Inotiv, Inc. (Nasdaq: NOTV) (the “Company”, “We”, “Our” or

“Inotiv”), a leading contract research organization

specializing in nonclinical and analytical drug discovery and

development services and research models and related products and

services, today announced financial results for the three months

(“Q2 FY 2023”) and six months (“YTD FY 2023”) ended March 31, 2023.

Financial Highlights

Q2 FY 2023 Highlights

- Revenue grew to $151.5 million in

Q2 FY 2023 from $140.3 million during the three months ended March

31, 2022 (“Q2 FY 2022”), driven by a $7.9 million, or 20.2%,

increase in Discovery and Safety Assessment (“DSA”) revenue and a

$3.3 million, or 3.3%, increase in Research Models and Services

(“RMS”) revenue.

- Consolidated net loss for Q2 FY

2023 was $(9.6) million, or (6.4)% of total revenue, compared to

consolidated net loss of $(6.7) million, or (4.7)% of total

revenue, in Q2 FY 2022.

- Adjusted EBITDA1 was $17.1 million,

or 11.3% of total revenue, compared to $25.3 million, or 18.0% of

total revenue, in Q2 FY 2022.

- Book-to-bill ratio was 0.95x for

the DSA services business.

- DSA backlog was $145.7 million, up

from $133.6 million at March 31, 2022.

YTD FY 2023 Highlights

- Revenue grew to $274.2 million in

YTD FY 2023 from $224.5 million during the six months ended March

31, 2022 (“YTD FY 2022”), driven by a $16.2 million, or 22.5%,

increase in DSA revenue and a $33.5 million, or 22.0%, increase in

RMS revenue.

- Consolidated net loss for YTD FY

2023 was $(96.6) million, or (35.2)% of total revenue, compared to

consolidated net loss of $(90.1) million, or (40.1)% of total

revenue, in YTD FY 2022. The YTD FY 2023 consolidated net loss

included a $66.4 million non-cash goodwill impairment charge

related to our RMS segment.

- Adjusted EBITDA1 was $11.6 million,

or 4.2% of total revenue, compared to $35.3 million, or 15.7% of

total revenue, in YTD FY 2022.

- Book-to-bill ratio was 0.98x for

the DSA services business.

1 This is a non-GAAP financial measure. Refer to “Non-GAAP

to GAAP Reconciliation” in this release for further

information.

Updating Select Financial Guidance for

the Full Fiscal Year Ending September 30, 2023 (“FY

2023”)

The Company's guidance takes into account a number of factors,

including existing DSA backlog, current sales pipeline, trends in

cancellations and delays, trends in pricing, the impact of new

products and services and efficiency initiatives including the

recent and planned facility consolidations in the U.S. and

globally. In addition, the guidance presented below represents the

Company’s best efforts to estimate the impact of the NHP supply

disruption that was identified and disclosed in the first quarter

of fiscal 2023. For FY 2023, we are confirming guidance of at least

$580 million of revenue and capital expenditures of no more than 5%

of revenue during FY 2023. However, as a result of the increased

legal and third party fees incurred during YTD FY 2023, we are

updating our guidance for Adjusted EBITDA to at least $70 million

down from previous guidance of $75 million. We continue to expect

that we will remain in compliance with our financial covenants for

FY 2023.

Management Commentary

Robert Leasure Jr., President and Chief

Executive Officer, commented, “We are very pleased with the pace

and progress of our integration and site optimization initiatives,

the growth we are achieving in new service lines, and the overall

positive returns being delivered by the investments we have made in

expanding our business over the last 12 to 18 months. We also

continue to address the current NHP supply disruption issues in the

U.S., which includes establishing procedures aimed at providing

additional assurances that future NHP imports are purpose-bred, and

pursuing alternative sourcing to meet client demand.”

Mr. Leasure continued, “Our recent investments

have expanded our services for the drug discovery and development

industry. These new services, including expanded genetic toxicology

and safety pharmacology offerings, new biotherapeutics services,

and enhanced proteomic technologies, increase our ability to

support the development of important new therapeutics including

cell and gene therapies, allow us to improve speed to market for

our clients, expand our market and client base, and help to reduce

our outsourcing expenses. We believe the completion of these growth

and consolidation activities will improve our ability to increase

sales and enhance margins. I am grateful for the continuing support

of the Inotiv team as we collectively address both the challenges

and opportunities facing our business and industry while continuing

to deliver a high level of client service.”

Q2 FY 2023 Review

Revenue (in millions)

| |

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

Segment |

|

Q2 FY2023 |

|

|

Q2 FY2022 |

|

|

Difference |

|

|

%Change |

|

|

DSA |

|

$ |

47.0 |

|

|

$ |

39.1 |

|

|

$ |

7.9 |

|

|

|

+20.2 |

% |

| RMS |

|

$ |

104.5 |

|

|

$ |

101.2 |

|

|

$ |

3.3 |

|

|

|

+3.3 |

% |

| Total |

|

$ |

151.5 |

|

|

$ |

140.3 |

|

|

$ |

11.2 |

|

|

|

+8.0 |

% |

Higher total revenue was driven by a $7.9 million increase in

DSA revenue and a $3.3 million increase in RMS revenue. The

increase in the DSA revenue was primarily driven by increasing

revenue within the current operating structure. Additionally, we

are beginning to see increased revenue from genetic toxicology

services in connection with new business at our Rockville facility.

The increase in RMS revenue was due primarily to favorable pricing

across several products, particularly NHPs, partially offset by the

negative impact of lower volumes of NHP sales.

