false

0001425205

0001425205

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event

reported): November 7, 2024

IOVANCE BIOTHERAPEUTICS, INC.

(Exact Name of Registrant as Specified in

Charter)

| Delaware |

| (State of Incorporation) |

| |

| 001-36860 |

|

75-3254381 |

| Commission File Number |

|

(I.R.S. Employer Identification No.) |

| |

|

|

| 825

Industrial Road, 4th Floor |

|

|

| San Carlos, California |

|

94070 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

| |

|

|

| (650) 260-7120 |

| (Registrant’s Telephone Number, Including Area Code) |

| |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act

of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name of each exchange on which

registered |

| Common stock, par value $0.000041666 per share |

IOVA |

The Nasdaq Stock Market LLC |

| Item 2.02. |

Results of Operations and Financial Condition. |

On November 7, 2024, Iovance Biotherapeutics, Inc.

(the “Company”) issued a press release announcing its financial results for the quarter ended September 30, 2024 and an update

on recent developments. A copy of that press release is furnished as Exhibit 99.1.

The information furnished under this Item 2.02,

including the accompanying Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall such

information be deemed to be incorporated by reference in any subsequent filing by the Company under the Securities Act of 1933, as amended,

or the Exchange Act, regardless of the general incorporation language of such filing, except as specifically stated in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Iovance Biotherapeutics, Inc. |

| |

|

|

| |

|

|

| Dated: November 7, 2024 |

By: |

/s/ Frederick G. Vogt |

| |

|

Name: |

Frederick G. Vogt, Ph.D., J.D. |

| |

|

Title: |

Interim CEO and President, and General Counsel |

Exhibit 99.1

Iovance Biotherapeutics Reports Financial Results

and Corporate Updates for Third Quarter and Year to Date 2024

Significant Demand for Amtagvi™ (Lifileucel)

Continues with $58.6M in

Total 3Q24 Product Revenue

Reaffirming Guidance of $160-$165M for FY24

and $450-$475M for FY25 of

Total Product Revenue

Marketing Authorization Applications Validated

and Accepted for Review by European Regulatory Authorities for Potential Approval Starting with the UK in 1H2025 and EU and Canada in

2H2025

Enrollment Accelerating in IOV-LUN-202 Registrational

Phase 2 Trial in Post-anti-PD-1 NSCLC

SAN CARLOS, Calif., November 7, 2024 -- Iovance Biotherapeutics, Inc.

(NASDAQ: IOVA), a commercial biotechnology company focused on innovating, developing, and delivering novel polyclonal tumor infiltrating

lymphocyte (TIL) therapies for patients with cancer, today reported third quarter and year to date 2024 financial results and corporate

updates.

Frederick Vogt, Ph.D., J.D., Interim President and Chief Executive

Officer of Iovance, stated, “Iovance is executing a successful U.S. commercial launch of Amtagvi™ for patients with previously

treated advanced melanoma. Robust demand for Amtagvi and Proleukin® continues to grow as our expanding network of authorized treatment

centers (ATCs) and outreach to community oncologists broaden the utilization of Amtagvi, driving a higher volume of patient referrals.

Demand trends are expected to accelerate growth throughout the remainder of the year and over the following years. As such, we are actively

pursuing additional regulatory approvals to expand our commercial footprint, driving growth beyond the U.S. into new markets with a high

prevalence of advanced melanoma. As a fully integrated company, Iovance is well positioned to remain the global leader in innovating,

developing, and delivering current and future generations of TIL cell therapy for patients with cancer.”

