Olaplex Holdings, Inc. (NASDAQ: OLPX) ("OLAPLEX" or the "Company"),

today announced financial results for the third quarter and nine

months ended September 30, 2022.

For the third

quarter of 2022 compared to the

third quarter

2021:

- Net sales increased 9.2% to $176.5

million;

- Net sales decreased 4.3% in the United

States and increased 27.8% internationally

- By channel:

- Specialty Retail increased 60.1% to

$74.2 million;

- Professional declined 16.0% to $63.0

million;

- Direct-To-Consumer declined 2.6% to

$39.3 million;

- Net income increased 7.4% and adjusted

net income decreased 1.6%;

- Diluted EPS was $0.09 for the third

quarter 2022, as compared to $0.08 for the third quarter 2021;

- Adjusted Diluted EPS was $0.11 for the

third quarter 2022, as compared to $0.11 for the third quarter

2021

JuE Wong, OLAPLEX’s President and Chief

Executive Officer, commented: "Our third quarter performance was in

line with the preliminary estimates provided in our business update

in October 2022. In response to the moderating sales growth trends,

we are taking actions that we believe will strengthen our

forecasting capabilities and accelerate demand for Olaplex

products. The successful execution of these initiatives is expected

to drive new customer acquisition and maintain our strong customer

retention rates. More broadly, we believe that the fundamental

competitive advantages of our business remain intact and that we

are well-positioned to capitalize on a broad and exciting range of

future growth opportunities."

