false

0001789192

0001789192

2024-07-31

2024-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 31, 2024

N2OFF,

Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40403 |

|

26-4684680 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

HaPardes

134 (Meshek Sander)

Neve

Yarak, Israel |

|

4994500 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(347)

468 9583

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

NITO |

|

The

Nasdaq Capital Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

1.01

Entry into a Material Agreement

On

June 30, 2024, N2OFF, Inc., a Nevada corporation (the “Company”) entered into a Loan Agreement (the “Loan Agreement”)

with Solterra, and other lenders signatory thereto pursuant to which such lenders committed to loan Solterra the aggregate principal

amount of € 500,000 (€ 375,000 of which was committed by the Company) with interest accruing on the principal at the rate of

7% per annum, to be paid annually beginning June 30, 2025.

In

connection with the Loan Agreement, on July 31, 2024, the Company, entered into a Loan and Partnership Agreement (the “Loan and

Partnership Agreement”), with Horizons RES PE1 UG (haftungsbeschränkt) & Co. KG (the “Partnership”), Solterra

Renewable Energy Ltd., (“Solterra”), and other lenders signatory thereto (collectively, the “Lenders”), pursuant

to which the Lenders committed to loan the Partnership (the “Loan”) an aggregate principal amount of € 2,080,000 (€

1,560,000 of which was committed by the Company). Interest accrues on the loan at the rate of 7% per annum. The Loan matures on the earlier

of (i) the sale of the Partnership or (ii) five years from the date of the Loan and Partnership Agreement.

All

loans to the Partnership from Solterra will be subordinate to the Loan.

Pursuant

to the Loan and Partnership Agreement, the Lenders are entitled to participation rights of 50% (of which the Company will be entitled

to receive 50% thereof) of the Partnership’s profits (the “Profits”), whether directly or by way of 50% membership

or ownership in the Partnership, or through legal rights for the distribution of 50% of the Partnership’s Profits where Solterra

acts as a trustee on behalf of the Lenders (the “Profit Rights Alternatives”). The Lenders will decide within three months

from the date of the Loan and Partnership Agreement on the chosen Profit Right Alternative.

Proceeds

from the sale of a Partnership asset must first be used to repay the Lenders at such amount that is pro rata with each Lender’s

respective portion of the Loan.

Repayment

of the Loan is secured by a lien on Solterra’s interests in the Partnership.

If

a Lender defaults from the payment schedule as detailed in the Loan and Partnership Agreement, and does not provide its portion of the

Loan, then such Lender’s rights to Profits will be proportionately decreased, based on the amount of the Loan that was actually

provided by such Lender to the Partnership out of its entire Loan commitment.

The

foregoing description of the Loan and Partnership Agreement

is qualified in its entirety by reference to the full text of the Loan and Partnership Agreement,

a copy of which is filed as Exhibit 10.1, and of which is incorporated herein by reference in its entirety.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information contained above in Item 1.01 is hereby incorporated by reference into this Item 2.03 in its entirety.

Item

7.01 Regulation FD Disclosure.

On

July 31, 2024, the Company issued a press release titled “N2OFF, INC. Entered into an Agreement to Fund up to €8 million

for 50% Rights in Several Solar PV Projects to be Developed by Solterra Renewable Energy Ltd”. A copy of this press release is

attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In

accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K that is furnished pursuant to

this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall

not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

| † |

Schedules

and similar attachments to this Exhibit have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to

furnish supplementally a copy of any omitted schedule or exhibit to the U.S. Securities and Exchange Commission (the “SEC”)

upon request. |

| * |

Certain

portions of this Exhibit have been redacted pursuant to Item 601(b)(10)(iv) of Regulation S-K. The omitted information

(i) is not material and (ii) would likely cause competitive harm to the Company if publicly disclosed. The Company agrees to furnish

supplementally an unredacted copy of this Exhibit to the SEC upon request. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

N2OFF,

Inc. |

| |

|

|

| Date:

July 31, 2024 |

By: |

/s/

David Palach |

| |

Name:

|

David

Palach |

| |

Title: |

Chief

Executive Officer |

Exhibit

10.1

Certain

portions of this Exhibit have been redacted pursuant to Item 601(b)(10)(iv) of Regulation S-K and, where applicable, have been

marked with “[***]” to indicate where redactions have been made. The marked information has been redacted because

it is both (i) not material and (ii) would likely cause competitive harm to the Company if publicly disclosed.

