U.S. commercial launch of RYTELO™ (imetelstat)

began in June 2024 for patients with lower-risk myelodysplastic

syndromes (LR-MDS) with transfusion-dependent anemia who are

relapsed/refractory to or ineligible for erythropoiesis-stimulating

agents (ESAs), regardless of ring sideroblast (RS) status

NCCN Guidelines® updated to include the

use of RYTELO in both RS+ and RS- patients for second-line

treatment of symptomatic anemia in patients with lower-risk MDS and

for first-line treatment of patients who are ESA ineligible (serum

EPO >500 mU/mL)

Geron Corporation (Nasdaq: GERN), a commercial-stage

biopharmaceutical company aiming to change lives by changing the

course of blood cancer, today reported financial results and

business highlights for the second quarter of 2024.

“We are thrilled to have begun the launch of RYTELO, our first

commercial product, in June, and are encouraged by the early

success we are seeing and the reception from the medical community

over these first six weeks," said John A. Scarlett, M.D., Geron’s

Chairman and Chief Executive Officer. "Our field teams have

mobilized efficiently and have already interacted with

approximately 60% of our top decile 1-4 accounts across the

community and academic settings. This has contributed to gratifying

uptake – as of July 31, 2024, we estimate that approximately 160

patients have received RYTELO, which is encouraging given the very

early stage of this launch. Further, the MDS NCCN Guidelines, which

guide clinical decision-making, prescriber behavior and

reimbursement decisions, were updated at the end of July to include

RYTELO as a Category 1 and 2A treatment of symptomatic anemia in

patients with lower-risk MDS. With the introduction of RYTELO as a

new therapeutic option, we are seeing increasing dialogue among

hematologists rethinking treatment approaches for eligible patients

with lower-risk MDS with transfusion-dependent anemia, regardless

of ring sideroblast status, and we believe that RYTELO can become

part of the standard-of-care for these patients.”

Business Highlights

- Received approval on June 6, 2024 from the U.S. Food & Drug

Administration (FDA) of RYTELO for the treatment of adult patients

with low- to intermediate-1 risk myelodysplastic syndromes (LR-MDS)

with transfusion-dependent (TD) anemia requiring four or more red

blood cell units over eight weeks who have not responded to or have

lost response to or are ineligible for erythropoiesis-stimulating

agents (ESAs).

- Launched RYTELO commercially in the U.S., with both dosage

strengths available for prescribers to order from specialty

distributors as of June 27, 2024.

- The National Comprehensive Cancer Network® (NCCN®) updated the

MDS NCCN Clinical Practice Guidelines in Oncology (NCCN

Guidelines®) to include RYTELO for the treatment of symptomatic

anemia in patients with LR-MDS. For both RS+ and RS- patients,

RYTELO has a Category 1 designation for second-line treatment

regardless of first-line treatment and a Category 2A designation

for first-line treatment of patients who are ESA ineligible (serum

EPO >500 mU/mL).

- Achieved approximately 70% enrollment in the Phase 3 IMpactMF

trial of imetelstat as of August 2024, which has a primary endpoint

of overall survival, in patients with myelofibrosis (MF) who are

relapsed/refractory to JAK-inhibitors. As previously disclosed,

based on the most recent planning assumptions for enrollment and

death rates in the trial, an interim analysis is expected in early

2026 (when approximately 35% of planned enrolled patients have

died) and final analysis is expected in early 2027 (when

approximately 50% of planned enrolled patients have died).

- Expanded the dose level 4 cohort (imetelstat 9.4 mg/kg) in the

Part 1 dose-finding stage of the Phase 1 IMproveMF study evaluating

imetelstat as a combination therapy with ruxolitinib in patients

with frontline MF. This followed a unanimous decision by the

study’s Safety Evaluation Team (SET), who in July 2024 reviewed

data from the first three patients in the dose level 4 cohort and

identified no dose-limiting toxicities.

Second Quarter 2024 Financial Results

As of June 30, 2024 the Company had approximately $430.4 million

in cash, cash and equivalents and marketable securities.

Net Loss

For the three and six months ended June 30, 2024, the Company

reported a net loss of $67.4 million, or $0.10 per share, and

$122.8 million, or $0.19 per share, respectively, compared to $49.2

million, or $0.09 per share and $87.3 million, or $0.16 per share,

respectively, for the three and six months ended June 30, 2023.