Third Quarter and Year

to Date 2024 Financial Results, Corporate Guidance, and Updates

Product Revenue and Guidance

| · | 3Q24 Total Product Revenue: Iovance recognized total

revenue of $58.6 million from sales of Amtagvi and Proleukin during the third quarter ended September 30, 2024. |

| o | Amtagvi Revenue: Product revenue was $42.1 million from U.S. Amtagvi sales in the third quarter of 2024, reflecting increasing

strong demand and adoption. The Amtagvi launch, with revenue recognized upon patient infusion, began during the second quarter of 2024. |

| o | Proleukin Revenue: Product revenue also included $16.5 million of Proleukin sales in the third quarter of 2024. Proleukin is

used in the Amtagvi treatment regimen and other commercial and clinical settings. Proleukin revenue is recognized upon delivery to distributors

and ATCs and purchased several months in advance of anticipated infusions and Amtagvi revenue recognition. |

| · | Year to Date Total Product Revenue and Infusions: Through

the end of the third quarter of 2024, $90.4 million in total product revenue has been recognized following the U.S. launch of Amtagvi

on February 20, 2024. |

| o | Amtagvi Infusions: A total of 146 patients have been infused with Amtagvi since the first commercial infusion in April 2024,

including 25 patients infused in the second quarter, 82 patients infused in the third quarter, and 39 patients infused since the start

of the fourth quarter. |

| o | Amtagvi and Proleukin Revenue: Amtagvi and Proleukin revenue is $54.9 million and $35.5 million year to date, respectively. |

| · | FY24 and FY25 Total Product Revenue Guidance: Amtagvi

adoption is on track to continue accelerating, driven by broader utilization, higher demand from our expanding ATC network, and growth

in community referrals. Iovance is reaffirming its guidance for FY24 and FY25 and expects quarter-over-quarter product revenue growth

for the fourth quarter of 2024, full year 2025, and beyond. |

| o | Revenue Guidance in FY24: Total product revenue for the full year 2024 continues to be within the range of $160 to $165

million, reflecting three quarters of Amtagvi sales following U.S. Food and Drug Administration (FDA) approval in

mid-February. |

| o | Revenue Guidance in FY25: Total product revenue remains on track to be within the range of $450 to $475 million in 2025, the

first full calendar year of Amtagvi sales. Gross margins are increasing as the launch advances and are expected to surpass 70% over the

next several years. In line with anticipated growth in Amtagvi demand, Proleukin revenue is also expected to increase significantly in

2025 and beyond. |

| · | Cash Position: As of September 30, 2024, Iovance

had cash, cash equivalents, investments, and restricted cash of $403.8 million. The current cash position and anticipated product revenue

are expected to be sufficient to fund current and planned operations, including manufacturing expansion, into early 2026. |

Amtagvi (Lifileucel) U.S. Launch Highlights in Advanced Melanoma

| · | The

U.S. FDA approved Amtagvi (lifileucel) on February 16, 2024, as the first treatment

option for patients with advanced melanoma after anti-PD-1 and targeted therapy. Amtagvi

is the first FDA-approved T cell therapy for a solid tumor indication. |

| · | Onboarding is complete at 56 U.S. ATCs across

29 states and more than 90% of addressable patients are now located within 200 miles of an ATC. Approximately 70 ATCs remain on track

to be onboarded by the end of 2024. |

| · | Manufacturing turnaround time has been on target, with launch

expectations of approximately 34 days from inbound to return shipment to ATCs. With efforts underway, turnaround time is expected to be

reduced in the near term. The commercial manufacturing experience is consistent with prior clinical experience. |

| · | Amtagvi is a preferred second-line or subsequent therapy

in the National Comprehensive Cancer Network® guidelines for treatment of cutaneous melanoma. |

| · | Reimbursement remains successful, with an average financial

clearance time of about three weeks. |

| · | Approximately 75% of enrolled Amtagvi patients are covered

by private payers. To date, payers or plans covering more than 250 million lives have added Amtagvi to policies since its launch. |