LOAN

AND PARTNERSHIP AGREEMENT

This

Agreement (the “Agreement”) is effective as of July 31, 2024 (the “Effective Date”) by and between

Horizons RES PE1 UG (haftungsbeschränkt) & Co. KG, a German Partnership, registered in the commercial register of the local

court of Coburg under No. HRA 5449 (the “Partnership”), wholly owned by Solterra Renewable Energy Ltd., an Israeli

company number 516641602 with its address located at 6l Jabotinsky Street, B.S.R Tower l, Petach Tikva, Israel (the “Company”)

and the lenders, severally and not jointly, who will provide the Partnership an aggregate loan amount pursuant to such allocations as

set forth in Schedule A (the “Lenders”). The Partnership and the Lenders referred to collectively as

the “Parties” and individually as a “Party”.

WHEREAS,

the Partnership desires funding to cover its immediate obligations and working capital requirements; and

WHEREAS,

the Lenders have agreed to provide such aggregate amount of funds as set forth in Schedule A, to the Partnership in the form

of a loan, subject to the terms and conditions of this Agreement.

NOW,

THEREFORE, THE PARTIES HEREBY AGREE AS FOLLOWS:

The

preamble to this Agreement shall constitute an integral part hereof.

| |

2.1 |

The

Lenders hereby commit to provide the Partnership a Loan in the aggregate amount of Euro 2,080,000 (two million Euros) in accordance

with the commitments listed in Schedule A (the “Principal Amount”), and subject to the payments schedule

included in Schedule B. |

| |

|

|

| |

2.2 |

Interest

shall accrue on the Principal Amount at a rate of 7% (seven percent) per annum (the “Interest”, and together with

the Principal Amount, the “Loan”) for a period of five (5) years following the date hereof (the “Maturity

Date”). |

| |

|

|

| |

2.3 |

The

Loan shall be repaid to the Lenders upon the earlier of (i) the sale of the Partnership or (ii) the Maturity Date. |

| |

|

|

| |

2.4 |

Any

loans granted by the Company to the Partnership, either prior to the date hereof or subsequent thereto, shall be fully subordinated

to the Loan owed by the Partnership to the Lenders. For the avoidance of doubt, the Partnership shall first repay the Loan (including

all Interest) to the Lenders, before repaying any other debt owed by the Partnership to the Company. |

| |

|

|

| |

2.5 |

The

Lenders shall be entitled to participation rights of 50% of the Partnership’s gains and/or profits (the “Profits”),

whether directly by way of 50% membership or ownership interests in the Partnership, or through legal rights for the distribution

of 50% of the Partnership’s Profits where the Comapany shall act as a trustee on behalf of the Lenders for these rights (the

“Profit Rights”). The Lenders will decide within three (3) months from the date hereof on the chosen alternative

and the Partnership will act to execute any actions needed to aplly such decision. |

| Melz – Partnership and Loan Agreement – July 2024 |

| |

2.6 |

Each

Lender’s participation in the Principal Amount and corresponding Profits are set forth in Schedule A. |

| |

|

|

| |

2.7 |

In

the event of a sale of any asset of the Partnership, the Partnership shall first and foremost repay the Lenders with proceeds generated

from such sale and pursuant to such amounts owed under the Loan outstanding as of the date of such sale. |

| |

|

|

| |

2.8 |

In

order to secure the Loan, the Lenders shall have a lien on the Company’s interests in the Partnership (the “Lien”).

The Company hereby represents that as of the Effective Date there are no previous liens on the Company’s interests in the Partnership,

and the Company shall not dispose such interests and/or apply any additional liens on such interests without a written consent by

the Lenders. |

| |

|

|

| |

2.9 |

In

the event a Lender defaults and does not provide its share in the Loan under this Agreement, then the holdings of such defualing

lender in the Profits Rights shall be linearly decreased, based on the amount of the Loan that was actually provided by such Lender

to the Partnership out of its entire Loan commitment. |

| 3 | Representations

and Undertakings of the Partnership |

The

Partnership hereby represents and warrants to the Lenders as follows:

| |

3.1 |

The

Partnership is an entity duly organized, validly existing and in good standing under the laws of Germany. |

| |

|

|

| |

3.2 |

The

Partnership has all requisite power and authority to execute and deliver this Agreement and to consummate the transactions and perform

