0001580670false00015806702025-02-252025-02-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): February 25, 2025

LGI HOMES, INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | | 001-36126 | | 46-3088013 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification Number) |

| | | | | | | | | | | | | | | | | |

| 1450 Lake Robbins Drive, | Suite 430, | The Woodlands, | Texas | | 77380 |

| (Address of principal executive offices) | | (Zip Code) |

(281) 362-8998

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | LGIH | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On February 25, 2025, LGI Homes, Inc. (the “Company”) issued a press release announcing its financial results for the three months and fiscal year ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. None of the information furnished in this Item 2.02 and the accompanying exhibit will be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor will it be deemed incorporated by reference into any filing by the Company under the Securities Act of 1933, as amended.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

The information set forth in Item 2.02 above and in Exhibit 99.1 to this Current Report on Form 8-K is incorporated herein by reference. None of the information furnished in this Item 7.01 and the accompanying exhibit will be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor will it be deemed incorporated by reference into any registration statement filed by the Company under the Securities Act of 1933, as amended.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | |

| (d) | Exhibits. |

| |

| 99.1 | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Dated: February 25, 2025 | |

| LGI HOMES, INC. |

| | |

| By: | /s/ Eric Lipar |

| | Eric Lipar |

| | Chief Executive Officer and Chairman of the Board |

EXHIBIT 99.1

LGI Homes, Inc. Reports Fourth Quarter and Full Year 2024 Results and Issues Guidance for 2025

THE WOODLANDS, Texas, February 25, 2025 (GLOBE NEWSWIRE) - LGI Homes, Inc. (NASDAQ: LGIH) today announced financial results for the fourth quarter and year ended December 31, 2024.

“In the face of a mixed macroeconomic backdrop, our strong finish in the fourth quarter enabled us to meet, and in many cases exceed, our strategic goals for 2024,” said Eric Lipar, Chairman and Chief Executive Officer of LGI Homes.

“Our strong execution in the fourth quarter resulted in full year closings of 6,131 homes, including the bulk sale of 103 leased, single-family homes. We successfully ended the year with a record high 151 active communities, an impressive increase of 29.1%. We made significant progress improving profitability. Our full year gross margin was 24.2% and adjusted gross margin was 26.3%. These results represented increases of 120 and 160 basis points over 2023, respectively, and were aligned with our pre-pandemic, historical levels. Our pre-tax net income margin was 11.8%, up 70 basis points from the prior year. Finally, we continued making strategic investments to drive our growth in the years ahead.

“Our near-term outlook for 2025 is tempered by our belief that the affordability challenges encountered in 2024 will continue into this year. Our current guidance reflects our conservatism in the face of this uncertainty and is based on what we believe is attainable if conditions this year are similar to our experience in 2024 and year-to-date. With this in mind, we are projecting full year closings between 6,200 and 7,000 homes, at an average sales price between $360,000 and $370,000. We will continue to lean into incentives while maintaining profitability metrics in-line with our historical averages, supported by a self-developed land pipeline that enables us to deliver margins at or near the top of our peer group. With this in mind, we are projecting full year gross margin between 23.2% and 24.2% and adjusted gross margin between 25.5% and 26.5%.”

Mr. Lipar concluded, “As we look out to 2025, we are staying the course and remain committed to driving profitability through operational discipline and positioning LGI Homes for sustainable success. I thank our team members for their dedication and congratulate them all on the successful results they delivered in 2024. I'm confident in the talent and experience we’ve built here at LGI Homes and believe we are well-positioned to navigate whatever comes our way in 2025.”

Fourth Quarter 2024 Highlights (comparisons to fourth quarter 2023)

•Home sales revenues decreased 8.4% to $557.4 million

•Home closings decreased 12.8% to 1,533 homes

•Average sales price per home closed increased 5.1% to $363,598

•Gross margin as a percentage of home sales revenues decreased 50 basis points to 22.9%.