Gross Profit2 (in millions)

| |

|

(unaudited) |

|

|

|

|

|

(unaudited) |

|

|

|

|

|

Segment |

|

Q2 FY2023 |

|

|

% ofSegmentRevenue |

|

|

Q2 FY2022 |

|

|

%

ofSegmentRevenue |

|

|

DSA |

|

$ |

15.1 |

|

|

|

32.1 |

% |

|

$ |

12.3 |

|

|

|

31.5 |

% |

| RMS |

|

$ |

29.8 |

|

|

|

28.5 |

% |

|

$ |

32.4 |

|

|

|

32.0 |

% |

| Total |

|

$ |

44.9 |

|

|

|

29.6 |

% |

|

$ |

44.7 |

|

|

|

31.9 |

% |

2 excludes amortization of intangible assets

Higher total gross profit in Q2 FY 2023 was the

result of a $2.8 million increase in DSA gross profit from Q2 FY

2022, and a $2.6 million decrease in RMS gross profit from Q2 FY

2022. The increase in DSA gross profit as a percent of DSA revenue

was driven primarily by increasing sales within the current

operating structure. The decrease in RMS gross profit as a percent

of RMS revenue was primarily due to the mix of products sold,

inflationary pressure on product expenses, energy and wages and

some duplication of expenses as we transfer production to implement

our site optimization plans, partially offset by favorable pricing

for several different RMS product lines. Additionally, the Company

experienced favorable margin impacts from the site closures of our

Cumberland and Dublin, VA, facilities, which partially offset the

inflationary pressures described above.

Consolidated Net Loss

Consolidated net loss for Q2 FY 2023 was $(9.6) million compared

to consolidated net loss of $(6.7) million in Q2 FY 2022.

Consolidated net loss for Q2 FY 2023 included $13.0 million of

depreciation and amortization expense, an increase of $3.1 million

from Q2 FY 2022, and $1.8 million of stock compensation expense, an

increase of $0.6 million from Q2 FY 2022. Other increases in

operating expenses were driven by increases in general and

administrative (“G&A”) and other operating expenses, reflecting

the integration of previous acquisitions, increases in start-up

costs related to our Rockville facility, higher compensation

expense and higher legal and third party fees, among other costs.

Net loss for Q2 FY 2023 included $6.7 million in legal and third

party fees. Based on current information, we expect legal and third

party fees to be lower in the third quarter of fiscal 2023. The

Company also incurred $10.5 million of interest expense during Q2

FY 2023 as compared to $7.5 million in Q2 FY 2022.

YTD FY 2023 Review

Revenue (in millions)

| |

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

Segment |

|

YTD FY2023 |

|

|

YTD FY2022 |

|

|

Difference |

|

|

%Change |

|

|

DSA |

|

$ |

88.1 |

|

|

$ |

71.9 |

|

|

$ |

16.2 |

|

|

|

+22.5 |

% |

| RMS |

|

$ |

186.1 |

|

|

$ |

152.6 |

|

|

$ |

33.5 |

|

|

|

+22.0 |

% |

| Total |

|

$ |

274.2 |

|

|

$ |

224.5 |

|

|

$ |

49.7 |

|

|

|

+22.1 |

% |

Higher total revenue was driven by a $16.2 million increase in

DSA revenue and a $33.5 million increase in RMS revenue. The

increase in DSA revenue was primarily driven by additional YTD FY

2023 revenue generated from Integrated Laboratory Systems, LLC

(“ILS”), which was acquired on January 10, 2022, plus new services

related to genetic toxicicology and organic growth in general

toxicology services. The increase in the RMS revenue was due

primarily to favorable pricing, particularly NHPs, partially offset

by the negative impact of lower volumes of NHP sales. Additionally,

the increase in RMS revenue was impacted by the timing of

contributions from acquisitions. Envigo was acquired on November 5,

2021, RSI was acquired on December 29, 2021, and OBRC was acquired

on January 27, 2022. Gross

Profit2 (in millions)

| |

|

(unaudited) |

|

|

|

|

|

(unaudited) |

|

|

|

|

|

Segment |

|

YTD FY2023 |

|

|

% ofSegmentRevenue |

|

|

YTD FY2022 |

|

|

%

ofSegmentRevenue |

|

|

DSA |

|

$ |

28.2 |

|

|

|

32.0 |

% |

|

$ |

24.6 |

|

|

|

34.2 |

% |

| RMS |

|

$ |

38.4 |

|

|

|

20.6 |

% |

|

$ |

39.5 |

|

|

|

25.9 |

% |

| Total |

|

$ |

66.6 |

|

|

|

24.3 |

% |

|

$ |

64.1 |

|

|

|

28.6 |

% |

2 excludes amortization of intangible assets

Higher total gross profit in YTD FY 2023 was the

result of a $3.6 million increase in DSA gross profit from YTD FY

2022, and a $1.1 million decrease in RMS gross profit from YTD FY

2022. The decrease in DSA gross profit as a percent of DSA revenue

was primarily due to laboratory capacity investments and costs

associated with the successful recruitment of scientists in YTD FY

2023, to begin adding services and capacity, some of which became

available in Q2 FY 2023 and some of which we expect to become

available during the remainder of FY 2023. The decrease in RMS

gross profit as a percent of RMS revenue was primarily due to

significantly reduced margins in the first fiscal quarter of 2023

due to the mix of products sold and inflationary pressure on

product expenses, energy and wages and some duplication of expenses

as we transfer production to implement our site optimization plans,

partially offset by favorable pricing for several different RMS

product lines which were effective beginning in Q2 FY 2023, and

favorable margin impacts from the site closures of our Cumberland

and Dublin, VA, facilities.