Lifileucel Launch Expansion into New Markets

| · | Amtagvi has the potential to address more than 20,000 patients

annually with previously treated advanced melanoma across the U.S. and multiple global markets where regulatory submissions have been

submitted or are planned for 2024 and 2025.1 |

| · | Regulatory dossiers are under review, submitted, or planned

across multiple international markets for lifileucel for the treatment of adult patients with unresectable or metastatic melanoma previously

treated with a PD-1 blocking antibody, and if BRAF V600 mutation positive, a BRAF inhibitor with or without a MEK inhibitor. If approved,

lifileucel will be the first and only approved therapy in this treatment setting in all markets. |

| o | A marketing authorization application (MAA) for all EU member states was validated and accepted for review by the European Medicines

Agency for potential approval in the second half of 2025. |

| o | An MAA was submitted to the Medicines and Healthcare products Regulatory Agency in the United Kingdom for potential approval in the

first half of 2025. |

| o | A near-term new drug submission (NDS) was deemed eligible for Notice of Compliance with Conditions (NOC/c) by Health Canada. The NOC/c

policy includes a prioritized 200-day review process for potential NDS approval in mid-2025. |

| o | Additional regulatory dossiers remain on track for submission in 2025 and 2026 in markets with significant populations of previously

treated advanced melanoma patients, including Australia in the first half of 2025 and Switzerland in the second half of 2025. |

Iovance TIL Cell Therapy Pipeline Highlights

| · | Lifileucel in Frontline Advanced Melanoma |

| o | Updated clinical data from Cohort 1A of the IOV-COM-202 trial was

presented at ASCO 2024 and demonstrated an unprecedented rate, depth and durability

of responses, including a 30% confirmed complete response rate, and a differentiated safety

profile in advanced melanoma patients who were naive to immune checkpoint inhibitors. |

| o | Cohort 1D in the IOV-COM-202 trial is exploring lifileucel in combination with nivolumab and relatlimab in patients with frontline

advanced melanoma, representing another potential best-in-class frontline alternative for physicians and patients in the U.S. |

| o | Strong momentum continues with global site activation and patient enrollment in the TILVANCE-301 trial, with nearly 50 active

sites across 11 countries, including the U.S., Europe, Australia, and Canada, and more than 50 additional sites across 15 countries

committed to join the trial. TILVANCE-301 is intended to support accelerated and full U.S. approvals of Amtagvi in combination with

pembrolizumab in frontline advanced melanoma, as well as full approval of Amtagvi in post-anti-PD-1 melanoma. |

| · | Lifileucel in Non-Small Cell Lung Cancer (NSCLC) |

| o | Enrollment is accelerating in the IOV-LUN-202 registrational Phase 2 trial in post-anti-PD-1 NSCLC with high demand at clinical sites

in the U.S., Canada, and Europe. Iovance is also activating sites in additional regions with strong track records for enrollment in NSCLC

studies. Iovance expects to present updated data from the IOV-LUN-202 trial at a medical conference in 2025. |

| ꟷ | The FDA previously provided positive regulatory feedback on the proposed potency matrix for lifileucel in NSCLC, as well as the single-arm

IOV-LUN-202 trial design to support accelerated approval of lifileucel in post-anti-PD-1 NSCLC. |

| ꟷ | Iovance expects data from the IOV-LUN-202 trial to support a potential

accelerated U.S. approval for lifileucel in NSCLC in 2027. |

| |

o |

Updated preliminary results from Cohort 3A in the IOV-COM-202 trial continue to demonstrate robust response rates and durability for lifileucel in combination with pembrolizumab in NSCLC patients who were not previously treated with immune checkpoint inhibitor therapy. |

| ꟷ | A confirmed objective response was observed in 9 of 14 EGFR wild type patients (64.3%), including 6 of 11 (54.5%) patients who also

had difficult-to-treat PD-L1 negative disease. |

| ꟷ | Median duration of response (DOR) was not reached at a median study follow up of 26.5 months. |

| |

ꟷ |

This data supports the opening of a new cohort, 3D, in the IOV-COM-202 trial to investigate lifileucel plus pembrolizumab following chemotherapy as part of frontline therapy for patients with EGFR wild type NSCLC, representing the majority of patients with an unmet medical need in this setting. |

| ꟷ | Additional Cohort 3A results are available in a late-breaking

poster that will be presented at the upcoming Society for Immunotherapy of Cancer

