0001056285false00010562852024-09-052024-09-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

Date of Report (Date of Earliest Event Reported): |

|

September 5, 2024 |

Kirkland's, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Tennessee |

|

000-49885 |

|

62-1287151 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

5310 Maryland Way, Brentwood, Tennessee |

|

|

|

37027 |

(Address of principal executive offices) |

|

|

|

(Zip Code) |

|

|

|

Registrant’s telephone number, including area code: |

|

615-872-4800 |

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock |

KIRK |

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On September 5, 2024, the Company issued a press release reporting its results of operations for the second fiscal quarter ended August 3, 2024 (the “Press Release”).

A copy of the Press Release is attached hereto as Exhibit 99.1, and is being furnished, not filed, under Item 2.02 of this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Kirkland's, Inc. |

|

|

|

|

September 5, 2024 |

|

By: |

/s/ Carter R. Todd |

|

|

|

Name: Carter R. Todd |

|

|

|

Title: Senior Vice President and General Counsel |

Exhibit 99.1

KIRKLAND’S HOME REPORTS SECOND QUARTER 2024 RESULTS

NASHVILLE, Tenn. (September 5, 2024) — Kirkland’s, Inc. (Nasdaq: KIRK) (“Kirkland’s Home” or the “Company”), a specialty retailer of home décor and furnishings, announced financial results for the 13-week and 26-week periods ended August 3, 2024.

Second Quarter 2024 Summary

•Net sales of $86.3 million; Overall comparable sales decreased 1.7%, inclusive of 1.8% growth in comparable brick-and-mortar stores compared to Q2 2023.

•Gross profit margin expanded 100 bps to 20.5% compared to Q2 2023.

•Operating loss of $13.3 million, a $4.8 million improvement compared to Q2 2023.

•Adjusted EBITDA loss of $10.2 million, a $3.3 million improvement compared to Q2 2023.

•Closed 4 stores to end the quarter with 325 stores.

•Ended the period with a cash balance of $4.5 million and $62.7 million in outstanding debt.

Management Commentary

Amy Sullivan, CEO of Kirkland’s Home, said, “Our second quarter comparable sales results reflect a sequential improvement from the first quarter and continued progress against our strategic initiatives. Our merchandising and marketing plans have continued to drive traffic to our stores resulting in positive comparable sales performance in the channel helping to offset the headwinds we are experiencing with our e-commerce business. Toward the end of the quarter, we began to introduce our fall and holiday assortment, and we are encouraged by our early reads, giving us further confidence in our plans for the second half of the year and our peak selling season. Through our ongoing efforts to re-engage our core customer, refocus our product assortment, and strengthen our omnichannel capabilities, we are positioning Kirkland’s for improved financial performance and long-term success.”

Second Quarter 2024 Financial Results

Net sales in the second quarter of 2024 were $86.3 million, compared to $89.5 million in the prior year quarter. Comparable sales decreased 1.7%, including a 10.6% decline in e-commerce sales and a 1.8% increase in comparable store sales. The decrease was primarily driven by a decrease in consolidated average ticket and e-commerce traffic, partially offset by an increase in store traffic and conversion.

Gross profit in the second quarter of 2024 was $17.7 million, or 20.5% of net sales, compared to $17.4 million, or 19.5% of net sales in the prior year quarter. The improvement as a percentage of net sales was primarily a result of increased merchandise margin, largely due to favorable shrink results and lower outbound freight costs, partially offset by the deleverage of store occupancy costs.

Operating expenses in the second quarter of 2024 were $31.0 million, or 35.9% of net sales, compared to $35.5 million, or 39.7% of net sales in the prior year quarter. The decline in operating expenses was driven by reduced advertising costs, asset impairment charges and corporate salaries and benefits expenses. In addition, we received a state tax refund due to a recent change in state tax law that offset operating expenses in the quarter.

