- 5.1% “BTC Yield” KPI achieved in Q3 2024

- Announces a $21 billion at-the-market (ATM) equity

offering

- Announces a target of raising $21 billion using fixed-income

securities

- Revises annual BTC Yield target to 6% to 10% for 2025 through

2027

MicroStrategy® Incorporated (Nasdaq: MSTR) (“MicroStrategy” or

the “Company”), the largest corporate holder of bitcoin and the

world’s first Bitcoin Treasury Company, today announced financial

results for the three-month period ended September 30, 2024 (the

third quarter of its 2024 fiscal year).

“Our focus remains to increase value generated to our

shareholders by leveraging the digital transformation of capital.

Today, we are announcing a strategic goal of raising $42 billion of

capital over the next 3 years, comprised of $21 billion of equity

and $21 billion of fixed income securities, which we refer to as

our “21/21 Plan.” As a Bitcoin Treasury Company, we plan to use the

additional capital to buy more bitcoin as a treasury reserve asset

in a manner that will allow us to achieve higher BTC Yield,” said

Phong Le, President and Chief Executive Officer, MicroStrategy.

“Q3 2024 was another transformational quarter for MicroStrategy,

as we raised $2.1 billion in equity and debt. Our proven track

record of using intelligent leverage serves as the foundation to

execute on our strategic three-year 21/21 Plan. Through our

treasury strategy, we increased our bitcoin holdings by 11% in the

quarter, increased our year-to-date BTC Yield to 17.8%, and reduced

our total annualized interest expense by $24 million,” said Andrew

Kang, Chief Financial Officer, MicroStrategy.

On August 7, 2024, the Company completed a 10-for-1 stock split

of the Company’s class A and class B common stock. All prior period

share and per share information presented herein has been

retroactively adjusted to reflect the stock split.

Bitcoin Treasury Highlights

- “BTC Yield” KPI: Year-to-date 2024, the Company’s BTC

Yield is 17.8%. The Company is revising its long-term target to

achieve an annual BTC Yield of 6% to 10% between 2025 and 2027. BTC

Yield is a key performance indicator (“KPI”) that the Company uses

to help assess the performance of its strategy of acquiring bitcoin

in a manner the Company believes is accretive to shareholders. See

“Important Information about BTC Yield KPI” in this press release

for the definition of BTC Yield and how it is calculated.

- Digital Assets: As of September 30, 2024, the carrying

value of the Company’s digital assets (comprised of approximately

252,220 bitcoins) was $6.851 billion. As of September 30, 2024, the

original cost basis and market value of the Company’s bitcoin were

$9.904 billion and $16.007 billion, respectively, which reflects an

average cost per bitcoin of approximately $39,266 and a market

price per bitcoin of $63,463, respectively.

- At-the-Market Equity Offering Program: During the three

months ended September 30, 2024, the Company issued and sold

8,048,449 shares of its class A common stock for aggregate net

proceeds of approximately $1.1 billion. As of September 30, 2024,

approximately $891.3 million of the Company's class A common stock

remained available for issuance and sale pursuant to our current

at-the-market equity offering program.

- New At-the-Market Equity Offering Program: On October

30, 2024, the Company announced a new At-the-Market Equity Offering

Program pursuant to which MicroStrategy may issue and sell shares

of its class A common stock having an aggregate offering price of

up to $21 billion from time to time.

- Issuance of 2028 Convertible Notes: In September 2024,

the Company issued $1.010 billion aggregate principal amount of

0.625% Convertible Senior Notes due 2028 (the “2028 Convertible

Notes”) with an initial conversion price of $183.19 per share of

class A common stock.

- Redemption of 2028 Senior Secured Notes: On September

26, 2024, the Company used proceeds from the 2028 Convertible Notes

to redeem all $500 million aggregate principal amount of the

Company’s 6.125% Senior Secured Notes due 2028 (the “2028 Secured

Notes”) at a redemption price equal to 103.063% of the principal

amount of the 2028 Secured Notes, plus accrued and unpaid interest

to but excluding September 26, 2024.

Q3 2024 Software Business Highlights

- Revenues:

- Total revenues were $116.1 million, a 10.3% decrease

year-over-year.

- Subscription Services Revenues were $27.8 million, a 32.5%

increase year-over-year.

- Product licenses and subscription services revenues were $38.9

million, a 13.6% decrease year-over-year.

- Product support revenues were $61.0 million, an 8.7% decrease

year-over-year.

- Other services revenues were $16.2 million, an 8.0% decrease

year-over-year.

- Gross Profit: Gross profit was $81.7 million,

representing a 70.4% gross margin, compared to $102.8 million,

representing a gross margin of 79.4%, for the third quarter of

2023.

Other Q3 Financial Highlights

- Operating Expenses: Operating expenses were $514.3

million, a 301.6% increase year-over-year. Operating expenses

include impairment losses on the Company’s digital assets, which

were $412.1 million, compared to $33.6 million in the third quarter

of 2023.

- Loss from Operations and Net (Loss) Income: Loss from

operations was $432.6 million, compared to $25.2 million for the

third quarter of 2023. Net loss was $340.2 million, or $1.72 per

share on a diluted basis, as compared to a net loss of $143.4

million, or $1.01 per share on a diluted basis, for the third

quarter of 2023.

