Standard BioTools Inc. (“Standard BioTools” or the “Company”)

(NASDAQ: LAB) today announced unaudited interim financial results

for the second quarter and six months ended June 30, 2024.

“We are laser-focused on optimizing our cost

structure, already seeing early integration synergy realization in

the second quarter of 2024, and accelerating our $80 million cost

reduction target, which we expect to be operationalized by the end

of 2024 – a year ahead of plan,” said Michael Egholm, PhD,

President and Chief Executive Officer of Standard BioTools. “We

remain on-track to hit our adjusted EBITDA break-even target for

the full year 2026 and are well-capitalized with nearly $400

million in cash to execute on our strategic vision.”

Egholm continued, “Strong operational execution

was offset by weaker-than-anticipated second quarter revenues.

SomaScan® services experienced service contract delays and

instrument sales were impacted by the lingering constrained capital

purchase environment. We are confident the business issues we

experienced are transitory, as we believe the challenge of running

a concentrated services business will moderate as Standard BioTools

Business System is more fully deployed.”

“It is early days for the Standard BioTools

strategy and vision as we bring improved operational discipline to

a diversified set of product solutions. Our potential M&A

pipeline remains robust, and we are all fully committed to

delivering long-term sustainable growth and value for our

shareholders," added Egholm.

2024 Selected Unaudited Interim

Financial Results

|

|

As Reported |

|

(Unaudited, in millions) |

Quarter Ended June 30, 2024 |

|

Six Months Ended June 30, 2024 |

|

Revenue |

$ |

37.2 |

|

|

$ |

82.7 |

|

|

Gross margin |

|

40.1 |

% |

|

|

47.2 |

% |

|

Non-GAAP gross margin |

|

45.0 |

% |

|

|

51.1 |

% |

|

Operating expenses |

$ |

65.4 |

|

|

$ |

149.8 |

|

|

Non-GAAP operating expenses |

$ |

47.8 |

|

|

$ |

97.1 |

|

|

Operating loss |

$ |

(50.5 |

) |

|

$ |

(110.7 |

) |

|

Net loss |

$ |

(45.7 |

) |

|

$ |

(77.9 |

) |

|

Adjusted EBITDA |

$ |

(31.0 |

) |

|

$ |

(54.8 |

) |

|

Cash, cash equivalents, restricted cash & short-term

investments |

$ |

396.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Revenue was $37 million in the second quarter, up 34%

year-over-year, and $83 million for the first half of 2024, up 57%,

reflecting the impact of SomaScan assay services, kits and related

revenue in 2024.

- Cash, cash equivalents, restricted cash and short-term

investments at June 30, 2024 were $396 million, reflecting payment

in the second quarter of $38 million of expenses related

to the merger (the “Merger”) with SomaLogic, Inc. (“SomaLogic”) and

the completed repurchases of the Company’s common stock in the

second quarter.

Selected Pro Forma Combined Unaudited

Interim Financial Results

The selected 2024 unaudited pro forma financial

information combines the Company's financial results for the three-

and six- month periods ended June 30, 2024, and the historical

results of SomaLogic for the five-day period ended on January 5,

2024, the closing date of the Merger. The selected unaudited pro

forma financial information for 2023 combines the historical

results of the Company and SomaLogic for their respective three-

and six- month periods ended June 30, 2023. See “Unaudited Pro

Forma Results” below for discussion of the pro forma financial

information.

| |

|

|

|

Pro Forma Combined |

|

(Unaudited, in millions) |

Quarter Ended June 30, 2024 |

|

Quarter Ended June 30, 2023 |

|

Six Months Ended June 30, 2024 |

|

Six Months Ended June 30, 2023 |

|

Revenue |

$ |

37.2 |

|

|

$ |

48.1 |

|

|

$ |

83.4 |

|

|

$ |

93.6 |

|

|

Gross margin |

|

40.1 |

% |

|

|

44.6 |

% |

|

|

45.2 |

% |

|

|

44.6 |

% |

|

Non-GAAP gross margin |

|

45.0 |

% |

|

|

53.4 |

% |

|

|

51.2 |

% |

|

|

52.5 |

% |

|

Operating expenses |

$ |

65.4 |

|

|

$ |

67.8 |

|

|

$ |

153.2 |

|

|

$ |

147.3 |

|

|

Non-GAAP operating expenses |

$ |

47.8 |

|

|

$ |

58.9 |

|

|

$ |

90.3 |

|

|

$ |

123.0 |

|

|

Operating loss |

$ |

(50.5 |

) |

|

$ |

(46.3 |

) |

|

$ |

(115.5 |

) |

|

$ |

(105.5 |

) |

|

Net loss |

$ |

(45.7 |

) |

|

$ |

(39.6 |

) |

|

$ |

(107.7 |

) |

|

$ |

(67.8 |

) |

|

Adjusted EBITDA |

$ |

(31.0 |

) |

|

$ |

(32.6 |

) |

|

$ |

(47.4 |

) |

|

$ |

(71.2 |

) |

|

|

|

|

|

|

|

|

|

- Revenue of $37 million in the second quarter was down 23%

year-over-year; and first half 2024 revenue of $83 million was down

11% year-over-year, primarily reflecting timing of large customer

projects and continuing macroeconomic headwinds.