Operating loss in the second quarter of 2024 was $13.3 million compared to operating loss of $18.1 million in the prior year quarter. The improvement was primarily a result of the aforementioned lower operating expenses. Adjusted operating loss in the second quarter of 2024 was $12.7 million compared to adjusted operating loss of $16.6 million in the prior year quarter.

EBITDA in the second quarter of 2024 was a loss of $10.8 million compared to a loss of $14.0 million in the prior year quarter. Adjusted EBITDA in the second quarter of 2024 was a loss of $10.2 million compared to a loss of $13.5 million in the prior year quarter.

Net loss in the second quarter of 2024 was $14.5 million, or a loss of $1.11 per diluted share, compared to a net loss of $19.4 million, or a loss of $1.51 per diluted share in the prior year quarter.

Balance Sheet

As of August 3, 2024, inventory was $92.8 million, a 6.3% decrease compared to the prior year quarter, mainly due to a 4.4% decrease in store count as well as the closure of one e-commerce distribution location in the third quarter of fiscal 2023.

As of August 3, 2024, the Company had a cash balance of $4.5 million, with $52.7 million of outstanding debt under its $90.0 million senior secured revolving credit facility and $10.0 million of outstanding debt under its $12.0 million “first-in, last-out” asset-based term loan. As of August 3, 2024, the Company had approximately $7.9 million available for borrowing under the revolving credit facility and the term loan, after the minimum required excess availability covenant.

The Company’s inventories are typically at seasonal lows during the first quarter of the fiscal year and begin to build as the second quarter progresses. Availability under the Company’s revolving credit facility and term loan fluctuates largely based on eligible inventory levels, and as eligible inventory increases in the second and third fiscal quarters in support of the Company’s back-half sales plans, the Company’s borrowing capacity increases correspondingly. The Company anticipates that cash flow from seasonal sales in the third and fourth quarters of fiscal 2024 will be used to reduce borrowing levels and increase liquidity.

Subsequent to August 3, 2024, the Company borrowed an additional $5.7 million under the revolving credit facility, and as of September 5, 2024, the Company had $58.4 million of outstanding debt under its revolving credit facility and $10.0 million in borrowings under its term loan.

Cost Savings Initiatives and Review of Strategic Alternatives

As previously announced, during the second quarter, the Company implemented several cost savings initiatives to better align its cost structure with the current business environment. The Company believes these actions are necessary as part of improving its profitability and liquidity trajectory while minimizing disruption to the Company’s focus on its strategic initiatives and the overall customer experience. The cost savings initiatives include a reduction in corporate overhead, store payroll, marketing and third-party technology expenses. In the second through fourth quarters of fiscal 2024, the Company expects to realize approximately $6 million of savings and estimates approximately $7 million in ongoing annual pre-tax savings from these initiatives.

As previously disclosed, the Company is currently engaged in the pursuit and evaluation of potential strategic opportunities to support the Company and its initiatives. This process is ongoing. The Company has not set a deadline or definitive timetable for the completion of the strategic alternatives review process, and there can be no assurance that this process will result in any particular outcome. The Company does not intend to comment further regarding the review of strategic alternatives until it determines disclosure is necessary or advisable.

Conference Call

Kirkland’s Home management will host a conference call to discuss its financial results for the second quarter ended August 3, 2024, followed by a question-and-answer period with President and CEO, Amy Sullivan, and EVP and CFO, Mike Madden.

Date: Thursday, September 5, 2024

Time: 9:00 a.m. Eastern Time

Toll-free dial-in number: (855) 560-2577

International dial-in number: (412) 542-4163

Conference ID: 10191210

Please call the conference telephone number 10-15 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact ICR at KIRK@icrinc.com.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website at www.kirklands.com. The online replay will follow shortly after the call and continue for one year.

A telephonic replay of the conference call will be available after the conference call through September 12, 2024.

Toll-free replay number: (877) 344-7529

International replay number: (412) 317-0088

Replay ID: 3267325

About Kirkland’s, Inc.