- Cash and Cash Equivalents: As of September 30, 2024, the

Company had cash and cash equivalents of $46.3 million, as compared

to $46.8 million as of December 31, 2023, a decrease of $0.5

million.

The tables provided at the end of this press release include a

reconciliation of the most directly comparable financial measures

prepared in accordance with generally accepted accounting

principles in the United States (“GAAP”) to non-GAAP financial

measures for the three and nine months ended September 30, 2024 and

2023. An explanation of non-GAAP financial measures is also

included under the heading “Non-GAAP Financial Measures” below.

Additional non-GAAP financial measures are included in

MicroStrategy’s “Q3 2024 Earnings Presentation,” which will be

available under the “Events and Presentations” section of

MicroStrategy’s investor relations website at

https://www.microstrategy.com/en/investor-relations.

Conference Call

MicroStrategy will be discussing its third quarter 2024

financial results on a live Video Webinar today beginning at

approximately 5:00 p.m. ET. The live Video Webinar and accompanying

presentation materials will be available under the “Events and

Presentations” section of MicroStrategy’s investor relations

website at https://www.microstrategy.com/en/investor-relations.

Log-in instructions will be available after registering for the

event. An archived replay of the event will be available beginning

approximately two hours after the call concludes.

About MicroStrategy Incorporated

MicroStrategy (Nasdaq: MSTR) is the world's first and largest

Bitcoin Treasury Company. We are a publicly traded company that

has adopted Bitcoin as our primary treasury reserve asset. By using

proceeds from equity and debt financings, as well as cash flows

from our operations, we strategically accumulate Bitcoin and

advocate for its role as digital capital. Our treasury strategy is

designed to provide investors varying degrees of economic exposure

to Bitcoin by offering a range of securities, including equity and

fixed-income instruments.

In addition, we provide industry-leading AI-powered enterprise

analytics software, advancing our vision of Intelligence

Everywhere. We leverage our development capabilities to explore

innovation in Bitcoin applications, integrating analytics expertise

with our commitment to digital asset growth. We believe our

combination of operational excellence, strategic Bitcoin reserve,

and focus on technological innovation positions us as a leader in

both the digital asset and enterprise analytics sectors, offering a

unique opportunity for long-term value creation.

MicroStrategy, MicroStrategy AI, Intelligence Everywhere,

Intelligent Enterprise, and MicroStrategy Library are either

trademarks or registered trademarks of MicroStrategy Incorporated

in the United States and certain other countries. Other product and

company names mentioned herein may be the trademarks of their

respective owners.

Non-GAAP Financial Measures

MicroStrategy is providing supplemental financial measures for

(i) non-GAAP loss from operations that excludes the impact of

share-based compensation expense, (ii) non-GAAP net (loss) income

and non-GAAP diluted (loss) earnings per share that exclude the

impacts of share-based compensation expense, interest expense

arising from the amortization of debt issuance costs related to

MicroStrategy’s long-term debt, gains and losses on debt

extinguishment, and related income tax effects, and (iii) non-GAAP

constant currency revenues that exclude certain foreign currency

exchange rate fluctuations. These supplemental financial measures

are not measurements of financial performance under GAAP and, as a

result, these supplemental financial measures may not be comparable

to similarly titled measures of other companies. Management uses

these non-GAAP financial measures internally to help understand,

manage, and evaluate business performance and to help make

operating decisions.

MicroStrategy believes that these non-GAAP financial measures

are also useful to investors and analysts in comparing its

performance across reporting periods on a consistent basis. The

first supplemental financial measure excludes a significant

non-cash expense that MicroStrategy believes is not reflective of

its general business performance, and for which the accounting

requires management judgment and the resulting share-based

compensation expense could vary significantly in comparison to

other companies. The second set of supplemental financial measures

excludes the impacts of (i) share-based compensation expense, (ii)

non-cash interest expense arising from the amortization of debt

issuance costs related to MicroStrategy’s long-term debt, (iii)

gains and losses on debt extinguishment, and (iv) related income

tax effects. The third set of supplemental financial measures

excludes changes resulting from certain fluctuations in foreign

currency exchange rates so that results may be compared to the same

period in the prior year on a non-GAAP constant currency basis.

MicroStrategy believes the use of these non-GAAP financial measures

can also facilitate comparison of MicroStrategy’s operating results

to those of its competitors.

Important Information about BTC Yield KPI

BTC Yield is a key performance indicator (“KPI”) that represents

the % change period-to-period of the ratio between the Company’s

bitcoin holdings and its Assumed Diluted Shares Outstanding.

Assumed Diluted Shares Outstanding refers to the aggregate of the

Company’s actual shares of common stock outstanding as of the end

of each period plus all additional shares that would result from

the assumed conversion of all outstanding convertible notes,

exercise of all outstanding stock option awards, and settlement of

all outstanding restricted stock units and performance stock units.

Assumed Diluted Shares Outstanding is not calculated using the

treasury method and does not take into account any vesting

conditions (in the case of equity awards), the exercise price of

any stock option awards or any contractual conditions limiting

convertibility of convertible debt instruments.