•Adjusted gross margin (non-GAAP) as a percentage of home sales revenues increased 10 basis points to 25.2%

•Net income before income taxes decreased 2.1% to $67.1 million

•Net income decreased 2.3% to $50.9 million, or $2.16 basic EPS and $2.15 diluted EPS

Full Year 2024 Highlights (comparisons to full year 2023)

•Home sales revenues decreased 6.6% to $2.2 billion

•Home closings decreased 10.4% to 6,028 homes. Including the bulk sale of 103 leased, single-family homes, home closings decreased 8.9% to 6,131 homes

•Average sales price per home closed increased 4.2% to $365,394

•Gross margin as a percentage of home sales revenues increased 120 basis points to 24.2%

•Adjusted gross margin (non-GAAP) as a percentage of home sales revenues increased 160 basis points to 26.3%

•Net income before income taxes decreased 1.1% to $258.9 million

•Net income decreased 1.6% to $196.1 million, or $8.33 basic EPS and $8.30 diluted EPS

•Active selling communities at December 31, 2024 increased 29.1% to 151

•Total owned and controlled lots at December 31, 2024 of 70,899

•Ending backlog at December 31, 2024 of 599 homes

•Ending backlog value at December 31, 2024 of $236.5 million

Please see “Non-GAAP Measures” for a reconciliation of Adjusted Gross Margin (a non-GAAP measure) to Gross Margin, the most directly comparable GAAP measure. Balance Sheet Highlights

•Net debt to capitalization of 41.2% at December 31, 2024

•Total liquidity of $323.7 million at December 31, 2024, including cash and cash equivalents of $53.2 million and $270.5 million of availability under the Company’s revolving credit facility

Full Year 2025 Outlook

Subject to the caveats in the Forward-Looking Statements section of this press release and the assumptions noted below, the Company is providing the following guidance for the full year 2025. The Company expects:

•Home closings between 6,200 and 7,000

•Active selling communities at the end of 2025 between 160 and 170

•Average sales price per home closed between $360,000 and $370,000

•Gross margin as a percentage of home sales revenues between 23.2% and 24.2%

•Adjusted gross margin (non-GAAP) as a percentage of home sales revenues between 25.5% and 26.5% with capitalized interest accounting for substantially all of the difference between gross margin and adjusted gross margin

•SG&A as a percentage of home sales revenues between 14.0% and 15.0%

•Effective tax rate of approximately 24.5%

This outlook assumes that general economic conditions, including input costs, materials, product and labor availability, interest rates and mortgage availability, in the remainder of 2025 are similar to those experienced to date in 2025 and that the average sales price per home closed, construction costs, availability of land and land development costs in the remainder of 2025 are consistent with the Company’s recent experience. In addition, this outlook assumes that governmental regulations relating to land development and home construction are similar to those currently in place and does not take into account any changes to U.S. trade policies, including the imposition of tariffs and duties on homebuilding products.

Earnings Conference Call

The Company will host a conference call via live webcast for investors and other interested parties beginning at 12:30 p.m. Eastern Time on Tuesday, February 25, 2025 (the “Earnings Call”).

Participants may access the live webcast by visiting the Investor Relations section of the Company’s website at https://investor.lgihomes.com.

An archive of the Earnings Call webcast will be available for replay on the Company’s website for one year from the date of the Earnings Call.

About LGI Homes, Inc.

Headquartered in The Woodlands, Texas, LGI Homes, Inc. is a pioneer in the homebuilding industry, successfully applying an innovative and systematic approach to the design, construction and sale of homes across 36 markets in 21 states. As one of America’s fastest growing companies, LGI Homes has closed over 75,000 homes since its founding in 2003 and has delivered profitable financial results every year. Nationally recognized for its quality construction and exceptional customer service, LGI Homes was named to Newsweek’s list of the World’s Most Trustworthy Companies. LGI Homes’ commitment to excellence extends to its more than 1,000 employees, earning the Company numerous workplace awards at the local, state, and national level, including the Top Workplaces USA 2024 Award. For more information about LGI Homes and its unique operating model focused on making the dream of homeownership a reality for families across the nation, please visit the Company’s website at www.lgihomes.com.

