false

0000813762

0000813762

2024-02-28

2024-02-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 28, 2024

(Commission

File

Number) |

(Exact

Name of Registrant as Specified in Its Charter)

(Address of Principal Executive Offices) (Zip Code)

(Telephone Number) |

(State or Other

Jurisdiction of

Incorporation

or

Organization) |

(IRS

Employer

Identification

No.) |

| 1-9516 |

ICAHN

ENTERPRISES L.P.

16690

Collins Avenue, PH-1

Sunny

Isles Beach, FL

33160

(305)

422-4100 |

Delaware |

13-3398766 |

(Former Name or Former Address, if Changed Since

Last Report)

N/A

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communication pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Depositary

Units of Icahn Enterprises L.P. Representing Limited Partner Interests |

|

IEP |

|

NASDAQ Global Select Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Exchange Act of 1934. Emerging Growth Company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

On February 28, 2024, Icahn Enterprises L.P. issued

a press release reporting its financial results for the fourth quarter of 2023. A copy of the press release is attached hereto as Exhibit

99.1.

The information furnished pursuant to this Item

2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended, or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any

filing under the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 – Press Release dated February 28, 2024.

104 – Cover

Page Interactive Data File (formatted in Inline XBRL in Exhibit 101).

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ICAHN ENTERPRISES L.P.

(Registrant) |

| |

|

|

|

| |

By: |

Icahn Enterprises G.P. Inc.,

its general partner |

| |

|

|

|

| |

|

By: |

/s/ Ted Papapostolou |

|

|

|

Ted Papapostolou

Chief Financial Officer |

Date: February 28, 2024

Exhibit 99.1

Icahn Enterprises L.P. (Nasdaq: IEP) Today

Announced Its Fourth Quarter and Full Year 2023 Financial Results

Sunny Isles Beach, Fla, February 28, 2024 –

| · | Fourth

quarter net loss attributable to IEP of $139 million, an improvement of $116 million over

prior year quarter |

| · | Fourth

quarter Adjusted EBITDA attributable to IEP of $9 million, an increase of $84 million over

prior year quarter |

| · | Indicative

Net Asset Value was $4.76 billion as of December 31, 2023, a decrease of approximately $411

million compared to September 30, 2023, primarily driven by the shorts in the investment

funds, which are used for hedging, and the distributions to our unitholders |

| · | IEP

declares fourth quarter distribution of $1.00 per depositary unit |

| · | In

December 2023 we defeased our 2024 notes and the next note maturity of $750 million is December

of 2025 |

| · | Our

cash position was $2.7 billion across the Holding Company and Investment segments as of Year

End 2023 (1) |

As Chairman Carl C. Icahn has previously stated:

"I have come to believe that activism, on a risk reward basis, is the best investment paradigm that exists. While this method of

investing certainly is somewhat volatile, over the long term the returns cannot be matched.”

“In 2000, IEP began to expand its business

beyond its traditional real estate activities to fully embrace the activist strategy. On January 1, 2000, the closing sale price of our

depositary units was $7.63 per depositary unit. On February 16, 2024, our depositary units closed at $21.22 per depositary unit, representing

an increase of approximately 1,066% since January 1, 2000 (including reinvestment of distributions into additional depositary units and

taking into account in-kind distributions of depositary units). Comparatively, the S&P 500, Dow Jones Industrial and Russell 2000

indices increased approximately 436%, 491% and 453%, respectively, over the same period (including reinvestment of distributions into

those indices).”

“The reason activism works so well is that,

somewhat unfortunately, many public companies are not well run. It is very difficult and expensive to remove a poorly-performing CEO

and board. And that is why so few investors today employ true activism. Fortunately for IEP and its unitholders, we are in a unique position

to be activists. Given our track record, our stable capital base, and our willingness to launch proxy contests (which are extremely arduous

and expensive to conduct and even more so to win), we are frequently invited into the tent without ever having to take aggressive actions.

To that end, we currently have 25 board seats in our disclosed public company investments.”

“We encourage all of our companies to pursue

spin-offs and asset sales when they create value, improve leadership in key positions and help manage and settle complex litigation.

We often find ourselves investing in companies that are temporarily out of favor and/or contain hidden jewels. We have continued to pick

our spots and find new, exciting activist opportunities, including the recently announced positions in American Electric Power Company,

Inc. (ticker: AEP) and JetBlue Airways Corp. (ticker: JBLU) within our Investment segment.”

