SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

Under the Securities Exchange Act of 1934

For the month of February 2025

Commission File Number: 001-37829

NISUN INTERNATIONAL ENTERPRISE DEVELOPMENT GROUP

CO., LTD

(Registrant’s name)

21F, 55 Loushanguan Rd

Changning District Shanghai 200336

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.:

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Nisun International Enterprise Development Group Co., Ltd |

| |

|

|

| Date: February 18, 2025 |

By: |

/s/ Xin Liu |

| |

Name: |

Xin Liu |

| |

Title: |

Chief Executive Officer

(Principal Executive Officer) and

Duly Authorized Officer |

2

Exhibit 99.1

Nisun International (NISN) Unveils Ambitious 2025 Business Forecast,

Highlighting Significant Growth Opportunities Across Core Businesses

The Company Expects Revenue

Between $420 Million and $510 Million Generating a Net Profit Between $16 Million and $20 Million in 2025, Driven by Strategic Initiatives

in Supply Chain Financing Solution Services, Small and Medium Enterprise financing solutions, and KFC Franchise Expansion

SHANGHAI, China, February 10, 2025 /PRNewswire/ -- Nisun International

Enterprise Development Group Co., Ltd (“Nisun International” or the “Company”) (Nasdaq: NISN), a technology and

industry driven integrated supply chain solutions provider, today provided a comprehensive business forecast for 2025, outlining its strategic

initiatives and growth expectations across its core businesses. The Company expects to achieve significant growth in 2025, driven by a

combination of operational efficiencies, market expansion, and strategic partnerships.

Robust Growth Expected in 2025

The Company anticipates revenue for 2025 to range between $420 million

and $510 million, with net profit projected to reach $16 million to $20 million. This growth is expected to be fueled by three key businesses:

supply chain financing solutions, small and medium enterprise financing solutions and the Company’s recent expansion into the KFC

franchise business.

1. Supply Chain Financing Solution Business Poised for Growth

Nisun International’s supply chain financing solution business

is expected to be a major contributor to the Company’s growth in 2025. Through targeted strategic initiatives, including optimizing

customer service, expanding business channels, and strengthening customer retention strategies, the Company has successfully attracted

new customers and positioned itself for significant growth.

Recent milestones include:

| ● | Strategic Partnership with Beijing Tongrentang

Technology: In October 2024, the Company entered into a strategic cooperation agreement to purchase traditional Chinese medicine materials,

further diversifying its supply chain offerings. |

| ● | Entry into the Rubber Supply Chain Market:

In November 2024, the Company secured a strategic partnership to supply rubber and plastic products, delivering over 6,400 tons with an

initial order valued at $13.5 million. |

| ● | Corn Purchase and Sales Business: In December

2024, the Company signed agreements with leading enterprises for corn purchase and sales. |

Based on existing orders and market demand, the Company expects its

supply chain financing solutions services business to grow by more than 36% year-over-year.

2. Small and Medium Enterprise

financing solutions Positioned to Benefit from Economic Recovery

Nisun International remains optimistic about the outlook for its Small

and Medium Enterprise financing solutions business, despite a general slowdown in domestic economic growth in 2024. The Company believes

that the recent series of stimulus policies introduced by the Chinese government has significantly boosted market confidence and economic

vitality, creating favorable conditions for the development of the financing sector.

Leveraging its dominant position in the industry, the Company expects

its financing business to grow by 20%-30% in 2025, driven by its strategic positioning in key business areas and the gradual recovery

of market demand. The Company is well-positioned to capitalize on emerging opportunities and further strengthen its market share.

3. KFC Franchise Business to Drive Additional Revenue and Profit

Nisun International’s recent entry into the KFC franchise business

is expected to be a significant contributor to the Company’s growth in 2025. The Company acquired a minority stake in Nanjing Pin

Bai Sheng Catering Management Co., Ltd. (“Nanjing Pin Bai Sheng”), a prominent franchisee and partner in China’s thriving

food and beverage sector in October 2024. Nanjing Pin Bai Sheng officially obtained the franchise rights for KFC college restaurants.

Nanjing Pin Bai Sheng plans to expand its presence in the university market by adding 50 KFC restaurants in 2025.

