SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of: November 2024 (Report No. 5)

Commission file number: 001-37600

NANO DIMENSION LTD.

(Translation of registrant’s name into English)

2 Ilan Ramon

Ness Ziona 7403635 Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

CONTENTS

On November

20, 2024, Nano Dimension Ltd. (the “Registrant”) issued a press release titled “Nano Dimension Announces Q3/2024 Results

– The Best 3rd Quarter in the Company’s History,” a copy of which is furnished herewith as Exhibit 99.1 and incorporated

by reference herein.

Attached

hereto as Exhibit 99.2 and incorporated herein is the Registrant’s investor presentation, dated November 20, 2024.

The sections titled “Financial

Results” and “Forward-Looking Statements” and the IFRS financial statements of Exhibit 99.1 and Exhibit 99.2 to this

Report of Foreign Private Issuer on Form 6-K are incorporated by reference into the Registrant’s registration statements on

Form F-3 (File No. Nos. 333-255960, 333-233905, 333-251155, 333-252848, and 333-278368) and Form S-8 (File No. 333-214520, 333-248419

and 333-269436), filed with the Securities and Exchange Commission, to be a part thereof from the date on which this report is submitted,

to the extent not superseded by documents or reports subsequently filed or furnished.

No Offer or Solicitation

This communication is not

intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation

of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall

be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information

about the Transaction and Where to Find It

In connection with the proposed

transaction, Markforged Holding Corporation (“Markforged”) filed with the SEC a proxy statement (the “Proxy Statement”)

on November 13, 2024. Markforged may also file other relevant documents with the SEC regarding the proposed transaction. This document

is not a substitute for the Proxy Statement or any other document that Markforged may file with the SEC. The definitive Proxy Statement

has been mailed to shareholders of Markforged. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT

DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY

IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors

and security holders can obtain free copies of the Proxy Statement and other documents containing important information about Markforged

and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov.

Copies of the documents filed with the SEC by the Registrant will be available free of charge on the Registrant’s website at https://investors.nano-di.com/sec-filings-1/default.aspx.

Participants in the Solicitation

The Registrant, Markforged

and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from

Markforged shareholders in respect of the proposed transaction. Information about the directors and executive officers of the Registrant,

including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in the Registrant’s

Annual Report on Form 20-F for the fiscal year ended December 31, 2023, which was filed with the SEC on March 21, 2024. Information about

the directors and executive officers of Markforged, including a description of their direct or indirect interests, by security holdings

or otherwise, is set forth in Markforged’s proxy statement for its 2024 Annual Meeting of Stockholders, which was filed with the

SEC on April 26, 2024 and Markforged’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with

the SEC on March 15, 2024. Other information regarding the participants in the proxy solicitation and a description of their direct and

indirect interests, by security holdings or otherwise, is contained in the proxy statement and other relevant materials to be filed with

the SEC regarding the proposed transaction when such materials become available. Investors should read the proxy statement carefully before

making any voting or investment decisions. You may obtain free copies of these documents from the Registrant or Markforged using the sources

indicated above.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Nano Dimension Ltd. |

| |

(Registrant) |

| |

|

|

| Date: November 20, 2024 |

By: |

/s/ Tomer Pinchas |

| |

Name: |

Tomer Pinchas |

| |

Title: |

Chief Financial Officer and

Chief Operating Officer |

Exhibit

99.1

Nano

Dimension Announces Q3/2024 Results – The Best 3rd Quarter in the Company’s History

Revenue $14.9M, Up 22% from

the Same Period in 2023

Announced Two Transformational

M&A Agreements in Q3/24 Alone

– With Desktop Metal and Markforged

Gross

Margin Higher

48.2% in Q3/2024, Up 4.0% From Q3/2023

46.6% in the First Nine Months of 2024, Up 2.6% From the Same Period in 2023

Adjusted

Gross Margin Higher

50.5% in Q3/2024, Up 2.5% From Q3/2023

Net

Cash Burn Reduced Substantially

$3M in Q3/2024, Down From $16M in Q3/2023 – a Decrease of 80%

The

Company Continues to Urge Shareholders to Vote by December 1st, 2024 for Upcoming Annual General Meeting to Protect This Continued

Success

Conference

Call to be Held Today at 9:00 a.m. ET

WALTHAM,

Mass., Nov. 20, 2024 (GLOBE NEWSWIRE) -- Nano Dimension Ltd. (Nasdaq: NNDM), “Nano Dimension” or the “Company”),

a leading supplier of Additively Manufactured Electronics (“AME”) and multi-dimensional polymer, metal & ceramic Additive

Manufacturing (“AM”) 3D printing solutions, today announced financial results for the third quarter ended September 30th,

2024 and shared a letter from Yoav Stern, the Company’s Chief Executive Officer and member of the Board of Directors.

Revenue:

| ● | For

Q3/2024 was $14.9 million, compared to $12.2 million in Q3/2023. |

| ● | For

the first nine months of 2024 was $43.2 million, compared to $41.9 million in the same period in 2023. |

Gross

Margin (“GM”):

| ● | For

Q3/2024 was 48.2%, compared to 44.2% in Q3/2023. |

| ● | For

the first nine months of 2024 was 46.6%, compared to 44% in the same period in 2023. |

Adjusted1 Gross

Margin (“Adjusted GM”):

| ● | For

Q3/2024 was 50.5%, compared to 48.0% in Q3/2023. |

| ● | For

the first nine months of 2024 was 48.9%, compared to 47.5%. in the same period in 2023. |

Net

Loss:

| ● | For

Q3/2024 was a loss of $8.6 million, compared to a loss of $66.9 million in Q3/2023. |

| ● | For

the first nine months of 2024 was a loss of $87.9 million, compared to $54.3 million loss in the same period in 2023. |

Net

Loss excluding changes in the Company’s holdings in Stratasys Ltd.’s (“Stratasys”) shares:

| ● | For

Q3/2024 was a loss of $7.9 million, compared to a loss of $26.6 million in Q3/2023. |

| ● | For

the first nine months of 2024 was a loss $30 million, compared to $71.3 million loss in the same period in 2023. |

Adjusted

EBITDA:

| ● | For

Q3/2024 was negative $14.8 million, compared to negative $30.1 million in Q3/2023. |

| ● | For

the first nine months of 2024 was negative $44.5 million, compared to negative $77.3 million in same period in 2023. |

| 1 | Excluding cost of revenues from depreciation and share-based

payments expenses. |

Net

cash burn:

| ● | For

Q3/2024 was $3 million, compared to Q3/2023’s $16 million2. |

| ● | For

the first nine months of 2024 was $21 million, compared to $74 million for same period in 2023. |

Details

regarding Adjusted GM, Net Loss excluding changes in Company’s holdings in Stratasys’ shares, Adjusted EBITDA, Net Cash Burn

and Net Loss excluding changes in Company’s holdings in Stratasys shares can be found below in this press release under “Non-IFRS

Measures.”

CEO

MESSAGE TO SHAREHOLDERS:

Dear

Fellow Shareholders,

I

am pleased to report that we have achieved the strongest third quarter performance in our Company’s history. This remarkable accomplishment

comes despite the broader market experiencing continued uncertainty in capital spending on manufacturing equipment – a challenge

that has notably impacted many of our industry peers.

Crucially,

it is not just about the top-line. As part of our “Reshaping Nano Initiative,” we have reduced our net cash burn to $3 million

for the quarter. This is 80% less than the same quarter last year and a key milestone on our path to being an EBITDA positive business.

