Paylocity Holding Corporation (Nasdaq: PCTY), a leading provider of

cloud-based HCM and payroll software solutions, today announced

financial results for the fourth quarter and full fiscal year 2024,

which ended June 30, 2024.

“Our position as the most modern HCM provider drove strong

financial results in fiscal 24, as we ended the year with 19% total

revenue growth, 17% recurring & other revenue growth, and a

significant increase in profitability. Our financial performance in

fiscal 24 was supported by 8% year-over-year client growth to

39,050 clients, and 8% growth in average revenue per client – while

also focusing on efficiency and productivity across our

organization. We continue to attach more product at time of sale,

and have realized increased success selling back into existing

clients as our modern workforce products continue to resonate

across our entire client base, with Learning Management,

Recognition & Rewards, and Employee Voice seeing particular

success. In addition to healthy revenue and profitability growth in

fiscal 24, in Q4 we also returned capital to shareholders by

repurchasing $150 million of our stock. As we close fiscal 24, I

would like to thank all of our employees for their efforts

supporting our clients, and congratulate our teams for another

successful year. We enter fiscal 25 with a high degree of

confidence in our ability to execute against our multi-year goal of

$2 billion in total revenue,” said Toby Williams, President and

Co-Chief Executive Officer of Paylocity.

Key Recent Achievements

- FY 2024 Recurring & other revenue

of $1,281.7 million, up 17% year-over-year.

- FY 2024 Total revenue of $1,402.5

million, up 19% year-over-year.

- FY 2024 GAAP net income increased 47%

to $206.8 million from $140.8 million in FY 2023 and $3.63 per

diluted share from $2.49 in FY 2023.

- FY 2024 Adjusted EBITDA, a non-GAAP

measure, increased 35% to $505.6 million from $375.2 million in FY

2023, or 36.0% of Total revenue compared to 31.9% in FY 2023.

- FY 2024 Adjusted EBITDA excluding

interest income on funds held for clients, a non-GAAP measure,

increased 29% to $384.7 million from $298.6 million in FY 2023, or

30.0% of Recurring and other revenue compared to 27.2% in FY

2023.

- FY 2024 Net cash provided by operating

activities increased 36% to $384.7 million from $282.7 million in

FY 2023, or 27.4% of Total revenue compared to 24.1% in FY

2023.

- FY 2024 Free cash flow, a non-GAAP

measure, increased 42% to $305.9 million from $215.8 million in FY

2023, or 21.8% of Total revenue compared to 18.4% in FY 2023.

- FY 2024 Free cash flow excluding

interest income on funds held for clients, a non-GAAP measure,

increased 33% to $185.1 million from $139.2 million in FY 2023, or

14.4% of Recurring and other revenue compared to 12.7% in FY

2023.

- Ending FY 2024 Cash and cash

equivalents balance of $401.8 million.

Fourth Quarter Fiscal 2024 Financial

Highlights

Revenue:

- Total revenue was $357.3 million, an

increase of 16% from the fourth quarter of fiscal year 2023.

- Recurring & other revenue was

$324.7 million, an increase of 15% from the fourth quarter of

fiscal year 2023.

Operating Income:

- GAAP operating income was

$62.9 million and non-GAAP operating income was

$96.3 million in the fourth quarter of fiscal year 2024,

compared to GAAP operating income of $49.4 million and non-GAAP

operating income of $84.0 million in the fourth quarter of fiscal

year 2023.

Net Income:

- GAAP net income was $48.8 million

or $0.86 per share in the fourth quarter of fiscal year 2024 based

on 56.9 million diluted weighted average common shares

outstanding, compared to $37.3 million or $0.66 per share in the

fourth quarter of fiscal year 2023 based on 56.7 million

diluted weighted average common shares outstanding.

Adjusted EBITDA:

- Adjusted EBITDA, a non-GAAP measure,

was $120.2 million in the fourth quarter of fiscal year 2024

compared to $100.6 million in the fourth quarter of fiscal year

2023.

- Adjusted EBITDA excluding interest

income on funds held for clients, a non-GAAP measure, was $87.6

million in the fourth quarter of fiscal year 2024 compared to $74.1

million in the fourth quarter of fiscal year 2023.

Fiscal Year 2024 Financial Highlights

Revenue:

- Total revenue was

$1,402.5 million, an increase of 19% from fiscal year

2023.

- Recurring & other revenue was

$1,281.7 million, an increase of 17% from fiscal year

2023.

Operating Income:

- GAAP operating income was

$260.1 million and non-GAAP operating income was

$421.9 million in fiscal year 2024, compared to GAAP operating

income of $155.0 million and non-GAAP operating income of $320.9

million in fiscal year 2023.

Net Income:

- GAAP net income was

$206.8 million or $3.63 per share for fiscal year 2024, based

on 57.0 million diluted weighted average common shares

outstanding, compared to $140.8 million or $2.49 per share for

fiscal year 2023 based on 56.6 million diluted weighted

average common shares outstanding.

Adjusted EBITDA:

- Adjusted EBITDA, a non-GAAP measure,

was $505.6 million for fiscal year 2024 compared to $375.2

million for fiscal year 2023.

