FALSE000130940200013094022025-02-072025-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 7, 2025

_______________________________

GREEN PLAINS INC.

(Exact name of registrant as specified in its charter)

_______________________________

| | | | | | | | |

| Iowa | 001-32924 | 84-1652107 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1811 Aksarben Drive

Omaha, Nebraska 68106

(Address of Principal Executive Offices) (Zip Code)

(402) 884-8700

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | GPRE | | The Nasdaq Stock Market LLC |

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

Green Plains Inc. issued a press release announcing its financial results for the three and twelve months ended December 31, 2024. A copy of this press release is attached as Exhibit 99.1.

The information in this current report on Form 8-K, including Exhibit 99.1, is “furnished,” not “filed,” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and is not subject to liability of that section nor deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, before or after this date and regardless of any general incorporation language in the filing, unless explicitly incorporated by reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following exhibits are filed as part of this report.

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Green Plains Inc. | |

| | | |

| Date: February 7, 2025 | By: | /s/ Philip B. Boggs | |

| | Philip B. Boggs | |

| | Chief Financial Officer (Principal Financial Officer) | |

| | | | | | | | |

| | Exhibit 99.1

FOR IMMEDIATE RELEASE |

Green Plains Reports Fourth Quarter and Full Year 2024 Financial Results

Results for the Fourth Quarter 2024 and Future Outlook:

•EPS of $(0.86) per diluted share, compared to EPS of $0.12 per diluted share, for the same period in 2023

•Green Plains has launched a corporate reorganization and cost reduction initiative to significantly reduce ongoing expenses over the next year with anticipated annualized benefit of up to $50 million when completed

•The Board of Directors and its financial and legal advisors continue to work on the strategic review process as evidenced by the corporate reorganization and cost reduction initiative

•Platform run rate of 92% including Mount Vernon’s extended shutdown in October

•Achieved key milestones for ‘Advantage Nebraska’ carbon strategy as Nebraska pipeline partner received six Class VI Carbon Capture and Sequestration well permits in Wyoming, acquired all necessary rights of way for the laterals and began construction to connect the Nebraska plants to the Trailblazer mainline

OMAHA, Neb., Feb 7, 2025 (BUSINESS WIRE) - Green Plains Inc. (NASDAQ:GPRE) (“Green Plains” or the “company”) today announced financial results for the fourth quarter and full year 2024. Net loss attributable to the company was $54.9 million, or $(0.86) per diluted share for the fourth quarter compared to net income attributable to the company of $7.2 million, or $0.12 per diluted share, for the same period in 2023. Revenues for the quarter were $584.0 million compared with $712.4 million for the same period in the prior year. EBITDA was $(18.9) million for the quarter compared to $44.7 million for the same period in 2023.

“As we embark on 2025, we have launched a corporate reorganization and cost reduction initiative which will significantly reduce expenses on an ongoing basis,” said Todd Becker, president and chief executive officer. “As part of this initiative we are targeting up to $50 million dollars of savings per year and have implemented this week the first $30 million in improvements on an ongoing basis. Over the last several years we have strategically allocated capital in sales, marketing and innovation to develop and validate our ingredients and get them to market and we are moving from that phase to the commercialization phase of our strategy which includes the rationalization of expenses. These savings also include the idling of our Fairmont, Minnesota facility due to sustained localized margin pressure from the flooding that occurred in that region. Lastly, we have realigned our corporate and trade group SG&A functions, increasing our focus on the strategic initiatives that provide the most value to shareholders as we approach the start-up of our carbon strategy later this year.”

“Our ‘Advantage Nebraska’ strategy remains firmly on track as we continue to reach milestones in permitting, construction and regulatory guidance,” continued Becker. “Our 287-million-gallon Nebraska platform is positioned to be among the first in the nation to benefit from the 45Z Clean Fuel Production Credit, including the recently released and updated GREET model which was favorable to our assets and has the potential to be even better financially than originally expected. Our carbon capture operations in Nebraska are on pace to begin sequestering biogenic carbon dioxide in the second half of this year, and we believe this will be a consistent contributor to our valuation once the improvements from this asset base are reflected in our share price.”

