Reports SG&A reductions of $6.4 million in

the first six months of 2024 vs. 2023

Expects a significant boost in earnings in

subsequent quarters due to ongoing cost savings and introduction of

new offerings

Greenidge Generation Holdings Inc. (NASDAQ: GREE) (“Greenidge”)

or (the “Company”), a vertically integrated cryptocurrency

datacenter and power generation company, announced financial and

operating results for the second quarter 2024 and provided an

update on the actions the Company has taken to continue the

transformation of the business.

Second Quarter 2024 Financial

Results:

- Total revenue of $13.1 million;

- Net loss from continuing operations of $5.5 million;

- EBITDA loss of $0.4 million;

- Adjusted EBITDA loss of $0.1 million;

- Cryptocurrency datacenter self-mining revenue of $4.8

million;

- Cryptocurrency datacenter hosting revenue of $6.6 million;

and

- Power and capacity revenue of $1.5 million.

Year to Date 2024 Financial

Results:

- Total revenue of $32.4 million;

- Net loss from continuing operations of $9.5 million;

- EBITDA of $0.6 million;

- Adjusted EBITDA of $2.5 million;

- Cryptocurrency datacenter self-mining revenue of $11.8

million;

- Cryptocurrency datacenter hosting revenue of $15.8 million;

and

- Power and capacity revenue of $4.5 million.

2024 Highlights:

- SG&A year to date decreased by $6.4 million in 2024 vs.

2023, from $16.1 million to $9.7 million

- Retention of 41 Bitcoin as of August 13, 2024.

- Reduction in go-forward operating costs for Bitcoin mining

operations as a result of relocating owned miners to facilities

managed by Greenidge in Mississippi and North Dakota.

- Significant expansion of power capacity, with the addition of

100 MW of low-cost power capacity:

- Secured access to 60 MW in South Carolina for development of

datacenter;

- Commenced 7.5 MW of mining at acquired site in Mississippi with

additional 25 MW of mining capacity;

- Commenced 7.5 MW of mining at leased site in North Dakota;

- Launch of Greenidge Pod X, a best-in-class crypto mining

infrastructure solution;

- Launch of new self-mined bitcoin retention strategy to further

drive growth;

- Commencement of GPU datacenter pilot program;

- Commencement of EPCM and O&M offerings; and

- Evaluation of future sites with significant low-cost power

capacity.

Greenidge ended the second quarter with $10.3 million of cash

and $69.2 million of debt at book value.

In the first six months of 2024, Greenidge has made significant

efforts to reduce costs, leading to SG&A reductions of $6.4

million from 2023. Greenidge also reported a reduction in operating

costs for its Bitcoin mining operations in Q2 2024. This reduction

resulted from the relocation of the majority of Greenidge’s mining

fleet from a third-party operated site with monthly operational

fees to facilities managed by Greenidge directly. These strategic

buildouts and moves position the Company well for the future and

will positively impact its profitability compared to maintaining

operations at the third-party site.

Greenidge’s relocation of owned miners from third-party operated

sites to Greenidge-operated facilities resulted in the Company’s

miners being non-operational for a period, which impacted Q2

earnings. As anticipated, Greenidge’s successful planned June plant

outage also impacted Q2 earnings but positions the Company to

continue its industry leading uptime in the quarters ahead.

Despite these temporary disruptions, Greenidge anticipates a

significant boost in earnings in subsequent quarters due to the

ongoing cost savings. The Company also continues to explore

additional opportunities to further streamline operations and

improve efficiency across its business units.

Greenidge CEO Jordan Kovler commented: “The actions we took in

the first half of 2024 created a strong foundation that positions

Greenidge to grow efficiently moving forward as we continue to

scale our business. This quarter, we followed through on our

promises to significantly reduce SG&A, expand our power

capacity and obtain and build new sites with low power where we can

deploy our own miners. With increased access to capital and a

robust operational footprint across the country, we see numerous

paths ahead to increase shareholder value and to build on the new

offerings we introduced this quarter.”

Kovler added: “Over the last several months, we not only

continued to expand our AI infrastructure and data center

footprint, but we also made remarkable progress evolving our

business with the launch of the Greenidge Pod X, the introduction

of our new EPCM business and the decision to maintain a treasury of

bitcoin. With the halving and many strategic decisions to increase

long-term value for the sake of short-term profit now behind us, we

believe Greenidge is well positioned to capitalize on the

opportunities ahead that will continue to add value to our

story.”

About Greenidge Generation Holdings Inc. Greenidge

Generation Holdings Inc. (NASDAQ: GREE) is a vertically integrated

power generation company, focusing on cryptocurrency mining,

infrastructure development, engineering, procurement, construction

management, operations and maintenance of sites.