Annual Meeting (SITC) on November 9, 2024 |

| · | Lifileucel in Endometrial Cancer |

| o | Patient enrollment commenced in the IOV-END-201 Phase 2 trial to investigate

lifileucel for advanced endometrial cancer patients who have progressed after platinum-based

chemotherapy and anti-PD-1 therapy regardless of mismatch repair (MMR) status. IOV-END-201

is supported by preclinical and manufacturing success data presented at the International

Gynecologic Cancer Society (IGCS) 2024 annual global meeting in October 2024, as well

as positive feedback from gynecological oncology experts. |

| o | Endometrial cancer represents a significant opportunity for TIL cell therapy to address an additional unmet medical need in the post-anti-PD-1

treatment setting and may address both mismatch repair deficient and proficient tumors. There are no currently approved therapies in the

second-line setting after frontline post-anti-PD-1 therapy and chemotherapy. |

| · | Next Generation TIL Pipeline |

| o | IOV-4001 (PD-1 Inactivated TIL Cell Therapy): The first in human IOV-GM1-201 trial to investigate PD-1 inactivated TIL

cell therapy (IOV-4001) in previously treated advanced melanoma and NSCLC is in the multi-center Phase 2 efficacy stage. Iovance continues

to utilize the TALEN® technology licensed from Cellectis to develop other investigational gene-edited TIL cell therapies with multiple

knockout targets to potentially improve efficacy. |

| o | Next Generation IL-2 for TIL Treatment Regimen: An Investigational

New Drug application (IND) was submitted and allowed to proceed for a Phase 1/2 clinical

trial of IOV-3001, a second-generation, modified interleukin-2 (IL-2) analog, for use in

the TIL therapy treatment regimen. Non-human primate and IND-enabling studies of IOV-3001

demonstrated the potential for improved safety with strong effector T cell expansion. |

| o | Next

Generation, Cytokine-Tethered TIL Therapy: IND-enabling studies are proceeding for IOV-5001,

a genetically engineered, inducible, and tethered interleukin-12 (IL-12) TIL cell therapy.

A clinical trial of a prior generation IL-12 TIL therapy at the National Cancer Institute

showed improved efficacy with low cell doses and provides the rationale for modifying IOV-5001

to enhance TIL efficacy while optimizing safety. In preclinical studies, IOV-5001 drove

superior antitumor activity in a simulated tumor microenvironment. These results will be

featured in a poster at SITC on November 9, 2024. Iovance plans to submit a

pre-IND

meeting request to FDA in 2024 and commence clinical development for multiple indications

in 2025. |

Manufacturing

Capacity Expansion

| · | The Iovance Cell Therapy Center (iCTC), and an FDA-approved

contract manufacturer, currently have capacity to treat several thousands of patients annually. Expansion is currently underway for the

iCTC campus to supply TIL cell therapies to more than 5,000 patients annually in the next few years. Iovance is also developing

a manufacturing network to address more than 10,000 patients annually. |

Corporate Updates

| · | Iovance

currently owns more than 230 granted or allowed U.S. and international patents

and patent rights for Amtagvi and other TIL-related technologies that are expected to provide

Amtagvi with exclusivity through at least 2042. This patent portfolio covers TIL compositions

and methods of treatment and manufacturing in a broad range of cancers, with Gen 2 patent

rights expected to provide exclusivity for Amtagvi into 2038 and additional patent rights,

including methods of treating melanoma and compositions and methods for potency assays, expected

to provide exclusivity into 2039 and 2042, respectively. Iovance also owns an industry-leading

patent portfolio covering TIL products produced with genetic engineering, using core biopsies

and peripheral blood as starting material, and using combinations of TIL products with checkpoint

inhibitors, as well as Iovance’s proprietary IovanceCares™ system. More information

on Iovance’s patent portfolio is available on the Intellectual Property page on www.iovance.com. |

Third Quarter and Year to Date 2024 Financial

Results

As of September 30, 2024, Iovance’s

cash position is approximately $403.8 million, which includes net proceeds of approximately $200.0 million raised from an at-the

market (ATM) equity financing facility during the second and early third quarter of 2024. The current cash position and anticipated product

revenue are expected to be sufficient to fund current and planned operations into early 2026.