- Product revenue of $22 million in the second quarter was down

10% year-over-year; and first half 2024 revenue of $46 million was

up 6% year-over-year. The Company saw expansion in authorized sites

and related pull-through, offset by a decline in instruments and

consumables.

- Service revenue of $14 million in the second quarter was down

37% year-over-year, and first half 2024 revenue of $36 million was

down 25% year-over-year. The biggest driver of the year-over-year

declines was the SomaScan assay services business, where

lower-then-expected revenue results were driven primarily by timing

of large projects from top customers, largely in Europe.

- Gross margins in the second quarter of 2024 were approximately

40%, versus 45% in the second quarter of 2023; and non-GAAP gross

margins in the second quarter of 2024 were approximately 45%,

versus 53% in the second quarter of 2023. Gross margins in the

first half of the year were approximately 45% in both 2024 and

2023; and non-GAAP gross margins were approximately 51% in the

first half of 2024 and 53% for the same period in 2023. Gross

margins and non-GAAP gross margins in 2024 were impacted by volume

declines in assay services and instrument replacement costs in the

second quarter.

- Operating expenses in the second quarter of 2024

decreased $2 million, or 3%, compared to the second quarter of

2023, to $65 million, and non-GAAP operating expenses, which

exclude Merger-related costs, stock-based compensation, and

restructuring charges, declined $11 million, or 19%, compared to

the second quarter of 2023, to $48 million. For the first half

of 2024, operating expenses increased by $6 million, or 4%,

compared to the first half of 2023, to $153 million, while non-GAAP

operating expenses decreased by $33 million, or 27%, compared to

the same period in 2023, to $90 million.

- Net loss for the second quarter of 2024 increased by $6

million, or 16%, compared to the second quarter of 2023, to a loss

of $46 million, while adjusted EBITDA improved nearly $2

million, or 5%, compared to the second quarter of 2023, to a loss

of $31 million. Net loss for the first half of 2024 increased

by $40 million, or 59%, compared to the first half of 2023, to

a loss of $108 million, due in large part to a $25 million

bargain purchase gain related to the merger with SomaLogic that is

assumed to have occurred in 2023 for purposes of the pro formas,

while adjusted EBITDA improved $24 million, or 33%, compared

to the first half of 2023, to a loss of $47 million.

Other Financial Highlights

- The Company repurchased approximately 11.3 million shares of

common stock during the second quarter of 2024 for an aggregate

purchase price of approximately $29 million at an average

price of $2.57 per share under the Company’s previously

announced common stock repurchase program.

Updated FY 2024 Revenue

Outlook

Following its second quarter 2024 results, the

Company has revised its full year 2024 revenue guidance to a range

of $170 million to $175 million.

Second Quarter 2024 Earnings Conference

Call Information

Standard BioTools will host a conference call and

webcast on July 31, 2024 at 1:30 p.m. PDT (4:30 p.m. EDT) to

discuss second quarter 2024 financial results. Live audio of the

webcast will be available online along with an archived version of

the webcast under the Events & Presentations page of the

Company’s website.

Individuals interested in listening to the

conference call may do so by dialing:

US domestic callers: 1-888-346-3970 Outside US

callers: 1-412-902-4297

Use of Non-GAAP Financial

Information

Standard BioTools has presented certain

financial information in accordance with U.S. GAAP and also on a

non-GAAP basis. The non-GAAP financial measures included in this

press release are non-GAAP gross margin, non-GAAP operating

expenses, and adjusted EBITDA. Management uses these non-GAAP

financial measures, in addition to GAAP financial measures, as a

measure of operating performance because the non-GAAP financial

measures do not include the impact of items that management does

not consider indicative of the Company’s core operating

performance. Management believes that non-GAAP financial measures,

taken in conjunction with GAAP financial measures, provide useful

information for both management and investors by excluding certain

non-cash and other expenses that are not indicative of the

Company’s core operating results. Management uses non-GAAP measures

to compare the Company’s performance relative to forecasts and

strategic plans and to benchmark the company’s performance

externally against competitors. Non-GAAP information is not

prepared under a comprehensive set of accounting rules and should

only be used to supplement an understanding of the company’s

operating results as reported under U.S. GAAP. Standard BioTools

encourages investors to carefully consider its results under GAAP,

as well as its supplemental non-GAAP information and the

reconciliations between these presentations, to more fully

understand its business. Reconciliations between GAAP and non-GAAP

operating results are presented in the accompanying tables of this

release.

Unaudited Pro Forma Results

The unaudited pro forma financial information for

six months ended June 30, 2024 combines the Company's

financial results for the six months ended June 30,

2024 and the historical results of SomaLogic for the 5-day

period ended on the January 5, 2024, the closing date of the

Merger. The unaudited pro forma financial information for the three

and six months ended June 30, 2023 combines the

historical results of the Company and SomaLogic for their

respective three- and six-month periods ended June 30, 2023.

The pro forma financial information for all periods

presented has been adjusted to include certain nonrecurring

impacts associated with the Merger, including the bargain purchase

gain and transaction costs.