Consolidated Net Loss

Consolidated net loss for YTD FY 2023 was $(96.6) million

compared to consolidated net loss of $(90.1) million in YTD FY

2022. Consolidated net loss for YTD FY 2023 included: a previously

announced $66.4 million non-cash goodwill impairment charge related

to our RMS segment; $26.3 million of depreciation and amortization

expense, an increase of $10.4 million from YTD FY 2022; and $3.8

million of stock compensation expense, a decrease of $21.2 million

from YTD FY 2022. Other increases in operating expenses were driven

by higher selling costs, primarily due to increased revenue, higher

G&A expenses, reflecting various acquisitions, higher legal,

audit and third party fees and higher start-up costs related to our

Rockville facility, among other costs. Net loss for YTD FY 2023

included $10.1 million in legal and third party fees. Based on

current information, we expect legal and third party fees to be

lower in the third quarter of fiscal 2023. Consolidated net loss

for YTD FY 2022 also included one-time charges of $56.7 million of

fair value remeasurement of the embedded derivative component of

the convertible notes issued in September 2021 and $23.0 million of

post combination stock compensation expense relating to the

adoption of the Envigo Equity Plan. Further, consolidated net loss

included $21.0 million of interest expense during YTD FY 2023, up

from $12.4 million in YTD FY 2022.

Cash Provided by Operating and Financing Activities and

Financial Condition

As of March 31, 2023, the Company had $24.6

million in cash and cash equivalents and no borrowings on its $15.0

million revolving credit facility. Total debt, net of debt issuance

costs, as of March 31, 2023, was $374.1 million. We were in

compliance with our debt covenants as of March 31, 2023. Cash

provided by operating activities was $5.4 million for YTD FY 2023,

compared to cash provided by operating activities of $4.0 million

for YTD FY 2022. For YTD FY 2023, capital expenditures totaled

$16.8 million.

Update on DSA and RMS

Activities

- The Company will

be co-locating and further integrating its genetically engineered

models and services (“GEMS”) business with its existing

Pharmacology, Toxicology, Pharmacokinetic and Laboratory Sciences

operations in St. Louis, MO, allowing colleagues with similar

skills and expertise to collaborate more closely. We expect the

completion of this project to occur in the third fiscal quarter of

2023, and upon completion we will eliminate the need for one of our

leased facilities in St Louis. The lease expires in July 2023 and

will not be renewed.

- Within its DSA business segment, the

Company’s Rockville, MD, site is now operational with GLP

biotherapeutics analytical and genetic toxicology capabilities; the

facility expansion in Boulder, CO, has been completed; and the

expansion activities at Fort Collins, CO, remain on track and are

expected to become operational by the end of FY 2023.

- Within its RMS

business segment, as previously announced during the first fiscal

quarter of 2023, the Company completed the shutdown of its

Cumberland and Dublin, VA, facilities and initiated a relocation of

its operations in Haslett, MI, and Boyertown, PA, to its newly

refurbished facility in Denver, PA. The facility closures in

Haslett and Boyertown were completed as planned in March 2023, and

these facilities have been listed for sale.

- In the first fiscal quarter of 2023,

the Company initiated the relocation of two RMS facilities in

Indianapolis, IN, which are expected to be completed by June 30,

2023.

- The relocation of the Company’s RMS

facility in France to recently updated operations in The

Netherlands is now underway, and we expect to have this process

completed by the end of June 2023.

- The Company has completed its

consultations with employee representatives to relocate its

Blackthorne, U.K., facility to operations in Hillcrest, U.K., and

currently expects this relocation to be completed during the third

quarter of fiscal 2024.

- In conjunction with these RMS

changes, the Company is reviewing alternatives and route

enhancements to our transportation system and has begun to initiate

changes, which we expect will result in a reduction in the number

of vehicles required, a reduction in energy consumption and its

associated greenhouse gas emissions, and ultimately a reduction in

transportation expenses while maintaining and improving our service

levels.

- The previously announced sale of the

Company’s Israel operations is still in process and is expected to

be completed within this fiscal year.

Subsequent Events:

The Company extended by one year the maturity of a $3.7 million

unsecured seller payable pursuant to the stock purchase agreement

(“SPA”) with Orient Bio, Inc. The unsecured seller payable, which

was originally due on July 27, 2023, is now due July 27, 2024. This

extension did not affect the rights and remedies of any party to

the SPA, nor alter, modify or amend or in any way affect any of the

terms and conditions, obligations, covenants or agreements

contained in the SPA.

On May 4, 2023, the Company announced the

expansion of its safety pharmacology offering with the validation

and verification of a cardiopulmonary telemetry study model in

cynomolgus macaques. Offered through Inotiv’s DSA business,

telemetry allows for the continuous observation of ECG, respiratory

rate and volume, blood pressure and other cardiovascular parameters

during preclinical safety studies.

Management will host a conference call on

Thursday, May 11, 2023, at 4:30 pm ET to discuss second quarter

results for fiscal year 2023.

Interested parties may participate in the call by dialing:

- (877) 407-9753 (Domestic)

- (201) 493-6739 (International)

The live conference call webcast will be accessible in the

Investors section of the Company’s web site and directly via the

following link:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=j0NY3Nu6

For those who cannot listen to the live broadcast, an online

replay will be available in the Investors section of Inotiv’s web

site

at: https://www.inotivco.com/investors/investor-information/.