Forward-Looking Statements

Any statements made in this press release or on the Earnings Call that are not statements of historical fact, including statements about the Company’s beliefs and expectations, are forward-looking statements within the meaning of the federal securities laws, and should be evaluated as such. Forward-looking statements include information concerning projected 2025 home closings, active selling communities, average sales price per home closed, gross margin as a percentage of home sales revenues, adjusted gross margin as a percentage of homes sales revenues, SG&A as a percentage of home sales revenues, and effective tax rate, as well as market conditions and possible or assumed future results of operations, including descriptions of the Company's business plan and strategies. These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “predict,” “projection,” “should,” “will” or, in each case, their negative, or other variations or comparable terminology. For more information concerning factors that could cause actual results to differ materially from those contained in the forward-looking statements please refer to the “Risk Factors” section in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, including the “Cautionary Statement about Forward-Looking Statements” subsection within the “Risk Factors” section, the “Risk Factors” and “Cautionary Statement about Forward-Looking Statements” sections in the Company’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024 and September 30, 2024 and subsequent filings by the Company with the Securities and Exchange Commission (“SEC”), including the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 when it is filed with the SEC. The Company bases these forward-looking statements or projections on its current expectations, plans and assumptions that it has made in light of its experience in the industry, as well as its perceptions of historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances and at such time. As you read and consider this press release or listen to the Earnings Call, you should understand that these statements are not guarantees of future performance or results. The forward-looking statements and projections are subject to and involve risks, uncertainties and assumptions and you should not place undue reliance on these forward-looking statements or projections. Although the Company believes that these forward-looking statements and projections are based on reasonable assumptions at the time they are made, you should be aware that many factors could affect the Company’s actual results to differ materially from those expressed in the forward-looking statements and projections. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. If the Company does update one or more forward-looking statements, there should be no inference that it will make additional updates with respect to those or other forward-looking statements.

LGI HOMES, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands, except share and per share data)

| | | | | | | | | | | | | | |

| | | December 31, |

| | | 2024 | | 2023 |

| ASSETS | | | | |

| Cash and cash equivalents | | $ | 53,197 | | | $ | 48,978 | |

| Accounts receivable | | 28,717 | | | 41,319 | |

| Real estate inventory | | 3,387,853 | | | 3,107,648 | |

| Pre-acquisition costs and deposits | | 36,049 | | | 30,354 | |

| Property and equipment, net | | 57,038 | | | 45,522 | |

| Other assets | | 174,391 | | | 113,849 | |

| Deferred tax assets, net | | 9,271 | | | 8,163 | |

| Goodwill | | 12,018 | | | 12,018 | |

| Total assets | | $ | 3,758,534 | | | $ | 3,407,851 | |

| | | | |

| LIABILITIES AND EQUITY | | | | |

| Accounts payable | | $ | 33,271 | | | $ | 31,616 | |

| Accrued expenses and other liabilities | | 207,317 | | | 271,872 | |

| Notes payable | | 1,480,718 | | | 1,248,332 | |

| Total liabilities | | 1,721,306 | | | 1,551,820 | |

| | | | |

| COMMITMENTS AND CONTINGENCIES | | | | |

| EQUITY | | | | |

Common stock, par value $0.01, 250,000,000 shares authorized, 27,644,413 shares issued and 23,397,074 shares outstanding as of December 31, 2024 and 27,521,120 shares issued and 23,581,648 shares outstanding as of December 31, 2023 | | 276 | | | 275 | |

| Additional paid-in capital | | 337,161 | | | 321,062 | |

| Retained earnings | | 2,085,787 | | | 1,889,716 | |

Treasury stock, at cost, 4,247,339 shares and 3,939,472 shares, respectively | | (385,996) | | | (355,022) | |

