Select Results Include Q1 Adjusted EBITDA of

$2.1 million to $3.1 million and Loss Per Share of $0.33 to

$0.43

Company Reports Second Consecutive Quarter of

Positive Cash Flow

Greenidge Generation Holdings Inc. (NASDAQ: GREE) (“Greenidge”),

a vertically integrated cryptocurrency datacenter and power

generation company, today announced preliminary financial and

operating results for the first quarter of 2024. The Company also

highlighted CEO Jordan Kovler’s presentation at the Planet MicroCap

Showcase: Vegas 2024 taking place today, May 1, 2024, at 4:00 pm

PST, which may be attended and accessed live along with the

accompanying presentation materials by visiting

https://www.webcaster4.com/Webcast/Page/3026/50312. Greenidge will

be filing an updated investor presentation in conjunction with the

event.

Preliminary First Quarter 2024 Financial Results1:

- Revenue of approximately $19.2 million;

- Net loss from continuing operations of approximately $3.1

million to $4.1 million;

- Adjusted EBITDA of approximately $2.1 to approximately $3.1

million;

- Loss per share of $0.33 to $0.432;

- Cryptocurrency datacenter self-mining revenue of $7.1 million;

Cryptocurrency datacenter hosting revenue of $9.1 million; and

- Power and capacity revenue of $3.0 million.

First Quarter 2024

Highlights:

Greenidge’s cryptocurrency datacenter operations produced

approximately 409 bitcoin during the first quarter of 2024, of

which 275 bitcoin were produced for colocation and 134 bitcoin were

produced for self-mining. The average opening price of Bitcoin

during the first quarter of 2024 was $53,260.04.

As of March 31, 2024, Greenidge datacenter operations consisted

of approximately 29,400 miners with approximately 3.0 EH/s of

combined capacity for both datacenter hosting and cryptocurrency

mining, of which 18,700 miners, or 1.8 EH/s, is associated with

datacenter hosting and 10,700 miners, or 1.2 EH/s, is associated

with Greenidge's cryptocurrency mining.

Greenidge ended the quarter with approximately $14.3 million of

cash and approximately $69.0 million of debt.

Greenidge CEO Jordan Kovler commented: “It is an exciting time

for Greenidge, with two consecutive quarters of positive cash flow,

a valuable and growing real estate portfolio of sites suited for

data center development and a significant reduction in SG&A

spend going forward. We will continue to find properties with the

potential for power expansion and will follow our new roadmap for

the best utilization of each, in order to benefit the short- and

long- term interests of all stockholders. We believe now is the

time to focus on execution and to capitalize on the strengths of

our team in energy and infrastructure development.”

The preliminary financial information presented in this press

release is based on Greenidge’s current expectations and may be

adjusted as a result of, among other things, completion of

customary quarterly audit procedures.

Preliminary Financial and Operating Results

The preliminary financial and operating results set forth above

for the three months ended March 31, 2024, reflect preliminary

estimates with respect to such results based solely on currently

available information, which is subject to change. Readers are

cautioned not to place undue reliance on such preliminary results

which are unaudited and constitute forward-looking statements.

Greenidge has not completed its standard closing process, including

the completion of all of its controls procedures, which could

identify adjustments causing the actual results to be different

from the expectations presented in this release. These estimates

should not be viewed as a substitute for Greenidge's full quarterly

financial statements for the three months ended March 31, 2024,

which will be prepared in accordance with U.S. GAAP.

About Greenidge Generation Holdings Inc.

Greenidge Generation Holdings Inc. (NASDAQ: GREE) is a

vertically integrated power generation company, focusing on

cryptocurrency mining, infrastructure development, engineering,

procurement, construction management, operations and maintenance of

sites.

Forward-Looking Statements

This press release includes certain statements that may

constitute “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. All

statements other than statements of historical fact are

forward-looking statements for purposes of federal and state

securities laws. These forward-looking statements involve

uncertainties that could significantly affect Greenidge’s financial

or operating results. These forward-looking statements may be

identified by terms such as “anticipate,” “believe,” “continue,”

“foresee,” “expect,” “intend,” “plan,” “may,” “will,” “would,”

“could,” and “should,” and the negative of these terms or other

similar expressions. Forward-looking statements are based on

current beliefs and assumptions that are subject to risks and

uncertainties and are not guarantees of future performance.