its obligations contemplated hereby. |

| |

|

|

| |

3.3 |

This

Agreement has been duly and validly authorized, executed and delivered by the relevant bodies of the Partnership and it constitutes

a binding obligation of the Partnership, enforceable against it in accordance with the applicable laws of Germany. |

| |

|

|

| |

3.4 |

The

execution of this Agreement and the performance of any of the transactions contemplated by it do not and shall not contravene or

constitute a default under, or cause to be exceeded, any limitation on the Partnership or the powers of its authorized managers imposed

by or contained in. |

| |

|

|

| |

3.5 |

The

entry into this Agreement by the Partnership does not conflict with: (i) any applicable law; (ii) the organizational documents of

the Partnership or any of its other constitutional documents; or (iii) any agreement which it is a party or under which it is bound. |

| Melz – Partnership and Loan Agreement – July 2024 |

| |

3.6 |

No

consent, approval, order or authorization of any third party, or registration, qualification, designation, declaration or filing

with governmental authority is required on the part of the Partnership in connection with the consummation of the transactions contemplated

by this Agreement. |

| |

|

|

| |

3.7 |

There

is no action, suit, claim, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory

organization or body pending against or, to the knowledge of the Partnership, threatened against the Partnership. The Partnership

is not subject to any order, writ, judgment, injunction, decree or award of any court or any governmental authority. |

| |

|

|

| |

3.8 |

The

Partnership has not been advised, nor does the Partnership have reason to believe, that it is not conducting its business in compliance

with all applicable laws, rules and regulations of the jurisdictions in which it is conducting its business. |

Each

Party shall bear its own tax liability (including any withholding tax, if any), deriving from all rights and benefits granted under this

Agreement, including without limitation all present or future taxes, levies, deductions, penalties, fines, or similar liability under

any applicable law.

| |

5.1 |

The

Company has an obligation under the agreement dated August 4, 2023 between the Company and Solarpack Corporation Tecnologica, S.A.U

(“Zelestra”), to introduce to Zelestra all the solar photovoltaic projects developed by the Company in Germany

(“Subsequent Projects”) until February 4, 2025 (the “Exclusivity Term”). During such Exclusivity

Term, Zelestra has the option to evaluate any Subsequent Project (by means, among others, of conducting due diligence) and to decide

whether to acquire the Subsequent Project(s) within twenty (20) business days from the date the relevant Subsequent Project has been

submitted to Zelestra (the “Call Option”). |

| |

|

|

| |

5.2 |

In

the event Zelestra shall exercise its Call Option during the Exclusivity Period and will acquire the Subsequent Project, then the

Lenders shall be entitled to 5% (five percent) from the Company’s profits in the relevant Subsequent Project. |

| |

|

|

| |

5.3 |

In

the event Zelestra shall not exercise its Call Option during the Exclusivity Period, then the Company shall first introduce

the Subsequent Project to the Lenders, including the due diligence documents and the relevant budget until RTB stage, and the Lenders

shall have the option (but not the obligation) within 15 business days to finance the development costs through a loan under the

same terms of this Agreement and 50% of Profits Rights of the Company in the Subsequent Project. |

| Melz – Partnership and Loan Agreement – July 2024 |

| |

5.4 |

At

the end of the Exclusivity Period (i.e. after February 4, 2025) all Subsequent Projects shall be introduced first and foremost to

the Lenders by the Company, under the same mechanism as described in section 5.3 above, until the earlier of (a) 2 years from the

date hereof; (b) Euro 6 million have been committed by the Lenders for projects being promoted by the Company (c) over 500MW have

been introduced to the Lenders. |

Each

Party will bear its own legal fees and any other expenses with respect to this Agreement.

Each

Party hereto agrees to: (a) subject to the reporitng requirements of any Lenders and the obligations relating thereto, keep the existence

of this Agreement and all matters contained herein strictly confidential and not to disclose them, except to their legal and other advisers;

(b) to consult with each other and agree on desirability, timing and substance of any public announcement or disclosure to the public

relating to the Agreement, subject to any applicable law or requirement by any authority.

| 8 | Entire

Agreement; Amendment |

The

Parties acknowledge and agree that this Agreement is the entire complete and exclusive statement of their agreement relating to the subject

matter hereof and supersedes all other proposals (whether oral or written), understandings, representations, conditions, and other communications

between the Parties relating hereto. This Agreement may be amended only by a subsequent writing that specifically refers to this Agreement

and is signed by all Parties, and no other act, document, usage, or custom shall be deemed to amend this Agreement.

| 9 | Governing

Law; Dispute Resolution |

This

Agreement shall be governed by and construed exclusively in accordance with the laws of the State of Israel. Any and all disputes arising

out of or in connection with the execution, interpretation, performance, or non-performance of this Agreement, that are not resolved

amicably and in good faith by the Parties, shall be resolved by the competent courts in Tel-Aviv, Israel.