Non-GAAP to GAAP

Reconciliation

This press release contains financial measures that are not

calculated in accordance with generally accepted accounting

principles in the United States (GAAP), including Adjusted EBITDA

and Adjusted EBITDA as a percentage of total revenue for the three

and six months ended March 31, 2023 and 2022 and selected business

segment information for those periods. Adjusted EBITDA as reported

herein refers to a financial measure that excludes from

consolidated net income (loss) statement of operations line items

interest expense and income tax (benefit) expense, as well as

non-cash charges for depreciation and amortization, stock

compensation expense, acquisition and integration costs, startup

costs, restructuring costs incurred in connection with the exit of

multiple facilities, unrealized foreign exchange gain/ loss, loss

on debt extinguishment, amortization of inventory step up,

loss/gain on disposition of assets, loss on fair value

remeasurement of convertible notes, other non-recurring third-party

costs and goodwill impairment loss. The adjusted business segment

information excludes from operating income and unallocated

corporate G&A these same expenses.

Adjusted EBITDA and Adjusted EBITDA margin

guidance for fiscal year 2023 and periods within the year are

provided on a non-GAAP basis. The Company cannot reconcile this

guidance to expected net income/loss or expected net income/loss

margin without unreasonable effort because certain items that

impact net income/loss and net income/loss margin are out of the

Company's control and/or cannot be reasonably predicted at this

time, which unavailable information could have a significant impact

on the Company’s GAAP financial results.

The Company believes that these non-GAAP

measures provide useful information to investors. Among other

things, they may help investors evaluate the Company’s ongoing

operations. They can assist in making meaningful period-over-period

comparisons and in identifying operating trends that would

otherwise be masked or distorted by the items subject to the

adjustments. Management uses these non-GAAP measures internally to

evaluate the performance of the business, including to allocate

resources. Investors should consider these non-GAAP measures as

supplemental and in addition to, not as a substitute for or

superior to, measures of financial performance prepared in

accordance with GAAP.

Management has chosen to provide this

supplemental information to investors, analysts, and other

interested parties to enable them to perform additional analyses of

our results and to illustrate our results giving effect to the

non-GAAP adjustments. Management strongly encourages investors to

review the Company's consolidated financial statements and publicly

filed reports in their entirety and cautions investors that the

non-GAAP measures used by the Company may differ from similar

measures used by other companies, even when similar terms are used

to identify such measures.

About the Company

Inotiv, Inc. is a leading contract research

organization dedicated to providing nonclinical and analytical drug

discovery and development services and research models and related

products and services. The Company’s products and services focus on

bringing new drugs and medical devices through the discovery and

preclinical phases of development, all while increasing efficiency,

improving data, and reducing the cost of taking new drugs to

market. Inotiv is committed to supporting discovery and development

objectives as well as helping researchers realize the full

potential of their critical R&D projects, all while working

together to build a healthier and safer world. Further information

about Inotiv can be found here: https://www.inotivco.com/.

This release contains forward-looking statements

that are subject to risks and uncertainties including, but not

limited to, risks and uncertainties related to the impact of recent

events related to NHP matters on the Company’s business,

operations, results, financial condition, cash flows, and assets,

the Company’s ability to comply with covenants under its credit

agreement, Company’s ability to reduce its legal and third party

fees, changes in the market and demand for the Company’s products

and services, the development, marketing and sales of products and

services, changes in technology, industry and regulatory standards,

the timing of acquisitions and the successful closing, integration

and business and financial impact thereof, governmental

regulations, inspections and investigations, claims, investigations

and litigation against or involving the Company, its business

and/or its industry, the impact of site closures and

consolidations, expansion and related efforts, and various other

market and operating risks, including those detailed in the

Company's filings with the U.S. Securities and Exchange

Commission.

|

Company Contact |

Investor Relations |

|

Inotiv, Inc. |

The Equity Group Inc. |

|

Beth A. Taylor, Chief Financial Officer |

Devin Sullivan |

|

(765) 497-8381 |

(212) 836-9608 |

|

btaylor@inotivco.com |

dsullivan@equityny.com |

|

INOTIV, INC.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS(In thousands, except per share

amounts)(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

March 31, |

|

March 31, |

| |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Service revenue |

$ |

58,752 |

|

|

$ |

49,584 |

|

|

$ |

108,800 |

|

|

$ |

87,760 |

|

| Product revenue |

|

92,711 |

|

|

|

90,729 |

|

|

|

165,417 |

|

|

|

136,764 |

|

|

Total revenue |

$ |

151,463 |

|

|

|

140,313 |

|

|

$ |

274,217 |

|

|

$ |

224,524 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of services provided (excluding amortization of intangible