- Adjusted EBITDA excluding interest

income on funds held for clients, a non-GAAP measure, was $384.7

million for fiscal year 2024 compared to $298.6 million for fiscal

year 2023.

Balance Sheet and Cash Flow:

- Cash and cash equivalents totaled

$401.8 million at the end of fiscal year 2024.

- Net cash provided by operating

activities for the fiscal year 2024 was $384.7 million

compared to $282.7 million for fiscal year 2023.

- Free cash flow, a non-GAAP measure,

was $305.9 million or 21.8% of Total revenue for fiscal year

2024.

- Free cash flow excluding interest

income on funds held for clients, a non-GAAP measure, was $185.1

million or 14.4% of Recurring and other revenue for fiscal year

2024.

A reconciliation of GAAP to non-GAAP financial measures has been

provided in this press release, including the accompanying tables.

An explanation of these measures is also included below under the

heading “Non-GAAP Financial Measures.”

Business Outlook

Based on information available as of August 1, 2024,

Paylocity is issuing guidance for the first quarter and full fiscal

year 2025 as indicated below.

First Quarter 2025:

- Recurring and other revenue is

expected to be in the range of $325.5 million to $330.5 million,

which represents approximately 12.5% growth over fiscal year 2024

first quarter recurring and other revenue.

- Total revenue is expected to be in the

range of $353.5 million to $358.5 million, which represents

approximately 12.1% growth over fiscal year 2024 first quarter

total revenue.

- Adjusted EBITDA, a non-GAAP measure,

is expected to be in the range of $116.5 million to $120.5

million.

- Adjusted EBITDA excluding interest

income on funds held for clients, a non-GAAP measure, is expected

to be in the range of $88.5 million to $92.5 million.

Fiscal Year 2025:

- Recurring and other revenue is

expected to be in the range of $1.405 billion to $1.420 billion,

which represents approximately 10.2% growth over fiscal year 2024

recurring and other revenue.

- Total revenue is expected to be in the

range of $1.512 billion to $1.527 billion, which represents

approximately 8.3% growth over fiscal year 2024 total revenue.

- Adjusted EBITDA, a non-GAAP measure,

is expected to be in the range of $533.0 million to $543.0

million.

- Adjusted EBITDA excluding interest

income on funds held for clients, a non-GAAP measure, is expected

to be in the range of $426.0 million to $436.0 million.

We are unable to reconcile forward-looking non-GAAP financial

measures included in our guidance to their directly comparable GAAP

financial measures because the information which is needed to

complete the reconciliations is unavailable at this time without

unreasonable effort.

Conference Call Details

Paylocity will host a conference call to discuss its fourth

quarter and full fiscal year 2024 results today at 4:30 p.m.

Central Time (5:30 p.m. Eastern Time). A live audio webcast of the

conference call, together with detailed financial information, can

be accessed through

https://investors.paylocity.com/events-and-presentations where

you will be provided with dial in details. A replay of the call

will be available and archived via webcast

at https://investors.paylocity.com/.

About Paylocity

Paylocity is a leading provider of cloud-based HCM and payroll

software solutions headquartered in Schaumburg, IL. Founded in 1997

and publicly traded since 2014, Paylocity offers an intuitive,

easy-to-use product suite that helps businesses tackle today’s

challenges while moving them toward the promise of tomorrow. Known

for its unique culture and consistently recognized as one of the

best places to work, Paylocity accompanies its clients on the

journey to create great workplaces and help people achieve their

best through automation, data-driven insights, and engagement. For

more information, visit www.paylocity.com.