The Company uses BTC Yield as a KPI to help assess the

performance of its strategy of acquiring bitcoin in a manner the

Company believes is accretive to shareholders. The Company believes

this KPI can be used to supplement an investor’s understanding of

its decision to fund the purchase of bitcoin by issuing additional

shares of its common stock or instruments convertible to common

stock. When the Company uses this KPI, management also takes into

account the various limitations of this metric, including that it

does not take into account debt and other liabilities and claims on

company assets that would be senior to common equity and that it

assumes that all indebtedness will be refinanced or, in the case of

the Company’s senior convertible debt instruments, converted into

shares of common stock in accordance with their respective

terms.

Additionally, this KPI is not, and should not be understood as,

an operating performance measure or a financial or liquidity

measure. In particular, BTC Yield is not equivalent to “yield” in

the traditional financial context. It is not a measure of the

return on investment the Company’s shareholders may have achieved

historically or can achieve in the future by purchasing stock of

the Company, or a measure of income generated by the Company’s

operations or its bitcoin holdings, return on investment on its

bitcoin holdings, or any other similar financial measure of the

performance of its business or assets.

The trading price of the Company’s class A common stock is

informed by numerous factors in addition to the amount of bitcoins

the Company holds and number of actual or potential shares of its

stock outstanding, and as a result, the market value of the

Company’s shares may trade at a discount or a premium relative to

the market value of the bitcoin the Company holds, and BTC Yield is

not indicative nor predictive of the trading price of the Company’s

shares of class A common stock.

As noted above, this KPI is narrow in its purpose and is used by

management to assist it in assessing whether the Company is using

equity capital in a manner accretive to shareholders solely as it

pertains to its bitcoin holdings.

In calculating this KPI, the Company does not take into account

the source of capital used for the acquisition of its bitcoin. The

Company notes in particular, it has acquired bitcoin using proceeds

from the offerings of the 2028 Secured Notes (which the Company has

since redeemed), which were not convertible to shares of the

Company’s common stock, as well as convertible senior notes, which

at the time of issuance had, and may from time-to-time thereafter

have, conversion prices above the current trading prices of the

Company’s common stock, or as to which the holders of such

convertible notes may not then be entitled to exercise the

conversion rights of the notes. Such offerings have had the effect

of increasing the BTC Yield without taking into account the

corresponding debt. Conversely, if any of the Company’s convertible

senior notes mature or are redeemed without being converted into

common stock, the Company may be required to sell shares in

quantities greater than the shares such notes are convertible into

or generate cash proceeds from the sale of bitcoin, either of which

would have the effect of decreasing the BTC Yield due to changes in

the Company’s bitcoin holdings and shares in ways that were not

contemplated by the assumptions in calculating BTC Yield.

Accordingly, this metric might overstate or understate the

accretive nature of the Company’s use of equity capital to buy

bitcoin because not all bitcoin may be acquired using proceeds of

equity offerings and not all issuances of equity may involve the

acquisition of bitcoin.

The Company determines its KPI targets based on its history and

future goals. The Company’s ability to achieve positive BTC Yield

may depend on a variety of factors, including its ability to

generate cash from operations in excess of its fixed charges and

other expenses, as well as factors outside of its control, such as

the availability of debt and equity financing on favorable terms.

Past performance is not indicative of future results.

The Company has historically not paid any dividends on its

shares of common stock, and by presenting this KPI the Company

makes no suggestion that it intends to do so in the future.

Ownership of common stock does not represent an ownership interest

in the bitcoin the Company holds.

Investors should rely on the financial statements and other

disclosures contained in the Company’s SEC filings. This KPI is

merely a supplement, not a substitute. It should be used only by

sophisticated investors who understand its limited purpose and many

limitations.

Forward-Looking Statements

This press release may include statements that may constitute

“forward-looking statements,” including estimates of future

business prospects or financial results, our targets relating to

our BTC Yield, and statements containing the words “believe,”

“estimate,” “project,” “expect,” “will,” or similar expressions.