Neither

Party may assign any of its rights or obligations under this Agreement without the express prior written consent of the other Party.

A

failure to delay or delay in exercising a right or remedy provided by this Agreement or by law does not constitute a waiver of the right

or remedy or a waiver of other rights or remedies. No single or partial exercise of a right or remedy provided by this Agreement or by

law prevents further exercise of the right or remedy or exercise of another right or remedy.

| Melz – Partnership and Loan Agreement – July 2024 |

Each

Party shall do and execute, or arrange for the doing and executing of, each necessary act, document and thing reasonably within its power

to implement this Agreement.

All

notices, certificates, acknowledgements and other responses hereunder shall be in writing and shall be deemed properly delivered after

one (1) business day if delivered by e-mail, or seven (7) business days after being duly mailed by registered mail to the other Party.

If

any term or provision of this Agreement is found to be illegal or unenforceable, the validity of the remainder of the Agreement will

remain in full force and effect.

This

Agreement may be executed in one or more counterparts, each of which shall be deemed an original and all of which together shall constitute

one instrument. Facsimile signatures shall be binding as original signature.

IN

WITNESS WHEREOF, the Parties have caused this Agreement to be executed by their duly authorized signatories identified below as of

this 31st day of July 2024.

| BORROWER |

|

COMPANY

|

|

LENDERS

|

Horizons

RES PE1

Signature:

/s/ Yair Harel

Name:

Yair Harel

Title:

Managing Director |

|

Solterra

Renewable Energy Ltd.

Signature:

[corporate seal] /s/ Eran Litvak, /s/ Yair Harel

Name:

Eran Litvak, Yair Harel

Title:

Co- CEOs |

|

N2OFF

Inc.

Signature:

/s/ David Palach

Name:

David Palach

Title:

CEO |

| |

|

|

|

L.I.A.

Pure Capital Ltd.

Signature:

Name:

Title: |

| Melz – Partnership and Loan Agreement – July 2024 |

Schedule

A

List

of Lenders

[***]

| Melz – Partnership and Loan Agreement – July 2024 |

Schedule

B

Payments

Schedule

[***]

| Melz – Partnership and Loan Agreement – July 2024 |

Exhibit

99.1

N2OFF,

INC. Entered into an Agreement to Fund up to € 8 million for 50% Rights in Several Solar PV Projects to be Developed by Solterra

Renewable Energy Ltd.

First

PV project in a capacity of 111 MW, received a municipal approval as well as an indicative solution for grid connection by a large regional

energy service provider in Germany

Neve

Yarak, Israel, July 31, 2024 (GLOBE NEWSWIRE) — N2OFF, Inc. (NASDAQ: NITO) (FSE:80W) (“N2OFF” and the “Company”),

a clean tech company engaged in sustainable solutions for energy and innovation for the agri- tech, announced today that together with

a number of private investors (the “Investors”), it entered into an agreement with Solterra Renewable Energy Ltd. (“Solterra”),

to fund up to €8 million solar PV (photovoltaic) projects. The first project which was agreed upon is planned in Melz, Germany,

with a total Capacity of 111 MWp (Megawatt peak) for which the Company and Investors will loan an aggregate amount of €2.08 million.

Yair

Harel, Solterra’s CEO, commented, “Our goal is to fully develop the Melz project and sell it at Ready-to-Build (RTB) status.

We see high demand in today’s markets for RTB projects from multiple types of investors. Our cooperation with N2OFF will allow

us to bring multiple projects to fruition, extracting substantial value from these projects for the benefit of both companies’

investors.”

David

Palach, N2OFF’s CEO, added “We are pleased to announce our entry in the solar energy sector with our first project. Our goal

is to create a reliable revenue stream by financing projects carefully selected by the Solterra team, our experts in the field. Based

on recent market trends, we expect the global demand for alternative energy solutions to continue growing annually, as awareness of the

need to create environmentally friendly solutions to help preserve our planet increases. We believe this to be a contributing factor

to the attractive profit margins in this sector. Subject to the right of first refusal granted to us, we look forward to analyzing and

investing in future projects.”