Non-GAAP Financial Measures

The company uses certain non-GAAP financial measures when

reporting its financial results, including Adjusted EBITDA,

Adjusted EBITDA margin, adjusted gross profit, adjusted gross

profit margin, non-GAAP operating income, non-GAAP net income,

non-GAAP net income per share, non-GAAP sales and marketing and

non-GAAP sales and marketing margin, non-GAAP total research and

development and non-GAAP total research and development margin,

non-GAAP general and administrative and non-GAAP general and

administrative margin, free cash flow and free cash flow margin,

certain of which are included in this release. Generally, a

non-GAAP financial measure is a numerical measure of a company’s

performance, financial position or cash flow that either excludes

or includes amounts that are not normally excluded or included in

the most directly comparable measure calculated and presented in

accordance with GAAP. We define Adjusted EBITDA as net income

before interest expense, income tax expense (benefit), and

depreciation and amortization expense, adjusted to eliminate

stock-based compensation expense and employer payroll taxes related

to stock releases and option exercises and other items as described

later in this release. Adjusted EBITDA excluding interest income on

funds held for clients is calculated in the same manner as Adjusted

EBITDA and is further adjusted to eliminate interest income on

funds held for clients. We calculate Adjusted EBITDA margin as

Adjusted EBITDA divided by total revenues. Adjusted EBITDA margin

excluding interest income on funds held for clients is Adjusted

EBITDA excluding interest income on funds held for clients divided

by recurring and other revenue. Adjusted gross profit is adjusted

to eliminate stock-based compensation expense and employer payroll

taxes related to stock releases and option exercises, the

amortization of capitalized internal-use software costs and certain

acquired intangibles and other items as described later in this

release. Adjusted gross profit margin is calculated as adjusted

gross profit as described in the preceding sentence divided by

total revenues. Non-GAAP operating income is adjusted to eliminate

stock-based compensation expense and employer payroll taxes related

to stock releases and option exercises, the amortization of

acquired intangibles and other items as described later in this

release. Non-GAAP net income and non-GAAP net income per share are

adjusted to eliminate stock-based compensation expense and employer

payroll taxes related to stock releases and option exercises, the

amortization of acquired intangibles and other items as described

later in this release, including the income tax effect on these

items. Non-GAAP sales and marketing expense is adjusted to

eliminate stock-based compensation expense and employer payroll

taxes related to stock releases and option exercises and other

items as described later in this release. Non-GAAP sales and

marketing margin is calculated by dividing non-GAAP sales and

marketing by total revenues. Non-GAAP total research and

development is adjusted for capitalized internal-use software costs

paid and to eliminate stock-based compensation expense and employer

payroll taxes related to stock releases and option exercises and

other items as described later in this release. Non-GAAP total

research and development margin is calculated by dividing non-GAAP

total research and development by total revenues. Non-GAAP general

and administrative expense is adjusted to eliminate stock-based

compensation expense and employer payroll taxes related to stock

releases and option exercises, the amortization of certain acquired

intangibles and other items as described later in this release.

Non-GAAP general and administrative margin is calculated by

dividing non-GAAP general and administrative expense by total

revenues. Free cash flow is defined as net cash provided by

operating activities less capitalized internal-use software costs

and purchases of property and equipment. Free cash flow margin is

calculated by dividing free cash flow by total revenues. Free cash

flow excluding interest income on funds held for clients is defined

in the same manner as free cash flow but also excludes interest

income on funds held for clients. Free cash flow margin excluding

interest income on funds held for clients is calculated by dividing

free cash flow excluding interest income on funds held for clients

by recurring and other revenue. Please note that other companies

may define their non-GAAP financial measures differently than we

do. Management presents certain non-GAAP financial measures in this

release because it considers them to be important supplemental

measures of performance. Management uses these non-GAAP financial

measures for planning purposes, including analysis of the company's

performance against prior periods, the preparation of operating

budgets and to determine appropriate levels of operating and

capital investments. Management believes that these non-GAAP

financial measures provide additional insight for analysts and

investors in evaluating the company's financial and operational

performance. Non-GAAP financial measures have limitations as an

analytical tool. Investors are encouraged to review the

reconciliation of the non-GAAP measures to their most directly

comparable GAAP measures provided in this release.

Safe Harbor/Forward Looking Statements

This press release contains forward-looking statements that

involve substantial risks and uncertainties. All statements, other

than statements of historical facts, included herein regarding

Paylocity’s future operations, ability to scale its business,

future financial position and performance, future revenues,

projected costs, prospects, plans and objectives of management are

forward-looking statements. The words “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “may,” “plan,” “will,” “would,”

“seek” and similar expressions (or the negative of these terms) are

intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. These

forward-looking statements include, among other things, statements

about management's estimates regarding future revenues and

financial performance, long-term financial targets, future share

repurchases and other statements about management’s beliefs,

intentions or goals. Paylocity may not actually achieve the

expectations disclosed in the forward-looking statements, and you

should not place undue reliance on Paylocity’s forward-looking

statements. These forward-looking statements involve risks and

uncertainties that could cause actual results or events to differ

materially from the expectations disclosed in the forward-looking

statements, including, but not limited to the general economic

conditions in regions in which Paylocity does business, changes in

interest rates, business disruptions, reductions in employment and

an increase in business failures that have occurred or may occur in

the future; Paylocity’s ability to leverage AI Assist and other

forms of artificial intelligence and machine learning in its

technology, which may be constrained by current and future laws,

regulations, interpretive positions or standards governing new and

evolving technologies and ethical considerations that could

restrict or impose burdensome and costly requirements on its

ability to continue to leverage data in innovative ways;

Paylocity’s ability to retain existing clients and to attract new

clients to enter into subscriptions for its services; the

challenges associated with a growing company’s ability to

effectively service clients in a dynamic and competitive market;

challenges associated with expanding and evolving a sales

organization to effectively address new geographies and products

and services; challenges related to cybersecurity threats and

evolving cybersecurity regulations; Paylocity’s reliance on and

ability to expand its referral network of third parties;

Paylocity’s reliance on third party payroll partners in foreign

jurisdictions in its Blue Marble business; difficulties associated

with accurately forecasting revenue and appropriately planning

expenses; challenges with managing growth effectively; risks

related to regulatory, legislative and judicial uncertainty in

Paylocity’s markets; Paylocity’s ability to protect and defend its

intellectual property; the risk that Paylocity’s security measures

are compromised or a threat actor gains unauthorized access to

customer data; unexpected events in the market for Paylocity’s

solutions; changes in the competitive environment in Paylocity’s

industry and the markets in which it operates; adverse changes in

general economic or market conditions; changes in the employment

rates of Paylocity’s clients and the resultant impact on revenue;

the possibility that Paylocity may be adversely affected by other

economic, business, and/or competitive factors; and other risks and

potential factors that could affect Paylocity’s business and

financial results identified in Paylocity’s filings with the

Securities and Exchange Commission (the “SEC”), including its 10-K

filed with the SEC on August 4, 2023. Additional information will

also be set forth in Paylocity’s future quarterly reports on Form

10-Q, annual reports on Form 10-K and other filings that Paylocity

makes with the SEC. These forward-looking statements represent

Paylocity’s expectations as of the date of this press release.