Forward-looking statements inherently involve risks and

uncertainties that could cause actual results of MicroStrategy

Incorporated and its subsidiaries (collectively, the “Company”) to

differ materially from the forward-looking statements. Factors that

could contribute to such differences include: fluctuations in the

market price of bitcoin and any associated impairment charges that

the Company may incur as a result of a decrease in the market price

of bitcoin below the value at which the Company’s bitcoins are

carried on its balance sheet; the availability of debt and equity

financing on favorable terms; gains or losses on any sales of

bitcoins; changes in the accounting treatment relating to the

Company’s bitcoin holdings; changes in securities laws or other

laws or regulations, or the adoption of new laws or regulations,

relating to bitcoin that adversely affect the price of bitcoin or

the Company’s ability to transact in or own bitcoin; the impact of

the availability of spot exchange traded products for bitcoin and

other digital assets; a decrease in liquidity in the markets in

which bitcoin is traded; security breaches, cyberattacks,

unauthorized access, loss of private keys, fraud or other

circumstances or events that result in the loss of the Company’s

bitcoins; impacts to the price and rate of adoption of bitcoin

associated with financial difficulties and bankruptcies of various

participants in the digital asset industry; the level and terms of

the Company’s substantial indebtedness and its ability to service

such debt; the extent and timing of market acceptance of the

Company’s new product offerings; continued acceptance of the

Company’s other products in the marketplace; the Company’s ability

to recognize revenue or deferred revenue through delivery of

products or satisfactory performance of services; the timing of

significant orders; delays in or the inability of the Company to

develop or ship new products; customers continuing to shift from a

product license model to a cloud subscription model, which may

delay the Company’s ability to recognize revenue; fluctuations in

tax benefits or provisions; changes in the market price of bitcoin

as of period-end and their effect on our deferred tax assets,

related valuation allowance, and tax expense; other potentially

adverse tax consequences, including the potential taxation of

unrealized gains on our bitcoin holdings; competitive factors;

general economic conditions, including levels of inflation and

interest rates; currency fluctuations; and other risks detailed in

MicroStrategy’s registration statements and periodic reports filed

with the Securities and Exchange Commission (“SEC”). The Company

undertakes no obligation to update these forward-looking statements

for revisions or changes after the date of this release.

MICROSTRATEGY

INCORPORATED

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per

share data)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Revenues:

Product licenses

$

11,087

$

24,045

$

33,311

$

56,979

Subscription services

27,800

20,974

74,846

59,662

Total product licenses and subscription

services

38,887

45,019

108,157

116,641

Product support

61,015

66,860

185,440

198,422

Other services

16,169

17,583

49,162

56,714

Total revenues

116,071

129,462

342,759

371,777

Cost of revenues:

Product licenses

769

342

2,130

1,320

Subscription services

11,454

8,028

29,618

23,100

Total product licenses and subscription

services

12,223

8,370

31,748

24,420

Product support

8,572

5,531

25,312

17,115

Other services

13,554

12,760

38,239

40,188

Total cost of revenues

34,349

26,661

95,299

81,723

Gross profit

81,722

102,801

247,460

290,054

Operating expenses:

Sales and marketing

35,414

35,606

103,116

109,372

Research and development

33,301

29,660

92,795

90,372

General and administrative

33,505

29,223

104,300

85,959

Digital asset impairment losses

412,084

33,559

783,807

76,613

Total operating expenses

514,304

128,048

1,084,018

362,316

Loss from operations

(432,582

)

(25,247

)

(836,558

)

(72,262

)

Interest expense, net

(18,129

)

(11,006

)

(45,476

)

(37,031

)

(Loss) gain on debt extinguishment

(22,933

)

0

(22,933

)

44,686

Other (expense) income, net

(5,034

)

2,419

(2,644

)

726

Loss before income taxes

(478,678

)

(33,834

)

(907,611

)

(63,881

)

(Benefit from) provision for income

taxes

(138,504

)

109,607

(411,760

)

(403,876

)

Net (loss) income

$

(340,174

)

$

(143,441

)

$

(495,851

)

$

339,995

Basic (loss) earnings per share

(1)

$

(1.72

)

$

(1.01

)

$

(2.71

)

$

2.91

Weighted average shares outstanding used

in computing basic (loss) earnings per share

197,273

142,214

182,695

116,648

Diluted (loss) earnings per share

(1)

$

(1.72

)

$

(1.01

)

$

(2.71

)

$

2.39

Weighted average shares outstanding used

in computing diluted (loss) earnings per share

197,273

142,214

182,695

145,125

(1) Basic and fully diluted (loss)

earnings per share for class A and class B common stock are the

same.

MICROSTRATEGY

INCORPORATED

CONSOLIDATED BALANCE

SHEETS

(in thousands, except per

share data)

September 30,

December 31,

2024

2023*

(unaudited)

Assets

Current assets

Cash and cash equivalents

$

46,343

$

46,817

Restricted cash

1,862

1,856

Accounts receivable, net

107,169

183,815

Prepaid expenses and other current

assets

30,668

35,407

Total current assets

186,042

267,895

Digital assets

6,850,879

3,626,476

Property and equipment, net

27,517

28,941

Right-of-use assets

55,308

57,343

Deposits and other assets

51,109

24,300

Deferred tax assets, net

1,172,726

757,573

Total Assets

$

8,343,581

$

4,762,528

Liabilities and Stockholders’

Equity

Current liabilities

Accounts payable, accrued expenses, and

operating lease liabilities

$

45,714

$

43,090

Accrued compensation and employee

benefits

51,686

50,045

Accrued interest

5,800

1,493

Current portion of long-term debt, net

509

483

Deferred revenue and advance payments

184,402

228,162

Total current liabilities

288,111

323,273

Long-term debt, net

4,211,949

2,182,108

Deferred revenue and advance payments

6,344

8,524

Operating lease liabilities

57,495

61,086

Other long-term liabilities

5,676

22,208

Deferred tax liabilities

357

357

Total liabilities

4,569,932

2,597,556

Stockholders’ Equity

Preferred stock undesignated, $0.001 par

value; 5,000 shares authorized; no shares issued or outstanding

0

0

Class A common stock, $0.001 par value;

