Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

November 17 2023 - 6:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number 001-40529

Missfresh Limited

(Registrant’s name)

3rd Floor, Block A,

Vanke Times Center

No. 9 Wangjing

Street

Chaoyang District,

Beijing 100016

The People’s

Republic of China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F. Form 20-F x Form 40-F

¨

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Missfresh Limited |

| |

|

| |

By: |

/s/ Zheng Xu |

| |

Name: |

Zheng Xu |

| |

Title: |

Chairman of the Board of Directors and Chief Executive Officer |

| |

|

| Date: November 17, 2023 |

|

Exhibit Index

Exhibit 99.1—Press Release—Missfresh Receives Delisting Notice from Nasdaq

Exhibit 99.1

Missfresh Receives Delisting Notice from Nasdaq

BEIJING, November 17, 2023—Missfresh Limited (“Missfresh”

or the “Company”) today announced that the equity financings and the business acquisition under the share purchase agreements,

as previously announced on August 3, 2023, and the transactions under the share transfer agreement, as previously announced on August

7, 2023, have been terminated. On November 15, 2023, the Nasdaq Hearings

Panel (the “Panel”) notified the Company that the Panel has determined to delist the Company’s securities from The

Nasdaq Stock Market LLC (“Nasdaq”) and suspend trading in those securities effective at the open of trading on Friday,

November 17, 2023 (the “Decision”). Nasdaq will complete the delisting

by filing a Form 25 Notification of Delisting with the SEC, after applicable appeal periods have lapsed.

The Company expects its American

Depositary Shares to be eligible trade on the OTC Markets effective with the open of trading on Friday, November 17, 2023. This delisting

and transition to the OTC Markets will not change the Company’s obligation to file annual reports and certain other reports with

the SEC under the applicable federal securities laws. The Company cautions the reader to read this press release in its entirety and refer

to the Company’s press releases and reports filed with the SEC, including the risks and uncertainties discussed therein, before

making any investment decision.

Safe Harbor Statement

This announcement contains statements that may constitute “forward-looking”

statements which are made pursuant to the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“aims,” “future,” “intends,” “plans,” “believes,” “estimates,”

“likely to,” and similar statements. Statements that are not historical facts, including statements about the Company’s

beliefs, plans, and expectations, are forward-looking statements. The Company has based these forward-looking statements largely on its

current expectations and projections about future events and financial trends, which involve known or unknown risks, uncertainties and

other factors, all of which are difficult to predict and many of which are beyond the Company’s control. Forward-looking statements

involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in

any forward-looking statement, including but not limited to the following: adverse changes in general economic or market conditions; potential

changes in laws, regulations and governmental policies or changes in the interpretation and implementation of laws, regulations and governmental

policies that could adversely affect the industries in which Missfresh or its business partners operate, including, among others, initiatives

to enhance supervision of companies listed on an overseas exchange and tighten scrutiny over data privacy and data security; natural disasters

and geopolitical events; and intensity of competition. Further information regarding these and other risks is included in the Company’s

filings with the SEC. All information provided in this press release is as of the date of this press release, and the Company does not

undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

In China:

Missfresh Limited

Investor Relations

Tel: +86 (10) 5954-4422

E-mail: ir@missfresh.cn

The Piacente Group, Inc.

Jenny Cai

Tel: +86 (10) 6508-0677

E-mail: missfresh@tpg-ir.com

In the United States:

The Piacente Group, Inc.

Brandi Piacente

Tel: +1-212-481-2050

E-mail: missfresh@tpg-ir.com

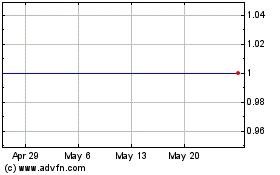

Missfresh (NASDAQ:MF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Missfresh (NASDAQ:MF)

Historical Stock Chart

From Nov 2023 to Nov 2024