Investors Title Company (NASDAQ: ITIC) today announced its

results for the fourth quarter and year ended December 31,

2017.

For the year, net income attributable to the Company increased

31.7% to an all-time record high of $25.7 million, or $13.56 per

diluted share, versus $19.5 million, or $10.19 per diluted share,

for the prior year. For the quarter, net income attributable to the

Company increased 90.6% to an all-time record high of $9.6 million,

or $5.08 per diluted share, versus $5.1 million, or $2.67 per

diluted share, for the prior year period.

Revenues for the year increased 16.7% to a record $161.6

million, compared with $138.5 million in the prior year. The

majority of the revenue increase is attributable to higher

premiums. Even though refinance activity dropped from the prior

year, net premiums written increased 14.9% to $138.6 million as a

result of higher levels of home sales in our core markets, a

continuation of the multi-year trend of increases in the underlying

values of real estate, and business from newly-signed agents. Other

income sources, including revenue from ancillary services

coincident with providing title insurance as well as premiums

written for other title companies, increased 40.9% to $17.6

million.

Operating expenses increased 19.0% to $131.4 million, compared

with $110.4 million in the prior year. Expenses which fluctuate

directly with revenues, including agent commissions and claims

expense, were up commensurate with the increases in associated

revenues. Although claims expense for the year was low by

historical standards, it increased over the prior year due to lower

levels of favorable loss development. In addition to normal

inflationary increases, the primary factor contributing to the

increase in other categories of operating expenses is the inclusion

of expenses for a title insurance agency acquired in the fourth

quarter of 2016.

The quarter was shaped predominantly by the same factors that

affected the year, with the exception of claims expense, which was

slightly more favorable in the current quarter. Revenues increased

4.6% to a fourth quarter record, while operating expenses increased

9.1%.

On December 22, 2017, the Tax Cuts and Jobs Act was enacted into

law, reducing the federal corporate income tax rate from 35% to

21%, effective January 1, 2018. Accordingly, the Company’s deferred

tax assets and liabilities were revalued at the new tax rate, and

the impact was recognized in the provision for income taxes in the

fourth quarter. The revaluation resulted in a benefit to the year

and the quarter of approximately $5.3 million, or $2.82 per diluted

share.

Chairman J. Allen Fine commented, “We are pleased to report the

third consecutive year with record levels of revenues, reflecting a

growing national economy, a strong real estate market, and the

success of our long-term business model, which is centered on

building mutually successful relationships with like-minded

business partners. In addition to consistently strong revenue

growth, 2017 marks a new Company record for net income, and the

third consecutive year of net income growth.

“Aided by macroeconomic factors such as historically low

foreclosure rates, the Company continues to be successful in

maintaining a relatively low level of claims through a combination

of a proactive approach to risk management and investments in

education programs designed to improve the Company’s risk profile

as well as that of our business partners.

“As we head into 2018, we are optimistic about the prospects for

another strong year of real estate activity, and remain focused on

expanding our presence in the marketplace.”

Investors Title Company’s subsidiaries issue and underwrite

title insurance policies. The Company also provides investment

management services and services in connection with tax-deferred

exchanges of like-kind property.

Certain statements contained herein constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements include, among others, any

statements regarding the Company’s expected performance for this

year, future home price fluctuations, changes in home purchase or

refinance activity and the mix thereof, interest rate changes,

expansion of the Company’s market presence, enhancing competitive

strengths, positive development in housing affordability,

unemployment or overall economic conditions or statements regarding

our actuarial assumptions and the application of recent historical

claims experience to future periods. These statements involve a

number of risks and uncertainties that could cause actual results

to differ materially from anticipated and historical results. Such

risks and uncertainties include, without limitation: the cyclical

demand for title insurance due to changes in the residential and

commercial real estate markets; the occurrence of fraud,

defalcation or misconduct; variances between actual claims

experience and underwriting and reserving assumptions, including

the limited predictive power of historical claims experience;

declines in the performance of the Company’s investments;

government regulation; changes in the economy; loss of agency

relationships, or significant reductions in agent-originated

business; difficulties managing growth, whether organic or through

acquisitions and other considerations set forth under the caption

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2016, as filed with the Securities and

Exchange Commission, and in subsequent filings.