Subsequent events may cause these expectations to change, and

Paylocity disclaims any obligations to update or alter these

forward-looking statements in the future, whether as a result of

new information, future events or otherwise.

CONTACT: Ryan Glenn investors@paylocity.com

www.paylocity.com

|

|

|

PAYLOCITY HOLDING CORPORATION |

|

Consolidated Balance Sheets |

|

(in thousands, except per share data) |

| |

| |

June 30, |

| |

2023 |

|

2024 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

288,767 |

|

|

$ |

401,811 |

|

|

Accounts receivable, net |

|

25,085 |

|

|

|

32,997 |

|

|

Deferred contract costs |

|

78,109 |

|

|

|

97,859 |

|

|

Prepaid expenses and other |

|

35,061 |

|

|

|

39,765 |

|

|

Total current assets before funds held for clients |

|

427,022 |

|

|

|

572,432 |

|

|

Funds held for clients |

|

2,621,415 |

|

|

|

2,952,060 |

|

|

Total current assets |

|

3,048,437 |

|

|

|

3,524,492 |

|

| Capitalized internal-use

software, net |

|

86,127 |

|

|

|

116,412 |

|

| Property and equipment,

net |

|

64,069 |

|

|

|

60,640 |

|

| Operating lease right-of-use

assets |

|

44,067 |

|

|

|

33,792 |

|

| Intangible assets, net |

|

34,527 |

|

|

|

28,291 |

|

| Goodwill |

|

102,054 |

|

|

|

108,937 |

|

| Long-term deferred contract

costs |

|

294,222 |

|

|

|

348,003 |

|

| Long‑term prepaid expenses and

other |

|

6,331 |

|

|

|

7,077 |

|

| Deferred income tax

assets |

|

15,846 |

|

|

|

17,816 |

|

|

Total assets |

$ |

3,695,680 |

|

|

$ |

4,245,460 |

|

| |

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

6,153 |

|

|

$ |

8,638 |

|

|

Accrued expenses |

|

143,287 |

|

|

|

158,311 |

|

|

Total current liabilities before client fund obligations |

|

149,440 |

|

|

|

166,949 |

|

|

Client fund obligations |

|

2,625,355 |

|

|

|

2,950,411 |

|

|

Total current liabilities |

|

2,774,795 |

|

|

|

3,117,360 |

|

| Long-term operating lease

liabilities |

|

62,471 |

|

|

|

46,814 |

|

| Other long-term

liabilities |

|

3,731 |

|

|

|

6,398 |

|

| Deferred income tax

liabilities |

|

11,820 |

|

|

|

41,824 |

|

|

Total liabilities |

$ |

2,852,817 |

|

|

$ |

3,212,396 |

|

| Stockholders’ equity: |

|

|

|

|

Preferred stock, $0.001 par value, 5,000 authorized, no shares

issued and outstanding at June 30, 2023 and June 30,

2024 |

$ |

— |

|

|

$ |

— |

|

|

Common stock, $0.001 par value, 155,000 shares authorized at

June 30, 2023 and June 30, 2024; 55,912 shares issued and

outstanding at June 30, 2023 and 55,514 shares issued and

outstanding at June 30, 2024 |

|

56 |

|

|

|

56 |

|

|

Additional paid-in capital |

|

380,632 |

|

|

|

360,488 |

|

|

Retained earnings |

|

466,690 |

|

|

|

673,456 |

|

|

Accumulated other comprehensive loss |

|

(4,515 |

) |

|

|

(936 |

) |

|

Total stockholders' equity |

$ |

842,863 |

|

|

$ |

1,033,064 |

|

|

Total liabilities and stockholders’ equity |

$ |

3,695,680 |

|

|

$ |

4,245,460 |

|

|

PAYLOCITY HOLDING CORPORATION |

|

Consolidated Statements of Operations and Comprehensive

Income |

|

(in thousands, except per share data) |

| |

| |

Three Months EndedJune 30, |

|

Year Ended June 30, |

| |

2023 |

|

2024 |

|

2023 |

|

2024 |

| Revenues: |

|

|

|

|

|

|

|

|

Recurring and other revenue |

$ |

282,026 |

|

|

$ |

324,739 |

|

|

$ |

1,098,036 |

|

|

$ |

1,281,680 |

|

Interest income on funds held for clients |

|

26,427 |

|

|

|

32,548 |

|

|

|

76,562 |

|

|

|

120,835 |

| Total revenues |

|

308,453 |

|

|

|

357,287 |

|

|

|

1,174,598 |

|

|

|

1,402,515 |

| Cost of revenues |

|

96,706 |

|

|

|

116,880 |

|

|

|

367,039 |

|

|

|

441,729 |

| Gross profit |

|

211,747 |

|

|

|

240,407 |

|

|

|

807,559 |

|

|

|

960,786 |

| Operating expenses: |

|

|

|

|

|

|

|

|

Sales and marketing |

|

75,895 |

|

|

|

88,014 |

|

|

|

296,716 |

|

|

|

334,954 |

|

Research and development |

|

40,549 |

|

|

|

44,203 |

|

|

|

163,994 |

|

|

|

178,333 |

|

General and administrative |

|

45,951 |

|

|

|

45,281 |

|

|

|

191,823 |

|

|

|

187,406 |

| Total operating expenses |

|

162,395 |

|

|

|

177,498 |

|

|

|

652,533 |

|

|

|

700,693 |

|

Operating income |

|

49,352 |

|

|

|

62,909 |

|

|

|

155,026 |

|

|

|

260,093 |

| Other income |

|

2,617 |

|

|

|

5,573 |

|

|

|

3,588 |

|

|

|

16,922 |

|

Income before income taxes |

|

51,969 |

|

|

|

68,482 |

|

|

|

158,614 |

|

|

|

277,015 |

| Income tax expense |

|

14,715 |

|

|

|

19,663 |

|

|

|

17,792 |

|

|

|

70,249 |

| Net income |

$ |

37,254 |

|

|

$ |

48,819 |

|

|

$ |

140,822 |

|

|

$ |

206,766 |

| Other comprehensive income

(loss), net of tax |

|

(2,275 |

) |

|

|

(243 |

) |

|

|

(2,212 |

) |

|

|

3,579 |

| Comprehensive income |

$ |

34,979 |

|

|

$ |

48,576 |

|

|

$ |

138,610 |

|

|

$ |

210,345 |

| |

|

|

|

|

|

|

|

| Net income per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.67 |

|

|

$ |

0.87 |

|

|

$ |

2.53 |

|

|

$ |

3.68 |

|

Diluted |

$ |

0.66 |

|

|

$ |

0.86 |

|

|

$ |

2.49 |

|

|

$ |

3.63 |

| |

|

|

|

|

|

|

|

| Weighted-average shares used

in computing net income per share: |

|

|

|

|

|

|

|

|

Basic |

|

55,864 |

|

|

|

56,209 |

|

|

|

55,706 |

|

|

|

56,214 |

|

Diluted |

|

56,665 |

|

|

|

56,890 |

|

|

|

56,596 |

|

|

|

56,976 |

|

|

Stock-based compensation expense and employer payroll taxes

related to stock releases and option exercises for each of the

three and twelve months ended June 30 are included in the

above line items:

| |

Three Months EndedJune 30, |

|

Year EndedJune 30, |

| |

2023 |

2024 |

|

2023 |

|

2024 |

|

Cost of revenues |

$ |

3,750 |

|

$ |

4,156 |

|

$ |

18,446 |

|

$ |

20,350 |

| Sales and marketing |

|

7,967 |

|

|

7,446 |

|

|

38,376 |

|

|

37,010 |

| Research and development |

|

8,020 |

|

|

8,017 |

|

|

38,719 |

|

|

38,483 |

| General and

administrative |

|

12,276 |

|

|

10,280 |

|

|

58,964 |

|

|

56,603 |

| Total stock-based compensation

expense and employer payroll taxes related to stock releases and

option exercises |

$ |

32,013 |

|

$ |

29,899 |

|

$ |

154,505 |

|

$ |

152,446 |

|

PAYLOCITY HOLDING CORPORATION |

|

Consolidated Statements of Cash Flows |

|

(in thousands) |

| |

| |

Year Ended June 30, |

| |

2022 |

|

2023 |

|

2024 |

| Cash flows from operating

activities: |

|

|

|

|

|

|

Net income |

$ |

90,777 |

|

|

$ |

140,822 |

|

|

$ |

206,766 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities |

|

|

|

|

|

|

Stock-based compensation expense |

|

96,202 |

|

|

|

147,300 |

|

|

|

146,032 |

|

|

Depreciation and amortization expense |

|

50,218 |

|

|

|

60,866 |

|

|

|

76,426 |

|

|

Deferred income tax expense (benefit) |

|

(7,180 |

) |

|

|

13,540 |

|

|

|

27,835 |

|

|

Provision for credit losses |

|

311 |

|

|

|

1,245 |

|

|

|

1,565 |

|

|

Net amortization of premiums (accretion of discounts) on

available-for-sale securities |

|

381 |

|

|

|

(5,412 |

) |

|

|

(4,378 |

) |

|

Other |

|

503 |

|

|

|

1,682 |

|

|

|

(962 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

(7,605 |

) |

|

|

(9,407 |

) |

|

|

(8,186 |

) |

|

Deferred contract costs |

|

(73,263 |

) |

|

|

(80,781 |

) |

|

|

(70,337 |

) |

|

Prepaid expenses and other |

|

(14,767 |

) |

|

|

(3,994 |

) |

|

|

(5,829 |

) |

|

Accounts payable |

|

2,553 |

|

|

|

(1,554 |

) |

|

|

2,423 |

|

|

Accrued expenses and other |

|

16,923 |

|

|

|

18,416 |

|

|

|

13,315 |

|

|

Net cash provided by operating activities |

|

155,053 |

|

|

|

282,723 |

|

|

|

384,670 |

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

Purchases of available-for-sale securities and other |

|

(433,962 |

) |

|

|

(598,895 |

) |

|

|

(304,465 |

) |

|

Proceeds from sales and maturities of available-for-sale

securities |

|

116,848 |

|

|

|

446,751 |

|

|

|

294,438 |

|

|

Capitalized internal-use software costs |

|

(34,515 |

) |

|

|

(45,004 |

) |

|

|

(60,726 |

) |

|

Purchases of property and equipment |

|

(18,069 |

) |

|

|

(21,910 |

) |

|

|

(18,028 |

) |

|

Acquisitions of businesses, net of cash acquired |

|

(107,576 |

) |

|

|

— |

|

|

|

(12,031 |

) |

|

Other investing activities |

|

(2,500 |

) |

|

|

(1,104 |

) |

|

|

(1,079 |

) |

|

Net cash used in investing activities |

|

(479,774 |

) |

|

|

(220,162 |

) |

|

|

(101,891 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

Net change in client fund obligations |

|

2,228,038 |

|

|

|

(1,362,421 |

) |

|

|

325,056 |

|

|

Borrowings under credit facility |

|

50,000 |

|

|

|

— |

|

|

|

— |

|

|

Repayment of credit facility |

|

(50,000 |

) |

|

|

— |

|

|

|

— |

|

|

Repurchases of common shares |

|

— |

|

|

|

— |

|

|

|

(150,000 |

) |

|

Proceeds from employee stock purchase plan |

|

14,103 |

|

|

|

16,916 |

|

|

|

19,143 |

|

|

Taxes paid related to net share settlement of equity awards |