Third Quarter Highlights

|

(Dollars in $000’s, except per share data) |

|

|

|

|

|

|

|

Quarter to Date |

|

Q3 2022 |

|

Q3 2021 |

|

% Change |

|

Net Sales |

|

$ |

176,454 |

|

|

$ |

161,624 |

|

|

9.2% |

|

Gross Profit |

|

$ |

129,828 |

|

|

$ |

127,482 |

|

|

1.8% |

|

Gross Profit Margin |

|

|

73.6 |

% |

|

|

78.9 |

% |

|

|

|

Adjusted Gross Profit |

|

$ |

132,604 |

|

|

$ |

129,162 |

|

|

2.7% |

|

Adjusted Gross Profit Margin |

|

|

75.1 |

% |

|

|

79.9 |

% |

|

|

|

SG&A |

|

$ |

30,807 |

|

|

$ |

30,257 |

|

|

1.8% |

|

Adjusted SG&A |

|

$ |

28,397 |

|

|

$ |

22,194 |

|

|

27.9% |

|

Net Income |

|

$ |

60,763 |

|

|

$ |

56,591 |

|

|

7.4% |

|

Adjusted Net Income |

|

$ |

73,272 |

|

|

$ |

74,434 |

|

|

(1.6)% |

|

Adjusted EBITDA |

|

$ |

102,037 |

|

|

$ |

106,842 |

|

|

(4.5)% |

|

Adjusted EBITDA Margin |

|

|

57.8 |

% |

|

|

66.1 |

% |

|

|

|

Diluted EPS |

|

$ |

0.09 |

|

|

$ |

0.08 |

|

|

12.5% |

|

Adjusted Diluted EPS |

|

$ |

0.11 |

|

|

$ |

0.11 |

|

|

—% |

|

Weighted Average Diluted Shares Outstanding |

|

|

691,257,654 |

|

|

|

690,711,782 |

|

|

|

Nine Months Highlights

|

(Dollars in $000’s, except per share data) |

|

|

|

|

|

|

|

Year to Date |

|

Nine MonthsYear to Date2022 |

|

Nine MonthsYear to Date2021 |

|

% Change |

|

Net Sales |

|

$ |

573,553 |

|

|

$ |

431,867 |

|

|

32.8% |

|

Gross Profit |

|

$ |

427,463 |

|

|

$ |

341,609 |

|

|

25.1% |

|

Gross Profit Margin |

|

|

74.5 |

% |

|

|

79.1 |

% |

|

|

|

Adjusted Gross Profit |

|

$ |

438,512 |

|

|

$ |

348,008 |

|

|

26.0% |

|

Adjusted Gross Profit Margin |

|

|

76.5 |

% |

|

|

80.6 |

% |

|

|

|

SG&A |

|

$ |

79,232 |

|

|

$ |

75,323 |

|

|

5.2% |

|

Adjusted SG&A |

|

$ |

73,399 |

|

|

$ |

49,572 |

|

|

48.1% |

|

Net Income |

|

$ |

210,439 |

|

|

$ |

151,473 |

|

|

38.9% |

|

Adjusted Net Income |

|

$ |

263,451 |

|

|

$ |

204,257 |

|

|

29.0% |

|

Adjusted EBITDA |

|

$ |

361,494 |

|

|

$ |

298,106 |

|

|

21.3% |

|

Adjusted EBITDA Margin |

|

|

63.0 |

% |

|

|

69.0 |

% |

|

|

|

Diluted EPS |

|

$ |

0.30 |

|

|

$ |

0.22 |

|

|

36.4% |

|

Adjusted Diluted EPS |

|

$ |

0.38 |

|

|

$ |

0.30 |

|

|

26.7% |

|

Weighted Average Diluted Shares Outstanding |

|

|

691,585,787 |

|

|

|

689,108,272 |

|

|

|

Adjusted gross profit, adjusted gross profit

margin, adjusted SG&A, adjusted net income, adjusted diluted

EPS, adjusted EBITDA and adjusted EBITDA margin are measures that

are not calculated or presented in accordance with generally

accepted accounting principles in the United States ("GAAP"). For

more information about how we use these non-GAAP financial measures

in our business, the limitations of these measures, and a

reconciliation of these measures to the most directly comparable

GAAP measures, please see "Disclosure Regarding Non-GAAP Measures"

and the reconciliation tables that accompany this release.

Balance Sheet

As of September 30, 2022, the Company had

$249.4 million of cash and cash equivalents, compared to $186.4

million as of December 31, 2021. Inventory at the end of the

third quarter 2022 was $151.3 million, compared to $98.4 million at

the end of December 2021. Long-term debt, net of current portion

was $655.7 million as of September 30, 2022, compared to

$738.1 million as of the end of December 2021.

Fiscal Year 2022 Guidance

The Company re-affirmed its updated guidance for

fiscal year 2022 on net sales, adjusted net income and adjusted

EBITDA, as initially disclosed by the Company on October 18, 2022

and as set forth below.

|

For Fiscal 2022: |

|

|

|

|

(Dollars in millions) |

2022 |

2021 Actual |

% change(based on mid-point) |

|

Net Sales |

$704 - $711 |

$598 |

+18% |

|

Adjusted Net Income* |

$303 - $307 |

$276 |

+11% |

|

Adjusted EBITDA* |

$425 - $431 |

$409 |

+5% |

*Adjusted net income and Adjusted EBITDA are

non-GAAP measures. See "Disclosure Regarding Non-GAAP Financial

Measures" for additional information.

Assuming fiscal 2022 sales at the midpoint of

the range reflected in the net sales guidance above, the Company’s

implied expectation for net sales growth by channel and geography

in the three months ending December 31, 2022 (“fourth quarter”) as

compared to the fourth quarter of 2021 remains consistent with its

disclosure on October 18, 2022. Further, the Company expects the

inventory rebalancing across certain of its customers, as noted in

that October 18, 2022 disclosure, to normalize by the end of the

first quarter 2023.

Webcast and Conference Call

Information

The company plans to host an investor conference

call and webcast to review third quarter 2022 financial results at

9:00am ET/6:00am PT on November 9, 2022. The webcast can be

accessed at https://ir.olaplex.com/events-presentations. After

registering, an email will be sent including dial-in details and a

unique conference call pin required to join the live call. A replay

of the webcast will remain available on the website for 90

days.

About OLAPLEX

OLAPLEX is an innovative, science-enabled,

technology-driven beauty company with a mission to improve the hair

health of its consumers. A revolutionary brand, OLAPLEX paved the

way for a new category of hair care called "bond-building," the

process of protecting, strengthening and rebuilding broken bonds in

the hair during and after hair services. The brand’s products have

an active, patent-protected ingredient that works on a molecular

level to protect and repair hair from damage. OLAPLEX’s

award-winning products are sold through an expanding omnichannel

model serving the professional, specialty retail, and

direct-to-consumer channels.

