Form DEFR14A - Revised definitive proxy soliciting materials

February 23 2024 - 4:18PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the Appropriate Box:

| ☐ |

Preliminary

Proxy Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☒ |

Definitive

Proxy Statement |

| |

|

| ☐ |

Definitive

Additional Materials |

| |

|

| ☐ |

Soliciting

Material Under Rule 14a-12 |

iSUN,

INC.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement if other than the Registrant)

| Payment

of Filing Fee (Check the appropriate box): |

| |

| ☒ |

No

fee required |

| |

|

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

(5) |

Total

fee paid: |

| |

|

|

| |

|

|

| |

|

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

|

| |

(1) |

Amount

Previously paid: |

| |

|

|

| |

|

|

| |

(2) |

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

|

|

| |

(4) |

Date

Filed |

| |

|

|

| |

|

|

iSun,

Inc.

400

Avenue D, Suite 10

Williston,

VT 05495

Amendment

No. 1 to Proxy Statement

This

amendment, dated February 23, 2024, amends the definitive proxy statement (the “Proxy Statement”) of iSun, Inc. (the “Company”)

filed with the Securities and Exchange Commission on January 29, 2024 related to the Company’s Special Meeting of Stockholders

to be held on February 27, 2024 at 2:00 p.m. EDT. The purpose of this amendment is to reflect the determinations that Broadridge Financial

Services, Inc. (“Broadridge”) made following its receipt of the Proxy Statement about the proposals on which banks and brokers

will have discretionary voting authority. Broadridge has informed the Company that Proposals No. 1, 2, and 5 are matters for which banks

and brokers will have discretionary authority to vote, so the Company does not expect any broker non-votes on these proposals. Broadridge

informed the Company that banks and brokers will not have discretionary authority to vote on Proposals No. 3 and 4. The Company is supplementing

the disclosure in the Proxy Statement to reflect the receipt of this information.

WHETHER

OR NOT YOU EXPECT TO ATTEND THE SPECIAL MEETING, WE URGE YOU TO VOTE YOUR SHARES. If you have already voted, you do not need to

vote again unless you would like to change or revoke your prior vote on any proposal. If you would like to change or revoke your prior

vote on any proposal, please refer to the Proxy Statement for instructions on how to do so. If you hold your shares in a bank or brokerage

account, please refer to the materials provided by your bank or broker for voting instructions. Since beneficial owners may not know

how their bank, broker or other nominee will exercise its discretion, the Company urges beneficial owners to vote their shares in accordance

with the instructions included in the materials they received from their bank, broker or other nominee.

Supplemental

Information to the Proxy Statement

PROPOSAL

NO. 1 - TO AUTHORIZE THE BOARD TO AMEND THE CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF ALL OF THE COMPANY’S

OUTSTANDING SHARES OF COMMON STOCK BY A RATIO IN THE RANGE OF NOT LESS THAN ONE-FOR-SIX AND NOT MORE THAN ONE-FOR-TWENTY.

As

described on page 12 of the Proxy Statement, the affirmative vote of a majority of the outstanding shares of common stock is required

to approve the amendment to our Certificate of Incorporation. Abstentions will have the effect of a vote against this proposal. Broadridge

has informed the Company that banks and brokers will have discretionary authority to vote on this proposal, so the Company does not expect

broker non-votes on this proposal.

PROPOSAL

NO. 2 - TO AUTHORIZE THE BOARD TO AMEND THE CERTIFICATE OF INCORPORATION, TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK

FROM 49,000,000 TO 100,000,000.

As

described on page 21 of the Proxy Statement, the affirmative vote of a majority of the outstanding shares of common stock is required

to approve the amendment to our Certificate of Incorporation. Abstentions will have the effect of a vote against this proposal. Broadridge

has informed the Company that banks and brokers will have discretionary authority to vote on this proposal, so the Company does not expect

broker non-votes on this proposal.

PROPOSAL

NO. 3 - TO APPROVE, FOR THE PURPOSES OF NASDAQ LISTING RULE 5635, THE ISSUANCE OF SHARES OF THE COMPANY’S COMMON STOCK UPON CONVERSION

OF THE SERIES A CONVERTIBLE REDEEMABLE PREFERRED STOCK ISSUED BY THE COMPANY ON DECEMBER 12, 2023.

As

described on Page 22 of the Proxy Statement a majority of votes cast is necessary to approve the issuance of shares of the Company’s

Common Stock upon conversion of the Series A Convertible Redeemable Preferred Stock issued by the Company on December 12, 2023. Abstentions

and broker non-votes will have no effect on the outcome of this proposal. Broadridge has informed the Company that banks and brokers

will not have discretionary authority to vote on this proposal, so the Company expects broker non-votes on this proposal.

PROPOSAL

NO. 4 - TO APPROVE AN AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO ADJUST VOTING REQUIREMENTS FOR CERTAIN FUTURE AMENDMENTS TO THE

CERTIFICATE IN ACCORDANCE WITH RECENT AMENDMENTS TO SECTION 242(D) OF THE DELAWARE GENERAL CORPORATION LAW.

As

described on page 24 of the Proxy Statement, the affirmative vote of a majority of the outstanding shares of common stock is required

to approve the amendment to our Certificate of Incorporation. Abstentions and broker non-votes will have the effect of a vote against

this proposal. Broadridge has informed the Company that banks and brokers will not have discretionary authority to vote on this proposal,

so the Company expects broker non-votes on this proposal.

PROPOSAL

NO. 5 - TO APPROVE THE ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IN THE EVENT THAT THERE ARE NOT

SUFFICIENT VOTES AT THE TIME OF THE SPECIAL MEETING TO APPROVE THE OTHER PROPOSALS.

As

described on Page 25 of the Proxy Statement a majority of votes cast is necessary to approve the adjournment of the Special Meeting.

Abstentions will have no effect on the outcome of this proposal. Broadridge has informed the Company that banks and brokers will have

discretionary authority to vote on this proposal, so the Company does not expect broker non-votes on this proposal.

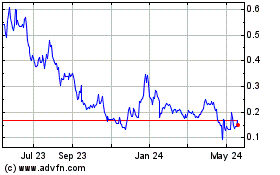

iSun (NASDAQ:ISUN)

Historical Stock Chart

From Nov 2024 to Dec 2024

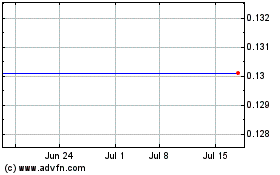

iSun (NASDAQ:ISUN)

Historical Stock Chart

From Dec 2023 to Dec 2024