“We commenced operations at our clean sugar facility and continued to produce on-spec product in the fourth quarter and have sent samples to customers for validation,” added Becker. “We have secured religious certifications and the Iowa Food Processer license which was the last major hurdle in our Food Safety System Certification (FSSC) audit, and we now have a clear path to certification in the first quarter. This opens the door for the inclusion of our low-CI dextrose in a wide range of food and ingredient applications. We will continue to address de-bottlenecking around wastewater capacity improvements over the next year as the plant runs at a reduced rate, produces specific campaigns for customers or idles for a period of time to maximize Shenandoah site earnings. We remain confident that this technology is a game changer globally and that the value of this technology will pay dividends in the long-term value creation for Green Plains and its shareholders.”

“When combining the cost reduction initiatives with carbon earnings from Nebraska, those two alone could achieve a combined $180 million annualized contribution to our future earnings before taking into consideration ethanol, renewable corn oil (DCO) and our high protein initiative,” said Becker. “While global and local protein markets remain oversupplied, our high protein production strategy and technology continues to contribute to our earnings. DCO is now clearly an advantaged feedstock as evidenced by the recent premium prices received verses soybean oil for use in renewable diesel production. Ethanol blending continues to inch higher and with several idled plants across the industry, including Fairmont, we expect to see ethanol physical stocks improve as we move through the year, which could lead to a more constructive environment. With carbon capture planned to commence in the second half of the year, we believe we are poised to fundamentally reshape the margin structure for Green Plains.”

Full Year Highlights:

•Completed acquisition of remaining interest in Green Plains Partners LP on January 9, 2024 streamlining operations and improving efficiencies

•MSC™ turnkey partner Tharaldson Ethanol in Casselton, North Dakota, began operating the world’s largest MSC™ facility in the second quarter, bringing total Ultra-High Protein production capacity to 430,000 tons per year

•Commissioned the York, Nebraska, demonstration facility combining Fluid Quip Technologies’ precision separation and processing technology (MSC™) with Shell Fiber Conversion Technology (SFCT), beginning in the first half of 2024

•Executed construction management agreements and ordered major equipment necessary to capture carbon from the Central City, Wood River and York facilities as part of ‘Advantage Nebraska’ strategy

•Completed the sale of the unit train terminal in Birmingham, Ala. to Lincoln Birmingham, LLC on September 30, 2024. The proceeds of the sale were used to repay the outstanding balance of the Green Plains Partners term loan due July 20, 2026

•Began operating the Clean Sugar Technology™ deployment in Shenandoah, Iowa, with samples sent to customers for evaluation.

Results of Operations

Green Plains’ ethanol production segment sold 209.5 million gallons of ethanol during the fourth quarter of 2024, compared with 215.7 million gallons for the same period in 2023. The consolidated ethanol crush margin was $(15.5) million for the fourth quarter of 2024, compared with $53.0 million for the same period in 2023. The consolidated ethanol crush margin is the ethanol production segment’s operating income before depreciation and amortization, which includes renewable corn oil and Ultra-High Protein, plus marketing and agribusiness fees, nonrecurring decommissioning costs, and nonethanol operating activities.

Consolidated revenues decreased $128.4 million for the three months ended December 31, 2024, compared with the same period in 2023, primarily due to lower weighted average selling prices on ethanol, distillers grains and renewable corn oil in addition to lower ethanol and distillers grains volumes sold within our ethanol production segment. Revenues were higher within our agribusiness and energy services segment due to higher ethanol and natural gas trading volumes.

Net loss attributable to Green Plains increased $62.2 million and EBITDA decreased $63.6 million for the three months ended December 31, 2024, compared with the same period last year, due to lower margins in our ethanol production segment. Interest expense decreased $0.9 million for the three months ended December 31, 2024 compared with the same period in 2023. Income tax expense was $7.0 million for the three months ended December 31, 2024 compared with income tax benefit of $0.3 million for the same period in 2023. The increase in income tax expense was primarily due to an agreement in principle with the IRS Independent Office of Appeals covering the tax years 2013 through 2018 that occurred during the three months ended December 31, 2024 which is expected to resolve uncertain tax matters regarding our claim for research and development tax credits.

Segment Information

The company reports the financial and operating performance for the following two operating segments: (1) ethanol production, which includes the production, storage and transportation of ethanol, distillers grains, Ultra-High Protein and renewable corn oil and (2) agribusiness and energy services, which includes grain handling and storage, commodity marketing and merchant trading for company-produced and third-party ethanol, distillers grains, renewable corn oil, natural gas and other commodities.