Cautionary Note Regarding

Forward-Looking Statements

This press release includes forward-looking

statements and information relating to the Company that are based

on the beliefs of management as well as assumptions made by, and

information currently available to, the Company. These

forward-looking statements generally can be identified by the use

of words such as "may," "will," “could," "should," "intend,"

"potential," "continue," "anticipate," "believe," "estimate,"

"expect," "plan," "target," "predict," "project," "seek" and

similar expressions as they relate to us. These forward-looking

statements address various matters including: the Company’s

financial position and operating results, including financial

guidance for fiscal year 2022; inventory rebalancing across certain

of its customers and the timing related thereto; business plans and

objectives, including the Company's plan to respond to moderating

sales growth trends; the Company's initiatives to drive customer

acquisition and maintain customer retention; and growth and

expansion opportunities and the growth and resiliency of the global

premium hair care industry. These statements reflect management’s

current views with respect to future events, are not guarantees of

future performance and involve risks and uncertainties that are

difficult to predict. Each forward-looking statement contained in

this press release is subject to risks and uncertainties that could

cause actual results to differ materially from those expressed or

implied by such statement. Applicable risks and uncertainties

include, among others: the Company’s ability to execute on its

growth strategies and expansion opportunities; increased

competition causing the Company to reduce the prices of its

products or to increase significantly its marketing efforts in

order to avoid losing market share; impacts on the Company’s

business due to the sensitivity of its business to unfavorable

economic and business conditions; the Company’s dependence on a

limited number of customers for a significant portion of its net

sales; the Company’s ability to effectively market and maintain a

positive brand image and expand its brand awareness; the Company’s

ability to accurately forecast consumer demand for its products;

the Company's ability to attract new customers and encourage

consumer spending across its product portfolio; changes in consumer

preferences or changes in demand for hair care products or other

products the Company may develop; the Company's ability to maintain

favorable relationships with suppliers and manage its supply chain,

including obtaining and maintaining shipping distribution and raw

materials at favorable pricing; the Company’s relationships with

and the performance of distributors and retailers who sell its

products to hair care professionals and other customers; the impact

of material cost increases and other inflation and the Company’s

ability to pass on such increases to customers; the Company’s

ability to develop, manufacture and effectively and profitably

market and sell future products; the Company’s ability to

anticipate and effectively respond to market trends, including with

respect to new product introductions; the Company’s ability to

successfully implement new or additional marketing efforts; the

Company’s ability to attract and retain senior management and other

qualified personnel; regulatory changes and developments affecting

the Company's current and future products; the Company’s existing

and any future indebtedness, including the Company’s ability to

comply with affirmative and negative covenants under its credit

agreement to which it will remain subject to until maturity, and

the Company’s ability to obtain additional financing on favorable

terms or at all; increasing cost of debt and the Company’s ability

to service its existing indebtedness and obtain additional capital

to finance operations and its growth opportunities; impacts on the

Company’s business from political, regulatory, economic, trade, and

other risks associated with operating internationally including

volatility in currency exchange rates, and imposition of tariffs;

the Company’s ability to establish and maintain intellectual

property protection for its products, as well as the Company’s

ability to operate its business without infringing,

misappropriating or otherwise violating the intellectual property

rights of others; the impact of changes in laws, regulations and

administrative policy, including those that limit U.S. tax benefits

or impact trade agreements and tariffs; the outcome of litigation

and governmental proceedings; impacts on the Company’s business

from the COVID-19 pandemic; and the other risks identified under

the heading "Risk Factors" in Company’s Annual Report on Form 10-K

for the year ended December 31, 2021, filed with the Securities and

Exchange Commission (the "SEC") on March 8, 2022, as well as the

other information the Company files with the SEC. The Company

cautions investors not to place considerable reliance on the

forward-looking statements contained in this press release. You are

encouraged to read the Company’s filings with the SEC, available at

www.sec.gov, for a discussion of these and other risks and

uncertainties. The forward-looking statements in this press release

speak only as of the date hereof, and the Company undertakes no

obligation to update or revise any of these statements, except as

required by applicable law. The Company’s business is subject to

substantial risks and uncertainties, including those referenced

above. Investors, potential investors, and others should give

careful consideration to these risks and uncertainties.