330,000 shares authorized; 191,684 shares issued and 183,000 shares

outstanding, and 157,725 shares issued and 149,041 shares

outstanding, respectively

192

24

Class B convertible common stock, $0.001

par value; 165,000 shares authorized; 19,640 shares issued and

outstanding, and 19,640 shares issued and outstanding,

respectively

20

2

Additional paid-in capital

6,060,206

3,957,728

Treasury stock, at cost; 8,684 shares and

8,684 shares, respectively

(782,104

)

(782,104

)

Accumulated other comprehensive loss

(9,580

)

(11,444

)

Accumulated deficit

(1,495,085

)

(999,234

)

Total Stockholders’ Equity

3,773,649

2,164,972

Total Liabilities and Stockholders’

Equity

$

8,343,581

$

4,762,528

* Derived from audited financial

statements.

MICROSTRATEGY

INCORPORATED

CONSOLIDATED CONDENSED

STATEMENTS OF CASH FLOWS

(in thousands)

Nine Months Ended

September 30,

2024

2023

(unaudited)

(unaudited)

Net cash (used in) provided by operating

activities

$

(35,708

)

$

11,528

Net cash used in investing activities

(4,010,904

)

(690,550

)

Net cash provided by financing

activities

4,046,067

676,025

Effect of foreign exchange rate changes on

cash, cash equivalents, and restricted cash

77

(997

)

Net decrease in cash, cash equivalents,

and restricted cash

(468

)

(3,994

)

Cash, cash equivalents, and restricted

cash, beginning of period

48,673

50,868

Cash, cash equivalents, and restricted

cash, end of period

$

48,205

$

46,874

MICROSTRATEGY

INCORPORATED

DIGITAL ASSETS – ADDITIONAL

INFORMATION

ROLLFORWARD OF BITCOIN

HOLDINGS

(unaudited)

Source of Capital Used to

Purchase Bitcoin

Digital Asset Original Cost

Basis (in thousands)

Digital Asset Impairment

Losses (in thousands)

Digital Asset Carrying Value

(in thousands)

Approximate Number of Bitcoins

Held *

Approximate Average Purchase

Price Per Bitcoin

Balance at December 31, 2022

$

3,993,190

$

(2,153,162

)

$

1,840,028

132,500

$

30,137

Digital asset purchases

(a)

179,275

179,275

7,500

23,903

Digital asset impairment losses

(18,911

)

(18,911

)

Balance at March 31, 2023

$

4,172,465

$

(2,172,073

)

$

2,000,392

140,000

$

29,803

Digital asset purchases

(b)

347,003

347,003

12,333

28,136

Digital asset impairment losses

(24,143

)

(24,143

)

Balance at June 30, 2023

$

4,519,468

$

(2,196,216

)

$

2,323,252

152,333

$

29,668

Digital asset purchases

(c)

161,681

161,681

5,912

27,348

Digital asset impairment losses

(33,559

)

(33,559

)

Balance at September 30, 2023

$

4,681,149

$

(2,229,775

)

$

2,451,374

158,245

$

29,582

Digital asset purchases

(d)

1,214,340

1,214,340

30,905

39,293

Digital asset impairment losses

(39,238

)

(39,238

)

Balance at December 31, 2023

$

5,895,489

$

(2,269,013

)

$

3,626,476

189,150

$

31,168

Digital asset purchases

(e)

1,639,309

1,639,309

25,128

65,238

Digital asset impairment losses

(191,633

)

(191,633

)

Balance at March 31, 2024

$

7,534,798

$

(2,460,646

)

$

5,074,152

214,278

$

35,164

Digital asset purchases

(f)

793,828

793,828

12,053

65,861

Digital asset impairment losses

(180,090

)

(180,090

)

Balance at June 30, 2024

$

8,328,626

$

(2,640,736

)

$

5,687,890

226,331

$

36,798

Digital asset purchases

(g)

1,575,073

1,575,073

25,889

60,839

Digital asset impairment losses

(412,084

)

(412,084

)

Balance at September 30, 2024

$

9,903,699

$

(3,052,820

)

$

6,850,879

252,220

$

39,266

* MicroStrategy owns and has purchased

bitcoins both directly and indirectly through its wholly-owned

subsidiary, MacroStrategy. References to MicroStrategy below refer

to MicroStrategy and its subsidiaries on a consolidated basis.

(a) In the first quarter of 2023,

MicroStrategy purchased bitcoin using $179.3 million of the net

proceeds from its sale of class A common stock under its

at-the-market equity offering program.

(b) In the second quarter of 2023,

MicroStrategy purchased bitcoin using $336.9 million of the net

proceeds from its sale of class A common stock under its

at-the-market equity offering program and Excess Cash.

(c) In the third quarter of 2023,

MicroStrategy purchased bitcoin using $147.3 million of the net

proceeds from its sale of class A common stock under its

at-the-market equity offering program and Excess Cash.

(d) In the fourth quarter of 2023,

MicroStrategy purchased bitcoin using $1.201 billion of the net

proceeds from its sale of class A common stock under its

at-the-market equity offering program and Excess Cash.

