HMN Financial, Inc. (NASDAQ:HMNF): First Quarter Highlights Net

income of $3.3 million, up $528,000, or 19.3% from first quarter of

2006 Diluted earnings per share of $0.82, up $0.14, or 20.6%, from

first quarter of 2006 Net interest income up $395,000, or 4.2%,

over first quarter of 2006 Net interest margin down 9 basis points

from first quarter of 2006 Gain on sales of loans up $550,000, or

223.6%, over first quarter 2006 EARNINGS SUMMARY Three Months Ended

March 31, 2007 � 2006 Net income � $3,268,000� 2,740,000� Diluted

earnings per share 0.82� 0.68� Return on average assets 1.28% 1.14%

Return on average equity 13.79% 11.82% Book value per share �

$22.01� 20.99� HMN Financial, Inc. (HMN) (NASDAQ:HMNF), the $1.1

billion holding company for Home Federal Savings Bank (the Bank),

today reported net income of $3.3 million for the first quarter of

2007, up $528,000, or 19.3%, from net income of $2.7 million for

the first quarter of 2006. Diluted earnings per common share for

the first quarter of 2007 were $0.82, up $0.14, or 20.6%, from

$0.68 for the first quarter of 2006. The increase in net income was

due primarily to increases in net interest income and the gains

recognized on the sale of commercial loans. First Quarter Results

Net Interest Income Net interest income was $9.8 million for the

first quarter of 2007, an increase of $395,000, or 4.2%, compared

to $9.4 million for the first quarter of 2006. Interest income was

$18.3 million for the first quarter of 2007, an increase of $2.3

million, or 14.4%, from $16.0 million for the first quarter of

2006. Interest income increased primarily because of an increase in

the average interest rate earned on loans and investments. Interest

rates increased primarily because of the 50 basis point increase in

the prime interest rate between the periods. Increases in the prime

rate, which is the rate that banks charge their prime business

customers, generally increase the rates on adjustable rate consumer

and commercial loans in the portfolio and on new loans originated.

The average yield earned on interest-earning assets was 7.49% for

the first quarter of 2007, an increase of 51 basis points from the

6.98% average yield for the first quarter of 2006. Interest income

also increased because of the $61 million increase in the average

interest earning assets between the periods. Interest expense was

$8.5 million for the first quarter of 2007, an increase of $1.9

million, or 28.8%, compared to $6.6 million for the first quarter

of 2006. Interest expense increased because of the higher interest

rates paid on deposits which were caused by the 50 basis point

increase in the federal funds rate between the periods. Increases

in the federal funds rate, which is the rate that banks charge

other banks for short term loans, generally increase the rates

banks pay for deposits. The average interest rate paid on

interest-bearing liabilities was 3.69% for the first quarter of

2007, an increase of 62 basis points from the 3.07% average

interest rate paid in the first quarter of 2006. The average rate

on interest bearing liabilities increased more than the average

yield on interest bearing assets primarily because most of the

deposit growth between the periods was in higher rate money market

accounts while the majority of the asset growth was in lower

yielding investments. Net interest margin (net interest income

divided by average interest earning assets) for the first quarter

of 2007 was 4.01%, a decrease of 9 basis points, compared to 4.10%

for the first quarter of 2006. Provision for Loan Losses The

provision for loan losses was $455,000 for the first quarter of

2007, a decrease of $60,000, compared to $515,000 for the first

quarter of 2006. The provision for loan losses decreased primarily

because of a decrease in the number of commercial loan risk rating

downgrades in the first quarter of 2007 when compared to the same

period of 2006. The decrease in the provision due to fewer loan

risk ratings downgrades was partially offset by the $33 million in

loan growth that was experienced in the first quarter of 2007.

Total non-performing assets were $12.7 million at March 31, 2007,

an increase of $2.3 million, from $10.4 million at December 31,

2006. Non-performing loans decreased $785,000 and foreclosed and

repossessed assets increased $3.1 million during the period. Of the

increase in foreclosed and repossessed assets, $1.8 million was the

result of purchasing the first mortgage on a previously classified

non-performing second mortgage loan in order to improve the

Company�s lien position. A reconciliation of the Company�s

allowance for loan losses for the quarters ended March 31, 2007 and

2006 is summarized as follows: � � � � � (in thousands) 2007 2006

Balance at January 1, $9,873� $8,778� Provision 455� 515� Charge

offs: Commercial loans (42) 0� Consumer loans (580) (91) Recoveries

50� 47� Balance at March 31, $9,756� $9,249� � � � � The increase

in consumer loan charge offs is primarily the result of a home

equity loan that was charged off in the first quarter of 2007 for

which a reserve was established in the fourth quarter of 2006.

Non-Interest Income and Expense Non-interest income was $2.1

million for the first quarter of 2007, an increase of $582,000, or

39.2%, from $1.5 million for the first quarter of 2006. Gain on

sale of loans increased $550,000 between the periods due to a

$612,000 increase in the gain recognized on the sale of government

guaranteed commercial loans that was partially offset by a $62,000

decrease in the gain recognized on the sale of single family loans

due to a decrease in the volume and profit margins on the loans

that were sold. Competition in the single-family loan origination

market continues to be very strong and profit margins were lowered

in order to remain competitive and maintain origination volumes.

