Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

October 11 2023 - 4:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 21)*

Minim, Inc.

(Name of Issuer)

Common Stock, $0.01 par value

(Title

of Class of Securities)

60365W102

(CUSIP Number)

Megan Ward

Orbit Group LLC

848 Elm Street, 2nd Floor

Manchester, NH 03101

(603) 943-0020

(Name, Address and

Telephone Number of Person Authorized to Receive Notices and Communications)

September 29, 2023

(Date of Event which

Requires Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§

240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are

to be sent.

| * | The remainder of this cover page shall be filled out for a reporting person’s initial filing

on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would

alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

SCHEDULE 13D

CUSIP No. 60365W102

| 1 |

NAMES OF REPORTING PERSONS

Jeremy

P. Hitchcock |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒

(b) ☐ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United

States |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

|

| 8 |

SHARED VOTING POWER

713,5241 |

|

| 9 |

SOLE DISPOSITIVE POWER

0 |

|

| 10 |

SHARED DISPOSITIVE POWER

713,5241 |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

713,5241 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

38.4% |

|

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN |

|

| 1 | Includes 7,500 shares of the common stock (“Common Stock”)

of Minim, Inc. (the “Issuer”) that Jeremy P. Hitchcock has the right to acquire upon exercise of outstanding stock options

and/or restricted stock units that are currently exercisable or will become exercisable within 60 days. Such stock options and/or restricted

stock units, as applicable, were granted to Jeremy P. Hitchcock in connection with his service as a member of the Board of Directors

(the “Board”) of the Issuer. The shares reported in this Amendment have been split adjusted to reflect the reverse stock

split of the Issuer’s shares of common stock at a ratio of 1-for-25, which became effective on April 17,2023. The percentage represented

in Row 13 is based off of the Issuer’s shares outstanding as of March 29, 2023 included in the Issuer’s most recent periodic

report, which is its Form 10-K filed on March 31, 2023. |

SCHEDULE 13D

CUSIP No. 60365W102

| 1 |

NAMES OF REPORTING PERSONS

Elizabeth

Cash Hitchcock |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒

(b) ☐ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

|

| 8 |

SHARED VOTING POWER

713,5242 |

|

| 9 |

SOLE DISPOSITIVE POWER

0 |

|

| 10 |

SHARED DISPOSITIVE POWER

713,5242 |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

713,5242 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

38.4% |

|

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN |

|

| 2 | Includes 7,500 shares of Common Stock of Issuer that Jeremy

P. Hitchcock has the right to acquire upon exercise of outstanding stock options and/or restricted stock units that are currently exercisable

or will become exercisable within 60 days. Such stock options and/or restricted stock units, as applicable, were granted to Jeremy P.

Hitchcock in connection with his service as a member of the Board of the Issuer. The shares reported in this Amendment have been split

adjusted to reflect the reverse stock split of the Issuer’s shares of common stock at a ratio of 1-for-25, which became effective

on April 17,2023. The percentage represented in Row 13 is based off of the Issuer’s shares outstanding as of March 29, 2023 included

in the Issuer’s most recent periodic report, which is its Form 10-K filed on March 31, 2023. |

SCHEDULE 13D

CUSIP No. 60365W102

| 1 |

NAMES OF REPORTING PERSONS

Orbit

Group LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒

(b) ☐ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

WC |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

New

Hampshire |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

|

| 8 |

SHARED VOTING POWER

627,8473 |

|

| 9 |

SOLE DISPOSITIVE POWER

0 |

|

| 10 |

SHARED DISPOSITIVE POWER

627,8473 |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

627,8473 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

33.7% |

|

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO |

|

| 3 | The Reporting Person disclaims beneficial ownership of such

shares, except to the extent of its pecuniary interest in such shares, if any, and this Schedule 13D shall not be deemed an admission

that the Reporting Person is the beneficial owner of such securities any purpose. The shares reported in this Amendment have been split

adjusted to reflect the reverse stock split of the Issuer’s shares of common stock at a ratio of 1-for-25, which became effective

on April 17,2023. The percentage represented in Row 13 is based off of the Issuer’s shares outstanding as of March 29, 2023 included

in the Issuer’s most recent periodic report, which is its Form 10-K filed on March 31, 2023. |

SCHEDULE 13D

CUSIP No. 60365W102

| 1 |

NAMES OF REPORTING PERSONS

Hitchcock

Capital Partners, LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒

(b) ☐ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

WC |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

New

Hampshire |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

|

| 8 |

SHARED VOTING POWER

627,8474 |

|

| 9 |

SOLE DISPOSITIVE POWER

0 |

|

| 10 |

SHARED DISPOSITIVE POWER

627,8474 |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

627,8474 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

33.7% |

|

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

PN |

|

| 4 | Represents 3,316,932 shares owned by Hitchcock Capital Partners,

LLC and 12,379,252 shares owned by Zulu Holdings LLC. The Reporting Person disclaims beneficial ownership of the shares held by Zulu

Holdings LLC, except to the extent of its pecuniary interest in such shares, if any, and this Schedule 13D shall not be deemed an admission

that the Reporting Person is the beneficial owner of such securities any purpose. The shares reported in this Amendment have been split

adjusted to reflect the reverse stock split of the Issuer’s shares of common stock at a ratio of 1-for-25, which became effective

on April 17,2023. The percentage represented in Row 13 is based off of the Issuer’s shares outstanding as of March 29, 2023 included

in the Issuer’s most recent periodic report, which is its Form 10-K filed on March 31, 2023. |