What

makes this quarter truly extraordinary is not just our financial performance, but also the strategic milestones we’ve reached. In

Q3 alone, our team successfully announced two transformational M&A agreements – with Desktop

Metal, Inc. (on July 3rd, 2024) (“Desktop Metal”) and Markforged Holding Corporation (on September

25th, 2024) (“Markforged”). Each of these deals would be considered landmarks in their own right;

to execute both in a single quarter is a testament to our team’s exceptional execution capabilities and our clear

strategic vision.

What

is surely more exciting is not what we have done, but what the future of Nano Dimension will be and what it is poised to accomplish.

The New Nano

Dimension – which includes the business as it is today and Desktop Metal and Markforged – will

have:

| ● | An

exemplary technology portfolio that spans digital manufacturing solutions with a focus on additive manufacturing systems that are aligned

with the strongest expected future growth of our industry, e.g. additively manufactured electronics, binder jetting for metal, fused

filament fabrication (“FFF”) for metal and composites, to name a few. |

| ● | Revenue

of $340 million based on 2023 results that delivers scale and the promise of sizeable financial results that can flow down

to the bottom-line. |

| ● | A

robust capital position of $475 million expected at the time both transactions will have closed, which provides us the flexibility

to support our continued development and secure our business well into the future. |

| ● | All

of this, along with our financial prowess and meaningful post-merger integration strategy, are expected to enable us to be EBITDA positive

in Q4 2026. |

Importantly,

the above is happening in an industry context where others are losing scale and are themselves jeopardized with a weak capital position.

Whether the metric is product or financial, we are poised to succeed.

For

those that have followed us over the last few years, most, if not all of this, is not a surprise to you. We have indicated or even said

we would accomplish this.

Simply

put: Promises made. Promises delivered.

I

must address an important matter that requires your attention. An activist investor, Murchinson Ltd. (“Murchinson”), who

some of you may recall from their activity last year, has emerged yet again. They seek to challenge and constrain our proven program

of growth and transformation through proposals at our upcoming Annual General Meeting. While we respect the right of all shareholders

to express their views, we believe their approach will put the very initiatives that have delivered our current successes and positioned

us for future growth at risk. A look at their proposals will indicate that Murchinson STILL has yet to create the most basic of plans

for value creation, providing NO insight into the business and NO executable ideas.

I

urge shareholders to protect their investment and vote “FOR” all of Nano Dimension’s proposals. Act fast – voting

cut-off is on Sunday, December 1st, 2024, at 11:59 p.m. ET (it may be even earlier, so please check with your broker). To learn more

visit: www.ProtectingNanoValue.com.

Thank

you for your continued trust and investment in our Company.

Sincerely,

Yoav Stern

Chief Executive Officer and member of the Board of Directors of Nano Dimension

| 2 | Change

in cash, cash equivalents and deposits net of treasury shares repurchase |

FINANCIAL

RESULTS:

Financial

results for the third quarter ended September 30, 2024

| ● | Total

revenues for the third quarter of 2024 were $14,856,000, compared to $12,158,000 in the third quarter of 2023. The increase is attributed

to increased sales of the Company’s product lines. |

| ● | Total

cost of revenues for the third quarter of 2024 was $7,700,000, compared to $6,789,000 in the third quarter of 2023. The increase is attributed

to increased sales of the Company’s product lines, partially offset by favorable product mix and operational efficiencies. |

| ● | As

a result of the reorganizational plan executed by the Company in the fourth quarter of 2023 and other cost reduction efforts taken in

2024, the Company’s operating expenses across all departments have decreased in the third quarter of 2024 compared to the third

quarter of 2023. |

| ● | Research

and development (“R&D”) expenses for the third quarter of 2024 were $9,801,000, compared to $12,788,000 in the third

quarter of 2023. The decrease is mainly attributed to a decrease in payroll and related expenses, subcontractors and professional services,

and materials for R&D use, as well as a decrease in share-based payments expenses, largely associated with organizational synergies. |

| ● | Sales

and marketing (“S&M”) expenses for the third quarter of 2024 were $6,952,000, compared to $7,715,000 in the third quarter

of 2023. The decrease is mainly attributed to a decrease in payroll and related expenses, as well as a decrease in share-based payments

expenses, largely associated with organizational synergies. |

| ● | General

and administrative (“G&A”) expenses for the third quarter of 2024 were $9,960,000, compared to $20,848,000 in the third

quarter of 2023. The decrease is mainly attributed to a decrease in professional services, associated in part with organizational synergies. |

| ● | Other

expenses, net for the third quarter of 2024 were $721,000. The forementioned expenses were related to Desktop Metal and Markforged transaction

costs. |

| ● | Net

loss attributable to owners of the Company for the third quarter of 2024 was $8,346,000, or $0.05 loss per share, compared to net loss

of $66,604,000, or $0.26 per share, in the third quarter of 2023. The decrease is mainly attributed to the revaluation of the Company’s

investment in Stratasys shares, as well as a decrease in the Company’s operating expenses across all departments. |

Financial

results for the Nine months ended September 30, 2024

| ● | Total

revenues for the nine months period ended September 30, 2024, were $43,206,000, compared to $41,860,000 in the nine months period

ended September 30, 2023. The increase is attributed to increased sales of the Company’s product lines in 2024. |

| ● | Total

cost of revenues for the nine months period ended September 30, 2024, were $23,064,000, compared to $23,430,000 in the nine months

period ended September 30, 2023. The decrease is attributed mostly to favorable product mix and increased operational efficiencies. |

| ● | As

a result of the reorganization plan executed by the Company in the fourth quarter of 2023 and other cost reduction efforts taken in 2024,

the Company’s operating expenses across all departments have decreased in the first nine months of 2024 compared to the first nine

months of 2023. |

| ● | R&D

expenses for the nine months period ended September 30, 2024, were $28,055,000, compared to $48,424,000 in the nine months period

ended September 30, 2023. The decrease is attributed mostly to a decrease in payroll and related expenses, materials for R&D

use, subcontractors and professional services, share-based payments expenses and other R&D expenses, largely associated with organizational

synergies. |

| ● | S&M

expenses for the nine months period ended September 30, 2024, were $20,690,000, compared to $23,418,000 in the nine months period

ended September 30, 2023. The decrease is mainly attributed to a decrease in payroll and related expenses, as well as a decrease

in share-based payments expenses, largely associated with organizational synergies. |

| ● | G&A

expenses for the nine months period ended September 30, 2024, were $28,143,000, compared to $44,203,000 in the nine months period

ended September 30, 2023. The decrease is mainly attributed to a decrease in professional services expenses, associated in part

with organizational synergies. |

| ● | Other

expenses, net for the nine months period ended September 30, 2024, were $3,333,000. The forementioned expenses mainly related to

Desktop Metal and Markforged transaction costs. |

| ● | Net

loss attributable to owners of the Company for the nine months period ended September 30, 2024 was $87,089,000, or $0.40 loss per

share, compared to net loss of $53,501,000, or $0.21 per share, in the nine months period ended September 30, 2023. The increase

is mainly attributed to the revaluation of the Company’s investment in Stratasys shares. |

Conference

call information

The

Company will host a conference call to discuss these financial results today, November 20th, 2024, at 9:00 a.m. ET (4:00 p.m.

IDT).

We

encourage participants to pre-register for the conference call using the following link: https://dpregister.com/sreg/10194549/fdfe9b0a00

Participants

can also dial-in/connect by following the below:

| ● | Toll-free:

844-695-5517 (to listen in an ask questions) |

| ● | International:

+1-412-902-6751 (to listen in and ask questions) |

| ● | Webcast: https://event.choruscall.com/mediaframe/webcast.html?webcastid=ruEpbhYm (to

view a presentation) |

For

those unable to participate in the conference call, there will be a replay available from a link on Nano Dimension’s website at http://investors.nano-di.com/events-and-presentations.

