Golden Matrix Group Inc. (NASDAQ: GMGI) is delighted to announce

that its subsidiary, Meridian Gaming Brasil SPE LTDA (CNPJ:

56.195.600/0001-07), has successfully passed another crucial round

of Brazil’s exclusive licensing process for sports betting and

iGaming.

As one of only 89 companies selected at the Federal level,

Meridian Gaming Brasil remains well-positioned to continue

operating nationwide during the adaptation period, which extends

until December 31, 2024.

This shortlist, released by the Brazilian Ministry of Finance,

narrows the pool of companies eligible to operate in a market

projected to reach around $2.2 billion in 2024. The Brazilian

gambling industry is forecasted to generate $34 billion in sports

betting turnover by 2028, with an onshore gross win of $2.8

billion, according to a report by the International Betting

Integrity Association (IBIA).

This licensing process will grant GMGI’s subsidiary Meridianbet

nationwide access to the Brazilian market, allowing the company to

tap into the country’s rapidly expanding market and reach a diverse

and eager audience.

Meridian Gaming Brasil’s proprietary platform, thoroughly tested

for compliance, along with its robust marketing plans and

responsible gambling standards and policies, have helped secure its

place among the newly shortlisted operators.

Brian Goodman, CEO of Golden Matrix, commented, "Passing this

additional round reaffirms Meridian Gaming Brasil’s technological

and operational leadership in the rapidly evolving Brazilian

market. With our state-of-the-art platform, comprehensive marketing

strategies and unwavering focus on responsible gambling, we are

well-equipped to capture significant market share in what is

forecasted to become one of the world’s largest gaming

markets.”

Meridianbet’s application includes both sports betting and

iGaming under Brazil’s comprehensive licensing regime, positioning

it as one of the few operators capable of offering a full suite of

gaming experiences to Brazilian players.

For more information about the Brazilian licensing process or to

view the official list of shortlisted companies, visit the

Brazilian Ministry of Finance website at the following link.

About Golden Matrix Group

Golden Matrix Group, based in Las Vegas, NV, is an established

B2B and B2C gaming technology company operating across multiple

international markets. The B2B division of Golden Matrix develops

and licenses proprietary gaming platforms for its extensive list of

clients, while its B2C division, including Meridianbet, operates

regulated online sports betting and gaming sites.

Connect with us:

X - https://twitter.com/gmgi_official

Instagram - https://www.instagram.com/goldenmatrixgroup/

About Meridianbet

Founded in 2001, Meridianbet Group is a well-established online

sports betting and gaming group, licensed and currently operating

in 18 jurisdictions across Europe, Africa and South America.

Meridianbet's successful business model utilizes proprietary

technology and scalable systems, thus allowing it to operate in

multiple countries and currencies and with an omni-channel approach

to markets, including retail, desktop online and mobile.

Connect with us:

X: https://x.com/meridianbet_ofc

Email: ir@meridianbet.com

Forward-Looking Statements

Certain statements made in this press release contain

forward-looking information within the meaning of applicable

securities laws, including within the meaning of the Private

Securities Litigation Reform Act of 1995 (“forward-looking

statements”). Words such as “strategy,” “expects,” “continues,”

“plans,” “anticipates,” “believes,” “would,” “will,” “estimates,”

“intends,” “projects,” “goals,” “targets” and other words of

similar meaning are intended to identify forward-looking statements

but are not the exclusive means of identifying these

statements.