Fees and service charges decreased $19,000 between the periods

primarily because of decreased late fees. Loan servicing fees

decreased $32,000 primarily because of a decrease in the number of

single-family loans that are being serviced for others. Other

non-interest income increased $83,000 primarily because of

increased revenues from the sale of uninsured investment products.

Non-interest expense was $6.0 million for the first quarter of

2007, an increase of $10,000, or 0.2%, from $5.9 million for the

first quarter of 2006. Compensation expense increased $102,000

primarily because of annual payroll cost increases. Occupancy

expense decreased $16,000 due primarily to a decrease in real

estate taxes. Advertising expense decreased $25,000 between the

periods primarily because of a decrease in the costs associated

with promoting the new branch and the introduction of new checking

account offerings that occurred in the first quarter of 2006.

Mortgage servicing rights amortization decreased $35,000 between

the periods because there are fewer mortgage loans being serviced.

Income tax expense increased $499,000 between the periods due to an

increase in taxable income and an effective tax rate that increased

from 38.0% for the first quarter of 2006 to 40.0% for the first

quarter of 2007. The increase in the effective tax rate was the

result of changes in state tax allocations, a decrease in low

income tax credits and an increase in the federal tax rate due to

increased income. Return on Assets and Equity Return on average

assets for the first quarter of 2007 was 1.28%, compared to 1.14%

for the first quarter of 2006. Return on average equity was 13.79%

for the first quarter of 2007, compared to 11.82% for the same

quarter in 2006. Book value per common share at March 31, 2007 was

$22.01, compared to $20.99 at March 31, 2006. President�s Statement

"Net interest income continued to increase despite the compression

in net interest margin that occurred during the first quarter of

2007,� said HMN President, Michael McNeil. �We are also encouraged

with the loan and deposit growth that we experienced during the

quarter.� General Information HMN Financial, Inc. and Home Federal

Savings Bank are headquartered in Rochester, Minnesota. The Bank

operates ten full service offices in southern Minnesota located in

Albert Lea, Austin, LaCrescent, Rochester, Spring Valley and Winona

and two full service offices in Iowa located in Marshalltown and

Toledo. Home Federal Savings Bank also operates loan origination

offices located in Sartell and Rochester, Minnesota. Eagle Crest

Capital Bank, a division of Home Federal Savings Bank, operates

branches in Edina and Rochester, Minnesota. Safe Harbor Statement

This press release may contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements include, but are not limited to those

relating to the Company�s financial expectations for earnings and

revenues. A number of factors could cause actual results to differ

materially from the Company�s assumptions and expectations. These

include but are not limited to possible legislative changes and

adverse economic, business and competitive developments such as

shrinking interest margins; reduced collateral values; deposit

outflows; reduced demand for financial services and loan products;

changes in accounting policies and guidelines, or monetary and

fiscal policies of the federal government or tax laws; changes in

credit or other risks posed by the Company�s loan and investment

portfolios; technological, computer-related or operational

difficulties; adverse changes in securities markets; results of

litigation or other significant uncertainties. Additional factors

that may cause actual results to differ from the Company�s

assumptions and expectations include those set forth in the

Company�s most recent filings on form 10-K and Form 10-Q with the

Securities and Exchange Commission. All forward-looking statements

are qualified by, and should be considered in conjunction with,

such cautionary statements. HMN FINANCIAL, INC. AND SUBSIDIARIES

Consolidated Balance Sheets � � � � � March 31, December 31,

(dollars in thousands) � 2007 � 2006 (unaudited) Assets Cash and

cash equivalents $85,633� 43,776� Securities available for sale:

Mortgage-backed and related securities (amortized cost $11,445 and

$6,671) 11,110� 6,178� Other marketable securities (amortized cost

$179,694 and $119,940) 179,931� 119,962� 191,041� 126,140� � Loans

held for sale 1,412� 1,493� Loans receivable, net 798,502� 768,232�

Accrued interest receivable 6,206� 5,061� Real estate, net 5,127�

2,072� Federal Home Loan Bank stock, at cost 7,511� 7,956� Mortgage

servicing rights, net 1,780� 1,958� Premises and equipment, net

11,121� 11,372� Goodwill 3,801� 3,801� Core deposit intangible, net

77� 106� Prepaid expenses and other assets 1,891� 2,943� Deferred

tax asset, net 2,941� 2,879� Total assets $1,117,043� 977,789� � �

Liabilities and Stockholders� Equity Deposits $871,929� 725,959�

Federal Home Loan Bank advances 140,900� 150,900� Accrued interest

payable 2,203� 1,176� Customer escrows 1,240� 721� Accrued expenses

and other liabilities 5,958� 5,891� Total liabilities 1,022,230�

884,647� Commitments and contingencies Stockholders� equity: Serial

preferred stock ($.01 par value): Authorized 500,000 shares; none

issued and outstanding 0� 0� Common stock ($.01 par value):