| Total equity | | 2,037,228 | | | 1,856,031 | |

| Total liabilities and equity | | $ | 3,758,534 | | | $ | 3,407,851 | |

LGI HOMES, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Home sales revenues | | $ | 557,396 | | | $ | 608,414 | | | $ | 2,202,598 | | | $ | 2,358,580 | |

| | | | | | | | |

| Cost of sales | | 429,885 | | | 465,785 | | | 1,669,310 | | | 1,816,393 | |

| Selling expenses | | 50,754 | | | 49,771 | | | 199,950 | | | 191,582 | |

| General and administrative | | 31,170 | | | 33,016 | | | 121,192 | | | 117,350 | |

| Operating income | | 45,587 | | | 59,842 | | | 212,146 | | | 233,255 | |

| | | | | | | | |

| Other income, net | | (21,497) | | | (8,706) | | | (46,767) | | | (28,499) | |

| Net income before income taxes | | 67,084 | | | 68,548 | | | 258,913 | | | 261,754 | |

| Income tax provision | | 16,214 | | | 16,459 | | | 62,842 | | | 62,527 | |

| Net income | | $ | 50,870 | | | $ | 52,089 | | | $ | 196,071 | | | $ | 199,227 | |

| Earnings per share: | | | | | | | | |

| Basic | | $ | 2.16 | | | $ | 2.21 | | | $ | 8.33 | | | $ | 8.48 | |

| Diluted | | $ | 2.15 | | | $ | 2.19 | | | $ | 8.30 | | | $ | 8.42 | |

| | | | | | | | |

| Weighted average shares outstanding: | | | | | | | | |

| Basic | | 23,497,275 | | | 23,565,640 | | | 23,529,724 | | | 23,507,136 | |

| Diluted | | 23,620,777 | | | 23,737,448 | | | 23,610,457 | | | 23,648,548 | |

Non-GAAP Measures

In addition to the results reported in accordance with accounting principles generally accepted in the United States (“GAAP”), the Company has provided information in this press release relating to adjusted gross margin.

Adjusted Gross Margin

Adjusted gross margin is a non-GAAP financial measure used by management as a supplemental measure in evaluating operating performance. The Company defines adjusted gross margin as gross margin less capitalized interest and adjustments resulting from the application of purchase accounting included in the cost of sales. Management believes this information is useful because it isolates the impact that capitalized interest and purchase accounting adjustments have on gross margin. However, because adjusted gross margin information excludes capitalized interest and purchase accounting adjustments, which have real economic effects and could impact results, the utility of adjusted gross margin information as a measure of the Company’s operating performance may be limited. In addition, other companies may not calculate adjusted gross margin information in the same manner that the Company does. Accordingly, adjusted gross margin information should be considered only as a supplement to gross margin information as a measure of the Company’s performance.

The following table reconciles adjusted gross margin to gross margin, which is the GAAP financial measure that management believes to be most directly comparable (dollars in thousands, unaudited):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Home sales revenues | | $ | 557,396 | | | $ | 608,414 | | | $ | 2,202,598 | | | $ | 2,358,580 | |

| Cost of sales | | 429,885 | | | 465,785 | | | 1,669,310 | | | 1,816,393 | |

| Gross margin | | 127,511 | | | 142,629 | | | 533,288 | | | 542,187 | |

| Capitalized interest charged to cost of sales | | 11,884 | | | 8,893 | | | 42,071 | | | 33,368 | |

Purchase accounting adjustments (1) | | 900 | | | 981 | | | 4,034 | | | 6,492 | |

| Adjusted gross margin | | $ | 140,295 | | | $ | 152,503 | | | $ | 579,393 | | | $ | 582,047 | |

Gross margin % (2) | | 22.9 | % | | 23.4 | % | | 24.2 | % | | 23.0 | % |

Adjusted gross margin % (2) | | 25.2 | % | | 25.1 | % | | 26.3 | % | | 24.7 | % |

| | | | | | | | |

(1)Adjustments result from the application of purchase accounting for acquisitions and represent the amount of the fair value step-up adjustments included in cost of sales for real estate inventory sold after the acquisition dates.