Disclosure Regarding Non-GAAP Financial

Measures

In addition to the financial measures presented

in this release in accordance GAAP, the Company has included

certain non-GAAP financial measures, including adjusted EBITDA,

adjusted EBITDA margin, adjusted net income, adjusted gross profit,

adjusted gross profit margin, adjusted SG&A and adjusted

diluted EPS. Management believes these non-GAAP financial measures,

when taken together with the Company’s financial results presented

in accordance with GAAP, provide meaningful supplemental

information regarding the Company’s operating performance and

facilitate internal comparisons of its historical operating

performance on a more consistent basis by excluding certain items

that may not be indicative of its business, results of operations

or outlook. In particular, management believes that the use of

these non-GAAP measures may be helpful to investors as they are

measures used by management in assessing the health of the

Company’s business, determining incentive compensation and

evaluating its operating performance, as well as for internal

planning and forecasting purposes.

The Company calculates adjusted EBITDA as net

income, adjusted to exclude: (1) interest expense, net; (2) income

tax provision; (3) depreciation and amortization; (4) share-based

compensation expense; (5) non-ordinary inventory adjustments; (6)

non-ordinary costs and fees; (7) non-ordinary legal costs; (8)

non-capitalizable IPO and strategic transition costs; and (9) as

applicable, Tax Receivable Agreement liability adjustments. The

Company calculates adjusted EBITDA margin by dividing adjusted

EBITDA by net sales. The Company calculates adjusted net income as

net income, adjusted to exclude: (1) amortization of intangible

assets (excluding software); (2) non-ordinary costs and fees; (3)

non-ordinary legal costs; (4) non-ordinary inventory adjustments;

(5) share-based compensation expense; (6) non-capitalizable IPO and

strategic transition costs; (7) Tax Receivable Agreement liability

adjustment; and (8) tax effect of non-GAAP adjustments. The Company

calculates adjusted basic and diluted EPS as adjusted net income

divided by weighted average basic and diluted shares outstanding

respectively. The Company calculates adjusted gross profit as gross

profit, adjusted to exclude: (1) non-ordinary inventory adjustments

and (2) amortization of patented formulations pertaining to the

acquisition of the Olaplex, LLC business in 2020 by certain

investment funds affiliated with Advent International Corporation

and other investors (the "Acquisition"). The Company calculates

adjusted gross profit margin by dividing adjusted gross profit by

net sales. The Company calculates adjusted SG&A as SG&A,

adjusted to exclude: (1) share-based compensation expense; (2)

non-ordinary legal costs, (3) non-capitalizable IPO and strategic

transition costs; and (4) non-ordinary costs and fees.

Please refer to "Reconciliation of Non-GAAP

Financial Measures to GAAP Equivalents" located in the financial

supplement in this release for a reconciliation of these non-GAAP

metrics to their most directly comparable financial measure stated

in accordance with GAAP.

This release includes forward-looking guidance

for adjusted EBITDA and adjusted net income. The Company is not

able to provide, without unreasonable effort, a reconciliation of

the guidance for adjusted EBITDA and adjusted net income to the

most directly comparable GAAP measure because the Company does not

currently have sufficient data to accurately estimate the variables

and individual adjustments included in the most directly comparable

GAAP measure that would be necessary for such reconciliations,

including (a) income tax related accruals in respect of certain

one-time items, (b) costs related to potential debt or equity

transactions, and (c) other non-recurring expenses that cannot

reasonably be estimated in advance. These adjustments are

inherently variable and uncertain and depend on various factors

that are beyond the Company's control and as a result it is also

unable to predict their probable significance. Therefore, because

management cannot estimate on a forward-looking basis without

unreasonable effort the impact these variables and individual

adjustments will have on its reported results in accordance with

GAAP, it is unable to provide a reconciliation of the non-GAAP

measures included in its fiscal 2022 guidance.

