NCR Rolls Out 85 Cinema Kiosk - Analyst Blog

April 11 2013 - 12:41PM

Zacks

In an effort to establish itself as a primary provider of cash

delivery and payment system solutions, NCR

Corporation (NCR) is consistently introducing new products

and expanding the scope of old ones. The latest product from this

company is the NCR slim line 85 for cinema.

This is basically a kiosk providing automated ticketing, from

which consumers can buy tickets using mobile devices such as

tablets. Moreover, moviegoers can also obtain tickets at a

consessional rate.

The all-new 32-inch touch-screen can display multi-media of

movie art and trailers during the ticket-buying process.

NCR is providing services across different industries to

diversify its portfolio of products and engage in business with

customers across the globe. The Slimline 85 enhances the

movie-going experience of the theater goers, while it also builds a

better brand loyalty by making the ticket purchase easy.

The higher visibility, self-service capabilities and consistent

promotion of key items will help the company to improve sales.

As per IBIS World’s Mar 2013 report on movie theaters in the

U.S., apart from being hit by recession, the movie theater industry

has also suffered setbacks amounting to $14.5 billion over the past

5 years due to increasing competition.

NCR is slowly adapting to some new expansion strategies for its

indirect business, which spans across the retail, financial

services, travel and healthcare sectors. These strategies are

likely to aid the company’s penetration in different global

markets.

NCR’s focus is on providing innovation, growing its business on

a region-by-region basis and building excellent infrastructure to

attract more business. The company’s partners have helped it build

its customer base by offering its products across the globe.

NCR is also exploring opportunities in the growing markets of

the Asia-Pacific, and the Middle East and Africa, which are

expecting strong growth. Thus, these regions appear to be apt for

companies like NCR to focus on.

On the other hand, as more players are introducing new products,

competition is increasing. NCR’s broad exposure and years of

experience in the ATM space is encouraging and could help it stay

ahead of its traditional competitors Diebold Inc.

(DBD) and Wincor Nixdorf.

Currently, NCR Corp. has a Zacks Rank #2 (Buy). Investors can

also consider other technology stocks such as Faro Tech

Inc. (FARO) and Orbotech Ltd. (ORBK),

both carrying a Zacks Rank #1 (Strong Buy).

DIEBOLD INC (DBD): Free Stock Analysis Report

FARO TECH INC (FARO): Free Stock Analysis Report

NCR CORP-NEW (NCR): Free Stock Analysis Report

ORBOTECH LTD (ORBK): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

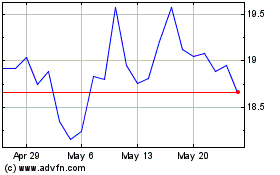

FARO Technologies (NASDAQ:FARO)

Historical Stock Chart

From Jun 2024 to Jul 2024

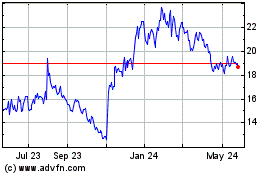

FARO Technologies (NASDAQ:FARO)

Historical Stock Chart

From Jul 2023 to Jul 2024