Revenues

Total product revenue, net for the three and six months ended

June 30, 2024, was approximately $780,000.

Total net revenues for the three and six months ended June 30,

2024, were $882,000 and $1.2 million, compared to $29,000 and

$50,000 for the same periods in 2023. The increase in revenue is

due to product revenue from U.S. sales of RYTELO, which was

available for prescribers to order from specialty distributors as

of June 27, 2024.

Operating Expenses

Total operating expenses for the three and six months ended June

30, 2024 were $70.2 million and $126.7 million, compared to $52.0

million and $92.1 million for the same periods in 2023.

Cost of goods sold was approximately $17,000 for the three and

six months ended June 30, 2024, which consisted of costs to

manufacture and distribute RYTELO.

Research and development expenses for the three months and six

months ended June 30, 2024 were $30.8 million and $60.2 million,

respectively, and $35.5 million and $62.7 million, for the same

periods in 2023. The decrease is primarily due to IMerge Phase 3

operations moving into the long-term follow-up stage.

Selling, general and administrative expenses for the three and

six months ended June 30, 2024 were $39.4 million, and $66.5

million, respectively, and $16.5 million and $29.4 million for the

same periods in 2023. The increase in selling, general and

administrative expenses primarily reflects higher commercial launch

expenses, increases in headcount and stock-based compensation

expense recognized due to the vesting of performance-based stock

options upon FDA approval of RYTELO.

Interest income was $5.3 million and $9.6 million for the three

and six months ended June 30, 2024, compared to $4.7 million and

$8.6 million for the same periods in 2023. The increase in interest

income primarily reflects a larger marketable securities portfolio

with the receipt of net cash proceeds from the underwritten

offering completed in March 2024, as well as higher yields from

recent marketable securities purchases.

Interest expense was $3.3 million and $6.8 million for the three

and six months ended June 30, 2024, compared to $2.0 million and

$3.9 million for the same periods in 2023. The increase in interest

expense primarily reflects rising interest rates. Currently, we

have $80.0 million in principal debt outstanding. Interest expense

reflects interest owed under the loan agreement, as well as

amortization of associated debt issuance costs and debt discounts

using the effective interest method and accrual for an end of term

charge.

2024 Financial Guidance

For fiscal year 2024, we expect total operating expenses to be

in the range of approximately $270 million to $280 million, which

includes non-cash items such as stock-based compensation expense,

amortization of debt discounts and issuance costs, and depreciation

and amortization.

Based on our current operating plans and assumptions, we believe

that our existing cash, cash equivalents, and marketable

securities, together with projected revenues from U.S. sales of

RYTELO, will be sufficient to fund our projected operating

requirements into the second quarter of 2026.

As of June 30, 2024, we had 220 full-time employees. We plan to

grow to a total of approximately 230-260 employees by year-end

2024.

Conference Call

Geron will host a conference call at 8:00 a.m. ET on Thursday,

August 8, 2024, to discuss business updates and second quarter

financial results.

A live webcast of the conference call and related presentation

will be available on the Company’s website at

www.geron.com/investors/events. An archive of the webcast will be

available on the Company’s website for 30 days.

Participants may access the webcast by registering online using

the following link, https://events.q4inc.com/attendee/182024239

About RYTELO (imetelstat)

RYTELO (imetelstat) is an FDA-approved oligonucleotide

telomerase inhibitor for the treatment of adult patients with

low-to-intermediate-1 risk myelodysplastic syndromes (LR-MDS) with

transfusion-dependent anemia requiring four or more red blood cell

units over eight weeks who have not responded to or have lost

response to or are ineligible for erythropoiesis-stimulating agents

(ESAs). It is indicated to be administered as an intravenous

infusion over two hours every four weeks.

RYTELO is a first-in-class treatment that works by inhibiting

telomerase enzymatic activity. Telomeres are protective caps at the

end of chromosomes that naturally shorten each time a cell divides.

In LR-MDS, abnormal bone marrow cells often express the enzyme

telomerase, which rebuilds those telomeres, allowing for

uncontrolled cell division. Developed and exclusively owned by

Geron, RYTELO is the first and only telomerase inhibitor approved

by the U.S. Food and Drug Administration.