About

Nano Dimension

Nano

Dimension’s (Nasdaq: NNDM) vision is to transform existing electronics and mechanical manufacturing into Industry 4.0 environmentally

friendly & economically efficient precision additive electronics and manufacturing – by delivering solutions that convert digital

designs to electronic or mechanical devices - on demand, anytime, anywhere.

Nano

Dimension’s strategy is driven by the application of deep learning based AI to drive improvements in manufacturing capabilities

by using self-learning & self-improving systems, along with the management of a distributed manufacturing network via the cloud.

Nano

Dimension has served over 2,000 customers across vertical target markets such as aerospace and defense, advanced automotive, high-tech

industrial, specialty medical technology, R&D and academia. The Company designs and makes Additive Electronics and Additive Manufacturing

3D printing machines and consumable materials. Additive Electronics are manufacturing machines that enable the design and development

of High-Performance-Electronic-Devices (Hi-PED®s). Additive Manufacturing includes manufacturing solutions for production of metal,

ceramic, and specialty polymers-based applications - from millimeters to several centimeters in size with micron precision.

Through

the integration of its portfolio of products, Nano Dimension is offering the advantages of rapid prototyping, high-mix-low-volume production,

IP security, minimal environmental footprint, and design-for-manufacturing capabilities, which is all unleashed with the limitless possibilities

of additive manufacturing.

For

more information, please visit www.nano-di.com.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995 and other Federal securities laws. Words such as “expects,” “anticipates,” “intends,”

“plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such

words are intended to identify forward-looking statements. Because such statements deal with future events and are based on Nano Dimension’s,

Desktop Metal’s and Markforged’s current expectations, they are subject to various risks and uncertainties, and actual results,

performance or achievements of Nano Dimension could differ materially from those described in or implied by the statements in this press

release. The acquisitions of Desktop Metal and Markforged are subject to closing conditions, some of which are beyond the control of

Nano Dimension, Desktop Metal or Markforged. For example, Nano Dimension is using forward-looking statements when it discusses benefits

and advantages of the proposed transactions with Markforged and Desktop Metal, and the combined company, the combined company’s

revenues and cash, the Company’s vision, and that the Company will be EBITDA positive by Q4 2026. The forward-looking statements

contained or implied in this press release are subject to other risks and uncertainties, including those discussed under the heading

“Risk Factors” in Nano Dimension’s Annual Report on Form 20-F filed with the Securities and Exchange Commission (“SEC”)

on March 21, 2024, and in any subsequent filings with the SEC. The combined company financial information included in this communication

has not been audited or reviewed by Nano’s auditors and such information is provided for illustrative purposes only. Except as

otherwise required by law, Nano Dimension undertakes no obligation to publicly release any revisions to these forward-looking statements

to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. References and links to

websites have been provided as a convenience, and the information contained on such websites is not incorporated by reference into this

press release. Nano Dimension is not responsible for the contents of third-party websites.

No

Offer or Solicitation

This

communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any

securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No

offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of

1933, as amended.

Additional

Information about the Transaction and Where to Find It

In

connection with the proposed transaction, Markforged filed a definitive proxy statement with the SEC on November 13, 2024. Markforged

may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the proxy

statement or any other document that Markforged may file with the SEC. The definitive proxy statement has been mailed to shareholders

of Markforged. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED

WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE

BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able

to obtain free copies of the proxy statement and other documents containing important information about Markforged and the proposed transaction,

at the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Markforged will be available

free of charge on Markforged’s website at https://investors.markforged.com/sec-filings.

Participants

in the Solicitation

Nano,

Markforged and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies

from Markforged shareholders in respect of the proposed transaction. Information about the directors and executive officers of Nano,

including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Nano’s Annual

Report on Form 20-F for the fiscal year ended December 31, 2023, which was filed with the SEC on March 21, 2024. Information about the

directors and executive officers of Markforged, including a description of their direct or indirect interests, by security holdings or

otherwise, is set forth in Markforged’s proxy statement for its 2024 Annual Meeting of Stockholders, which was filed with the SEC

on April 26, 2024 and Markforged’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with

the SEC on March 15, 2024. Other information regarding the participants in the proxy solicitation and a description of their direct and

indirect interests, by security holdings or otherwise, is contained in the proxy statement and other relevant materials to be filed with

the SEC regarding the proposed transaction when such materials become available. Investors should read the proxy statement carefully

before making any voting or investment decisions. You may obtain free copies of these documents from Nano or Markforged using the sources

indicated above.

