respect to a

proposed transaction, including the possibility that the parties may not agree to pursue a business combination or that the terms of any

transaction will be materially different from those described herein; our ability to consummate the proposed acquisition or achieve the

expected synergies and/or efficiencies; our ability to consummate the financing to acquire the EMCORE shares; potential regulatory delays;

the industry and market reaction to our proposal to acquire EMCORE; the effect of the announcement of the proposed transaction on the

ability of Mobix Labs and EMCORE to operate their businesses and retain and hire key personnel and to maintain favorable business

relationships; the possibility that the integration of EMCORE may be more difficult, time-consuming or costly than expected or that operating

costs and business disruptions may be greater than expected; the risk that the price of our securities may be volatile due to a variety

of factors, including changes in the highly competitive industries in which we operate, variations in performance across competitors,

changes in laws, regulations, technologies, the global supply chain, and macro-economic and social environments affecting our business;

our ability to regain compliance and maintain our listing of securities on Nasdaq; the risks concerning our ability to continue as a going

concern; the inability to meet future capital requirements and risks related to our ability to raise additional capital including potential

dilution to our stockholders; the risk that we are unable to successfully commercialize our products and solutions, or experience significant

delays in doing so; the risk that we may not be able to generate income from operations in the foreseeable future; the risk that we experience

difficulties in managing our growth and expanding operations; the risk that we may not be able to consummate planned strategic acquisitions,

or fully realize anticipated benefits or capture synergies from past or future acquisitions or investments; the risk that we may be unable

to successfully defend ourselves in ongoing litigation or that additional actions may be commenced against us; the risk that our patent

applications may not be approved or may take longer than expected, and we may incur substantial costs in enforcing and protecting our

intellectual property; the risk of being an early stage company and that our limited operating history may make it difficult to evaluate

our future prospects and the risks and challenges that we may encounter; the risk that we cannot predict whether we will maintain revenue

growth; the risk that the markets for our products and solutions are highly competitive; the risk that future sales of our Class A Common

Stock may cause the market price of our Class A Common Stock to drop significantly, even if our business is doing well; and inflation

and unfavorable global economic conditions could adversely affect our business. In addition, these forward-looking statements and the

information in this press release are qualified in their entirety by cautionary statements and risk factor disclosures contained in the

Company’s Securities and Exchange Commission (“SEC”) filings, including the Company’s prospectus filed

on August 29, 2024, its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, its Quarterly Report on Form 10-Q

for the quarter ended March 31, 2024 and any subsequent SEC filings. All forward-looking statements in this press

release are based on information available to us on the date hereof, and we assume no obligation to update such statements.

No Offer or Solicitation

This press release shall not constitute an offer to sell or the solicitation

of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale

would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as

amended.

This press release is also not a solicitation of a proxy nor a substitute

for any proxy statement or other filings that may be made with the SEC. Nonetheless, Mobix Labs and its directors and executive

officers may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about

the directors and executive officers of Mobix Labs is set forth in the prospectus filed with the SEC on August

29, 2024. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the potential

participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will

be contained in one or more proxy statements, or other documents filed with the SEC if and when they become available.

Additional Information and Where to Find It

This press release relates to a proposal that Mobix Labs has

made to acquire EMCORE. In furtherance of this proposal and subject to future developments, Mobix Labs and EMCORE may file one

or more proxy statements or other documents with the SEC. This press release is not a substitute for any proxy statement or other

document Mobix Labs and/or EMCORE may file with the SEC in connection with the proposed transaction. INVESTORS AND

SECURITY HOLDERS OF MOBIX LABS AND EMCORE ARE URGED TO READ THE PROXY STATEMENT(S), AND/OR OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY

IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Any definitive

proxy statement(s) (if and when available) will be mailed to security holders of Mobix Labs and/or EMCORE, as applicable. Investors

and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Mobix

Labs through the website maintained by the SEC at www.sec.gov, and by visiting Mobix Labs’ investor relations

site at https://investors.mobixlabs.com.

Media Contact:

Jeff Fox, The Blueshirt Group

jeff@blueshirtgroup.com

Investor Contact:

Lori Barker, The Blueshirt Group

lori@blueshirtgroup.com

Source: Mobix Labs, Inc.

3

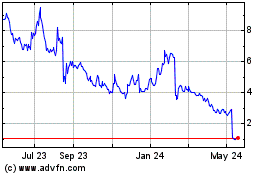

EMCORE (NASDAQ:EMKR)

Historical Stock Chart

From Nov 2024 to Dec 2024

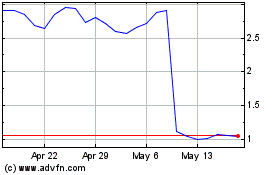

EMCORE (NASDAQ:EMKR)

Historical Stock Chart

From Dec 2023 to Dec 2024