Geron aims to ensure broad access to RYTELO for eligible

patients. Accordingly, our REACH4RYTELO™ Patient Support Program

provides a range of resources that support access and affordability

to eligible patients prescribed RYTELO.

About Geron

Geron is a commercial-stage biopharmaceutical company aiming to

change lives by changing the course of blood cancer. Our

first-in-class telomerase inhibitor RYTELO (imetelstat) is

FDA-approved for the treatment of adult patients with lower-risk

MDS with transfusion dependent anemia. We are also conducting a

pivotal Phase 3 clinical trial of imetelstat in JAK-inhibitor

relapsed/refractory myelofibrosis (R/R MF), as well as studies in

other hematologic malignancies. Inhibiting telomerase activity,

which is increased in malignant stem and progenitor cells in the

bone marrow, aims to potentially reduce proliferation and induce

death of malignant cells. To learn more, visit www.geron.com or

follow us on LinkedIn.

About IMpactMF Phase 3

IMpactMF is an open label, randomized, controlled Phase 3

clinical trial with registrational intent. The trial is designed to

enroll approximately 320 patients with intermediate-2 or high-risk

myelofibrosis (MF) who are relapsed after or refractory to prior

treatment with a JAK inhibitor, also referred to as

relapsed/refractory MF. Patients will be randomized to receive

either imetelstat or best available therapy. The primary endpoint

is overall survival (OS). Key secondary endpoints include symptom

response, spleen response, progression free survival, complete

remission, partial remission, clinical improvement, duration of

response, safety, pharmacokinetics, and patient reported outcomes.

IMpactMF is currently enrolling patients. For further information

about IMpactMF, including enrollment criteria, locations and

current status, visit ClinicalTrials.gov/study/NCT04576156.

About IMproveMF

IMproveMF is a single arm, open label, two-part Phase 1 study to

evaluate the safety, pharmacokinetics, pharmacodynamics and

clinical activity of imetelstat in combination with ruxolitinib as

a frontline treatment in patients with intermediate-2 or high-risk

MF (frontline MF). In both parts, patients will receive ruxolitinib

followed by imetelstat, a dosing schedule that showed synergistic

and additive effects of the two agents in preclinical experiments.

Part 1 will enroll up to 20 frontline MF patients who, at the time

of enrollment, have received an optimized dose of ruxolitinib, to

which imetelstat treatment will be added at increasing dose levels

based on safety and tolerability. The primary purpose of Part 1 is

to identify a safe dose for treating frontline MF patients with a

combination of imetelstat and ruxolitinib. If a safe dose is

identified in Part 1, participants in Part 2 will be JAK inhibitor

naïve and will receive treatment with ruxolitinib after screening

and enrollment at a starting dose based on standard-of-care or

local prescribing information. Treatment with single-agent

ruxolitinib will continue for at least 12 weeks, including four

consecutive weeks at a stable dose prior to the addition of

imetelstat. Part 2 is designed to confirm the safety profile of

imetelstat in combination with ruxolitinib and to evaluate for

preliminary clinical activity of the combination.

IMPORTANT SAFETY INFORMATION ABOUT RYTELO

WARNINGS AND PRECAUTIONS

Thrombocytopenia

RYTELO can cause thrombocytopenia based on laboratory values. In

the clinical trial, new or worsening Grade 3 or 4 decreased

platelets occurred in 65% of patients with MDS treated with

RYTELO.

Monitor patients with thrombocytopenia for bleeding. Monitor

complete blood cell counts prior to initiation of RYTELO, weekly

for the first two cycles, prior to each cycle thereafter, and as

clinically indicated. Administer platelet transfusions as

appropriate. Delay the next cycle and resume at the same or reduced

dose, or discontinue as recommended.

Neutropenia

RYTELO can cause neutropenia based on laboratory values. In the

clinical trial, new or worsening Grade 3 or 4 decreased neutrophils

occurred in 72% of patients with MDS treated with RYTELO.

Monitor patients with Grade 3 or 4 neutropenia for infections,

including sepsis. Monitor complete blood cell counts prior to

initiation of RYTELO, weekly for the first two cycles, prior to

each cycle thereafter, and as clinically indicated. Administer

growth factors and anti-infective therapies for treatment or

prophylaxis as appropriate. Delay the next cycle and resume at the

same or reduced dose, or discontinue as recommended.

