Investors Title Company today announced its results for the

quarter ended March 31, 2016. The Company reported net income

attributable to the Company of $1,814,040, or $0.93 per diluted

share, compared with $1,726,124, or $0.86 per diluted share, for

the prior year period.

Revenues for the quarter totaled $24.9 million, a decrease of

12.2% versus the prior year period, reflecting lower levels of

premiums written. Although revenues for most issuing offices

increased from last year, they were offset by reductions in a few

larger agencies, resulting in an unfavorable total revenue

comparison. Transaction volume was down slightly from the prior

year period, but with a mix more heavily weighted toward

higher-margin purchase business.

Operating expenses decreased 14.1% versus the prior year period,

mainly due to decreases in commissions and the provision for

claims. Lower agent premiums resulted in a 21.0% decrease in

commissions. The provision for claims was $15,959, down

substantially for the quarter as a result of continued favorable

claims experience in recent policy years. All other expenses

increased 1.7%, mainly due to normal inflationary increases in

payroll and other overhead expenses, partially offset by a

reduction in premium taxes due to lower volumes and lower effective

premium tax rates.

Chairman J. Allen Fine commented, “We were pleased to see

continuation of an active real estate market and increasing real

estate values during the quarter. While volume reductions from a

handful of agencies resulted in an unfavorable comparison to the

prior year, revenues for most of our issuing offices increased. A

higher mix of direct business, favorable loss development, and

stable overhead expenses resulted in positive net income growth

versus the prior year.”

“With interest rates remaining low, and an improving economy in

our core markets, we remain optimistic that the strong housing

market will drive higher transaction volumes throughout the year.

Higher volumes, coupled with continued increases in real estate

values and a purchase-weighted market, should result in another

year of solid performance for Investors Title.”

Investors Title Company’s subsidiaries issue and underwrite

title insurance policies. The Company also provides investment

management services and services in connection with tax-deferred

exchanges of like-kind property.

Certain statements contained herein may constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such statements include,

among others, any statements regarding the Company’s expected

performance for the year, future home price increases, changes in

home purchase or refinance activity and the mix thereof, interest

rate changes, expansion of the Company’s market presence, enhancing

competitive strengths, positive development in housing

affordability, unemployment or overall economic conditions or

statements regarding our actuarial assumptions and the application

of recent historical claims experience to future periods. These

statements involve a number of risks and uncertainties that could

cause actual results to differ materially from anticipated and

historical results. Such risks and uncertainties include, without

limitation: the cyclical demand for title insurance due to changes

in the residential and commercial real estate markets; the

occurrence of fraud, defalcation or misconduct; variances between

actual claims experience and underwriting and reserving

assumptions, including the limited predictive power of historical

claims experience; declines in the performance of the Company’s

investments; government regulation; changes in the economy; loss of

agency relationships, or significant reductions in agent-originated

business and other considerations set forth under the caption “Risk

Factors” in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2015, as filed with the Securities and Exchange

Commission, and in subsequent filings.

Investors Title Company and

Subsidiaries

Consolidated Statements of

Income

For the Three Months Ended March 31,

2016 and 2015

(Unaudited)

Three Months Ended March 31, 2016 2015

Revenues: Net premiums written

$

21,508,997 $ 24,962,041 Investment income

– interest

and dividends

1,151,011 1,178,039 Net realized gain on

investments

149,830 14,803 Other

2,052,184

2,146,926 Total Revenues

24,862,022

28,301,809

Operating Expenses: Commissions to agents

11,532,882 14,596,539 Provision for claims

15,959

786,612 Salaries, employee benefits and payroll taxes

7,471,951 7,277,449 Office occupancy and operations

1,493,860 1,304,221 Business development

480,390

486,975 Filing fees, franchise and local taxes

230,054

216,643 Premium and retaliatory taxes

311,831 476,591

Professional and contract labor fees

538,653 584,107 Other

202,981 203,548 Total Operating Expenses

22,278,561 25,932,685

Income before

Income Taxes 2,583,461 2,369,124

Provision for

Income Taxes 779,000 643,000

Net

Income 1,804,461 1,726,124

Net Loss

Attributable to Noncontrolling Interests 9,579

—

Net Income Attributable to the Company

$ 1,814,040 $ 1,726,124

Basic

Earnings per Common Share $ 0.94 $

0.86

Weighted Average Shares Outstanding – Basic

1,934,318 2,012,738

Diluted Earnings

per Common Share $ 0.93 $ 0.86

Weighted Average Shares Outstanding – Diluted

1,940,963 2,018,504

Investors Title Company and

Subsidiaries

Consolidated Balance Sheets

As of March 31, 2016 and December

31, 2015

(Unaudited)

March 31, 2016 December 31,2015

Assets: Investments in securities: Fixed maturities,

available-for-sale, at fair value

$ 106,383,823 $

106,066,384 Equity securities, available-for-sale, at fair value

37,681,569 37,513,464 Short-term investments

7,520,069 6,865,406 Other investments

8,814,605

10,106,828 Total investments

160,400,066

160,552,082 Cash and cash equivalents

21,873,731 21,790,068 Premium and fees receivable

6,940,127 8,392,697 Accrued interest and dividends

1,320,942 1,004,126 Prepaid expenses and other assets

8,267,670 12,634,105 Property, net

7,502,745

7,148,951 Current income taxes recoverable

1,036,309

—

Total Assets $ 207,341,590

$ 211,522,029

Liabilities and Stockholders’

Equity

Liabilities:

Reserves for claims

$ 37,397,000 $ 37,788,000

Accounts payable and accrued liabilities

18,768,195

25,043,588 Current income taxes payable

— 210,355 Deferred

income taxes, net

7,762,160 5,703,006 Total

liabilities

63,927,355 68,744,949

Stockholders’ Equity:

Common stock – no par value

(10,000,000 authorized shares; 1,932,291 and 1,949,797

shares issued and outstanding 2016

and 2015, respectively, excluding 291,676 shares

for 2016 and 2015 of common stock

held by the Company's subsidiary)

1 1 Retained earnings

131,132,279 131,186,866

Accumulated other comprehensive income

12,184,336

11,483,015 Total stockholders’ equity attributable to the

Company

143,316,616 142,669,882 Noncontrolling interests

97,619 107,198 Total stockholders’ equity

143,414,235 142,777,080

Total Liabilities

and Stockholders’ Equity $ 207,341,590

$ 211,522,029

Investors Title Company and

Subsidiaries

Net Premiums Written By Branch and

Agency

For the Three Months Ended March 31,

2016 and 2015

(Unaudited)

Three Months Ended

March 31, 2016 % 2015 %

Branch

$ 5,477,657 25.5 $ 5,605,764 22.5

Agency 16,031,340 74.5

19,356,277 77.5

Total $

21,508,997 100.0 $ 24,962,041

100.0

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160504006032/en/

Investors Title CompanyElizabeth B. Lewter, 919-968-2200

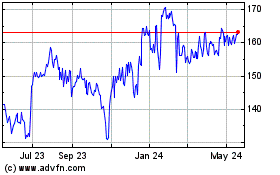

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Jun 2024 to Jul 2024

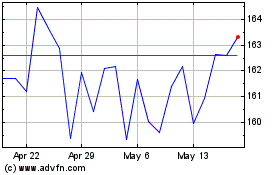

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Jul 2023 to Jul 2024