As a result of the company’s acquisition of the minority interests in Green Plains Partners LP (the partnership), the partnership's operations are included in the ethanol production operating segment. The following changes were made to the company's operating segments:

•The revenue and operating results from fuel storage and transportation services previously disclosed within the partnership segment are now included within the ethanol production segment.

•Intersegment activities between the partnership and Green Plains Trade associated with ethanol storage and transportation services previously treated like third-party transactions and eliminated on a consolidated level are now eliminated within the ethanol production segment.

Intersegment activities between the remaining terminal and Green Plains Trade associated with terminal services transacted with the agribusiness and energy services segment will continue to be eliminated on a consolidated level.

GREEN PLAINS INC.

SEGMENT OPERATIONS

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | % Var. | | 2024 | | 2023 | | % Var. |

| Revenues | | | | | | | | | | | |

| Ethanol production | $ | 471,348 | | | $ | 622,359 | | | (24.3)% | | $ | 2,067,089 | | $ | 2,824,541 | | | (26.8)% |

| Agribusiness and energy services | 119,302 | | | 97,613 | | | 22.2 | | 421,107 | | 500,903 | | | (15.9) |

| Intersegment eliminations | (6,628) | | | (7,580) | | | (12.6) | | (29,400) | | | (29,701) | | | (1.0) |

| $ | 584,022 | | | $ | 712,392 | | | (18.0)% | | $ | 2,458,796 | | | $ | 3,295,743 | | | (25.4)% |

| | | | | | | | | | | |

| Gross margin | | | | | | | | | | | |

Ethanol production (1)(2) | $ | (10,431) | | | $ | 59,009 | | | * | | $ | 83,629 | | | $ | 118,624 | | | (29.5)% |

| Agribusiness and energy services | 16,582 | | | 14,818 | | | 11.9 | | 46,821 | | | 46,127 | | | 1.5 |

| $ | 6,151 | | | $ | 73,827 | | | (91.7)% | | $ | 130,450 | | | $ | 164,751 | | | (20.8)% |

| | | | | | | | | | | |

| Depreciation and amortization | | | | | | | | | | | |

| Ethanol production | $ | 20,262 | | | $ | 23,109 | | | (12.3)% | | $ | 82,784 | | $ | 92,712 | | | (10.7)% |

| Agribusiness and energy services | 678 | | | 477 | | | 42.1 | | 2,185 | | 2,360 | | | (7.4) |

Corporate activities (3) | 506 | | | 747 | | | (32.3) | | 5,618 | | 3,172 | | | 77.1 |

| $ | 21,446 | | | $ | 24,333 | | | (11.9)% | | $ | 90,587 | | | $ | 98,244 | | | (7.8)% |

| | | | | | | | | | | |

| Operating income (loss) | | | | | | | | | | | |

Ethanol production (2) | $ | (40,132) | | | $ | 23,200 | | | * | | $ | (40,758) | | | $ | (19,958) | | | 104.2% |

| Agribusiness and energy services | 12,156 | | | 10,488 | | | 15.9 | | 28,156 | | 28,100 | | | 0.2 |

Corporate activities (4) | (12,935) | | | (17,420) | | | (25.7) | | (34,857) | | | (69,720) | | | (50.0) |

| $ | (40,911) | | | $ | 16,268 | | | * | | $ | (47,459) | | | $ | (61,578) | | | (22.9)% |

| | | | | | | | | | | |

| Adjusted EBITDA | | | | | | | | | | | |

| Ethanol production | $ | (20,830) | | | $ | 46,523 | | | * | | $ | 39,645 | | | $ | 78,561 | | | (49.5)% |

| Agribusiness and energy services | 13,080 | | | 11,431 | | | 14.4 | | 31,935 | | | 31,689 | | | 0.8 |

Corporate activities (4) | (11,169) | | | (13,233) | | | (15.6) | | (23,934) | | | (56,219) | | | (57.4) |

| EBITDA | (18,919) | | | 44,721 | | | * | | 47,646 | | | 54,031 | | | (11.8) |

Other income (5) | — | | | — | | | — | | — | | | (3,440) | | | (100.0) |

| Loss (gain) on sale of assets, net | — | | | 386 | | | (100.0) | | (30,723) | | | (5,265) | | | * |

| Proportional share of EBITDA adjustments to equity method investees | 753 | | | 45 | | | * | | 1,792 | | | 180 | | | * |

| $ | (18,166) | | | $ | 45,152 | | | * | | $ | 18,715 | | | $ | 45,506 | | | (58.9)% |

(1) Costs historically reported as operations and maintenance expenses in the consolidated statements of operations are now being reported within cost of goods sold, resulting in increased cost of goods sold and decreased gross margin within the ethanol production segment.