CONDENSED CONSOLIDATED BALANCE

SHEETS (in thousands, except shares) (Unaudited)

| |

September 30,2022 |

|

December 31,2021 |

|

Assets |

|

|

|

|

Current Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

249,399 |

|

$ |

186,388 |

|

Accounts receivable, net of allowance of $14,976 and $8,231 |

|

93,286 |

|

|

40,779 |

|

Inventory |

|

151,283 |

|

|

98,399 |

|

Other current assets |

|

3,277 |

|

|

9,621 |

|

Total current assets |

|

497,245 |

|

|

335,187 |

|

Property and equipment, net |

|

614 |

|

|

747 |

|

Intangible assets, net |

|

1,007,267 |

|

|

1,043,344 |

|

Goodwill |

|

168,300 |

|

|

168,300 |

|

Deferred taxes, net |

|

12,876 |

|

|

8,344 |

|

Other assets |

|

10,498 |

|

|

4,500 |

|

Total assets |

$ |

1,696,800 |

|

$ |

1,560,422 |

| |

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

Current Liabilities: |

|

|

|

|

Accounts payable |

$ |

23,126 |

|

$ |

19,167 |

|

Accrued expenses and other current liabilities |

|

26,031 |

|

|

17,332 |

|

Accrued sales and income taxes |

|

16,096 |

|

|

12,144 |

|

Current portion of long-term debt |

|

6,750 |

|

|

20,112 |

|

Current portion of Tax Receivable Agreement |

|

16,557 |

|

|

4,157 |

|

Total current liabilities |

|

88,560 |

|

|

72,912 |

|

Related Party payable pursuant to Tax Receivable Agreement |

|

208,582 |

|

|

225,122 |

|

Long-term debt |

|

655,662 |

|

|

738,090 |

|

Total liabilities |

|

952,804 |

|

|

1,036,124 |

| |

|

|

|

|

Contingencies |

|

|

|

| |

|

|

|

|

Stockholders’ equity |

|

|

|

|

Common stock, $0.001 par value per share; 2,000,000,000 shares

authorized, 649,112,823 and 648,794,041shares issued and

outstanding as of September 30, 2022 and December 31,

2021, respectively |

|

649 |

|

|

648 |

|

Preferred stock, $0.001 par value per share; 25,000,000 shares

authorized and no shares issued and outstanding |

|

— |

|

|

— |

|

Additional paid-in capital |

|

310,193 |

|

|

302,866 |

|

Accumulated other comprehensive income |

|

1,931 |

|

|

— |

|

Retained earnings |

|

431,223 |

|

|

220,784 |

|

Total stockholders’ equity |

|

743,996 |

|

|

524,298 |

|

Total liabilities and stockholders’ equity |

$ |

1,696,800 |

|

$ |

1,560,422 |

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME (amounts in thousands,

except per share and share data) (Unaudited)

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Net sales |

$ |

176,454 |

|

|

$ |

161,624 |

|

|

$ |

573,553 |

|

|

$ |

431,867 |

|

|

Cost of sales: |

|

|

|

|

|

|

|

|

Cost of product (excluding amortization) |

|

45,484 |

|

|

|

32,462 |

|

|

|

140,999 |

|

|

|

83,859 |

|

|

Amortization of patented formulations |

|

1,142 |

|

|

|

1,680 |

|

|

|

5,091 |

|

|

|

6,399 |

|

|

Total cost of sales |

|

46,626 |

|

|

|

34,142 |

|

|

|

146,090 |

|

|

|

90,258 |

|

|

Gross profit |

|

129,828 |

|

|

|

127,482 |

|

|

|

427,463 |

|

|

|

341,609 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Selling, general, and administrative |