(1) Our cash position of $2.7 billion consists of Investment segment cash held at consolidated partnerships of $1.1 billion, Holding Company cash and cash equivalents of $1.6 billion and Investment segment cash and cash equivalents of $23 million.

“Over the long term, our activist returns

have been outstanding. Given our hedge portfolio and the frequent long time horizon of our complex activist investments, our returns

can often be lumpy. There are also times when our hedge book can go against us and overwhelm the performance of our long positions. This

underperformance has occurred several times in IEP's history. While there are never guarantees, we expect our returns to improve back

to historical levels where our long positions far outperform our hedges. If successful, this should result in greatly enhanced NAV."

Financial Summary

(Net loss and Adjusted EBITDA figures in commentary below are attributable

to Icahn Enterprises, unless otherwise specified)

For the three months ended December 31, 2023,

revenues were $2.7 billion and net losses were $139 million, or a loss of $0.33 per depositary unit. Losses for the quarter were primarily

driven by shorts in the investment funds, which are used for hedging. For the three months ended December 31, 2022, revenues were $3.1

billion and net losses were $255 million, or a loss of $0.74 per depository unit. Adjusted EBITDA was $9 million for the three months

ended December 31, 2023, compared to an Adjusted EBITDA loss of $75 million for the three months ended December 31, 2022.

For the twelve months ended December 31, 2023,

revenues were $10.8 billion and net losses were $684 million, or a loss of $1.75 per depositary unit. An important factor included in

these results are losses from our shorts in the investment funds, which are used for hedging. For the twelve months ended December 31,

2022, revenues were $14.1 billion and net losses were $183 million, or $0.57 per depositary unit. Adjusted EBITDA was $361 million for

the twelve months ended December 31, 2023, compared to $679 million for the twelve months ended December 31, 2022.

As of December 31, 2023, indicative net asset

value decreased $411 million compared to September 30, 2023. This decrease is primarily driven by the shorts in the investment funds,

which are used for hedging, and the distributions to our unitholders.

On February 26, 2024, the Board

of Directors of the general partner of Icahn Enterprises declared a quarterly distribution in the amount of $1.00 per depositary unit,

which will be paid on or about April 18, 2024, to depositary unitholders of record at the close of business on March 11, 2024. Depositary

unitholders will have until April 5, 2024, to make a timely election to receive either cash or additional depositary units. If a unitholder

does not make a timely election, it will automatically be deemed to have elected to receive the distribution in additional depositary

units. Depositary unitholders who elect to receive (or who are deemed to have elected to receive) additional depositary units will receive

units valued at the volume weighted average trading price of the units during the five consecutive trading days ending April 12,

2024. Icahn Enterprises will make a cash payment in lieu of issuing fractional depositary units to any unitholders electing to receive

(or who are deemed to have elected to receive) depositary units.

***

Icahn Enterprises L.P., a master limited partnership,

is a diversified holding company owning subsidiaries currently engaged in the following continuing operating businesses: Investment,

Energy, Automotive, Food Packaging, Real Estate, Home Fashion and Pharma.

Caution Concerning Forward-Looking Statements

This

release may contain certain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act

of 1995, many of which are beyond our ability to control or predict. Forward-looking statements may be identified by words such as "expects,"

"anticipates," "intends," "plans," "believes," "seeks," "estimates," "will"

or words of similar meaning and include, but are not limited to, statements about the expected future business and financial performance

of Icahn Enterprises and its subsidiaries. Actual events, results and outcomes may differ materially from our expectations

due to a variety of known and unknown risks, uncertainties and other factors, including risks related to economic downturns, substantial

competition and rising operating costs; the impacts from the Russia/Ukraine conflict and conflict in the Middle East, including economic

volatility and the impacts of export controls and other economic sanctions, risks related to our investment activities, including the

nature of the investments made by the private funds in which we invest, declines in the fair value of our investments as a result of

the COVID-19 pandemic, losses in the private funds and loss of key employees; risks related to our ability to continue to conduct our

activities in a manner so as to not be deemed an investment company under the Investment Company Act of 1940, as amended, or to be taxed

as a corporation; risks related to short sellers and associated litigation and regulatory inquiries; risks related to our general partner

and controlling unitholder; risks related to our energy business, including the volatility and availability of crude oil, other feed

stocks and refined products, declines in global demand for crude oil, refined products and liquid transportation fuels, unfavorable refining