The unaudited pro forma financial information for

all periods presented includes the business combination accounting

effects resulting from the Merger, mainly including adjustments to

reflect additional amortization expense from acquired intangible

assets, adjustments to stock-based compensation expense, and

additional depreciation expense from the acquired property and

equipment. The unaudited pro forma financial information is for

informational purposes only and is not necessarily indicative of

the results of operations that would have been achieved if the

acquisitions had taken place on January 1, 2023. The results

of SomaLogic have been consolidated with the Company's results

since the Closing Date.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, including, among others, statements regarding

future financial and business performance, including with respect

to future revenue, net loss and adjusted EBITDA; operational and

strategic plans; deployment of capital; market and growth

opportunity and potential; and the potential to realize the

expected benefits of the Merger and the Company’s integration of

SomaLogic, including the potential for it to drive long-term

profitable growth. Forward-looking statements are subject to

numerous risks and uncertainties that could cause actual results to

differ materially from currently anticipated results, including,

but not limited to, risks that the anticipated benefits of the

Merger and the integration of SomaLogic, including the potential

for it to drive long-term profitable growth, may not be fully

realized or may take longer to realize than expected; risks that

the Company may not realize expected cost savings from the Merger

or its restructuring, including the anticipated decrease in

operational expenses, at the levels it expects; possible

integration, restructuring and transition-related disruption,

including through the loss of customers, suppliers, and employees

and adverse impacts on the Company’s development activities and

results of operation; integration and restructuring activities,

including customer and employee relations, management distraction,

and reduced operating performance; risks that internal and external

costs required for ongoing and planned activities may be higher

than expected, which may cause the Company to use cash more quickly

than it expects or change or curtail some of the Company’s plans,

or both; risks that the Company’s expectations as to expenses, cash

usage, and cash needs may prove not to be correct for other reasons

such as changes in plans or actual events being different than our

assumptions; changes in the Company’s business or external market

conditions; challenges inherent in developing, manufacturing,

launching, marketing, and selling new products; interruptions or

delays in the supply of components or materials for, or

manufacturing of, the Company’s products; reliance on sales of

capital equipment for a significant proportion of revenues in each

quarter; seasonal variations in customer operations; unanticipated

increases in costs or expenses; continued or sustained budgetary,

inflationary, or recessionary pressures; uncertainties in

contractual relationships; reductions in research and development

spending or changes in budget priorities by customers;

uncertainties relating to the Company’s research and development

activities, and distribution plans and capabilities; potential

product performance and quality issues; risks associated with

international operations; intellectual property risks; and

competition. For information regarding other related risks, see the

“Risk Factors” section of the Company’s annual report on Form 10-K

filed with the SEC on March 1, 2024, and in the Company’s

other filings with the SEC. These forward-looking statements

speak only as of the date hereof. The Company disclaims any

obligation to update these forward-looking statements except as may

be required by law.

About Standard BioTools

Inc.

Standard BioTools Inc. (Nasdaq:LAB), the parent

company of SomaLogic Inc. and previously known as Fluidigm

Corporation has an established portfolio of essential, standardized

next-generation technologies that help biomedical researchers

develop medicines faster and better. As a leading solutions

provider, the company provides reliable and repeatable insights in

health and disease using its proprietary mass cytometry and

microfluidics technologies, which help transform scientific

discoveries into better patient outcomes. Standard BioTools works

with leading academic, government, pharmaceutical, biotechnology,

plant and animal research and clinical laboratories worldwide,

focusing on the most pressing needs in translational and clinical

research, including oncology, immunology and immunotherapy. Learn

more at standardbio.com or connect with us on X, Facebook®,

LinkedIn, and YouTube™.

For Research Use Only. Not for use in diagnostic

procedures.

Limited Use Label License and other terms may

apply: www.standardbio.com/legal/salesterms. Patent and License

Information: www.standardbio.com/legal/notices. Trademarks:

www.standardbio.com/legal/trademarks. Any other trademarks are the

sole property of their respective owners. ©2024 Standard BioTools

Inc. (f.k.a. Fluidigm Corporation). All rights reserved.

Investor Contact

David Holmes Gilmartin Group LLC

ir@standardbio.com

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STANDARD BIOTOOLS INC. CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (In

thousands, except per share amounts)

