false

0000885307

0000885307

2024-02-23

2024-02-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current

Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 23, 2024

JEWETT-CAMERON TRADING COMPANY LTD.

(Exact name of registrant as specified in its charter)

| A1BRITISH

COLUMBIA |

000-19954 |

00-0000000 |

| (State

or other jurisdiction |

(Commission

|

(IRS

Employer |

| of

incorporation) |

File

Number) |

Identification

No.) |

32275

N.W. Hillcrest, North Plains, OR

97133

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area

code (503) 647-0110

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, no par value |

|

JCTCF |

|

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

| (a) | The Annual General Meeting of shareholders was held on February 23, 2024. |

| (b) | The following is a brief description and vote count of all items voted on at the meeting: |

| Item 1. | Fix the Number of Directors |

Item No. 1 was approved

with the following vote:

Shares Voted

“For” | | |

Shares Voted

“Against” | | |

Withheld/

Abstentions | | |

Non-Votes | |

| | 1,642,297 | | |

| 983,239 | | |

| 0 | | |

| 0 | |

| Item 2. | Election of Directors |

The following persons were elected

as Directors to serve until the conclusion of the next annual meeting:

| Nominees | |

Shares Voted

“For” | | |

Shares Voted

“Against” | | |

Withheld/

Abstentions | | |

Non-Votes | |

| Charles E. Hopewell | |

| 1,341,392 | | |

| 0 | | |

| 978,142 | | |

| 306,002 | |

| Geoff Guilfoy | |

| 1,339,876 | | |

| 0 | | |

| 979,658 | | |

| 306,002 | |

| Sarah Johnson | |

| 1,341,591 | | |

| 0 | | |

| 977,943 | | |

| 306,002 | |

| Chris Karlin | |

| 1,339,876 | | |

| 0 | | |

| 979,658 | | |

| 306,002 | |

| Michelle Walker | |

| 1,340,591 | | |

| 0 | | |

| 978,943 | | |

| 306,002 | |

| Chad Summers | |

| 1,345,220 | | |

| 0 | | |

| 974,314 | | |

| 306,002 | |

| Mike Henningsen | |

| 1,341,735 | | |

| 0 | | |

| 977,799 | | |

| 306,002 | |

| Subriana Pierce | |

| 1,340,026 | | |

| 0 | | |

| 979,508 | | |

| 306,002 | |

| Ian Wendler | |

| 1,341,591 | | |

| 0 | | |

| 977,943 | | |

| 306,002 | |

| Item 3. | Appointment of Auditors |

Item No. 3 was approved with the following vote:

Shares Voted

“For” | | |

Shares Voted

“Against” | | |

Withheld/

Abstentions | | |

Non-Votes | |

| | 2,569,240 | | |

| 0 | | |

| 56,296 | | |

| 0 | |

| Item 4. | Acts and Deeds of Directors and Officers |

Item No. 4 was approved with the following vote:

Shares Voted

“For” | | |

Shares Voted

“Against” | | |

Withheld/

Abstentions | | |

Non-Votes | |

| | 1,341,689 | | |

| 977,845 | | |

| 0 | | |

| 306,002 | |

| Item 5. | Advisory Vote on the Approval of Executive Compensation |

Item No. 5 was approved with the following vote:

Shares Voted

“For” | | |

Shares Voted

“Against” | | |

Withheld/

Abstentions | | |

Non-Votes | |

| | 1,340,691 | | |

| 978,843 | | |

| 0 | | |

| 306,002 | |

| Item 6. | Advisory Vote on the Frequency of Holding an Advisory Vote on Executive Compensation |

Item No. 6 had the following votes:

| 1 Year | | |

2 Years | | |

3 Years | | |

Withheld/

Abstentions | | |

Non-Votes | |

| | 2,301,606 | | |

| 17,383 | | |

| 145 | | |

| 400 | | |

| 306,002 | |

| Item 7. | Staggered Terms and Term Limits |

Item No. 7 was rejected with the following vote:

Shares Voted

“For” | | |

Shares Voted

“Against” | | |

Withheld/

Abstentions | | |

Non-Votes | |

| | 1,063,811 | | |

| 1,255,723 | | |

| 0 | | |

| 306,002 | |

| Item 8. | Advance Notice Requirements |

Item No. 8 was rejected with the following vote:

Shares Voted

“For” | | |

Shares Voted

“Against” | | |

Withheld/

Abstentions | | |

Non-Votes | |

| | 1,269,921 | | |

| 1,049,613 | | |

| 0 | | |

| 306,002 | |

| Item 9. | Permitted Amendments and Variations |

Item No. 9 was rejected with the following vote:

Shares Voted

“For” | | |

Shares Voted

“Against” | | |

Withheld/

Abstentions | | |

Non-Votes | |

| | 1,090,270 | | |

| 1,229,264 | | |

| 0 | | |

| 306,002 | |

| Item 10. | Transact Other Business |

Item No. 10 was rejected with the following vote:

Shares Voted

“For” | | |

Shares Voted

“Against” | | |

Withheld/

Abstentions | | |

Non-Votes | |

| | 1,088,218 | | |

| 1,231,316 | | |

| 0 | | |

| 306,002 | |

| (d) | The Board of Directors decided that the Company’s proxy materials will include an advisory shareholder

vote on the executive compensation annually, with the next vote to occur in 2025. |

Item 8.01 Other Events

The following CEO Statement was read by Chad Summers,

Chief Executive Officer, at the Annual General and Special Meeting of Shareholders held remotely on February 23, 2024.