Kirkland’s, Inc. is a specialty retailer of home décor and furnishings in the United States, currently operating 325 stores in 35 states as well as an e-commerce website, www.kirklands.com, under the Kirkland’s Home brand. The Company provides its customers an engaging shopping experience characterized by a curated, affordable selection of home décor and furnishings along with inspirational design ideas. This combination of quality and stylish merchandise, value pricing and a stimulating in-store and online environment provides the Company’s customers with a unique brand experience. More information can be found at www.kirklands.com.

Forward-Looking Statements

Except for historical information contained herein, certain statements in this release, constitute forward-looking statements that are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and are subject to the finalization of the Company’s quarterly financial and accounting procedures. Forward-looking statements deal with potential future circumstances and developments and are, accordingly, forward-looking in nature. You are cautioned that such forward-looking statements, which may be identified by words such as "anticipate," "believe," "expect," "estimate," "intend," "plan," "seek," "may," "could," "strategy," and similar expressions, involve known and unknown risks and uncertainties, many of which are outside of the Company’s control, which may cause the Company's actual results to differ materially from forecasted results. Those risks and uncertainties include, among other things, risks associated with the Company's liquidity including cash flows from operations and the amount of borrowings under the secured revolving credit facility and term loan, the Company’s ability to successfully implement cost savings and other strategic initiatives intended to improve operating results and liquidity positions, the Company’s actual and anticipated progress towards its short-term and long-term objectives including its brand strategy, the risk that natural disasters, pandemic outbreaks (such as COVID-19), global political events, war and terrorism could impact on the Company’s revenues, inventory and supply chain, the continuing consumer impact of inflation and countermeasures, including raising interest rates, the effectiveness of the Company’s marketing campaigns, risks related to changes in U.S. policy related to imported merchandise, particularly with regard to the impact of tariffs on goods imported from China and strategies undertaken to mitigate such impact, the Company’s ability to retain its senior management team, continued volatility in the price of the Company’s common stock, the competitive environment in the home décor industry in general and in the Company's specific market areas, inflation, fluctuations in cost and availability of inventory, increased transportation costs and potential interruptions in supply chain, distribution systems and delivery network, including our e-commerce systems and channels, the ability to control employment and other operating costs, availability of suitable retail locations and other growth opportunities, disruptions in information technology systems including the potential for security breaches of the Company's information or its customers’ information, seasonal fluctuations in consumer spending, and economic conditions in general. Those and other risks are more fully described in the Company's filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K filed on March 29, 2024 and subsequent reports. Forward-looking statements included in this release are made as of the date of this release. Any changes in assumptions or factors on which such statements are based could produce materially different results. Except as required by law, the Company disclaims any obligation to update any such factors or to publicly announce results of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