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue |

$ |

22,163 |

|

|

$ |

21,665 |

|

|

$ |

45,755 |

|

|

$ |

39,103 |

|

|

Services revenue |

14,053 |

|

|

5,821 |

|

|

35,080 |

|

|

12,702 |

|

|

Collaboration and other revenue |

989 |

|

|

180 |

|

|

1,910 |

|

|

980 |

|

|

Total revenue |

37,205 |

|

|

27,666 |

|

|

82,745 |

|

|

52,785 |

|

|

Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product revenue |

12,202 |

|

|

11,883 |

|

|

24,983 |

|

|

21,873 |

|

|

Cost of services revenue |

10,070 |

|

|

2,181 |

|

|

18,579 |

|

|

4,973 |

|

|

Cost of collaboration and other revenue |

25 |

|

|

— |

|

|

87 |

|

|

56 |

|

|

Total cost of revenue |

22,297 |

|

|

14,064 |

|

|

43,649 |

|

|

26,902 |

|

|

Gross profit |

14,908 |

|

|

13,602 |

|

|

39,096 |

|

|

25,883 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

19,222 |

|

|

6,184 |

|

|

35,202 |

|

|

12,613 |

|

|

Selling, general and administrative |

37,674 |

|

|

22,600 |

|

|

84,617 |

|

|

43,895 |

|

|

Restructuring and related charges |

5,749 |

|

|

2,267 |

|

|

10,033 |

|

|

3,417 |

|

|

Transaction and integration expenses |

2,782 |

|

|

— |

|

|

19,945 |

|

|

— |

|

|

Total operating expenses |

65,427 |

|

|

31,051 |

|

|

149,797 |

|

|

59,925 |

|

|

Loss from operations |

(50,519 |

) |

|

(17,449 |

) |

|

(110,701 |

) |

|

(34,042 |

) |

|

Bargain purchase gain |

— |

|

|

— |

|

|

25,213 |

|

|

— |

|

|

Interest income, net |

4,444 |

|

|

244 |

|

|

9,618 |

|

|

316 |

|

|

Other income (expense), net |

412 |

|

|

466 |

|

|

(1,822 |

) |

|

407 |

|

|

Loss before income taxes |

(45,663 |

) |

|

(16,739 |

) |

|

(77,692 |

) |

|

(33,319 |

) |

|

Income tax benefit (expense) |

(55 |

) |

|

(301 |

) |

|

(183 |

) |

|

(564 |

) |

|

Net loss |

$ |

(45,718 |

) |

|

$ |

(17,040 |

) |

|

$ |

(77,875 |

) |

|

$ |

(33,883 |

) |

|

Induced conversion of redeemable preferred stock |

— |

|

|

— |

|

|

(46,014 |

) |

|

— |

|

|

Net loss attributable to common stockholders |

$ |

(45,718 |

) |

|

$ |

(17,040 |

) |

|

$ |

(123,889 |

) |

|

$ |

(33,883 |

) |

|

Net loss per share attributable to common stockholders, basic and

diluted |

$ |

(0.12 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.37 |

) |

|

$ |

(0.43 |

) |

|

Shares used in computing net loss per share attributable to common

stockholders, basic and diluted |

372,331 |

|

|

78,669 |

|

|

333,228 |

|

|

78,873 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

STANDARD BIOTOOLS INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (In

thousands) |

|

|

|

|

June 30,2024 |

|

December 31, 2023 |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

269,811 |

|

|

$ |

51,704 |

|

|

Short-term investments |

124,902 |

|

|

63,191 |

|

|

Accounts receivable, net |

32,441 |

|

|

19,660 |

|

|

Inventory |

42,618 |

|

|

20,533 |

|

|

Prepaid expenses and other current assets |

10,257 |

|

|

3,127 |

|

|

Total current assets |

480,029 |

|

|

158,215 |

|

|

Inventory, non-current |

16,252 |

|

|

— |

|

|

Royalty receivable, non-current |

3,738 |

|

|

— |

|

|

Property and equipment, net |

42,569 |

|

|

24,187 |

|

|

Operating lease right-of-use asset, net |

31,531 |

|

|

30,663 |

|

|

Other non-current assets |

4,282 |

|

|

2,285 |

|

|

Acquired intangible assets, net |

24,078 |

|

|

1,400 |

|

|

Goodwill |

106,253 |

|

|

106,317 |

|

|

Total assets |

$ |

708,732 |

|

|

$ |

323,067 |

|

|

|

|

|

|

|

|

|

LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS’ EQUITY

(DEFICIT) |

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

12,570 |

|