Important factors that may cause actual results and outcomes to

differ materially from those contained in such forward-looking

statements include, without limitation, the ability of the Company

to obtain the funding required to pay certain Meridianbet Group

acquisition post-closing obligations, the terms of such funding,

potential dilution caused thereby and/or covenants agreed to in

connection therewith; potential lawsuits regarding the acquisition;

dilution caused by the terms of the Note and Warrant, the Company’s

ability to pay amounts due under the Note and covenants associated

therewith and penalties which could be due under the Note and

securities purchase agreement for failure to comply with the terms

thereof; the business, economic and political conditions in the

markets in which the Company operates; the effect on the Company

and its operations of the ongoing Ukraine/Russia conflict and the

conflict in Israel, changing interest rates and inflation, and

risks of recessions; the need for additional financing, the terms

of such financing and the availability of such financing; the

ability of the Company and/or its subsidiaries to obtain additional

gaming licenses; the ability of the Company to manage growth; the

Company’s ability to complete acquisitions and the availability of

funding for such acquisitions; disruptions caused by acquisitions;

dilution caused by fund raising, the conversion of outstanding

preferred stock, convertible securities and/or acquisitions; the

Company’s ability to maintain the listing of its common stock on

the Nasdaq Capital Market; the Company’s expectations for future

growth, revenues, and profitability; the Company’s expectations

regarding future plans and timing thereof; the Company’s reliance

on its management; the fact that the sellers of the Meridianbet

Group hold voting control over the Company; related party

relationships; the potential effect of economic downturns,

recessions, increases in interest rates and inflation, and market

conditions, decreases in discretionary spending and therefore

demand for our products and services, and increases in the cost of

capital, related thereto, among other affects thereof, on the

Company’s operations and prospects; the Company’s ability to

protect proprietary information; the ability of the Company to

compete in its market; the effect of current and future regulation,

the Company’s ability to comply with regulations and potential

penalties in the event it fails to comply with such regulations and

changes in the enforcement and interpretation of existing laws and

regulations and the adoption of new laws and regulations that may

unfavorably impact our business; the risks associated with gaming

fraud, user cheating and cyber-attacks; risks associated with

systems failures and failures of technology and infrastructure on

which the Company’s programs rely; foreign exchange and currency

risks; the outcome of contingencies, including legal proceedings in

the normal course of business; the ability to compete against

existing and new competitors; the ability to manage expenses

associated with sales and marketing and necessary general and

administrative and technology investments; and general consumer

sentiment and economic conditions that may affect levels of

discretionary customer purchases of the Company’s products,

including potential recessions and global economic slowdowns.

Although we believe that our plans, intentions and expectations

reflected in or suggested by the forward-looking statements we make

in this press release are reasonable, we provide no assurance that

these plans, intentions or expectations will be achieved.

Other important factors that may cause actual results and

outcomes to differ materially from those contained in the

forward-looking statements included in this communication are

described in the Company’s publicly-filed reports, including, but

not limited to, under the “Special Note Regarding Forward-Looking

Statements,” “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” sections

of the Company’s periodic and current filings with the SEC,

including the Form 10-Qs and Form 10-Ks, including, but not limited

to, the Company’s Annual Report on Form 10-K for the year ended

October 31, 2023 and its Quarterly Report on Form 10-Q for the

quarter ended January 31, 2024, and future periodic reports on Form

10-K and Form 10‑Q. These reports are available at www.sec.gov.

Connect With Us

ir@goldenmatrix.com

https://twitter.com/gmgi_official

https://www.instagram.com/goldenmatrixgroup/

https://x.com/meridianbet_ofc

ir@meridianbet.com

ICR

Brett Milotte

Brett.Milotte@icrinc.com

Greg Michaels

Gregory.Michaels@icrinc.com

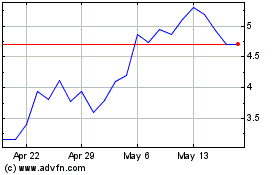

Golden Matrix (NASDAQ:GMGI)

Historical Stock Chart

From Nov 2024 to Dec 2024

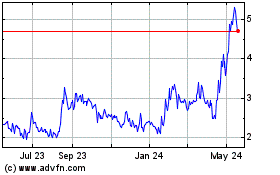

Golden Matrix (NASDAQ:GMGI)

Historical Stock Chart

From Dec 2023 to Dec 2024