margin (crack spread), interrupted access to pipelines, significant fluctuations in nitrogen fertilizer demand in the agricultural industry

and seasonality of results; risks related to the success of a spin-off of the fertilizer business including risks related to any

decision to cease exploration of a spin-off; risks related to our automotive activities and exposure

to adverse conditions in the automotive industry, including as a result of the COVID-19 pandemic and the Chapter 11 filing of our automotive

parts subsidiary; risks related to our food packaging activities, including competition from better capitalized competitors, inability

of our suppliers to timely deliver raw materials, and the failure to effectively respond to industry changes in casings technology; supply

chain issues; inflation, including increased costs of raw materials and shipping, including as a result of the Russia/Ukraine conflict

and conflict in the Middle East; interest rate increases; labor shortages and workforce availability; risks related to our real estate

activities, including the extent of any tenant bankruptcies and insolvencies; risks related to our home fashion operations, including

changes in the availability and price of raw materials, manufacturing disruptions, and changes in transportation costs and delivery times;

and other risks and uncertainties detailed from time to time in our filings with the Securities and Exchange Commission including

out Annual Report on Form 10-K and our quarterly reports on Form 10-Q under the caption “Risk Factors”. Additionally, there

may be other factors not presently known to us or which we currently consider to be immaterial that may cause our actual results to differ

materially from the forward-looking statements. Past performance in our Investment segment is not

indicative of future performance. We undertake no obligation to publicly update or review any forward-looking information, whether as

a result of new information, future developments or otherwise.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | |

Three Months

Ended December 31, | | |

Year Ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| | |

(in millions, except per unit amounts) | |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Net sales | |

$ | 2,644 | | |

$ | 3,280 | | |

$ | 11,077 | | |

$ | 13,378 | |

| Other revenues from operations | |

| 182 | | |

| 186 | | |

| 770 | | |

| 748 | |

| Net loss from investment activities | |

| (300 | ) | |

| (478 | ) | |

| (1,575 | ) | |

| (168 | ) |

| Interest and dividend income | |

| 155 | | |

| 148 | | |

| 636 | | |

| 328 | |

| Gain (loss) on disposition of assets, net | |

| 3 | | |

| (11 | ) | |

| 8 | | |

| (8 | ) |

| Other loss, net | |

| (7 | ) | |

| (24 | ) | |

| (69 | ) | |

| (177 | ) |

| | |

| 2,677 | | |

| 3,101 | | |

| 10,847 | | |

| 14,101 | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of goods sold | |

| 2,380 | | |

| 2,951 | | |

| 9,327 | | |

| 11,689 | |

| Other expenses from operations | |

| 160 | | |

| 142 | | |

| 643 | | |

| 583 | |

| Selling, general and administrative | |

| 199 | | |

| 329 | | |

| 852 | | |

| 1,250 | |

| Restructuring, net | |

| — | | |

| 2 | | |

| 1 | | |

| 2 | |

| Impairment | |

| 7 | | |

| — | | |

| 7 | | |

| — | |

| Credit loss on related party note receivable | |

| — | | |

| — | | |

| 139 | | |

| — | |

| Loss on deconsolidation of subsidiary | |

| — | | |

| — | | |

| 246 | | |

| — | |

| Interest expense | |

| 128 | | |

| 144 | | |

| 554 | | |

| 568 | |

| | |

| 2,874 | | |

| 3,568 | | |

| 11,769 | | |

| 14,092 | |

| (Loss) income before income tax benefit (expense) | |

| (197 | ) | |

| (467 | ) | |

| (922 | ) | |

| 9 | |

| Income tax (expense) benefit | |

| (8 | ) | |

| 59 | | |

| (90 | ) | |

| (34 | ) |

| Net loss | |

| (205 | ) | |

| (408 | ) | |

| (1,012 | ) | |

| (25 | ) |

| Less: net loss attributable to non-controlling

interests | |

| (66 | ) | |

| (153 | ) | |

| (328 | ) | |

| 158 | |

| Net loss attributable to Icahn Enterprises | |

$ | (139 | ) | |

$ | (255 | ) | |

$ | (684 | ) | |

$ | (183 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to Icahn Enterprises allocated to: | |

| | | |

| | | |

| | | |

| | |

| Limited partners | |

$ | (136 | ) | |

$ | (250 | ) | |

$ | (670 | ) | |

$ | (179 | ) |

| General partner | |

| (3 | ) | |

| (5 | ) | |

| (14 | ) | |

| (4 | ) |

| | |

$ | (139 | ) | |

$ | (255 | ) | |

$ | (684 | ) | |

$ | (183 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted loss per LP unit | |