|

30,807 |

|

|

|

30,257 |

|

|

|

79,232 |

|

|

|

75,323 |

|

|

Amortization of other intangible assets |

|

10,329 |

|

|

|

10,182 |

|

|

|

30,890 |

|

|

|

30,547 |

|

|

Total operating expenses |

|

41,136 |

|

|

|

40,439 |

|

|

|

110,122 |

|

|

|

105,870 |

|

|

Operating income |

|

88,692 |

|

|

|

87,043 |

|

|

|

317,341 |

|

|

|

235,739 |

|

|

Interest expense |

|

(10,499 |

) |

|

|

(14,987 |

) |

|

|

(30,653 |

) |

|

|

(46,052 |

) |

|

Other expense, net |

|

|

|

|

|

|

|

|

Loss on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

(18,803 |

) |

|

|

— |

|

|

Other expense |

|

(2,251 |

) |

|

|

(213 |

) |

|

|

(3,852 |

) |

|

|

(417 |

) |

|

Total other expense, net |

|

(2,251 |

) |

|

|

(213 |

) |

|

|

(22,655 |

) |

|

|

(417 |

) |

|

Income before provision for income taxes |

|

75,942 |

|

|

|

71,843 |

|

|

|

264,033 |

|

|

|

189,270 |

|

|

Income tax provision |

|

15,179 |

|

|

|

15,252 |

|

|

|

53,594 |

|

|

|

37,797 |

|

|

Net income |

$ |

60,763 |

|

|

$ |

56,591 |

|

|

$ |

210,439 |

|

|

$ |

151,473 |

|

|

Net income per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.09 |

|

|

$ |

0.09 |

|

|

$ |

0.32 |

|

|

$ |

0.23 |

|

|

Diluted |

$ |

0.09 |

|

|

$ |

0.08 |

|

|

$ |

0.30 |

|

|

$ |

0.22 |

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

649,099,780 |

|

|

|

648,124,642 |

|

|

|

648,963,625 |

|

|

|

648,082,081 |

|

|

Diluted |

|

691,257,654 |

|

|

|

690,711,782 |

|

|

|

691,585,787 |

|

|

|

689,108,272 |

|

| |

|

|

|

|

|

|

|

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

Unrealized gain on derivatives, net of income tax effect |

$ |

1,931 |

|

|

$ |

— |

|

|

$ |

1,931 |

|

|

$ |

— |

|

|

Total other comprehensive income: |

|

1,931 |

|

|

|

— |

|

|

|

1,931 |

|

|

|

— |

|

|

Total comprehensive income: |

$ |

62,694 |

|

|

$ |

56,591 |

|

|

$ |

212,370 |

|

|

$ |

151,473 |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (amounts in thousands) (Unaudited)

| |

Nine Months EndedSeptember

30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

Cash flows from operating activities |

|

|

|

|

Net income |

$ |

210,439 |

|

|

$ |

151,473 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

(28,632 |

) |

|

|

(21,148 |

) |

|

Net cash provided by operating activities |

|

181,807 |

|

|

|

130,325 |

|

|

Net cash used in investing activities |

|

(1,712 |

) |

|

|

(5,359 |

) |

|

Net cash used in financing activities |

|

(117,084 |

) |

|

|

(14,451 |

) |

|

Net increase in cash and cash equivalents |

|

63,011 |

|

|

|

110,515 |

|

|

Cash and cash equivalents - beginning of period |

|

186,388 |

|

|

|

10,964 |

|

|

Cash and cash equivalents - end of period |

$ |

249,399 |

|

|

$ |

121,479 |

|

The following tables present a reconciliation of

net income, SG&A and gross profit, as the most directly

comparable financial measure stated in accordance with U.S. GAAP,

to adjusted EBITDA, adjusted EBITDA margin, adjusted gross profit,

adjusted gross profit margin, adjusted SG&A, adjusted net

income and adjusted net income per share for each of the periods

presented.

| |

For the Three Months EndedSeptember

30, |

|

For the Nine Months EndedSeptember

30, |

|

(in thousands) |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Reconciliation of Net Income to Adjusted