(2) Ethanol production includes an inventory lower of cost or net realizable value adjustment of $2.1 million for the three and twelve months ended December 31, 2024, and $2.6 million for the three and twelve months ended December 31, 2023.

(3) Depreciation and amortization for corporate activities includes an impairment of a research and development technology intangible asset of $3.5 million for the twelve months ended December 31, 2024.

(4) Corporate activities includes a $30.7 million gain on sale of assets for the twelve months ended December 31, 2024 and a $4.1 million gain on sale of assets for the twelve months ended December 31, 2023, respectively.

(5) Other income includes a grant received from the USDA related to the Biofuel Producer Program of $3.4 million for the twelve months ended December 31, 2023.

* Percentage variances not considered meaningful

GREEN PLAINS INC.

SELECTED OPERATING DATA

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | % Var. | | 2024 | | 2023 | | % Var. |

| | | | | | | | | | | |

| Ethanol production | | | | | | | | | | | |

| Ethanol (gallons) | 209,540 | | | 215,717 | | | (2.9)% | | 846,226 | | | 840,819 | | | 0.6% |

| Distillers grains (equivalent dried tons) | 469 | | | 479 | | | (2.1) | | 1,890 | | | 1,933 | | | (2.2) |

| Ultra-High Protein (tons) | 54 | | | 66 | | | (18.2) | | 248 | | | 223 | | | 11.2 |

| Renewable corn oil (pounds) | 73,376 | | | 72,934 | | | 0.6 | | 290,801 | | | 279,861 | | | 3.9 |

| Corn consumed (bushels) | 71,221 | | | 74,152 | | | (4.0) | | 289,454 | | | 289,267 | | | 0.1 |

| | | | | | | | | | | |

Agribusiness and energy services (1) | | | | | | | | | | | |

| Ethanol (gallons) | 269,758 | | | 258,496 | | | 4.4 | | 1,050,602 | | | 1,089,763 | | | (3.6) |

(1) Includes gallons from the ethanol production segment

GREEN PLAINS INC.

CONSOLIDATED CRUSH MARGIN

(unaudited, in thousands)

| | | | | | | | | | | |

| Three Months Ended

December 31, |

| 2024 | | 2023 |

| | | |

| | | |

Ethanol production operating income (loss) (1) | $ | (40,132) | | | $ | 23,200 | |

| Depreciation and amortization | 20,262 | | | 23,109 | |

| Adjusted ethanol production operating income (loss) | (19,870) | | | 46,309 | |

Intercompany fees and nonethanol operating activities, net (2) | 4,388 | | | 6,705 | |

| Consolidated ethanol crush margin | $ | (15,482) | | | $ | 53,014 | |

(1) Ethanol production includes an inventory lower of cost or net realizable value adjustment of $2.1 million and $2.6 million for the three months ended December 31, 2024 and 2023, respectively.

(2) For the three months ended December 31, 2024 and 2023, includes $(0.3) million and $1.8 million, respectively, for certain nonrecurring decommissioning costs and nonethanol operating activities.

Liquidity and Capital Resources

As of December 31, 2024, Green Plains had $209.4 million in total cash and cash equivalents, and restricted cash, and $200.7 million available under a committed revolving credit facility, which is subject to restrictions and other lending conditions. Total debt outstanding at December 31, 2024 was $575.4 million, including $140.8 million outstanding debt under working capital revolvers and other short-term borrowing arrangements.

Conference Call Information

On February 7, 2025, Green Plains Inc. will host a conference call at 9 a.m. Eastern time (8 a.m. Central time) to discuss fourth quarter and full year 2024 operating results. Domestic and international participants can access the conference call by dialing 888.210.4215 and 646.960.0269, respectively, and referencing conference ID 5027523. Participants are advised to call at least 10 minutes prior to the start time. Alternatively, the conference call and presentation will be accessible on Green Plains’ website https://investor.gpreinc.com/events-and-presentations.