According to market research, validated by the Company’s early

results from the rollout, the average daily revenue of college KFC stores is expected to be between $2,061 and $2,518, with a net profit

margin of about 15%. Based on this, the KFC college restaurant business is expected to contribute $30 million to $40 million in revenue

in 2025.

This strategic expansion aligns with KFC’s broader market expansion

in China and leverages Nisun International’s strong supply chain management system and brand influence. The franchise model allows

the Company to quickly replicate successful business practices, reduce operational risks, and increase market share and profitability.

Strong Outlook for 2025

The Company is confident that its operation management, business structure

optimization, and expansion into new business fields will drive significant growth in 2025. The Company expects its overall performance

to increase by 25%-50% year-over-year, driven by the strong growth momentum across its core businesses.

CEO’s Commentary

“We are very pleased with the progress we have made in 2024 and are

excited about the growth opportunities ahead in 2025,” commented Mr. Xin Liu, Chief Executive Officer of Nisun International. “Our

strategic initiatives in supply chain

financing solutions, financing services, and the KFC franchise business

have positioned us well to capitalize on market demand and drive long-term growth. We remain committed to delivering value to our shareholders

and are confident that our efforts will further strengthen our position as a leader in the supply chain solutions and financial services

industry.

I also want to address our current stock valuation. We believe that

our stock is deeply undervalued given the strong fundamentals and growth trajectory of our company. We are expanding our outreach to new

investors to ensure that our story is heard broadly and that the market fully understands the potential and value that Nisun International

offers. We are confident that these efforts will help our stock price more accurately reflect the true value of our company over time.

We remain committed to delivering value to our shareholders and are

confident that our efforts will further strengthen our position as a leader in the supply chain solutions and financial services industry.”

About Nisun International Enterprise Development Group Co., Ltd

Nisun International Enterprise Development Group Co., Ltd (NASDAQ:

NISN) is a technology-driven, integrated supply chain solutions provider focused on transforming the corporate finance industry. Leveraging

its industry experience, Nisun International is dedicated to providing professional supply chain solutions to Chinese and foreign enterprises

and financial institutions. Through its subsidiaries, Nisun International provides users with professional solutions for technology supply

chain management, technology asset routing, and digital transformation of tech and finance institutions, enabling the industry to strengthen

and grow. At the same time, Nisun International continues to deepen the field of industry segmentation through industrial and financial

integration. Focusing on industry-finance linkages, Nisun International aims to serve the upstream and downstream of the industrial supply

chain while also assisting with supply-side sub-sector reform. For more information, please visit http://ir.nisun-international.com/

Cautionary Note Regarding Forward-Looking

Statements

This press release contains information

about Nisun International ’s view of its future expectations, plans and prospects that constitute forward-looking statements. Actual results

may differ materially from historical results or those indicated by these forward-looking statements as a result of a variety of factors

including, but not limited to, risks and uncertainties associated with its ability to raise additional funding, its ability to maintain

and grow its business, variability of operating results, its ability to maintain and enhance its brand, its development and introduction

of new products and services, the successful integration of acquired companies, technologies and assets into its portfolio of products

and services, marketing and other business development initiatives, competition in the industry, general government regulation, economic

conditions, dependence on key personnel, the ability to attract, hire and retain personnel who possess the technical skills and experience

necessary to meet the requirements of its clients, and its ability to protect its intellectual property. Nisun International encourages

you to review other factors that may affect its future results in Nisun International ’s registration statement and in its other filings

with the Securities and Exchange Commission. Nisun International assumes no obligation to update or revise its forward-looking statements

as a result of new information, future events or otherwise, except as expressly required by applicable law.

Contacts

Nisun International Enterprise Development

Group Co., Ltd

Investor Relations

Tel: +86 (21) 6266-2366

Email: ir@cnisun.com

3

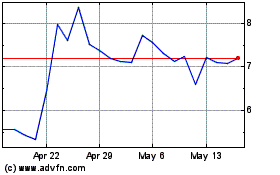

NiSun International Ente... (NASDAQ:NISN)

Historical Stock Chart

From Feb 2025 to Mar 2025

NiSun International Ente... (NASDAQ:NISN)

Historical Stock Chart

From Mar 2024 to Mar 2025