Net loss for the third quarter of 2024 was $83.5

million, or $0.28 per share, compared to a net loss of $113.8 million, or $0.46 per share, for the third quarter ended September 30,

2023. Net loss for the first nine months of 2024 was $293.6 million, or $1.03 per share, compared to a net loss of $327.7

million, or $1.44 per share, for the nine-month period ended September 30, 2023.

Revenue was $58.6 million for the third quarter

of 2024 and consisted of product revenue from Amtagvi sales as well as recurring revenue from Proleukin. Iovance recognized $42.1 million

in revenue from Amtagvi infusions that were completed during the third quarter of 2024 and $16.5 million in global revenue for Proleukin.

Revenue for the first nine months of 2024

was $90.4 million and reflected product revenue from Proleukin and Amtagvi. Revenue for the first nine months of 2023 was $0.7 million

for global sales of Proleukin, which Iovance began to recognize during the three-month period ended June 30, 2023.

The increases in revenue in the third quarter

and first nine months of 2024 over the prior year periods were primarily attributable to the U.S. launch of Amtagvi, including revenue

recognized for Amtagvi, as well as significant growth in U.S. Proleukin revenue for use in the Amtagvi treatment regimen, beginning in

the second quarter of 2024.

Cost of sales includes inventory, overhead

and related cash and non-cash expenses that are directly associated with sales of Amtagvi and Proleukin, as well as manufacturing costs

for Amtagvi. Cost of sales for the three months ended September 30, 2024 was $39.8 million, primarily attributed to $8.3 million

in period costs associated with patient drop off and manufacturing success rates, $5.5 million for non-cash amortization expense for intangible

assets, and $3.9 million in royalties payable on product sales. Cost of sales for the three months ended September 30, 2023 was $4.3

million, primarily related to non-cash amortization for intangible assets.

Cost of sales for the nine months ended September 30,

2024 was $78.5 million, primarily related to $17.2 million in certain costs associated with patient drop off and manufacturing success

rates, $15.5 million in non-cash amortization expense for intangible assets, and $8.2 million royalties payable on product sales. Cost

of sales for the nine months ended September 30, 2023 was $6.4 million, primarily related to non-cash amortization for intangible

assets.

The increases in cost of sales in the third

quarter and year to date 2024 over the prior year periods were primarily attributable to the initiation of product sales, commercial manufacturing

and related cash and non-cash expenses tied to the U.S. launch of Amtagvi that began during the first quarter of 2024.

Research and development expenses were $68.2

million for the third quarter of 2024, a decrease of $19.3 million compared to $87.5 million for the same period

ended September 30, 2023. Research and development expenses were $210.1 million for the first nine months of 2024,

a decrease of $46.5 million compared to $256.6 million for the same period ended September 30, 2023.

The decreases in research and development

expenses in the third quarter and year to date 2024 over the prior year periods were primarily attributable to the transition of Amtagvi

to commercial manufacturing, decreased costs associated with certain clinical activities, and the completion of pre-commercial qualification

activities in 2023. These decreases in research and development were partially offset by increases in headcount and related costs, including

stock-based compensation resulting from growth in headcount.

Selling, general and administrative expenses

were $39.6 million for the third quarter of 2024, an increase of $12.6 million compared to $27.0 million for

the same period ended September 30, 2023. Selling, general and administrative expenses were $110.5 million for the

first nine months of 2024, an increase of $33.5 million compared to $77.0 million for the prior year’s nine-month

period.