Infusion-Related Reactions

RYTELO can cause infusion-related reactions. In the clinical

trial, infusion-related reactions occurred in 8% of patients with

MDS treated with RYTELO; Grade 3 or 4 infusion-related reactions

occurred in 1.7%, including hypertensive crisis (0.8%). The most

common infusion-related reaction was headache (4.2%).

Infusion-related reactions usually occur during or shortly after

the end of the infusion.

Premedicate patients at least 30 minutes prior to infusion with

diphenhydramine and hydrocortisone as recommended and monitor

patients for one hour following the infusion as recommended. Manage

symptoms of infusion-related reactions with supportive care and

infusion interruptions, decrease infusion rate, or permanently

discontinue as recommended.

Embryo-Fetal Toxicity

RYTELO can cause embryo-fetal harm when administered to a

pregnant woman. Advise pregnant women of the potential risk to a

fetus. Advise females of reproductive potential to use effective

contraception during treatment with RYTELO and for 1 week after the

last dose.

ADVERSE REACTIONS

Serious adverse reactions occurred in 32% of patients who

received RYTELO. Serious adverse reactions in >2% of patients

included sepsis (4.2%) and fracture (3.4%), cardiac failure (2.5%),

and hemorrhage (2.5%). Fatal adverse reactions occurred in 0.8% of

patients who received RYTELO, including sepsis (0.8%).

Most common adverse reactions (≥10% with a difference between

arms of >5% compared to placebo), including laboratory

abnormalities, were decreased platelets, decreased white blood

cells, decreased neutrophils, increased AST, increased alkaline

phosphatase, increased ALT, fatigue, prolonged partial

thromboplastin time, arthralgia/myalgia, COVID-19 infections, and

headache.

Please see RYTELO (imetelstat) full Prescribing Information,

including Medication Guide, available at

https://pi.geron.com/products/US/pi/rytelo_pi.pdf.

Use of Forward-Looking Statements

Except for the historical information contained herein, this

press release contains forward-looking statements made pursuant to

the “safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. Investors are cautioned that such statements,

include, without limitation, those regarding: (i) the Company’s

views, estimates and expectations concerning the commercial launch

of RYTELO, including estimates of accounts reached and patients

receiving RYTELO; (ii) the potential impact on clinical

decision-making, prescriber behavior and reimbursement decisions of

the inclusion of RYTELO in the NCCN Guidelines as a Category 1 and

2A treatment of symptomatic anemia in patients with lower-risk MDS;

(iii) the Company seeing increasing dialogue among hematologists

rethinking treatment approaches for eligible patients with

lower-risk MDS with transfusion-dependent anemia, regardless of

ring sideroblast status, and the Company’s belief that RYTELO can

become part of the standard-of-care for these patients; (iv) that

the interim analysis of IMpactMF is expected in early 2026 and the

final analysis is expected in early 2027; (v) the Company’s

projections and expectations regarding the sufficiency of its cash

resources and expected available resources to fund its projected

operating requirements into Q2 2026, and the assumptions underlying

such projections and expectations; (vi) the Company’s projections

for total operating expenses for fiscal 2024 and employee headcount

as of the end of 2024; (vii) that inhibiting telomerase activity

aims to potentially reduce proliferation and induce death of

malignant cells; (viii) that Geron aims to ensure broad access to

RYTELO; (ix) that IMpactMF has registrational intent; and (x) other

statements that are not historical facts, constitute

forward-looking statements. These forward-looking statements

involve risks and uncertainties that can cause actual results to

differ materially from those in such forward-looking statements.

These risks and uncertainties, include, without limitation, risks

and uncertainties related to: (a) whether Geron is successful in

commercializing RYTELO (imetelstat) for the treatment of patients

with LR-MDS with transfusion dependent anemia; (b) whether Geron

overcomes potential delays and other adverse impacts caused by

enrollment, clinical, safety, efficacy, technical, scientific,

intellectual property, manufacturing and regulatory challenges in

order to have the financial resources for and meet expected

timelines and planned milestones; (c) whether regulatory

authorities permit the further development of imetelstat on a

timely basis, or at all, without any clinical holds; (d) whether

any future safety or efficacy results of imetelstat treatment cause

the benefit-risk profile of imetelstat to become unacceptable; (e)

whether imetelstat actually demonstrates disease-modifying activity

in patients and the ability to target the malignant stem and

progenitor cells of the underlying disease; (f) that Geron may seek

to raise substantial additional capital in order to continue the

development and commercialization of imetelstat; (g) whether Geron

meets its post-marketing requirements and commitments in the U.S.