|

(69,761 |

) |

|

|

(88,312 |

) |

|

|

(52,549 |

) |

|

Other financing activities |

|

(87 |

) |

|

|

(885 |

) |

|

|

(72 |

) |

|

Net cash provided by (used in) financing activities |

|

2,172,293 |

|

|

|

(1,434,702 |

) |

|

|

141,578 |

|

| Net change in cash, cash

equivalents and funds held for clients' cash and cash

equivalents |

|

1,847,572 |

|

|

|

(1,372,141 |

) |

|

|

424,357 |

|

| Cash, cash equivalents and

funds held for clients' cash and cash equivalents—beginning of

year |

|

1,945,881 |

|

|

|

3,793,453 |

|

|

|

2,421,312 |

|

| Cash, cash equivalents and

funds held for clients' cash and cash equivalents—end of year |

$ |

3,793,453 |

|

|

$ |

2,421,312 |

|

|

$ |

2,845,669 |

|

| Supplemental Disclosure of

Non-Cash Investing and Financing Activities |

|

|

|

|

|

|

Purchases of property and equipment and internal-use software,

accrued but not paid |

$ |

2,052 |

|

|

$ |

— |

|

|

$ |

1,118 |

|

|

Liabilities assumed for acquisitions |

$ |

4,581 |

|

|

$ |

117 |

|

|

$ |

378 |

|

| Supplemental Disclosure of

Cash Flow Information |

|

|

|

|

|

|

Cash paid for interest |

$ |

311 |

|

|

$ |

404 |

|

|

$ |

494 |

|

|

Cash paid for income taxes |

$ |

11 |

|

|

$ |

1,359 |

|

|

$ |

47,619 |

|

| Reconciliation of cash, cash

equivalents and funds held for clients' cash and cash equivalents

to the Consolidated Balance Sheets |

|

|

|

|

|

| Cash and cash equivalents |

$ |

139,756 |

|

|

$ |

288,767 |

|

|

$ |

401,811 |

|

| Funds held for clients' cash

and cash equivalents |

|

3,653,697 |

|

|

|

2,132,545 |

|

|

|

2,443,858 |

|

| Total cash, cash equivalents

and funds held for clients' cash and cash equivalents |

$ |

3,793,453 |

|

|

$ |

2,421,312 |

|

|

$ |

2,845,669 |

|

|

Paylocity Holding Corporation |

|

Reconciliation of GAAP to non-GAAP Financial

Measures |

|

(In thousands except per share data) |

| |

| |

Three Months EndedJune 30, |

|

Year Ended June 30, |

| |

2023 |

|

2024 |

|

2023 |

|

2024 |

| Reconciliation from

Gross profit to Adjusted gross profit: |

|

|

|

|

|

|

|

|

Gross profit |

$ |

211,747 |

|

$ |

240,407 |

|

$ |

807,559 |

|

$ |

960,786 |

| Amortization of capitalized

internal-use software costs |

|

8,936 |

|

|

12,775 |

|

|

31,440 |

|

|

45,246 |

| Amortization of certain

acquired intangibles |

|

1,853 |

|

|

2,064 |

|

|

7,414 |

|

|

7,907 |

| Stock-based compensation

expense and employer payroll taxes related to stock releases and

option exercises |

|

3,750 |

|

|

4,156 |

|

|

18,446 |

|

|

20,350 |

| Other items (1) |

|

— |

|

|

469 |

|

|

19 |

|

|

469 |

| Adjusted gross profit |

$ |

226,286 |

|

$ |

259,871 |

|

$ |

864,878 |

|

$ |

1,034,758 |

| |

Three Months EndedJune 30, |

|

Year Ended June 30, |

| |

2023 |

|

2024 |

|

2023 |

|

2024 |

| Reconciliation from

Operating income to Non-GAAP Operating income: |

|

|

|

|

|

|

|

|

Operating income |

$ |

49,352 |

|

$ |

62,909 |

|

$ |

155,026 |

|

$ |

260,093 |

|

| Stock-based compensation

expense and employer payroll taxes related to stock releases and

option exercises |

|

32,013 |

|

|

29,899 |

|

|

154,505 |

|

|

152,446 |

|

| Amortization of acquired

intangibles |

|

2,637 |

|

|

2,577 |

|

|

10,948 |

|

|

10,436 |

|

| Other items (2) |

|

— |

|

|

940 |

|

|

446 |

|

|

(1,091 |

) |

| Non-GAAP Operating income |

$ |

84,002 |

|

$ |

96,325 |

|