Investors Title Company and Subsidiaries

Consolidated Statements of Income

For the Three and Twelve Months Ended

December 31, 2017 and 2016

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2017 2016

2017 2016

Revenues: Net premiums written

$

35,180,588 $ 33,211,179

$ 138,588,877 $

120,569,151 Investment income

– interest and dividends

1,146,813 1,205,490

4,444,447 4,684,489 Net realized

gain on investments

50,783 194,108

1,040,901 768,436

Other

4,200,736 4,190,199

17,575,071 12,470,338 Total Revenues

40,578,920 38,800,976

161,649,296 138,492,414

Operating

Expenses: Commissions to agents

18,073,248 17,696,942

68,643,220 63,643,321 Provision for claims

596,363

646,935

3,311,080 242,953 Salaries, employee benefits and

payroll taxes

9,547,530 8,426,127

39,012,354

31,372,099 Office occupancy and operations

2,520,743

1,739,198

8,966,623 6,265,908 Business development

1,177,702 816,519

3,164,730 2,511,699 Filing fees,

franchise and local taxes

283,176 218,494

1,198,013

907,225 Premium and retaliatory taxes

732,444 642,964

2,672,034 2,202,595 Professional and contract labor fees

450,307 516,151

1,825,598 2,115,754 Other

640,655 469,869

2,585,074

1,099,408 Total Operating Expenses

34,022,168

31,173,199

131,378,726

110,360,962

Income before Income Taxes

6,556,752 7,627,777

30,270,570 28,131,452

(Benefit) Provision for Income Taxes (3,077,000

) 2,576,000

4,570,000

8,616,000

Net Income 9,633,752

5,051,777

25,700,570 19,515,452

Net (Gain) Loss Attributable to

Noncontrolling Interests

(4,954 ) 982

5,932

7,666

Net Income Attributable to the Company

$ 9,628,798 $ 5,052,759

$ 25,706,502 $ 19,523,118

Basic Earnings per Common Share $ 5.11

$ 2.68

$ 13.63 $

10.23

Weighted Average Shares Outstanding – Basic

1,885,992 1,884,283

1,886,354 1,907,675

Diluted Earnings

per Common Share $ 5.08 $ 2.67

$ 13.56 $ 10.19

Weighted Average Shares Outstanding – Diluted

1,895,390 1,893,252

1,895,871 1,915,057

Investors Title Company and Subsidiaries Consolidated

Balance Sheets

As of December 31, 2017 and

2016

(Unaudited)

December 31, 2017 December 31,2016

Assets: Investments in securities: Fixed maturities,

available-for-sale, at fair value

$ 103,341,083 $

101,934,077 Equity securities, available-for-sale, at fair value

47,366,826 41,179,259 Short-term investments

23,779,672 6,558,840 Other investments

12,032,426

11,181,531 Total investments

186,520,007

160,853,707 Cash and cash equivalents

20,214,468 27,928,472 Premium and fees receivable

10,159,519 8,654,161 Accrued interest and dividends

1,099,879 1,035,152 Prepaid expenses and other assets

9,003,683 9,456,523 Property, net

10,172,904

8,753,466 Goodwill and other intangible assets, net

11,357,290 12,256,641 Current income taxes receivable

385,109 —

Total Assets $

248,912,859 $ 228,938,122

Liabilities and Stockholders’ Equity Liabilities:

Reserves for claims

$ 34,801,000 $ 35,305,000

Accounts payable and accrued liabilities

27,565,660

26,146,480 Current income taxes payable

— 1,232,432 Deferred

income taxes, net

8,625,759 11,118,256 Total

liabilities

70,992,419 73,802,168

Stockholders’ Equity: Common stock

– no par value

(10,000,000 authorized shares; 1,885,993 and 1,884,283 shares

issued and outstanding as of December 31, 2017 and 2016,

respectively, excluding in each period 291,676 shares of common

stock held by the Company's subsidiary)

1 1 Retained

earnings

161,890,660 143,283,621 Accumulated other

comprehensive income

15,944,826 11,761,447

Total stockholders’ equity attributable to the Company

177,835,487 155,045,069 Noncontrolling interests

84,953 90,885 Total stockholders’ equity

177,920,440 155,135,954

Total Liabilities

and Stockholders’ Equity $ 248,912,859

$ 228,938,122

Investors Title Company and Subsidiaries Net Premiums

Written By Branch and Agency

For the Three and Twelve Months Ended

December 31, 2017 and 2016

(Unaudited)

Three Months Ended December 31,

Twelve Months Ended December 31, 2017 %

2016 %

2017 %

2016 %

Branch $ 9,457,862

26.9 $ 9,179,050 27.6

$

40,244,394 29.0 $ 33,482,154

27.8

Agency 25,722,726

73.1 24,032,129 72.4

98,344,483 71.0 87,086,997

72.2

Total $ 35,180,588

100.0 $ 33,211,179 100.0

$ 138,588,877

100.0 $ 120,569,151 100.0

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180207005237/en/

Investors Title CompanyElizabeth B. Lewter, 919-968-2200

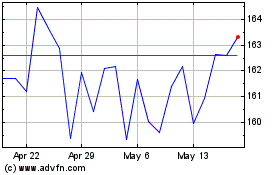

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Jun 2024 to Jul 2024

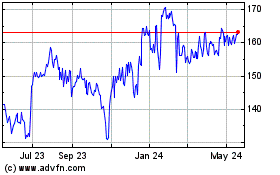

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Jul 2023 to Jul 2024