The increase in selling, general and administrative

expenses in the third quarter and year to date 2024 compared to the prior year periods was primarily attributable to increases in headcount

and related costs, including stock-based compensation, to support the growth in the overall business and related corporate infrastructure,

as well as legal costs and costs incurred to support the commercialization of Amtagvi and Proleukin.

For additional information, please see the

Company’s Selected Condensed Consolidated Balance Sheets and Statements of Operations below.

Webcast and Conference Call

Management will host a conference call and live audio webcast to discuss

these results and provide a corporate update today at 4:30 p.m. ET. To listen to the live or archived audio webcast, please register

at https://edge.media-server.com/mmc/p/vxykqwaf. The live and archived webcast can be accessed in the Investors section of the Company’s

website, IR.Iovance.com, for one year.

1. World Health Organization International

Agency for Research on Cancer (IARC) GLOBOCAN 2022.

About Iovance Biotherapeutics, Inc.

Iovance Biotherapeutics, Inc. aims to be the global leader

in innovating, developing, and delivering tumor infiltrating lymphocyte (TIL) therapies for patients with cancer. We are pioneering a

transformational approach to cure cancer by harnessing the human immune system’s ability to recognize and destroy diverse cancer

cells in each patient. The Iovance TIL platform has demonstrated promising clinical data across multiple solid tumors. Iovance’s

Amtagvi™ is the first FDA-approved T cell therapy for a solid tumor indication. We are committed to continuous innovation in cell

therapy, including gene-edited cell therapy, that may extend and improve life for patients with cancer. For more information, please visit

www.iovance.com.

Amtagvi™ and its accompanying design marks, Proleukin®, Iovance®,

and IovanceCares™ are trademarks and registered trademarks of Iovance Biotherapeutics, Inc. or its subsidiaries.

All other trademarks and registered trademarks are the property of their respective owners.

Forward-Looking Statements

Certain matters discussed in this press release

are “forward-looking statements” of Iovance Biotherapeutics, Inc. (hereinafter referred to as the “Company,”

“we,” “us,” or “our”) within the meaning of the Private Securities Litigation Reform Act of 1995 (the

“PSLRA”). Without limiting the foregoing, we may, in some cases, use terms such as “predicts,” “believes,”

“potential,” “continue,” “estimates,” “anticipates,” “expects,” “plans,”

“intends,” “forecast,” “guidance,” “outlook,” “may,” “can,” “could,”

“might,” “will,” “should,” or other words that convey uncertainty of future events or outcomes and

are intended to identify forward-looking statements. Forward-looking statements are based on assumptions and assessments made in light

of management’s experience and perception of historical trends, current conditions, expected future developments, and other factors

believed to be appropriate. Forward-looking statements in this press release are made as of the date of this press release, and we undertake

no duty to update or revise any such statements, whether as a result of new information, future events or otherwise. Forward-looking statements

are not guarantees of future performance and are subject to risks, uncertainties, and other factors, many of which are outside of our

control, that may cause actual results, levels of activity, performance, achievements, and developments to be materially different from

those expressed in or implied by these forward-looking statements. Important factors that could cause actual results, developments, and

business decisions to differ materially from forward-looking statements are described in the sections titled "Risk Factors"

in our filings with the U.S. Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q, and include, but are not limited to, the following substantial known and unknown risks and uncertainties inherent

in our business: the risks related to our ability to successfully commercialize our products, including Amtagvi, for which we have obtained

U.S. Food and Drug Administration (“FDA”) approval, and Proleukin, for which we have obtained FDA and European Medicines Agency