KIRKLAND’S, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

13-Week Period Ended |

|

|

|

August 3, |

|

|

July 29, |

|

|

|

2024 |

|

|

2023 |

|

Net sales |

|

$ |

86,289 |

|

|

$ |

89,504 |

|

Cost of sales |

|

|

68,629 |

|

|

|

72,065 |

|

Gross profit |

|

|

17,660 |

|

|

|

17,439 |

|

Operating expenses: |

|

|

|

|

|

|

Compensation and benefits |

|

|

18,653 |

|

|

|

19,217 |

|

Other operating expenses |

|

|

11,384 |

|

|

|

14,090 |

|

Depreciation (exclusive of depreciation included in cost of sales) |

|

|

925 |

|

|

|

1,222 |

|

Asset impairment |

|

|

20 |

|

|

|

1,001 |

|

Total operating expenses |

|

|

30,982 |

|

|

|

35,530 |

|

Operating loss |

|

|

(13,322 |

) |

|

|

(18,091 |

) |

Other expense, net |

|

|

1,300 |

|

|

|

623 |

|

Loss before income taxes |

|

|

(14,622 |

) |

|

|

(18,714 |

) |

Income tax (benefit) expense |

|

|

(118 |

) |

|

|

650 |

|

Net loss |

|

$ |

(14,504 |

) |

|

$ |

(19,364 |

) |

Loss per share: |

|

|

|

|

|

|

Basic |

|

$ |

(1.11 |

) |

|

$ |

(1.51 |

) |

Diluted |

|

$ |

(1.11 |

) |

|

$ |

(1.51 |

) |

Weighted average shares outstanding: |

|

|

|

|

|

|

Basic |

|

|

13,074 |

|

|

|

12,857 |

|

Diluted |

|

|

13,074 |

|

|

|

12,857 |

|

KIRKLAND’S, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

26-Week Period Ended |

|

|

|

August 3, |

|

|

July 29, |

|

|

|

2024 |

|

|

2023 |

|

Net sales |

|

$ |

178,042 |

|

|

$ |

186,379 |

|

Cost of sales |

|

|

133,314 |

|

|

|

143,069 |

|

Gross profit |

|

|

44,728 |

|

|

|

43,310 |

|

Operating expenses: |

|

|

|

|

|

|

Compensation and benefits |

|

|

37,939 |

|

|

|

39,256 |

|

Other operating expenses |

|

|

25,702 |

|

|

|

28,828 |

|

Depreciation (exclusive of depreciation included in cost of sales) |

|

|

1,886 |

|

|

|

2,428 |

|

Asset impairment |

|

|

31 |

|

|

|

1,226 |

|

Total operating expenses |

|

|

65,558 |

|

|

|

71,738 |

|

Operating loss |

|

|

(20,830 |

) |

|

|

(28,428 |

) |

Other expense, net |

|

|

2,311 |

|

|

|

1,033 |

|

Loss before income taxes |

|

|

(23,141 |

) |

|

|

(29,461 |

) |

Income tax expense |

|

|

193 |

|

|

|

2,010 |

|

Net loss |

|

$ |

(23,334 |

) |

|

$ |

(31,471 |

) |

Loss per share: |

|

|

|

|

|

|

Basic |

|

$ |

(1.79 |

) |

|

$ |

(2.46 |

) |

Diluted |

|

$ |

(1.79 |

) |

|

$ |

(2.46 |

) |

Weighted average shares outstanding: |

|

|

|

|

|

|

Basic |

|

|

13,019 |

|

|

|

12,817 |

|

Diluted |

|

|

13,019 |

|

|

|

12,817 |

|

KIRKLAND’S, INC.

UNAUDITED CONSOLIDATED CONDENSED BALANCE SHEETS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

August 3, |

|

|

February 3, |

|

|

July 29, |

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

4,461 |

|

|

$ |

3,805 |

|

|

$ |

4,890 |

|

Inventories, net |

|

|

92,760 |

|

|

|

74,090 |

|

|

|

98,949 |

|

Prepaid expenses and other current assets |

|

|

8,216 |

|

|

|

7,614 |

|

|

|

5,697 |

|

Total current assets |

|

|

105,437 |

|

|

|

85,509 |

|

|

|

109,536 |

|

Property and equipment, net |

|

|

25,454 |

|

|

|

29,705 |

|

|

|

33,878 |

|

Operating lease right-of-use assets |

|

|

128,046 |

|

|

|

126,725 |

|

|

|

133,352 |

|

Other assets |

|

|

7,282 |

|

|

|

8,634 |

|

|

|

6,818 |

|

Total assets |

|

$ |

266,219 |

|

|

$ |

250,573 |

|

|

$ |

283,584 |

|

LIABILITIES AND SHAREHOLDERS’ (DEFICIT) EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