$ | (0.33 | ) | |

$ | (0.74 | ) | |

$ | (1.75 | ) | |

$ | (0.57 | ) |

| Basic and diluted weighted average

LP units outstanding | |

| 412 | | |

| 340 | | |

| 382 | | |

| 316 | |

| Distributions declared per LP unit | |

$ | 1.00 | | |

$ | 2.00 | | |

$ | 6.00 | | |

$ | 8.00 | |

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| | |

(in millions, except unit amounts) | |

| ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 2,951 | | |

$ | 2,337 | |

| Cash held at consolidated affiliated partnerships and restricted

cash | |

| 2,995 | | |

| 2,549 | |

| Investments | |

| 3,012 | | |

| 6,809 | |

| Due from brokers | |

| 4,367 | | |

| 7,051 | |

| Accounts receivable, net | |

| 485 | | |

| 606 | |

| Related party notes receivable, net | |

| 11 | | |

| — | |

| Inventories | |

| 1,047 | | |

| 1,531 | |

| Property, plant and equipment, net | |

| 3,969 | | |

| 4,038 | |

| Deferred tax asset | |

| 184 | | |

| 127 | |

| Derivative assets, net | |

| 64 | | |

| 805 | |

| Goodwill | |

| 288 | | |

| 288 | |

| Intangible assets, net | |

| 466 | | |

| 533 | |

| Other assets | |

| 1,019 | | |

| 1,240 | |

| Total Assets | |

$ | 20,858 | | |

$ | 27,914 | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| Accounts payable | |

$ | 830 | | |

$ | 870 | |

| Accrued expenses and other liabilities | |

| 1,596 | | |

| 1,981 | |

| Deferred tax liabilities | |

| 399 | | |

| 338 | |

| Derivative liabilities, net | |

| 979 | | |

| 691 | |

| Securities sold, not yet purchased, at fair value | |

| 3,473 | | |

| 6,495 | |

| Due to brokers | |

| 301 | | |

| 885 | |

| Debt | |

| 7,207 | | |

| 7,096 | |

| Total liabilities | |

| 14,785 | | |

| 18,356 | |

| | |

| | | |

| | |

| Commitments and contingencies (Note 19) | |

| | | |

| | |

| | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| Limited partners: Depositary units: 429,033,241

units issued and outstanding at December 31, 2023 and 353,572,182 units issued and outstanding at December 31, 2022 | |

| 3,969 | | |

| 4,647 | |

| General partner | |

| (761 | ) | |

| (747 | ) |

| Equity attributable to Icahn Enterprises | |

| 3,208 | | |

| 3,900 | |

| Equity attributable to non-controlling

interests | |

| 2,865 | | |

| 5,658 | |

| Total equity | |

| 6,073 | | |

| 9,558 | |

| Total Liabilities and Equity | |

$ | 20,858 | | |

$ | 27,914 | |

Use of Non-GAAP Financial Measures

The

Company uses certain non-GAAP financial measures in evaluating its performance. These include non-GAAP EBITDA and Adjusted EBITDA. EBITDA

represents earnings from continuing operations before net interest expense (excluding our Investment segment), income tax (benefit) expense

and depreciation and amortization. We define Adjusted EBITDA as EBITDA excluding certain effects of impairment, restructuring costs,

transformation costs, certain pension plan expenses, gains/losses on disposition of assets, gains/losses on extinguishment of debt and

certain other non-operational charges. We present EBITDA and Adjusted EBITDA on a consolidated basis and on a basis attributable to Icahn

Enterprises net of the effects of non-controlling interests. We conduct substantially all of our operations through subsidiaries. The

operating results of our subsidiaries may not be sufficient to make distributions to us. In addition, our subsidiaries are not obligated

to make funds available to us for payment of our indebtedness, payment of distributions on our depositary units or otherwise, and distributions

and intercompany transfers from our subsidiaries to us may be restricted by applicable law or covenants contained in debt agreements

and other agreements to which these subsidiaries currently may be subject or into which they may enter into in the future. The terms

of any borrowings of our subsidiaries or other entities in which we own equity may restrict dividends, distributions or loans to us.