Forward-Looking Statements This press release includes

certain statements that may constitute “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements other than statements of historical fact

are forward-looking statements for purposes of federal and state

securities laws. These forward-looking statements involve

uncertainties that could significantly affect Greenidge’s financial

or operating results. These forward-looking statements may be

identified by terms such as “anticipate,” “believe,” “continue,”

“foresee,” “expect,” “intend,” “plan,” “may,” “will,” “would,”

“could,” and “should,” and the negative of these terms or other

similar expressions. Forward-looking statements are based on

current beliefs and assumptions that are subject to risks and

uncertainties and are not guarantees of future performance.

Forward-looking statements in this press release include, among

other things, statements regarding the business plan, business

strategy and operations of Greenidge in the future. In addition,

all statements that address operating performance and future

performance, events or developments that are expected or

anticipated to occur in the future are forward looking statements.

Forward-looking statements are subject to a number of risks,

uncertainties and assumptions. Matters and factors that could cause

actual results to differ materially from those expressed or implied

in such forward-looking statements include but are not limited to

the matters and factors described in Part I, Item 1A. “Risk

Factors” of Greenidge’s Annual Report on Form 10-K and its other

filings with the Securities and Exchange Commission. Consequently,

all of the forward-looking statements made in this press release

are qualified by the information contained under this caption. No

assurance can be given that these are all of the factors that could

cause actual results to vary materially from the forward-looking

statements in this press release. You should not put undue reliance

on forward-looking statements. No assurances can be given that any

of the events anticipated by the forward-looking statements will

transpire or occur, or if any of them do occur, the actual results,

performance, or achievements of Greenidge could differ materially

from the results expressed in, or implied by, any forward-looking

statements. All forward-looking statements speak only as of the

date of this press release and Greenidge does not assume any duty

to update or revise any forward-looking statements included in this

press release, whether as a result of new information, the

occurrence of future events, uncertainties or otherwise, after the

date of this press release.

Use of Non-GAAP Information To provide investors and

others with additional information regarding Greenidge’s financial

results, Greenidge has disclosed in this press release the non-GAAP

operating performance measures of Adjusted EBITDA. Adjusted EBITDA

is defined as earnings before interest, taxes and depreciation and

amortization, which is then adjusted for stock-based compensation

and other special items determined by management, including, but

not limited to, business expansion costs, impairments of long-lived

assets, gains or losses from the sales of long-lived assets,

remeasurement of environmental liabilities, restructuring and loss

on extinguishment of debt. These non-GAAP financial measures are a

supplement to and not a substitute for or superior to, Greenidge’s

results presented in accordance with U.S. GAAP. The non-GAAP

financial measures presented by Greenidge may be different from

non-GAAP financial measures presented by other companies.

Specifically, Greenidge believes the non-GAAP information provides

useful measures to investors regarding Greenidge’s financial

performance by excluding certain costs and expenses that Greenidge

believes are not indicative of its core operating results. The

presentation of these non-GAAP financial measures is not meant to

be considered in isolation or as a substitute for results or

guidance prepared and presented in accordance with U.S. GAAP.

Because of these limitations, EBITDA and Adjusted EBITDA should

not be considered in isolation or as a substitute for performance

measures calculated in accordance with GAAP. Greenidge compensates

for these limitations by relying primarily on its GAAP results and

using EBITDA and Adjusted EBITDA on a supplemental basis.

Three Months Ended

Six Months Ended

Amounts denoted in millions

June 30, 2024

June 30, 2024

Net loss from continuing operations

$

(5.5

)

$

(9.5

)

Interest expense, net

1.8

3.6

Depreciation

3.3

6.5

EBITDA (loss) from continuing

operations

(0.4

)

0.6

Stock based compensation

0.3

1.4

Gain on sale of assets

—

—

Change in fair value of warrant assets

—

0.4

Impairment of long-lived assets

—

0.2

Adjusted EBITDA (loss) from continuing

operations

$

(0.1

)

$

2.5

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240814930768/en/

Investors Nick Ratti 315-536-2359 nratti@greenidge.com

investorrelations@greenidge.com

Media Longacre Square Partners Kate Sylvester / Liz

Shoemaker 646-386-0091 greenidge@longacresquare.com

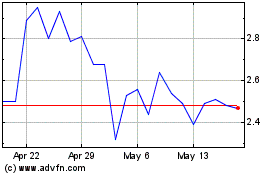

Greenidge Generation (NASDAQ:GREE)

Historical Stock Chart

From Nov 2024 to Dec 2024

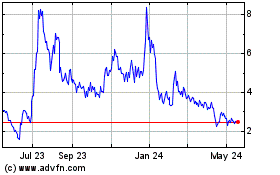

Greenidge Generation (NASDAQ:GREE)

Historical Stock Chart

From Dec 2023 to Dec 2024