$ |

320,925 |

|

$ |

421,884 |

|

| |

Three Months EndedJune 30, |

|

Year Ended June 30, |

| |

2023 |

|

2024 |

|

2023 |

|

2024 |

| Reconciliation from

Net income to Non-GAAP Net income: |

|

|

|

|

|

|

|

|

Net income |

$ |

37,254 |

|

$ |

48,819 |

|

$ |

140,822 |

|

|

$ |

206,766 |

|

| Stock-based compensation

expense and employer payroll taxes related to stock releases and

option exercises |

|

32,013 |

|

|

29,899 |

|

|

154,505 |

|

|

|

152,446 |

|

| Amortization of acquired

intangibles |

|

2,637 |

|

|

2,577 |

|

|

10,948 |

|

|

|

10,436 |

|

| Other items (2) |

|

— |

|

|

940 |

|

|

446 |

|

|

|

(1,091 |

) |

| Income tax effect on

adjustments (3) |

|

2,896 |

|

|

1,832 |

|

|

(15,003 |

) |

|

|

5,493 |

|

| Non-GAAP Net income |

$ |

74,800 |

|

$ |

84,067 |

|

$ |

291,718 |

|

|

$ |

374,050 |

|

| |

Three Months EndedJune 30, |

|

Year Ended June 30, |

| |

2023 |

|

2024 |

|

2023 |

|

2024 |

| Calculation of

Non-GAAP Net income per share: |

|

|

|

|

|

|

|

|

Non-GAAP Net income |

$ |

74,800 |

|

$ |

84,067 |

|

$ |

291,718 |

|

$ |

374,050 |

| Diluted weighted-average

number of common shares |

|

56,665 |

|

|

56,890 |

|

|

56,596 |

|

|

56,976 |

| Non-GAAP Net income per

share |

$ |

1.32 |

|

$ |

1.48 |

|

$ |

5.15 |

|

$ |

6.57 |

| |

Three Months EndedJune 30, |

|

Year Ended June 30, |

| |

2023 |

|

2024 |

|

2023 |

|

2024 |

| Reconciliation from

Net income to Adjusted EBITDA and Adjusted EBITDA excluding

interest income on funds held for clients |

|

|

|

|

|

|

|

|

Net income |

$ |

37,254 |

|

|

$ |

48,819 |

|

|

$ |

140,822 |

|

|

$ |

206,766 |

|

| Interest expense |

|

188 |

|

|

|

190 |

|

|

|

752 |

|

|

|

758 |

|

| Income tax expense

(benefit) |

|

14,715 |

|

|

|

19,663 |

|

|

|

17,792 |

|

|

|

70,249 |

|

| Depreciation and amortization

expense |

|

16,385 |

|

|

|

20,647 |

|

|

|

60,866 |

|

|

|

76,426 |

|

| EBITDA |

|

68,542 |

|

|

|

89,319 |

|

|

|

220,232 |

|

|

|

354,199 |

|

| Stock-based compensation

expense and employer payroll taxes related to stock releases and

option exercises |

|

32,013 |

|

|

|

29,899 |

|

|

|

154,505 |

|

|

|

152,446 |

|

| Other items (2) |

|

— |

|

|

|

940 |

|

|

|

446 |

|

|

|

(1,091 |

) |

| Adjusted EBITDA |

$ |

100,555 |

|

|

$ |

120,158 |

|

|

$ |

375,183 |

|

|

$ |

505,554 |

|

| Interest income on funds held

for clients |

$ |

(26,427 |

) |

|

$ |

(32,548 |

) |

|

$ |

(76,562 |

) |

|

$ |

(120,835 |

) |

| Adjusted EBITDA excluding

interest income on funds held for clients |

$ |

74,128 |

|

|

$ |

87,610 |

|

|

$ |

298,621 |

|

|

$ |

384,719 |

|

| |

Three Months EndedJune 30, |

|

Year Ended June 30, |

| |

2023 |

|

2024 |

|

2023 |

|

2024 |

| Reconciliation of

Non-GAAP sales and marketing: |

|

|

|

|

|

|

|

|

Sales and marketing |

$ |

75,895 |

|

$ |

88,014 |

|

$ |

296,716 |

|

$ |

334,954 |

| Less: Stock-based compensation

expense and employer payroll taxes related to stock releases and

option exercises |

|

7,967 |

|

|

7,446 |

|

|

38,376 |

|

|

37,010 |

| Less: Other items (4) |

|

— |

|

|

— |

|

|

22 |

|

|

— |

| Non-GAAP sales and

marketing |

$ |

67,928 |

|

$ |

80,568 |

|

$ |

258,318 |

|

$ |

297,944 |

| |

Three Months EndedJune 30, |

|

Year Ended June 30, |

|

|

2023 |

|

2024 |

|

2023 |

|

2024 |

| Reconciliation of

