Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

November 04 2024 - 3:30PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 2)*

Mawson

Infrastructure Group Inc.

(Name

of Issuer)

Common

Stock, par value $0.001 per share

(Title

of Class of Securities)

57778N307

(CUSIP

Number)

Rahul

Mewawalla

C/O

Mawson Infrastructure Group Inc.

950

Railroad Avenue

Midland,

Pennsylvania 15059

(412)

515-0896

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

November

2, 2024

(Date

of Event Which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

| * | The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior

cover page. |

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

CUSIP

NO. 57778N307

| 1 |

NAMES

OF REPORTING PERSONS

Rahul

Mewawalla |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☐ (b) ☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States of America |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

3,308,892(1) |

| 8 |

SHARED

VOTING POWER

|

| 9 |

SOLE

DISPOSITIVE POWER

3,308,892(1) |

| 10 |

SHARED

DISPOSITIVE POWER

|

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,308,892(1) |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

16.6%(2) |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| (1) | The

Reporting Person’s shares consist of (i) 1,908,892 shares held directly by the Reporting Person, and (ii) 1,400,000 shares that

may be acquired by the Reporting Person through exercise of stock options that vest on January 1, 2025. |

| (2) | All

ownership percentages in this schedule are calculated based on 18,553,603 shares of Common Stock, par value $0.001 per share, of Mawson

Infrastructure Group Inc. outstanding as set forth in its quarterly report on Form 10-Q filed with the Securities and Exchange Commission

on August 19, 2024. |

This Amendment No. 2 amends the Schedule 13D first filed with the Securities

and Exchange Commission on July 3, 2024, as amended by Amendment No. 1 on November 4, 2024 (collectively, the “Schedule 13D”),

and is filed by Rahul Mewawalla with respect to the Common Stock, par value $0.001 per share (“Common Stock”), of Mawson Infrastructure

Group Inc. (the “Issuer”) in order to amend a mathematical calculation in Amendment No. 1.

Except

as amended herein, the Schedule 13D is unchanged and remains in effect.

| Item 3. | Source

and Amount of Funds or Other Consideration. |

Item

3 of the Schedule 13D is amended by adding the following paragraph to the end of such item:

On November 21, 2023, the Reporting Person was granted stock options

to purchase 1,750,000 shares of Common Stock vesting in different tranches based on the average market price of a share of Common Stock

exceeding a specified target for at least thirty days, provided however, that if such condition was satisfied prior to January 1, 2025,

the options that would vest as a result of such condition being satisfied would not vest until January 1, 2025. The conditions to vesting

for 1,400,000 of the shares of Common Stock underlying the stock options have been satisfied and stock options to purchase 1,400,000 shares

of Common Stock will vest on January 1, 2025.

| Item 5. | Interest

in Securities of the Issuer. |

Item

5 of the Schedule 13D is amended and restated as follows:

| (a) | The

Reporting Person beneficially owns an aggregate of 3,308,892

shares of Common Stock, which represents 16.6% of the outstanding shares of Common

Stock based upon the 18,553,603 shares of Common Stock of the Issuer outstanding

as set forth in its quarterly report on Form 10-Q filed with the Securities and Exchange Commission on August 19, 2024 (the “Form

10-Q”). |

| (b) | The

Reporting Person has the sole power to vote and to dispose of or direct the disposition of all shares of Common Stock beneficially owned

by the Reporting Person. |

| (c) | On

July 1, 2024, the Reporting Person was issued and vested 1,801,153 restricted stock units, and the Reporting Person received 1,035,120

shares of Common Stock on that date after settlement of the restricted stock units and 766,033 shares of Common Stock were withheld for

taxes. |

On

November 21, 2023, the Reporting Person was granted stock options to purchase 1,750,000 shares of Common Stock vesting in different tranches

based on the average market price of a share of Common Stock exceeding a specified target for at least thirty days, provided however,

that if such condition was satisfied prior to January 1, 2025, the options that would vest as a result of such condition being satisfied

would not vest until January 1, 2025. The conditions to vesting for 1,400,000 of the shares of Common Stock underlying the stock options

have been satisfied and stock options to purchase 1,400,000 shares of Common Stock will vest on January 1, 2025.

On

September 5, 2024, the Reporting Person was granted 2,500,000 Restricted Stock Units (“RSUs”), of which 833,333 will vest

and settle on May 22, 2025, 833,333 will vest and settle on September 23, 2025, and 833,334 will vest and settle on March 31, 2026.

SIGNATURE

After

reasonable inquiry and to the best of the undersigned’s knowledge and belief, the undersigned hereby certifies that the information

set forth in this statement is true, complete and correct.

| Dated:

November 4, 2024 |

/s/

Rahul Mewawalla |

| |

Rahul

Mewawalla |

4

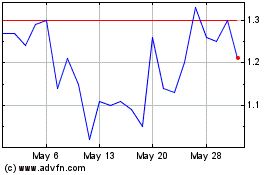

Mawson Infrastructure (NASDAQ:MIGI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mawson Infrastructure (NASDAQ:MIGI)

Historical Stock Chart

From Nov 2023 to Nov 2024