(e) In the first quarter of 2024,

MicroStrategy purchased bitcoin using $782.0 million of the net

proceeds from its issuance of the 2030 Convertible Notes, $592.3

million of the net proceeds from its issuance of the 2031

Convertible Notes, $137.3 million of the net proceeds from its sale

of class A common stock under its at-the-market equity offering

program, and Excess Cash.

(f) In the second quarter of 2024,

MicroStrategy purchased $793.8 million of bitcoin using net

proceeds from its issuance of the 2032 Convertible Notes and Excess

Cash.

(g) In the third quarter of 2024,

MicroStrategy purchased bitcoin using $1.105 billion of the net

proceeds from its sale of class A common stock under its

at-the-market offering program, $458.2 million of the net proceeds

from its issuance of the 2028 Convertible Notes, and Excess

Cash.

Excess Cash refers to cash in excess of the minimum Cash Assets

that MicroStrategy is required to hold under its Treasury Reserve

Policy, which may include cash generated by operating activities

and cash from the proceeds of financing activities. Cash Assets

refers to cash and cash equivalents and short-term investments.

MICROSTRATEGY

INCORPORATED

DIGITAL ASSETS – ADDITIONAL

INFORMATION

MARKET VALUE OF BITCOIN

HOLDINGS

(unaudited)

Approximate Number of Bitcoins

Held at End of Quarter *

Lowest Market Price Per

Bitcoin During Quarter (a)

Market Value of Bitcoin Held

at End of Quarter Using Lowest Market Price (in thousands)

(b)

Highest Market Price Per

Bitcoin During Quarter (c)

Market Value of Bitcoin Held

at End of Quarter Using Highest Market Price (in thousands)

(d)

Market Price Per Bitcoin at

End of Quarter (e)

Market Value of Bitcoin Held

at End of Quarter Using Ending Market Price (in thousands)

(f)

December 31, 2022

132,500

$

15,460.00

$

2,048,450

$

21,478.80

$

2,845,941

$

16,556.32

$

2,193,712

March 31, 2023

140,000

$

16,490.00

$

2,308,600

$

29,190.04

$

4,086,606

$

28,468.44

$

3,985,582

June 30, 2023

152,333

$

24,750.00

$

3,770,242

$

31,443.67

$

4,789,909

$

30,361.51

$

4,625,060

September 30, 2023

158,245

$

24,900.00

$

3,940,301

$

31,862.21

$

5,042,035

$

27,030.47

$

4,277,437

December 31, 2023

189,150

$

26,521.32

$

5,016,508

$

45,000.00

$

8,511,750

$

42,531.41

$

8,044,816

March 31, 2024

214,278

$

38,501.00

$

8,249,917

$

73,835.57

$

15,821,338

$

71,028.14

$

15,219,768

June 30, 2024

226,331

$

56,500.00

$

12,787,702

$

72,777.00

$

16,471,691

$

61,926.69

$

14,015,930

September 30, 2024

252,220

$

49,050.01

$

12,371,394

$

70,000.00

$

17,655,400

$

63,462.97

$

16,006,630

* MicroStrategy owns and has purchased

bitcoins both directly and indirectly through its wholly-owned

subsidiary, MacroStrategy. References to MicroStrategy below refer

to MicroStrategy and its subsidiaries on a consolidated basis.

(a) The "Lowest Market Price Per Bitcoin

During Quarter" represents the lowest market price for one bitcoin

reported on the Coinbase exchange during the respective quarter,

without regard to when MicroStrategy purchased any of its

bitcoin.

(b) The "Market Value of Bitcoin Held at

End of Quarter Using Lowest Market Price" represents a mathematical

calculation consisting of the lowest market price for one bitcoin

reported on the Coinbase exchange during the respective quarter

multiplied by the number of bitcoins held by MicroStrategy at the

end of the applicable period.

(c) The "Highest Market Price Per Bitcoin

During Quarter" represents the highest market price for one bitcoin

reported on the Coinbase exchange during the respective quarter,

without regard to when MicroStrategy purchased any of its

bitcoin.

(d) The "Market Value of Bitcoin Held at

End of Quarter Using Highest Market Price" represents a

mathematical calculation consisting of the highest market price for

one bitcoin reported on the Coinbase exchange during the respective

quarter multiplied by the number of bitcoins held by MicroStrategy

at the end of the applicable period.

(e) The "Market Price Per Bitcoin at End

of Quarter" represents the market price of one bitcoin on the

Coinbase exchange at 4:00 p.m. Eastern Time on the last day of the

respective quarter.

(f) The "Market Value of Bitcoin Held at

End of Quarter Using Ending Market Price" represents a mathematical

calculation consisting of the market price of one bitcoin on the

Coinbase exchange at 4:00 p.m. Eastern Time on the last day of the

respective quarter multiplied by the number of bitcoins held by

MicroStrategy at the end of the applicable period.