Non-GAAP total research and development: |

|

|

|

|

|

|

|

|

Research and development |

$ |

40,549 |

|

$ |

44,203 |

|

$ |

163,994 |

|

$ |

178,333 |

| Add: Capitalized internal-use

software costs |

|

14,278 |

|

|

16,225 |

|

|

45,004 |

|

|

60,726 |

| Less: Stock-based compensation

expense and employer payroll taxes related to stock releases and

option exercises |

|

8,020 |

|

|

8,017 |

|

|

38,719 |

|

|

38,483 |

| Less: Other items (4) |

|

— |

|

|

229 |

|

|

399 |

|

|

741 |

| Non-GAAP total research and

development |

$ |

46,807 |

|

$ |

52,182 |

|

$ |

169,880 |

|

$ |

199,835 |

| |

Three Months EndedJune 30, |

|

Year Ended June 30, |

|

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

| Reconciliation of

Non-GAAP general and administrative: |

|

|

|

|

|

|

|

|

General and administrative |

$ |

45,951 |

|

$ |

45,281 |

|

$ |

191,823 |

|

$ |

187,406 |

|

| Less: Stock-based compensation

expense and employer payroll taxes related to stock releases and

option exercises |

|

12,276 |

|

|

10,280 |

|

|

58,964 |

|

|

56,603 |

|

| Less: Amortization of certain

acquired intangibles |

|

784 |

|

|

513 |

|

|

3,534 |

|

|

2,529 |

|

| Less: Other items (5) |

|

— |

|

|

242 |

|

|

6 |

|

|

(2,301 |

) |

| Non-GAAP general and

administrative |

$ |

32,891 |

|

$ |

34,246 |

|

$ |

129,319 |

|

$ |

130,575 |

|

| |

Year Ended June 30, |

| |

2023 |

|

2024 |

| Reconciliation of Free

cash flow and Free cash flow excluding interest income on funds

held for clients: |

|

|

|

|

Net cash provided by operating activities |

$ |

282,723 |

|

|

$ |

384,670 |

|

| Capitalized internal-use

software costs |

|

(45,004 |

) |

|

|

(60,726 |

) |

| Purchases of property and

equipment |

|

(21,910 |

) |

|

|

(18,028 |

) |

| Free cash flow |

$ |

215,809 |

|

|

$ |

305,916 |

|

| Interest income on funds held

for clients |

|

(76,562 |

) |

|

|

(120,835 |

) |

| Free cash flow excluding

interest income on funds held for clients |

$ |

139,247 |

|

|

$ |

185,081 |

|

| |

(1) Represents acquisition-related costs and severance costs

related to certain roles that have been eliminated. We exclude

one-off severance costs that we incur as part of the normal course

of our business operations.

(2) Represents acquisition and nonrecurring transaction-related

costs, lease exit activity and severance costs related to certain

roles that have been eliminated. We exclude one-off severance costs

that we incur as part of the normal course of our business

operations.

(3) Includes the income tax effect on non-GAAP net income

adjustments related to stock-based compensation expense and

employer payroll taxes related to stock releases and option

exercises, amortization of acquired intangibles and other items,

which include acquisition and nonrecurring transaction-related

costs, lease exit activity and severance costs related to certain

roles that have been eliminated. We exclude one-off severance costs

that we incur as part of the normal course of our business

operations.

(4) Represents acquisition and nonrecurring transaction-related

costs.

(5) Represents acquisition and nonrecurring transaction-related

costs and lease exit activity.

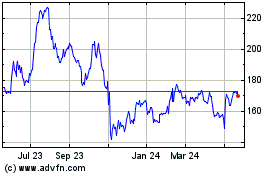

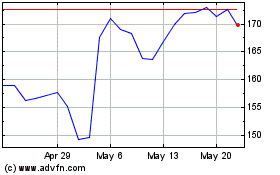

Paylocity (NASDAQ:PCTY)

Historical Stock Chart

From Aug 2024 to Sep 2024

Paylocity (NASDAQ:PCTY)

Historical Stock Chart

From Sep 2023 to Sep 2024