(2)Calculated as a percentage of home sales revenues.

Home Sales Revenues, Home Closings, Average Sales Price Per Home Closed (ASP), Average Community Count, Average Monthly Absorption Rate, and Closing Community Count by Reportable Segment

(Revenues in thousands, unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2024 |

| Reportable Segment | | Revenues | | Home Closings | | ASP | | Average Community Count | | Average

Monthly

Absorption Rate |

| Central | | $ | 122,999 | | | 394 | | | $ | 312,180 | | | 48.0 | | | 2.7 | |

| Southeast | | 131,102 | | | 404 | | | 324,510 | | | 30.0 | | | 4.5 | |

| Northwest | | 71,154 | | | 139 | | | 511,899 | | | 16.7 | | | 2.8 | |

| West | | 120,775 | | | 292 | | | 413,613 | | | 24.7 | | | 3.9 | |

| Florida | | 111,366 | | | 304 | | | 366,336 | | | 24.3 | | | 4.2 | |

| Total | | $ | 557,396 | | | 1,533 | | | $ | 363,598 | | | 143.7 | | | 3.6 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2023 |

| Reportable Segment | | Revenues | | Home Closings | | ASP | | Average Community Count | | Average

Monthly

Absorption Rate |

| Central | | $ | 166,108 | | | 517 | | | $ | 321,292 | | | 36.7 | | | 4.7 | |

| Southeast | | 159,190 | | | 500 | | | 318,380 | | | 27.0 | | | 6.2 | |

| Northwest | | 38,286 | | | 78 | | | 490,846 | | | 10.3 | | | 2.5 | |

| West | | 124,527 | | | 320 | | | 389,147 | | | 16.0 | | | 6.7 | |

| Florida | | 120,303 | | | 343 | | | 350,738 | | | 22.3 | | | 5.1 | |

| Total | | $ | 608,414 | | | 1,758 | | | $ | 346,083 | | | 112.3 | | | 5.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2024 | | As of December 31, 2024 |

| Reportable Segment | | Revenues | | Home Closings | | ASP | | Average Community Count | | Average

Monthly

Absorption Rate | | Community Count at End of Period |

| Central | | $ | 564,608 | | | 1,757 | | | $ | 321,348 | | | 44.8 | | | 3.3 | | | 50 |

| Southeast | | 538,170 | | | 1,635 | | | 329,156 | | | 27.2 | | | 5.0 | | | 31 |

| Northwest | | 258,407 | | | 483 | | | 535,004 | | | 14.3 | | | 2.8 | | | 18 |

| West | | 472,655 | | | 1,140 | | | 414,610 | | | 21.7 | | | 4.4 | | | 26 |

| Florida | | 368,758 | | | 1,013 | | | 364,026 | | | 22.5 | | | 3.8 | | | 26 |

| Total | | $ | 2,202,598 | | | 6,028 | | | $ | 365,394 | | | 130.5 | | | 3.8 | | | 151 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2023 | | As of December 31, 2023 |

| Reportable Segment | | Revenues | | Home Closings | | ASP | | Average Community Count | | Average Monthly

Absorption Rate | | Community Count at End of Period |

| Central | | $ | 730,688 | | | 2,241 | | | $ | 326,054 | | | 35.7 | | | 5.2 | | | 40 |

| Southeast | | 556,808 | | | 1,716 | | | 324,480 | | | 24.8 | | | 5.8 | | | 28 |

| Northwest | | 251,171 | | | 511 | | | 491,528 | | | 10.2 | | | 4.2 | | | 11 |

| West | | 381,102 | | | 992 | | | 384,175 | | | 14.0 | | | 5.9 | | | 16 |

| Florida | | 438,811 | | | 1,269 | | | 345,793 | | | 19.2 | | | 5.5 | | | 22 |

| Total | | $ | 2,358,580 | | | 6,729 | | | $ | 350,510 | | | 103.9 | | | 5.4 | | | 117 |