We believe that providing EBITDA and Adjusted

EBITDA to investors has economic substance as these measures provide important supplemental information of our performance to investors

and permits investors and management to evaluate the core operating performance of our business without regard to interest (except with

respect to our Investment segment), taxes and depreciation and amortization and certain effects of impairment, restructuring costs, certain

pension plan expenses, gains/losses on disposition of assets, gains/losses on extinguishment of debt and certain other non-operational

charges. Additionally, we believe this information is frequently used by securities analysts, investors and other interested parties

in the evaluation of companies that have issued debt. Management uses, and believes that investors benefit from referring to, these non-GAAP

financial measures in assessing our operating results, as well as in planning, forecasting and analyzing future periods. Adjusting earnings

for these charges allows investors to evaluate our performance from period to period, as well as our peers, without the effects of certain

items that may vary depending on accounting methods and the book value of assets. Additionally, EBITDA and Adjusted EBITDA present meaningful

measures of performance exclusive of our capital structure and the method by which assets were acquired and financed. Effective December

31, 2023, we modified our calculation of EBITDA to exclude the impact of net interest expense from the Investment segment. This change

has been applied to all periods presented. We believe that this revised presentation improves the supplemental information provided to

our investors because interest expense within the Investment segment is associated with its core operations of investment activity rather

than representative of its capital structure.

EBITDA

and Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation, or as substitutes for analysis

of our results as reported under generally accepted accounting principles in the United States, or U.S. GAAP. For example, EBITDA and

Adjusted EBITDA:

| · | do

not reflect our cash expenditures, or future requirements for capital expenditures, or contractual

commitments; |

| · | do

not reflect changes in, or cash requirements for, our working capital needs; and |

| · | do

not reflect the significant interest expense, or the cash requirements necessary to service

interest or principal payments on our debt. |

Although

depreciation and amortization are non-cash charges, the assets being depreciated or amortized often will have to be replaced in the future,

and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements. Other companies in the industries in which

we operate may calculate EBITDA and Adjusted EBITDA differently than we do, limiting their usefulness as comparative measures.

In addition, EBITDA and Adjusted EBITDA do not reflect the impact of earnings or charges resulting from matters we consider not

to be indicative of our ongoing operations.

EBITDA

and Adjusted EBITDA are not measurements of our financial performance under U.S. GAAP and should not be considered as alternatives to

net income or any other performance measures derived in accordance with U.S. GAAP or as alternatives to cash flow from operating activities

as a measure of our liquidity. Given these limitations, we rely primarily on our U.S. GAAP results and use EBITDA and Adjusted EBITDA

only as a supplemental measure of our financial performance.

Use of Indicative Net Asset Value Data

The

Company uses indicative net asset value as an additional method for considering the value of the Company’s assets, and we believe

that this information can be helpful to investors. Please note, however, that the indicative net asset value does not represent the market

price at which the depositary units trade. Accordingly, data regarding indicative net asset value is of limited use and should not be

considered in isolation.

The

Company's depositary units are not redeemable, which means that investors have no right or ability to obtain from the Company the indicative

net asset value of units that they own. Units may be bought and sold on The Nasdaq Global Select Market at prevailing market prices.

Those prices may be higher or lower than the indicative net asset value of the depositary units as calculated by management.

See

below for more information on how we calculate the Company’s indicative net asset value.

| | |

December 31, | | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| |

| | |

(in millions)(unaudited) | |

| Market-valued Subsidiaries and Investments: | |

| | | |

| | | |

| | |

| Holding

Company interest in Investment Funds(1) | |

$ | 3,243 | | |

$ | 3,634 | | |

$ | 4,184 | |

| CVR

Energy(2) | |

| 2,021 | | |

| 2,270 | | |

| 2,231 | |

| Total market-valued subsidiaries and investments | |

$ | 5,264 | | |

$ | 5,904 | | |

$ | 6,415 | |

| | |

| | | |

| | | |

| | |

| Other Subsidiaries: | |

| | | |

| | | |

| | |

| Viskase(3) | |

$ | 386 | | |

$ | 378 | | |

$ | 243 | |

| Real

Estate Holdings(1) | |

| 439 | | |

| 440 | | |

| 455 | |

| WestPoint

Home(1) | |

| 153 | | |

| 158 | | |

| 156 | |

| Vivus(1) | |

| 227 | | |

| 227 | | |

| 241 | |

| | |

| | | |

| | | |

| | |

| Automotive

Services(4) | |

| 660 | | |

| 601 | | |

| 490 | |

| Automotive

Parts(1)(5)(6) | |

| 15 | | |

| 8 | | |

| 381 | |

| Automotive

Owned Real Estate Assets(7) | |

| 763 | | |

| 831 | | |

| 831 | |

| Icahn Automotive Group | |

| 1,438 | | |

| 1,440 | | |

| 1,702 | |

| | |

| | | |

| | | |

| | |

| Total other subsidiaries | |

$ | 2,643 | | |

$ | 2,643 | | |

$ | 2,797 | |

| Add:

Other Net Assets(8) | |

| 114 | | |

| 117 | | |

| 20 | |

| Indicative Gross Asset Value | |

$ | 8,021 | | |

$ | 8,664 | | |

$ | 9,232 | |

| Add:

Holding Company cash and cash equivalents(9) | |

| 1,584 | | |

| 1,813 | | |

| 1,720 | |

| Less:

Holding Company debt(9) | |

| (4,847 | ) | |

| (5,308 | ) | |

| (5,309 | ) |

| Indicative Net Asset Value | |

$ | 4,758 | | |

$ | 5,169 | | |

$ | 5,643 | |

Indicative

net asset value does not purport to reflect a valuation of IEP. The calculated indicative net asset value does not include any value

for our Investment Segment other than the fair market value of our investment in the Investment Funds. A valuation is a subjective exercise

and indicative net asset value does not necessarily consider all elements or consider in the adequate proportion the elements that could

affect the valuation of IEP. Investors may reasonably differ on what such elements are and their impact on IEP. No representation or

assurance, express or implied, is made as to the accuracy and correctness of indicative net asset value as of these dates or with respect

to any future indicative or prospective results which may vary.

| (1) | Represents

GAAP equity attributable to us as of each respective date. |

| (2) | Based

on closing share price on each date (or if such date was not a trading day, the immediately

preceding trading day) and the number of shares owned by the Holding Company as of each respective

date. |

| (3) | Amounts based on market comparables

due to lack of material trading volume, valued at 9.0x Adjusted EBITDA for the trailing twelve months ended

as of each respective date |

| (4) | Amounts based on market comparables, valued

at 10.0x Adjusted EBITDA for the trailing twelve months ended December 31, 2023 and September

30, 2023, valued at 14.0x Adjusted EBITDA for the trailing twelve months ended December 31,

2022, respectively. |

| (5) | On January 31, 2023, a subsidiary of Icahn

Automotive, IEH Auto Parts Holding LLC and its subsidiaries (“Auto Plus”), an

aftermarket parts distributor held within our Automotive segment, filed voluntary petitions

in the United States Bankruptcy Court. As a result, IEP deconsolidated Auto Plus, writing

down its remaining equity interest to zero which was offset by the recognition of a related

party note receivable reflected in Other Net Assets. |

| (6) | Beginning in Q2 2023, a wholly owned subsidiary

of IEP within the Automotive segment acquired assets from the Auto Plus bankruptcy auction,

which are reflected in Automotive Parts. |

| (7) | Management

performed a valuation on the owned real-estate with the assistance of third-party consultants

to estimate fair-market-value. This analysis utilized property-level market rents, location

level profitability, and utilized prevailing cap rates ranging from 7.0% to 10.0%

as of December 31, 2023, and 6.8% to 8.0% as of September 30, 2023, and December 31, 2022.

The valuation assumed that triple net leases are in place for all the locations at rents

estimated by management based on market conditions. There is no assurance we would be able

to sell the assets on the timeline or at the prices and lease terms we estimate. Different

judgments or assumptions would result in different estimates of the value of these real estate

assets. Moreover, although we evaluate and provide our indicative net asset value on a regular

basis, the estimated values may fluctuate in the interim, so that any actual transaction

could result in a higher or lower valuation. |

| (8) | Represents GAAP equity of the Holding Company

Segment, excluding cash and cash equivalents, debt and non-cash deferred tax assets or liabilities.