(“EMA”) approval; the risk that the EMA or other ex-U.S. regulatory authorities may not approve or may delay approval for

our marketing authorization application submission for lifileucel in metastatic melanoma; the acceptance by the market of our products,

including Amtagvi and Proleukin, and their potential pricing and/or reimbursement by payors, if approved (in the case of our product candidates),

in the U.S. and other international markets and whether such acceptance is sufficient to support continued commercialization or development

of our products, including Amtagvi and Proleukin, or product candidates, respectively; future competitive or other market factors may

adversely affect the commercial potential for Amtagvi or Proleukin; the risk regarding our ability or inability to manufacture our therapies

using third party manufacturers or at our own facility, including our ability to increase manufacturing capacity at such third party manufacturers

and our own facility, may adversely affect our commercial launch; the results of clinical trials with collaborators using different manufacturing

processes may not be reflected in our sponsored trials; the risk regarding the successful integration of the recent Proleukin acquisition;

the risk that the successful development or commercialization of our products, including Amtagvi and Proleukin, may not generate sufficient

revenue from product sales, and we may not become profitable in the near term, or at all; the risks related to the timing of and our ability

to successfully develop, submit, obtain, or maintain FDA, EMA, or other regulatory authority approval of, or other action with respect

to, our product candidates; whether clinical trial results from our pivotal studies and cohorts, and meetings with the FDA, EMA, or other

regulatory authorities may support registrational studies and subsequent approvals by the FDA, EMA, or other regulatory authorities, including

the risk that the planned single arm Phase 2 IOV-LUN-202 trial may not support registration; preliminary and interim clinical results,

which may include efficacy and safety results, from ongoing clinical trials or cohorts may not be reflected in the final analyses of our

ongoing clinical trials or subgroups within these trials or in other prior trials or cohorts; the risk that enrollment may need to be

adjusted for our trials and cohorts within those trials based on FDA and other regulatory agency input; the risk that the changing landscape

of care for cervical cancer patients may impact our clinical trials in this indication; the risk that we may be required to conduct additional

clinical trials or modify ongoing or future clinical trials based on feedback from the FDA, EMA, or other regulatory authorities; the

risk that our interpretation of the results of our clinical trials or communications with the FDA, EMA, or other regulatory authorities

may differ from the interpretation of such results or communications by such regulatory authorities (including from our prior meetings

with the FDA regarding our non-small cell lung cancer clinical trials); the risk that clinical data from ongoing clinical trials of Amtagvi

will not continue or be repeated in ongoing or planned clinical trials or may not support regulatory approval or renewal of authorization;

the risk that unanticipated expenses may decrease our estimated cash balances and forecasts and increase our estimated capital requirements;

the risk that we may not be able to recognize revenue for our products; the risk that Proleukin revenues may not continue to serve as

a leading indicator for Amtagvi revenues; the risks regarding our anticipated operating and financial performance, including our financial

guidance and projections; the effects of global pandemic; the effects of global and domestic geopolitical factors; and other factors,

including general economic conditions and regulatory developments, not within our control. Any financial guidance provided in this press

release assumes the following: no material change in our ability to manufacture our products; no material change in payor coverage; no

material change in revenue recognition policies; no new business development transactions not completed as of the period covered by this

press release; and no material fluctuation in exchange rates.

IOVANCE BIOTHERAPEUTICS, INC.

Selected Condensed Consolidated Balance Sheets

(in thousands)

| | |

September 30, 2024

(unaudited) | | |

December 31, 2023 | |

| Cash, cash equivalents, and investments | |

$ | 397,488 | | |

$ | 279,867 | |

| Restricted cash | |

$ | 6,355 | | |

$ | 66,430 | |

| Total assets | |

$ | 991,115 | | |

$ | 780,351 | |

| Stockholders' equity | |

$ | 773,455 | | |

$ | 584,613 | |

Condensed Consolidated Statements of Operations

(unaudited, in thousands, except per share information)