CEO Statement

Thank you to those of you who have taken the

time to participate in our Annual Shareholders Meeting today. Given the increased questions throughout this past year, I thought

you all may appreciate a prepared statement from me as the President and CEO regarding the current state of Jewett Cameron Company.

I'll read it to you before we open it up for Q&A as this may prompt further questions. Given the reality of our current financials

we recognize the questions you may have. I’d like to provide narrative that may not be easily garnered in simply reading the financials.

As you know, our products are well designed

and offered at desirable prices through major retail stores and online. Our core product categories are fence products, Lucky Dog®

branded pet containment, and our newest addition of alternatives to traditional plastic bags within the MyEcoWorld® brand.

Strategically, MyEcoWorld® products help

combat some of our historical seasonality related to fence and kennel sales which move in higher volumes during the spring and summer

months. Trash bags / Bin liners and pet waste bags are used year round and offer consumers repeat purchasing opportunities as a

more consumable product than our gates and kennels. This also allows us to offer a subscription service to secure ongoing repeat

sales and communicate more often directly with consumers.

Our fence products remain our strongest sales

segment with continued growth potential. We've seen bolstered demand for several of our fence products launched within the last

5 years as they grow and gain market share traction. Our commitment to innovation is driving new product introductions in the year

ahead to further stabilize our presence in the gate and fence category.

The pet containment products were hit the hardest

by inflationary pressures and other effects of the pandemic throughout the supply chain. This has contributed to our increased inventory

over the past year in part due to the high shipping cost incurred during the pandemic as well as both demand and pricing pressures slowing

sales velocity. Fortunately we are seeing positive signs more recently that we would expect to continue as the season approaches.

We work with a varied customer portfolio for

both in-store and online sales. Our sales team is focused on expanding sales of our core products to our primary customers. We’ve

also added to our team to focus on new customer generation and expand our channels. Our margins have been impacted by the increased raw

materials, logistics, etc. coming out of the pandemic as well as our customer’s timeliness of accepting pricing changes. We will

continue to work on regaining margin lost due to the factors mentioned above.

While inventory has been higher than historical

levels, we are approaching desired levels for our primary products. Inventory is down 19%, $4M from a year ago and is a much improved

mix of products to meet seasonal demands.

As we’ve shared previously, one significant

driver of our increased inventory has been our lumber contract with a major retailer that we launched 12 months ago. This contract

provides greater visibility and stability for a large portion of our lumber sales and we've managed the program well over the past year.

However, it does require increased inventory to support as well as delayed revenue recognition from year’s past. There is

great opportunity to grow lumber sales beyond this contract in the years ahead.

With regards to our supply, historically the

company has sourced most of our products from China. We continue to evaluate diversifying our sourcing to take advantage of cost

reductions and logistical mitigations without compromising our quality or reliability of our delivery.

Our organization has not been immune to many

of the operational cost increases hitting businesses like ours in recent years including competitive wages, insurance premiums, etc.,

but we continue to aggressively evaluate available cost savings. We are pursuing cost reductions, prioritizing elements that will

not impede our ability to serve our customers or growth opportunities. It is worth noting that the successful resolution of the

multi-year dispute covered our legal expenses impacting our financials in recent years.

As for our subsidiaries, we've disclosed that

Greenwood Products, our trading company subsidiary, added a trader recently and we look forward to expanding sales and products in the

future. Additionally we successfully closed down our Seed cleaning operation and are considering all possible options to capitalize

our 11.7 acres of land which resides in a prime commercial location.

We will continue to focus on improving operational

strengths and our core product lines.

Item 9.01 Exhibits

| Exhibit No. |

|

Description |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained

in Exhibit 101) |

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the Registrant has duly caused this Current Report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

|

|

|

|

|

|

| |

|

|

|

JEWETT-CAMERON TRADING COMPANY LTD. |

| |

|

|

|

| Date: February 29, 2024 |

|

|

|

By: |

|

/s/ “Chad Summers” |

| |

|

|

|

Name: |

|

Chad Summers |

| |

|

|

|

Title: |

|

President

and Chief Executive Officer |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

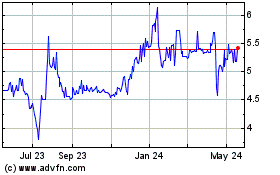

Jewett Cameron Trading (NASDAQ:JCTCF)

Historical Stock Chart

From Dec 2024 to Jan 2025

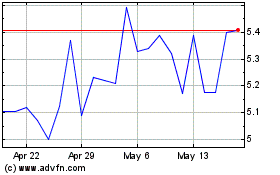

Jewett Cameron Trading (NASDAQ:JCTCF)

Historical Stock Chart

From Jan 2024 to Jan 2025