Authorized 11,000,000; issued shares 9,128,662 91� 91� Additional

paid-in capital 57,537� 57,914� Retained earnings, subject to

certain restrictions 105,715� 103,643� Accumulated other

comprehensive loss (59) (284) Unearned employee stock ownership

plan shares (4,110) (4,158) Treasury stock, at cost 4,821,493 and

4,813,232 shares (64,361) (64,064) Total stockholders� equity

94,813� 93,142� Total liabilities and stockholders� equity

$1,117,043� 977,789� � � � � � HMN FINANCIAL, INC. AND SUBSIDIARIES

Consolidated Statements of Income (unaudited) � � � � � Three

Months Ended March 31, (dollars in thousands) � 2007 � 2006

Interest income: Loans receivable $15,745� 14,703� Securities

available for sale: Mortgage-backed and related 111� 71� Other

marketable 1,896� 890� Cash equivalents 443� 256� Other 84� 63�

Total interest income 18,279� 15,983� � Interest expense: Deposits

6,877� 4,868� Federal Home Loan Bank advances 1,618� 1,726� Total

interest expense 8,495� 6,594� Net interest income 9,784� 9,389�

Provision for loan losses 455� 515� Net interest income after

provision for loan losses 9,329� 8,874� � Non-interest income: Fees

and service charges 696� 715� Mortgage servicing fees 271� 303�

Gain on sales of loans 796� 246� Other 305� 222� Total non-interest

income 2,068� 1,486� � Non-interest expense: Compensation and

benefits 3,361� 3,259� Occupancy 1,084� 1,100� Advertising 106�

131� Data processing 295� 289� Amortization of mortgage servicing

rights, net 182� 217� Other 922� 944� Total non-interest expense

5,950� 5,940� Income before income tax expense 5,447� 4,420� Income

tax expense 2,179� 1,680� Net income $3,268� 2,740� Basic earnings

per share $0.87� 0.71� Diluted earnings per share $0.82� 0.68� � �

� � � � � HMN FINANCIAL, INC. AND SUBSIDIARIES Selected

Consolidated Financial Information (unaudited) � � � � � � �

SELECTED FINANCIAL DATA: Three Months EndedMarch 31, (dollars in

thousands, except per share data) � 2007 � 2006 � � I. ���OPERATING

DATA: Interest income � $18,279� 15,983� Interest expense 8,495�

6,594� Net interest income 9,784� 9,389� � II. ��AVERAGE BALANCES:

Assets (1) 1,037,984� 973,110� Loans receivable, net 787,937�

778,271� Mortgage-backed and related securities (1) 9,996� 7,360�

Interest-earning assets (1) 989,701� 928,945� Interest-bearing

liabilities 933,726� 871,172� Equity (1) 96,104� 94,054� � III.

PERFORMANCE RATIOS: (1) Return on average assets (annualized) 1.28%

1.14% � Interest rate spread information: Average during period

3.80� 3.91� End of period 3.55� 3.90� Net interest margin 4.01�

4.10� Ratio of operating expense to average total assets

(annualized) 2.32� 2.48� Return on average equity (annualized)

13.79� 11.82� Efficiency 50.20� 54.62� � � � � � � March 31,

December 31, March 31, � 2007 � 2006 � 2006 IV. ��ASSET QUALITY :

Total non-performing assets � $12,708� 10,424� 3,491�

Non-performing assets to total assets 1.14% 1.07% � 0.35%

Non-performing loans to total loans receivable, net 0.94� 1.08�

0.27� Allowance for loan losses � $9,756� 9,873� 9,249� Allowance

for loan losses to total loans receivable, net 1.22% 1.29% � 1.20%

Allowance for loan losses to non-performing loans 129.68� 118.84�

454.37� � V. ���BOOK VALUE PER SHARE: Book value per share �

$22.01� 21.58� 20.99� � � � � � � � Three Months Ended Mar 31, 2007

� Year Ended Dec 31, 2006 � Three Months Ended Mar 31, 2006 VI.

��CAPITAL RATIOS : � Stockholders� equity to total assets, at end

of period 8.49% 9.53% � 9.36% Average stockholders� equity to

average assets (1) 9.26� 9.70� 9.67� Ratio of average

interest-earning assets to average interest-bearing liabilities (1)

� 105.99� � 106.67� � 106.63� March 31, December 31, March 31, �

2007 � 2006 � 2006 VII. �EMPLOYEE DATA: Number of full time

equivalent employees 205� 203� 213� � � � � � � � (1) Average

balances were calculated based upon amortized cost without the

market value impact of SFAS 115.

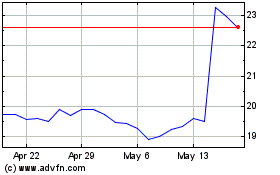

HMN Financial (NASDAQ:HMNF)

Historical Stock Chart

From Jun 2024 to Jul 2024

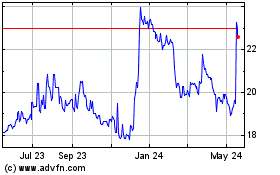

HMN Financial (NASDAQ:HMNF)

Historical Stock Chart

From Jul 2023 to Jul 2024