0001289419false00012894192025-01-312025-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 31, 2025

MORNINGSTAR, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Illinois (State or other jurisdiction of incorporation) | 000-51280 (Commission File Number)

| 36-3297908 (I.R.S. Employer Identification No.) |

| | 22 West Washington Street Chicago, Illinois (Address of principal executive offices) |

60602 (Zip Code) |

| | (312) 696-6000 (Registrant’s telephone number, including area code) | |

|

N/A | | |

(Former name or former address, if changed since last report) __________________________________

| |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common stock, no par value | MORN | The Nasdaq Stock Market LLC |

Item 7.01. Regulation FD Disclosure

In accordance with Morningstar, Inc.’s (the “Company”) policy regarding public disclosure of corporate information, Investor questions primarily received by the Company through December 31, 2024, and Company responses (the “Investor Q&A”) are attached to this Current Report on Form 8-K (this “Report”) as Exhibit 99.1 and incorporated herein by reference. The Investor Q&A shall be deemed furnished, not filed, for purposes of this Report.

Caution Concerning Forward-Looking Statements

This Report, including the document incorporated by reference herein, contains forward-looking statements as that term is used in the Private Securities Litigation Reform Act of 1995. These statements are based on our current expectations about future events or future financial performance. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and often contain words such as "consider,” “estimate,” “forecast,” “future,” “goal,” “designed to,” “maintain,” “may,” “objective,” “ongoing,” “could,” “expect,” “intend,” “plan,” “possible,” “potential,” “anticipate,” “believe,” “predict,” “continue,” “strategy,” “strive,” “will,” “would,” "determine," "evaluate," or the negative thereof, and similar expressions. These statements involve known and unknown risks and uncertainties that may cause the events we discuss not to occur or to differ significantly from what we expect. For us, these risks and uncertainties include, among others:

• failing to maintain and protect our brand, independence, and reputation;

• failure to prevent and/or mitigate cybersecurity events and the failure to protect confidential information, including personal information about individuals;

• compliance failures, regulatory action, or changes in laws applicable to our credit ratings operations, investment advisory, environmental, social, and governance (ESG), and index businesses;

• failing to innovate our product and service offerings or anticipate our clients’ changing needs;

• the impact of artificial intelligence (AI) and related new technologies on our business, legal, and regulatory exposure profile and reputation;

• failure to detect errors in our products or failure of our products to perform properly due to defects, malfunctions or similar problems;

• failing to recruit, develop, and retain qualified employees;

• prolonged volatility or downturns affecting the financial sector, global financial markets, and the global economy and its effect on our revenue from asset-based fees and credit ratings business;

• failing to scale our operations and increase productivity in order to implement our business plans and strategies;

• liability for any losses that result from errors in our automated advisory tools or errors in the use of the information and data we collect;

• inadequacy of our operational risk management, business continuity programs and insurance coverage in the event of a material disruptive event;

• failing to close, or achieve the anticipated economic or other benefits of, a strategic transaction on a timely basis or at all;

• failing to efficiently integrate and leverage acquisitions and other investments, which may not realize the expected business or financial benefits, to produce the results we anticipate;

• failing to maintain growth across our businesses in today's fragmented geopolitical, regulatory and cultural world;

• liability relating to the information and data we collect, store, use, create, and distribute or the reports that we publish or are produced by our software products;

• the potential adverse effect of our indebtedness on our cash flows and financial and operational flexibility;

• challenges in accounting for tax complexities in the global jurisdictions we operate in could materially affect our tax obligations and tax rates; and

• failing to protect our intellectual property rights or claims of intellectual property infringement against us.

A more complete description of these risks and uncertainties can be found in our filings with the Securities and Exchange Commission (SEC), including our most recent Reports on Form 10-K and 10-Q. If any of these risks and uncertainties materialize, our actual future results and other future events may vary significantly from what we expect. We do not undertake to update our forward-looking statements as a result of new information, future events, or otherwise, except as may be required by law. You are advised to review any further disclosures we make on related subjects, and about new or additional risks, uncertainties, and assumptions in our filings with the SEC on Forms 10-K, 10-Q, and 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | The cover page from this Current Report on Form 8-K formatted in Inline XBRL (included as Exhibit 101). |