SCHEDULE 13D

CUSIP No. 60365W102

| 1 |

NAMES OF REPORTING PERSONS

Zulu

Holdings LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒

(b) ☐ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

WC |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

New

Hampshire |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

|

| 8 |

SHARED VOTING POWER

627,8474 |

|

| 9 |

SOLE DISPOSITIVE POWER

0 |

|

| 10 |

SHARED DISPOSITIVE POWER

627,8474 |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

627,8474 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

33.7% |

|

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO |

|

| 4 | Represents 3,316,932 shares owned by Hitchcock Capital Partners,

LLC and 12,379,252 shares owned by Zulu Holdings LLC. The Reporting Person disclaims beneficial ownership of the shares held by Hitchcock

Capital Partners, LLC, except to the extent of its pecuniary interest in such shares, if any, and this Schedule 13D shall not be deemed

an admission that the Reporting Person is the beneficial owner of such securities any purpose. The shares reported in this Amendment

have been split adjusted to reflect the reverse stock split of the Issuer’s shares of common stock at a ratio of 1-for-25, which

became effective on April 17,2023. The percentage represented in Row 13 is based off of the Issuer’s shares outstanding as of March

29, 2023 included in the Issuer’s most recent periodic report, which is its Form 10-K filed on March 31, 2023. |

Amendment No. 21 to Schedule 13D

This Amendment is being filed by Jeremy P. Hitchcock,

Elizabeth Cash Hitchcock, Orbit Group LLC (“Orbit”), Hitchcock Capital Partners, LLC (“HCP”), Zulu Holdings LLC

(“Zulu”), and a stockholders group pursuant to Section 13(d)(3) of the Securities Exchange Act of 1934. The stockholders group

(the “Group”) is comprised of Jeremy P. Hitchcock, Elizabeth Cash Hitchcock, Orbit, HCP and Zulu.

This Amendment further amends the Schedule 13D

filed on May 3, 2019, and Amendments 1 through 20 that have been filed with respect thereto (collectively, the “Schedule 13D”).

Capitalized terms used herein but not otherwise

defined herein shall have the respective meanings ascribed thereto in the Schedule 13D as amended hereby.

| Item 4. | Purpose of Transaction |

Item 4 of the Schedule 13D is amended and supplemented

by the addition of the following at the end of Item 4:

On September 29, 2023, Elizabeth C. Hitchcock

resigned as a director of the Issuer. Mrs. Hitchcock had previously served on the Cybersecurity and Privacy Committee of the Board and

by resigning as director, Mrs. Hitchcock also resigned from such Committee, as reported in Item 5.02 of the Issuer’s Current Report

on Form 8-K filed with the SEC on September 22, 2023, which is incorporated herein by reference.

On September 29, 2023, the Issuer entered into

a non-binding letter of intent (the “Letter”) with a third party to purchase from the Issuer $2.4 million of convertible preferred

stock and warrants, which, on a fully-diluted basis, would constitute a majority of the Issuer’s outstanding common stock and the

proceeds of which would be used for the settlement of liabilities of the Company and its subsidiaries. The Letter provides that, upon

closing of the transaction contemplated by the Letter, the third party and its nominees would be appointed to the Issuer’s Board

of Directors and constitute at least a majority of it, and the third party would be engaged as CEO of the Issuer. The Letter may result

in one or more of the transactions, events or actions specified in clauses (a) through (j) of Item 4 of Schedule 13D, including,

without limitation, the disposition of securities of the Issuer, an extraordinary corporate transaction (such as a merger) involving the

Issuer, delisting of the Common Stock from the Nasdaq and other material changes in the Issuer’s business or corporate structure.

No assurance can be given that a definitive agreement will be reached or that the transaction contemplated by the Letter will be consummated.

Each of the Issuer and the third party reserves the right to modify or withdraw the Agreement at any time.

| Item 6. | Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

The information set forth in Item 4 is incorporated

herein by reference.

| Item 7. | Material to be Filed as Exhibits |

Signature

After reasonable inquiry and to the best of the

undersigned’s knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true,

complete and correct.

| Dated: October 11, 2023 |

/s/ Jeremy P. Hitchcock |

|

Jeremy P. Hitchcock |

| |

|

|

/s/ Elizabeth Cash Hitchcock |

|

Elizabeth Cash Hitchcock |

| |

Orbit Group LLC |

| |

|

|

| |

By: |

/s/ Jeremy P. Hitchcock |

| |

Name: |

Jeremy P. Hitchcock |

| |

Title: |

Manager |

| |

Hitchcock Capital Partners, LLC |

| |

|

| |

By: |

Orbit Group LLC, its Manager |

| |

|

|

| |

|

By: |

/s/ Jeremy P. Hitchcock |

| |

|

Name: |

Jeremy P. Hitchcock |

| |

|

Title: |

Manager |

| |

Zulu Holdings LLC |

| |

|

| |

By: |

Orbit Group LLC, its Manager |

| |

|

|

|

| |

|

By: |

/s/ Jeremy P. Hitchcock |

| |

|

Name: |

Jeremy P. Hitchcock |

| |

|

Title: |

Manager |

8

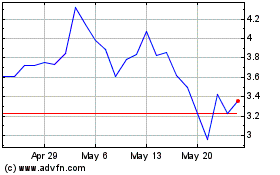

Minim (NASDAQ:MINM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Minim (NASDAQ:MINM)

Historical Stock Chart

From Jan 2024 to Jan 2025