| |

|

For the Three Months Ended |

|

|

For the Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

| Product revenue |

|

$ |

58,555 |

|

|

$ |

469 |

|

|

$ |

90,376 |

|

|

$ |

707 |

|

| Total revenue |

|

|

58,555 |

|

|

|

469 |

|

|

|

90,376 |

|

|

|

707 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

$ |

39,823 |

|

|

$ |

4,340 |

|

|

$ |

78,452 |

|

|

$ |

6,390 |

|

| Research and development |

|

|

68,245 |

|

|

|

87,526 |

|

|

|

210,112 |

|

|

|

256,607 |

|

| Selling, general and administrative |

|

|

39,553 |

|

|

|

26,964 |

|

|

|

110,514 |

|

|

|

77,013 |

|

| Total costs and expenses |

|

|

147,621 |

|

|

|

118,830 |

|

|

|

399,078 |

|

|

|

340,010 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(89,066 |

) |

|

|

(118,361 |

) |

|

|

(308,702 |

) |

|

|

(339,303 |

) |

| Other income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income, net |

|

|

4,005 |

|

|

|

3,358 |

|

|

|

10,698 |

|

|

|

9,925 |

|

| Net Loss before income taxes |

|

$ |

(85,061 |

) |

|

$ |

(115,003 |

) |

|

$ |

(298,004 |

) |

|

$ |

(329,378 |

) |

| Income taxes benefit |

|

|

1,520 |

|

|

|

1,243 |

|

|

|

4,386 |

|

|

|

1,720 |

|

| Net Loss |

|

$ |

(83,541 |

) |

|

$ |

(113,760 |

) |

|

$ |

(293,618 |

) |

|

$ |

(327,658 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss Per Share of Common Stock, Basic and Diluted |

|

$ |

(0.28 |

) |

|

$ |

(0.46 |

) |

|

$ |

(1.03 |

) |

|

$ |

(1.44 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-Average Shares of Common Stock Outstanding, Basic and Diluted |

|

|

303,269 |

|

|

|

245,817 |

|

|

|

284,836 |

|

|

|

228,115 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| *Includes stock-based compensation as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

$ |

3,065 |

|

|

$ |

— |

|

|

$ |

5,362 |

|

|

$ |

— |

|

| Research and development |

|

|

13,803 |

|

|

|

8,787 |

|

|

|

35,825 |

|

|

|

27,036 |

|

| Selling, general and administrative |

|

|

14,138 |

|

|

|

7,034 |

|

|

|

37,463 |

|

|

|

21,190 |

|

| Total stock-based compensation included in costs and expenses |

|

$ |

31,006 |

|

|

$ |

15,821 |

|

|

$ |

78,650 |

|

|

$ |

48,226 |

|

CONTACTS

Iovance Biotherapeutics, Inc.:

Sara Pellegrino, IRC

SVP, Investor Relations & Corporate Communications

650-260-7120 ext. 264

Sara.Pellegrino@iovance.com

Jen Saunders

Senior Director, Investor Relations & Corporate Communications

267-485-3119

Jen.Saunders@iovance.com

v3.24.3

Cover

|

Nov. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity File Number |

001-36860

|

| Entity Registrant Name |

IOVANCE BIOTHERAPEUTICS, INC.

|

| Entity Central Index Key |

0001425205

|

| Entity Tax Identification Number |

75-3254381

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

825

Industrial Road

|

| Entity Address, Address Line Two |

4th Floor

|

| Entity Address, City or Town |

San Carlos

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94070

|

| City Area Code |

650

|

| Local Phone Number |

260-7120

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.000041666 per share

|

| Trading Symbol |

IOVA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

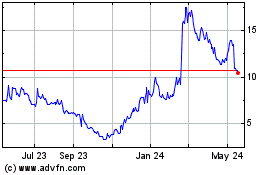

Iovance Biotherapeutics (NASDAQ:IOVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

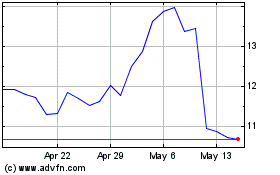

Iovance Biotherapeutics (NASDAQ:IOVA)

Historical Stock Chart

From Nov 2023 to Nov 2024