59,967 |

|

|

$ |

46,010 |

|

|

$ |

56,483 |

|

Accrued expenses |

|

|

20,956 |

|

|

|

23,163 |

|

|

|

26,432 |

|

Operating lease liabilities |

|

|

38,602 |

|

|

|

40,018 |

|

|

|

40,249 |

|

Total current liabilities |

|

|

119,525 |

|

|

|

109,191 |

|

|

|

123,164 |

|

Operating lease liabilities |

|

|

100,565 |

|

|

|

99,772 |

|

|

|

111,746 |

|

Long-term debt, net |

|

|

61,396 |

|

|

|

34,000 |

|

|

|

46,000 |

|

Other liabilities |

|

|

4,438 |

|

|

|

4,486 |

|

|

|

3,834 |

|

Total liabilities |

|

|

285,924 |

|

|

|

247,449 |

|

|

|

284,744 |

|

Shareholders’ (deficit) equity |

|

|

(19,705 |

) |

|

|

3,124 |

|

|

|

(1,160 |

) |

Total liabilities and shareholders’ (deficit) equity |

|

$ |

266,219 |

|

|

$ |

250,573 |

|

|

$ |

283,584 |

|

KIRKLAND’S, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

26-Week Period Ended |

|

|

|

August 3, |

|

|

July 29, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(23,334 |

) |

|

$ |

(31,471 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation of property and equipment |

|

|

5,137 |

|

|

|

6,349 |

|

Amortization of debt issue costs |

|

|

256 |

|

|

|

50 |

|

Asset impairment |

|

|

31 |

|

|

|

1,226 |

|

Gain on disposal of property and equipment |

|

|

(7 |

) |

|

|

(18 |

) |

Stock-based compensation expense |

|

|

556 |

|

|

|

614 |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Inventories, net |

|

|

(18,670 |

) |

|

|

(14,878 |

) |

Prepaid expenses and other current assets |

|

|

(613 |

) |

|

|

(608 |

) |

Accounts payable |

|

|

14,514 |

|

|

|

12,529 |

|

Accrued expenses |

|

|

(2,207 |

) |

|

|

363 |

|

Operating lease assets and liabilities |

|

|

(1,990 |

) |

|

|

(2,976 |

) |

Other assets and liabilities |

|

|

(61 |

) |

|

|

291 |

|

Net cash used in operating activities |

|

|

(26,388 |

) |

|

|

(28,529 |

) |

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Proceeds from sale of property and equipment |

|

|

17 |

|

|

|

74 |

|

Capital expenditures |

|

|

(1,193 |

) |

|

|

(2,294 |

) |

Net cash used in investing activities |

|

|

(1,176 |

) |

|

|

(2,220 |

) |

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Borrowings on revolving line of credit |

|

|

22,800 |

|

|

|

36,000 |

|

Repayments on revolving line of credit |

|

|

(4,100 |

) |

|

|

(5,000 |

) |

Borrowings on term loan |

|

|

10,000 |

|

|

|

— |

|

Debt issuance costs |

|

|

(429 |

) |

|

|

(456 |

) |

Cash used in net share settlement of stock options and restricted stock units |

|

|

(51 |

) |

|

|

(76 |

) |

Net cash provided by financing activities |

|

|

28,220 |

|

|

|

30,468 |

|

|

|

|

|

|

|

|

Cash and cash equivalents: |

|

|

|

|

|

|

Net increase (decrease) |

|

|

656 |

|

|

|

(281 |

) |

Beginning of the period |

|

|

3,805 |

|

|

|

5,171 |

|

End of the period |

|

$ |

4,461 |

|

|

$ |

4,890 |

|

|

|

|

|

|

|

|

Supplemental schedule of non-cash activities: |

|

|

|

|

|

|

Non-cash accruals for purchases of property and equipment |

|

$ |

227 |

|

|

$ |

914 |

|

Non-cash accruals for debt issuance costs |

|

|

830 |

|

|

|

— |

|

Non-GAAP Financial Measures

To supplement our unaudited consolidated condensed financial statements presented in accordance with generally accepted accounting principles (“GAAP”), this earnings release and the related earnings conference call contain certain non-GAAP financial measures, including EBITDA, adjusted EBITDA and adjusted operating loss. These measures are not in accordance with, and are not intended as alternatives to, GAAP financial measures. The Company uses these non-GAAP financial measures internally in analyzing our financial results and believes that they provide useful information to analysts and investors, as a supplement to GAAP financial measures, in evaluating the Company’s operational performance.