The amounts reported as “Market Value” in the above table

represent only a mathematical calculation consisting of the price

for one bitcoin reported on the Coinbase exchange (MicroStrategy’s

principal market for bitcoin) in each scenario defined above

multiplied by the number of bitcoins held by MicroStrategy at the

end of the applicable period. Bitcoin and bitcoin markets may be

subject to manipulation and the spot price of bitcoin may be

subject to fraud and manipulation. Accordingly, the Market Value

amounts reported above may not accurately represent fair market

value, and the actual fair market value of MicroStrategy’s bitcoin

may be different from such amounts and such deviation may be

material. Moreover, (i) the bitcoin market historically has been

characterized by significant volatility in price, limited liquidity

and trading volumes compared to sovereign currencies markets,

relative anonymity, a developing regulatory landscape, potential

susceptibility to market abuse and manipulation, compliance and

internal control failures at exchanges, and various other risks

that are, or may be, inherent in its entirely electronic, virtual

form and decentralized network and (ii) MicroStrategy may not be

able to sell its bitcoins at the Market Value amounts indicated

above, at the market price as reported on the Coinbase exchange

(its principal market) on the date of sale, or at all.

MICROSTRATEGY

INCORPORATED

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

LOSS FROM OPERATIONS

(in thousands)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Reconciliation of non-GAAP loss from

operations:

Loss from operations

$

(432,582

)

$

(25,247

)

$

(836,558

)

$

(72,262

)

Share-based compensation expense

19,377

16,806

57,789

49,855

Non-GAAP loss from operations

$

(413,205

)

$

(8,441

)

$

(778,769

)

$

(22,407

)

MICROSTRATEGY

INCORPORATED

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

NET (LOSS) INCOME AND DILUTED

(LOSS) EARNINGS PER SHARE

(in thousands, except per

share data)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Reconciliation of non-GAAP net (loss)

income:

Net (loss) income

$

(340,174

)

$

(143,441

)

$

(495,851

)

$

339,995

Share-based compensation expense

19,377

16,806

57,789

49,855

Interest expense arising from amortization

of debt issuance costs

3,832

2,199

10,231

6,599

Loss (gain) on debt extinguishment

22,933

0

22,933

(44,686

)

Income tax effects (1)

(13,764

)

(3,230

)

(180,964

)

2,538

Non-GAAP net (loss) income

$

(307,796

)

$

(127,666

)

$

(585,862

)

$

354,301

Reconciliation of non-GAAP diluted

(loss) earnings per share (2):

Diluted (loss) earnings per share

$

(1.72

)

$

(1.01

)

$

(2.71

)

$

2.39

Share-based compensation expense (per

diluted share)

0.10

0.12

0.32

0.34

Interest expense arising from amortization

of debt issuance costs (per diluted share) (3)

0.02

0.02

0.06

0.01

Loss (gain) on debt extinguishment (per

diluted share)

0.12

0.00

0.13

(0.31

)

Income tax effects (per diluted share)

(3)

(0.08

)

(0.03

)

(1.01

)

0.03

Non-GAAP diluted (loss) earnings per

share

$

(1.56

)

$

(0.90

)

$

(3.21

)

$

2.46

(1) Income tax effects reflect the net tax

effects of share-based compensation, which includes tax benefits

and expenses on exercises of stock options and vesting of

share-settled restricted stock units, interest expense for

amortization of debt issuance costs, and gains and losses on debt

extinguishment.

(2) For reconciliation purposes, the

non-GAAP diluted earnings (loss) per share calculations use the

same weighted average shares outstanding as that used in the GAAP

diluted earnings (loss) per share calculations for the same period.

For example, in periods of GAAP net loss, otherwise dilutive

potential shares of common stock from MicroStrategy’s share-based

compensation arrangements and convertible notes are excluded from

the GAAP diluted loss per share calculation as they would be

antidilutive, and therefore are also excluded from the non-GAAP

diluted earnings or loss per share calculation.

(3) For the nine months ended September

30, 2023, interest expense from the amortization of issuance costs

of the convertible notes has been added back to the numerator in

the GAAP diluted earnings per share calculation, and therefore the

per diluted share effects of the amortization of issuance costs of

the convertible notes have been excluded from the “Interest expense

arising from amortization of debt issuance costs (per diluted

share)” and “Income tax effects (per diluted share)” lines in the

above reconciliation for the nine months ended September 30,

2023.

MICROSTRATEGY

INCORPORATED

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES

CONSTANT CURRENCY

(in thousands)

Three Months Ended

September 30,

(unaudited)

GAAP

Foreign Currency Exchange Rate

Impact (1)

Non-GAAP Constant Currency

(2)

GAAP

GAAP % Change

Non-GAAP Constant Currency %

Change (3)

2024

2024

2024

2023

2024

2024

Revenues

Product licenses

$

11,087

$

(163

)

$

11,250

$

24,045

-53.9

%

-53.2

%

Subscription services

27,800

109

27,691

20,974

32.5

%

32.0

%

Total product licenses and subscription

services

38,887

(54

)

38,941

45,019

-13.6

%

-13.5

%

Product support

61,015

147

60,868

66,860

-8.7

%

-9.0

%

Other services

16,169

76

16,093

17,583

-8.0

%

-8.5

%

Total revenues

116,071

169

115,902

129,462

-10.3

%

-10.5

%

Nine Months Ended

September 30,

(unaudited)

GAAP

Foreign Currency Exchange Rate

Impact (1)