Forward-looking statements in this press release include, among

other things, statements regarding the business plan, business

strategy and operations of Greenidge in the future. In addition,

all statements that address operating performance and future

performance, events or developments that are expected or

anticipated to occur in the future are forward looking statements.

Forward-looking statements are subject to a number of risks,

uncertainties and assumptions. Matters and factors that could cause

actual results to differ materially from those expressed or implied

in such forward-looking statements include but are not limited to

the matters and factors described in Part I, Item 1A. “Risk

Factors” of Greenidge’s Annual Report on Form 10-K for the year

ended December 31, 2023, as may be amended from time to time, our

subsequently filed Quarterly Reports on Form 10-Q, as well as

statements about or relating to or otherwise affected by the

completion of management’s final review of the financial results

and Greenidge’s other closing procedures. Consequently, all of the

forward-looking statements made in this press release are qualified

by the information contained under this caption. No assurance can

be given that these are all of the factors that could cause actual

results to vary materially from the forward-looking statements in

this press release. You should not put undue reliance on

forward-looking statements. No assurances can be given that any of

the events anticipated by the forward-looking statements will

transpire or occur, or if any of them do occur, the actual results,

performance, or achievements of Greenidge could differ materially

from the results expressed in, or implied by, any forward-looking

statements. All forward-looking statements speak only as of the

date of this press release and Greenidge does not assume any duty

to update or revise any forward-looking statements included in this

press release, whether as a result of new information, the

occurrence of future events, uncertainties or otherwise, after the

date of this press release.

Use of Non-GAAP Information

To provide investors and others with additional information

regarding Greenidge’s financial results, Greenidge has disclosed in

this press release the non-GAAP operating performance measures of

Adjusted EBITDA. Adjusted EBITDA is defined as earnings before

interest, taxes and depreciation and amortization, which is then

adjusted for stock-based compensation and other special items

determined by management, including, but not limited to, business

expansion costs, impairments of long-lived assets, gains or losses

from the sales of long-lived assets, remeasurement of environmental

liabilities, restructuring and loss on extinguishment of debt.

These non-GAAP financial measures are a supplement to and not a

substitute for or superior to, Greenidge’s results presented in

accordance with U.S. GAAP. The non-GAAP financial measures

presented by Greenidge may be different from non-GAAP financial

measures presented by other companies. Specifically, Greenidge

believes the non-GAAP information provides useful measures to

investors regarding Greenidge’s financial performance by excluding

certain costs and expenses that Greenidge believes are not

indicative of its core operating results. The presentation of these

non-GAAP financial measures is not meant to be considered in

isolation or as a substitute for results or guidance prepared and

presented in accordance with U.S. GAAP.

Because of these limitations, EBITDA and Adjusted EBITDA should

not be considered in isolation or as a substitute for performance

measures calculated in accordance with GAAP. Greenidge compensates

for these limitations by relying primarily on its GAAP results and

using EBITDA and Adjusted EBITDA on a supplemental basis.

Amounts denoted in millions

First Quarter 2024

Low

High

Net loss from continuing operations

$ (4.1)

$ (3.1)

Provision for income taxes

—

—

Interest expense, net

1.8

1.8

Depreciation and amortization

3.2

3.2

EBITDA from continuing operations

$ 0.9

$ 1.9

Stock-based compensation

1.1

1.1

Adjusted EBITDA from continuing

operations

$ 2.1

$ 3.1

____________________________________ 1 For the three months

ended March 31, 2024; Greenidge expected, approximate financial

results. 2 Based on 9,493,686 weighted average Class A and Class B

shares outstanding for the three months ended March 31, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240501704173/en/

Investors Nick Ratti 315-536-2359 nratti@greenidge.com

investorrelations@greenidge.com Media Longacre Square

Partners Charlotte Kiaie / Kate Sylvester 646-386-0091

greenidge@longacresquare.com

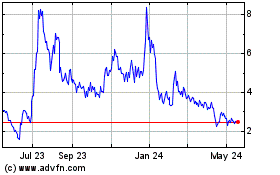

Greenidge Generation (NASDAQ:GREE)

Historical Stock Chart

From Dec 2024 to Jan 2025

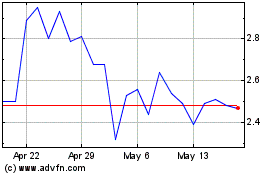

Greenidge Generation (NASDAQ:GREE)

Historical Stock Chart

From Jan 2024 to Jan 2025