assets) |

|

38,143 |

|

|

|

33,305 |

|

|

|

73,573 |

|

|

|

57,514 |

|

|

Cost of products sold (excluding amortization of intangible

assets) |

|

68,387 |

|

|

|

62,282 |

|

|

|

134,026 |

|

|

|

102,959 |

|

|

Selling |

|

4,758 |

|

|

|

4,647 |

|

|

|

9,265 |

|

|

|

7,385 |

|

|

General and administrative |

|

29,035 |

|

|

|

21,347 |

|

|

|

58,004 |

|

|

|

34,599 |

|

|

Amortization of intangible assets |

|

8,453 |

|

|

|

6,414 |

|

|

|

17,234 |

|

|

|

9,810 |

|

|

Other operating expense |

|

4,812 |

|

|

|

4,450 |

|

|

|

8,451 |

|

|

|

38,030 |

|

|

Goodwill impairment loss |

|

— |

|

|

|

— |

|

|

|

66,367 |

|

|

|

— |

|

| Operating income (loss) |

$ |

(2,125 |

) |

|

$ |

7,868 |

|

|

$ |

(92,703 |

) |

|

$ |

(25,773 |

) |

| Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(10,515 |

) |

|

|

(7,547 |

) |

|

|

(20,965 |

) |

|

|

(12,375 |

) |

|

Other expense (income) |

|

545 |

|

|

|

(139 |

) |

|

|

(1,333 |

) |

|

|

(57,866 |

) |

| (Loss) income before income

taxes |

$ |

(12,095 |

) |

|

$ |

182 |

|

|

$ |

(115,001 |

) |

|

$ |

(96,014 |

) |

| Income tax benefit

(expense) |

|

2,466 |

|

|

|

(6,846 |

) |

|

|

18,440 |

|

|

|

5,939 |

|

| Consolidated net loss |

$ |

(9,629 |

) |

|

$ |

(6,664 |

) |

|

$ |

(96,561 |

) |

|

$ |

(90,075 |

) |

|

Less: Net income (loss) attributable to noncontrolling

interests |

|

365 |

|

|

|

(577 |

) |

|

|

756 |

|

|

|

(941 |

) |

| Net loss attributable to

common shareholders |

$ |

(9,994 |

) |

|

$ |

(6,087 |

) |

|

$ |

(97,317 |

) |

|

$ |

(89,134 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Loss per common share |

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to

common shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

(0.39 |

) |

|

$ |

(0.24 |

) |

|

$ |

(3.79 |

) |

|

$ |

(3.84 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average number of

common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

25,687 |

|

|

|

25,315 |

|

|

|

25,645 |

|

|

|

23,197 |

|

|

INOTIV, INC.CONDENSED CONSOLIDATED

BALANCE SHEETS(In thousands, except share amounts) |

| |

|

|

|

|

|

| |

March 31, |

|

|

September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

| |

(Unaudited) |

|

|

|

| Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

24,596 |

|

|

$ |

18,515 |

|

|

Restricted cash |

|

— |

|

|

|

465 |

|

|

Trade receivables and contract assets, net of allowances for credit

losses of $7,523 and $6,268, respectively |

|

74,014 |

|

|

|

100,073 |

|

|

Inventories, net |

|

64,286 |

|

|

|

71,441 |

|

|

Prepaid expenses and other current assets |

|

40,479 |

|

|

|

42,483 |

|

|

Assets held for sale |

|

7,270 |

|

|

|

— |

|

|

Total current assets |

|

210,645 |

|

|

|

232,977 |

|

| |

|

|

|

|

|

| Property and equipment,

net |

|

188,496 |

|

|

|

186,199 |

|

| Operating lease right-of-use

assets, net |

|

42,014 |

|

|

|

32,489 |

|

| Goodwill |

|

94,286 |

|

|

|

157,825 |

|

| Other intangible assets,

net |

|

326,261 |

|

|

|

345,886 |

|

| Other assets |

|

6,964 |

|

|

|

7,524 |

|

|

Total assets |

$ |

868,666 |

|

|

$ |

962,900 |

|

| |

|

|

|

|

|

| Liabilities,

shareholders' equity and noncontrolling interest |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

30,114 |

|

|

$ |

28,695 |

|

|

Accrued expenses and other liabilities |

|

30,958 |

|

|

|

35,801 |

|

|

Revolving credit facility |

|

— |

|

|

|

15,000 |

|

|

Fees invoiced in advance |

|

55,196 |

|

|

|

68,642 |

|

|

Current portion of long-term operating lease |

|

10,061 |

|

|

|

7,982 |

|

|

Current portion of long-term debt |

|

4,023 |

|

|

|

7,979 |

|

|

Liabilities held for sale |

|

2,101 |

|

|

|

— |

|

|

Total current liabilities |

|

132,453 |

|

|

|

164,099 |

|

| Long-term operating leases,

net |

|

32,730 |

|

|

|

24,854 |

|

| Long-term debt, less current

portion, net of debt issuance costs |

|

370,040 |

|

|

|

330,677 |

|

| Other long-term

liabilities |

|

6,023 |

|

|

|

6,477 |

|

| Deferred tax liabilities,

net |

|

54,785 |

|

|

|

77,027 |

|

|

Total liabilities |

|

596,031 |

|

|

|

603,134 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Shareholders’ equity and

noncontrolling interest: |

|

|

|

|

|

|

Common shares, no par value: |

|

|

|

|

|

|

Authorized 74,000,000 shares at March 31, 2023 and at September 30,

2022; 25,759,107 issued and outstanding at March 31, 2023

and 25,598,289 at September 30, 2022 |

|

6,491 |

|

|

|

6,362 |

|

|

Additional paid-in capital |

|

711,591 |

|

|

|

707,787 |

|

|

Accumulated deficit |

|

(444,838 |

) |

|

|

(348,277 |

) |

|

Accumulated other comprehensive income (loss) |

|

702 |

|

|

|

(5,500 |

) |

| Total equity attributable to

common shareholders |

|

273,946 |

|

|

|

360,372 |

|

|

Noncontrolling interest |

|

(1,311 |

) |

|

|

(606 |

) |

|

Total shareholders’ equity and noncontrolling interest |

|

272,635 |

|

|

|

359,766 |

|

|

Total liabilities and shareholders’ equity and noncontrolling

interest |

$ |

868,666 |

|

|

$ |

962,900 |

|

|

INOTIV, INC.CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS(In thousands)(Unaudited) |

| |

|

|

|

|

|

| |

Six Months Ended |

| |

March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| Operating activities: |

|

|

|

|

|

|

Consolidated net loss |

$ |

(96,561 |

) |

|

$ |

(90,075 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities, net of acquisitions: |