EBITDA |

|

|

|

|

|

|

|

|

Net income |

$ |

60,763 |

|

|

$ |

56,591 |

|

|

$ |

210,439 |

|

|

$ |

151,473 |

|

|

Income tax provision |

|

15,179 |

|

|

|

15,252 |

|

|

|

53,594 |

|

|

|

37,797 |

|

|

Depreciation and amortization of intangible assets |

|

11,552 |

|

|

|

11,949 |

|

|

|

36,214 |

|

|

|

37,033 |

|

|

Interest expense |

|

10,499 |

|

|

|

14,987 |

|

|

|

30,653 |

|

|

|

46,052 |

|

|

Loss on extinguishment of debt(1) |

|

— |

|

|

|

— |

|

|

|

18,803 |

|

|

|

— |

|

|

Share-based compensation |

|

2,031 |

|

|

|

1,945 |

|

|

|

5,454 |

|

|

|

3,119 |

|

|

Inventory write off and disposal(2) |

|

— |

|

|

|

— |

|

|

|

4,324 |

|

|

|

— |

|

|

Labelling stock write off and disposal(3) |

|

1,634 |

|

|

|

— |

|

|

|

1,634 |

|

|

|

— |

|

|

Distribution start-up costs(4) |

|

379 |

|

|

|

— |

|

|

|

379 |

|

|

|

— |

|

|

Non-recurring litigation costs(5) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

14,250 |

|

|

Non-capitalizable IPO and strategic transition costs (6) |

|

— |

|

|

|

6,118 |

|

|

|

— |

|

|

|

8,382 |

|

|

Adjusted EBITDA |

$ |

102,037 |

|

|

$ |

106,842 |

|

|

$ |

361,494 |

|

|

$ |

298,106 |

|

|

Adjusted EBITDA margin |

|

57.8 |

% |

|

|

66.1 |

% |

|

|

63.0 |

% |

|

|

69.0 |

% |

| |

For the Three Months EndedSeptember

30, |

|

For the Nine Months EndedSeptember

30, |

|

(in thousands) |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Reconciliation of Gross Profit to Adjusted Gross

Profit |

|

|

|

|

|

|

|

|

Gross profit |

$ |

129,828 |

|

|

$ |

127,482 |

|

|

$ |

427,463 |

|

|

$ |

341,609 |

|

|

Inventory write off and disposal(2) |

|

— |

|

|

|

— |

|

|

|

4,324 |

|

|

|

— |

|

|

Amortization of patented formulations |

|

1,142 |

|

|

|

1,680 |

|

|

|

5,091 |

|

|

|

6,399 |

|

|

Labelling stock write off and disposal(3) |

|

1,634 |

|

|

|

— |

|

|

|

1,634 |

|

|

|

— |

|

|

Adjusted gross profit |

$ |

132,604 |

|

|

$ |

129,162 |

|

|

$ |

438,512 |

|

|

$ |

348,008 |

|

|

Adjusted gross profit margin |

|

75.1 |

% |

|

|

79.9 |

% |

|

|

76.5 |

% |

|

|

80.6 |

% |

| |

|

For the Three Months EndedSeptember

30, |

|

For the Nine Months EndedSeptember

30, |

|

(in thousands) |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Reconciliation of SG&A to Adjusted

SG&A |

|

|

|

|

|

|

|

|

|

SG&A |

|

$ |

30,807 |

|

|

$ |

30,257 |

|

|

$ |

79,232 |

|

|

$ |

75,323 |

|

|

Share-based compensation |

|

|

(2,031 |

) |

|

|

(1,945 |

) |

|

|

(5,454 |

) |

|

|

(3,119 |

) |

|

Distribution start-up costs(4) |

|

|

(379 |

) |

|

|

— |

|

|

|

(379 |

) |

|

|

— |

|

|

Non-recurring litigation costs(5) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(14,250 |

) |

|

Non-capitalizable IPO and strategic transition costs (6) |

|

|

— |

|

|

|

(6,118 |

) |

|

|

— |

|

|

|

(8,382 |

) |

|

Adjusted SG&A |

|

$ |

28,397 |

|

|

$ |

22,194 |

|

|

$ |

73,399 |

|

|

$ |

49,572 |

|

| |

For the Three Months EndedSeptember 30, |

|

For the Nine Months EndedSeptember 30, |

|

(in thousands, except per share data) |

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Reconciliation of Net Income to Adjusted Net