Non-GAAP Financial Measures

Management uses EBITDA, adjusted EBITDA, segment EBITDA and consolidated ethanol crush margins to measure the company’s financial performance and to internally manage its businesses. EBITDA is defined as earnings before interest expense, income taxes, depreciation and amortization excluding the change in right-of-use assets and debt issuance costs. Adjusted EBITDA includes adjustments related to other income associated with the USDA COVID-19 relief grant, gain on asset dispositions, and our proportional share of EBITDA adjustments of our equity method investees. Management believes these measures provide useful information to investors for comparison with peer and other companies. These measures should not be considered alternatives to net income or segment operating income, which are determined in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). These non-GAAP calculations may vary from company to company. Accordingly, the company’s computation of adjusted EBITDA, segment EBITDA and consolidated ethanol crush margins may not be comparable with similarly titled measures of another company.

About Green Plains Inc.

Green Plains Inc. (NASDAQ:GPRE) is a leading biorefining company focused on the development and utilization of fermentation, agricultural and biological technologies in the processing of annually renewable crops into sustainable value-added ingredients. This includes the production of cleaner low carbon biofuels and renewable feedstocks for advanced biofuels. Green Plains is an innovative producer of Sequence™ and novel ingredients for animal and aquaculture diets to help satisfy a growing global appetite for sustainable protein. For more information, visit www.gpreinc.com.

Forward-Looking Statements

All statements in this press release (and oral statements made regarding the subjects of this communication), including those that express a belief, expectation or intention, may be considered forward-looking statements (as defined in Section 21E of the Securities Exchange Act, as amended, and Section 27A of the Securities Act of 1933, as amended) that involve risks and uncertainties that could cause actual results to differ materially from projected results. Without limiting the generality of the foregoing, forward-looking statements contained in this communication include statements relying on a number of assumptions concerning future events and are subject to a number of uncertainties and factors, many of which are outside the control of the company, which could cause actual results to differ materially from such statements. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. The forward-looking statements may include, but are not limited to the expected future growth, dividends and distributions; and plans and objectives of management for future operations. Forward-looking statements may be identified by words such as “believe,” “intend,” “expect,” “may,” “should,” “will,” “anticipate,” “could,” “estimate,” “plan,” “predict,” “project” and variations of these words or similar expressions (or the negative versions of such words or expressions). While the company believes that the assumptions concerning future events are reasonable, it cautions that there are inherent difficulties in predicting certain important factors that could impact the future performance or results of its business. Among the factors that could cause results to differ materially from those indicated by such forward-looking statements are: the failure to realize the anticipated results from the new products being developed; the failure to realize the anticipated costs savings or other benefits of the merger; local, regional and national economic conditions and the impact they may have on the company and its customers; disruption caused by health epidemics, such as the COVID-19 outbreak; conditions in the ethanol and biofuels industry, including a sustained decrease in the level of supply or demand for ethanol and biofuels or a sustained decrease in the price of ethanol or biofuels; competition in the ethanol industry and other industries in which we operate; commodity market risks, including those that may result from weather conditions; the financial condition of the company’s customers; any non-performance by customers of their contractual obligations; changes in safety, health, environmental and other governmental policy and regulation, including changes to tax laws; risks related to acquisition and disposition activities and achieving anticipated results; risks associated with merchant trading; risks related to our equity method investees; the results of any reviews, investigations or other proceedings by government authorities; and the performance of the company.

The foregoing list of factors is not exhaustive. The forward-looking statements in this press release speak only as of the date they are made and the company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by securities and other applicable laws. We have based these forward-looking statements on our current expectations and assumptions about future events. While the company’s management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond the company’s control. These risks, contingencies and uncertainties relate to, among other matters, the risks and uncertainties set forth in the “Risk Factors” section of the company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission (the “SEC”), and any subsequent reports filed by the company with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