|

$ |

9,236 |

|

|

Accrued liabilities |

31,929 |

|

|

21,019 |

|

|

Operating lease liabilities, current |

5,851 |

|

|

4,323 |

|

|

Deferred revenue, current |

15,113 |

|

|

11,607 |

|

|

Deferred grant income, current |

3,562 |

|

|

3,612 |

|

|

Term loan, current |

— |

|

|

5,000 |

|

|

Convertible notes, current |

54,783 |

|

|

54,530 |

|

|

Total current liabilities |

123,808 |

|

|

109,327 |

|

|

Convertible notes, non-current |

299 |

|

|

569 |

|

|

Term loan, non-current |

— |

|

|

3,414 |

|

|

Deferred tax liability |

841 |

|

|

841 |

|

|

Operating lease liabilities, non-current |

29,617 |

|

|

30,374 |

|

|

Deferred revenue, non-current |

33,395 |

|

|

3,520 |

|

|

Deferred grant income, non-current |

8,995 |

|

|

10,755 |

|

|

Other non-current liabilities |

1,516 |

|

|

1,065 |

|

|

Total liabilities |

198,471 |

|

|

159,865 |

|

|

Mezzanine equity: |

|

|

|

|

|

|

Redeemable preferred stock |

— |

|

|

311,253 |

|

|

Total stockholders’ equity (deficit) |

510,261 |

|

|

(148,051 |

) |

|

Total liabilities, mezzanine equity and stockholders’ equity

(deficit) |

$ |

708,732 |

|

|

$ |

323,067 |

|

|

|

|

|

|

|

|

|

STANDARD BIOTOOLS INC. CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (In

thousands) |

|

|

|

|

Six Months Ended June 30, |

|

|

2024 |

|

2023 |

|

Operating activities |

|

|

|

|

|

|

Net loss |

$ |

(77,875 |

) |

|

$ |

(33,883 |

) |

|

Bargain purchase gain |

(25,213 |

) |

|

— |

|

|

Stock-based compensation expense |

18,341 |

|

|

6,262 |

|

|

Amortization of acquired intangible assets |

2,822 |

|

|

5,600 |

|

|

Depreciation and amortization |

6,228 |

|

|

1,688 |

|

|

Accretion of discount on short-term investments, net |

(4,544 |

) |

|

(151 |

) |

|

Non-cash lease expense |

2,949 |

|

|

1,902 |

|

|

Provision for excess and obsolete inventory |

1,874 |

|

|

572 |

|

|

Change in fair value of warrants |

(453 |

) |

|

— |

|

|

Other non-cash items |

868 |

|

|

327 |

|

|

Changes in assets and liabilities, net |

(26,523 |

) |

|

(131 |

) |

|

Net cash used in operating activities |

(101,526 |

) |

|

(17,814 |

) |

|

|

|

|

|

|

|

|

Investing activities |

|

|

|

|

|

|

Cash and restricted cash acquired in merger |

280,033 |

|

|

— |

|

|

Purchases of short-term investments |

(147,984 |

) |

|

(6,836 |

) |

|

Proceeds from sales and maturities of investments |

239,000 |

|

|

91,964 |

|

|

Purchases of property and equipment |

(2,718 |

) |

|

(1,848 |

) |

|

Net cash provided by investing activities |

368,331 |

|

|

83,280 |

|

|

|

|

|

|

|

|

|

Financing activities |

|

|

|

|

|

|

Repayment of term loan and convertible notes |

(8,192 |

) |

|

— |

|

|

Payment of term loan fee |

(545 |

) |

|

— |

|

|

Repurchase of common stock |

(40,490 |

) |

|

(4,841 |

) |

|

Proceeds from ESPP stock issuance |

425 |

|

|

326 |

|

|

Payments for taxes related to net share settlement of equity awards

and other |

(344 |

) |

|

(127 |

) |

|

Proceeds from exercise of stock options |

1,052 |

|

|

— |

|

|

Net cash used in financing activities |

(48,094 |

) |

|

(4,642 |

) |

|

Effect of foreign exchange rate fluctuations on cash and cash

equivalents |

(110 |

) |

|

(49 |

) |

|

Net increase in cash, cash equivalents and restricted cash |

218,601 |

|

|

60,775 |

|

|

Cash, cash equivalents and restricted cash at beginning of

period |

52,499 |

|

|

82,324 |

|

|

Cash, cash equivalents and restricted cash at end of period |

$ |

271,100 |

|

|

$ |

143,099 |

|

|

|

|

|

|

|

|

|

Cash, cash equivalents, and restricted cash consists of: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

