Facebook's Libra Bets It Can Bank the Unbanked

August 22 2019 - 6:29AM

Dow Jones News

By Paul Vigna

Facebook Inc. has an ambitious goal for its proposed

cryptocurrency, Libra: to bring financial services to the hundreds

of millions of people world-wide who don't use banks or other

traditional institutions. The cryptocurrency sector has for years

tried to do the same and failed.

In the decade since bitcoin was born, cryptocurrencies have

fascinated investors and speculators. But the crypto industry has

struggled to get consumers to use it for daily transactions, and

the bar for reaching unbanked adults in particular could be even

higher.

The unbanked represent a big potential customer base for crypto:

Roughly 1.7 billion adults around the world don't have an account

at a financial institution or through a mobile money provider,

according to the World Bank.

But getting people to use a new monetary standard requires more

than just the underlying software. It calls for erecting

infrastructure that allows people to easily use cryptocurrencies,

working with governments and tailoring services to local cultures

and customs.

Elizabeth Rossiello learned that lesson on the ground. She

founded payments processor BitPesa in 2014 with a plan to use

bitcoin as the underlying technology for a new, digital remittance

business. With a background in microfinance and banking, she had

experience, connections and backing.

The Queens, N.Y.-born Ms. Rossiello moved her company and family

to Nairobi, Kenya, and tried to build her network from the ground

up. She had staffers in London sign up Kenyan immigrants looking to

send money back home. BitPesa launched through a partnership with

M-Pesa, the local and dominant mobile money network. Ms.

Rossiello's company charged a flat rate of 3%, and users got their

money nearly instantly.

But BitPesa struggled to gain popularity. Only a handful of

businesses around the world accept bitcoin. Learning how to

acquire, store and use it is still too convoluted for most people

-- and all but impossible for those who don't have internet

access.

"It's very difficult to build frontier-market currency

products," Ms. Rossiello said.

Libra will have one big advantage: Facebook is the largest

social network with more than 2 billion users, so the proposed

cryptocurrency will easily be able to get in front of a huge pool

of potential consumers.

It couldn't be determined how many Facebook users are unbanked,

but the opportunity could be significant. Facebook executive David

Marcus, during a July congressional hearing, said fees were the

biggest problem for the unbanked. With Libra, he said, "anyone with

a $40 smartphone" would have access to affordable financial

services.

The unbanked aren't a monolithic group, though. Another issue is

understanding local conditions. That was a problem for many bitcoin

promoters who wanted to infuse the cryptocurrency around the world

but stay in Silicon Valley.

In Mexico, for example, more than half of all workers are in

what is known as the "informal economy," according to Mexico's

National Institute of Statistics and Geography. They often run or

work for small, cash-based businesses.

"You have this vicious cycle in which people are barely

surviving, they can't afford taxes, don't want to use bank

accounts, and because of that, accept only cash," said Adalberto

Flores, the chief executive of Kueski, a Guadalajara, Mexico-based

financial-services startup.

Moving those workers to a digital currency where every

transaction can be recorded, stored and taxed will be a challenge.

"They know the government will track their expenses and demand

taxes," Mr. Flores said.

Governments themselves could be another roadblock. Facebook and

the Libra Association, the Swiss-based nonprofit that will govern

the currency, have committed to expanding the network only to

countries that allow the use of cryptocurrencies. The governments

of some of Facebook's largest markets, though, aren't sold on

crypto's benefits.

While the U.S. appears to have a relatively open stance on

cryptocurrencies, it hasn't passed any comprehensive laws that

would provide regulatory clarity. Two congressional hearings in

July also made it clear that a number of lawmakers were very

concerned about Libra.

Two other large nations, India and Indonesia, may be even harder

to please. India has appeared eager to ban cryptocurrencies, and

Indonesia outlawed them for payments, though they remain legal for

trading there.

Those three countries are Facebook's largest markets, according

to research firm Statista.

Write to Paul Vigna at paul.vigna@wsj.com

(END) Dow Jones Newswires

August 22, 2019 07:14 ET (11:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

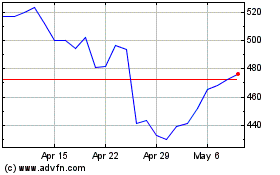

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2024 to May 2024

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From May 2023 to May 2024