Income |

|

|

|

|

|

|

|

|

Net income |

$ |

60,763 |

|

|

$ |

56,591 |

|

|

$ |

210,439 |

|

|

$ |

151,473 |

|

|

Amortization of intangible assets (excluding software) |

|

11,325 |

|

|

|

11,862 |

|

|

|

35,639 |

|

|

|

36,946 |

|

|

Loss on extinguishment of debt(1) |

|

— |

|

|

|

— |

|

|

|

18,803 |

|

|

|

— |

|

|

Share-based compensation |

|

2,031 |

|

|

|

1,945 |

|

|

|

5,454 |

|

|

|

3,119 |

|

|

Inventory write off and disposal(2) |

|

— |

|

|

|

— |

|

|

|

4,324 |

|

|

|

— |

|

|

Labelling stock write off and disposal(3) |

|

1,634 |

|

|

|

— |

|

|

|

1,634 |

|

|

|

— |

|

|

Distribution start-up costs(4) |

|

379 |

|

|

|

— |

|

|

|

379 |

|

|

|

— |

|

|

Non-recurring litigation costs(5) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

14,250 |

|

|

Non-capitalizable IPO and strategic transition costs (6) |

|

— |

|

|

|

6,118 |

|

|

|

— |

|

|

|

8,382 |

|

|

Tax effect of adjustments |

|

(2,860 |

) |

|

|

(2,082 |

) |

|

|

(13,221 |

) |

|

|

(9,913 |

) |

|

Adjusted net income |

$ |

73,272 |

|

|

$ |

74,434 |

|

|

$ |

263,451 |

|

|

$ |

204,257 |

|

|

Adjusted net income per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.11 |

|

|

$ |

0.11 |

|

|

$ |

0.41 |

|

|

$ |

0.32 |

|

|

Diluted |

$ |

0.11 |

|

|

$ |

0.11 |

|

|

$ |

0.38 |

|

|

$ |

0.30 |

|

(1) On February 23, 2022, the

Company refinanced its existing secured credit facility with a new

credit agreement comprised of a $675 million senior secured term

loan facility and a $150 million senior secured revolving credit

facility. This refinancing resulted in recognition of loss on

extinguishment of debt of $18.8 million which is comprised of $11.0

million in deferred financing fee write off, and $7.8 million of

prepayment fees for the previously existing credit facility. Loss

on extinguishment of debt is included as non-ordinary costs and

fees in the reconciliations above.

(2) The inventory write-off and

disposal costs relate to unused stock of a product that the Company

reformulated in June 2021 as a result of regulation changes in the

E.U. In the interest of having a single formulation for sale

worldwide, the Company reformulated on a global basis and is now

disposing of unused stock.

(3) Labelling stock write-off

and disposal costs relate to disposal of unused product labels that

the Company was required to update as a result of regulation

changes in the E.U that become effective in the first quarter of

2023.

(4) The distribution start-up

costs relate to one-time charges associated with the set-up of a

new third party logistics provider.

(5) Represents costs incurred

related to the payment to LIQWD, Inc., a predecessor entity to the

Company substantially all of whose assets and liabilities were

purchased as part of the Acquisition ("LIQWD"), of certain amounts

due in connection with the resolution of certain litigation and

contingency matters involving LIQWD, which amounts were required to

be paid pursuant to the purchase agreement for the Acquisition.

(6) Represents

non-capitalizable professional fees and executive severance

incurred in connection with the Company's initial public offering

and the Company’s public company transition.

Contacts:

ICR, Inc.

For Investors:Allison MalkinAnnie Erner

For Media:Alecia PulmanBrittany Fraser

Olaplex@icrinc.com203.682.8220

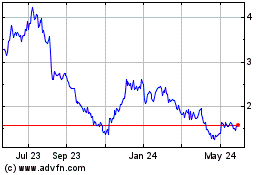

Olaplex (NASDAQ:OLPX)

Historical Stock Chart

From Dec 2024 to Jan 2025

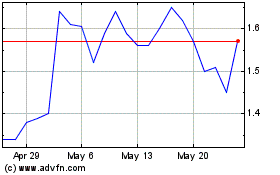

Olaplex (NASDAQ:OLPX)

Historical Stock Chart

From Jan 2024 to Jan 2025