The

project has been approved by the municipality of Melz and additionally received attention for a potential grid connection by a large

regional energy service provider in Germany.

Solterra

was founded in 2022 by Eran Litvak and Yair Harel, in the field of renewable energy. Each of the founders is a veteran in the energy

sector, with a track record of dozens of successful projects. In addition, both founders are experienced entrepreneurs and managers with

over 20 years of proven experience in identifying business opportunities, enhancing projects, and maximizing value in both the energy

and financial sectors.

Solterra

is currently active in three primary target markets: Italy, Poland, and Germany, managing a portfolio of at various stages of Solar PV

development with a total cumulative capacity of approximately 300 megawatts. According to Precedence Research, the global solar

PV market was estimated at $150 billion in 2022 and is predicted to hit over $383.78 billion by 2032 and poised to grow at a CAGR of

9.90% during the forecast period from 2023 to 2032.

Pursuant

to the Agreement, N2OFF and the Investors will finance the project up to an aggregate of $2.2 million (approximately 2 million Euro)

in order to assist the project in reaching its goal of obtaining RTB status. The loan will be given based on accomplished milestones,

with an accrued interest at a rate of 7% per annum, and provide the Company and Investors with up to 50% of the rights to the net earnings.

Furthermore, the Agreement also contemplates for a right of refusal in favor of the company and the Investors, for additional project

investments of up to 6 million Euro.

About

N2OFF Inc:

N2OFF,

Inc. (formerly known as Save Foods, Inc.) is a clean tech company engaged in sustainable solutions for energy and innovation for the

agri- tech. Through its operational activities it delivers integrated solutions for sustainable energy, greenhouse gas emissions reduction

and safety, quality solutions for the agri- tech market. NTWO OFF Ltd., N2OFF’s majority-owned Israeli subsidiary, aims to contribute

in tackling greenhouse gas emissions, offering a pioneering solution to mitigate nitrous oxide (N2O) emissions, a potent greenhouse gas

with 310 times the global warming impact of carbon dioxide. NTWO OFF Ltd., aims to promote agricultural practices that are both environmentally

friendly and economically viable. N2OFF recently entered the solar PV market and will provide funding to Solterra Renewable Energy for

the current project in the total Capacity of 111 MWp, as well as future projects. Save Foods Ltd., N2OFF’s majority-owned Israeli

subsidiary, focuses on post-harvest treatments in fruit and vegetables to control and prevent pathogen contamination. N2OFF also has

a minority ownership in Plantify Foods, Inc., a Canadian company listed on the TSXV that offers a wide range of clean-label healthy food

options. For more information on Save Foods Ltd. and NTWO OFF Ltd. visit our website: www.n2off.com.

Forward-looking

Statements:

This

press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995 and other Federal securities laws. Words such as “expects,” “anticipates,” “intends,”

“plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such

words are intended to identify forward-looking statements. Because such statements deal with future events and are based on our current

expectations, they are subject to various risks and uncertainties including the success of our collaboration with Solterra, entry into

future projects, our ability to successfully enter the solar PV sector and the profitability of such industry. Actual results, performance

or achievements could differ materially from those described in or implied by the statements in this press release. The forward-looking

statements contained or implied in this press release are subject to other risks and uncertainties, including market conditions as well

as those discussed under the heading “Risk Factors” in N2OFF’s Annual Report on Form 10-K filed with the SEC on April

1, 2024, and in any subsequent filings with the SEC. Except as otherwise required by law, we undertake no obligation to publicly release

any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence

of unanticipated events. References and links to websites have been provided as a convenience, and the information contained on such

websites is not incorporated by reference into this press release. We are not responsible for the contents of third-party websites.

Investor

Relations Contacts:

Michal

Efraty

michal@efraty.com

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

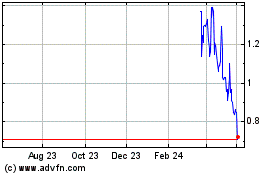

N2OFF (NASDAQ:NITO)

Historical Stock Chart

From Oct 2024 to Nov 2024

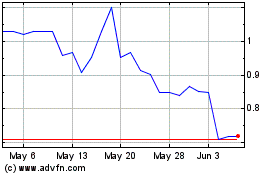

N2OFF (NASDAQ:NITO)

Historical Stock Chart

From Nov 2023 to Nov 2024