NANO

DIMENSION INVESTOR RELATIONS CONTACT

Tomer

Pinchas, CFO & COO | ir@nano-di.com

Unaudited Consolidated

Statements of Financial Position as at

| | |

September 30, | | |

December 31, | |

| | |

2023 | | |

2024 | | |

20233 | |

| (In thousands of USD) | |

(Unaudited) | | |

(Unaudited) | | |

| |

| Assets | |

| | |

| | |

| |

| Cash and cash equivalents | |

| 489,323 | | |

| 213,660 | | |

| 309,571 | |

| Bank deposits | |

| 383,354 | | |

| 547,091 | | |

| 541,967 | |

| Restricted deposits | |

| 60 | | |

| 60 | | |

| 60 | |

| Trade receivables | |

| 10,310 | | |

| 12,534 | | |

| 12,710 | |

| Other receivables | |

| 4,845 | | |

| 4,782 | | |

| 11,290 | |

| Inventory | |

| 21,276 | | |

| 19,510 | | |

| 18,390 | |

| Total current assets | |

| 909,168 | | |

| 797,637 | | |

| 893,988 | |

| | |

| | | |

| | | |

| | |

| Restricted deposits | |

| 846 | | |

| 861 | | |

| 881 | |

| Investment in securities | |

| 131,951 | | |

| 80,566 | | |

| 138,446 | |

| Deferred tax | |

| 259 | | |

| — | | |

| — | |

| Other receivables | |

| 831 | | |

| — | | |

| — | |

| Property plant and equipment, net | |

| 14,814 | | |

| 16,658 | | |

| 16,716 | |

| Right-of-use assets | |

| 12,963 | | |

| 10,166 | | |

| 12,072 | |

| Intangible assets | |

| 2,235 | | |

| 2,235 | | |

| 2,235 | |

| Total non-current assets | |

| 163,899 | | |

| 110,486 | | |

| 170,350 | |

| Total assets | |

| 1,073,067 | | |

| 908,123 | | |

| 1,064,338 | |

| | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | |

| Trade payables | |

| 8,148 | | |

| 3,433 | | |

| 4,696 | |

| Other payables | |

| 24,117 | | |

| 20,242 | | |

| 25,265 | |

| Current portion of lease liability | |

| 4,507 | | |

| 4,014 | | |

| 4,473 | |

| Current portion of bank loan | |

| 235 | | |

| 148 | | |

| 38 | |

| Total current liabilities | |

| 37,007 | | |

| 27,837 | | |

| 34,472 | |

| | |

| | | |

| | | |

| | |

| Liability in respect of government grants | |

| 1,861 | | |

| 983 | | |

| 1,895 | |

| Employee benefits | |

| 2,468 | | |

| 3,941 | | |

| 2,773 | |

| Long term lease liability | |

| 9,000 | | |

| 7,429 | | |

| 8,742 | |

| Deferred tax liabilities | |

| — | | |

| — | | |

| 75 | |

| Bank loan | |

| 588 | | |

| 333 | | |

| 595 | |

| Total non-current liabilities | |

| 13,917 | | |

| 12,686 | | |

| 14,080 | |

| Total liabilities | |

| 50,924 | | |

| 40,523 | | |

| 48,552 | |

| | |

| | | |

| | | |

| | |

| Equity | |

| | | |

| | | |

| | |

| Non-controlling interests | |

| 660 | | |

| 965 | | |

| 1,011 | |

| Share capital | |

| 399,327 | | |

| 407,338 | | |

| 400,700 | |

| Share premium and capital reserves | |

| 1,299,303 | | |

| 1,303,332 | | |

| 1,299,542 | |

| Treasury shares | |

| (89,375 | ) | |

| (167,651 | ) | |

| (97,896 | ) |

| Foreign currency translation reserve | |

| 938 | | |

| 2,638 | | |

| 2,929 | |

| Remeasurement of net defined benefit liability (IAS 19) | |

| 1,448 | | |

| (726 | ) | |

| 707 | |

| Accumulated loss | |

| (590,158 | ) | |

| (678,296 | ) | |

| (591,207 | ) |

| Equity attributable to owners of the Company | |

| 1,021,483 | | |

| 866,635 | | |

| 1,014,775 | |

| Total equity | |

| 1,022,143 | | |

| 867,600 | | |

| 1,015,786 | |

| Total liabilities and equity | |

| 1,073,067 | | |

| 908,123 | | |

| 1,064,338 | |

| 3 | The December 31, 2023 balances were derived from the Company’s

audited annual financial statements |

Unaudited Consolidated

Statements of Profit or Loss and Other Comprehensive Income

| | |

Nine Months Ended

September 30, | | |

Three Months Ended

September 30, | | |

For the Year Ended | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

Thousands | | |

Thousands | | |

Thousands | | |

Thousands | | |

Thousands | |

| | |

USD | | |

USD | | |

USD | | |

USD | | |

USD | |

| Revenues | |

| 41,860 | | |

| 43,206 | | |

| 12,158 | | |

| 14,856 | | |

| 56,314 | |

| Cost of revenues | |

| 23,186 | | |

| 22,992 | | |

| 6,739 | | |

| 7,693 | | |

| 30,759 | |

| Cost of revenues - write-down of inventories | |

| 244 | | |

| 72 | | |

| 50 | | |

| 7 | | |

| 97 | |

| Total cost of revenues | |

| 23,430 | | |

| 23,064 | | |

| 6,789 | | |

| 7,700 | | |

| 30,856 | |

| Gross profit | |

| 18,430 | | |

| 20,142 | | |

| 5,369 | | |

| 7,156 | | |

| 25,458 | |

| Research and development expenses | |

| 48,424 | | |

| 28,055 | | |

| 12,788 | | |

| 9,801 | | |

| 62,004 | |

| Sales and marketing expenses | |

| 23,418 | | |

| 20,690 | | |

| 7,715 | | |

| 6,952 | | |

| 31,707 | |

| General and administrative expenses | |

| 44,203 | | |

| 28,143 | | |

| 20,848 | | |

| 9,960 | | |

| 58,254 | |

| Other expenses (income), net | |

| — | | |

| 3,333 | | |

| — | | |

| 721 | | |

| (1,627 | ) |

| Operating loss | |

| (97,615 | ) | |

| (60,079 | ) | |

| (35,982 | ) | |

| (20,278 | ) | |

| (124,880 | ) |

| Finance income | |

| 51,559 | | |

| 33,332 | | |

| 11,101 | | |

| 12,704 | | |

| 70,934 | |

| Finance expenses | |

| 8,385 | | |

| 61,038 | | |

| 42,265 | | |

| 1,113 | | |

| 1,652 | |

| Loss before taxes on income | |

| (54,441 | ) | |

| (87,785 | ) | |

| (67,146 | ) | |

| (8,687 | ) | |

| (55,598 | ) |

| Tax (expenses) benefit | |

| 121 | | |

| (78 | ) | |

| 273 | | |

| 47 | | |

| (62 | ) |

| Loss for the period | |

| (54,320 | ) | |

| (87,863 | ) | |

| (66,873 | ) | |

| (8,640 | ) | |

| (55,660 | ) |

| Loss attributable to non-controlling interests | |

| (819 | ) | |

| (774 | ) | |

| (269 | ) | |

| (294 | ) | |

| (1,110 | ) |

| Loss attributable to owners | |

| (53,501 | ) | |

| (87,089 | ) | |

| (66,604 | ) | |

| (8,346 | ) | |

| (54,550 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss per share | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic loss per share | |

| (0.21 | ) | |

| (0.40 | ) | |

| (0.26 | ) | |

| (0.05 | ) | |

| (0.22 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income items that after initial recognition in comprehensive income were or will be transferred to profit or loss | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation differences for foreign operations | |

| 344 | | |

| (297 | ) | |

| (253 | ) | |

| 1,411 | | |

| 2,368 | |

| Other comprehensive income items that will not be transferred to profit or loss | |

| | | |

| | | |

| | | |

| | | |

| | |

| Remeasurement of net defined benefit liability (IAS 19), net of tax | |

| (1,060 | ) | |

| (1,433 | ) | |

| — | | |

| — | | |

| (1,801 | ) |

| Total other comprehensive (loss) income for the period | |

| (716 | ) | |

| (1,730 | ) | |

| (253 | ) | |

| 1,411 | | |

| 567 | |

| Total comprehensive loss for the period | |

| (55,036 | ) | |

| (89,593 | ) | |

| (67,126 | ) | |

| (7,229 | ) | |

| (55,093 | ) |

| Comprehensive loss attributable to non-controlling interests | |

| (830 | ) | |

| (780 | ) | |

| (284 | ) | |

| (269 | ) | |

| (1,088 | ) |

| Comprehensive loss attributable to owners of the Company | |

| (54,206 | ) | |

| (88,813 | ) | |

| (66,842 | ) | |

| (6,960 | ) | |

| (54,005 | ) |

Consolidated Statements

of Changes in Equity (Unaudited)

(In thousands of USD)

| | |

Share

capital | | |

Share

premium

and capital

reserves | | |

Remeasurement

of IAS 19 | | |

Treasury

shares | | |

Foreign

currency

translation

reserve | | |

Accumulated

loss | | |

Total | | |

Non-controlling

interests | | |

Total

equity | |

| | |

Thousands | | |

Thousands | | |

Thousands | | |

Thousands | | |

Thousands | | |

Thousands | | |

Thousands | | |

Thousands | | |

Thousands | |

| | |

USD | | |

USD | | |

USD | | |

USD | | |

USD | | |

USD | | |

USD | | |

USD | | |

USD | |

| For

the nine months ended September 30, 2024: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance

as December 31, 2023 | |

| 400,700 | | |

| 1,299,542 | | |

| 707 | | |

| (97,896 | ) | |

| 2,929 | | |

| (591,207 | ) | |

| 1,014,775 | | |

| 1,011 | | |

| 1,015,786 | |

| Investment

of non-controlling party in subsidiary | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 734 | | |

| 734 | |

| Loss

for the period | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (87,089 | ) | |

