Form 8-K - Current report

August 14 2023 - 3:13PM

Edgar (US Regulatory)

false 0001786255 0001786255 2023-08-14 2023-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 14, 2023

ICOSAVAX, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-40655 |

|

82-3640549 |

| (State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

1930 Boren Avenue, Suite 1000

Seattle, Washington 98101

(Address of principal executive offices) (Zip Code)

(206) 737-0085

(Registrant’s telephone number, include area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ICVX |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 2.02 Results of Operations and Financial Condition.

On August 14, 2023, Icosavax, Inc. issued a press release announcing its financial results for the quarter ended June 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ICOSAVAX, INC. |

|

|

|

|

| Date: August 14, 2023 |

|

|

|

By: |

|

/s/ Thomas Russo |

|

|

|

|

|

|

Thomas Russo |

|

|

|

|

|

|

Chief Financial Officer |

Exhibit 99.1

Icosavax Reports Second Quarter 2023 Financial Results and Provides Corporate Update

- Positive topline interim Phase 1 results for bivalent VLP vaccine candidate IVX-A12 against RSV

and hMPV in older adults -

- Positive twelve-month immunogenicity data and initial proof-of-concept for revaccination with IVX-121 against RSV -

- Initiation of Phase 2 Trial of IVX-A12 with topline interim results now expected by end 2023 -

- Closed $67.8 million registered direct offering of common stock; extended cash runway into 2H 2025 -

SEATTLE, August 14, 2023 — Icosavax, Inc. (Nasdaq: ICVX), a biopharmaceutical company leveraging its innovative virus-like

particle (VLP) platform technology to develop vaccines against infectious diseases, with an initial focus on life-threatening respiratory diseases and a vision of creating pan-respiratory vaccines for older

adults, today reported financial results for the second quarter ended June 30, 2023 and provided a corporate update.

“The first half of 2023

has been particularly productive for Icosavax, highlighted by our positive topline interim Phase 1 data and the initiation of a Phase 2 trial for IVX-A12, our potential first-in-class bivalent vaccine candidate for RSV and hMPV,” said Adam Simpson, Chief Executive Officer of Icosavax. “From our Phase 1b extension trial of

IVX-121 in RSV, we recently announced positive 12-month immunogenicity and initial revaccination data; these were exciting because better durability and improved

response to boosting are potential opportunities for differentiation of our VLP technology. Looking ahead we have additional near-term clinical milestones, including topline interim data from our Phase 2 study of

IVX-A12 by the end of the year.”

Second Quarter 2023 and Subsequent Highlights

| |

• |

|

Reported positive topline interim phase 1 results for bivalent VLP vaccine candidate IVX-A12 against RSV and hMPV in older adults. In May 2023, Icosavax announced positive topline interim results from a Phase 1 clinical trial of IVX-A12 against respiratory

syncytial virus (RSV) and human metapneumovirus (hMPV) in older adults. IVX-A12 is comprised of IVX-121, Icosavax’s RSV prefusion F protein VLP vaccine candidate,

and IVX-241, Icosavax’s hMPV prefusion F protein VLP vaccine candidate. In this Phase 1 trial, IVX-A12 induced robust immune responses against both RSV and hMPV at

day 28 in older adults, with no evidence of immune interference between RSV and hMPV VLPs administered in combination, and was generally well-tolerated across all dosage groups. |

| |

• |

|

Initiated Phase 2 clinical trial of IVX-A12 against RSV and hMPV in

older adults. In June 2023, Icosavax announced the initiation of a Phase 2 clinical trial of IVX-A12 in older adults. Dosing has been completed and topline interim data is now expected by the end of 2023.

|

| |

• |

|

Reported positive 12-month durability data for IVX-121 against RSV and initial evidence for revaccination potential. In August 2023, Icosavax provided a 12-month immunogenicity update from its Phase 1b extension trial

of IVX-121 against RSV in older adults. These data demonstrate substantial durability of neutralizing antibody (NAb) response against RSV at twelve months after a single administration of IVX-121. The company also reported initial evidence for revaccination potential with its VLP-based vaccines, including robust immune responses against RSV-A in Phase 1b extension trial participants who received 75 µg unadjuvanted IVX-121 at one year after their first dose. |

| |

• |

|

Completed a $67.8 million registered direct offering of common stock. In May 2023,

Icosavax closed a registered direct offering of 8,369,754 shares of its common stock at a purchase price of $8.10 per share. The $67.8 million financing was led by new investor TCGX with participation by additional new investors including

Logos Capital and Vivo Capital. |

| |

• |

|

Appointed Dr. M. Amin Khan, PhD as Executive Vice President, Head of Research and