|

|

|

|

|

|

Depreciation and amortization |

|

26,253 |

|

|

|

15,866 |

|

|

Employee stock compensation expense |

|

3,827 |

|

|

|

20,300 |

|

|

Changes in deferred taxes |

|

(21,303 |

) |

|

|

(1,907 |

) |

|

Provision for doubtful accounts |

|

1,333 |

|

|

|

381 |

|

|

Amortization of debt issuance costs and original issue

discount |

|

1,512 |

|

|

|

1,203 |

|

|

Noncash interest and accretion expense |

|

2,870 |

|

|

|

2,512 |

|

|

Loss on fair value remeasurement of embedded derivative |

|

— |

|

|

|

56,714 |

|

|

Other non-cash operating activities |

|

8 |

|

|

|

603 |

|

|

Goodwill impairment loss |

|

66,367 |

|

|

|

— |

|

|

Loss on debt extinguishment |

|

— |

|

|

|

878 |

|

|

Non-cash amortization of inventory fair value step-up |

|

427 |

|

|

|

6,277 |

|

|

Non-cash restructuring costs |

|

678 |

|

|

|

— |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Trade receivables and contract assets |

|

22,836 |

|

|

|

(8,926 |

) |

|

Inventories |

|

7,125 |

|

|

|

(14,688 |

) |

|

Prepaid expenses and other current assets |

|

1,862 |

|

|

|

(10,149 |

) |

|

Operating lease right-of-use assets and liabilities, net |

|

429 |

|

|

|

1,457 |

|

|

Accounts payable |

|

5,018 |

|

|

|

5,222 |

|

|

Accrued expenses and other liabilities |

|

(3,474 |

) |

|

|

(11,510 |

) |

|

Fees invoiced in advance |

|

(13,720 |

) |

|

|

28,402 |

|

|

Other asset and liabilities, net |

|

(61 |

) |

|

|

1,467 |

|

|

Net cash provided by operating activities |

|

5,426 |

|

|

|

4,027 |

|

| |

|

|

|

|

|

| Investing activities: |

|

|

|

|

|

|

Capital expenditures |

|

(16,840 |

) |

|

|

(15,202 |

) |

|

Proceeds from sale of equipment |

|

276 |

|

|

|

283 |

|

|

Cash paid in acquisitions |

|

— |

|

|

|

(288,702 |

) |

|

Net cash used in investing activities |

|

(16,564 |

) |

|

|

(303,621 |

) |

| |

|

|

|

|

|

| Financing activities: |

|

|

|

|

|

|

Payments of long-term debt |

|

— |

|

|

|

(37,746 |

) |

|

Payments of debt issuance costs |

|

(54 |

) |

|

|

(9,887 |

) |

|

Payments on promissory notes |

|

(1,454 |

) |

|

|

(763 |

) |

|

Payments on revolving credit facility |

|

(21,000 |

) |

|

|

(10,000 |

) |

|

Payments on senior term notes and delayed draw term loans |

|

(1,375 |

) |

|

|

(601 |

) |

|

Borrowings on construction loan |

|

— |

|

|

|

1,184 |

|

|

Borrowings on revolving loan facility |

|

6,000 |

|

|

|

10,000 |

|

|

Borrowings on delayed draw term loan |

|

35,000 |

|

|

|

35,000 |

|

|

Proceeds from exercise of stock options |

|

107 |

|

|

|

93 |

|

|

Proceeds from issuance of senior term notes |

|

— |

|

|

|

205,000 |

|

|

Payments on capex line of credit |

|

— |

|

|

|

(1,749 |

) |

|

Net cash provided by financing activities |

|

17,224 |

|

|

|

190,531 |

|

| |

|

|

|

|

|

| Effect of exchange rate changes

on cash and cash equivalents |

|

1,052 |

|

|

|

(392 |

) |

| |

|

|

|

|

|

| Net increase (decrease) in cash

and cash equivalents |

|

7,138 |

|

|

|

(109,455 |

) |

| Less: cash, cash equivalents, and

restricted cash held for sale |

|

(1,522 |

) |

|

|

— |

|

| Cash, cash equivalents, and

restricted cash at beginning of period |

|

18,980 |

|

|

|

156,924 |

|

| Cash, cash equivalents, and

restricted cash at end of period, net of cash, cash equivalents and

restricted cash held for sale |

$ |

24,596 |

|

|

$ |

47,469 |

|

| |

|

|

|

|

|

| Noncash financing activity: |

|

|

|

|

|

| Seller financed acquisition |

$ |

— |

|

|

$ |

6,325 |

|

| Paid in kind debt issuance

costs |

$ |

1,363 |

|

|

$ |

— |

|

| |

|

|

|

|

|

| Supplemental disclosure of cash

flow information: |

|

|

|

|

|

|

Cash paid for interest |

$ |

16,374 |

|

|

$ |

5,989 |

|

|

Income taxes paid, net |

$ |

3,952 |

|

|

$ |

614 |

|

|

INOTIV, INC.RECONCILIATION OF GAAP TO

NON-GAAP SELECT BUSINESS SEGMENT

INFORMATION(In thousands)(Unaudited) |

| |

|

|

|

|

| |

Three Months Ended |

|

|

Six Months Ended |

|

| |

March 31, |

|

|

March 31, |

|

| |

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

DSA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

47,023 |

|

|

|

39,054 |

|

|

|

88,116 |

|

|

|

71,879 |

|

| Operating income |

|

1,924 |

|

|

|

3,752 |

|

|

|

4,296 |

|

|

|

9,794 |

|

| Operating income as a % of

total revenue |

|

1.2 |

% |

|

|

2.7 |

% |

|

|

1.5 |

% |

|

|

4.4 |

% |

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

3,611 |

|

|

|

3,417 |

|

|

|

7,591 |

|

|

|

5,958 |

|

|

Restructuring costs |

|

97 |

|

|

|

- |

|

|

|

97 |

|

|

|

- |

|

|

Startup costs |

|

2,281 |

|

|

|

1,474 |

|

|

|

3,786 |

|

|

|

2,431 |

|

| Total non-GAAP adjustments to

operating income |

|

5,989 |

|

|

|

4,891 |

|

|

|

11,474 |

|

|

|

8,389 |

|

| Non-GAAP operating income |

|

7,913 |

|

|

|

8,643 |

|

|

|

15,770 |

|

|

|

18,183 |

|

| Non-GAAP operating income as a

% of DSA revenue |

|

16.8 |

% |

|

|

22.1 |

% |

|

|

17.9 |

% |

|

|

25.3 |

% |

| Non-GAAP operating income as a

% of total revenue |

|

5.2 |

% |

|

|

6.2 |

% |

|

|

5.8 |

% |

|

|

8.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| RMS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