| (87,089 | ) | |

| (774 | ) | |

| (87,863 | ) |

| Other

comprehensive loss for the period | |

| — | | |

| — | | |

| (1,433 | ) | |

| — | | |

| (291 | ) | |

| — | | |

| (1,724 | ) | |

| (6 | ) | |

| (1,730 | ) |

| Exercise

of warrants, options and vesting of RSUs | |

| 6,638 | | |

| (6,638 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Repurchase

of treasury shares | |

| — | | |

| — | | |

| — | | |

| (69,755 | ) | |

| — | | |

| — | | |

| (69,755 | ) | |

| — | | |

| (69,755 | ) |

| Share-based

payment acquired | |

| — | | |

| (363 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| (363 | ) | |

| — | | |

| (363 | ) |

| Share-based

payments | |

| — | | |

| 10,791 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 10,791 | | |

| — | | |

| 10,791 | |

Balance

as of

September 30, 2024 | |

| 407,338 | | |

| 1,303,332 | | |

| (726 | ) | |

| (167,651 | ) | |

| 2,638 | | |

| (678,296 | ) | |

| 866,635 | | |

| 965 | | |

| 867,600 | |

| | |

Share

capital | | |

Share

premium

and

capital reserves | | |

Remeasurement

of IAS 19 | | |

Treasury

shares | | |

Presentation

/ Foreign currency translation reserve | | |

Accumulated

loss | | |

Total | | |

Non-controlling

interests | | |

Total

equity | |

| | |

Thousands | | |

Thousands | | |

Thousands | | |

Thousands | | |

Thousands | | |

Thousands | | |

Thousands | | |

Thousands | | |

Thousands | |

| | |

USD | | |

USD | | |

USD | | |

USD | | |

USD | | |

USD | | |

USD | | |

USD | | |

USD | |

| For

the three months ended September 30, 2024: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance

as of Jun 30, 2024 | |

| 405,690 | | |

| 1,301,022 | | |

| (726 | ) | |

| (167,651 | ) | |

| 1,252 | | |

| (669,950 | ) | |

| 869,637 | | |

| 618 | | |

| 870,255 | |

| Investment

of non-controlling party in subsidiary | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 616 | | |

| 616 | |

| Loss

for the period | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (8,346 | ) | |

| (8,346 | ) | |

| (294 | ) | |

| (8,640 | ) |

| Other

comprehensive gain for the period | |

| — | | |

| — | | |

| — | | |

| — | | |

| 1,386 | | |

| — | | |

| 1,386 | | |

| 25 | | |

| 1,411 | |

| Exercise

of warrants, options and vesting of RSUs | |

| 1,648 | | |

| (1,648 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Share-based

payments | |

| — | | |

| 3,958 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 3,958 | | |

| — | | |

| 3,958 | |

Balance

as of

September 30, 2024 | |

| 407,338 | | |

| 1,303,332 | | |

| (726 | ) | |

| (167,651 | ) | |

| 2,638 | | |

| (678,296 | ) | |

| 866,635 | | |

| 965 | | |

| 867,600 | |

Consolidated Statements

of Cash Flows (Unaudited)

(In thousands of USD)

| | |

Nine Months Ended

September 30, | | |

Three Months Ended

September 30, | | |

Year Ended

December 31, | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Cash flow from operating activities: | |

| | |

| | |

| | |

| | |

| |

| Net loss | |

| (54,320 | ) | |

| (87,863 | ) | |

| (66,873 | ) | |

| (8,640 | ) | |

| (55,660 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation | |

| 4,551 | | |

| 4,961 | | |

| 1,588 | | |

| 1,530 | | |

| 6,544 | |

| Financing income, net | |

| (26,675 | ) | |

| (30,165 | ) | |

| (9,053 | ) | |

| (12,325 | ) | |

| (46,281 | ) |

| (Loss) gain from revaluation of financial liabilities accounted at fair value | |

| 468 | | |

| (9 | ) | |

| (17 | ) | |

| (42 | ) | |

| 461 | |

| Loss (gain) from revaluation of financial assets accounted at fair value | |

| (16,967 | ) | |

| 57,880 | | |

| 40,234 | | |

| 776 | | |

| (23,462 | ) |

| Loss (gain) from disposal of property plant and equipment and right-of-use assets | |

| 333 | | |

| 72 | | |

| (12 | ) | |

| 66 | | |

| 326 | |

| Increase in deferred tax | |

| (95 | ) | |

| — | | |

| — | | |

| — | | |

| (11 | ) |

| Share-based payments | |

| 15,810 | | |

| 10,791 | | |

| 4,268 | | |

| 3,958 | | |

| 20,101 | |

| Other | |

| 121 | | |

| 116 | | |

| 53 | | |

| 42 | | |

| 164 | |

| | |

| (22,454 | ) | |

| 43,646 | | |

| 37,061 | | |

| (5,995 | ) | |

| (42,158 | ) |

| Changes in assets and liabilities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| (Increase) decrease in inventory | |

| (3,253 | ) | |

| (1,609 | ) | |

| (2,041 | ) | |

| 290 | | |

| (340 | ) |

| Decrease (increase) in other receivables | |

| 1,659 | | |

| 6,238 | | |

| 990 | | |

| 393 | | |

| (5,775 | ) |

| (Increase) decrease in trade receivables | |

| (3,951 | ) | |

| 217 | | |

| 2,088 | | |

| 214 | | |

| (5,603 | ) |

| Increase (decrease) in other payables | |

| 2,908 | | |

| (3,930 | ) | |

| 4,253 | | |

| (151 | ) | |

| 4,856 | |

| Decrease in employee benefits | |

| (992 | ) | |

| (282 | ) | |

| (593 | ) | |

| (414 | ) | |

| (1,478 | ) |

| Increase (decrease) in trade payables | |

| 4,742 | | |

| (1,015 | ) | |

| 5,570 | | |

| 395 | | |

| 1,089 | |

| | |

| 1,113 | | |

| (381 | ) | |

| 10,267 | | |

| 727 | | |

| (7,251 | ) |

| Net cash used in operating activities | |

| (75,661 | ) | |

| (44,598 | ) | |

| (19,545 | ) | |

| (13,908 | ) | |

| (105,069 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash flow from investing activities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Change in bank deposits | |

| (37,016 | ) | |

| (7,563 | ) | |

| 114,375 | | |

| (12,975 | ) | |

| (189,060 | ) |

| Interest received | |

| 29,804 | | |

| 32,835 | | |

| 11,806 | | |

| 10,120 | | |

| 41,529 | |

| Change in restricted bank deposits | |

| (38 | ) | |

| (11 | ) | |

| (4 | ) | |

| 14 | | |

| (27 | ) |

| Acquisition of property plant and equipment | |

| (9,066 | ) | |

| (1,659 | ) | |

| (1,945 | ) | |

| (490 | ) | |

| (9,098 | ) |

| Acquisition of intangible asset | |

| (1,524 | ) | |

| (711 | ) | |

| (1,524 | ) | |

| — | | |

| (1,524 | ) |

| Payment of a liability for contingent consideration in a business combination | |

| (9,255 | ) | |

| — | | |

| — | | |

| — | | |

| (9,255 | ) |

| Other | |

| — | | |

| — | | |

| — | | |

| — | | |

| 835 | |

| Net cash from (used in) investing activities | |

| (27,095 | ) | |

| 22,891 | | |

| 122,708 | | |

| (3,331 | ) | |

| (166,600 | ) |

| Cash flow from financing activities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Lease payments | |