Owned and Controlled Lots

The table below shows (i) home closings by reportable segment for the year ended December 31, 2024 and (ii) the Company’s owned or controlled lots by reportable segment as of December 31, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, 2024 | | As of December 31, 2024 |

| Reportable Segment | | Home Closings | | Owned (1) | | Controlled | | Total |

| Central | | 1,757 | | | 20,099 | | | 3,542 | | | 23,641 | |

| Southeast | | 1,635 | | | 13,870 | | | 4,434 | | | 18,304 | |

| Northwest | | 483 | | | 5,161 | | | 3,000 | | | 8,161 | |

| West | | 1,140 | | | 8,829 | | | 4,119 | | | 12,948 | |

| Florida | | 1,013 | | | 5,358 | | | 2,487 | | | 7,845 | |

| Total | | 6,028 | | | 53,317 | | | 17,582 | | | 70,899 | |

(1)Of the 53,317 owned lots as of December 31, 2024, 37,432 were raw/under development lots and 15,885 were finished lots.

Backlog Data

As of the dates set forth below, the Company’s net orders, cancellation rate, and ending backlog homes and value were as follows (dollars in thousands, unaudited):

| | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

2024 (4) | | 2023 (5) | | 2022 (6) |

Net orders (1) | | 6,037 | | | 6,617 | | | 5,268 | |

Cancellation rate (2) | | 22.8 | % | | 25.4 | % | | 24.4 | % |

Ending backlog - homes (3) | | 599 | | | 590 | | | 702 | |

Ending backlog - value (3) | | $ | 236,511 | | | $ | 224,851 | | | $ | 252,002 | |

(1)Net orders are new (gross) orders for the purchase of homes during the period, less cancellations of existing purchase contracts during the period.

(2)Cancellation rate for a period is the total number of purchase contracts cancelled during the period divided by the total new (gross) orders for the purchase of homes during the period.

(3)Ending backlog consists of retail homes at the end of the period that are under a purchase contract that has been signed by homebuyers who have met preliminary financing criteria but have not yet closed and wholesale contracts with varying terms. Ending backlog is valued at the contract amount.

(4)As of December 31, 2024, the Company had 146 units related to bulk sales agreements associated with its wholesale business.

(5)As of December 31, 2023, the Company had 60 units related to bulk sales agreements associated with its wholesale business.

(6)As of December 31, 2022, the Company had 157 units related to bulk sales agreements associated with its wholesale business.

CONTACT: Joshua D. Fattor

Executive Vice President, Investor Relations and Capital Markets

(281) 210-2586

investorrelations@lgihomes.com

v3.25.0.1

Cover Page Cover Page

|

Feb. 25, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 25, 2025

|

| Entity Registrant Name |

LGI HOMES, INC.

|

| Entity Central Index Key |

0001580670

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36126

|

| Entity Tax Identification Number |

46-3088013

|

| Entity Address, Address Line One |

1450 Lake Robbins Drive,

|

| Entity Address, Address Line Two |

Suite 430,

|

| Entity Address, City or Town |

The Woodlands,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77380

|

| City Area Code |

281

|

| Local Phone Number |

362-8998

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

LGIH

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

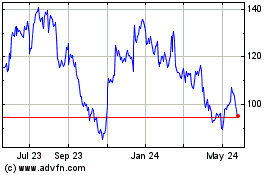

LGI Homes (NASDAQ:LGIH)

Historical Stock Chart

From Feb 2025 to Mar 2025

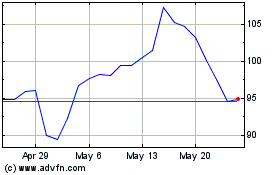

LGI Homes (NASDAQ:LGIH)

Historical Stock Chart

From Mar 2024 to Mar 2025