_____________________________________________________________________________________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | MORNINGSTAR, INC. |

| Date: January 31, 2025 | | By:/s/ Michael Holt |

| | Name: Michael Holt |

| | Title: Chief Financial Officer |

Investor Questions and Answers: January 31, 2025 We encourage current shareholders, potential shareholders, and other interested parties to send questions to us in writing and we make written responses available on a periodic basis. The following answers respond to selected questions primarily received through December 31, 2024. We retain the discretion to combine answers for duplicate or similar questions into one comprehensive response. If you would like to submit a question, please send an e-mail to investors@morningstar.com or write to us at the following address: Morningstar Inc. Investor Relations 22 W. Washington Chicago, IL 60602 Management Transitions 1. Morningstar recently appointed Michael Holt to CFO of the business. Can you share some examples of Michael’s impact on Morningstar during his career, specifically achieved outcomes that make him well suited to be the CFO? Please shed some more light on the CFO selection process. Did Morningstar interview candidates from outside of the company? Given the stated objective to grow revenues faster than expenses, please explain why Morningstar selected Michael Holt to become the next CFO. We followed a rigorous selection process in choosing Michael Holt as our next CFO, which included interviewing both internal and external candidates. Michael brings expertise in a number of key areas, including company strategy and analysis, as well as deep insight into Morningstar’s operations. In his 15-plus years at Morningstar, he’s built a track record of managing high-performing teams and working across Morningstar to drive results. Michael has been Morningstar’s chief strategy officer for the past seven years and was president of the Research and Investments group for the past two years, where he oversaw a 400-person team responsible for Morningstar’s equity and managed investment analysis and ratings as well as portfolio construction for the company’s investment management capabilities. During his tenure here, Michael centralized and scaled our Research & Investment capabilities; drove our M&A strategy leading the DBRS, Sustainalytics, and LCD acquisitions; and has been instrumental in reframing our approach to the Wealth space culminating in the AssetMark transaction. Additionally, Michael was a key partner to Kunal and our former CFO, Jason Dubinsky, in allocating investment and implementing and driving a focus on growing our adjusted operating income and margin improvement. Michael has a master’s degree in business administration from the University of Chicago Booth School of Business, and a bachelor’s degree in business from Indiana University. Market Environment 2. Please share some thoughts on how the recent U.S. Federal elections are expected to impact Morningstar’s businesses. Please touch on PitchBook (given industry-wide commentary on increasing capital markets activity), Credit (given impact on interest rates), and Sustainalytics (given ESG stance of the incoming Administration). There are a number of unknowns surrounding the economic and policy impacts of the recent U.S. federal elections. We’ve shared a few thoughts on the potential impact of the issues you raise.

PitchBook PitchBook sales tend to correlate to fundraising, M&A activity, and private capital trends. Should private market deal activity accelerate, that could create more use cases for PitchBook’s offering, which could translate into increased sales opportunities. If long-term interest rates continued to increase as they have since the election, that could have a dampening effect on market activity and potentially result in fewer new opportunities. Morningstar Credit Markets are projecting another strong year of issuance in areas including U.S. structured finance, and, in particular, asset- backed securities (ABS). We also expect to see continued activity in private credit, especially in areas including asset- based lending, commercial real estate, infrastructure, and non-investment grade corporates. If we do see higher inflation and a corresponding continued increase in interest rates, that could have a negative impact on issuance on a short-term basis. Morningstar Sustainalytics While we’ve noted headwinds in the U.S. for several years, we believe a focus on assessing financially material ESG risks will continue to be an important driver across markets. We also expect that focus will drive increased maturity in the sector as investors seek to better understand what risks are material and how those align with client preferences. Finally, we’d note that we serve a global client base and remain committed to providing our clients the data and research to serve the specific needs of investors across geographies. Morningstar Indexes 3. How much of the asset value linked to Morningstar Indexes is attributable to ETFs, mutual funds, or other products? Do you have a list of all the products which are linked to Morningstar Indexes? As of September 30, 2024, assets linked to and tracking Morningstar Indexes totaled $228.2 billion, an increase of 37.5% over the prior-year period. (This does not include actively managed assets benchmarked to a Morningstar index.) Roughly 70% of assets linked to a Morningstar index are in exchange-traded funds (ETFs), a little less than 30% are in open-ended funds, and the remaining small percentage is held in collective investment trusts, separately managed accounts, and derivatives. In total, there are more than 300 products linked to Morningstar Indexes. To review the ETFs and open-end funds on this list, you can create a search in Morningstar Direct to track the various products. Select the universe "Funds (Open End and Exchange-Traded Funds)" and use the following parameters: • Primary Prospectus Benchmark Contains "Morn" • Index Fund = "Yes" • Oldest Share Class = "Yes" Note that this search will capture the vast majority of assets in investable products that track Morningstar Indexes, although there are a few products that do not report holdings to Direct. Capital Structure 4. Is the interest on your term loan based on SOFR or the lender base rate plus a margin? It appears it is at the company’s option to pick. Which SOFR is used? There is spot SOFR, 30-day Term SOFR and 90-day Term SOFR? As you note, we have the option of paying interest based either on the applicable Secured Overnight Financing Rate (SOFR) plus a margin or the lender base rate plus a margin. To date we have opted to pay interest based on 1-month SOFR plus a spread based on our consolidated leverage ratio, to preserve prepayment flexibility.