GREEN PLAINS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

| | | | | | | | | | | |

| December 31, |

| 2024 | | 2023 |

| (unaudited) | | |

| ASSETS |

| Current assets | | | |

| Cash and cash equivalents | $ | 173,041 | | | $ | 349,574 | |

| Restricted cash | 36,354 | | | 29,188 | |

| Accounts receivable, net | 94,901 | | | 94,446 | |

| Inventories | 227,444 | | | 215,810 | |

| Other current assets | 37,292 | | | 43,712 | |

| Total current assets | 569,032 | | | 732,730 | |

| Property and equipment, net | 1,042,460 | | | 1,021,928 | |

| Operating lease right-of-use assets | 72,161 | | | 73,993 | |

| Other assets | 98,521 | | | 110,671 | |

| Total assets | $ | 1,782,174 | | | $ | 1,939,322 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY |

| Current liabilities | | | |

| Accounts payable | $ | 154,817 | | | $ | 186,643 | |

| Accrued and other liabilities | 53,712 | | | 57,029 | |

| Derivative financial instruments | 9,500 | | | 10,577 | |

| Operating lease current liabilities | 24,711 | | | 22,908 | |

| Short-term notes payable and other borrowings | 140,829 | | | 105,973 | |

| Current maturities of long-term debt | 2,118 | | | 1,832 | |

| Total current liabilities | 385,687 | | | 384,962 | |

| Long-term debt | 432,460 | | | 491,918 | |

| Operating lease long-term liabilities | 49,190 | | | 53,879 | |

| Other liabilities | 40,300 | | | 18,507 | |

| Total liabilities | 907,637 | | | 949,266 | |

| | | |

| Stockholders' equity | | | |

| Total Green Plains stockholders' equity | 865,215 | | | 843,733 | |

| Noncontrolling interests | 9,322 | | | 146,323 | |

| Total stockholders' equity | 874,537 | | | 990,056 | |

| Total liabilities and stockholders' equity | $ | 1,782,174 | | | $ | 1,939,322 | |

GREEN PLAINS INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited, in thousands except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | |

| 2024 | | 2023 | | 2024 | | 2023 | | |

| | | | | | | | | |

| Revenues | $ | 584,022 | | | $ | 712,392 | | | $ | 2,458,796 | | | $ | 3,295,743 | | | |

| | | | | | | | | |

| Costs and expenses | | | | | | | | | |

| Cost of goods sold (excluding depreciation and amortization expenses reflected below) | 577,871 | | | 638,565 | | | 2,328,346 | | | 3,130,992 | | | |

| Selling, general and administrative expenses | 25,616 | | | 32,840 | | | 118,045 | | | 133,350 | | | |

| Gain on sale of assets | — | | | 386 | | | (30,723) | | | (5,265) | | | |

| Depreciation and amortization expenses | 21,446 | | | 24,333 | | | 90,587 | | | 98,244 | | | |

| Total costs and expenses | 624,933 | | | 696,124 | | | 2,506,255 | | | 3,357,321 | | | |

| Operating income (loss) | (40,911) | | | 16,268 | | | (47,459) | | | (61,578) | | | |

| | | | | | | | | |

| Other income (expense) | | | | | | | | | |

| Interest income | 1,823 | | | 3,304 | | | 7,560 | | | 11,707 | | | |

| Interest expense | (7,726) | | | (8,674) | | | (33,095) | | | (37,703) | | | |

| Other, net | 424 | | | 915 | | | 1,696 | | | 5,225 | | | |

| Total other income (expense) | (5,479) | | | (4,455) | | | (23,839) | | | (20,771) | | | |

| Income (loss) before income taxes and income (loss) from equity method investees | (46,390) | | | 11,813 | | | (71,298) | | | (82,349) | | | |

| Income tax benefit (expense) | (6,981) | | | 264 | | | (6,212) | | | 5,617 | | | |

| Income (loss) from equity method investees, net of income taxes | (1,295) | | | (99) | | | (3,679) | | | 433 | | | |

| Net income (loss) | (54,666) | | | 11,978 | | | (81,189) | | | (76,299) | | | |

| Net income attributable to noncontrolling interests | 269 | | | 4,745 | | | 1,308 | | | 17,085 | | | |

| Net income (loss) attributable to Green Plains | $ | (54,935) | | | $ | 7,233 | | | $ | (82,497) | | | $ | (93,384) | | | |

| | | | | | | | | |

| Earnings per share | | | | | | | | | |

| Net income (loss) attributable to Green Plains - basic and diluted | $ | (0.86) | | | $ | 0.12 | | | $ | (1.29) | | | $ | (1.59) | | | |