| (3,640 | ) | |

| (3,458 | ) | |

| (1,169 | ) | |

| (1,152 | ) | |

| (4,823 | ) |

| Repayment long-term bank debt | |

| (193 | ) | |

| (143 | ) | |

| (97 | ) | |

| (36 | ) | |

| (536 | ) |

| Proceeds from non-controlling interests | |

| 550 | | |

| 555 | | |

| — | | |

| 555 | | |

| 1,089 | |

| Amounts recognized in respect of government grants liability | |

| (225 | ) | |

| (137 | ) | |

| (53 | ) | |

| (36 | ) | |

| (298 | ) |

| Payments of share price protection recognized in business combination | |

| (1,780 | ) | |

| (363 | ) | |

| — | | |

| — | | |

| (4,459 | ) |

| Repurchase of treasury shares | |

| (85,726 | ) | |

| (69,755 | ) | |

| (65,985 | ) | |

| — | | |

| (96,387 | ) |

| Net cash used in financing activities | |

| (91,014 | ) | |

| (73,301 | ) | |

| (67,304 | ) | |

| (669 | ) | |

| (105,414 | ) |

| Increase (decrease) in cash and cash equivalent s | |

| (193,770 | ) | |

| (95,008 | ) | |

| 35,859 | | |

| (17,908 | ) | |

| (377,083 | ) |

| Cash and cash equivalents at beginning of the period | |

| 685,362 | | |

| 309,571 | | |

| 454,555 | | |

| 231,777 | | |

| 685,362 | |

| Effect of exchange rate fluctuations on cash | |

| (2,269 | ) | |

| (903 | ) | |

| (1,091 | ) | |

| (209 | ) | |

| 1,292 | |

| Cash and cash equivalents at end of the period | |

| 489,323 | | |

| 213,660 | | |

| 489,323 | | |

| 213,660 | | |

| 309,571 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-cash transactions: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Intangible asset acquired on credit | |

| — | | |

| — | | |

| — | | |

| — | | |

| 711 | |

| Property plant and equipment acquired on credit | |

| 410 | | |

| 124 | | |

| 82 | | |

| 124 | | |

| 214 | |

| Repurchase of treasury shares on credit | |

| 2,140 | | |

| — | | |

| (1,378 | ) | |

| — | | |

| — | |

| Recognition of a right-of-use asset | |

| 199 | | |

| 1,215 | | |

| — | | |

| 992 | | |

| 929 | |

Non-IFRS Measures

The following are reconciliations of income

before taxes, as calculated in accordance with International Financial Reporting Standards (“IFRS”), to EBITDA and Adjusted

EBITDA, as well as of gross profit, as calculated in accordance with IFRS, to Adjusted Gross Profit:

| | |

For the

Nine-Months

Period Ended September 30,

2023 | | |

For the

Nine-Months

Period Ended

September 30,

2024 | | |

For the

Three-Month

Period Ended

September 30,

2023 | | |

For the

Three-Months

Period Ended

September 30,

2024 | |

| | |

In thousands of USD | | |

In thousands of USD | |

| Net loss | |

| (54,320 | ) | |

| (87,863 | ) | |

| (66,873 | ) | |

| (8,640 | ) |

| Tax expenses (benefits) | |

| (121 | ) | |

| 78 | | |

| (273 | ) | |

| (47 | ) |

| Depreciation | |

| 4,551 | | |

| 4,961 | | |

| 1,588 | | |

| 1,530 | |

| Interest income | |

| (34,575 | ) | |

| (32,481 | ) | |

| (11,008 | ) | |

| (10,635 | ) |

| EBITDA (loss) | |

| (84,465 | ) | |

| (115,305 | ) | |

| (76,566 | ) | |

| (17,792 | ) |

| Finance expenses (income) from revaluation of assets and liabilities | |

| (16,139 | ) | |

| 57,527 | | |

| 40,160 | | |

| 31 | |

| Exchange rate differences | |

| 7,490 | | |

| 2,297 | | |

| 2,015 | | |

| (1,011 | ) |

| Share-based payments expenses | |

| 15,810 | | |

| 10,791 | | |

| 4,268 | | |

| 3,958 | |

| Other extraordinary income | |

| — | | |

| (115 | ) | |

| — | | |

| — | |

| Adjusted EBITDA (loss) | |

| (77,304 | ) | |

| (44,505 | ) | |

| (30,123 | ) | |

| (14,814 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 18,430 | | |

| 20,142 | | |

| 5,369 | | |

| 7,156 | |

| Depreciation | |

| 275 | | |

| 309 | | |

| 89 | | |

| 125 | |

| Share-based payments expenses | |

| 1,189 | | |

| 687 | | |

| 377 | | |

| 225 | |

| Adjusted gross profit | |

| 19,894 | | |

| 21,138 | | |

| 5,835 | | |

| 7,506 | |

| | |

For the

Nine-Months

Period Ended

September 30,

2023 | | |

For the

Nine-Month

Period Ended

September 30,

2024 | | |

For the

Three-Months

Period Ended

September 30,

2023 | | |

For the

Three-Months

Period Ended

September 30,

2024 | |

| | |

In thousands of USD | | |

In thousands of USD | |

| Change in cash, cash equivalents and deposits | |

| (159,352 | ) | |

| (90,807 | ) | |

| (81,731 | ) | |

| (3,082 | ) |

| Repurchase of treasury shares | |

| 85,726 | | |

| 69,755 | | |

| 65,985 | | |

| - | |

| Net Cash Burn | |

| (73,626 | ) | |

| (21,052 | ) | |

| (15,746 | ) | |

| (3,082 | ) |

| | |

For the

Nine-Months Period Ended

September 30,

2023 | | |

For the

Nine-Months

Period Ended

September 30,

2024 | | |

For the

Three-Month

Period Ended

September 30,

2023 | | |

For the

Three-Months

Period Ended

September 30,

2024 | |

| | |

In thousands of USD | | |

In thousands of USD | |

| Loss for the period | |

| (54,320 | ) | |

| (87,863 | ) | |

| (66,873 | ) | |

| (8,640 | ) |

| Gain (loss) from revaluation of the investment in Stratasys shares | |

| 16,966 | | |

| (57,880 | ) | |

| (40,325 | ) | |

| (776 | ) |

| Net Loss excluding changes in Company’s holdings in Stratasys shares | |

| (71,286 | ) | |

| (29,983 | ) | |

| (26,638 | ) | |

| (7,864 | ) |

EBITDA is a non-IFRS measure and is defined

as income before taxes, excluding depreciation and amortization expenses and interest income. We believe that EBITDA, as described above,

should be considered in evaluating the Company’s operations. EBITDA facilitates the Company’s performance comparisons from

period to period and company to company by backing out potential differences caused by variations in capital structures, and the age and

depreciation charges and amortization of fixed and intangible assets, respectively (affecting relative depreciation and amortization expense,

respectively), and EBITDA is useful to an investor in evaluating our operating performance because it is widely used by investors, securities

analysts and other interested parties to measure a company’s operating performance without regard to the items mentioned above.

Adjusted EBITDA is a non-IFRS measure and

is defined as earnings before other financial income, income tax, depreciation and amortization, share-based payments and other extraordinary

income, net, which consists of additional compensation for damaged fixed assets. Other financial expenses (income), net includes exchange

rate differences as well as finance income or revaluation of assets and liabilities. We believe that Adjusted EBITDA, as described above,

should also be considered in evaluating the company’s operations. Like EBITDA, Adjusted EBITDA facilitates operating performance

comparisons from period to period and company to company by backing out potential differences caused by variations in capital structures

(affecting other financial expenses (income), net), and the age and depreciation charges and amortization of fixed and intangible assets,

respectively (affecting relative depreciation and amortization expense, respectively), as well as from share-based payment expenses, and

Adjusted EBITDA is useful to an investor in evaluating our operating performance because it is widely used by investors, securities analysts

and other interested parties to measure a company’s operating performance without regard to non-cash items, such as expenses related

to share-based payments.

Adjusted gross profit, excluding depreciation

and amortization and share-based compensation expenses, is a non-IFRS measure and is defined as gross profit excluding amortization expenses.