104,440 |

|

|

|

101,259 |

|

|

|

186,101 |

|

|

|

152,645 |

|

| Operating income/(loss) |

|

12,725 |

|

|

|

22,562 |

|

|

|

(58,547 |

) |

|

|

22,642 |

|

| Operating income/(loss) as a %

of total revenue |

|

8.4 |

% |

|

|

26.8 |

% |

|

|

(21.4 |

)% |

|

|

10.1 |

% |

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

9,379 |

|

|

|

6,425 |

|

|

|

18,662 |

|

|

|

9,908 |

|

|

Restructuring costs |

|

1,643 |

|

|

|

- |

|

|

|

1,909 |

|

|

|

- |

|

|

Amortization of inventory step up |

|

183 |

|

|

|

2,609 |

|

|

|

427 |

|

|

|

6,277 |

|

| Other non-recurring, third

party costs |

|

469 |

|

|

|

507 |

|

|

|

1,140 |

|

|

|

946 |

|

| Goodwill impairment loss |

|

- |

|

|

|

- |

|

|

|

66,367 |

|

|

|

- |

|

| Total non-GAAP adjustments to

operating income/(loss) |

|

11,674 |

|

|

|

9,541 |

|

|

|

88,505 |

|

|

|

17,131 |

|

| Non-GAAP operating income |

|

24,399 |

|

|

|

32,103 |

|

|

|

29,958 |

|

|

|

39,773 |

|

| Non-GAAP operating income as a

% of RMS revenue |

|

23.4 |

% |

|

|

31.7 |

% |

|

|

16.1 |

% |

|

|

26.1 |

% |

| Non-GAAP operating income as a

% of total revenue |

|

16.1 |

% |

|

|

22.9 |

% |

|

|

10.9 |

% |

|

|

17.7 |

% |

| |

Three Months Ended |

|

|

Six Months Ended |

|

| |

March 31, |

|

|

March 31, |

|

| |

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Unallocated Corporate G&A |

|

(16,774 |

) |

|

|

(18,445 |

) |

|

|

(38,452 |

) |

|

|

(58,209 |

) |

| Unallocated corporate G&A

as a % of total revenue |

|

(11.1 |

)% |

|

|

(13.1 |

)% |

|

|

(14.0 |

)% |

|

|

(25.9 |

)% |

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock option expense |

|

1,781 |

|

|

|

1,141 |

|

|

|

3,827 |

|

|

|

25,073 |

|

|

Acquisition and integration costs |

|

105 |

|

|

|

2,085 |

|

|

|

1,088 |

|

|

|

10,893 |

|

| Total non-GAAP adjustments to

operating income/(loss) |

|

1,886 |

|

|

|

3,226 |

|

|

|

4,915 |

|

|

|

35,966 |

|

| Non-GAAP operating loss |

|

(14,888 |

) |

|

|

(15,219 |

) |

|

|

(33,537 |

) |

|

|

(22,243 |

) |

| Non-GAAP operating loss as a %

of total revenue |

|

(9.8 |

)% |

|

|

(10.8 |

)% |

|

|

(12.2 |

)% |

|

|

(9.9 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

151,463 |

|

|

|

140,313 |

|

|

|

274,217 |

|

|

|

224,524 |

|

| Operating income/(loss) |

|

(2,125 |

) |

|

|

7,869 |

|

|

|

(92,703 |

) |

|

|

(25,773 |

) |

| Operating loss as a % of total

revenue |

|

(1.4 |

)% |

|

|

5.6 |

% |

|

|

(33.8 |

)% |

|

|

(11.5 |

)% |

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

12,990 |

|

|

|

9,842 |

|

|

|

26,253 |

|

|

|

15,866 |

|

|

Stock compensation expense |

|

1,781 |

|

|

|

1,141 |

|

|

|

3,827 |

|

|

|

25,073 |

|

|

Restructuring costs |

|

1,740 |

|

|

|

- |

|

|

|

2,006 |

|

|

|

- |

|

|

Acquisition and integration costs |

|

105 |

|

|

|

2,085 |

|

|

|

1,088 |

|

|

|

10,893 |

|

|

Amortization of inventory step up |

|

183 |

|

|

|

2,609 |

|

|

|

427 |

|

|

|

6,277 |

|

|

Startup costs |

|

2,281 |

|

|

|

1,474 |

|

|

|

3,786 |

|

|

|

2,431 |

|

|

Other non-recurring, third party costs |

|

469 |

|

|

|

507 |

|

|

|

1,140 |

|

|

|

946 |

|

|

Goodwill impairment loss |

|

- |

|

|

|

- |

|

|

|

66,367 |

|

|

|

- |

|

| Total non-GAAP adjustments to

operating loss |

|

19,549 |

|

|

|

17,658 |

|

|

|

104,894 |

|

|

|

61,486 |

|

| Non-GAAP operating

income/(loss) |

|

17,424 |

|

|

|

25,527 |

|

|

|

12,191 |

|

|

|

35,713 |

|

| Non-GAAP operating

income/(loss) as a % of total revenue |

|

11.5 |

% |

|

|

18.2 |

% |

|

|

4.4 |

% |

|

|

15.9 |

% |

|

INOTIV, INC.RECONCILIATION OF GAAP

NET LOSS TO NON-GAAP ADJUSTED EBITDA(In

thousands)(Unaudited) |

| |

|

|

|

|

|

| |

Three Months Ended |

|

|

Six Months Ended |

|

| |

March 31, |

|

|

