UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-39301

LION

GROUP HOLDING LTD.

Not Applicable

(Translation

of registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

3 Phillip Street, #15-04 Royal Group Building

Singapore 048693

(Address of principal executive office)

Registrant’s phone number, including area

code

+65 8877 3871

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On October 31, 2023, the Board of Directors (the

“Board”) of Lion Group Holding Ltd (the “Company”) adopted a Clawback Policy that allows recovery of certain cash

incentive payments and equity-based compensation provided to the Company’s current and former executive officers and such other senior

executives/employees.

A copy of the Clawback Policy is attached as

Exhibit 99.1 hereto, and incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: November 3, 2023 |

LION GROUP HOLDING LTD. |

| |

|

|

| |

By: |

/s/ Chunning Wang |

| |

Name: |

Chunning Wang |

| |

Title: |

Chief Executive Officer and Director |

EXHIBIT INDEX

Exhibit 99.1

Lion Group Holding Ltd.

(“the Company”)

CLAWBACK POLICY

Introduction

The Board of Directors of the Company (the “Board”)

believes that it is in the best interests of the Company and its shareholders to create and maintain a culture that emphasizes integrity

and accountability and that reinforces the Company’s pay-for-performance compensation philosophy. The Board has therefore adopted this

policy which provides for the recoupment of certain executive compensation in the event of an accounting restatement resulting from material

noncompliance with financial reporting requirements under the federal securities laws (the “Policy”). This Policy is

designed to comply with Section 10D of the Securities Exchange Act of 1934 (the “Exchange Act”).

Administration

This Policy shall be administered by the Board or, if so designated

by the Board, the Compensation Committee, in which case references herein to the Board shall be deemed references to the Compensation

Committee. Any determinations made by the Board shall be final and binding on all affected individuals.

Covered Executives

This Policy applies to the Company’s current and former executive officers,

as determined by the Board in accordance with Section 10D of the Exchange Act and the listing standards of the national securities exchange

on which the Company’s securities are listed, and such other senior executives/employees who may from time to time be deemed subject to

the Policy by the Board (“Covered Executives”).

Recoupment; Accounting Restatement

In the event the Company is required to prepare an accounting restatement

of its financial statements due to the Company’s material noncompliance with any financial reporting requirement under the securities

laws, the Board will require reimbursement or forfeiture of any excess Incentive Compensation received by any Covered Executive during

the three completed fiscal years immediately preceding the date on which the Company is required to prepare an accounting restatement.

Incentive Compensation

For purposes of this Policy, Incentive Compensation means any of the

following; provided that, such compensation is granted, earned, or vested based wholly or in part on the attainment of a financial reporting

measure:

| ● | Annual bonuses and other short- and long-term cash incentives. |

| ● | Stock appreciation rights. |

Financial reporting measures include:

| ● | Total shareholder return. |

| ● | Earnings before interest, taxes, depreciation, and amortization (EBITDA). |

| ● | Liquidity measures such as working capital or operating cash flow. |

| ● | Return measures such as return on invested capital or return on assets. |

| ● | Earnings measures such as earnings per share. |

Excess Incentive Compensation: Amount Subject to Recovery

The amount to be recovered will be the excess of the Incentive Compensation

paid to the Covered Executive based on the erroneous data over the Incentive Compensation that would have been paid to the Covered Executive

had it been based on the restated results, as determined by the Board.

If the Board cannot determine the amount of excess Incentive Compensation

received by the Covered Executive directly from the information in the accounting restatement, then it will make its determination based

on a reasonable estimate of the effect of the accounting restatement.

Method of Recoupment

The Board will determine, in its sole discretion, the method for recouping

Incentive Compensation hereunder which may include, without limitation:

(a) requiring reimbursement of cash Incentive Compensation previously

paid;

(b) seeking recovery of any gain realized on the vesting, exercise,

settlement, sale, transfer, or other disposition of any equity-based awards;

(c) offsetting the recouped amount from any compensation otherwise

owed by the Company to the Covered Executive;

(d)) cancelling outstanding vested or unvested equity awards; and/or

(e) taking any other remedial and recovery action permitted by law,

as determined by the Board.

No Indemnification

The Company shall not indemnify any Covered Executives against the

loss of any incorrectly awarded Incentive Compensation.

Interpretation

The Board is authorized to interpret and construe this Policy and to

make all determinations necessary, appropriate, or advisable for the administration of this Policy. It is intended that this Policy be

interpreted in a manner that is consistent with the requirements of Section 10D of the Exchange Act and any applicable rules or standards

adopted by the Securities and Exchange Commission or any national securities exchange on which the Company’s securities are listed.

Effective Date

This Policy shall be effective as of the date it is adopted by the

Board (the “Effective Date”) and shall apply to Incentive Compensation that is approved, awarded or granted to Covered

Executives on or after that date.

Amendment; Termination

The Board may amend this Policy from time to time in its discretion

and shall amend this Policy as it deems necessary to reflect final regulations adopted by the Securities and Exchange Commission under

Section 10D of the Exchange Act and to comply with any rules or standards adopted by a national securities exchange on which the Company’s

securities are listed. The Board may terminate this Policy at any time.

Other Recoupment Rights

The Board intends that this Policy will be applied to the fullest extent

of the law. The Board may require that any employment agreement, equity award agreement, or similar agreement entered into on or after

the Effective Date shall, as a condition to the grant of any benefit thereunder, require a Covered Executive to agree to abide by the

terms of this Policy. Any right of recoupment under this Policy is in addition to, and not in lieu of, any other remedies or rights of

recoupment that may be available to the Company pursuant to the terms of any similar policy in any employment agreement, equity award

agreement, or similar agreement and any other legal remedies available to the Company.

Impracticability

The Board shall recover any excess Incentive Compensation in accordance

with this Policy unless such recovery would be impracticable, as determined by the Board in accordance with Rule 10D-1 of the Exchange

Act and the listing standards of the national securities exchange on which the Company’s securities are listed.

Successors

This Policy shall be binding and enforceable against all Covered Executives

and their beneficiaries, heirs, executors, administrators or other legal representatives.

3

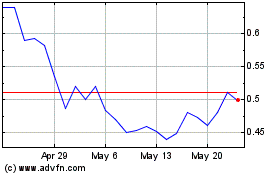

Lion (NASDAQ:LGHL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Lion (NASDAQ:LGHL)

Historical Stock Chart

From Nov 2023 to Nov 2024