We believe that adjusted gross profit, as described above, should also be considered in evaluating the Company’s operations. Adjusted

gross profit facilitates gross profit and gross margin comparisons from period to period and company to company by backing out potential

differences caused by variations in amortization of inventory and intangible assets. Adjusted gross profit is useful to an investor in

evaluating our performance because it enables investors, securities analysts and other interested parties to measure a company’s

performance without regard to non-cash items, such as amortization expenses. Adjusted gross margin is calculated by dividing the adjusted

gross profit by the revenues.

EBITDA, Adjusted EBITDA, and Adjusted gross

profit do not represent cash generated by operating activities in accordance with IFRS and should not be considered alternatives to net

income (loss) as indicators of our operating performance or as measures of our liquidity. These measures should be considered in conjunction

with net income (loss) as presented in our consolidated statements of profit or loss and other comprehensive income. Other companies may

calculate these measures differently than we do.

Net Loss excluding changes in Company’s

holdings in Stratasys’ shares. We believe that by excluding the value of the Company’s holdings in Stratasys’ shares

we neutralize the volatility of these shares and provide investors an additional measurement to evaluate the operating performance of

the Company and its liquidity. This measurement should not be considered as an alternative to net income (loss) as an indicator of our

operating performance or as a measure of our liquidity. This measurement should be considered in conjunction with net income (loss) as

presented in our consolidated statements of profit or loss and other comprehensive income.

Net cash burn is a non-IFRS measure and defined

as the change in cash, cash equivalents and deposits net of treasury shares repurchase and Stratasys shares. We believe that net cash

burn, as described above, should be considered in evaluating the Company’s financial strength. Net cash burn gives a sense of how

our use of cash and cash flow has changed overtime.

Exhibit 99.2

© 2024Nano Dimension. All Rights Reserved. Nano Dimension Leading Manufacturing into the Future 3 rd Quarter 2024 Results & Earnings Call Yoav Stern, CEO & Member of the Board Tomer Pinchas, CFO & COO Julien Lederman, VP Corporate Development November 20 th , 2024

© 2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 2 Forward Looking Statements Forward - Looking Statements This presentation contains forward - looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and other Federal securities laws . Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward - looking statements . Because such statements deal with future events and are based on Nano Dimension Ltd . (“Nano Dimension”), Desktop Metal Ltd . (“Desktop Metal”) and Markforged Ltd . (“Markforged”) current expectations, they are subject to various risks and uncertainties, and actual results, performance or achievements of Nano Dimension could differ materially from those described in or implied by the statements in this presentation . The acquisitions of Desktop Metal and Markforged are subject to closing conditions, some of which are beyond the control of Nano Dimension, Desktop Metal or Markforged . For example, Nano Dimension is using forward - looking statements when it discusses benefits and advantages of the proposed transactions with Markforged and Desktop Metal, including the timing thereof, and the combined company, the combined company’s revenues and cash and Nano Dimension’s M&A strategy . The forward - looking statements contained or implied in this presentation are subject to other risks and uncertainties, including those discussed under the heading “Risk Factors” in Nano Dimension’s Annual Report on Form 20 - F filed with the Securities and Exchange Commission (“SEC”) on March 21 , 2024 , and in any subsequent filings with the SEC . The combined company financial information included in this presentation has not been audited or reviewed by Nano Dimension’s auditors and such information is provided for illustrative purposes only . Except as otherwise required by law, Nano Dimension undertakes no obligation to publicly release any revisions to these forward - looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events . References and links to websites have been provided as a convenience, and the information contained on such websites is not incorporated by reference into this presentation . Nano Dimension is not responsible for the contents of third - party websites . No Offer or Solicitation This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended .

© 2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 3 Forward Looking Statements ( Con’t .) Additional Information about the Transaction and Where to Find It In connection with the proposed transaction, Markforged filed a definitive proxy statement with the SEC on November 13 , 2024 . Markforged may also file other relevant documents with the SEC regarding the proposed transaction . This document is not a substitute for the proxy statement or any other document that Markforged may file with the SEC . The definitive proxy statement has been mailed to shareholders of Markforged . INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION . Investors and security holders will be able to obtain free copies of the proxy statement and other documents containing important information about Markforged and the proposed transaction, at the website maintained by the SEC at http : //www . sec . gov . Copies of the documents filed with the SEC by Markforged will be available free of charge on Markforged’s website at https : //investors . markforged . com/sec - filings . Participants in the Solicitation Nano Dimension, Markforged and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Markforged shareholders in respect of the proposed transaction . Information about the directors and executive officers of Nano Dimension, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Nano Dimension’s Annual Report on Form 20 - F for the fiscal year ended December 31 , 2023 , which was filed with the SEC on March 21 , 2024 . Information about the directors and executive officers of Markforged, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Markforged’s proxy statement for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on April 26 , 2024 , and Markforged’s Annual Report on Form 10 - K for the fiscal year ended December 31 , 2023 , which was filed with the SEC on March 15 , 2024 . Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the proxy statement and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available . Investors should read the proxy statement carefully before making any voting or investment decisions . You may obtain free copies of these documents from Nano Dimension or Markforged using the sources indicated above .

© 2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 4 Headline financials ▪ $15M Revenue – Best 3 rd quarter ever ▪ Up 22% over Q3/2023 ▪ 48% Gross margin (IFRS) ▪ Up from 44% in Q3/2023 ▪ 51% Adj. Gross margin (non - IFRS) 1 ▪ Up from 48% in Q3/2023 ▪ $3M Net cash burn 2 ▪ Down from $16M in Q3/2023 Highlights for the Quarter Business updates ▪ Acquisition announcements of Desktop Metal (NYSE: DM) and Markforged (NYSE: MKFG) ▪ Notable sales to Applied Materials, University of Dayton, and a leading aerospace & defense company ▪ Annual General Meeting (AGM) to be held December 6 th , 2024 ▪ Vote cut - off is December 1 st , 2024 Strongest Q3 Revenue in History Along with Transformational M&A 1. See reconciliation of IFRS to non - IFRS financial measures on slide 15 2. See reconciliation of net cash burn o n slide 16

© 2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 5 Prudent Management Translating to Financial Strength Continued Shift from Building Scale to Margins and Cash Usage 44% 48% 48% 51% Gross margins Q3/23 Q3/24 $16M $3M Net cash burn Q3/23 Q3/24 $12M $15M Revenue Q3/23 Q3/24 GAAP Non - GAAP (Adjusted)

© 2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 6 Customer Highlights Driving Innovation in Advanced Digital Manufacturing Tier 1 customer success Working with a leader in electronics manufacturing Driving innovation Closing working to enable cutting edge research Continued support of national security Closely aligned with Western aerospace & defense

© 2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 7 From a Niche Player to an Additive Manufacturing Leader The New Nano Dimension We have Built Tech Inkjet x Apps Electronics x Technologies with 1000+ Patents FDM DLP Binder jet Inkjet x x x x Applications & Materials Micro polymer Polymer Metal casting Metal Electronics Composite Ceramic x x x x x x x April 2021 Before After

© 2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 8 The Right Deals at the Right Time Transformational M&A at Exceptional Value 0.0x 5.0x 10.0x 15.0x 20.0x 25.0x 30.0x 35.0x 40.0x Sep-21 Jan-22 May-22 Sep-22 Jan-23 May-23 Sep-23 Jan-24 May-24 Sep-24 Acquisition Multiple: 0.9x Acquisition Multiple: 1.3x 1 3 - Year LTM Revenue Multiples of Nano's Acquisitions • Our M&A strategy is committed to creating long - term value for shareholders by prioritizing ROI • During the market highs of 2021 into 2022, we made limited acquisitions and demonstrated patience • The average LTM r evenue m ultiple paid for Desktop Metal and Markforged is 1.1x Source: Management, FactSet, press releases, and public filings. 1) Assumes the average of maximum expected total consideration of $183m and minimum total consideration of $135m to be paid for Des ktop Metal, per public filings.