As of December 31, 2023 and September 30, 2023, Other Net Assets includes $20 million and

$26 million, respectively, of Automotive Segment liabilities assumed from the Auto Plus bankruptcy. |

| (9) | Holding Company’s balance as of each respective date. |

| | |

Three Months

Ended December 31, | | |

Year Ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| | |

(in millions)(unaudited) | |

| Adjusted EBITDA | |

| | | |

| | | |

| | | |

| | |

| Net (loss) income | |

($ | 205 | ) | |

($ | 408 | ) | |

($ | 1,012 | ) | |

($ | 25 | ) |

| Interest expense, net | |

| 54 | | |

| 75 | | |

| 253 | | |

| 355 | |

| Income tax expense (benefit) | |

| 8 | | |

| (59 | ) | |

| 90 | | |

| 34 | |

| Depreciation and amortization | |

| 134 | | |

| 129 | | |

| 518 | | |

| 509 | |

| EBITDA before non-controlling interests | |

| (9 | ) | |

| (263 | ) | |

| (151 | ) | |

| 873 | |

| Impairment | |

| 7 | | |

| - | | |

| 7 | | |

| - | |

| Credit loss on related party note receivable | |

| - | | |

| - | | |

| 139 | | |

| - | |

| Loss on deconsolidation of subsidiary | |

| - | | |

| - | | |

| 246 | | |

| - | |

| Restructuring costs | |

| 1 | | |

| 2 | | |

| 1 | | |

| 2 | |

| (Gain) loss on disposition of assets | |

| (4 | ) | |

| 1 | | |

| (10 | ) | |

| (3 | ) |

| Transformation costs | |

| 11 | | |

| 12 | | |

| 41 | | |

| 53 | |

| Net (gain) loss on extinguishment of debt | |

| (13 | ) | |

| - | | |

| (13 | ) | |

| 1 | |

| Out of period adjustments | |

| 2 | | |

| 52 | | |

| 10 | | |

| 52 | |

| Call option lawsuits settlement | |

| - | | |

| - | | |

| - | | |

| 79 | |

| Other | |

| 2 | | |

| 29 | | |

| 11 | | |

| 40 | |

| Adjusted EBITDA before non-controlling

interests | |

($ | 3 | ) | |

($ | 167 | ) | |

$ | 281 | | |

$ | 1,097 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA attributable

to IEP | |

| | | |

| | | |

| | | |

| | |

| Net (loss) income | |

($ | 139 | ) | |

($ | 255 | ) | |

($ | 684 | ) | |

($ | 183 | ) |

| Interest expense, net | |

| 49 | | |

| 66 | | |

| 224 | | |

| 314 | |

| Income tax expense (benefit) | |

| 4 | | |

| (72 | ) | |

| 36 | | |

| (4 | ) |

| Depreciation and amortization | |

| 89 | | |

| 90 | | |

| 354 | | |

| 352 | |

| EBITDA attributable to IEP | |

| 3 | | |

| (171 | ) | |

| (70 | ) | |

| 479 | |

| Impairment | |

| 7 | | |

| - | | |

| 7 | | |

| - | |

| Credit loss on related party note receivable | |

| - | | |

| - | | |

| 139 | | |

| - | |

| Loss on deconsolidation of subsidiary | |

| - | | |

| - | | |

| 246 | | |

| - | |

| Restructuring costs | |

| 1 | | |

| 2 | | |

| 1 | | |

| 2 | |

| (Gain) loss on disposition of assets | |

| (4 | ) | |

| 1 | | |

| (10 | ) | |

| (3 | ) |

| Transformation costs | |

| 11 | | |

| 12 | | |

| 41 | | |

| 53 | |

| Net (gain) loss on extinguishment of debt | |

| (13 | ) | |

| - | | |

| (13 | ) | |

| 1 | |

| Out of period adjustments | |

| 2 | | |

| 52 | | |

| 10 | | |

| 52 | |

| Call option lawsuits settlement | |

| - | | |

| - | | |

| - | | |

| 56 | |

| Other | |

| 2 | | |

| 29 | | |

| 10 | | |

| 39 | |

| Adjusted EBITDA attributable to

IEP | |

$ | 9 | | |

($ | 75 | ) | |

$ | 361 | | |

$ | 679 | |

Investor Contact:

Ted Papapostolou, Chief Financial Officer

IR@ielp.com

(800) 255-2737

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

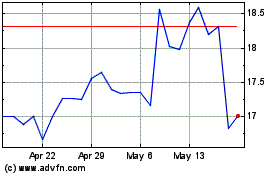

Icahn Enterprises (NASDAQ:IEP)

Historical Stock Chart

From Nov 2024 to Nov 2024

Icahn Enterprises (NASDAQ:IEP)

Historical Stock Chart

From Nov 2023 to Nov 2024