Development. During the quarter, Icosavax appointed Dr. M. Amin Khan as the company’s Head of Research and Development. Dr. Khan has more than 30 years’ experience in vaccine and pharmaceutical R&D, including senior

scientific and executive leadership roles at Eli Lilly, Novartis and GlaxoSmithKline. He has guided scientific and technical teams to develop novel vaccines for infectious diseases including targets for RSV, influenza, meningitis, group

B streptococcus, S. aureus, COPD, CMV, herpes zoster and SARS-Cov-2, and has contributed to the licensure of four vaccines.

|

Near-Term Milestone Expectations

| |

• |

|

IVX-A12 (RSV + hMPV) Phase 2 topline interim data expected by end 2023

|

| |

• |

|

IVX-A12 (RSV+ hMPV) Phase 1

six-month immunogenicity data expected in 1Q 2024 |

| |

• |

|

Other indications: no changes to milestones related to Flu and COVID-19

programs |

Second Quarter Financial Results

| |

• |

|

Cash and cash equivalents and short-term investments as of June 30, 2023 was

$246.9 million, compared to $219.4 million for the period ended December 31, 2022. Icosavax currently expects its cash balance to be sufficient to fund operations into 2H 2025. |

| |

• |

|

Research and development (R&D) expenses for the three months ended June 30, 2023 were

$19.9 million, compared to $15.8 million for the same period in 2022. The increase was primarily driven by increased clinical development activity, increased personnel related expenses and stock-based compensation expense, increased

expenses primarily related to facilities costs, and increased development-related consulting costs, partially offset by decreased preclinical development and manufacturing activity. Research and development expenses include non-cash stock-based compensation expenses of $2.4 million for the three months ended June 30, 2023. |

| |

• |

|

General and administrative (G&A) expenses for the three months ended June 30, 2023

were $9.1 million compared to $7.3 million for the same period in 2022. The increase was primarily due to increased expenses related to facilities costs to support the company’s growth, increased stock-based compensation expense,

increased professional services, and growth in the number of G&A employees. General and administrative expenses include non-cash stock-based compensation expenses of $3.9 million for the three months

ended June 30, 2023. |

| |

• |

|

Net loss for the three months ended June 30, 2023 was $26.5 million, or a

basic and diluted net loss per share of $0.59. This includes non-cash stock-based compensation expense of $6.3 million. Net loss for the same period in 2022 was $22.6 million or a basic and diluted

net loss per share of $0.57. |

About Icosavax

Icosavax is a biopharmaceutical company leveraging its innovative VLP platform technology to develop vaccines against infectious diseases, with an initial

focus on life-threatening respiratory diseases and a vision for combination and pan-respiratory vaccines. Icosavax’s VLP platform technology is designed to enable multivalent, particle-based display of

complex viral antigens, which it believes will induce broad, robust, and durable protection against the specific viruses targeted. Icosavax’s lead program is a combination vaccine candidate targeting respiratory syncytial virus (RSV) and human

metapneumovirus (hMPV), and its pipeline includes additional programs in influenza and severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). Icosavax was formed

in 2017 to advance the breakthrough VLP technology from the Institute for Protein Design at the University of Washington with the goal to discover, develop, and commercialize vaccines against infectious diseases. Icosavax is located in Seattle.

For more information, visit www.icosavax.com.

Forward-Looking Statements

Statements contained in this

press release regarding matters that are not historical facts are forward-looking statements. The forward-looking statements are based on the company’s current beliefs and expectations and include, but are not limited to: the company’s

expectation regarding the opportunities for, and the prophylactic and commercial potential of, its vaccine candidates and technology platform, including the potential for IVX-A12 to be a first-in-class vaccine; the company’s ability to advance its development program and achieve the noted development milestones in 2023; and the sufficiency of the

company’s current cash, cash equivalents and investments to fund its operations into 2H 2025. Actual results may differ from those set forth in this press release due to the risks and uncertainties inherent in the company’s business,

including, without limitation: the early stage of the company’s development efforts; the company’s approach to the development of vaccine candidates, including its development of a combination bivalent RSV/hMPV VLP vaccine candidate, which

is a novel and unproven approach; potential delays in the development process including without limitation in the commencement, enrollment, conduct of, and receipt of data from, clinical trials; difficulties in developing an hMPV challenge model and

the risk that the planned challenge study may produce negative or inconclusive results based on such model or otherwise; unexpected adverse side effects or inadequate immunogenicity or efficacy of the company’s vaccine candidates that may limit

their development, regulatory approval, and/or commercialization; the company’s dependence on third parties in connection with manufacturing, research, and clinical testing; the risk that approved third party RSV vaccines may make conducting

clinical trials more difficult and costly and otherwise adversely affect the company’s ability to successfully develop, obtain regulatory approval of and commercialize its vaccine candidates; approved vaccines and competing approaches limiting

the commercial value of the company’s vaccine candidates; regulatory developments in the United States and other countries; the company’s ability to fund its operating plans with its current cash, cash equivalents and investments; and

other risks described in the company’s prior filings with the Securities and Exchange Commission (SEC), including under the heading “Risk Factors” in the company’s quarterly report on Form

10-Q for the quarter ended March 31, 2023 and any subsequent filings with the

SEC. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and the company undertakes no obligation to update such statements

to reflect events that occur or circumstances that exist after the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, which is made under the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995.