© 2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 9 $35M $77M $80M $340M $488M $628M $2M $3M $1M $475M ($19M) $151M 0 Scale and Continued Capital Strength Cements Nano Leadership + + = Pro Forma 2023 Revenue Build 1 Old New 1) Pro Forma revenue calculated using 2023A figures, per public filings. 2) 2023 annual peer revenue figures per year - end public filings. Cash & cash equivalents and marketable securities net of long - term debt figures per latest publicly available data. Assumes EUR/USD exchange rate of $1.0651 as of November 11, 2024. New Nano Dimension Asserts Itself as an Industry Leader Amongst Peers 2 New Pro Forma 2023E Revenue PF Cash & Cash Equiv. Revenue Cash and Cash Equivalents, Net of Debt ($19M)

© 2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 10 © 2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 10 Vote FOR our Board and Proposals! Protect Your Investment! EXECUTING A FOCUSED VALUE CREATION STRATEGY PROMISES MADE. PROMISES DELIVERED. MURCHINSON HAS NO STRATEGY AND SEEKS TO DEPRIVE SHAREHOLDERS OF LONG - TERM VALUE CREATION OPPORTUNITY NANO'S LEADERSHIP AND BOARD OF DIRECTORS DRIVING OUR PROGRESS 1 2 3 4

© 2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 11 VOTE “FOR” all of Nano’s Proposals AGM to be Held Friday, December 6th, 2024 with Voting Cut - Off on Sunday, December 1st, 2024 at 11:59 p.m. ET Your vote is important. Voting is easy – you can use any of the methods by following the instructions on your voting instruction form: ELECTRONIC Locate the control number included on your voting instruction form and follow the easy instructions indicated. MAIL Mark, sign and date your voting instruction form and return it in the postage - paid envelope provided. If you vote electronically, you do not need to return your voting instruction form by mail. E - MAIL If you received your proxy materials via e - mail, you can click the “VOTE NOW” button in the body of the e - mail.

© 2024Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 12 Q&A

© 2024Nano Dimension. All Rights Reserved. Appendix

© 2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 14 Reconciliation for Non - IFRS Measures EBITDA is a non - IFRS measure and is defined as income before taxes, excluding depreciation and amortization expenses and amortiz ation of assets recognized in business combination and interest income. We believe that EBITDA, as described above, should be considered in evaluating the Com pany’s operations. EBITDA facilitates the Company’s performance comparisons from period to period and company to company by backing out potential diffe ren ces caused by variations in capital structures, and the age and depreciation charges and amortization of fixed and intangible assets, respectively (affecting rel ati ve depreciation and amortization expense, respectively), and EBITDA is useful to an investor in evaluating our operating performance because it is widely used by inves tor s, securities analysts and other interested parties to measure a company’s operating performance without regard to the items mentioned above. Adjusted EBITDA is a non - IFRS measure and is defined as income before taxes, excluding depreciation and amortization expenses, i nterest income, finance income for revaluation of assets and liabilities, exchange rate differences and share - based payments. We believe that Adjusted EBITDA, as d escribed above, should also be considered in evaluating the Company’s operations. Like EBITDA, Adjusted EBITDA facilitates the Company’s performance compari son s from period to period and company to company by backing out potential differences caused by variations in capital structures, and the age and depreciat ion charges and amortization of fixed and intangible assets, respectively (affecting relative depreciation and amortization expense, respectively), as well as from rev alu ation of assets and liabilities, exchange rate differences and share - based payment expenses. Adjusted EBITDA is useful to an investor in evaluating our operating performance b ecause it is widely used by investors, securities analysts and other interested parties to measure a company’s operating performance without regard to no n - c ash items, such as expenses related to revaluation, exchange rate differences and share - based payments. Adjusted gross profit, excluding depreciation and amortization and share - based payments expenses, is a non - IFRS measure and is d efined as gross profit excluding amortization expenses. We believe that adjusted gross profit, as described above, should also be considered in evaluating the Co mpany’s operations. Adjusted gross profit facilitates gross profit and gross margin comparisons from period to period and company to company by backing out pote nti al differences caused by variations in amortization of inventory and intangible assets. Adjusted gross profit is useful to an investor in evaluating our performance be cause it enables investors, securities analysts and other interested parties to measure a company’s performance without regard to non - cash items, such as amortization expenses. Adjusted gross margin is calculated by dividing the adjusted gross profit by the revenues. EBITDA, Adjusted EBITDA, and Adjusted gross profit do not represent cash generated by operating activities in accordance with IF RS and should not be considered alternatives to net income (loss) as indicators of our operating performance or as measures of our liquidity. These measures sho uld be considered in conjunction with net income (loss) as presented in our consolidated statements of profit or loss and other comprehensive income. Other companies m ay calculate these measures differently than we do. Net cash burn is a non - IFRS measure and defined as the change in cash, cash equivalents and deposits net of treasury shares repu rchase and Stratasys shares. We believe that net cash burn, as described above, should be considered in evaluating the Company’s financial strength. Net cash bu rn gives a sense of how our use of cash and cash flow has changed overtime.

© 2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 15 Reconciliation for Non - IFRS Measures The following are reconciliations of income before taxes, as calculated in accordance with International Financial Reporting Standards (“IFRS”), to EBITDA and Adjusted EBITDA, as well as of gross profit, as calculated in accordance with IFRS, to Adju ste d Gross Profit. See full reconciliation and explanation in Q3 2024 Nano Dimension press release published November 20 th , 2024 Q3 2024 Q3 2023 Amounts in thousands of USD (8,640) (66,873) Net loss (47) (273) Tax benefits 1,530 1,588 Depreciation (10,635) (11,008) Interest income (17,792) (76,566) EBITDA (loss) 31 40,160 Finance expenses from revaluation of assets and liabilities (1,011) 2,015 Exchange rate differences 3,958 4,268 Share - based payments expenses (14,814) (30,123) Adjusted EBITDA (loss) Q3 2024 Q3 2023 Amounts in thousands of USD 7,156 5,369 Gross profit 125 89 Depreciation 225 377 Share - based payments expenses 7,506 5,835 Adjusted gross profit

© 2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 16 Amounts in thousands of USD Key Metrics Q3 2024 Cash Flow Balance Sheet Income Statement Q3 2024 Q3 2023 Q3 2024 Q3 2023 Q3 2024 Q3 2023 (3,082) (81,731) Change in cash, cash equivalents and deposits 908,123 1,073,067 Total Assets 14,856 12,158 Total Revenue - 65,985 Treasury shares repurchase 40,523 50,924 Total Liabilities 7,506 5,835 Adjusted Gross Profit 1 (3,082) (15,746) Net Cash Burn 2 867,600 1,022,143 Total Equity 51% 48% Adjusted Gross Margin ( 14,814 ) ( 30,123 ) Adjusted EBITDA (loss)

© 2024Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 17 Thank you

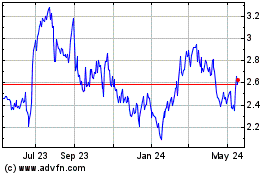

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Jan 2025 to Feb 2025

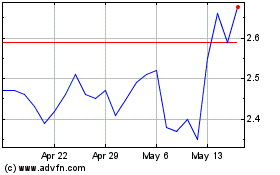

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Feb 2024 to Feb 2025