| | | | | | | | | |

| | | | | | | | | |

| Weighted average shares outstanding | | | | | | | | | |

| Basic and diluted | 63,961 | | | 58,913 | | | 63,796 | | | 58,814 | | | |

| | | | | | | | | |

GREEN PLAINS INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

| | | | | | | | | | | |

| Twelve Months Ended

December 31, |

| 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net loss | $ | (81,189) | | | $ | (76,299) | |

| Noncash operating adjustments | | | |

| Depreciation and amortization | 90,587 | | | 98,244 | |

| Gain on sale of assets, net | (30,723) | | | (5,265) | |

| Inventory lower of cost or net realizable value adjustment | 2,143 | | | 2,627 | |

| Other | 20,677 | | | 10,640 | |

| Net change in working capital | (31,460) | | | 26,399 | |

| Net cash provided by (used in) operating activities | (29,965) | | | 56,346 | |

| | | |

| Cash flows from investing activities | | | |

| Purchases of property and equipment, net | (95,084) | | | (108,093) | |

| Proceeds from the sale of assets, net | 48,704 | | | 25,403 | |

| Investment in equity method investees | (15,672) | | | (24,206) | |

| Net cash used in investing activities | (62,052) | | | (106,896) | |

| | | |

| Cash flows from financing activities | | | |

| Net payments - long term debt | (61,697) | | | (4,838) | |

| Net proceeds (payments) - short-term borrowings | 33,962 | | | (32,786) | |

| Payments on extinguishment of non-controlling interest | (29,196) | | | — | |

| Payments of transaction costs | (5,951) | | | — | |

| Other | (14,468) | | | (33,340) | |

| Net cash used in financing activities | (77,350) | | | (70,964) | |

| | | |

| Net change in cash and cash equivalents, and restricted cash | (169,367) | | | (121,514) | |

| Cash and cash equivalents, and restricted cash, beginning of period | 378,762 | | | 500,276 | |

| Cash and cash equivalents, and restricted cash, end of period | $ | 209,395 | | | $ | 378,762 | |

| | | |

| | | |

| Reconciliation of total cash and cash equivalents, and restricted cash | | | |

| Cash and cash equivalents | $ | 173,041 | | | $ | 349,574 | |

| Restricted cash | 36,354 | | | 29,188 | |

| Total cash and cash equivalents, and restricted cash | $ | 209,395 | | | $ | 378,762 | |

GREEN PLAINS INC.

RECONCILIATIONS TO NON-GAAP FINANCIAL MEASURES

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income (loss) | $ | (54,666) | | | $ | 11,978 | | | $ | (81,189) | | | $ | (76,299) | |

| Interest expense | 7,726 | | | 8,674 | | | 33,095 | | | 37,703 | |

| Income tax expense (benefit), net of equity method income taxes | 6,575 | | | (264) | | | 5,153 | | | (5,617) | |

Depreciation and amortization (1) | 21,446 | | | 24,333 | | | 90,587 | | | 98,244 | |

| EBITDA | (18,919) | | | 44,721 | | | 47,646 | | | 54,031 | |

Other income (2) | — | | | — | | | — | | | (3,440) | |

| Loss (gain) on sale of assets, net | — | | | 386 | | | (30,723) | | | (5,265) | |

| Proportional share of EBITDA adjustments to equity method investees | 753 | | | 45 | | | 1,792 | | | 180 | |

| Adjusted EBITDA | $ | (18,166) | | | $ | 45,152 | | | $ | 18,715 | | | $ | 45,506 | |

(1) Excludes amortization of operating lease right-of-use assets and amortization of debt issuance costs.

(2) Other income includes a grant received from the USDA related to the Biofuel Producer Program of $3.4 million for the twelve months ended December 31, 2023.

| | |

Green Plains Inc. Contact |

Investor Relations | 402.884.8700 | investor@gpreinc.com |

###

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

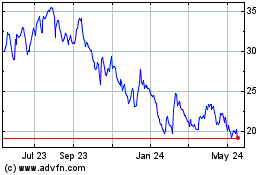

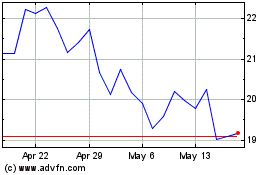

Green Plains (NASDAQ:GPRE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Green Plains (NASDAQ:GPRE)

Historical Stock Chart

From Mar 2024 to Mar 2025