269,811 |

|

|

$ |

142,304 |

|

|

Restricted cash |

1,289 |

|

|

795 |

|

|

Total cash, cash equivalents and restricted cash |

$ |

271,100 |

|

|

$ |

143,099 |

|

| |

|

|

|

|

|

|

STANDARD BIOTOOLS INC. REVENUE AND

NON-GAAP PRO FORMA COMBINED REVENUE (In

thousands) (Unaudited) |

|

|

|

|

As Reported |

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Product revenue: |

|

|

|

|

|

|

|

|

Instruments |

$ |

7,047 |

|

|

$ |

11,587 |

|

|

$ |

11,950 |

|

|

$ |

17,510 |

|

|

Consumables |

|

8,847 |

|

|

|

10,078 |

|

|

|

19,258 |

|

|

|

21,593 |

|

|

SomaScan assay kits and related |

|

6,269 |

|

|

|

- |

|

|

|

14,547 |

|

|

|

- |

|

|

Total product revenue |

|

22,163 |

|

|

|

21,665 |

|

|

|

45,755 |

|

|

|

39,103 |

|

|

Service revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assay services |

|

7,680 |

|

|

|

- |

|

|

|

22,542 |

|

|

|

- |

|

|

Instrument support services |

|

6,373 |

|

|

|

5,821 |

|

|

|

12,538 |

|

|

|

12,702 |

|

|

Total service revenue |

|

14,053 |

|

|

|

5,821 |

|

|

|

35,080 |

|

|

|

12,702 |

|

|

Product and service revenue |

|

36,216 |

|

|

|

27,486 |

|

|

|

80,835 |

|

|

|

51,805 |

|

|

Collaboration and other revenue |

|

989 |

|

|

|

180 |

|

|

|

1,910 |

|

|

|

980 |

|

|

Total revenue |

$ |

37,205 |

|

|

$ |

27,666 |

|

|

$ |

82,745 |

|

|

$ |

52,785 |

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Pro Forma |

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Product revenue: |

|

|

|

|

|

|

|

|

Instruments |

$ |

7,047 |

|

|

$ |

11,587 |

|

|

$ |

11,950 |

|

|

$ |

17,510 |

|

|

Consumables |

|

8,847 |

|

|

|

10,078 |

|

|

|

19,258 |

|

|

|

21,593 |

|

|

SomaScan assay kits and related |

|

6,269 |

|

|

|

2,909 |

|

|

|

14,548 |

|

|

|

4,095 |

|

|

Total product revenue |

|

22,163 |

|

|

|

24,574 |

|

|

|

45,756 |

|

|

|

43,198 |

|

|

Service revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assay services |

|

7,680 |

|

|

|

16,597 |

|

|

|

23,145 |

|

|

|

35,016 |

|

|

Instrument support services |

|

6,373 |

|

|

|

5,821 |

|

|

|

12,538 |

|

|

|

12,702 |

|

|

Total service revenue |

|

14,053 |

|

|

|

22,418 |

|

|

|

35,683 |

|

|

|

47,718 |

|

|

Product and service revenue |

|

36,216 |

|

|

|

46,992 |

|

|

|

81,439 |

|

|

|

90,916 |

|

|

Collaboration and other revenue |

|

989 |

|

|

|

1,142 |

|

|

|

1,951 |

|

|

|

2,716 |

|

|

Total revenue |

$ |

37,205 |

|

|

$ |

48,134 |

|

|

$ |

83,390 |

|

|

$ |

93,632 |

|

|

|

|

|

|

|

|

|

|

|

STANDARD BIOTOOLS INC. RECONCILIATION OF

GAAP TO NON-GAAP FINANCIAL INFORMATION (In

thousands) (Unaudited) |

|

|

|

ITEMIZED RECONCILIATION OF GROSS PROFIT TO NON-GAAP GROSS

PROFIT AND MARGIN PERCENTAGE |

|

|

| |

As Reported |

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2023 |

|

Gross profit |

$ |

14,908 |

|

|

$ |

13,602 |

|

|

$ |

39,096 |

|

|

$ |

25,883 |

|

|

Amortization of acquired intangible assets |

555 |

|

|

2,800 |

|

|

2,511 |

|

|

5,600 |

|

|

Depreciation and amortization |

967 |

|

|

335 |

|

|

1,991 |

|

|

658 |

|

|

Stock-based compensation expense |

294 |

|

|

107 |

|

|

533 |

|

|

460 |

|

|

Cost of sales adjustment |

— |

|

|

— |

|

|

(1,812 |

) |

|

— |

|

|

Restructuring costs |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Non-GAAP gross profit |

$ |

16,724 |

|

|

$ |

16,844 |

|

|

$ |

42,319 |

|

|

$ |

32,601 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin percentage |

40.1 |

% |

|

49.2 |

% |

|

47.2 |

% |

|

49.0 |

% |

|

Amortization of acquired intangible assets |

1.5 |

% |

|

10.1 |

% |

|

3.0 |

% |

|

10.6 |

% |

|

Depreciation and amortization |

2.6 |

% |

|

1.2 |

% |

|

2.4 |

% |

|

1.2 |

% |

|

Stock-based compensation expense |

0.8 |

% |

|

0.4 |

% |

|

0.6 |

% |

|

0.9 |

% |

|

Cost of sales adjustment |

0.0 |

% |

|

0.0 |

% |

|

(2.2 |

)% |

|

0.0 |

% |

|

Non-GAAP gross margin percentage |

45.0 |

% |

|

60.9 |

% |

|

51.1 |

% |

|

61.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Non-GAAP Pro Forma Combined |