The Company defines EBITDA as net loss before interest and the provision for income tax, which is equivalent to operating loss, adjusted for depreciation and asset impairment, adjusted EBITDA as EBITDA with non-GAAP adjustments and adjusted operating loss as adjusted EBITDA including depreciation.

Non-GAAP financial measures are intended to provide additional information only and do not have any standard meanings prescribed by GAAP. Use of these terms may differ from similar measures reported by other companies. Each non-GAAP financial measure has its limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. The Company’s non-GAAP adjustments remove stock based compensation expense, due to the non-cash nature of this expense, and remove severance, as it fluctuates based on the needs of the business and does not represent a normal, recurring operating expense.

The following table shows an unaudited non-GAAP measure reconciliation of operating loss to EBITDA, adjusted EBITDA and adjusted operating loss (in thousands) for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13-Week Period Ended |

|

|

26-Week Period Ended |

|

|

|

August 3, 2024 |

|

|

July 29, 2023 |

|

|

August 3, 2024 |

|

|

July 29, 2023 |

|

Operating loss |

|

$ |

(13,322 |

) |

|

$ |

(18,091 |

) |

|

$ |

(20,830 |

) |

|

$ |

(28,428 |

) |

Depreciation |

|

|

2,513 |

|

|

|

3,092 |

|

|

|

5,137 |

|

|

|

6,349 |

|

Asset impairment (1) |

|

|

20 |

|

|

|

1,001 |

|

|

|

31 |

|

|

|

1,226 |

|

EBITDA |

|

|

(10,789 |

) |

|

|

(13,998 |

) |

|

|

(15,662 |

) |

|

|

(20,853 |

) |

Non-GAAP adjustments to operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense(2) |

|

|

264 |

|

|

|

124 |

|

|

|

556 |

|

|

|

614 |

|

Severance charges(3) |

|

|

317 |

|

|

|

378 |

|

|

|

390 |

|

|

|

907 |

|

Total non-GAAP adjustments |

|

|

581 |

|

|

|

502 |

|

|

|

946 |

|

|

|

1,521 |

|

Adjusted EBITDA |

|

|

(10,208 |

) |

|

|

(13,496 |

) |

|

|

(14,716 |

) |

|

|

(19,332 |

) |

Depreciation |

|

|

2,513 |

|

|

|

3,092 |

|

|

|

5,137 |

|

|

|

6,349 |

|

Adjusted operating loss |

|

$ |

(12,721 |

) |

|

$ |

(16,588 |

) |

|

$ |

(19,853 |

) |

|

$ |

(25,681 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Asset impairment charges are related to property and equipment, software costs and cloud computing implementation costs. Asset impairment was previously shown as a non-GAAP adjustment. The current presentation includes asset impairment as a reconciling item between operating loss and EBITDA. Prior periods have been reclassified to conform to the current period presentation.

(2) Stock-based compensation expense includes amounts amortized to expense related to equity incentive plans.

(3) Severance charges include expenses related to severance agreements and permanent store closure compensation costs.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

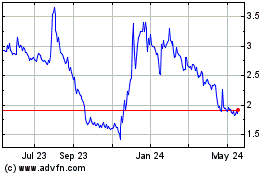

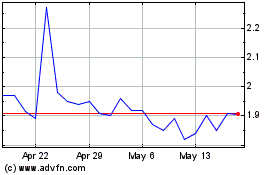

Kirklands (NASDAQ:KIRK)

Historical Stock Chart

From Oct 2024 to Nov 2024

Kirklands (NASDAQ:KIRK)

Historical Stock Chart

From Nov 2023 to Nov 2024