Icosavax’s Contacts

Media Contact:

Jessica Yingling, Ph.D.,

Little Dog Communications Inc.

jessica@litldog.com

858.344.8091

Investor Contact:

Laurence Watts

Gilmartin Group, LLC

laurence@gilmartinir.com

619.916.7620

ICOSAVAX, INC.

Condensed Balance Sheets

(Unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

155,073 |

|

|

$ |

58,846 |

|

| Restricted cash |

|

|

— |

|

|

|

1,061 |

|

| Short-term investments |

|

|

91,860 |

|

|

|

159,461 |

|

| Prepaid expenses and other current assets |

|

|

4,766 |

|

|

|

4,545 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

251,699 |

|

|

|

223,913 |

|

| Right-of-use

assets – operating leases |

|

|

3,072 |

|

|

|

3,247 |

|

| Property and equipment, net |

|

|

12,131 |

|

|

|

11,517 |

|

| Other noncurrent assets |

|

|

2,124 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

269,026 |

|

|

$ |

238,677 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

1,547 |

|

|

$ |

2,892 |

|

| Accrued and other current liabilities |

|

|

11,298 |

|

|

|

8,759 |

|

| Current portion of operating lease liabilities |

|

|

2,169 |

|

|

|

2,137 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

15,014 |

|

|

|

13,788 |

|

| Operating lease liabilities, net of current portion |

|

|

6,272 |

|

|

|

6,658 |

|

| Other noncurrent liabilities |

|

|

18 |

|

|

|

69 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

21,304 |

|

|

|

20,515 |

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Common stock |

|

|

7 |

|

|

|

6 |

|

| Additional paid-in capital |

|

|

484,666 |

|

|

|

404,386 |

|

| Accumulated other comprehensive loss |

|

|

(66 |

) |

|

|

(403 |

) |

| Accumulated deficit |

|

|

(236,885 |

) |

|

|

(185,827 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

247,722 |

|

|

|

218,162 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

269,026 |

|

|

$ |

238,677 |

|

|

|

|

|

|

|

|

|

|

ICOSAVAX, INC.

Condensed Statements of Operations and Comprehensive Loss

(Unaudited)

(in thousands,

except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Grant revenue |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

582 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

19,826 |

|

|

|

15,820 |

|

|

|

37,183 |

|

|

|

33,733 |

|

| General and administrative |

|

|

9,129 |

|

|

|

7,311 |

|

|

|

18,294 |

|

|

|

13,633 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

28,955 |

|

|

|

23,131 |

|

|

|

55,477 |

|

|

|

47,366 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(28,955 |

) |

|

|

(23,131 |

) |

|

|

(55,477 |

) |

|

|

(46,784 |

) |

| Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and other income |

|

|

2,458 |

|

|

|

495 |

|

|

|

4,419 |

|

|

|

615 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other income |

|

|

2,458 |

|

|

|

495 |

|

|

|

4,419 |

|

|

|

615 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(26,497 |

) |

|

$ |

(22,636 |

) |

|

$ |

(51,058 |

) |

|

$ |

(46,169 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive (loss) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized (losses) gains on

available-for-sale debt securities |

|

|

(3 |

) |

|

|

(275 |

) |

|

|

337 |

|

|

|

(275 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive loss |

|

$ |

(26,500 |

) |

|

$ |

(22,911 |

) |

|

$ |

(50,721 |

) |

|

$ |

(46,444 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share, basic and diluted |

|

$ |

(0.59 |

) |

|

$ |

(0.57 |

) |

|

$ |

(1.19 |

) |

|

$ |

(1.17 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average common shares outstanding, basic and diluted |

|

|

44,770,820 |

|

|

|

39,594,028 |

|

|

|

43,042,461 |

|

|

|

39,524,408 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

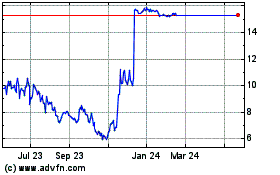

Icosavax (NASDAQ:ICVX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Icosavax (NASDAQ:ICVX)

Historical Stock Chart

From Jul 2023 to Jul 2024