Morningstar 5. In 2022, Morningstar updated its pledging policy as stated in its insider trading policy, such that employees and board members are prohibited from pledging more than 15% of the total number of Morningstar securities held by them. Please explain the rationale for the current pledging policy and how the audit committee gets comfortable with Joe Mansueto’s current pledging activity under the policy. While Morningstar’s insider trading policy generally restricts insiders from engaging in derivative or speculative transactions involving Morningstar stock, Morningstar has elected not to completely prohibit pledging, as it allows shareholders flexibility in financial planning without reliance on selling shares, further aligning the interests of management with those of our shareholders. We believe that the policy includes sufficient protective measures, such as the 15% cap, to mitigate risks of downward price pressure on Morningstar’s stock or inadvertent violation of our insider trading policy, in either case due to any forced sale of any pledged securities. Under our policy, any permitted pledging activity must be reported to the chief legal officer, or her designees, for monitoring. The audit committee reviews any pledges that have the potential to have a material impact on Morningstar or its shareholders. As of January 27, 2025, the only executive officer or director with a pledge is Joe Mansueto. Joe’s pledge is reviewed on an annual basis with the audit committee. The audit committee considered the following factors in 2024 in concluding that Joe’s pledging arrangement did not pose significant risk to Morningstar and its shareholders: • Declining number of pledged shares. The number of shares pledged is currently 1 million shares, a decrease of two thirds from the initial pledge of 3 million shares in 2021, and Joe’s intention is to continue to reduce the pledged amount over time. We’d also note that: o This amount represents 6.5% of Joe’s current total beneficial ownership, and roughly 2.3% of Morningstar’s total shares outstanding, as of January 27, 2025; o It would take approximately seven days to unwind the pledge based on three-month average daily trading volume of 140,152 shares; and o Joe remains in compliance with Morningstar’s stock ownership policy, excluding the pledged shares from the calculation. • Flexible Pledging Arrangement. The shares are pledged pursuant to a long-standing bank credit agreement to provide liquidity and diversification, under which no amounts were drawn as of January 27, 2025, and for which it is unlikely that the pledged shares would ultimately be called due to the following factors: o The agreement includes a 30-day grace period to cure any defaults prior to the pledge being called; o The agreement permits asset substitution and restructuring in the event of any default; and o Indebtedness may be repaid without recourse to the pledged securities. • Maintains ownership and alignment. Joe pledged his shares because he did not want to reduce his ownership and weaken his alignment with the Company's shareholders. Please also refer to our prior response on this topic in August 2022. License-Based Products 6. I am assuming most of your segments are seat/user-based (PitchBook), but can you quantify your exposure to enterprise licenses by segment if possible or holistically. Our license-based revenue model varies by product, as detailed below for our largest product areas.

- For PitchBook, we offer both unlimited (enterprise) licenses and seat-based contracts. In an earlier response, we noted that as of early July 2023 PitchBook’s unlimited license contracts accounted for roughly 20% of total annual contract value related to active PitchBook accounts, while individual seat-based contracts accounted for roughly 80% and that breakdown has not changed materially as of December 31, 2024. PitchBook also has a small but growing direct data business which is not seat-based. - In the Morningstar Data and Analytics segment, our approach varies based on product. Morningstar Direct follows a seat-based license model, while Morningstar Data pricing is based on the data package being licensed, the level of distribution, and the use case. Morningstar Advisor Workstation is primarily sold through an enterprise contract, and we can license single seats for individual advisors as well. - The Morningstar Sustainalytics pricing model is built around the Morningstar Data and Analytics approach for licensing data and research with pricing differentiated based on the content being licensed and the expected use case. Our revenue model for Morningstar Wealth and Morningstar Retirement segments is primarily based on fees paid based on assets under management and advisement, although Morningstar Wealth revenue also includes licensed-based revenue for Morningstar Investor and software products including Morningstar Office, and transaction-based advertising revenue. Morningstar Credit primarily has a transaction-based revenue model.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

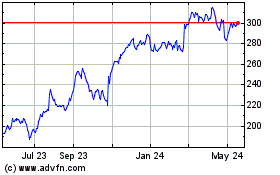

Morningstar (NASDAQ:MORN)

Historical Stock Chart

From Jan 2025 to Feb 2025

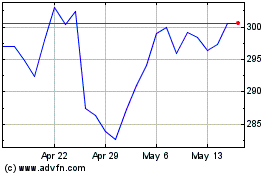

Morningstar (NASDAQ:MORN)

Historical Stock Chart

From Feb 2024 to Feb 2025