March 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

GAAP Consolidated net loss |

$ |

(9,629 |

) |

|

$ |

(6,664 |

) |

|

$ |

(96,561 |

) |

|

$ |

(90,075 |

) |

| Adjustments (a): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

10,515 |

|

|

|

7,547 |

|

|

|

20,965 |

|

|

|

12,375 |

|

|

Income tax (benefit) expense |

|

(2,466 |

) |

|

|

6,846 |

|

|

|

(18,440 |

) |

|

|

(5,939 |

) |

|

Depreciation and amortization |

|

12,990 |

|

|

|

9,842 |

|

|

|

26,253 |

|

|

|

15,866 |

|

|

Stock compensation expense (1) |

|

1,781 |

|

|

|

1,141 |

|

|

|

3,827 |

|

|

|

25,073 |

|

|

Acquisition and integration costs (2) |

|

105 |

|

|

|

2, 085 |

|

|

|

1,088 |

|

|

|

10,893 |

|

|

Startup costs |

|

2,281 |

|

|

|

1,474 |

|

|

|

3,786 |

|

|

|

2,431 |

|

|

Restructuring costs (3) |

|

1,740 |

|

|

|

- |

|

|

|

2,006 |

|

|

|

- |

|

|

Unrealized foreign exchange (gain)/loss |

|

(739 |

) |

|

|

(134 |

) |

|

|

511 |

|

|

|

60 |

|

|

Loss on debt extinguishment |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

877 |

|

|

Amortization of inventory step up |

|

183 |

|

|

|

2,609 |

|

|

|

427 |

|

|

|

6,277 |

|

|

Loss (gain) on disposition of assets |

|

(129 |

) |

|

|

12 |

|

|

|

251 |

|

|

|

(235 |

) |

|

Loss on fair value remeasurement of convertible notes (4) |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

56,714 |

|

|

Other non-recurring, third party costs |

|

469 |

|

|

|

507 |

|

|

|

1,140 |

|

|

|

946 |

|

|

Goodwill impairment loss (5) |

|

- |

|

|

|

- |

|

|

|

66,367 |

|

|

|

- |

|

| Adjusted EBITDA (b) |

$ |

17,101 |

|

|

$ |

25,265 |

|

|

$ |

11,620 |

|

|

$ |

35,263 |

|

| GAAP Consolidated net loss as

a percent of total revenue |

|

(6.4 |

)% |

|

|

(4.7 |

)% |

|

|

(35.2 |

)% |

|

|

(40.1 |

)% |

| Adjustments as a percent of

total revenue |

|

17.6 |

% |

|

|

22.8 |

% |

|

|

39.5 |

% |

|

|

55.8 |

% |

| Adjusted EBITDA as a percent

of total revenue |

|

11.3 |

% |

|

|

18.0 |

% |

|

|

4.2 |

% |

|

|

15.7 |

% |

| (a) |

Adjustments to certain GAAP reported measures for

the three and six months ended March 31, 2023 and 2022 include, but

are not limited to, the following: |

| |

|

(1) |

For the six

months ended March 31, 2022, $23.0 million relates to post

combination non-cash stock compensation expense relating to the

adoption of the Envigo Equity Plan recognized in connection with

the Envigo acquisition. |

| |

|

(2) |

For the three and six months ended March 31, 2023 and 2022,

represents charges for legal services, accounting services, travel

and other related activities in connection with various

acquisitions and the related integration of those

acquisitions. |

| |

|

(3) |

For the three and six months ended March 31, 2023, represents

costs incurred in connection with the exit of multiple sites as

previously disclosed. |

| |

|

(4) |

For the six months ended March 31, 2022, represents loss of

$56.7 million resulting from the fair value remeasurement of the

embedded derivative component of the convertible notes. |

| |

|

(5) |

For the six months ended March 31, 2023, represents a non-cash

goodwill impairment charge of $66.4 million related to the RMS

segment. |

| (b) |

Adjusted EBITDA - Consolidated net (loss)

income before interest expense, income tax expense (benefit),

depreciation and amortization, stock compensation expense,

acquisition and integration costs, startup costs, restructuring

costs, unrealized foreign exchange gain/loss, loss on debt

extinguishment, amortization of inventory step up, gain/loss on

disposition of assets, loss on fair value remeasurement of the

embedded derivative component of the convertible notes, other

non-recurring third party costs and goodwill impairment loss. |

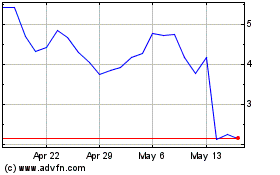

Inotiv (NASDAQ:NOTV)

Historical Stock Chart

From Oct 2024 to Nov 2024

Inotiv (NASDAQ:NOTV)

Historical Stock Chart

From Nov 2023 to Nov 2024