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2023 |

|

Gross profit |

$ |

14,908 |

|

|

$ |

21,484 |

|

|

$ |

37,681 |

|

|

$ |

41,783 |

|

|

Amortization of acquired intangible assets |

555 |

|

|

3,355 |

|

|

2,511 |

|

|

6,711 |

|

|

Depreciation and amortization |

967 |

|

|

709 |

|

|

1,991 |

|

|

1,389 |

|

|

Stock-based compensation expense |

294 |

|

|

157 |

|

|

533 |

|

|

561 |

|

|

Cost of sales adjustment |

— |

|

|

— |

|

|

— |

|

|

(1,337 |

) |

|

Restructuring costs |

— |

|

|

— |

|

|

— |

|

|

19 |

|

|

Non-GAAP gross profit |

$ |

16,724 |

|

|

$ |

25,705 |

|

|

$ |

42,716 |

|

|

$ |

49,126 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin percentage |

40.1 |

% |

|

44.6 |

% |

|

45.2 |

% |

|

44.6 |

% |

|

Amortization of acquired intangible assets |

1.5 |

% |

|

7.0 |

% |

|

3.0 |

% |

|

7.2 |

% |

|

Depreciation and amortization |

2.6 |

% |

|

1.5 |

% |

|

2.4 |

% |

|

1.5 |

% |

|

Stock-based compensation expense |

0.8 |

% |

|

0.3 |

% |

|

0.6 |

% |

|

0.6 |

% |

|

Cost of sales adjustment |

0.0 |

% |

|

0.0 |

% |

|

0.0 |

% |

|

(1.4 |

)% |

|

Non-GAAP gross margin percentage |

45.0 |

% |

|

53.4 |

% |

|

51.2 |

% |

|

52.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

STANDARD BIOTOOLS INC. RECONCILIATION OF

GAAP TO NON-GAAP FINANCIAL INFORMATION (In

thousands) (Unaudited) |

|

|

|

ITEMIZED RECONCILIATION OF OPERATING EXPENSES TO NON-GAAP

OPERATING EXPENSES, R&D OPERATING EXPENSES TO NON-GAAP R&D

OPERATING EXPENSES, AND SG&A EXPENSES TO NON-GAAP SG&A

EXPENSES |

|

|

| |

As Reported |

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2023 |

|

Operating expenses |

$ |

65,427 |

|

|

$ |

31,051 |

|

|

$ |

149,797 |

|

|

$ |

59,925 |

|

|

Restructuring and related charges |

(5,749 |

) |

|

(2,267 |

) |

|

(10,033 |

) |

|

(3,417 |

) |

|

Transaction and integration expenses |

(2,782 |

) |

|

- |

|

|

(19,945 |

) |

|

- |

|

|

Stock-based compensation expense |

(6,436 |

) |

|

(3,007 |

) |

|

(17,808 |

) |

|

(5,802 |

) |

|

Amortization of acquired intangible assets |

(161 |

) |

|

- |

|

|

(311 |

) |

|

- |

|

|

Depreciation and amortization |

(2,172 |

) |

|

(491 |

) |

|

(4,237 |

) |

|

(1,030 |

) |

|

Gain/loss on disposal of property and equipment |

(371 |

) |

|

(73 |

) |

|

(385 |

) |

|

(73 |

) |

|

Non-GAAP operating expenses |

$ |

47,756 |

|

|

$ |

25,213 |

|

|

$ |

97,078 |

|

|

$ |

49,603 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R&D operating expenses |

$ |

19,222 |

|

|

$ |

6,184 |

|

|

$ |

35,202 |

|

|

$ |

12,613 |

|

|

Stock-based compensation expense |

(2,428 |

) |

|

(366 |

) |

|

(3,756 |

) |

|

(782 |

) |

|

Depreciation and amortization |

(788 |

) |

|

(131 |

) |

|

(1,659 |

) |

|

(281 |

) |

|

Non-GAAP R&D operating expenses |

$ |

16,006 |

|

|

$ |

5,687 |

|

|

$ |

29,787 |

|

|

$ |

11,550 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SG&A operating expenses |

$ |

37,674 |

|

|

$ |

22,600 |

|

|

$ |

84,617 |

|

|

$ |

43,895 |

|

|

Stock-based compensation expense |

(4,008 |

) |

|

(2,641 |

) |

|

(14,052 |

) |

|

(5,020 |

) |

|

Amortization of acquired intangible assets |

(161 |

) |

|

- |

|

|

(311 |

) |

|

- |

|

|

Depreciation and amortization |

(1,384 |

) |

|

(360 |

) |

|

(2,578 |

) |

|

(749 |

) |

|

Gain/loss on disposal of property and equipment |

(371 |

) |

|

(73 |

) |

|

(385 |

) |

|

(73 |

) |

|

Non-GAAP SG&A operating expenses |

$ |

31,750 |

|

|

$ |

19,526 |

|

|

$ |

67,291 |

|

|

$ |

38,053 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Non-GAAP Pro Forma Combined |

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2023 |

|

Operating expenses |

$ |

65,427 |

|

|

$ |

67,773 |

|

|

$ |

153,195 |

|

|

$ |

147,264 |

|

|

Restructuring and related charges |

(5,749 |

) |

|

(2,326 |

) |

|

(10,033 |

) |

|

(4,517 |

) |

|

Transaction and integration expenses |

(2,782 |

) |

|

- |

|

|

(30,114 |

) |

|

- |

|

|

Stock-based compensation expense |

(6,436 |

) |

|

(4,500 |

) |

|

(17,808 |

) |

|

(15,675 |

) |

|

Amortization of acquired intangible assets |

(161 |

) |

|

(161 |

) |

|

(311 |

) |

|

(321 |

) |

|

Depreciation and amortization |

(2,172 |

) |

|

(1,800 |

) |

|

(4,237 |

) |

|

(3,666 |

) |

|

Gain/loss on disposal of property and equipment |

(371 |

) |

|

(107 |

) |

|

(385 |

) |

|

(107 |

) |

|

Non-GAAP operating expenses |

$ |

47,756 |

|

|

$ |

58,879 |

|

|

$ |

90,307 |

|

|

$ |

122,978 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R&D operating expenses |

$ |

19,222 |

|

|

$ |

14,918 |

|

|

$ |

35,854 |

|

|

$ |

32,762 |

|

|

Stock-based compensation expense |

(2,428 |

) |

|

(741 |

) |

|

(3,756 |

) |

|

(1,544 |

) |

|

Depreciation and amortization |

(788 |

) |

|

(523 |

) |

|

(1,659 |

) |

|

(1,051 |

) |

|

Non-GAAP R&D operating expenses |

$ |

16,006 |

|

|

$ |

13,654 |

|

|

$ |

30,439 |

|

|

$ |

30,167 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SG&A operating expenses |