for RYTELO for the treatment of patients with LR-MDS with

transfusion dependent anemia; (h) whether there are failures or

delays in manufacturing or supplying sufficient quantities of

imetelstat or other clinical trial materials that impact

commercialization of RYTELO for the treatment of patients with

LR-MDS with transfusion dependent anemia or the continuation of the

IMpactMF trial; (i) that the projected timing for the interim and

final analyses of the IMpactMF trial may vary depending on actual

enrollment and death rates in the trial; and (j) whether the EMA

will approve RYTELO for the treatment of patients with LR-MDS with

transfusion dependent anemia and whether the FDA and EMA will

approve imetelstat for other indications on the timelines expected,

or at all. Additional information on the above risks and

uncertainties and additional risks, uncertainties and factors that

could cause actual results to differ materially from those in the

forward-looking statements are contained in Geron’s filings and

periodic reports filed with the Securities and Exchange Commission

under the heading “Risk Factors” and elsewhere in such filings and

reports, including Geron’s quarterly report on Form 10-Q for the

quarter ended March 31, 2024, and subsequent filings and reports by

Geron. Undue reliance should not be placed on forward-looking

statements, which speak only as of the date they are made, and the

facts and assumptions underlying the forward-looking statements may

change. Except as required by law, Geron disclaims any obligation

to update these forward-looking statements to reflect future

information, events, or circumstances.

Financial table follows.

GERON CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

Three Months Ended

Six Months Ended

June 30,

June 30,

(In thousands, except share and per share

data)

2024

2023

2024

2023

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

Revenues:

Product revenue, net

$

780

$

-

$

780

$

-

Royalties

102

29

406

50

882

29

1,186

50

Operating expenses:

Cost of goods sold

17

-

17

-

Research and development

30,779

35,490

60,152

62,709

Selling, general and administrative

39,419

16,490

66,484

29,384

Total operating expenses

70,215

51,980

126,653

92,093

Loss from Operations

(69,333

)

(51,951

)

(125,467

)

(92,043

)

Interest income

5,332

4,738

9,571

8,591

Interest expense

(3,319

)

(2,003

)

(6,752

)

(3,925

)

Other income and (expense), net

(63

)

(11

)

(125

)

28

Net loss

$

(67,383

)

$

(49,227

)

$

(122,773

)

$

(87,349

)

Basic and diluted net loss per

share:

Net loss per share

$

(0.10

)

$

(0.09

)

$

(0.19

)

$

(0.16

)

Shares used in computing net loss per

share

653,904,978

547,280,946

628,699,214

553,772,809

CONDENSED CONSOLIDATED BALANCE

SHEETS

June 30,

December 31,

(In thousands)

2024

2023

(Unaudited)

(Note 1)

Current assets:

Cash, cash equivalents and restricted

cash

$

118,068

$

71,138

Current marketable securities

245,789

263,676

Other current assets

9,451

6,534

Total current assets

373,308

341,348

Noncurrent marketable securities

66,505

43,298

Property and equipment, net

1,626

1,177

Deposits and other assets

7,960

8,253

$

449,399

$

394,076

Current liabilities

$

103,540

$

108,070

Noncurrent liabilities

39,164

38,057

Stockholders’ equity

306,695

247,949

$

449,399

$

394,076

Note 1: Derived from audited financial

statements included in the Company’s annual report on Form 10-K for

the year ended December 31, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808881582/en/

Aron Feingold Vice President, Investor Relations and Corporate

Communications

Kristen Kelleher Associate Director, Investor Relations and

Corporate Communications

investor@geron.com media@geron.com

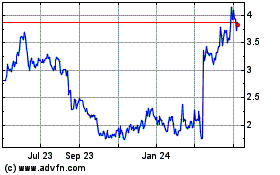

Geron (NASDAQ:GERN)

Historical Stock Chart

From Nov 2024 to Dec 2024

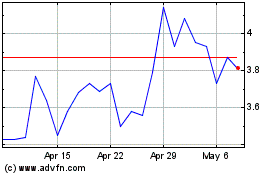

Geron (NASDAQ:GERN)

Historical Stock Chart

From Dec 2023 to Dec 2024