Non-GAAP Constant Currency

(2)

GAAP

GAAP % Change

Non-GAAP Constant Currency %

Change (3)

2024

2024

2024

2023

2024

2024

Revenues

Product licenses

$

33,311

$

(265

)

$

33,576

$

56,979

-41.5

%

-41.1

%

Subscription services

74,846

70

74,776

59,662

25.5

%

25.3

%

Total product licenses and subscription

services

108,157

(195

)

108,352

116,641

-7.3

%

-7.1

%

Product support

185,440

27

185,413

198,422

-6.5

%

-6.6

%

Other services

49,162

(12

)

49,174

56,714

-13.3

%

-13.3

%

Total revenues

342,759

(180

)

342,939

371,777

-7.8

%

-7.8

%

(1) The “Foreign Currency Exchange Rate

Impact” reflects the estimated impact of fluctuations in foreign

currency exchange rates on international revenues. It shows the

increase (decrease) in international revenues from the same period

in the prior year, based on comparisons to the prior year quarterly

average foreign currency exchange rates. “International revenues”

refers to revenues from operations outside of the United States and

Canada only where the functional currency is the local currency

(i.e., excluding any location whose economy is considered highly

inflationary).

(2) The “Non-GAAP Constant Currency”

reflects the current period GAAP amount, less the Foreign Currency

Exchange Rate Impact.

(3) The “Non-GAAP Constant Currency %

Change” reflects the percentage change between the current period

Non-GAAP Constant Currency amount and the GAAP amount for the same

period in the prior year.

MICROSTRATEGY

INCORPORATED

DEFERRED REVENUE

DETAIL

(in thousands)

September 30,

December 31,

September 30,

2024

2023*

2023

(unaudited)

(unaudited)

Current:

Deferred product licenses revenue

$

409

$

3,579

$

2,814

Deferred subscription services revenue

74,164

65,512

45,737

Deferred product support revenue

106,866

152,012

126,087

Deferred other services revenue

2,963

7,059

4,529

Total current deferred revenue and advance

payments

$

184,402

$

228,162

$

179,167

Non-current:

Deferred product licenses revenue

$

0

$

0

$

9

Deferred subscription services revenue

3,373

3,097

2,845

Deferred product support revenue

2,635

4,984

4,304

Deferred other services revenue

336

443

480

Total non-current deferred revenue and

advance payments

$

6,344

$

8,524

$

7,638

Total current and non-current:

Deferred product licenses revenue

$

409

$

3,579

$

2,823

Deferred subscription services revenue

77,537

68,609

48,582

Deferred product support revenue

109,501

156,996

130,391

Deferred other services revenue

3,299

7,502

5,009

Total current and non-current deferred

revenue and advance payments

$

190,746

$

236,686

$

186,805

* Derived from audited financial

statements.

MICROSTRATEGY

INCORPORATED

SEGMENT INFORMATION

(in thousands,

unaudited)

Three Months Ended September

30, 2024

Three Months Ended September

30, 2023

Software Business

Corporate & Other

Total Consolidated

Software Business

Corporate & Other

Total Consolidated

Total revenues

$

116,071

$

116,071

$

129,462

$

129,462

Total cost of revenues

34,349

34,349

26,661

26,661

Gross profit

$

81,722

$

81,722

$

102,801

$

102,801

Total operating expenses

100,182

414,122

514,304

93,725

34,323

128,048

(Loss) income from operations

$

(18,460

)

$

(414,122

)

$

(432,582

)

$

9,076

$

(34,323

)

$

(25,247

)

Nine Months Ended September

30, 2024

Nine Months Ended September

30, 2023

Software Business

Corporate & Other

Total Consolidated

Software Business

Corporate & Other

Total Consolidated

Total revenues

$

342,759

$

342,759

$

371,777

$

371,777

Total cost of revenues

95,299

95,299

81,723

81,723

Gross profit

$

247,460

$

247,460

$

290,054

$

290,054

Total operating expenses

295,541

788,477

1,084,018

283,733

78,583

362,316

(Loss) income from operations

$

(48,081

)

$

(788,477

)

$

(836,558

)

$

6,321

$

(78,583

)

$

(72,262

)

MicroStrategy manages its business in one reportable operating

segment which is engaged in the design, development, marketing, and

sales of its software platform through licensing arrangements and

cloud subscriptions and related services. Beginning in 2024,

MicroStrategy has broken out a Corporate & Other category,

which is not considered an operating segment, and includes the

impairment charges and other third-party costs associated with its

digital asset holdings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030040519/en/

MicroStrategy Incorporated Shirish Jajodia Investor Relations

ir@microstrategy.com

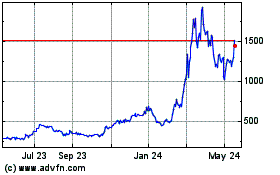

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Dec 2024 to Jan 2025

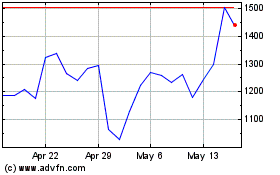

MicroStrategy (NASDAQ:MSTR)

Historical Stock Chart

From Jan 2024 to Jan 2025