$ |

37,674 |

|

|

$ |

50,529 |

|

|

$ |

77,194 |

|

|

$ |

109,985 |

|

|

Stock-based compensation expense |

(4,008 |

) |

|

(3,759 |

) |

|

(14,052 |

) |

|

(14,131 |

) |

|

Amortization of acquired intangible assets |

(161 |

) |

|

(161 |

) |

|

(311 |

) |

|

(321 |

) |

|

Depreciation and amortization |

(1,384 |

) |

|

(1,277 |

) |

|

(2,578 |

) |

|

(2,615 |

) |

|

Gain/loss on disposal of property and equipment |

(371 |

) |

|

(107 |

) |

|

(385 |

) |

|

(107 |

) |

|

Non-GAAP SG&A operating expenses |

$ |

31,750 |

|

|

$ |

45,225 |

|

|

$ |

59,868 |

|

|

$ |

92,811 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STANDARD BIOTOOLS INC. RECONCILIATION OF

GAAP TO NON-GAAP FINANCIAL INFORMATION (In

thousands) (Unaudited) |

|

|

|

ITEMIZED RECONCILIATION OF GAAP NET LOSS TO NON-GAAP

ADJUSTED EBITDA |

|

|

| |

As Reported |

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2023 |

|

Net loss |

$ |

(45,718 |

) |

|

$ |

(17,040 |

) |

|

$ |

(77,875 |

) |

|

$ |

(33,883 |

) |

|

Income tax expense (benefit) |

55 |

|

|

301 |

|

|

183 |

|

|

564 |

|

|

Interest income, net |

(4,444 |

) |

|

(244 |

) |

|

(9,618 |

) |

|

(316 |

) |

|

Amortization of acquired intangible assets |

716 |

|

|

2,800 |

|

|

2,822 |

|

|

5,600 |

|

|

Depreciation and amortization |

3,139 |

|

|

826 |

|

|

6,228 |

|

|

1,688 |

|

|

Bargain purchase gain |

— |

|

|

— |

|

|

(25,213 |

) |

|

— |

|

|

Restructuring and related charges |

5,749 |

|

|

2,267 |

|

|

10,033 |

|

|

3,417 |

|

|

Transaction and integration expenses |

2,782 |

|

|

— |

|

|

19,945 |

|

|

— |

|

|

Stock-based compensation expense |

6,730 |

|

|

3,114 |

|

|

18,341 |

|

|

6,262 |

|

|

Cost of sales adjustment |

— |

|

|

— |

|

|

(1,812 |

) |

|

— |

|

|

Gain/loss on disposal of property and equipment |

371 |

|

|

73 |

|

|

385 |

|

|

73 |

|

|

Other non-operating expense |

(412 |

) |

|

(466 |

) |

|

1,822 |

|

|

(407 |

) |

|

Adjusted EBITDA |

(31,032 |

) |

|

(8,369 |

) |

|

(54,759 |

) |

|

(17,002 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Non-GAAP Pro Forma Combined |

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2023 |

|

Net loss |

$ |

(45,718 |

) |

|

$ |

(39,557 |

) |

|

$ |

(107,693 |

) |

|

$ |

(67,795 |

) |

|

Income tax expense (benefit) |

55 |

|

|

303 |

|

|

183 |

|

|

568 |

|

|

Interest income, net |

(4,444 |

) |

|

(6,162 |

) |

|

(9,618 |

) |

|

(11,157 |

) |

|

Amortization of acquired intangible assets |

716 |

|

|

3,516 |

|

|

2,822 |

|

|

7,032 |

|

|

Depreciation and amortization |

3,139 |

|

|

2,509 |

|

|

6,228 |

|

|

5,055 |

|

|

Bargain purchase gain |

— |

|

|

— |

|

|

— |

|

|

(25,213 |

) |

|

Restructuring and related charges |

5,749 |

|

|

2,326 |

|

|

10,033 |

|

|

4,517 |

|

|

Transaction and integration expenses |

2,782 |

|

|

— |

|

|

30,114 |

|

|

— |

|

|

Stock-based compensation expense |

6,730 |

|

|

4,657 |

|

|

18,341 |

|

|

16,236 |

|

|

Cost of sales adjustment |

— |

|

|

— |

|

|

— |

|

|

(1,337 |

) |

|

Gain/loss on disposal of property and equipment |

371 |

|

|

107 |

|

|

385 |

|

|

107 |

|

|

Other non-operating expense |

(412 |

) |

|

(303 |

) |

|

1,822 |

|

|

754 |

|

|

Adjusted EBITDA |

(31,032 |

) |

|

(32,604 |

) |

|

(47,383 |

) |

|

(71,233 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

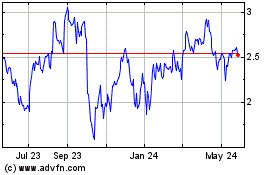

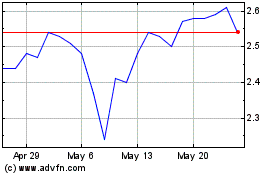

Standard BioTools (NASDAQ:LAB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Standard BioTools (NASDAQ:LAB)

Historical Stock Chart

From Dec 2023 to Dec 2024